KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets had its best week of the year ending Friday as a less hawkish sounding Fed and signs of a cooling labour market bolstered risk appetite. November started with a bang for the S&P 500 following October’s 2.2% decline and a 3-month long losing streak. The S&P 500 Index and the Nasdaq both climbed for a fifth straight session soaring for their best weeks since November 2022. The VIX fell to 14.91. The closely watched UST10Y yield continued its descend for a 3rd consecutive day Friday, tumbling to close at 4.57% whilst the 2 year yield fell to 4.83%, its lowest level since early August. This also came after the US Treasury announced plans to slow the pace of increases in quarterly long-term securities sales. Jobs data showed growth eased in October and the unemployment rate rose to an almost two-year high of 3.9%, indicating that employers’ strong demand for workers is beginning to cool as the Fed had (wanted) predicted. Non-farm payrolls increased below expectations at 150,000 in October, according to the Bureau of Labor Statistics, which also revised down the prior month’s figure by 29k to 297k. Monthly wage growth also slowed and a gauge of initial jobless claims rose for the 6th week in a row, signalling those losing their jobs are starting to have more trouble finding new ones.

Last Thursday morning’s FOMC meeting resulted in no change to the Fed Funds rate of 5.25%-5.50% as expected. While the Fed indicated its keeping open the potential for additional rate increases, Chair Jerome Powell suggested that the recent runup in Treasury yields could serve to restrict financial conditions enough to help tamp down inflation. Overall, Powell’s commentary was taken as dovish.

On the minds of investors were hopes that the latest jobs report and the Fed’s pause were enough to signal the central bank is done hiking rates. Other data out showed strong factory orders coupled with robust ISM services. Futures markets are now betting that the central bank could begin to cut rates in June rather than July next year. For the week unsurprisingly, tech and real estate were the best performing group benefitting directly on the back of lower yields.

Cryptos continue to impress taking out the BTC $35k level as demand is expected to pick up following recent passage for ETF’s to list in the States. FTX’s founder SB-Fried was charged on all accounts of allegation of fraud which temporarily saw cryptos decline, before marching on.

This week will be a tad quieter with only US trade balance, U. of Michigan Sentiment and Inflation expectations releases to contend with.

Europe

All the major indices in Europe are positive last week, with gains in Eurostoxx 50 (+3.99%), UK FTSE 100 (+1.73%) and Swiss SMI (+2.48%). Comparing to other European indices, UK FTSE 100 underperformed, weighed down by its large share of energy and materials stocks which underperformed.

EU Commission Economic Sentiment Index came in at 93.3 in October (C: 93.0; P: 93.4). Flash CPI release for the Euro Area fell to just 2.9% in October (C: 3.1%; P: 4.3%) which was the lowest since July 2021, and a big fall from its 10.7% rate at the same point in 2022.

Core inflation also fell to 4.2% (C: 4.2%; P: 4.5%). Market now expects 100bp of rate cuts next year, and have shifted their expectation of the first ECB rate cut from Sep-24 to Jun-24. Preliminary 3Q23 GDP contracted by 0.1% (C: 0.0%; P: 0.2%). This was the worst quarterly performance for the Euro Area since Q2 2020 at the height of the pandemic. Multiple ECB Governing Council members reiterated the “higher for longer” narrative and said “it is far too premature to talk about cuts in interest rates.”

This week, we are seeing the final Euro PMI on services and composite, PPI and retail sales.

UK BoE kept its base rate at 5.25% with a 6-3 vote, in-line with consensus. The committee reiterated that monetary policy would need to be sufficiently restrictive for sufficiently long, and would be data-dependent. The bank’s revised outlook now sees the CPI at around 4.75% in Q4 of 2023, followed by a fall to about 4.5% in Q1 of the next year and a further drop down to 3.75% in Q2. UK GDP is now expected to have stagnated in Q3 2023, which is a weaker performance compared to the August forecasts.

Asia

All the major indices in Asia are positive last week with the biggest gainer in Japan, where Nikkei 225 and Topix both rose 3%. High beta markets such as Korea KOSPI Index (+2.85%) and Taiwan (+2.31%) outperformed. Hang Seng Index and China CSI rose 1.53% and 0.61% respectively, underperforming in Asia, as China PMI data disappointed. Within ASEAN, Singapore STI (+2.67%) and Thailand (+2.27%) outperformed, while Vietnam was up 1.52% and India Nifty 50 index rose 0.96%.

Japan Prime Minister Kishida announced a fiscal stimulus package worth more than USD 100 billion (higher than consensus expectations) as the incumbent PM is facing higher inflation while at the same time grappling with his poll ratings being at a record low since taking office in 2021. The package’s highlight is income and residential tax rebates to low-income households.

BoJ kept its negative rate unchanged, but incorporates more flexibility into its YCC framework, where the reference rate for 10y JGB yields will move to 1.00% (this was previously the level of the strict cap). In order to encourage formation of a yield curve consistent with market operations, large-scale JGB purchases will now be “nimble” as opposed to daily fixed-rate purchase operations.

China October Caixin manufacturing PMI disappointed at 49.5 (vs 50.8 expected), slipping from 50.6 into mildly contractionary territory. Non-Manufacturing PMI fell to 50.6 in October (C: 52.0; P: 51.7). This points to slowing momentum and renewed deflationary pressure, with the slowdown in services especially notable despite strong activity during National Day holidays. For policy, recent fiscal stimulus looks timely, and more monetary easing will be necessary.

Australia retail Sales increased by 0.9% mom in September (C: 0.3%; P: 0.3%), the largest monthly increase since January. This release shows resilient demand in the wake of monetary tightening, although trends in discretionary categories remained weak. We have the RBA rate decision this Tuesday, where RBA is expected to hike 25 bps.

India RBI Governor Das said India’s 2Q23 GDP data is expected to surprise to the upside. Even though, geopolitics pose the largest risk for growth across the world, but India is in a better place than others to handle these risks. He characterized India’s index inclusion as a vote of confidence in the Indian economy and financial markets and said the central bank is well-equipped to deal with outflows and inflows.

Credit/treasuries

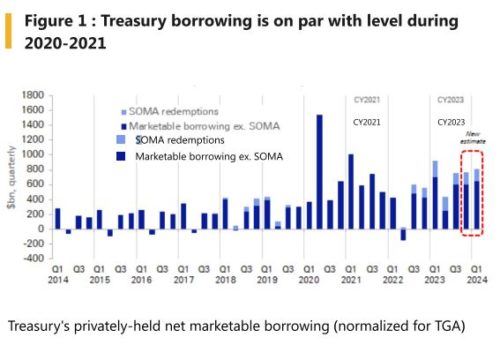

Early last week, the US Treasury announced net marketable borrowing estimates for the October – December 2023 and January – March 2024 quarters. During October – December, Treasury expects to borrow $776bn, assuming an endDecember TGA (Treasury General Account) cash balance of $750bn. This is $76bn lower than the estimate announced in July, primarily due to a lower deficit forecast (-$80bn) as a result of higher receipts (likely related to delayed tax receipts from California).

During the January – March quarter, Treasury expects to borrow $816bn in privately held net marketable debt, assuming an endof-March TGA cash balance of $750bn.

The Treasury delivered a second round of coupon size increases but moderated the pace for long-dated maturities compared to August. Consistent with a market pricing of larger increases to the longer maturities before the announcement (which was the dealer consensus), the immediate market reaction on the Treasury curve was a bull flattening.

While it was expected the Treasury to be responsive to the recent repricing in term premia and the weak October auctions, it was not a foregone conclusion as there was a “robust discussion” on whether to maintain the same increases or moderate longer-maturity size increases. At the margin, the Treasury’s decision to moderate the increases suggests that the debt managers are attentive to sharp changes in short-term market conditions, so long as their decision is within the construct of being regular and predictable. Importantly, investors are likely also encouraged by the Treasury’s statement that it anticipates “only one additional quarter of increases to coupon auction sizes”. This is different from the statement in August, where it said that further coupon increases are likely needed “in future quarters”, which could be interpreted as these increases potentially extending into late next year. The change in the statement language is significant, and it was likely intentional to help reduce uncertainties and potential anxiety about a further rise in coupon sizes. At minimum, investors are now assured that coupon auction sizes should top out after the March refunding period. In the near term, investors are asked to swallow the bitter pill of taking down more coupon supply, but in return they get reassurance of an improved deficit outlook, based on the Treasury’s confidence around its own projection, and more certainty around the path of Treasury supply. Las week quarterly refunding announcement is a short-term positive development that should help unwind some of the market’s move since August, all things being equal. Nevertheless, with a growing view that the Fed may lengthen the duration of QT, and annual deficits projected at around $1.7-$1.8 trillion over the next few years, these issues are unlikely to go away soon. At the same time, a widening mismatch between supply and demand for Treasuries could exacerbate the issue through increased debt interest expenses. These concerns will likely remain in the forefront in 2024.

As expected, the Fed held rates steady, and Chair Powell’s recent comments served as a blueprint for his press conference. Powell kept the door open for a rate hike in December and beyond, noting that the Committee is not confident they have achieved a “sufficiently restrictive” stance. At the same time, he also repeated that financial conditions have tightened “significantly” and that, if this is sustained, it could substitute for further rate increases. On the dovish side, Powell did not sound perturbed by recent data strength, likely reflecting concerns around tighter Financial Conditions Index and a desire to see more data to determine if these trends are sustained. Economist baseline remains that the Fed is done raising rates. This expectation requires evidence of a moderation in growth and labour market data, especially in the face of somewhat firmer inflation prints, as well as financial conditions remaining tight or tightening further. In the absence of these developments, heightened risk that the Fed will need to raise rates again in December / Q1 2024, and conditional on that outcome, that rates could need to rise further than currently signalled.

FX

DXY USD Index fell 1.44% to close the week at 105.02 due to weak US data and a slower pace of increase in quarterly long term debt sales. The main downward surprise is on the weak US labor data, nonfarm payrolls came in at 150k (C: 180k), with a downward revision of 101k in the prior two months. Unemployment rate came in at 3.9% (C: 3.8%; P: 3.9%), while average hourly earnings came in at 0.2% mom (C: 0.3%; P: 0.3%). ISM Services Index fell to 51.8 in October (C: 53.0; P: 53.6), below its 3Q23 average (53.6) and back near its 2Q23 average (52.0). US continuing jobless claims rose for a 6th consecutive week, at 217k (C: 210k), and were now at their highest level since April. Immediate support on DXY at 1.05 and 1.04.

EURUSD rose 1.57% to close the week at 1.0731 mainly due to a weak USD, despite weaker than expected Euro Area CPI and a downside surprise in retail sales. As discussed in previous weeks, EURUSD has broken its downward trend, and currently has risen above its 50 days MA (1.0636). The next resistance level is at both its 100 and 200 days MA of 1.0805.

GBPUSD rebounded sharply by 2.13% to 1.238 due to a weak USD and risk-on sentiment. Resistance level is at 1.2435 (200 days MA) and 1.25 (psychological level).

USDJPY fell 0.18% to close the week at 149.39 mainly due to a sharp fall in US treasury yields, and hence narrower US-JP rate differential. Volatility was high, as USDJPY hits a year to date high of 151.72 after BoJ made slight tweaks to its YCC policy, where the expectation was to raise the cap to above 1% on the 10 yr JGB. However, USDJPY immediately fell after Japan MoF officials gave stern communication that they are on standby to intervene in the market if needed. The officials said the current excessive move has mainly been driven by speculative positions, so they are ready to take necessary action if needed. Technically, a double top on USDJPY has been seen looking at its past 2 years chart.

Oil & Commodity

Gold and Crude oil both fell, as the war premium eased with Israel’s ground war against Hamas relatively well-controlled. Gold fell 0.68% to close the week at 1992.65, despite falling US real yield.

WTI and Brent fell 5.88% and 6.18% to close the week at 80.51 and 84.89 respectively. The focus on oil has now changed to demand side. Base metals continued its rebound as Copper (+0.97%), Aluminium (+1.13%) and Iron Ore (+5.41%) all rose.

ECO

-

Monday – NZ, ANZ Commodity Price, AU Inflation, JP/EU Svc/Comps PMI Oct Final, UK Construct. PMI

-

Tuesday – AU RBA OCR, CH Trade Balance, SZ Unemploy. Rate, EU PPI, US Trade Balance

-

Wednesday – EU Retail Sales, US MBA Mortg. App./ Wholesale Inv., CA Building Permits

-

Thursday – JP Current Acc. Balance, CH CPI/PPI, US Initial Jobless Claims

-

Friday – NZ Mfg PMI, UK Indust. Pdtn/Mfg Pdtn/Trade Balance/GDP, NO CPI, US MIch. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.