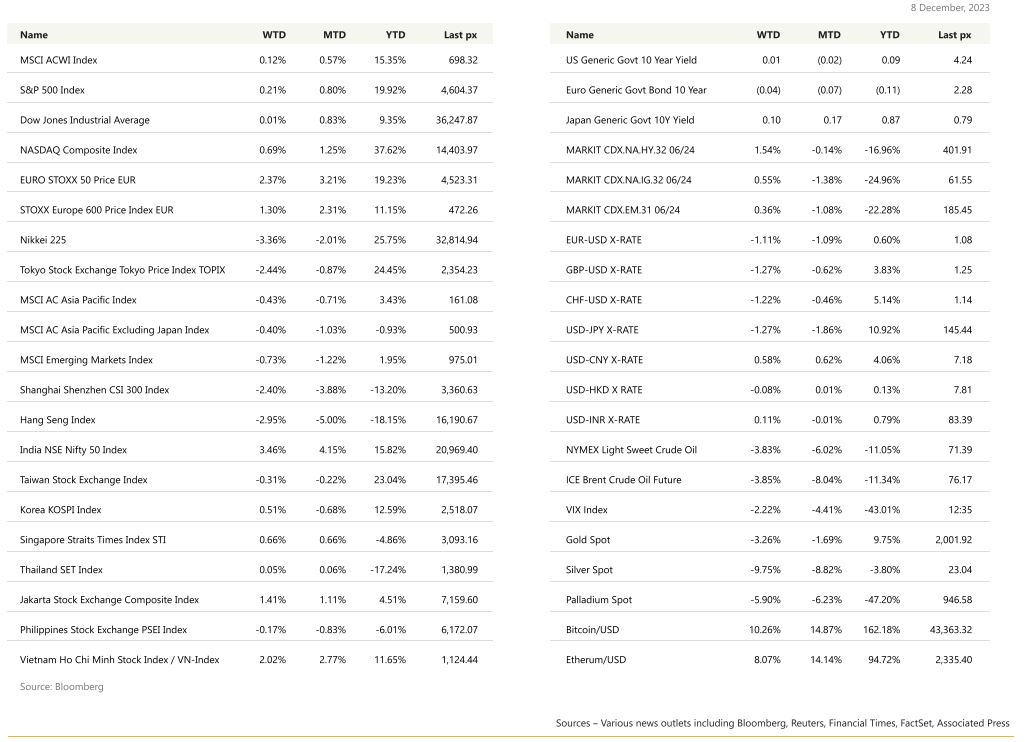

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets eked out a gain for the week, with the S&P 500 advancing for a sixth week to end at the highest level since March 2022. The trigger for the rally boosted optimism that the Fed Reserve can rein in inflation without causing a recession. Robust labour market data released Friday, although pushing yields higher, underlined the resilience of the economy. This was affirmed by the U. of Michigan’s consumer sentiment index which rebounded sharply to 69.4 from 61.3 in November. Recent forward inflation was rebounding but the preliminary data for December released last Friday saw a significant dropped in forward inflation with the 1-year inflation expectations fell to 3.1% from 4.5% whilst the 5-10 year expectations fell to 2.8% from 3.2% – both much lower than expectations. Odds continue to favour a no-change expectation at this week’s FOMC meeting. 10 year Treasuries closed at 4.22% whilst the 2’s closed at 4.72. The VIX closed at 12.35 its lowest since January 2022.

US NFP came in higher than expected at 199k (vs expectations of 185k) and the unemployment rate fell to 3.7% from 3.9% previously. Changes in both private payrolls and manufacturing were lower than expected. In the meantime, participation rate increased by 0.10% to reach 62.80%, higher than consensus and previous month. To add to this strong set of numbers, Average hourly earnings MoM printed at 0.40% in November Vs 0.30% expected and 0.20% the previous month. YoY Average hourly earnings came out in line at +4% in line with expectations and previous month, which was revised down 0.10%. Continuing claims for US jobless benefits fell by the most since July after climbing for the past two months, according to Thursday’s data. JOLTS job openings fell to 8,733k from last month’s 9,553k reading, its lowest since 2021.

Earlier last week, the November ISM Services was stronger than expected and previous month, reaching 52.7, new orders and price paid came out higher, but employment came out lower. November PMI Services came out in line with expectations at 50.8. Big winners were in Tech, fuelled by developments in the artificial intelligence space. Google climbed after releasing Gemini, its long-awaited AI model. AMD jumped 9.9% after unveiling new so-called accelerator chips aimed at taking on the lucrative AI market dominated by peer Nvidia Corp. We also saw Tesla Inc., Nvidia, and Amazon advancing.

This week is probably the latest big week in the US in term of economic data. Early this week, the November CPI & PPI will be released just before the big event of the week which will be the December FOMC. All market participants expect the Fed to keep Fed fund rate unchanged during this meeting, the important part is the publication of their SEP & Dot Plots, which will show if the Fed adjust their forward guidance for the US Economy as well as their Monetary Policy.

Fed chair Powell’s presser will be closely watched as the CB is in a rather tight spot for now – a still strong-ish labour market may leave concern that cutting too soon (as the market expects) could contribute to overheating aka Volker’s era. Some even went as far as saying the concern now is not so much that of inflation but of dis-inflation.

Right after the FOMC the November retail sales will be released as well as the December Empire Manufacturing Index and the November Industrial Production.

We think there is a little more upside to go given its strong sentiment, to which we would be looking to fade into rallies by engaging in some tail risk or hedging strategies via puts or contrarian structures. We had a massive increase in interest rates this last couple of years that the stats don’t quite add up – just haven’t totally hit the economy yet. Technically, the VIX has potential to retest its November 2019 lows of 11.54. Make use of this opportunity.

Europe

European markets closed in positive territory on Friday with European Stoxx 600 index closed up 0.7%. Travel and leisure stocks added 1.5% to lead gains while mining stocks fell 2.3%, contributed by the global mining company, Anglo American which was down 19% after announcing a plan to cut its capital expenditure amid a fall in metal demand.

Last week on the data front, the 3rd estimate of euro area 3Q GDP was down -0.1% qoq. Consumption added 0.2pp to GDP growth, while inventory change subtracted 0.3pp and other components were neutral. This was the first GDP fall since the 2022 Q4 and was further impacted by fixed expenditure remaining mostly flat. Exports dropped 1.1% with imports also decreasing 1.2%. However, employment in both the euro area and the EU was up 0.2%, compared to 0.1% the previous quarter.

Euro area retail sales rose 0.1%m/m in October and the September print was revised up from -0.3%m/m to -0.1%m/m. This leaves the October reading 0.8% ar below the 3Q level and continues to point to ongoing weakness in goods spending. Retail sales declined sharply last year and have broadly move sideways in 2023 as inflation fell sharply from its October 2022 peak. The details this year point to broadly stable readings in food spending and non-food ex. fuels spending, while fuel spending has been on a downward trend.

These recent inflation prints, ECB speak and expected downgrades on growth and inflation projections make it a dovish setting for this week’s meeting and the market pricing is already reflecting that. We expect the rates to remain unchanged, keeping the deposit rate at 4% and the main refinancing rate at 4.5%. Given the current circumstances, the Governing Council may announce its intention to phase out PEPP reinvestments from Q2 and the new macroeconomic projections will likely preserve the narrative of previous forecast rounds, characterized by a downward revision to near-term growth. This week we will also see the release of the flash PMIs for December (15 December) will give a first indication of the pace of growth at the end of the year

Asia

Asia closed lower last week dragged down by Japan and China. NKY index was lower by 3.36% while the CSI 300 was lower by 2.4%. MSCI Asia Index was lower by 0.43%.

Caixin and S&P Global released China’s service purchasing managers’ index last week which hit a three-month high. Caixin Services PMI 51.5 vs 50.4 in previous month, and the Caixin Composite PMI 51.6 vs 50.0 in prior month. China’s imports unexpectedly shrank in November from a Covid-hit period one year ago, dashing hopes domestic demand would rebound from a low base to spur growth in the nation’s slowing economy. Imports in dollar terms declined 0.6% after clocking an improvement the previous month, according to official data released Thursday. That was much worse than economists’ consensus forecast of a 3.9% gain.

Ratings agency Moody’s on Tuesday cut its outlook on China’s government credit ratings to negative from stable, citing lower medium-term economic growth and risks from a major correction in the country’s vast property sector. Local government debt reached 92 trillion yuan ($12.6 trillion), or 76% of China’s economic output in 2022, up from 62.2% in 2019, according to the latest data from the International Monetary Fund (IMF). Defaults by Chinese borrowers have surged to a record high since the outbreak of the coronavirus pandemic. A total of 8.54mn people, most of them between the ages of 18 and 59, are officially blacklisted by authorities after missing payments on everything from home mortgages to business loans, according to local courts.

Moody’s also placed Hong Kong, Macau and several of China’s state-owned firms and banks on downgrade warnings following the cut to sovereign. Eight Chinese banks had their outlook cut to negative.

In addition, 26 LGFVs and four state-owned enterprises had their outlook cut and were also placed under review for downgrades, which usually means a decision will be made within three months. All institutions currently maintain “A1” ratings. Separately, PBOC Governor Pan vowed to keep growth of money supply in check and yuan stable.

Moving to Japan and after much speculation last week on the BOJ next move and its timing, Nomura just published that they maintain their view that monetary policy will remain unchanged at the BOJ’s 19th December monetary policy meeting. However, they have brought forward the timing at which they forecast the lifting of negative interest rates to January 2024, from their previous forecast of Jul-Sep 2024. The timing at which they forecast the scrapping of the YCC (yield curve control) policy is unchanged; they still expect this to take place in Apr-Jun 2024 (mostly likely in April). The Japanese Yen started appreciating sharply middle of last week, from 147.50 to briefly reach a low of 141.71. The Yen is currently back at 145.45.

The Japanese economy lost an annualised 2.9% in JulySeptember, the revised Cabinet Office data showed, more than a previously estimated 2.1% contraction. Separate data showed inflation-adjusted real wages dropped 2.3% year-on-year in October to mark a 19th straight month of decline, although slower than the 2.9% fall in September. The Bank of Japan has stressed it needs to maintain ultra-low interest rates until sustainable inflation of 2% along with wage hikes comes into view.

RBA left rates on hold as expected, while statement takeaways leaned dovish. Japan and South Korea inflation prints came in a bit cooler than expected. Singapore retail sales dipped 0.1% y/y in October, reversing gains in prior month. Philippine central bank said it was necessary to keep monetary policy settings “sufficiently tight” and ready to take further action.

Indian stock market is on verge of $4T valuation for first time amid surge in investments by retail traders and foreign inflows. A recent EY analysis showed India IPOs expected to rise 45% this year to 209. It highlighted the contrast with shrinking offerings in China and Hong Kong amid US-China tensions and regulatory scrutiny that scuppered major listings. Indian equity strength is also reflecting higher household incomes and fall in rates on small savings schemes. Analysis also noted Indian IPOs have been fuelled by a rush to market ahead of general elections in May next year.

Heavy rains submerged roads in southern India early last week. Taiwan’s Foxconn and Pegatron halted Apple iPhone production at their facilities near Chennai due to heavy rains.

The Monetary Authority of Singapore will expand its financial cooperation with China via new digital finance and capital markets initiatives, according to a press statement. Initiatives include a cross-border e-CNY pilot between China and Singapore. Will allow travellers from both countries to use e-CNY for tourism spending. The two countries will also establish a 30-day mutual visa exemption agreement.

GeoPolitics

Italy – China. Italy has officially informed China that it is leaving the Belt and Road Initiative (BRI), dismissing fears the decision could sour relations and damage the Italian economy. Italy in 2019 became the first and so far, only major Western nation to join the trade and investment programme, ignoring warnings from the United States that it might allow China to take control of sensitive technologies and vital infrastructure.

US- Ukraine. Prospects for additional Ukraine aid fade after emergency spending bill is blocked in Congress. If the United States postpones military aid to Ukraine, there is a “big risk” the country could lose its war with Russia, Ukrainian President Volodymyr Zelenskyy’s chief of staff Andriy Yermak said last Tuesday. Speaking at the U.S. Institute for Peace during a visit to Washington, Yermak said failure by Congress to approve more aid to Ukraine could make it “impossible” to liberate more territory captured by Russia and “give the big risk to lose this war.”

Europe – China. EU leaders met President Xi Jinping in Beijing on last Thursday. The EU is worried China is increasing its industrial capacity, particularly in renewable energy products, at a time when Chinese domestic demand is weak and other trading partners such as the US are limiting access to their markets. This will leave Europe as an important target for an overflow of China’s exports. The EU is also urging China to use its influence on Russia to stop the war in Ukraine, and to stop Chinese companies from exporting European-made dual-use goods to Russia.

China – Philippines. Chinese and Philippine vessels faced off in multiple clashes in the South China Sea over the weekend as tensions continued to escalate between the two countries over maritime territory, prompting the US to reiterate its commitment to defend Manila.

Israel – Hamas. Israel has released maps, satellite photos, and video footage it says show that Hamas has fired rockets towards Israel from areas in southern Gaza where civilians were seeking shelter. Separately, watchdog group Human Rights Watch has released a report claiming that an Israeli strike that killed a Reuters videographer on 13 October appeared to be deliberate.

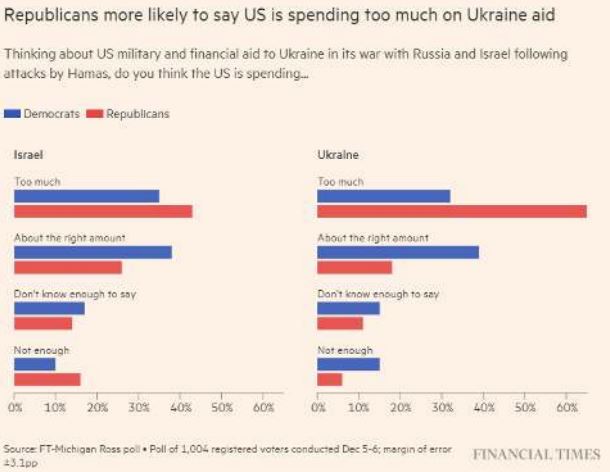

On another note, we believe that the war in Ukraine might possibly come to an end soon. There are a few reasons for that but the main one, in our view, is that the political consensus on both side of the Atlantic seems to be losing support. The White House has recently warned congress that funds designated to support Ukraine would run out by the end of the year, unless another aid package is agreed. However, now a big majority of Republicans, around 65% of them, believe that the US are spending too much on Ukraine. Funding of Ukraine seems to become more political than ever and with the incoming US presidential election less than 11 months away, further support might be a hard sell in the US.

Credit/Treasuries

The market is currently pricing around 110bps of interest rate cut for next year, slightly down compared to one week ago. The most important question in our view is not whether the Fed will cut interest rate and by how much, but why. If the Fed is bringing rates down in tandem with cooling inflation, that’s good news for the economy and investors. But if the Fed is reducing rates because the economy is deteriorating quicker than earlier expected, that is a different story.

After roughly 5 weeks moving down, last week saw a rebound in short term US Treasury yields. The 2years yield gained 15bps, 5years gained 8bps, 10years was roughly unchanged and 30years yield lost 7bps. US IG credit spreads were unchanged over the week and US HY credit spreads widened by only 2bps, still trading tight. In term of performance, US IG gained 60bps, US HY was roughly unchanged as well as leveraged loans.

FX

DXY USD Index rose 0.72% to close the week at 104.01, driven by stronger than consensus US employment data. Nonfarm payrolls, average hourly earnings, and labor force participation rate came in higher than expected, while the unemployment rate falls to 3.7%. On other US data, Michigan consumer sentiment rose sharply on the back of lower 1 year inflation expectation. We have the crucial US CPI number and FOMC rate decision next Tuesday/Wednesday.

GBPUSD fell 1.27% to close the week at 1.2549, driven mainly by USD strength. GBPUSD is now in a downward trend after reaching overbought territory based on RSI territory, touching a recent high of 1.273. Immediate resistance level at 1.26/1.27.

EURUSD fell 1.11% to close the week at 1.0763, driven by both USD strength and EUR weakness. In Europe, final print of euro area Q3 GDP confirmed a -0.1% quarterly decline, with details of release pointing to slowing wage growth. In addition, we had dovish comments from EU official, adding to EUR weakness. EURUSD has been in a downward trend since after touching a recent high of 1.10.

USDJPY fell 1.27% to close the week at 144.95, driven mainly by JPY strength. Speculation mounted that the Bank of Japan could soon end its negative interest rate policy in Dec/Jan, with BoJ Governor Ueda commenting that policy management would become even more challenging from the year-end and heading into next year and Deputy Governor Himono pointing out that households could benefit from higher net interest income if rates were positive. USDJPY touched a low of 141.71, before rebounding last Friday to 144.95.

Oil & Commodities

Crude Oil fell for the seven consecutive weeks, with WTI and Brent falling 3.83% and 3.85% to close the week at 71.23 and 75.84 respectively, with news that Saudi Arabia lowered its selling prices to Asia for next month. Support levels on WTI and Brent are at 70 and 75 respectively.

Gold fell 3.26% to close the week at 2004.67, driven by USD weakness and rebound in short term US Treasury yield. Immediate support level at 2000 and next key level at 1950 (200 days MA).

Economic News This Week

-

Monday – NO CPI

-

Tuesday – AU Cons. Confid./ Biz Confid., JP PPI, UK Jobless Claims Change, NO GDP, EU Zew, US Small Biz Optim./ CPI

-

Wednesday – NZ Food Prices, JP Tankan Index, UK GDP/ Indust. Pdtn/ Mfg Pdtn, EU Indust., US MBA Mortg. App/ PPI/ FOMC Rate Decision

-

Thursday – NZ GDP, JP Core Machine Orders/ Indust. Pdtn, AU Employ. data, SW CPI, SZ SNB Rate Decision, NO Rate Decision, UK BOE Rate Decision, EU ECB Rate Decision, US Retail Sales/ Initial Jobless Claims

-

Friday – NZ Biz Mfg, JP/EU/UK/US Mfg/Svc/Comps PMI Dec Prelim, CH 1 Yr LFR/ Industrial Pdtn/ Retail Sales, US Empire Mfg/ Indust. Pdtn

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.