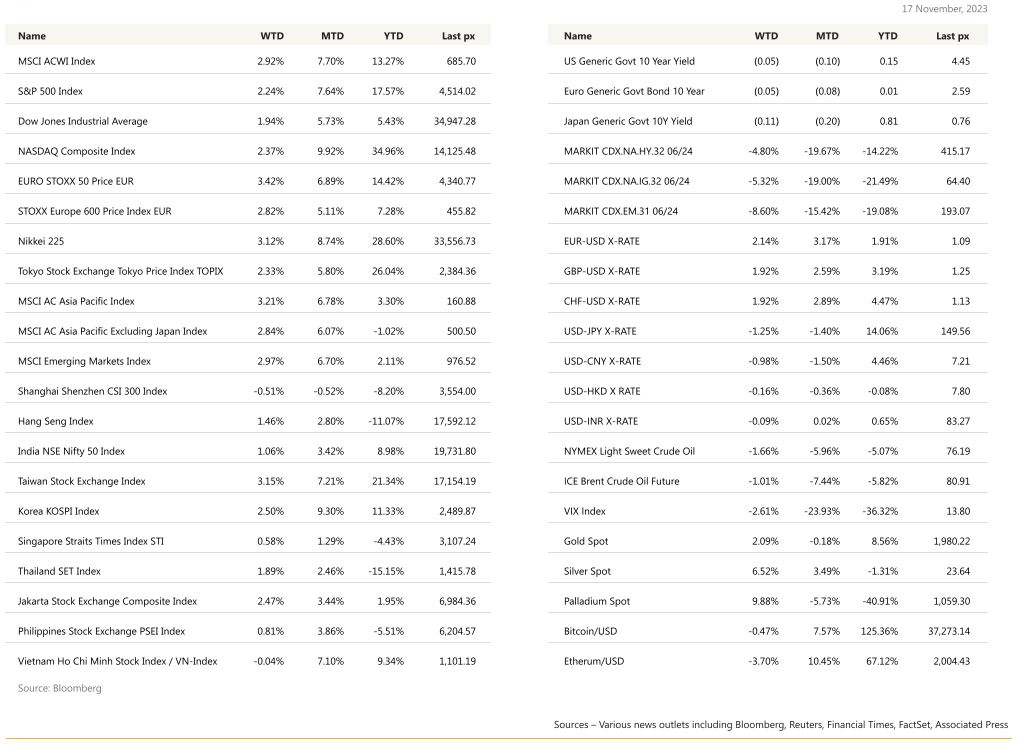

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

It all started with a cooler inflation print that triggered US stocks to notch 3 straight weeks of gains.

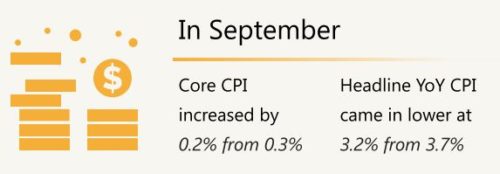

This is the 7th time with the last 6 failing to materialise, that investors are betting the Fed is ready to pivot. Seventh time lucky perhaps? The VIX fell to 13.80 which some have referred to as bull market territory. The US dollar retreated overall. Whilst rate cuts are still not expected till May-June of next year, the elimination of the constant overhanging fear of higher rates for longer, together with an earnings recovery in Q4 and possibly accelerating next year, will likely drive stocks higher going into year end. A note from Bank of America Corp., citing EPFR Global data, showed global stock funds drew their second-biggest inflows in the week through Nov. 15. Core CPI increased by 0.2% from 0.3% and headline YoY CPI came in lower at 3.2% from 3.7% in September.

Prices paid to US producers reported the next day, unexpectedly declined in October by the most since April 2020, adding to evidence that inflationary pressures are abating. Meanwhile, retail sales slowed in October, but the prior month’s reading was revised higher suggesting some resiliency in spending going into the holiday season. Jobless claims were a welcome addition to recent data that pointed to a slight cooling in the labor market.

Fed officials welcomed the data showing receding inflation, but added there’s still a way to go before it reaches their 2% target. Sectors which suffered in the last few months saw their fortunes turned as homebuilders climbed on expectations the Fed is done hiking together and bank stocks rising as well with regional banks leading the pack.

For now, with technicals being supported by fundamentals of a ‘holding’ Fed amidst a disinflationary environment, we would look only to fade this rally when we get toward the July’s highs of 4600. We see value MinVol stocks, being the laggard up only 5.11% YTD 5% relative to the SPX’s +17.5% as opportunistic to add selectively.

Europe

Europe markets closed 1% higher to end the week, with all sectors and major bourses in positive territory. The gains were led by financial services and mining stocks, which closed up by 1.7% and 1.8% respectively.

Last week, the euro area Industrial Production continued to disappoint at 1.1% m/m in September, more than market expectations of 1% m/m, leaving the 3Q23 level posting a sequential decline of 4.8% ar. The IP readings hint a significant decline in manufacturing largely offset by services. IP in the euro area has been trending down since 4Q22 with very limited signs of improvement recently across energy-intensive companies, which were hit by rising gas prices last year. The decline in manufacturing output was broad based, including a 3.2% m/m decline in auto production. GDP was broadly flat in 3Q.

Last week, the markets have fully priced in 100bp of cuts from the ECB in 2024. Markets are responding to weak survey and under-pricing the risk of more hikes. While talk of cuts remains so high, we think this is premature.

In the UK, it was a week of weaker data. There were 3 major pieces of weaker economic data published last week. First, wages. Private sector regular pay growth fell to 0.1% m-o-m in September. The data seems to support the view that the labour market is weakening but not at a particularly strong pace. It will take some time to see material weakness.

Second, inflation fell to a two-year low of 4.6%, lower than the expected of 4.7%, while core CPI fell to a 19-month low of 5.7% which was lower than the 5.8% expected..

Although inflation has more than halved from its October 2022 peak of 11.1%, the BoE has also warned that getting inflation down to 2% is going to be tough and it is forecasted that inflation will only be back to 2% target in late 2025.

Finally, October retail sales volumes fell 0.1% m-o-m (ex-auto fuel) versus a consensus forecast of +0.5%. After alternating ups and downs in retail sales monthly this number means there are two back-to-back monthly declines.

The week’s weaker economic news supported the case for no further policy tightening. Indeed, markets are pricing in no further hikes and have brought forward the first cut. A 25bp cut is expected in June 2024 and around 125bp of cuts are expected by end 2025.

Next week, we will see consumer confidence and PMI manufacturing prelim results in the Euro and PPI results for Germany. It is believed that the consumer confidence may weaken in November due to weakening activity data.

Asia

Risk appetite was boosted by the latest U.S. inflation data, which undershot expectations, signalling that an economic soft landing may be imminent and raising hopes that interest rates may have peaked. MSCI Asia closed the week higher by 3.21%.

Japan’s stock markets rose, the Nikkei 225 Index generated a 3.1% return and the broader TOPIX Index gained 2.3%. Gains were supported by upside earnings surprises to date in the earnings season. Japan’s third-quarter GDP data however showed that the economy shrunk by a worse-than-expected 0.5% over the three months (1.2% on an annualized basis) The main drag was from private inventories, while inflation and yen weakness continued to weigh on private consumption and sluggish global demand hit exports.

Anticipation of an end to U.S. monetary policy tightening lent support to the yen, which finished the week higher, in the JPY 149 against the USD range. However, the Japanese currency continued to hover around a 33-year low as investors remain focused on interest rate differentials. Japan’s government has repeatedly said that it will take every possible measure in response to volatility in the foreign exchange market.

Chinese equities were mixed after official indicators highlighted the fragility of the country’s economy. The Shanghai Composite Index rose 0.51% while the blue-chip CSI 300 Index lost 0.51%. In Hong Kong, the benchmark Hang Seng Index gained 1.46%

In the month of October, China experienced an uplift in economic activity, with industrial output growing at 4.6% YoY (compared to an expected 4.5%) and retail sales advancing by 7.6% YoY (surpassing the expected 7.0%). This marked the strongest industrial growth since April and the fastest retail sales growth since May. Despite this positive trend, there are signs that sequential growth momentum has softened recently. Fixed asset investment for the first 10 months of the year grew by 2.9% YoY, missing expectations (a 3.1% increase). Separately, new bank loans rose an above-consensus RMB 738.4 billion in October but plunged from September’s RMB 2.31 trillion, largely driven by a seasonal downturn in corporate lending.

The People’s Bank of China (PBOC) injected RMB 1.45 trillion into the banking system via its medium-term lending facility compared with RMB 850 billion in maturing loans, its largest net injection since December 2016. Many economists predict that the PBOC will step up policy easing for the rest of 2023, including a possible cut to its reserve ratio requirement, as the government ramps up measures to boost China’s economy.

Malaysia’s economy grew 3.3% YoY in Q3 beating analysts’ expectations, driven mainly by private consumption, services and construction and offsetting decline in exports which dropped 12% in the quarter. It also looks likely that the country will meet its full year target of 4% and the government estimates the economy will expand by 4% to 5% in 2024, supported by improved domestic spending, labour market conditions and rising tourism.

Reuters reported that Indonesia and the US are expected to discuss the advancement of a possible minerals partnership, to stimulate the trade of metals used to build EV batteries

Philippines central bank kept interest rate unchanged last week in line with market expectation.

GeoPolitics

U.S. and China: U.S. President Joe Biden and Chinese leader Xi Jinping agreed on Wednesday to open a presidential hotline, resume military-to-military communications and work to curb fentanyl production, showing tangible progress in their first face-to-face talks in a year. Biden and Xi met for about four hours on the outskirts of San Francisco to discuss issues that have strained U.S.-Chinese relations. Whilst no concrete decisions were made at the Summit, the positives of more open communication and dialogue were enough to address one less geopolitical headwind we ALL do not need. Simmering differences remain, particularly over Taiwan. In a comment likely to irk the Chinese, Biden told reporters later that he had not changed his view that Xi is a dictator. “Well, look, he is. I mean, he’s a dictator in the sense that he is a guy who runs a country that is a communist country,” Biden had said.

China and Japan: Xi Jinping and Japanese PM Fumio Kishida focused on shared economic interests in their talks, addressing issues like Japan’s Fukushima water discharge. They aim for mutually beneficial relations.

U.S. and Qatar: On Sunday, they signalled a deal was close by to release a significant number of civilian hostages held by Hamas in the besieged Gaza Strip. The plight of about 240 hostages has exacerbated the trauma of Israelis and become a politically sensitive issue for Prime Minister Benjamin Netanyahu as he pushes ahead with the offensive against Hamas.

U.S. and Philippines: A landmark deal enables the U.S. to export nuclear tech to the Philippines for energy goals by 2032, pending U.S. Congress approval.

Credit/Treasuries

Yields across the whole US treasury curve fell, driven by below consensus US CPI data. The 2 years and 30 years fell about 17 bps, while the 10 years fell 21 bps. The 5 years fell the most throughout the curve by 24 bps. The 10 years UST yield closed the week at 4.435, below the strong support level of 4.50.

The 2 years and 30 years closed the week at 4.886 and 4.589, respectively. The lower UST yields boosted risk sentiment, and hence US IG and HY were tighter last week, US IG and HY fell 100 and 15 bps respectively.

FX

DXY USD Index fell 1.84% to close the week at 103.92, driven by peak rate hopes due to below consensus US CPI data. As a result, OIS Fed Fund future is pricing for a cut next March 2024. Data wise, Core CPI rose by 0.23% m/m (C: 0.3%; P: 0.32%), which brought the annual rate down to 4.0% y/y (C: 4.1%; P: 4.1%). The Cleveland Fed’s trimmed mean CPI measure came in at 0.24% m/m (P: 0.40%), a sharp deceleration m/m, and very close to the six-month average (0.28%). US Retail Sales was better than expected, at -0.1% m/m (C: -0.3%). Initial Jobless claims spiked up to their highest since August, at 231k (vs. 220k expected), whilst the continuing claims hit their highest since late-2021, at 1.865m (vs. 1.843m expected).

EURUSD rose 2.14% to close the week at 1.092, driven by USD weakness and reaching overbought territory based on RSI indicator. Data wise, Eurozone 3Q23 preliminary came in in-line at -0.1% q/q and 0.1% y/y.

GBPUSD rose 1.92% to close the week at 1.246, above its 200 days MA, driven by USD weakness. Strong resistance level at 1.25. Data wise, UK CPI missed expectation, came in at 0.0% m/ m (C: 0.1%). Year-ended headline down to 4.6%, consensus at 4.7%. Core at 5.7%yoy, consensus at 5.8%. In the details, services inflation down to 6.6%yoy, also softer than expected. UK Retail Sales for the month of October, came in lower than consensus as well.

USDJPY fell 1.25% to close the week at 149.63, driven by decline in the yields across US treasury curve. Data wise, Japan 3Q23 GDP shrank at its fastest annualised quarterly pace in two years, contracting -2.1% (C: -0.4%) after strong post-Covid growth of +3.7% in 1Q23 and +4.5% in 2Q23, as domestic inflation weighed on consumer demand. Immediate support level at 149.45 (50 days MA), 148 and 146.50 (100 days MA). Resistance level at 152.

Oil & Commodity

Crude oil fell for a fourth weekly loss as signs of healthy supplies and rising stockpiles offset attempts by OPEC+ leaders Saudi Arabia and Russia to keep declines in check. IEA said that crude inventories were at their highest level since August, adding pressure on OPEC+ ahead of a meeting on its supply policy on Nov. 26.

As a result, crude oil fell more than 20% midweek into a bear market since its year to date high in September, before rebounding more than 3% last Friday due to better risk sentiment. WTI and Brent eventually closed the week at 75.89 and 80.61, falling 1.66% and 1.01% respectively.

On base metal, Copper headed for its biggest weekly gain (+4.22%) since July as easing tensions between the US and China helped boost sentiment. Aluminium fell 0.93%, while Iron Ore rose 1.37%. Gold rose 2.09% to close the week at 1980.82, driven by USD weakness and fall in US real yields.

ECO

-

Monday – CH LPR, US Leading Index

-

Tuesday – NZ Trade Balance, AU RBA Mins, CA CPI, US Chic. Fed Nat Act./ Existing Home Sales

-

Wednesday – US MBA Mortg. App/ Initial Jobless Claims/ Durable Goods Orders/ Mich Sentiment, EU Cons. Confid.

-

Thursday – AU/EU/UK Mfg/Svc/Comps PMI Nov Prelim., SW Riksbank Rate Decision

-

Friday – AU/EU/UK Mfg/Svc/Comps PMI Nov Prelim., SW Riksbank Rate Decision

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.