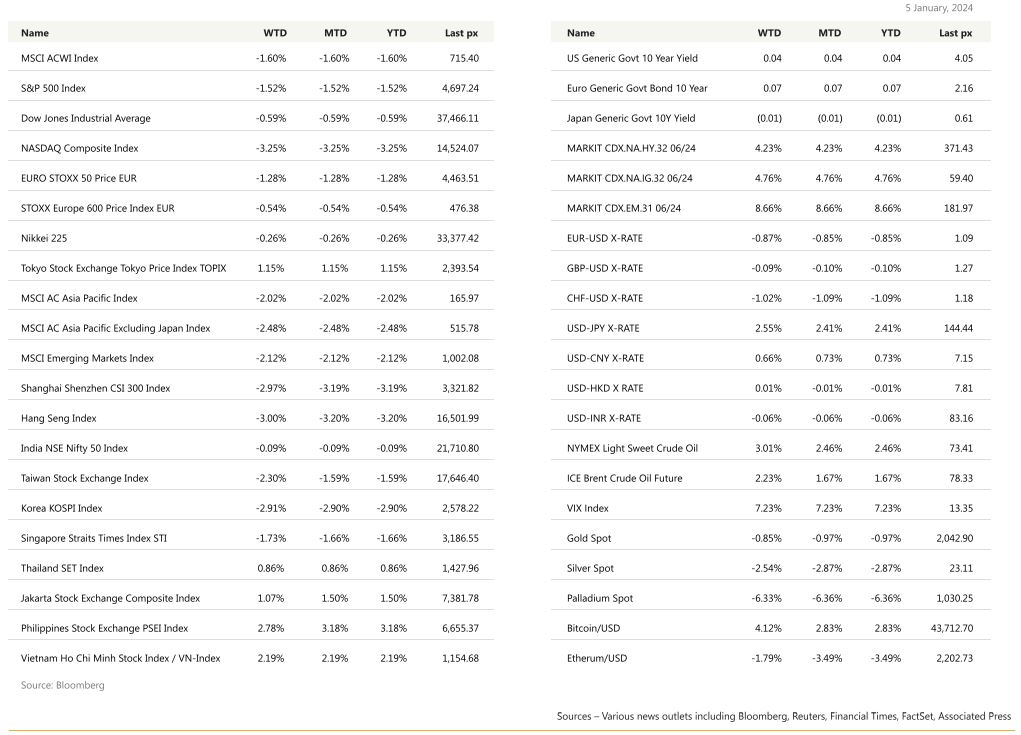

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

After a rocky start to 2024, US markets ended Friday up but were down for the week, its first weekly loss since October 2023.

The strong appetite for risk that pushed US markets higher the previous nine weeks faded on concerns about stretched valuations and tensions in the Mideast. Tuesday featured one of the worst-ever concerted drops in stocks and bonds to start a year.

After the release of US non-farm payrolls on Friday topping estimates at 216,000 jobs, stocks fluctuated throughout the session. December Initial jobless claims came out better than expected at 202K, continuing claims also printed lower at 1’855’000 Vs 1’881’000 expected. The unemployment rate remained unchanged at 3.7%, but in the meantime labour force participation dropped 0.30% to print at 62.50%.

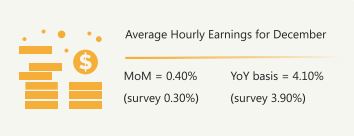

Also, the December ISM Services employment sub-category which printed much lower than expected at 43.3 VS 51.0 expected. So overall the job data that were released last Friday were mixed with some beats and some misses. In addition, last Friday the Average Hourly Earnings for December were released and printed, both on a MoM & YoY basis, at respectively 0.40% (survey 0.30%) & 4.10% (survey 3.90%). The December ISM Services printed at 50.6 lower than expected (52.5) and new orders also came out lower than expected at 52.8 Vs 56.1 in the survey.

ADP Data Thursday showed companies ramped up hiring in December and wage gains continued to cool, consistent with an outlook for sustained growth with ebbing inflation, while jobless claims came in below estimates. Post the data release, Richmond Fed President Barkin commented that the Fed can lower interest rates as the economy normalizes and confidence grows about the downward path of inflation. On Wednesday, Fed minutes indicated policymakers expressed a willingness to cut the benchmark lending rate in 2024, though they gave no indication easing could begin as soon as March, as traders expect.

Risks of rate hikes clearly remain, when the minutes indicated that the Fed would act appropriately should inflation flare-up. The JOLTS report eased in November to the lowest level since early 2021, coming in at 8.79 mln.

It briefly forced traders to push out estimates for when the central bank may begin to cut borrowing costs, from Q1 of this year.

Crypto-related stocks were in focus as Bitcoin climbed above $45,000 for the first time in almost two years earlier in the week as anticipation of an approval of an exchange-traded fund investing directly in the biggest token intensified. Ether also rode the wave higher to $2,300.

This week will see CPI & PPI among key data releases on Thursday and Friday, respectively. Bloomberg consensus expects YoY headline CPI at 3.2% with core at 3.8% and MoM core at 0.3%. Other than that, it will be a quiet week on the Macro front. On the election front, this year will be particularly busy, with elections later this year in India, Indonesia, the US and Mexico, to quote a few, but it will quick start this Saturday with the presidential & parliament election in Taiwan.

Investors enter 2024 by weighing bets on monetary policy easing by the Federal Reserve against elevated valuations, tension in the Middle East and rising oil prices. Whilst we think the risk-on balance may be on the heavy side, we see Value & small caps laggards presenting a buying opportunity on pullbacks – via ETF’s. For the broader exposure, we would be looking to hedge out 30% to 40% prudently.

Europe

European markets closed lower last Friday, rounded off a choppy first week of the new year as investors reacted to the eurozone inflation report and the December US jobs reports. The Stoxx 600 ended 0.3% lower as many major sectors were in negative territory. Retail sales fell 1.1% and led losses after the data showed German retail sales dropped far more than expected in November. Banking stocks were 0.5% higher.

Eurozone inflation climbed to an annual 2.9% in December from 2.4% the previous month, largely due to the base effect in German energy price inflation. Annual core inflation continued to decelerate and printed at 3.4%, down from 3.6% in November.

December Eurozone Services PMI coming in at 48.8 vs the preliminary reading of 48.1 and little changed from November’s 48.7. The survey showed business activity, new orders and employment remain in contraction, but confidence edged up. The reading shows Eurozone’s services industry edged closer to recession at the end of 2023, with composite PMI remaining under the growth mark. Despite slight improvements in service demand and outlook, analysts said the overall economic picture remains bleak.

In addition, rising output prices amid slow demand is seen adding pressure on the ECB’s inflation targets. Despite a marginally optimistic future sentiment, the composite future output index rose to a seven-month high of 57.6 from 56.0. On a country breakdown level, German and Irish services activity sitting at 2-month low but France at 4-month high, Italy at 3- month high and Spain at 5-month high.

The latest data would thus seem to indicate that it will take longer for the labor market and core inflation to ease and for the ECB to start contemplating a first rate cut.

This week, we will be seeing the European Sentiment Indictor for December and if it will confirm the trend of gradually improving confidence. Industrial production data for Germany and France, along with German factory orders which will allow us to better assess the weakness in industry in 4Q. In the UK, readings of GDP, Industrial and manufacturing production figures will be out as well.

Asia

In 2023, the MSCI Asia-ex Japan index experienced a modest 3.7% rise, significantly lagging behind developed markets in the US, Europe, Japan, and Australia, as well as Latin America. This underperformance was primarily attributed to the challenges faced by Hong Kong- and Shanghai-listed stocks, reflecting concerns about China’s sluggish economy and deepening worries over its debt-laden housing sector. Thailand’s SET notably underperformed due to foreign investor concerns surrounding the country’s election. However, there were robust returns from India, South Korea, and Taiwan, buoyed by improved macro conditions and a positive turn in the tech cycle. The start of 2024, however, witnessed a less favourable landscape, marked by a market pullback in the first week of trading. The Hang Seng continued its downward trend, declining by 3%, while the MSCI Asia ex Japan Index dropped by 2.5%. In contrast, the Nikkei showed a modest increase of 1.15%.

China’s factory output fell for third consecutive month in December and at its steepest decline in six months. Official PMI fell to 49.0 from 49.4 in November. Non-manufacturing PMI rose to 50.4 from 50.2, boosted by construction sector expansion which rose to 56.9 from 55.0, and government infrastructure investment that accelerated in final months of year. Services PMI unchanged at 49.3 to give 12-month low composite reading 50.3 from November’s 50.4.

NBS said decline in overseas orders together with “insufficient effective domestic demand” two biggest problems companies faced, added several sectors operated below capacity. New orders fell for third straight month to 48.7, new export orders to 45.8, suggesting further slowdown ahead.

India’s southern state of Tamil Nadu has inked $4.4 billion worth of deals with Apple suppliers and automaker Hyundai. The investments come as Apple tries to diversify production of its products out of China.

Some macro data from Asia – The RBA left the cash rate at 4.35% and repeated that further tightening will depend on upcoming data and an assessment of risks. South Korean inflation fell in December, tracking BOK’s long-term outlook. Asia PMIs (exChina and Japan) showed regional factory output weakened with Taiwan, South Korea and parts of Southeast Asia all shrinking. South Korean export growth slowed by more than expected as shipments to China declined again, offsetting an acceleration in chip export growth. In Japan, consumer confidence edged up in December, with a broad-based rise in indicators lifting the headline sentiment index 1.1 points to 37.2. This marks the highest reading since end-2021.

Singapore GDP logged fastest quarterly growth in two years amid rebound in industrial output but PM Lee warned on risks from global weakness and geopolitics. Singapore’s November manufacturing output fell, led by tech; expect trend to remain positive. Air travel continues to improve, but freight has stalled since 2022. Domestic demand expected to remain soft following the 1 January 1% GST hike. Core CPI expected to drift lower.

Thailand and China have agreed on a bilateral deal to waive visa requirements for travellers, according to Thai PM Srettha, a move likely to accelerate the pace of the post-pandemic recover. Chinese were Thailand’s largest group of tourists before the pandemic, accounted for more than 10m visitors in 2019.

GeoPolitics

ASML Holding cancelled shipments of some of its machines to China at Washington’s request before export bans on high-end chipmaking equipment came into effect. Noted the company had licenses to ship three DUV lithography machines to China until January when new Dutch restrictions take full effect.

China announces sanctions on five US defence companies over arms sales to Taiwan. The sanctions will freeze any property the companies have in China and prohibit organizations and individuals in China from doing business with them. Taiwan is a major flashpoint in U.S.-China relations that analysts worry could explode into military conflict between the two powers.

China says that U.S. arms sales to Taiwan are interference in its domestic affairs. We are now, just about one week away for the elections in Taiwan.

Red Sea tensions rose last week, after US Navy sunk three Houthi boats, prompting Maersk to halt shipping for 48 hours and Iran to dispatch a destroyer to the area.

Over the weekend, Israeli army said it had destroyed Hamas as a fighting force in northern Gaza. Separately, US officials raised concerned Israel may soon launch major military operation in Lebanon.

Credit/Treasuries

US Treasury curve started the new year with yields rebounding across the curve and with a slight steepening of the curve, the 2years gained 10bps, 5years +11bps, 10years +12bps & 30years +13bps. US 10 year yield broke through 4% to end at 4.046%.

IG credit spreads were marginally wider and HY credit spreads widened by 10bps. US IG lost 1.15% over the week while US HY lost 0.60% and leverage loans finished the week unchanged.

Market expectations about rate cuts in the US this year have come down from 6.4 cuts that were priced at the end of last year to 5.4 cuts that are currently priced, which is still well above the 3 cuts that the Fed forecasted during their latest SEP’s mid-December.

FX

DXY USD Index started the new year positive, rising 1.06% to close the at 102.41, as markets dialled back the probability of imminent rate cuts.

The Fed minutes did not offer any pointers to imminent Fed easing but provided guidance that eventually “it would be appropriate for the Committee to begin to discuss the technical factors that would guide a decision to slow the pace of runoff.” The latest jobs report showed a larger-than-expected increase in nonfarm payrolls, higher-than-expected average hourly earnings, and a steady unemployment rate distinctly aligned with a reduction in implied cuts. However, ISM services employment index plunges 7.4ppt into contraction. ISM Services index fell to 50.6, below consensus. Immediate support at 102/101.5, while resistance level at 103/103.5.

EURUSD fell 0.87% to close the week at 1.094, driven by USD rebound. The new year was kick-started by better European PMI data, all services/manufacturing/composite revised update. EU inflation came in in-line with consensus. Resistance level at 1.10, while support level (200 DMA) at 1.085.

GBP USD fell slightly (-0.09%), to close the week at 1.272. The start of the new year see brighter economic data from the UK. First, mortgage approvals were stronger than expected in November at 50.1k (vs. 48.8k expected), taking them up to a 5-month high. And alongside that, there were positive revisions in the final PMI readings, as the services PMI was revised up to 53.4 (vs. flash 52.7), and the composite PMI was revised up to 52.1 (vs. flash 51.7). There was also a bit more speculation about the date of the next UK election, after Prime Minister Sunak said that his “working assumption is we’ll have a general election in the second half of this year”. Technically, the 50 DMA crossed above the 200 DMA, and this can signal the exhaustion of downward market momentum.

USDJPY rose 2.55% to close the week at 144.63, driven by higher US yields and USD strength. The recent devastating earthquake makes it harder for the BOJ to imminently exit negative interest rates, contributing to JPY weakness. Immediate support at 144/143.50, while resistance level at 145/147.

Oil & Commodities

Crude Oil rose in the first week of 2024, with WTI and Brent rising 3.01% and 2.23% respectively, to close the week at 73.81 and 78.76. Simmering tensions in the Middle East and North Africa eclipsed signs of weakening US demand. US gasoline inventories swelled by the most in three decades, while Implied American gasoline demand dropped to the lowest in a year. A surge in supplies from outside the OPEC+ alliance, led by US shale drillers, is expected to continue, while consumption growth is forecast to slow.

Gold fell 0.85% to close the week at 2045.45, driven by higher US yields and USD strength. Immediate support level at 2025/2000, while resistance level at 2065/2080.

Economic News This Week

-

Monday – SZ CPI, EU Sentix Investor Confid./ Retail Sales/ Cons./Econ./Indust. Confid., US NY Fed 1 Yr Infl. Exp.

-

Tuesday – JP CPI, AU Retail Sales/ Building App., SZ Unemploy. Rate,/ Foreign Curr. Reserves, EU Unemploy. Rate, CA Building Permit, US Trade Balance

-

Wednesday – NZ ANZ Commodity Price, SW Retail Sales/ Indust. Orders, NO CPI, US Mortg. App./ Wholesale Inv.

-

Thursday – NZ Building Permits, AU Trade Balance, US CPI/ Initial Jobless Claims

-

Friday – JP Trade Balance, CH CPI/PPI, UK GDP/ Indust. Pdtn/ Mfg Pdtn/ Trade Balance, US PPI

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.