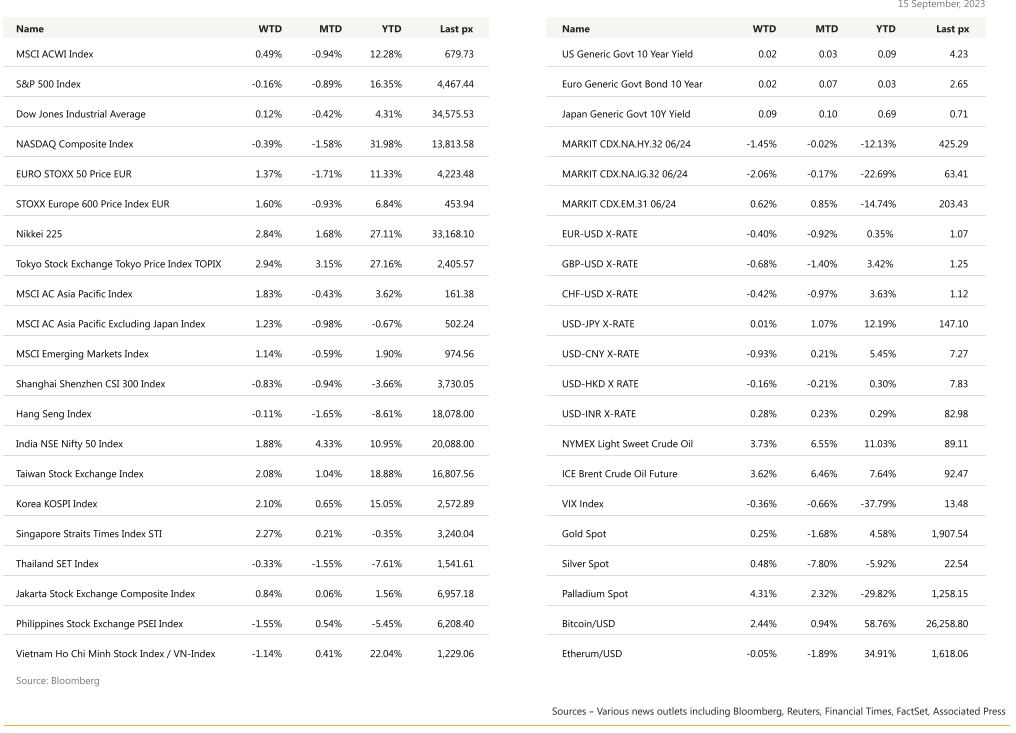

KEY MARKET MOVES

Source: Bloomberg

Source: Bloomberg

MACRO OVERVIEW

Global

US markets started positively following Yellen’s statement that she’s increasingly confident the US will contain price growth without major damage to the job market, and Chinese markets began stabilizing but for the week, markets ended flat to marginally lower on Friday’s selloff, with the latest concern surrounding an unprecedented strike in the auto sector and a weakening economic sentiment. The $4 trl triple witching option expiries didn’t help either. Consumer discretionary bore the brunt of the selloffs led by Ford and GM. Tech was dragged lower by Adobe whose results did not match high expectations for AI investors and China’s ban on Apple’s iphones. Its latest product and update launch underwhelmed. The Nasdaq had earlier been buoyed by ARM Holding’s stellar debut which soared some 30%. In short, Wall Street grew nervous over how long the UAW strike will last and on concerns the AI trade was too optimistically priced in. Economic data meanwhile showed prices continue to remain stubbornly high prompting concerns that the Fed is not yet done hiking rates.

Core CPI accelerated for the 1st time in 6 months to 0.3% MoM and headline CPI came in slightly higher at 3.7% YoY following higher energy prices. All in all, the data provided little direction for the markets – prompting Citi to expect: “The Fed is very likely to ‘skip’ hiking this month, followed by an emphasis on higher-for-longer policy.” Prices paid to US producers (PPI) increased by the most in over a year, due to rising energy and transportation costs. Oil & gas companies advanced following WTI rising above $90 for the first time since November of 2022. Retail sales also rose at a higher rate than expected. At the same time, University of Michigan sentiment survey on Friday showed US inflation expectations fell to the lowest level in more than two years to 3.1% and 2.7% for the 1-Yr and 5-10 Yr categories respectively, though sentiment also declined more than expected.

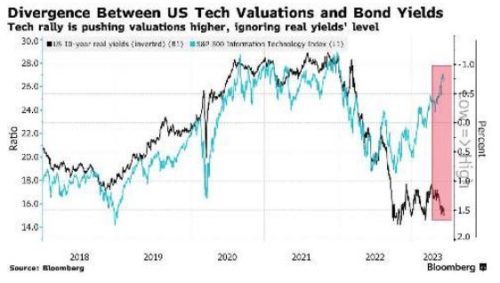

It is however, interesting to see that conditions at the moment are rather neutral (and not overly bought) when one looks at the S&P 500’s forward PE ratio and the US10YT real yield ~ 18.9x and 1.9% respectively prompting some analysts to label the markets to be in a goldilocks scenario:

The week ahead will focus on the Fed’s decision on rates expected out Thursday morning to be unchanged. We’ll also have housing starts and the S&P Global manufacturing, services and composite PMI’s.

Bloomberg reported that the higher for longer mantra has doubters in the bond markets. One trader positioned for a 3% rate by the middle of next year versus a current market level of around 5% with the premium paid on that bet being in excess of $10 million. Whilst we’re not as bold, I say “make hay while the sun shines’’ and take advantage of the current 5.5% to 6% yields on good IG rated 3 year duration papers.

Europe

The European Central Bank raised interest rates for the 10th meeting in a row last Thursday. The 25bp pushes the rate the ECB pays on bank deposits to 4.0%, the highest level since the euro currency was launched in 1999. Inflation was seen as still too high, more concerning than weakening growth prospects.

The market was sort of expecting ECB to hike 25bp but they were not expecting them to signal they are possibly done. ECB maintained a data-dependent stance but emphasized rates were sufficiently restrictive and this level would be maintained for inflation to return to the target which hinted that the ECB might have reached, with this hike, its terminal rate.

As a result, markets are now pricing in only a 15% probability of a hike for the rest of 2023, while more aggressive cuts have been priced in for 2024 (almost 80bp in total).

Market’s interpretation of ECB’s decision was dovish, leading to an ease of financing conditions. While the ECB decided to hike policy rates to reinforce the monetary tightening already in the pipeline, the action produced the opposite market reaction on the day. The EURUSD depreciated at announcement of the rate increase and market is pricing a greater risk of overtightening and reprice lower the probability of further rate hikes.

Also, Euro zone industrial production contracted by 1.1% m/m in July, below Bloomberg consensus, underlining downward revisions of economic growth for this year in European Commission forecasts. 2 points to highlight: The energy-sensitive sectors continued to reduce production levels in July, with little signs of bottoming. In addition, the post-pandemic normalisation in production of motor vehicles seemingly halted and even contracted in July. Levels are still markedly below those pre-pandemic.

Asia

Strong credit data published on Monday in China showed recent steps to bolster the real estate market may be starting to lift household demand for mortgages, while corporate loans also picked up. CPI data returned to gains after a drop in July, while factory-gate deflation also narrowed. Mainland markets were lifted by the series of encouraging news.’ The People’s Bank of China said it would cut the reserve requirement ratio (RRR) for yuan deposits by 0.25 percentage points, to 7.4 per cent, effective Friday. It is the second such cut this year. China’s yuan has lost more than 5% of its value against the dollar so far this year to become one of Asia’s worst performing currencies for 2023. The CSI 300 index closed the week weaker by 0.83% and Hang Seng index weaker also by 0.11% despite the positive news.

In Japan, private core machinery orders (domestic private orders excluding those from electric utilities and for ships) fell 1.1%m/m, sa in July after a 2.7% increase in June, broadly in line with our forecast. The July decline was attributable to orders from manufacturers, which fell 5.3% in the month. Japan manufacturer confidence fell by the most in eight months while services sector sentiment also dropped sharply.

A separate Japan MOF business sentiment index showed improvement for manufacturers and nonmanufacturers, while wholesale inflation slowed for an eighth straight month. The consensus view is that the Bank of Japan will keep policy on hold later this week.

South Korea’s unemployment rate on a seasonally adjusted basis unexpectedly dropped to a record low of 2.4% in August from a level of +2.8% in July, thus putting pressure on the Bank of Korea to retain a hawkish bias. Household debt rose sharply, prompting financial authorities to introduce loan curbs.

In Southeast Asia, looking ahead to the week, central banks in the Philippines and Indonesia will also set rates. Philippines is expected to lift rates by 25 bps to nip inflationary pressures in the bud. Fuel and food prices are heating up. The peso is also facing fresh downward pressure, boosting import costs. For Bank Indonesia, the story is familiar — we expect it to stay on hold and continue to think the next move will be to loosen policy. But it’s still too early for a rate cut, which could hurt the rupiah by narrowing the yield differential with the US dollar.

GEOPOLITICS

G20 members made announcements in the sidelines, including a US-led trade corridor from India to Europe through the Middle East; and an India-led pact on biofuels. Neither involved China.

India and Saudi Arabia, took part alongside other G20 leaders in the unveiling of ambitious plans to create a modern-day Spice Route, boosting trade ties with potentially wide-ranging geopolitical implications. “This corridor will not only connect the two countries, but economic cooperation, digital connectivity between Asia, West Asia and Europe,” Modi added. The initiative will link railways, ports, electricity and data networks and hydrogen pipelines.

President Biden said he thinks an invasion of Taiwan is less likely now with China undergoing an economic slowdown.

Japan, China share of US Treasuries falls to record low: Nikkei cited Refinitiv data showing Japan and China’s share of US Treasury holdings declined to the lowest on record as the US issues more debt and the two Asian countries try to keep their currencies from sliding past historic lows.

Combined $1.94T in Treasuries held as of June makes up about a quarter of all US debt held abroad but just under 8% of the total, compared with a high of 25.4% in 2007.

North Korea’s Kim visited Russia at the invitation of Putin. Despite denials by both Pyongyang and Moscow, the United States has said talks are advancing actively for North Korea to supply arms to Russia, which has expended vast stocks of weapons in more than 18 months of war. AFP News reported that the two sides discussed increasing supplies of grain and the resumption of regular air travel. The two countries also discussed reviving long-muted infrastructure projects.

Hong Kong-listed auto makers fell sharply in late trade Wednesday after EC President von der Leyen said Brussels would launch anti-subsidy investigation into Chinese EVs that are “distorting” EU market. The Probe would constitute as the largest trade case launched by EU as it tries to prevent replay of what happened to its solar industry in early 2010s. The EU investigation may lead to tariffs on Chinese EV imports close to the 27.5% level already imposed by the US on Chinese EVs. The probe could take up to nine month. The rapid expansion in the EV industry, in terms of innovation and advanced manufacturing techniques, holds promise for future economic growth of China. Potential EU tariffs on imports of Chinese EVs could exert more downward pressure on China’s exports to the region. Exports to the US and EU — which each account for about 15% of China’s total outbound shipments — have led this year’s export declines. Chinese shipments to the EU plunged 11% in the eight months through August versus the year-earlier period, reversing an 8% increase in the full 2022.

China announced it was sanctioning Northrop Grumman Corp. and a subsidiary of Lockheed Martin Corp. for supplying arms to Taiwan, the latest example of Beijing symbolically showing its displeasure at US support for the island. “In accordance with the Anti-Foreign Sanctions Law of the PRC, China decided to impose sanctions on these two above-mentioned US defense companies,” said Chinese Ministry of Foreign Affairs spokeswoman Mao Ning during a regular press briefing in Beijing on Friday. She used the abbreviation of the country’s formal name, the People’s Republic of China. Mao said Lockheed Martin has “directly participated in the US arms sales to Taiwan,” while Northrop Grumman “has participated in US arms sales to Taiwan several times.” Beijing claims sovereignty over Taiwan, although it has never had control of the self-ruled island. The action is likely nothing more than a symbol of China’s unhappiness about the weapon sales, as neither firm has any activities to sanction in China.

CREDIT/ TREASURIES

The impact on the US Treasury curve of all the data published last week was that every point on the curve moved higher by between 3 to 6 basis points, the long end moving the most. US IG & US HY lost 15bps over the week and leverage loans gained 0.30%. Credit spreads were unchanged last week.

The economic macro data in the US last week were, in average, stronger than expected and they could have an impact on the FOMC rate decision this Wednesday. Economists are now pricing in an even chance of another Fed rate hike this year. Furthermore, the “Supercore” measure that also excludes shelter and used cars and trucks spiked up to a 6-month high of +0.4%. A big driver of that was a strong performance for the transportation services category, which includes things like vehicle insurance and airline fares. That was up by +2.0% on the month. A slightly concerning underlying trend was also shown by Cleveland Fed’s estimates of median and trimmed mean inflation, both of which were at their highest in four months at +0.3% mom.

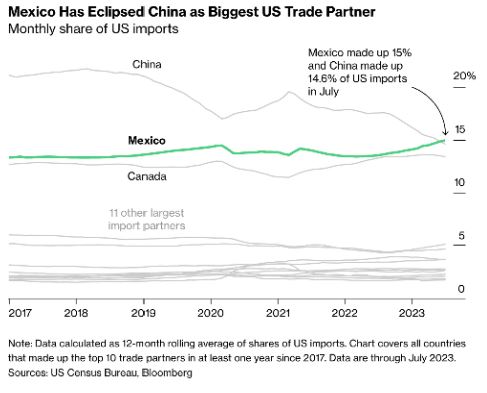

An interesting point to share, the de-globalisation or the cost of reshoring supply chains domestically or close to home that many economists are talking about, one of the main beneficiaries from the shift away from China, in regards of the US, is Mexico.

On average, wages in Mexico are similar or slightly lower than in China. The logistic cost savings due to Mexico proximity with the US is allowing the US to import goods at lower prices than if they were produced in China. The chart below shows Mexico has overtaken China as the US biggest trading partner in term of US imports. The Mexican peso seems to be benefiting from this trend and has appreciated by roughly 12% this year Vs the US dollar, which makes it one of the best performers this year. It is trading at its highest vs the US dollar over the past 7years. Core CPI in Mexico is trading at 5.95%, still way above the central bank target of 3%, which is not a fix target, they have some flexibility of about 1%, but still down from 9% 10Months ago. But Bank of Mexico are keeping a very restrictive monetary policy with a short-term rate currently at 11.25% (the curve is slightly inverted) which seems to have a negative impact on Growth recently (2nd Q GDP printed at +3.60%, down from 5% late last year.

FX

DXY USD Index rose 0.22% to 105.322, as UST yields across the curve rose amid resilient US data. In addition, EUR weakness added to DXY USD strength.

Data wise, US CPI broadly matched expectations, headline CPI mom rose 0.6% (in-line), which raised the yoy rate to 3.7% (C: 3.6%; P: 3.2%). Core CPI rose by 0.28% mom (C: 0.2%; P: 0.16%), which brought the yoy rate down to 4.3% (C: 4.3%; P: 4.7%). August retail sales rose 0.1% m/m (C: -0.1%; P: 0.7%) while headline retail sales rose 0.6% m/m (C: 0.1%; P: 0.5), however there were downward revisions to July and June numbers. Core PPI rose by 0.34% mom in (C: 0.2%; P: 0.32%) and 3.0% yoy (C: 2.7%; P: 2.9%). Headline PPI rose by 0.74% mom (C: 0.4%; P: 0.4%) and 1.6% yoy (C: 1.3%; P: 0.8%). Michigan sentiment came in at 67.7 (C: 59.0, P: 69.5).

EURUSD fell 0.40% to 1.066, as ECB raises the deposit rate by 25bp to 4.00% and signals “the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.” ECB downgraded its growth forecast for the Euro Area in 2023 and 2024 by three-tenths in both years. That now leaves its forecasts at +0.8% this year and +1.3% in 2024. For inflation, it sees a slightly lower figure this year at +5.6%, down two-tenths, but the 2024 projection has been raised a tenth to +2.9%.

GBPUSD fell 0.68% to 1.238 due to weak UK data. UK GDP was lower-than-expected at -0.5% mom in July (C: -0.2%; P: 0.5%), partially due to weather and NHS strikes, but also an actual softening in momentum. UK RICS house price data showed the largest net % of declines in house prices in the last three months (68%) since the global financial crisis.

USDJPY closed the week at 147.85 as UST yields rose, recovering from the dip to below 146 last Monday, that follows the interview that BoJ Governor Ueda gave, where he said an end to negative interest rates was possible if they were confident that wages and prices were rising sustainably, and that they could have enough information on the wage outlook by the end of the year.

Oil & Commodity

Bloomberg Commodity Index rose 1.31% with base metal, oil and gold prices all rising. Oil secured its second consecutive week of gains, with WTI and Brent rising 3.73% and 3.62% to 90.77 and 93.93 respectively. OPEC data showed global oil markets face a 3mn bpd supply shortfall next quarter with deficit possibly the biggest in over a decade, while IEA predicts a “significant supply shortfall” in coming months. US government also expects that global consumption will exceed production. Iron Ore rose 4.99%, while Copper rose 2.26%, as China data surprised to the upside. China Industrial Production yoy rose 4.5% (C: 3.9%, P: 3.7%, while Retail sales yoy rose 4.6% (C: 3.0%, P: 2.5%). Gold prices rose 0.25% to 1923.91 despite higher US real yields.

ECO

- Tuesday – EU/CA CPI, US Housing Starts/ Building Permit”

- Wednesday – JP Trade Balance, CH LPR, UK CPI, US MBA Mortg. App./ FOMC Rate Decisio9

- Thursday – NZ GDP, SZ SNB Rate Decision, SW Riksbank Rate Decision, NO Rate Decision, UK BOE Rate Decision, US Initial Jobless Claims, Existing Home Sales, EU Cons. Confid’

- Friday – NZ Trade Balance, UK Cons. Confid., JP/EU/UK/US Mfg/Svc/Comps PMI Sep Prelim, UK/CA Retail Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.