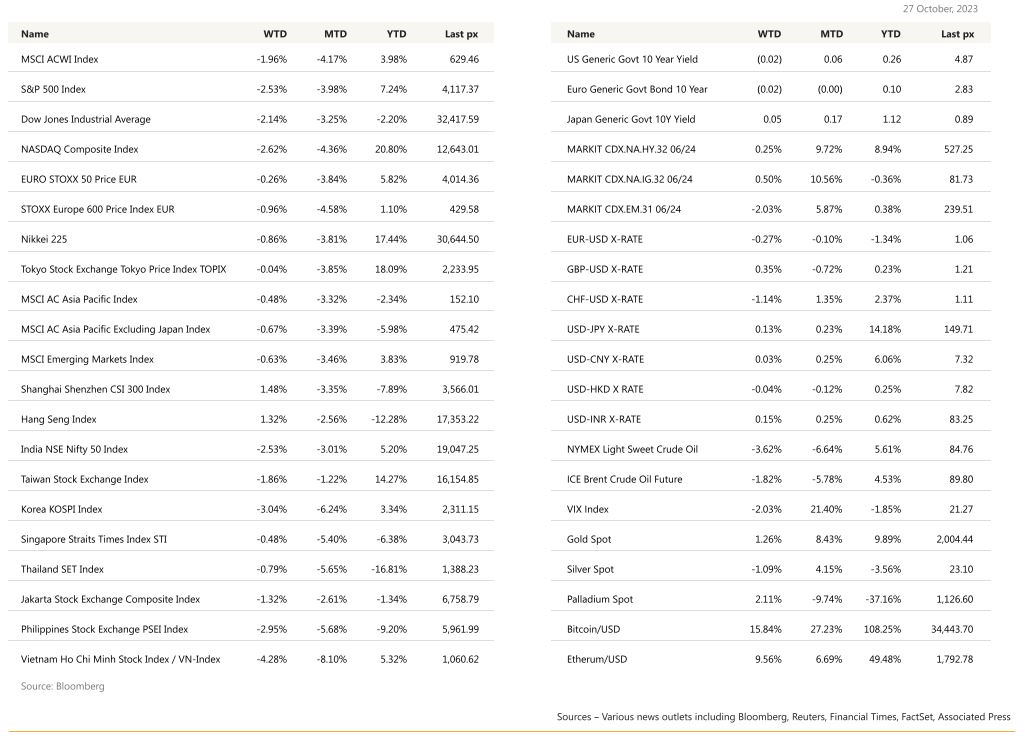

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

The number we were all looking out for, the PCE deflator, came in a tad higher than expected fuelling expectations further that the Fed is poised to keep interest rates higher for longer. The Fed’s preferred measure of inflation accelerated to a four-month high, core PCE rising 0.3% from 0.1% in September showing the persistent pressures that are driving the central bank to keep monetary policy tight. On the supply side, the core PCE price deflator slowed to 2.4% in Q3 versus a consensus of 2.5%, the slowest quarterly rise since Q4 2020, and a fall from 3.7% in Q2.

The S&P 500 entered a technical correction on Friday after closing some 10% below its recent peak. The Nasdaq which crossed the said 10% line earlier, rebounded on Friday, helped by better-thanexpected results from Amazon. Earlier in the week, Google disappointed with its results reporting a smaller than expected profit for its Cloud unit exacerbating concerns that, “If tech disappoints, it’s hard to see what drives equities higher in the near term,” said a strategist. CBOE’s VIX closed above 21. Clearly, data releases once again supported the narrative of good news is bad, such as consumer spending outpacing forecasts in September, underscoring the recent strength in the economy. GDP expanded at a better than expected 4.9% rate for the third quarter, while economists expected 4.5% growth. In addition, near-term inflation views rose to a five-month high of 4.2% from 3.8%, data from a University of Michigan sentiment survey showed Friday. Gold rose to breach $2,000 an oz as tension in the Middle East escalated and inflationary pressures remained. 10-year US Treasury yields came off the boiler of 5% plus after the release of weaker-thanexpected U.S. inflation price and disposable income data earlier, and crude oil slipped after a rise in US crude stockpiles and a stronger USD. UST10’s and 2’s are at 4.83% and 5.00% respectively.

Still, markets are expecting a November FOMC pause this week (the ECB last week kept rates unchanged) and a likely weariness of rate cuts under current robustness in the economy. BTC broke through the $30k resistance rising more than 14% over a couple of sessions as shares in cryptocurrency-linked companies gained, fueled by expectations of fresh demand from exchange-traded funds. BTC traded at $34k with ETH trailing at $1800.

The number of Americans falling behind on their car loans is at the highest level for nearly three decades. Fitch Ratings has reported that 6.11% of subprime auto borrowers were at least 60 days behind on their loans and up from the 5.80% seen in January.

A senior executive at Fitch, said after the release that the “subprime borrower is getting squeezed”, adding “They can often be a first line of where we start to see the negative effects of macroeconomic headwinds”. More than a third of Americans are considered subprime borrowers, meaning they have lower credit scores. As a result, they will pay higher interest rates, eyewatering so. For these borrowers, rates for new cars average 11.5% and 18.5% for used cars, whereas prime borrowers are charged far less, 6.4% and 8.75% respectively on average. Meanwhile, 30-year fixed mortgages in the US hit 8% last week for the first time since the turn of the century. The rise, for the sixth straight week, led to demand for mortgages to drop to the lowest level since 1995, applications dropping 6% week-on-week and 21% lower than the same week last year. Applications for remortgages fell 10% for the week and were 12% lower than a year ago.

Elevated VIX = opportunistic windows of Reverse Convertibles and/or FCN’s – speak to us for specific focussed sectors.

As far as key releases this week are concerned, watch out for the JOLTs and ADP private payrolls, the FOMC decision Thursday morning and NFP on Friday – a full week of market moving data. Consensus is for an unchanged 3.8% unemployment rate, a more down-to-earth 190k new jobs and an average weekly earnings YoY of 4%.

Europe

European stocks closed lower on Friday, with earnings and the state of the global economy keeping sentiment on edge. The benchmark Stoxx 600 ended down 0.8%, with most sectors and stock markets in negative territory. Healthcare stocks slipped 2.9% to lead losses, while chemicals stocks climbed 0.8%. Earlier in the week, Deutsche Bank gained on a forecast beat while Barclays tumbled after it warned of cost-cutting charges ahead.

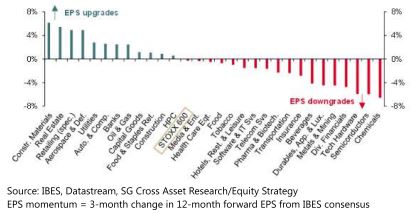

So far, around one quarter of STOXX 600 companies have published their 3Q results and this reporting season is quite similar to 2Q where we see some weakness at the sales level, but with solid profit margins softening the impact on earnings. 4 sectors have benefited from the strong positive EPS revisions over the last 3 months: Construction Materials, Real Estate, Retailing and Aerospace & Defence. At the other end, 3 sectors have seen their forecasts downgraded by consensus: Chemicals, Semiconductors and Technology Hardware & Equipment.

Last week brought a batch of negative macroeconomic news for the euro area. The PMIs went down in October to 46.5, down from 47.2 in September and the ECB’s Bank Lending Survey signalled more tightening of credit standards and much stronger fall in loan demand than expected. The PMIs was below consensus expectations and is a clear negative signal for growth ahead. Both services and manufacturing PMIs are significantly down in the euro area.

As expected, the ECB made no changes today to its policy rate – keeping it at 4%, to its PEPP reinvestments or to its reserve requirements. There was no discussion at all about when rates might be cut again. Hence, the ECB seems firmly in datawatching mode right now. President Lagarde said that it was far too early to talk about any rate cuts as uncertainty about the disinflation journey was still far too high. Future rate decisions will depend on three factors which are inflation outlook, the incoming inflation data, and the strength of transmission. The ECB noted signs of weaker job creation, but rising wages are still seen as a growing driver of domestic price pressures. Hence, the ECB is watching pressures in both directions and that December will be the next occasion to fully revisit the economic assessment.

This week, the agenda is heavy on data such as the Economic Sentiment Indicator, Euro area GDP and Euro area inflation figures.

Asia

Asia closed the week lower as the war between Israel and Gaza took over headlines and sentiment from the earnings season trickled into the broader stock market in the region. MSCI Asia ex Japan, was lower by 0.67%. All of Asia was down except for Hang Seng Index and CSI 300. Both higher by 1.32% and 1.48% respectively. China recently increased economic support, causing US-listed Chinese shares (ADRs) to surge, marking the most significant rise since July 28. This boost came as China raised the deficit ratio for 2023 to 3.8% of GDP from 3% and approved the issuance of an additional 1 trillion yuan ($137 billion) in debt. Notably, President Xi Jinping made his first known visit to the People’s Bank of China (PBOC).

Vietnam was lower this week, down 4.28%, the weakest in Asia. Foreign investment in Vietnam surged in October as the manufacturing hub attracted more than double the financial pledges it has received monthly this year, amid a big boost in spending for new plants, official data showed on Friday. Since the start of the year, the country has received foreign investment commitments worth $25.76 billion, 14.7% higher than in the same period last year. Pledges from China and Hong Kong combined were the highest so far this year, followed by Singapore and South Korea.

Here are some economic data points from around Asia. Japan’s preliminary October result for the global flash Purchasing Managers’ Index (PMI) recorded a decline from 52.1 to 49.9, indicating a move into contractionary territory.

This decline was primarily driven by a fall in the services sector, dropping from 53.8 in the previous month to 51.1. South Korea’s real GDP increased by 2.4% quarter on quarter. In Singapore, the inflation rate for September rose slightly to 4.1% from 4% in August, aligning with expectations. Record certificate of entitlement (COE) prices contributed to increased private transport inflation, outweighing the decline in core and accommodation inflation. Core inflation, excluding private transport and accommodation costs, rose by 3% year on year in September. The Monetary Authority of Singapore (MAS) maintained its monetary policy settings in October, anticipating a continued easing of inflation in the country.

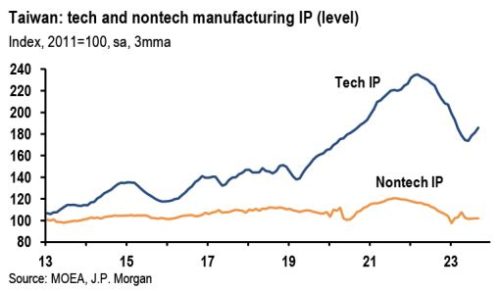

Taiwan reported September industrial production (IP) figures that surpassed expectations. Following a consistent decline in recent quarters, the underlying trend in IP started to show improvement in the third quarter, rising by 17.7% on a threemonth basis.

Indonesia is gearing up for its upcoming presidential elections on Valentine’s Day next year. Voters will choose from three presidential and vice-presidential candidates in what marks the first three-horse race since 2009. Defence Minister Prabowo declared his candidacy for president in 2024, with the 36-yearold son of the outgoing president as his running mate. Recent court rulings have eased the age requirement for candidates, allowing younger individuals to participate.

GEOPOLITICS

Secretary of State Antony J. Blinken met with PRC Director of the CCP Central Foreign Affairs Commission and Foreign Minister Wang Yi in Washington October 26-27. The two sides had much to discuss geopolitically, including the Israel-Hamas war, the Russian invasion of Ukraine and the presidential election in Taiwan early next year. China has said it is neutral in the Ukraine war but has been accused of propping up Russia’s economy in the face of heavy Western sanctions. The Pentagon recently estimated that China’s nuclear arsenal comprises around 500 warheads, with plans to triple this number by 2035. This development raises concerns, especially in light of Russia having the largest number of warheads globally at around 6,000, followed closely by the US with approximately 5,500 warheads.

Staying with China, there has been a tax investigation into Foxconn, one of China’s major employers and the largest iPhone manufacturer globally. Authorities had carried out multiple tax- and land-use investigations at subsidiaries of the $43 billion Apple supplier Hon Hai Precision Industry, also known as Foxconn. Meanwhile, Foxconn’s founder, Terry Gou, is running for Taiwan’s presidency in January, adding a political dimension to the situation.

In terms of international relations, President Joe Biden issued a warning to China, urging them not to engage in dangerous and unlawful activities towards the Philippines. He emphasized that any attack on the US ally would trigger Washington’s mutual defence treaty with Manila.

S&P downgraded Israel’s outlook from stable to negative, indicating potential challenges ahead. Additionally, concerns are rising about global inflation due to sustained high oil prices throughout 2023 and potentially into 2024.

Lastly, there is a positive development in India-Canada relations, with India announcing the reopening of visa services for Canadians. This move has the potential to ease tensions amid a high-profile dispute over the killing of a Sikh separatist on Canadian soil.

Credit/treasuries

The US Treasury curve was roughly unchanged over the week, all the points on the curve dropping by 10 to 12bps of yield. Credit spread on IG & HY finished the week roughly unchanged. Over the past 3Months, the 2-10 spread has moved from 110bps to 15bps currently. In the meantime, US HY spread has moved from roughly 400bps to 530bps currently. There seems to a clear correlation between the two over that period. In term of performance both IG & HY gained about 20bps last week. Leverage loan index lost 25bps.

This week we will have the decision by the Fed, BOJ & BOE. The market expects neither of them to do anything this Month. On the Fed, market expect Chair Powell press conference to emphasize that the Committee believes it can “proceed carefully” given incoming data flow, the tightening of financial conditions, and the emergence of several additional risks. All these factors would be presented as motivating the hold in November.

We also heard from a couple of prominent players in the US treasury market. First, Bill Ackman of Pershing Square announced that he closed his short position in the long end of the treasury market. His decision was driven by increasing geopolitical risks, such as the Israel-Hamas conflict, meaning investors are more likely to seek safety in bonds. Ackman said on social media that “Given the current long-term rates and the elevated global risk, it’s too risky to maintain short positions on bonds. We’ve closed our bond short position.” Second, Bill Gross, who is the former CIO of PIMCO, believes that “Higher for longer is yesterday’s mantra”. He thinks the “regional bank carnage and recent rise in auto delinquencies to long-term historical highs indicate the US economy slowing significantly”, adding that he sees a US “Recession in the 4th quarter”.

FX

DXY USD Index rose 0.37% to close the week at 106.56 due to a combination of strong US data and safe-haven demand. his was despite a rebound in US treasury yields. Data wise, US PMI for October preliminary were stronger than expected, with Composite at 51.0 (C: 50.0), Manufacturing at 50.0 (C: 49.5) and Services at 50.9 (C: 49.9). 3Q23 US GDP (4.9% qoq) (C: 4.5%) comes in below the Atlanta Fed’s GDPNow estimate of 5.405% qoq. US personal consumption came in at 4.0% (P: 0.8%), Durable goods orders came in at 4.7% (C: 1.9%), US new home sales came in at 759k (C: 680k), while Core PCE was largely inline with expectation at 2.4% (C: 2.5%). US headline Michigan Sentiment came in higher than expected, while 1y Inflation Expectations continued to rise to 4.2% (C: 3.8%). We have the FOMC this Thursday morning, where the FED is expected to hold rates.

EURUSD fell 0.27% to close the week at 1.0565, as ECB kept its deposit rate at 4.00%, in-line with expectation. ECB reiterates rates are likely at peak levels, showing a clear concern for a potential worsening economic backdrop and stronger transmission of monetary policy.

In addition, there were no changes to PEPP reinvestment, in line with expectations. Data wise, EU PMI for October preliminary were weaker than expected, with Composite at 46.5 (C: 47.4), Manufacturing at 43.0 (C: 43.7) and Services at 47.8 (C: 48.6). Technically, downward trend on EURUSD has been broken. Immediate support level at 1.05/1.045, where immediate resistance level at 1.06/1.065.

GBPUSD fell 0.35% to close the week at 1.2122. Data wise, UK PMI for October preliminary came in largely in-line, with Composite at 48.6 (C: 48.5), Manufacturing at 45.2 (C:44.7) and Services at 49.2 (C: 49.3). Immediate support level at 1.207/1.204, with the psychological level at 1.20.

USDJPY fell 0.13% to close the week at 149.66, after touching a year to date high of 150.78, as attention now focused on the BoJ meeting on Tuesday. Media reports suggested the BoJ might discuss a further adjustment to its YCC conduct at this meeting, due to the rise in US yields. Data wise, Tokyo CPI came in on the upside, with CPI (ex-fresh food) at 2.7% yoy (C: 2.5%; P: 2.5%), and core CPI (ex-food and energy) at 3.8% (C: 3.7%; P: 3.8%).

Oil & Commodity

Gold rose 1.26% to close the week at 2006.37, as Israel is ratcheting up ground operations in Gaza with Troops, tanks and artillery, while Iran Foreign Minister warns that situation will get out of control if Israel-Hamas war continues. Despite the ongoing tensions, Crude Oil fell last week, with both the WTI and Brent falling 3.62% and 1.82% respectively, closing the week at 85.54 and 90.48.

Base metals rose last week, with Aluminium (+2.25%), Copper (+2.33%) and Iron Ore (+2.57%), as China announced additional fiscal support through the issuance of $137 billion in additional sovereign debt. The fiscal deficit was raised to 3.8%, well above the 3% target set in March that was generally considered a limit.

ECO

- Monday – AU Retail Sales, UK Mortg. App., EU Cons./Econ./ Industr./Svc Confid., US Dallas Fed Mfg Act.

- Tuesday – NZ Building Permits/Biz Confid., JP Jobless Rate/ Retail Sales/Industr. Pdtn/BoJ Rate Decision, CH PMI, SZ Retail Sales, EU GDP/CPI, CA GDP, US Chic PMI/Cons. Confid.

- Wednesday – NZ Employ., JP/CH/NO/UK/US Mfg PMI Oct Final, AU Building App., UK Nationwide Hse Px, US JOLTS/ISM Mfg/FOMC Rate Decision

- Thursday – AU Trade Balance, SZ CPI, EU Mfg PMI Oct Final, UK BoE Rate Decision, US Initial Jobless Claims/Factory Orders/Durable Goods Orders

- Friday – AU/CH/UK/US Svc/Comps PMI Oct Final, EU/CA Unemploy. Rate, US NFP/ISM Svc

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.