KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets clocked their longest winning streak since June-July of this year following November’s 9% surge in both the S&P 500 and the Dow Jones. The Nasdaq Composite, being more sensitive to yields closed November with a 11%, $3 trillion surge. Falling yields and a weakening $ triggered strong risk-on positioning.

On Friday, Chair Powell said policy was “well into restrictive territory”. Powell, speaking in Atlanta, pushed back against cutting borrowing costs in the first half of 2024 but added that the central bank will move cautiously. The FOMC will next meet on the 13th of Dec where the Fed is widely expected to keep policy unchanged for its 3rd straight meeting. US consumer spending, inflation and the labor market all cooled in recent weeks, adding to evidence that the economy is slowing and fuelling bets the Federal Reserve will stop tightening and pivot to rate cuts next year.

The VIX Index of US stock-market volatility is holding near a prepandemic low reached last week below 13. The Fed’s preferred inflation gauge, the PCE core deflator fell to 0.2% from 0.3% last month MoM from a year ago, the gauge of underlying inflation advanced 3.5% from 3.7%. US GDP remained resilient with no signs of an imminent recession, coming in at 5.2% versus views of 5% QoQ. However, the Fed Reserve Beige Book noted that economic activity had slowed since the last update, with businesses reporting that high inflation and rising interest rates dragged down their economic outlook.

Fedspeak from members swayed to dove-territory with NY’s John Williams reiterating the Fed’s benchmark lending rate is at or near its peak level and said monetary policy is “quite restrictive” and SF’s Daly (a hawk) saying rates are in a “very good place” to control inflation although she’s not thinking about cuts just yet as it was still too soon to say if hikes are finished. Atlanta Fed’s Raphael Bostic said he’s growing increasingly confident that inflation is firmly on a downward trajectory. Even US Treasury Sec. Yellen added she doesn’t believe the Federal Reserve will need to push as harshly in lowering inflation as it has done in past instances when price rises ran out of control.

Last Tuesday, higher than expected November Conference Board Consumer Confidence 102.0 Vs 101.0 expected, but nevertheless lower than previous month. November Fed Richmond Manufacturing Index came out weaker than expected.

Continuing claims continue to deteriorate. October Core PCE Deflator printed at +3.50% YoY in line with expectation but down 2 tenth of 1% Vs previous Month. Over the last 6 months, this inflation indicator is now progressing by only +2.50%, not far from Fed target. Finally last Friday November ISM Manufacturing printed at 46.7, below expectations but in line with previous month. Price paid rebounded, employment was weaker but new orders printed better, therefore, we see some mixed signals coming from the ISM.

This week’s employment data should see what short-term direction sentiment will take, change in NFP is expected at +180k with an unemployment rate of 3.9% unchanged from October. Average hourly earnings are expected to cool a tad YoY to 4%. Given a drop in energy costs, the U. of Mich. Inflation expectations are also expected to show a fall to 4.3% and 3% for 1 and 5-10 yrs respectively. As we head to year end, ride the wave as sentiment is bullish given above tailwinds – but look to hedge out for the new year when 4600 +/- (SPX) is taken out.

Cryptos are also on the bandwagon as we see BTC flirt with $40k and ETC $2200 for the first time in over a year. After traders digested the Binance settlement, the hype around the markets’ belief that a spot BTC exchange-traded fund (ETF) would be approved and bring significant cash inflows to Bitcoin, prices across the crypto market were pushed higher

Europe

European markets closed higher Friday after finishing their best month since January. The Stoxx 600 index closed up 1% with mining stocks leading gains with a 4.2% rise after China’s manufacturing sector recorded an unexpected expansion. The Stoxx gained 6.45% overall in November.

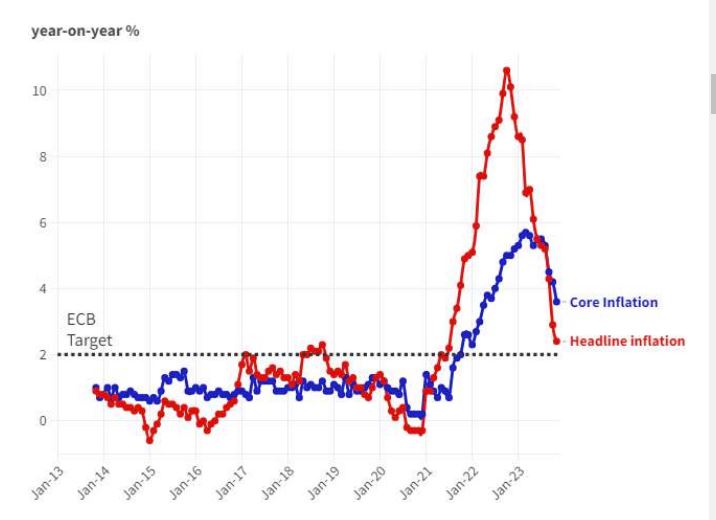

On the inflation front, the data are pointing to weak inflationary pressures in November. Euro area inflation came in substantially weaker than expected, both on headline and core HICP inflation measures. Headline HICP inflation fell to 2.4% yoy (vs 2.7%) in November from 2.9% in October. Core HICP inflation declined to 3.6% yoy (vs 3.9%) from 4.2% in October.

CPI inflation in Germany continued to soften in November, declined to 3.2% yoy in November from 3.8% in October, which was the lowest level since June 2021. On a monthly basis, the CPI dropped 0.4%. Similarly, CPI in Spain was down from 3.5% to 3.2% yoy.

Falling energy prices and lower growth in food and services prices were the main factors behind the slowdown. These downward surprises reinforced the narrative that the ECB could start cutting rates in 1H24. The market pricing for the ECB has moved substantially in the past week, with a greater than 50% chance of a cut in March 2024. Markets are pricing in 14-25bp of a cut by then, and around 30bp in total by April 2024. However, ECB president Christine Lagarde warned that it was “not the time to start declaring victory’’ and had added that wage pressures ‘’remain strong’’ and had become a ‘’key factor driving domestic inflation’’.

On the activity front, the trend in bank lending to real economy is flat, with net lending to both households and nonfinancial corporates at around zero in the last few months. The Economic Sentiment Index increased 0.3pt to 93.8 in November after having declined significantly in prior months. The November increase is a step in the right direction.

This week is a week of surveys, with the euro area sentix and Consumer Expectations. We will also see 3Q Euro Area GDP, PPI and retail sales.

Asia

MSCI Asia was relatively flat this past week. Hang Seng index continued its descend, taking the week lower by 4.15%, YTD returns are at -13.8%.

India’s Nifty was the best performer, benchmark NSE Nifty 50 Index closed at a record high on Friday taking gains to 11.20% YTD. India’s ruling nationalist Bharatiya Janata Party, BJP on Sunday won regional votes in three out of four major states, in a big boost for Prime Minister Narendra Modi ahead of a national election due by May. The central states of Rajasthan, Madhya Pradesh and Chhattisgarh, and the southern state of Telangana, voted last month in the last set of provincial elections before the national poll, in which Modi will seek a third term. The four states are home to more than 160 million voters and account for 82 seats in the 543-member parliament. BJP’s performance was better than widely expected as opinion and exit polls had suggested a close contest between Modi’s party and Congress.

Economic data suggests a fragile recovery in China. October retail sales surged 7.6% y/y but this was against a low base in 2022 . Property sales fell 20.33% y/y while sharply lower pork prices dragged CPI back into deflation and producer prices contracted further. Exports fell by much worse than forecast but imports unexpectedly rose. Official manufacturing PMI was 49.4 in November, compared to consensus 49.7. Nonmanufacturing PMI also disappointed at 50.2 vs consensus 50.9 and prior month’s 50.6. China Caixin manufacturing PMI however unexpectedly returned to expansion in November, in contrast to official PMI that shrank at a quicker pace.

China also recorded its first-ever quarterly deficit in foreign direct investment in July-September, suggesting capital outflow pressure.

WHO said China had shared data about recent surge in respiratory illness in children, indicating no detection of any unusual or novel pathogens. The data, which included laboratory results from infected children, showed rise in cases because of known viruses and bacteria.

Central banks in South Korea, New Zealand, Thailand, Indonesia, and the Philippines kept their base rates on hold as banks juggled slowing macro indicators against sticky forms of inflation. The BOK held rates steady just as industrial output figures slowed unexpectedly amid inflation that rose for the third consecutive month. Korea’s industrial production fell 3.5%m/m in October. Bank Indonesia also flagged lingering inflation and currency risks especially if US yields continued to rise and the RBI said its monetary policy needed to be ‘actively disinflationary’ given the country’s vulnerability to food and fuel prices. Singapore’s MAS also reiterated its monetary policy settings were ‘appropriate’ amid some calls for a loosening but also just as inflation rose again. Bank of Thailand is left its benchmark interest rate unchanged, at 2.5% after eight successive quarter-point increases since last year that pushed inflation below central bank’s target even as economic growth remained dismal.

Taiwanese chip foundries are expected to see significant price cuts on mature semiconductor production in the first quarter of 2024 due to fierce competition from Chinese and South Korean foundries. An estimated 32 new process wafer fabs will go online in China next year, creating a massive capacity glut, reported the Commercial Times. In anticipation of this surge in capacity, industry insiders said that Taiwanese wafer foundries are preparing for a price war with China’s Hua Hong Semiconductor and South Korea’s Key Foundry by slashing prices by 10% to 20% in the first quarter of 2024. Taiwan’s semiconductor firms are expected to invest US$210 billion over the next five years to cement the country’s lead over its peers in the global IC market. The government would continue to encourage the local semiconductor industry to invest by providing incentives under the Statute for Industrial Innovation. Taiwan economy continued with solid growth in 3Q. The economy grew 2.32% yoy.

Asia’s first ETF tracking Saudi Arabia equities debuted in Hong Kong. The ETF, called CSOP Saudi Arabia ETF (2830.HK), is managed by Hong Kong-based CSOP Asset Management. It counts Saudi sovereign wealth fund, Public Investment Fund (PIF), as an anchor investor.

GeoPolitics

Vietnam and Japan on Monday officially upgraded their relations to a “comprehensive strategic partnership” during a visit by Vietnamese president Vo Van Thuong to Tokyo. The elevation of ties with Japan followed Vietnam’s historic upgrade of relations with the United States in September, when the former foes signed multiple cooperation agreements, including on semiconductors and critical minerals. Vietnam has designated five other countries as comprehensive strategic partners, including China, India, Russia, South Korea and the United States. Japan is Vietnam’s third-largest source of foreign investment and its fourth-largest trading partner, with bilateral trade reaching $50 billion last year. Several Japanese multinationals, such as Canon (7739.T), Honda (7267.T), Panasonic (6752.T) and Bridgestone (5108.T), are among the largest foreign investors in Vietnam, turning it into a regional manufacturing hub, with one of the fastest-growing economies in Asia.

Indonesia’s outgoing president has approved a 20% increase in defence spending through the end of next year, to upgrade the country’s military hardware in response to geopolitical developments, its finance minister said. The defence budget will be increased from $20.75 billion to $25 billion.

Ballistics missiles fired by Yemen’s Houthi rebels struck three commercial ships Sunday in the Red Sea, while a U.S. warship shot down three drones in self-defence during the hours-long assault, the U.S. military said. The Iranian-backed Houthis claimed two of the attacks. The strikes marked an escalation in a series of maritime attacks in the Mideast linked to the IsraelHamas war, as multiple vessels found themselves in the crosshairs of a single Houthi assault for the first time in the conflict. The U.S. vowed to “consider all appropriate responses” in the wake of the attack, specifically calling out Iran, after tensions have been high for years now over Tehran’s rapidly advancing nuclear program. The attacks underline fears that the military conflict between Israel and Hamas could spread across the Middle East, which would have serious implications for stability in the region and for global trade.

Credit/Treasuries

Early last week, dovish tone from typically hawkish Fed’s Waller when he said he is “increasingly confident” that policy is well positioned to get inflation back to target, but “cannot say for sure” that the Fed is done. Recent loosening in financial conditions served as “a reminder to be careful” about letting market do Fed’s job. But he also said that, if inflation continues declining, there is “no reason” to keep rates “really high”.

The main catalyst for the bond rally last week were the comments from Fed Governor Waller when he suggested cuts were potentially possible in H1 if inflation behave as he thinks it could. There were some other Fed voters who spoke last week, but market participants really focus on Waller comments. Markets took Waller comments as another sign that the Fed were done hiking rates, and investors moved to price in a noticeably more dovish path for rates over the year ahead. For instance, the chance of a rate cut as soon as the March meeting rose from 16% to above 50% and the chance of a cut by May was up from 58% to 86%. Looking at 2024, the number of cuts priced in was up from 89bps to 103bps following those comments. Deutsche Bank expect 175bps of rate cuts in 2024 and a big rally down to 3.15% for 2-year yields but their forecast is based on their views of a recession rather than a soft landing one that markets are pricing. Some economic indicators are now showing that we could be reaching the end of the positive equity bond correlation soon.

Federal Reserve Chair Jerome Powell attempted to push back against investors’ growing expectations of interest-rate cuts in the first half of 2024. Wall Street responded by doubling down on Friday, despite Powell’s warning that “it would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease.”

Investors viewed Powell’s comments as sufficiently balanced to leave the door open an earlier pivot. The risks of under- and over-tightening are becoming more balanced,” Powell said. Despite Powell’s push-back, investors focused on his remarks that policy is now “well into restrictive territory” and that the full effect of previous rate hikes are still working through the economy.

All these Fed’s comments and the market reaction or understanding of these comments created a huge volatility on interest rates last week. The US Treasury curve bull steepened with the 2years yield down by 42bps, 5years down 38bps, 10years down 29bps & 30years down 23bps. 5years IG credit spreads tightened by another 2bps and are now trading at 61bps, the tightest level this year. 5Years HY credit spreads tightened by 11bps over the week to reach 395bps, also the lowest level of the year.

In term of performance, US IG gained 1.90% last week, US HY gained 1.63% and leverage loans gained 5bps. It must be noted that these performances were achieved while the 5 & 7years Treasury auctions last week were considered weak. Rates initially rebounded after these auctions but nevertheless ended these trading sessions down supported by dovish investors positionings.

As a recap, November was the best Month for global bonds since December 2008, the best Month for US bonds since May 1985 and the strongest Month for the S&P500 this year.

Moving to the week ahead, we have another big week in term of US Economic Data with the November PMI & ISM Service index, all the employment data on Friday as well as the December University of Michigan sentiment index.

FX

DXY USD Index fell 0.13% to close the week at 103.268, driven by softening in US growth data and renewed optimism for Fed rate cuts.

Data wise, US continuing jobless claims were up to their highest level in almost two years, at 1.927m (vs. 1.865m expected), headline PCE came in at a monthly 0.0% (vs. +0.1% expected), which brought the year-on-year number down to +3.0%, and the lowest since March 2021. ISM Manufacturing PMI remained at 46.7 in November (C: 47.8). Generally hawkish Fed Governor Waller was increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%. Fed Chair Powell assesses the policy rate is “well into” restrictive territory and the full effects of tightening have likely not yet been felt, but it is premature to speculate on when policy may ease.

EURUSD fell 0.50% to close the week at 1.0884, driven by lower than consensus CPI reading. Headline annual inflation was down to +2.4% (vs +2.7% expected) , the lowest since July 2021, and almost back at the ECB’s 2% target. Core inflation remained more

elevated at +3.6% but this also surprised clearly on the downside (+3.9% exp) with a marked slowdown in the past three months. ECB OIS is now pricing 100 bps cut by July 2024.

GBPUSD rose 0.85% to close the week at 1.271, driven by further positive UK data and USD weakness. UK mortgage approvals rose to 47.4k in October (vs. 45.3k expected), ending a run of three consecutive declines. This adds to the theme of better-than-expected UK data over the last 2 week, including the flash PMIs and the GfK’s consumer confidence reading. Positioning on long GBPUSD is neutral, indicating possible further strength.

USDJPY fell 1.75% to close the week at 146.82, driven by USD weakness and decline in US treasury yields, with UST 2 years yield falling 41 bps last week. USDJPY has closed below its 100 days MA (147.17), indicating further weakness. Data wise, Japan retail sales rose at its slowest pace so far this year, increasing +4.2% y/y in October (v/s +6.0% expected). Unemployment rate edged down to 2.5% in October (v/s 2.6% expected).

Oil & Commodities

Crude Oil fell last week, with WTI and Brent falling 1.95% and 2.11% to close the week at 74.07 and 78.88 respectively. Following the conclusion of the OPEC+ meeting, the group agreed additional supply cuts totalling about 900kb/d on top of an existing reduction of 1,300kb/d by Saudi Arabia and Russia. However, the move was in the form of “voluntary cuts” by several OPEC+ countries rather than a more typical agreement on reduced production quotas, leaving questions over how disciplined the implementation of the supply curbs will be. Market remained unconvinced, coupled with demand concerns from lower global growth and surging US oil production, leads to lower oil prices.

Gold rose 3.57% to close the week at 2072.22 (YTD high), driven renewed optimism for Fed rate cuts, therefore USD weakness and falling real yields. Based on RSI indicator, Gold is now trading in overbought territory. With current “Goldilock scenario”, gold price should remain well supported.

Economic News This Week

-

Monday – AU Inflation, SZ CPI, EU Sentix Inv. Confid., US Factory Orders/ Durable Goods Orders

-

Tuesday – JP CPI, NZ ANZ Commodity Price, AU Current Acc./ RBA OCR, JP/CH/EU/UK/US Svc/Comps PMI Nov Final, EU PPI, US JOLTS/ ISM Svc Index

-

Wednesday – AU GDP, UK Construction PMI, EU Retail Sales, US MBA Mortg. App./ ADP/ Trade Balance, CA BOC Rate Decision

-

Thursday – AU/CH Trade Balance, SZ Unemploy. Rate, EU GDP/ Employ., US Initial Jobless Claims/ Wholesale Inv.

-

Friday – JP GDP/ Current Acc., US NFP/ Unemploy./ Mich Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.