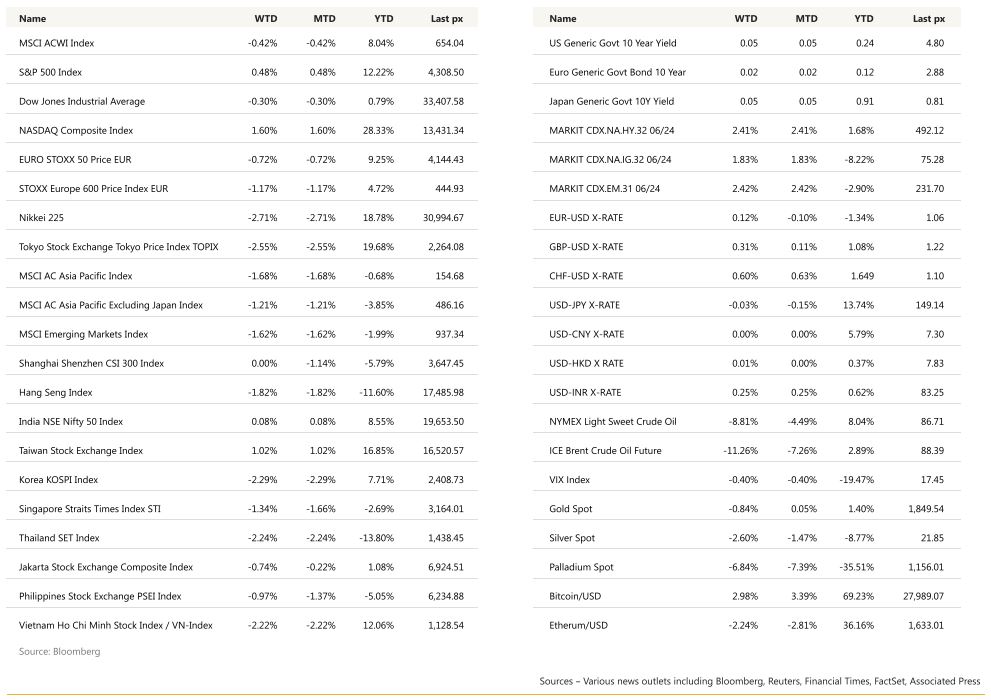

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

In a bizarre twist, US markets defied the gravitational pull of higher yields and closed the week higher with the Nasdaq up 1.6% and the S&P 500 up 0.5%. The nonfarm payrolls report on Friday showed employers accelerated the pace of hiring, with 336,000 jobs being added in September — well ahead of economists’ estimates with the unemployment rate holding steady at 3.8%. Wages however, rose at a more modest pace with MoM and YoY average hourly earnings underwhelming. The JOLTS data earlier supported this blockbuster reading, rising to 9.61 mln from a revised 8.92 mln previously indicating hirings edged up while layoffs remained low. In one of the big oxymorons in Wall Street, whether good news is bad news still, or vice versa, it appeared that good news is good after all, given that strong employment supports growth whilst inflation down-trends. US earnings-revision momentum ticked higher for a second straight month in September. Overall, analysts expect S&P 500 earnings to rise 6.5% in the fourth quarter compared with a year earlier, according to data compiled by Bloomberg Intelligence.

Fedspeak continued with Fed Governor Michelle Bowman this week saying that multiple interest-rate hikes may be required to get inflation down to the Fed’s goal, while Bank of Cleveland President Loretta Mester sees the case for another hike again in 2023. Crude oil posted its biggest drop since March, easing fears that the supply side of the economy will fuel an inflationary comeback with WTI falling to $82.79 a barrel. With events over the weekend following Hamas’ attack on Israel, crude has spike in excess of 4% this morning on fears of supply disruption – Brent trades $87.67 and WTI at $86.05 a barrel. A recent comparison to surging Treasury yields don’t intrinsically or necessarily spell doom for stocks.

For instance, between 1985 and 2005, inflation-adjusted yields averaged 3.5%, well above the current 2% plus, the S&P 500 managed to return 15% per year, according to Bank of America Corp.

This week will be yet another key data week with PPI on Wednesday and CPI Thursday: headline CPI YoY is expected at 3.6% and core at 4.1% whilst MoM Sept is expected at 0.3% both for headline and core. The end of week will also see Octobers reading for 1 yr and 5-10 yr inflation expectations.

With 10 year yields at 4.80% and the yield curve steepening significantly over the last month or so, we see an opportunity to capture this long duration play via an ETF on expectations that LT yield will soon be topping-out given the debate surrounding “landings”. We would articulate this expression via the LQD US etf iShares iBoxx $ IG Corporate Bond ETF with a dividend yield of 4.79%.

Today is a holiday in the US with Columbus Day although Exchanges will remain open.

Europe

Euro area employment report showed that the Euro area labor market remains solid. The number of unemployed fell by 107,000 in August, moving the unemployment rate down to 6.4% oya. This unemployment rate thus stands at a historical low and is consistent with solid labor markets.

Given the strong US labour market, it is proving that the economy is more resilient than expected. Similarly in the US, we also see a sharp sell-off for sovereign bonds in the EU. As in the US, there was also a sharp rise in European real yields. In Europe, already-cheap EUR duration could become cheaper.

Even with no further rate rises, the ECB is not yet done with monetary policy normalization. A more active form of quantitative tightening, such as the ECB reducing its reserves through selling bonds on the market rather than letting them expire, could be on the cards if slow disinflation persists. This would likely result in upward pressure on bond yields.

The composite output index was revised up by 0.1pt in September to an increase of 0.4pt to 47.2. this is noteworthy only because there have been downward revisions in recent months between the flash and the final reports and the final report this time round confirmed the increase/stabilization in the PMI in September after its sharp slide since April, Revisions were small but the 0.3pt upward revision of the composite employment PMI stands out: even though the output PMI points to stagnant GDP, companies are still hiring at a decent pace and this keeps a key support to the expansion in place.

Euro area retail sales fell 1.2% m/m in August and the decline was broad-based, with both food and non-food products seeing considerable declines of 1.2 and 0.9%. Overall, we think the retail sales currently under state spending in goods and that consumers are benefiting from increase in real income.

With that, the strength in real income, it has absorbed much of the inflation shock.

Overall, the weaker than expected retail demand might meanwhile help convince ECB to keep interest rates untouched, especially if inflation continues to ease and demand for goods and labor continues to cool.

This week, we see UK GDP and industrial production for Europe and UK. We will also have the ECB’s CPI expectations for one year and three years.

Asia

MSCI Asia closed the first week of October lower by 1.68%. China was closed for the Golden week holiday. Spending and travel over China’s Golden Week holiday undershot official expectations for growth. China recorded some 826 million domestic trips over the eight-day holiday that started Sept. 29, bringing in 753.4 billion yuan ($103 billion), official data showed. While much higher than 2022 — when the country was still largely contending with some of the world’s strictest pandemic controls — the figures fell short of government estimates for nearly 900 million trips generating 782.5 billion yuan.

Official manufacturing PMI showed factory activity returned to expansion for first time in China since March, in contrast with more export oriented Caixin PMI, which showed manufacturing slowed (though remained in expansion). Both showed stronger output and a pickup in inflation, but exports were weak. World Bank has cut its 2024 growth forecast for China to 4.4%, down from 4.8% estimated in April as its economy struggles with property sector crisis which threatens to harm growth prospects.

Hong Kong markets remained open, Hang Seng closed the week lower by 1.8%. China Evergrande (3333 HK) shares soared 28% on the resumption of trading Tuesday, which at one time jumped as much as 42% before paring much of early gains. Analysts caution against reading too much into the share surge as ongoing police probe of founder Hui Ka Yan and uncertainties about debt restructuring will continue to weigh on investor sentiment.

South Korean exports declined at a slower pace in September as semiconductor shipments shrunk at slowest pace in 12 months. South Korean industrial production grew at fastest pace since Jun-2020 led by chip production while manufacturing shrank, adding to signs of economic stabilization after trade data signalled semiconductor market is bottoming.

Manufacturing activity remained muted in Asia in September amid lacklustre global demand. Japan and Taiwan were both in contraction territories, as well as Vietnam, Thailand, and Malaysia. Indonesia saw expansion slow and only Philippines saw an improvement, flipping from contraction to expansion. Thailand expects $4B in tourism revenue from Chinese visitors after launching visa waivers. Thai Airways (THAI.TB) says flights from China have been over 90% full after visa waiver program launched for Chinese tourists. We also saw Thailand’s inflation data for September, it rose 0.3% yoy but fell 0.4% month on month. India s services sector strengthened further in September, witnessing strongest output in 13 years. India s S&P Global s services PMI stood at 61 in September, up from 60.1 in August.

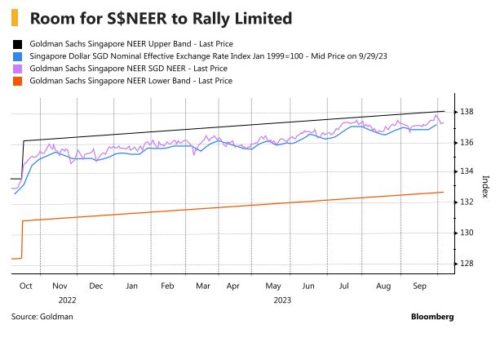

This week, we will see reporting on trade numbers across Asian countries, Balance of payments. We also have Singapore’s MAS on monetary policy. The Singapore dollar has held up fairly well against the stronger greenback this year but its resilience may soon be tested. Even after a 2% decline since end-December, the currency has stayed near top of the pack in Asia. Analysts expect the challenging export backdrop will likely continue to weigh on third-quarter GDP in ultra-open Singapore.

GEOPOLITICS

Global financial markets already rattled by elevated interest rates now face a fresh dose of geopolitical uncertainty following Hamas’s surprise attack on Israel. The yen and dollar — both haven currencies — strengthened as the trading week began following the deadly attacks. The flaring of tensions in the Middle East could drive energy prices higher, and undermine the efforts of central banks to bring inflation under control.

During the latest Hamas Israel conflict that just started, 700 Israelis have died, which was the deadliest attack in decades. Israel will probably have to answer very strongly to the recent events that started last Saturday on the exact 50th anniversary of the 1973 Yom Kippur war. So far, “only” 400 Palestinians have died. If extrapolated, using past conflict observations over the last 15years or since Hamas took control of Gaza, unfortunately thousands more people will probably be impacted. Israel has now formally declared war against Hamas. It remains to be seen if Israel Defence Force (IDF) will launch a full-scale offensive operation and invasion of the Gaza Strip. Supply of electricity, fuel and goods to Gaza have been stopped. The US are ordering an aircraft carrier to Eastern Mediterranean as well as other military ships. WTI price is up by about 5% this morning. Futures in the US are down currently 0.70%. Volatility is expected to increase in the coming days. The US were recently pushing for a more normalized relationship between Israel and Saudi Arabia.

This will probably not happen and will have to see if the current situation spread out to other countries in the region. Hezbollah in Lebanon already started targeting Israeli positions yesterday with rockets. Gaza covers 225 square KM, less than a third size of Singapore. The population of Gaza is estimated to more than 2.1Mio people, which make Gaza one of the most densely populated place in the world.

Israel has remained one of India s most dependable and crucial defence and security partners on the global stage. However, India faces a complex geopolitical landscape in West Asia, where it enjoys friendships on multiple fronts, including Saudi Arabia, Iran, Israel, and the UAE, among the region s major powers. The current situation will place the US-brokered Abraham Accords between Israel, the UAE, and Bahrain to a severe test, while the I2U2 (India, Israel, US, and UAE) coalition, primarily oriented towards economic collaboration, will encounter challenges.

Credit/treasuries

US September ISM Manufacturing came in at 49.0 Vs 47.9 expected, employment and new orders higher than expected, but prices below expectations. September ISM & PMI Services roughly in line with expectations and still above 50 (53.6 for ISM). August JOLTS +800k Vs expectations. September NFP 336K Vs 170K expected and private payrolls +263K Vs 160K expected. With respect to private sector hiring, leisure / hospitality (+96k) and private education / health services (+70k) once again accounted for the majority of job gains. Amidst the strength in hiring, it is worth noting that average hourly earnings were revised down slightly over the past few months, the three-month annualized growth rate of Average Hourly Earnings (3.4%) is closing in on that level. Though the 4.2% year-over-year growth rate of Average Hourly Earnings is still well-above the 3% threshold that Fed Chair Powell had referenced as consistent with the Fed s inflation goal.

The UST10Y yields tested 4.88% steepening to its highest against the UST2 s since October of last year, at -28 bps. Underpinning this resilience is a view that the economy remains strong enough for financial markets to withstand higher borrowing costs. Should the reason for higher yields be because we have a resilient economy and a strong labour market, then that would likely drive revenues and earnings growth and ultimately be a positive for markets.

The impact on the US Treasury curve were the following, the 2years yield was unchanged, 5years was up10bps, 10years was up 19bps, 30years was up 24bps. 2-10 spread is now trading at only -28bps.

Regarding credit market, US IG Credit Spreads widened by 2bps and US HY Credit Spreads widened by 12bps last week.

In term of performances last week, US IG lost 0.70%, US HY lost 0.30% & leverage loans lost 0.40%

This week main macro-economic data will be the September PPI & September CPI, the minutes of the September 20th FOMC minutes will be published and finally on Friday the October University of Michigan Sentiment Index will be announced.

FX

DXY USD Index fell 0.12% to 106.04 despite significant upside surprise in September US non-farm payrolls (C: 170k; P: 227k), and with upward revisions to prior months. Unemployment rate remain unchanged at 3.8% (C: 3.7%). Average Hourly Earnings remained at 0.2% m/m (C: 0.3%), which resulted in a slowdown in the labor income proxy. The ISM Manufacturing PMI came in well above consensus expectations at 49.0 in September (C: 47.9; P: 47.6), the highest level since November 2022 when the headline index also registered 49.0. DXY USD index is still in an upward trend, with an immediate support level at 1.06 and next at 1.056.

EURUSD rebounded from RSI oversold territory, to close the week +0.12% at 1.0586. EURUSD touched a ytd low of 1.045 intra-week. Technically, EURUSD is still in a downward territory, and the important level to watch for the rebound to be sustainable is 1.06/1.065. Data wise, the final September Composite PMI came in at 47.2 (C: 47.1; August: 46.7. PPI fell 11.5% y/y in August (C: -11.5%; P: -7.6%). Retail Sales fell by 1.2% m/m in August (C: -0.5%; P: -0.1%).

GBPUSD rebounded from RSI oversold territory, to close the week at +0.31% at 1.2237. GBPUSD touched an intra-week low of 1.2037, before the rebound. Data wise, UK Construction PMI collapsed to 45 in September (C: 50; P: 50.8). Final Composite PMI in September came in higher than expected at 48.5 (C: 46.8). UK Decision Maker Panel Survey for September was balanced. Expected wage growth ticked up a bit m/m, but the three-month average remained at 5%. Expected output prices ticked down again, with the single month metric at 4.4% and the three-month average at 4.8%. Inflation expectations were broadly unchanged, while the expected employment growth series ticked higher.

USDJPY was relatively unchanged from previous week at 149.32 (-0.03%). Volatility was high with USDJPY touching an intra-week high of 150.14, before falling sharply to 147.5o. Despite rumors that BoJ had intervened, but the change in the BoJ’s current account balance data for October 5 was almost in line with what money market brokers had anticipated, which suggested there was no intervention by the JP MOF Finance on October 3. The BoJ announced another unscheduled JGB purchase operation for October 4, in response to the continued sell-off in JGBs. In addition, BoJ Summary of Opinions from the September Monetary Policy Meeting suggested participants increasingly believe there is risk of sticky inflation but remain divided on its sustainability

Oil & Commodity

Crude oil fell significantly after the EIA releases indicating that US gasoline consumption drops to a 22 year low with inventories rising which resulted in oil demand concerns. WTI and Brent fell 8.81% and 11.26% respectively, to close the week at 87 and 88.83 last Friday. However, Hamas surprise attacks on Israel resulted in a surge in oil prices this morning, as oil prices are up more than 4% currently. The attacks threatened to inflame tensions in the Middle East, home to almost a third of global supply.

Gold fell 0.84% to close the week at 1833.01, as US treasury yields continued to rise. US real rate rose to a high of 2.54% last week. However, Middle east tensions caused a surge in gold prices this morning, where gold opened the week +0.69% at 1845

ECO

- Monday – NO GDP, EU Sentix Inv. Confid

- Tuesday – AU Cons. Confid./ Biz Confid., JP Trade Balance, NO CPI, US Small Biz Optim./ Wholesale Inv., NY Fed 1Yr Inflat. Exp

- Wednesday – JP Machine Tool Orders, EU ECB 1 & 3 yr CPI Exp., CA Building Permits, US PP

- Thursday – NZ House Sales/ Food Prices, JP PPI/ Core Machine Orders, UK GDP/ Indust. Pdtn/ Mfg Pdtn/ Trade Balance, US CPI/ Initial Jobless Claim

- Friday – NZ Biz Mfg PMI, JP Money Stock, CH CPI/ PPI, SW CPI, EU Indust. Pdtn/ Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.