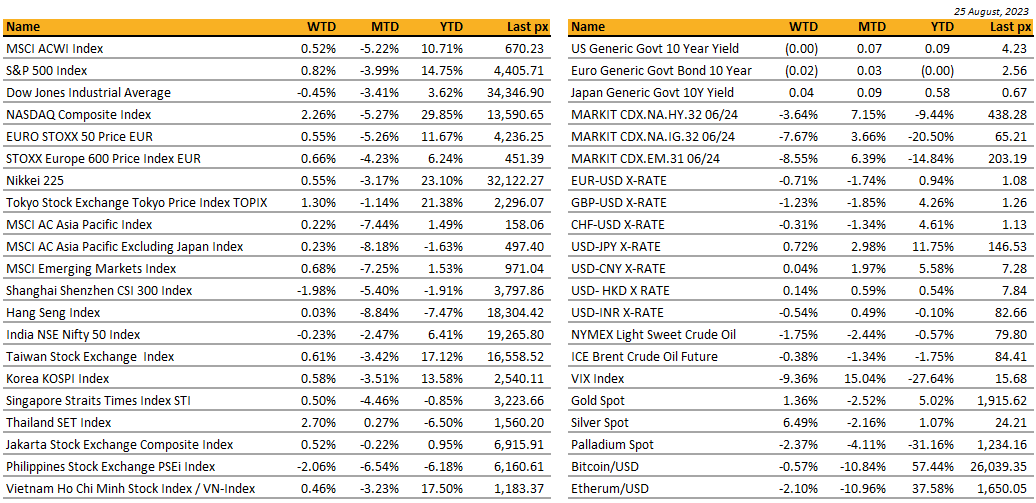

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

After 3 brutal weeks of continued selloff, US stocks staged a first winning week since July as markets digest Chair Powell’s remarks from the Jackson Hole symposium on Friday. Powell suggested policy could remain tighter for longer and will “proceed carefully” on whether to raise rates again. Whilst welcoming the slower pace of gains in the US economy, he cautioned that the process still has a long way to go, to get inflation down to 2%. His comments are consistent with expectations that the Fed will leave rates unchanged at the Sept. 19-20 meeting, with the possibility of a hike later in the year and then, a pause. No hints just yet of a peak which indicate no cuts on the table for now. Members of the Fed are less unanimous with a couple of dissenters that think policymakers have likely undertaken sufficient tightening. UST10Y yields retreated from its highs after readings earlier showed US services and manufacturing businesses dropped to a 6-month lows. Post Powell’s speech, 10’s closed at 4.235% and widened against the 2’s at 5.08%. The USD was pretty much unchanged on the week against major currencies.

Tech for the week led the rally again, where Nvidia reported better than expected/forecast results as the generative AI theme remain a focus, Tesla recovered on a broader bounce-back, but headwinds remain for growth stocks as longer term yield remain elevated. Bank stocks fell after S&P joined Moody’s in cutting its outlook for some US regional lenders.

The value proposition in the S&P remain our pick as earnings resilience, better managed cash flows support a brighter outlook over growth. (SPYV/IVE – large cap value)

This week, we will get a chance to sift through more key economic data including unemployment, PCE, pending home sales and second-quarter GDP, which should offer more insight on whether the central bank is making substantial enough progress in its fight to slow inflation. PCE core is expected to remain unchained at 0.2% MoM and at 4.2% YoY and NFP to come in at 168k. On jobs, a US government report said that job growth in the year through March will probably be revised down by 306,000 — a smaller adjustment than some economists had expected but could cheer risk assets, nevertheless.

Asia

The small rally towards the end of the week was not sufficient to pull Asian markets out from the monthly pullbacks. For August, month to date, MSCI Asia ex Japan was down 8.18%. The bulk of which was contributed by Hang Seng which was down 8.84% for the same period.

Thailand was the best performer last week, up 2.7% as Srettha Thavisin, a former property tycoon, became the first new leader to take charge of Thailand since 2014 coup. Thailand’s economy however expanded at a slower pace than forecast, +1.8% yoy in June, which is less than 3% estimate. This could be a case for the central bank to pause its monetary tightening to support growth in the face of an exports downturn and a political impasse. Thailand’s July 2023 exports (-6.2% yoy) and imports (-11.1% yoy) both came in below consensus’ estimates.

In China, Beijing halved the stamp duty on stock trades and pledged to slow the pace of IPOs to revive confidence. The 50% cut of stamp duty for A shares has generated much analyses that went viral among domestic investors, comparing it to the last cut in Apr 2008 to support the market after a plunge, which spurred a bull run the following year. The CSRC said restrictions would also be set on the frequency and size of refinancing for some firms, with property developers exempted from the rule. Meanwhile, Hong Kong plans a task force to boost liquidity

The Bank of Korea left its key policy rate unchanged at 3.50% for a fifth consecutive meeting on Thursday. Over in Indonesia, Bank Indonesia also held rates steady at 5.75%. MoUs were signed between Bank Indonesia, Bank Negara Malaysia, and Bank of Thailand at the sidelines of the ASEAN Finance Ministers and Central Bank Governors’ Meeting in Jakarta last Friday. “The MoUs are set to strengthen cross-border economic activities, enhance regional financial market stability, and deepen local currency markets in the three countries,” the central banks said in the statement.

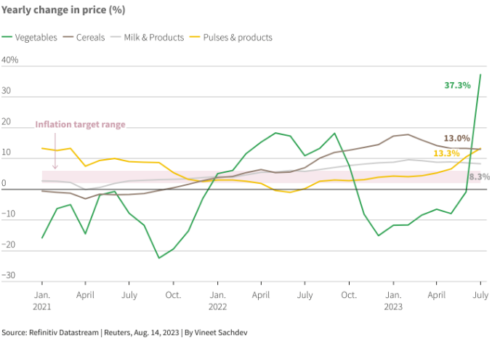

India has imposed a 20% duty on exports of parboiled rice with immediate effect, a move that could further reduce shipments from the world’s largest exporter and lift global rice prices, which are already trading near their highest levels in 12 years. Rainfall in some key rice growing states has been 15% lower than normal so far this season, raising concerns about domestic supply. Last month, India surprised buyers by imposing a ban on exports of widely consumed non-basmati white rice, following a ban on broken rice exports last year. India accounts for more than 40% of world rice exports, and low inventories with other exporters mean any cut in shipments could inflate food prices already driven up by Russia’s invasion of Ukraine last year and by erratic weather.

In India, the annual retail inflation was at a 15-month high of 7.44% in July, food price inflation rose to 11.5%, its highest in more than 3 1/2 years. While government actions (inventory management, imports) are likely to be the first line of defence to manage food prices, higher food—and therefore headline—inflation is likely to keep the RBI cautious.

GEOPOLITICS

The five BRICS nations have invited Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates to join their emerging market group. The inclusion of Iran and Saudi Arabia, the world’s biggest oil producer outside the US, among the first Middle Eastern Brics members also follows Beijing’s brokering of the normalisation of relations between Riyadh and Tehran this year. The new BRICS will control 6 of the top 9 oil producing nations, +40% of the world’s population and a huge amount of the natural resources in the world.

US has agreed to sell to Taiwan a system with which its F-16 fighters can search and track enemy aircraft through infrared technology, a rare move by the administration of President Joe Biden to help Taipei push back against ongoing Chinese military pressure near the island. The new system, to be provided by Lockheed Martin, would better enable Taiwan to defend its airspace, provide regional security and increase its ability to operate with US forces through its F-16 programme, said the US defence department’s Defense Security Cooperation Agency.

Japan has started to release radioactive water from its stricken Fukushima nuclear plant into the Pacific Ocean, sparking retaliation from China which suspended imports of Japanese aquatic products. “What Japan has done is pass on the risks to the world and pass on the pain to future generations of mankind, becoming ecological and environmental destroyers and global marine polluters, and violating the people’s rights to health, development and environmental rights,” the Chinese Ministry of Foreign Affairs said in an online statement. The release of water is expected to take decades.

CREDIT/ TREASURIES

Following economic data in the US, the US Treasury curve inverted some more over the week, the 2 years yield gained 13bps, 5 years yield gained 5bps, 10 years yield was down 2bps & 30 years yield lost 9bps.

On the credit side, US IG spreads tightened by 4bps and US HY spreads tightened by 12bps. That resulted on US IG Corporate Index gaining 1.40% over the week, US HY gained 70bps and leverage loans end up the week slightly positive.

Regarding interest rates, with investors continuing to expect higher rates for longer, this period feels increasingly reminiscent of the early 2010s, in reverse. Back then after the GFC, policy rates had been slashed to zero by central banks, but there was always the expectation that rate hikes were never too far away. Yet in reality, they kept being pushed out year after year. Today, it feels like the same process is happening again, except with rate cuts this time, which are also being pushed out ever further into the future. For instance, the first rate cut from the Fed is now priced in for May 2024, but that timing has continued to move into the distant future. Indeed, back in March at the height of the SVB turmoil, investors were pricing in that rate cuts would already have begun by now.

FX

DXY USD Index rose 0.68% to 104.08 due to weak sentiment as global PMIs deteriorate. Chair Powell stuck to script at Jackson Hole, where Fed will proceed carefully, is prepared to raise rates further if appropriate. He commented that persistent above trend growth could warrant tightening, suggesting that the September dot plot still showing another hike if the labour market and growth continue to outperform. Data wise, prelim. Aug PMI for Mfg came in at 47.0, and svc came in at 51.0, both below consensus. Michigan Sentiment came in at 69.5 (below consensus), and 5-10 year inflation expectation came in at 3.0, above consensus.

EURUSD fell 0.71% to 1.0796, as EU PMI for Aug Prelim deteriorates. Mfg PMI came in at 43.7 (above consensus), but Svc PMI deteriorates to 48.3 (below consensus). Composite PMI fell to 47.0, below consensus. President Lagarde stuck to script, where ECB is set to raise rates as high as necessary and will remain data dependent.

GBPUSD fell 1.23% to 1.2578, as UK PMI for Aug Prelim deteriorates. Mfg PMI came in at 42.5 (above consensus), but Svc PMI deteriorates to 48.7 (below consensus). Composite PMI fell below 50, to 47.9.

USDJPY rose 0.72% to 146.39 due to wider US-JP yield differential. Short term US yields rose further, with 2 years UST at 5.078, up 13.54 basis points. Tokyo CPI yoy came in at 2.9%, consensus at 3.0%.

Oil & Commodity

Bloomberg Commodity Index rose 1.18%, as gold price rose 1.36% to 1914.96. Base metals rose as well, with Aluminium (+0.70%), Copper (+1.51%) and Iron Ore (+6.43%). Oil prices fell, with WTI falling 1.75% to 79.83 and Brent falling 0.38% to 84.48.

ECO

M – AU Retail Sales, EU Money Supply, US Dallas Fed Mfg Act.

T – JP Jobless Rate, SW GDP, US Cons. Confid.

W – NZ Building Permits, AU Building App./ CPI, US Mortg. App, EU Cons./Econ./Indust./Svc Confid., US Mortg. App./ ADP/ GDP/ Core PCE/ Personal Cons./ Pending Home Sales

Th – JP Retail Sales/ Indust. Pdtn, CH PMI, EU CPI, US Initial Jobless Claims/ Personal Income/ Personal Spending/ MNI Chic. PMI/

F – NZ Cons. Confid., JP Capital Spending, JP/CH/SZ/EU/UK/US/CA Mfg PMI Aug Final, UK Hse Px. SZ CPI, NO Unemploy. Rate, US NFP/ Unemploy. Rate/ ISM Mfg/ ISM Prices Paid, CA GDP

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.