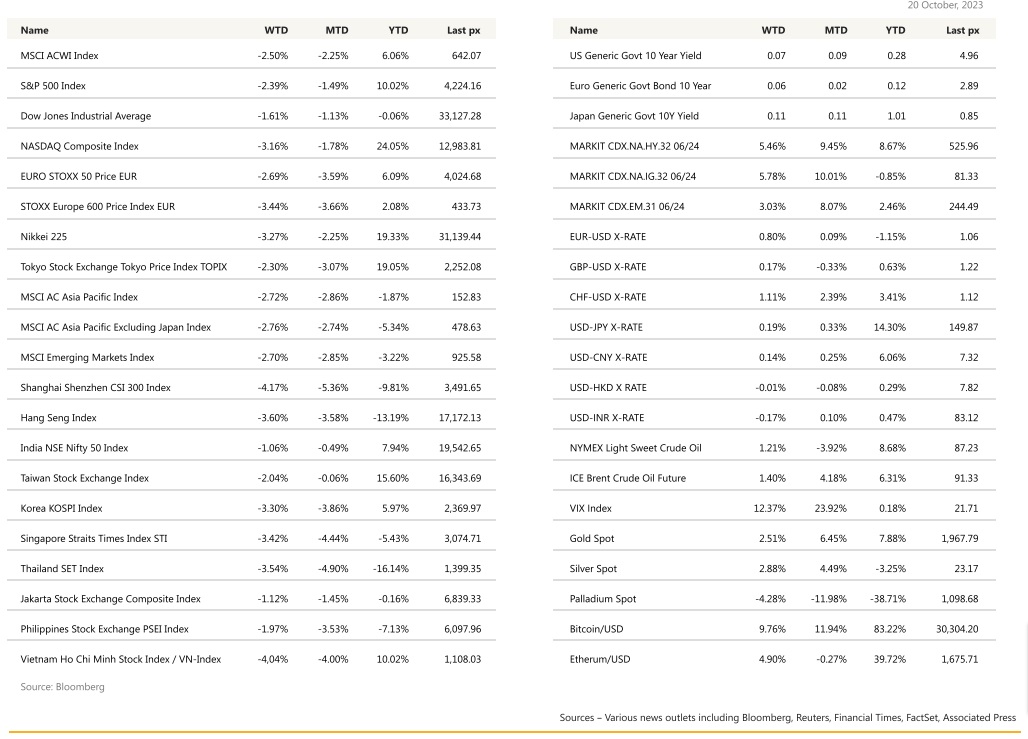

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

Stocks ended the week lower with rising treasury yields and geopolitical concerns weighing heavily on sentiment.

After briefly trending higher at the start of the week, by midweek markets headed lower with the S&P 500 declining 2.4% and the Nasdaq Composite by -3.2%. The S&P 500 fell below its 200-day moving average for the first time since March. The VIX remained above 21, the highest in seven months. The threat of the “next stage” of Israel’s military operation, likely a ground invasion after stepping up aerial strikes over Gaza has kept markets on edge. Discussions with dozens of leaders and senior officials from the Middle East, Europe and Africa converged on Cairo, searching for ways to prevent the Israel-Hamas war becoming a wider conflict remains unresolved. Friday in NY, Chair Powell once again noted that inflation was still too high, and left the door open for another rate hike but he also acknowledged that rising yields, especially on the long bond, have tightened financial conditions “significantly in recent months”. He echoed the sentiments from of several of his colleagues in saying that rising yields may mean the Fed may not have to tighten any further. UST10’s retreated to 4.91% from an intraday high of 4.99% whilst the policy sensitive UST2Yr closed at 5.07% down from its high of 5.25%. These are all classic signs of risk-off where bond yields fell, stocks declined and gold rallied. However, investor positioning in stocks has become so bearish that it’s triggered a “contrarian buy signal” in a custom Bank of America Corp. indicator, setting the market up for a short-term rally, according to strategist Michael Hartnett. Noted movers in the market were Netflix, which surged on its earnings and subscription numbers and, price hikes, Tesla which fell after missing profit & revenue expectation and Nvidia which slumped further as the US ramped up its efforts to keep advanced chips out of China.

Thus far, earnings have proven to be “better than our constructive view” according to Deutsche Bank. Given that the US is supporting wars on two fronts, the Fed may be inclined to hold rates in the face of sticky inflation”, said one veteran CIO.

Weekly jobless claims fell less than expected, once again supporting a resilient labour market in spite of the ongoing UAW strikes. Retail sales earlier in the week jumped, beating expectations and pushed yields higher underscoring the persistent strength of the economy. The Fed’s Beige Book report showed little change vs last month and it also noted that the near-term outlook for the economy was “stable or having slightly weaker growth”. This week will see the release of GDP annualised QoQ, Personal Income & Spending as well as PCE Deflator at the back end. Consensus is looking for PCE Core YoY to come in at 3.7% and MoM at 0.3% – both up from August.

Gold has seen a surge from lows of $1825 to a high of $1985 an oz. Demand for gold as a safe have typically plays out at the onset (as in the Ukraine invasion) but tends to fizzle out after a month or two into the conflict. We see an opportunistic window here to consider a gold deccumulator for 6 months ~ strike at $2075/$2080 with a knock-out at $1830.

Europe

With higher global yields and high geopolitical tensions, European markets lost a decent amount of ground last week, with Eurostoxx posting a decline of 2.69% to a 7-month low. That was echoed across the major indices, with losses for the FTSE 100 (-2.60%) and the DAX (-2.56%), whilst the Swiss Market Index (-5.06%) had its worst weekly performance of 2023 so far. Over in Europe, there was a similar shift in long-term borrowing costs, with yields on 10yr bunds (+15.2bps), OATs (+14.6bps) and BTPs (+15bps) all moving higher.

UK 10 yr yields rose 26.5 bps, as the latest UK CPI release surprised on the upside. In turn, that led investors to ramp up their expectations of another hike from the Bank of England.

Polish equities saw a major outperformance following the election on last Sunday which will likely yield a pro-EU government under the leadership of former Polish PM and European Council President Donald Tusk. That rally included the WIG20 index (+2.75%), whilst the Polish Zloty rose (+1.66%) the Euro.

Asia

Asian shares plumbed a fresh 11-month low last Friday (20th) as fears of a regional conflict in the Middle East intensified and as a relentless rise in long-term U.S. yields pressured valuations, while supply concerns lifted oil prices further. Powell’s comments that additional interest rate hikes could be warranted in view of economic resiliency and labour market tightness did not help sentiments in the bond markets. MSCI’s broadest index of Asia-Pacific ex- Japan dropped to a fresh low, down 2.7% last week.

China’s blue chips index, the CSI300 fell 0.4%, while Hong Kong’s Hang Seng index slumped 1%. China on Friday held its benchmark lending rates steady as the economy showed signs of stabilisation. CSI is now lower 9.8% for the year and Hang Seng down 13.2% for the year.

China Securities Regulatory Commission said it’s increasing margin ratio for ordinary securities borrowing to at least 80% from 50% and that for hedge funds to 100%, effective from 30- Oct. Other rules will restrict lending of shares by strategic investors and senior management and increase supervision of “various arbitrage activities”. Beijing is trying to arrest a sharp fall in its stock markets after exodus of foreign funds.

China Q3 GDP expanded 4.9% y/y, above consensus. Industrial production growth steady at 4.5% y/y in September. Fixed asset investment growth slipped to 3.1% YTD, continuing gradual deceleration throughout the year. Infrastructure moderated to 6.2% from 6.4%. Real estate declines deepened to 9.1% from 8.8% as housing sales continued to tail and new construction starts remained down by more than 20%. Unemployment rate fell to 5.0% from 5.2%.

Japan’s core inflation in September retreated to 2.8% from 3.1 % the previous month for the first time in over a year on the back of lower imported fuel prices. It remained above the Bank of Japan’s target of 2 per cent for the 18th consecutive month. Stripping out both energy and fresh food prices showed inflation also slowed to 4.2% from the previous month’s 4.3%.

China’s Beige Book highlighted weakness in corporate borrowing. RBA minutes showed members warning of low tolerance for sticky inflation, November’s meeting now considered “live”. BOK held benchmark 7D repo rate unchanged at 3.5% Thursday, as widely expected. Bank said it will maintain restrictive policy stance for considerable time, will monitor inflation slowdown, economic downside risks, household debt, monetary policy changes in major countries. Singapore’s volatile exports slid again y/y as pharma shipments plunged but overall figure at least showed deceleration in the slowdown. Bank Indonesia unexpectedly raised its base rates by 25bps to 6.0% as its currency sank to near record lows. New Zealand Q3 CPI was slightly softer than expected

GEOPOLITICS

Putin arrived in Beijing for meeting with Xi. It is for a forum on China’s Belt and Road with the heads of Rosneft and Gazprom as part of the Russian delegation. China has become the top buyer of Russian oil and coal and has seen its imports to Russia increase, the relationship mostly reflects Russia’s lack of viable trade avenues.

Middle East tensions continue to dominate the headlines. There are growing reports Israel may be shifting its strategy away from a general ground assault due to US pressure to preserve civilian life and after considering the advantages urban warfare would offer Hamas. A US warship shot down missiles likely targeting Israel that were fired by Yemen-based Houthi rebels. The incident marks the first shots the US has fired in Israel’s defense since the recent conflict began.

In Washington, President Biden delivered an Oval Office address where he asked Congress to approve a $105B security package with $14B for Israel and $60B for Ukraine. The US is also to send more advanced weapons systems to Middle East. A small convoy of international aid enters Gaza hours after two US hostages released.

China believes “force is not a way to resolve” the Israeli- Palestinian conflict and is once again calling for a ceasefire, its envoy for the Middle East pleaded in Egypt, the foreign ministry said on Sunday (Oct 22). UN Secretary- General Antonio Guterres called for swift “action to end this godawful nightmare” after two weeks of war between Israel and the Palestinian Islamist movement Hamas.

The US is to refine rules and close loopholes on regulations first introduced in Oct-22, which limit China’s access to advanced semiconductors and chipmaking equipment. The amendments will strengthen controls on selling graphics chips for AI applications and impose additional checks on Chinese firms that try to evade export restrictions by routing shipments through third countries.

China has threatened to throttle exports of graphite, an important material used in electric vehicle batteries, as Beijing hits back at US-led restrictions on technology sales to Chinese companies. China, which dominates global chains for the critical resource, will require special export permits for three grades of graphite. China produces about 65 per cent of the world’s natural graphite, according to the US Geological Survey’s 2023 annual report on the mineral.

Credit/treasuries

Treasuries were weaker again, with the 30Y yield moving firmly above 5% and the 10Y touching that level before retreating. The curve steepened again, with the 2/10 spread at one point moving to its least inverted point since last September.

After being spurred to the highest levels since at least 2007 this week, most US government bond yields declined by at least 5 and as much as 10 basis points. The 10-year’s traded near 4.91% after touching 4.993% earlier Friday. It remained higher on the week by about 30 basis points, among the biggest moves in the past five years.

Interesting fact, 8 years after Greece became the first developed country to default on an IMF loan, the U.S. 10-year yields have now surpassed those of Greece!

Japan’s 10Y yield above 0.8% for first time in ten years despite BoJ announcing unscheduled bond-purchase operation to cap gains. Bloomberg commented intervention intended to remind markets of its determination to slow pace of yield increases but operation failed to make immediate impact. Economists said correlation between JGBs and US Treasuries mean JGB yield trajectory remains upward with more robust US economic data overnight reinforcing the higher-for-longer rates mantra.

FX

DXY USD Index fell 0.45% to 106.163 despite US data reacceleration, higher local yields and high geopolitical tensions in the Middle East. In the speech on the economic outlook, Powell said that they were “proceeding carefully”, and explicitly agreed to the fact that financial conditions “have tightened significantly in recent months”. There were also some hawkish comments, including that “Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy.” Powell then added a notable comment that he thinks that policy is too tight right now. Data wise, US retail sales came in above consensus, and there was an upward revision to the August number as well. Weekly initial jobless claims fell beneath 200k for the first time since January, coming in at 198k (C: 210k).

EURUSD rose 0.80% to 1.0594. Data wise, EU CPI came in in-line with consensus, mom at 0.3% and yoy at 4.5%. EURUSD downward trend is still intact, with key resistance level at 1.06/1.065. EURCHF fell 0.33% to 0.945 with CHF the best performing G10 currency due to its safe-haven status.

GBPUSD rose 0.17% to 1.2164. Data wise, the latest UK CPI release surprised on the upside at +6.7% in September (C: +6.6%). In turn, that led investors to ramp up their expectations of another hike from the Bank of England. In addition, there were comments from BoE Chief economist Pill that there was still “some work to do” for the Monetary Policy Committee to achieve their inflation target.

USDJPY rose 0.19% to 149.86, supported by wider US-JP rates differential, as US yields continue to rise. Data wise, Japan’s core inflation dropped below 3% to 2.8% (P: 3.1%) for the first time in over a year on the back of easing gas and electricity prices. BoJ announced another unscheduled bond buying operation to cap the 10 yields on JGB.

Oil & Commodity

Crude oil rose with WTI rising 1.21% to 88.75 and Brent rising 1.40% to 92.16 due to high geopolitical tensions in the Middle East. There was no lack of action where there were headlines that a US Destroyer intercepted missiles fired by a Houthi terrorist group and a US military base in Syria was attacked by drones. In addition, Iran’s foreign minister called for an oil embargo against Israel. For reference, Israel only plays a small role in the global oil market, but the comments added to fears of a broader escalation and served as a reminder of the 1973 oil embargo (50 years ago) that sent several Western countries into recession and led to a sharp rise in inflation.

Gold touched a year to date high of 1997.22 before closing the week at 1981.40 (+2.51%) due to the geopolitical tensions in the middle east. We see resistance level at around 2000 levels.

ECO

- Monday – US Chicago Fed Nat Act./ EU Cons. Confid.

- Tuesday – AU/JP/EU/UK/US Mfg/Svc/Comps PMI Oct Prelim., UK Employ., US Richmond Fed Mfg

- Wednesday – AU CPI, SW PPI, EU M3 Money Supply, US MBA Mortg. App/ New Home Sales, CA BOC Rate Decision

- Thursday – JP Machine Tool Orders, EU ECB Rate Decision, CA Employ., US Wholesale Inv./ GDP/ Durable Goods Orders/ Core PCE/ Initial Jobless Claims/ Pending Home Sales

- Friday – NZ Cons. Confid., JP CPI, AU PPI, CH Indust. Profit, SW Retail Sales, US Personal Income/ Personal Spending/ Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.