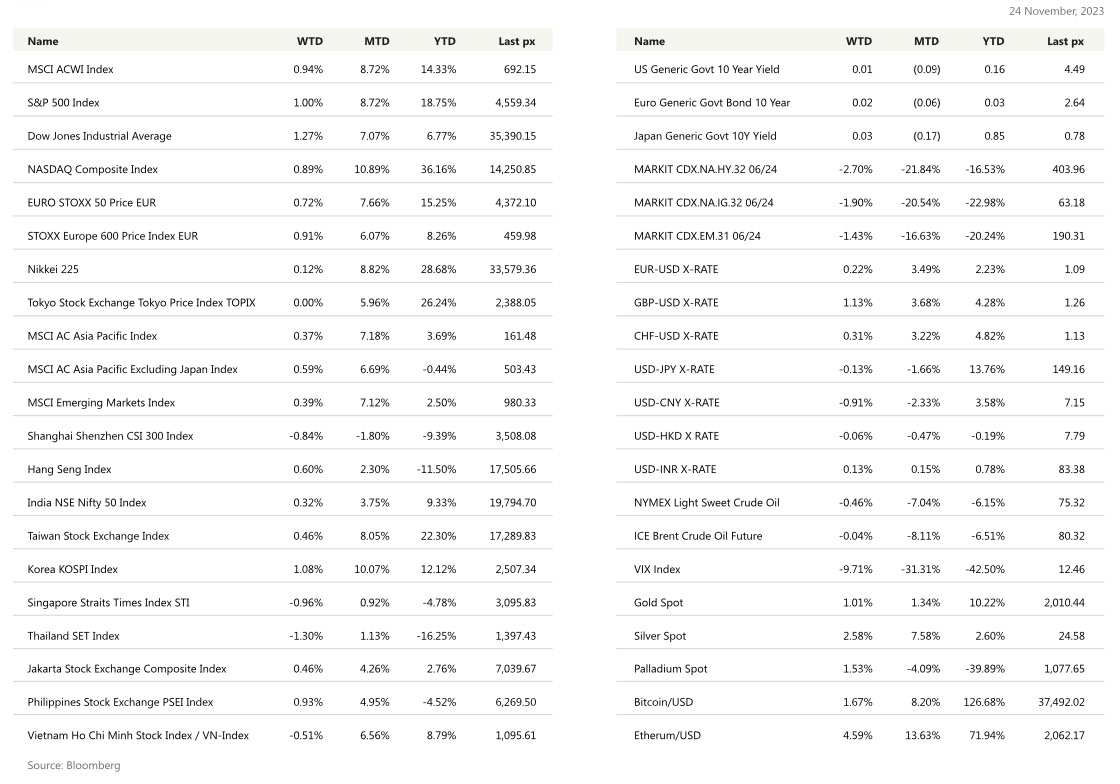

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

The November Final University of Michigan Sentiment Index, following the preliminary numbers that were released two weeks ago, printed better than expected at 61.3 vs 60.4 previous month.

More importantly, the 1Year forward inflation printed at 4.50% vs 4.20% the previous month & 5-10Years forward inflation at 3.30% Vs 3.00% the previous month. It is important to note that these data were not known by the Fed prior to the FOMC decision early November, decision that was considered dovish by the market. At that time, the Fed was saying that the tightening of Financial Conditions, which include long term yield, credit spreads and supply/demand of credit, as expressed in the SLOOS (Senior Loans Officer Opinion Survey) were supporting their decision not to hike short term interest rates in November.

Since the last FOMC meeting, 10years yield dropped from 4.95% to 4.45% area, IG credit spread tightened by 18bps, from 80 to 62bps which is a pretty significant move. SLOOS high level announcements released a couple of day after the latest FOMC meeting were indeed showing a tighter supply of credit for many categories of loans, personal, auto, consumer credit, especially for borrowers with low FICO scores (riskier or subprime borrowers). Demand for credit has also been slowing.

But all in all, the financial conditions have eased quite a lot since the latest FOMC meeting and therefore Fed members speeches over the next few weeks might sound a little less dovish which might translate into an overall less dovish communication by the Fed during mid-December FOMC meeting. It is still a bit too early to be fully convinced about that as some key data, for example November CPI, which will be announced on the 12th of December, 2days before December FOMC meeting, will also have an impact on Fed decision. December is going to be a key meeting as during quarterly meetings, the Fed will be updating their SEP’s and DOTS.

This week main economic data in the US will be the November Conference Board Consumer Confidence Index, the October PCE and finally on Friday the November ISM Manufacturing index.

Europe

The European market rose 0.4% to close out the week with a 0.9% gain. For the week, the real estate shares lagged while media, and retail stocks were the top performers. The chemical sector led Friday’s gains with a rise of 0.9% as Germany’s BASF climbed 1.8% after Bloomberg News reported Abu Dhabi National Oil Co is exploring a potential acquisition of its Wintershall Dea Unit.

The minutes from ECB’s meeting in October indicated little support for any more interest rate increases. None of this is very surprising and reflects a cautious optimism about the disinflation process. There is not much value in the ECB giving any real guidance at this point. We see hawkish commentary from ECB officials as they continued to push back on rate cuts.

In addition, last week saw the release of the November flash PMIs in Europe, which came in slightly on the upside. That included the Euro Area composite PMI, which rose to 47.1 in November (vs 46.8 expected) and both the manufacturing and services number were both slightly above consensus too. In the UK, there was a larger upside surprise, the composite PMI rose up to 50.1 (vs 48.7 expected), which puts it just above the expansionary 50-mark for the first time since July.

All these contributed to a selloff in European government bonds, with yields on 10yr bunds at +5.8bps. 10yr glit yield saw the biggest increase at 10bps due to the upside surprise in the UK PMIs. Investors continued to price in a more hawkish path for the BoE over the months ahead.

Market pricing for a rate cut by April hit an intraday peak of 93% the week before but was down to 59% by last Thursday. Overall, investors are still expecting a rate cut by ECB in Q2 2024, but it was with less conviction relative to a week ago.

Finally in Germany, the government announced they would suspend the debt brake for a 4th consecutive year. This meant that they couldn’t use the €60bn in unused debt originally earmarked for pandemic aid to the off-budget Climate and Transformation Fund (KTF), which is a fund set up to address climate change and support the country’s economic transformation. Germany’s fiscal policy outlook has become much more uncertain.

This could reduce GDP growth by 0.5% point next year, jeopardizing the gradual recovery after the downturn in 2023, adding downside risk to 2024 forecast.

This week is going to be a data week, with CPI PPI results released within the Eurozone and final figures for consumer confidence and PMI manufacturing. This Thursday, Eurostat will release the preliminary reading for euro-area inflation for November. The headline inflation is forecasted to ease to 2.6% YoY, from 2.9% in October. The decline should be relatively broad based across food, core goods and services inflation. This decline should keep ECB confident about maintaining rates unchanged at its next meeting on 14 December.

Asia

Asian markets were mixed last week, the MSCI Asia ex Japan managed to edge up higher by 60bps. The largest laggards last week were Thailand (-1.3%), Singapore )(-0.91%) and Shanghai Shenzhen CSI300 Index(-0.84%). The VIX index, dropped a further 9.7% to 12.46.

Japan’s equity rally this year has been one of the standouts. YTD, TOPIX is up 26.2%. Last week, Japanese stocks climbed towards a three-decade high, as investors returned after a public holiday. For the week, TOPIX index was flat, with the USDYEN pair weaker by 0.13% to close the week at 149.16. Japan’s core CPI, which excludes fresh food prices, rose slightly from 2.8% yoy to 2.9% yoy in October. Headline CPI, which includes all items, accelerated from 3.0% yoy to 3.3% yoy. However, core-core CPI, which excludes both food and energy, showed a slight deceleration, dropping from 4.2% yoy to 4.0% yoy. Despite this decrease, core-core CPI has remained above 4.0% for seven consecutive months, highlighting sustained inflation in areas beyond just the volatile items.

Chinese regulators have drafted a list of 50 real estate firms that will be able draw on bank loans, and debt and equity financing to shore up balance sheets. If executed on, banks will aim to plug an estimated $446 billion shortfall in funding needed to stabilize the industry and deliver millions of unfinished apartments. Country Garden (2007.HK) and Sino Ocean Land (3377.HK) have been added to the draft list of developers for banks to offer easier finance access, according to reports. The country’s top lawmaking body said banks should increase funding for developers to reduce the risk of additional defaults and make certain that housing projects get completed. Moody’s downgraded China Vanke issuer ratings to Baa3 from Baa1; Vanke Real Estate senior unsecured rating to Ba1 from Baa2; outlooks negative.

Chinese officials are to hold the annual Central Economic Work Conference in December to flesh out policy objectives for the coming year. Some economists believe that, for the latest policies to be effective, authorities will need to force banks to comply.

Various pathogens are responsible for a surge in acute respiratory illnesses among children, Chinese health authorities said on Sunday (Nov 26) as paediatric departments across the country grappled with the caseload. Different age groups were being affected by different pathogens. The commission did not say how many children were affected but Beijing told the World Health Organization (WHO) on Thursday that outpatient and hospital admissions of children with mycoplasma pneumoniae started to rise as early as May.

Some data points across Asia last week – Singapore’s Q3 GDP came in at +1.1% yoy vs. +0.8% yoy expected. Core inflation accelerated 3.3% in October YoY. Korea’s producer prices rose by 0.3%m/m in October, for the fourth consecutive month. While the PPI extended the rise, its monthly pace moderated from 1.0% in August and 0.5% in September. Bank Indonesia (BI) left its key policy rate unchanged at 6.00% last Thursday and likely keep it at that level until at least mid-2024. Minutes from the Reserve Bank of Australia’s (RBA) latest meeting indicated that the central bank opted to raise its key interest rate for the 13th time in the current cycle due to increased inflation risks along with stronger than expected performance of the economy. Also, the RBA Governor acknowledged that inflation will remain a crucial challenge over the next one to two years. The Australian dollar found support from the hawkish minute, +1% for last week.

Thai government may waive visa requirements for travellers from more European countries and plans hundreds of cultural and sporting events. This is also expected to help with the medical tourism sector in Thailand.

Malaysia will grant visa-free entry to citizens of China and India for stays of up to 30 days starting on Dec. 1, according to Prime Minister Anwar Ibrahim.

India is going to start blending biogas with natural gas to curb its reliance on imports. The mixing will start in April 2025 for use in cars and in homes. The mandatory phased introduction will start at 1% for use in automobiles and households from April 2025, it said. The share of mandatory blending will then be increased to around 5% by 2028. The government also aims to have 1% sustainable aviation fuel (SAF) in aircraft turbine fuel by 2027, doubling to 2% in 2028. The SAF targets will initially apply to international flights, the statement said. The steps are aimed at helping India achieve net zero emissions targets by 2070.

Oil & Commodities

Crude oil fell last week, as OPEC+ meeting scheduled for the weekend was delayed. Investors interpreted the delay as lowering the likelihood that supplies would be tightened. In addition, US crude oil inventories were up another 8.7m barrels last week, taking them up to their highest level since July.

WTI fell 0.46% to close the week at 75.54, while Brent fell 0.04% to 80.58. Base metals rose last week as well, as risk sentiment in China was better, where it was reported that Chinese regulators have drafted a list of 50 real estate firms who will be able to tap low-cost financing. Aluminium (+0.29%), Copper (+1.35%) and Iron Ore (+1.4%). Gold rose 1.01% to close the week at 2000.82.

Economic News This Week

-

Monday – JP PPI Svc/ Machine Tool Orders, US New Home Sales/ Dallas Fed Mfg ActO

-

Tuesday – AU Retail Sales, EU M3 Money Supply, US Cons. Confid./ Richmond Fed MfR / Existing Home Sales

-

Wednesday – NZ RBNZ Rate Decision, SW GDP, UK Mortg. App., EU Cons./Econ./Indust./Svc Confid., US Mortg. App./ Wholesale Inv./ GDP/ Personal Consump./ Core PCH

-

Thursday – NZ Building Permits, JP Retail Sales/ Indust. Pdtn/ Retail Sales, NZ ANZ Biz Confid., AU Building App., CH PMI, EU CPI, CA GDP, US Initial Jobless Claims/ Personal Income/ Personal Spending/ MNI Chicago/ Pending Home SaleJ

-

Friday –NZ Cons. Confid., JP Jobless Rate, JP/CH/SW/EU/UK/ US Mfg PMI Nov Final, CA Unemploy. Rate, US ISM Mfg/ ISM Prices Paid

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.