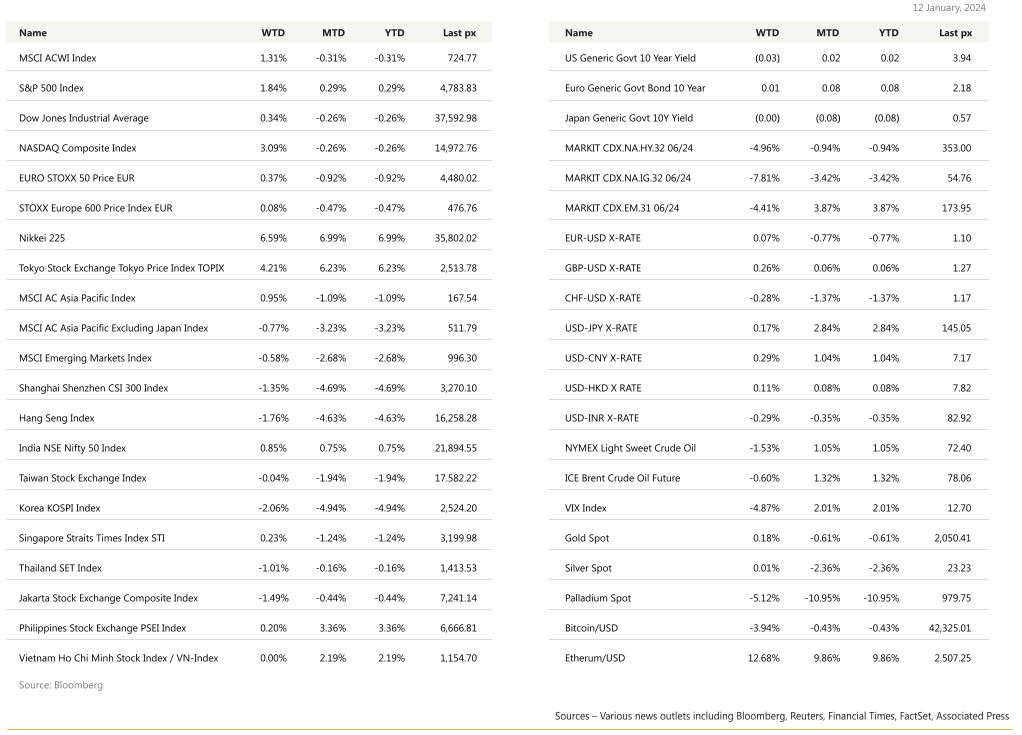

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

CPI overwhelms but PPI underwhelms. Such is the inflation picture reported last week. Coupled with slightly lower than expected jobless claims, the Fed’s soft-landing stance appear to remain intact.

On a weekly basis, both the S&P 500and the Nasdaq 100 posted their biggest weekly gains in a month as investors adjusted their Fed rate cut expectations on these mixed economic readings. Quarterly earnings kicked off Friday from several major banks with mixed results, Citi warned of a very disappointing 4th quarter and announced 20,000 staff cuts, Bank of America had a 4th quarter cut in profits whilst JP Morgan closed out the most profitable year in US banking history. Guidance for 2024’s earnings will be much more important than 4Q23 results with current valuations counting on double-digit earnings growth and multiple cuts by the Fed this year. Anything below that could trigger what some have called a delayed inevitable recession.

The December CPI data came almost exactly in line with expectations at +0.30% MoM while core rose by 0.31%. Taken together, the year-over-year rate for headline rose two-tenths to 3.3%, while that for core fell a tenth to 3.9%. Shorter term trends in core show mixed progress on disinflation, with the six-month annualized rate rising by three-tenths to 3.2%, while the three-month annualized rate fell by a tenth to 3.3%. The PPI components that inform core PCE also came in soft, implying that December core PCE, which will be release on the 26th, will grow by around 0.16% from November, causing the year-over-year rate to drop by 30bps to 2.9%.

Revising forecasts lower appears odd given December core CPI data came in nearly dead-on with expectation, but technical factors behind the revision, help explain the difference between CPI & PCE data. First, core PCE uses inputs from PPI to calculate inflation for certain services: airfares, healthcare, financial and insurance services. Even though financial services came in stronger than expected in the PPI report, airfares and heath care came softer on net bringing core PCE forecast for December down.

Second, goods that have a relatively larger weight in core goods PCE, like electronics and computer software, continued to show strong deflation in December. Also, both used and new cars, which have a higher weight on CPI than in PCE, accelerated in December. The typical wedge between core goods CPI & core goods PCE is implying lower core goods deflation for PCE.

Altogether, last week’s data largely support the Fed’s narrative around inflation, though some potential challenges to the story are beginning to emerge, specifically as it relates to rental disinflation. While goods inflation seems to be largely “solved” and the labor market coming into better balance should reassure the Fed that core services ex housing will likely cool, substantial rental disinflation remains elusive thus far.

On the one hand, until more progress is made on rental inflation, it is hard to argue that inflation is on a sustainable path back down to the Fed’s target. On the other, core PCE, which is what the Fed targets, seems to be normalizing faster than expected and could argue for bringing forward rate cuts to prevent real rates from becoming more restrictive. The base case is that the first cut will occur at the June meeting, but there are reasonable scenarios on the near-term inflation data in which the Fed begins to cut earlier.

Market reaction from the data was down initially before recovering, as the reading sowed doubts in the Fed cutting in March. Average hourly and weekly earnings came in unchanged from the previous month.

Cleveland Fed President Mester said it was still premature to consider cutting rates in March and needs to see more evidence before deciding to cut. NY Fed President Williams echoed the same sentiment although he said monetary is now tight enough to guide inflation back to the Fed’s target of 2%.

Crude oil traded higher after the US and UK launched airstrikes on Houthi targets in Yemen following more attacks on commercial ships in the Red Sea. Cryptos hit 2-year highs when the SEC finally approved Bitcoin ETF’s before profit-taking settled them circa $42,500 and $2,550 for BTC and ETH respectively

This week will see retail sales, January Empire Manufacturing, inflation, and sentiment expectations as well as existing home sales.

With the resumption of risk assets rallying last week, VIX is now heading back toward 12. We continue to advocate buying Puts on the S&P 500.

From a value perspective – look at Johnson & Johnson. One of only 2 companies to have a AAA rating from both Moody’s and S&P, the stock lagged last year due to its outstanding litigation talc-based baby powder. JNJ sits in the defensive bucket and of note is its ongoing shift to pharmaceuticals and operating diversity

Europe

European equity markets finish higher Friday, with the Stoxx 600 index closed 0.77% higher, but off best levels. Energy, Real Estate and industrial Goods/Services lead. Consumer Products/Services lag. In terms of European news, ECB’s chief economist Lane said rate cuts not a topic until inflation is on the way back to 2% target.

As expected, last week’s eurozone consumer confidence was up and this was the highest reading since February 2022. This increase in sentiment is encouraging as expecting the Euro economy to move out from stagnation in 1Q24. It was driven by higher confidence among consumers and managers in retail trade, services, and construction, while confidence in the industry remained broadly unchanged.

The eurozone’s unemployment rate fell to 6.4%, down from 6.5% in the previous month and 6.7% the previous year. This is remarkable given the weakness in output over the past year. In addition, there are hints that retail sales may be stabilizing. But, on the other hand, Euro area manufacturing continues to struggle, led by Germany. By now, most countries have released their November estimates. The information suggests that Euro Area IP ex construction is likely to contract by 0.4% m/m.

Regarding the ECB, markets have prepared for expectations for rate cuts a bit further, especially in 1H24. 2 cuts are however still priced by mid-year, despite cautious ECB commentary. So far, none of the ECB speakers are willing to debate rate cuts, despite acknowledging the weakness in growth. The ECB remains focused on the incoming inflation data and labour market in the early part of this year. This week’s final final HICP for December will at least reveal the extent to which distortions played a role in generating another soft monthly print.

In the UK, the monthly GDP for November rebounded by 0.3% m/m with gains of 0.4% in services and manufacturing helping to offset small drags from construction and energy. Information and communication, as well as retail and distribution, stood out as making the strongest contributions. The gains may have been boosted by Black Friday Sales. This may have hinted at a broader underlying improvement, but we expect retail sales to fall back in December.

This week UK releases inflation, employment, and retail sales data help assess recession risks and the next move from the BoE.

Asia

Japanese stocks pushed higher last week., outperforming regional peers again. YTD Nikkie is up close to 7% while MSCI Asia Ex Japan index is lower by 3.23%. The largest laggards were China and South Korea, lower by 4.7% and 4.9% respectively for 2024 so far.

The BOJ remains a dovish outlier among global peers, having maintained ultra-loose policy even as central banks elsewhere have raised interest rates aggressively and kept them elevated to fend off inflation risks.

Tokyo’s core consumer price index (CPI), which excludes volatile fresh food but includes fuel costs, rose 2.1% in December from a year earlier government data showed.

The People’s Bank of China maintained the rate on its oneyear policy loans — called the medium-term lending facility (MLF) — at 2.5%, contrary to widespread expectations among economists that it would make its first trim to the rate since August. It also offered 995 billion yuan ($139 billion) through the MLF, resulting in a 216 billion yuan net injection that will boost liquidity and help meet funding demand.

Taiwan elected VP Lai Ching-te as president with a 40.1% vote but deprived the DPP of control of the legislature. DPP, party failed to win parliamentary majority, taking 51 of 113 legislature seats, ten fewer than 2020. DPP was voted in despite frustrations over the Democratic Progressive Party’s handling of the economy and rising military tensions with Beijing. (more in geopolitics below)

Thai Prime Minister Srettha Thavisin on Monday said the central bank should consider cutting interest rates as inflation was very low and planned to speak to its governor to urge him to reconsider its policy stance. The central bank left its policy rate unchanged at a decade high of 2.50% in November after raising it by 200 basis points since August 2022 to curb inflation. It will next review policy on Feb. 7.

Visitor arrivals in Thailand jumped to 2.64m in November, 12% higher than the monthly average in 3Q, after the nation dropped visa requirement for mainland Chinese tourists. That was upgraded on Jan. 2 to a permanent visa waive for both nations starting in March 2024. Thai tourism authority expects arrivals to rise 25% in 2024.

India raised its FY23/24 GDP growth forecast to 7.3% ahead of its budget scheduled for 1-Feb.

Other data points out from Asia last week – A report showed China’s population likely fell for a second successive year in 2023 on Covid deaths and depressed birth rates. Korea’s employment fell marginally by 0.1%m/m, sa, in December, for the second monthly fall. A PBOC official flagged a potential RRR cut, backing consensus forecasts for 25 bp easing in Q1. Tokyo CPI inflation eased while Japan household spending lagged. Bank of Korea kept its base policy rate at 3.5. Policy statement and the governor’s press conference confirmed that the BoK is not actively considering an additional rate hike in the current policy environment

GeoPolitics

US- China – Taiwan : Taiwanese election results signal largely a maintenance of the status quo. The election outcome does not change the global trend of de-risking. Taiwanese firms have no choice but to pursue overseas investment more than ever for friend-shoring integration in non-China markets. The fact that the US is the biggest client of export orders means Taiwan will continue to decouple from China, though the pace may be affected by a hung parliament. The DPP will need to negotiate with the KMT and/or TPP to pass budgets and legislation, which could slow or hinder the DPP’s ability to advance its agenda. It could also hold up US priorities for Taiwan: when the DPP last held the presidency but lacked a legislative majority (2004-2008), it repeatedly clashed with the KMT over Taiwan’s arms purchases and defense budget. How Beijing responds to Lai’s win in the coming months will test its fragile relationship with Washington, Taipei’s main military and political backer. Despite not advocating for Taiwanese independence, Joe Biden has arranged for a delegation of former top US officials to visit Taiwan, a move that will test China’s patience.

US – Iran : Iran’s navy captured an oil tanker Thursday in the Gulf of Oman that only months earlier had seen its cargo of Iranian oil seized by the United States over sanctions linked to Tehran’s nuclear program, further escalating the tensions gripping the Mideast’s waterways. The vessel was previously known as the Suez Rajan when it was involved in a yearlong dispute beginning in 2021 that ultimately saw the U.S. Justice Department take the 1 million barrels of Iranian crude oil on it. The seizure also comes after weeks of attacks by Yemen’s Iranian-backed Houthi rebels on shipping in the Red Sea, including their largest barrage ever of drones and missiles launched late Tuesday. U.S.-led forces launched retaliatory strikes early Friday.

US- Yemen : On Friday, the US and its allies launched airstrikes on more than a dozen Houthi rebel targets in Yemen, escalating a conflict with an Iranian proxy in response to a string of attacks that have disrupted commercial shipping in the Red Sea. They took place hours after Secretary of State Antony Blinken wrapped up a multi-nation trip through the Middle East that was aimed in part at getting support for more aggressive action toward the Houthis, as he insisted “there will have to be consequences” if the attacks at sea persisted. How Beijing responds to Lai’s win in the coming months will test its fragile relationship with Washington, Taipei’s main military and political backer. Despite not advocating for Taiwanese independence, Joe Biden has arranged for a delegation of former top US officials to visit Taiwan, a move that will test China’s patience.

US – Iran : Iran’s navy captured an oil tanker Thursday in the Gulf of Oman that only months earlier had seen its cargo of Iranian oil seized by the United States over sanctions linked to Tehran’s nuclear program, further escalating the tensions gripping the Mideast’s waterways. The vessel was previously known as the Suez Rajan when it was involved in a yearlong dispute beginning in 2021 that ultimately saw the U.S. Justice Department take the 1 million barrels of Iranian crude oil on it. The seizure also comes after weeks of attacks by Yemen’s Iranian-backed Houthi rebels on shipping in the Red Sea, including their largest barrage ever of drones and missiles launched late Tuesday. U.S.-led forces launched retaliatory strikes early Friday.

US- Yemen : On Friday, the US and its allies launched airstrikes on more than a dozen Houthi rebel targets in Yemen, escalating a conflict with an Iranian proxy in response to a string of attacks that have disrupted commercial shipping in the Red Sea. They took place hours after Secretary of State Antony Blinken wrapped up a multi-nation trip through the Middle East that was aimed in part at getting support for more aggressive action toward the Houthis, as he insisted “there will have to be consequences” if the attacks at sea persisted.

This marks a significant escalation in the weeks since Hamas militants attacked Israel on Oct. 7 and Israeli forces responded with a devastating air and ground campaign in the Gaza Strip. The Houthis began their harassment of commercial vessels soon after and have vowed not to let up until Israel ends its assault on Gaza. In his own statement, British Prime Minister Rishi Sunak said the Houthi attacks had continued “despite the repeated warnings from the international community.”

“This cannot stand,” he said.

Israel – Palestine : Benjamin Netanyahu has vowed to continue Israel’s war in Gaza “until total victory” as he marked 100 days of conflict against Hamas, with pressure on his government mounting through protests at home and criticism abroad. More than 23,000 Palestinians have been killed so far in Gaza, according to health officials in the Hamas-controlled territory, with about 85 per cent of residents displaced from their homes and UN officials warning that “famine is around the corner”.

India – Mauritius : Even though New Delhi and Male have traditionally had close ties, relations have been tense since President Mohamed Muizzu came to power in November winning the election on an ‘India Out’ campaign.

The controversy over comments by three Maldivian nowsuspended-ministers about Modi comes just as Muizzu embarks for China on his first state visit from Jan. 8-12, breaking from the convention of most Maldivian leaders choosing New Delhi to be their first international port of call. The Maldives government suspended deputy ministers Malsha Shareef, Mariyam Shiuna and Abdulla Mahzoom Majid for calling Modi a “clown”, “terrorist” and “puppet of Israel” on social media platform X, in response to a video of him visiting the Indian islands of Lakshadweep, north of the Maldives, to promote local tourism.

Credit/Treasuries

Following all the inflation data published last Thursday & Friday, the US Treasury curve bull steepened. The 2years US Treasury yield lost 24bps over the week, 5years lost 18bps, 10years lost 10bps & 30years lost 5bps. US IG credit spreads tightened by 5bps and US HY credit spreads tightened by 20bps.

The combination of lower rates and tighter credit spreads helped IG gained 0.90% over the week while HY gained 0.80%. Leverage loans were marginally up over the week.

FX

DXY USD Index close the week at 102.40, unchanged from the previous week, despite stronger than expected US CPI. Core CPI ticked up to 0.309% m/m in December (C: 0.3%; P: 0.28%) but brought the annual rate down to 3.90% y/y (C: 3.8%; P: 3.99%). However, soft healthcare services and airfares in PPI lead to lower estimates for December core PCE inflation. Technically, death cross on DXY formed last week, with the 50 days MA cutting below the 200 days MA, which supported the downward trend on USD. Immediate resistance level at 102.80/103.30. Support level at 102/101.50.

EURUSD rose 0.07% to close the week at 1.0951, relatively unchanged from previous week. ECB Chief Economist Lane says rate cuts “will come to the forefront” only when “we have developed sufficient confidence that we are firmly on our way back to 2% inflation.” Data wise, Euro area unemployment rate came in at 6.4% in November (C: 6.5%; P: 6.5%). Immediate resistance at 1.10/1.11. Immediate support level at 1.088/1.08.

GBPUSD rose 0.26% to close the week at 1.2753, due to receding UK growth concerns. Data wise, UK GDP grew by 0.3% m/m in November (C: 0.2%; P: -0.3%), driven by a services sector rebound following a very weak October. Immediate resistance level at 1.28, while support level at 1.27/1.26.

USDJPY rose 0.17% to close the week at 144.88, driven by further declines in front-end US real yields. In addition, Media reports suggested the BoJ may revise down its growth and inflation outlook at its upcoming January meeting. Data wise, JPY exhibits broad-based weakness after total cash earnings decelerate significantly in November while real wages remain negative. In addition, Japan CPI (ex-fresh food) slowed to 2.1% y/ y (C: 2.1%; P: 2.3%), a continued deceleration as the lagged effect of higher import prices dissipated. CPI (ex-fresh food and energy) or core-core CPI was 3.5% y/y (C: 3.5%; P: 3.6%).

Oil & Commodities

Crude Oil fell last week, with WTI and Brent falling 1.53% and 0.60%, to close the week at 72.68 and 78.29 respectively. This was despite of an escalation of conflict in the Middle East, as markets continued to underprice the risk of conflict spreading. On another note, Saudi Arabia cuts its official selling prices in Asia amid persistent weakness in the global market.

Gold rose 0.18% to close the week at 2049.06, driven by further declines in front-end US real yields, with UST 2 years falling 23 bps. Immediate support at 2015 (50 Days MA) and next at 2000. Resistance level at 2075/2100.

Economic News This Week

-

Monday – AU Melbourne Inflation, CH 1 Yr Medium LFR, SW CPI, EU Indust. Pdtn/ Trade Balance, CA Mfg Sales

-

Tuesday – AU Westpac Cons. Confid., JP PPI, UK Unemploy. Rate, NO GDP, EU Zew, CA Housing Starts/ CPI, US Empire Mfg

-

Wednesday –CH GDP/ Indust. Pdtn/ Retail Sales, UK CPI/RPI, EU CPI, US Retail Sales/ Indust. Pdtn

-

Thursday – NZ House Sales, JP Core Machine Orders/ Indust. Pdtn, AU Unemploy. Rate, US Building Permits/ Housing Starts/ Initial Jobless Claims

-

Friday – Z Biz Mfg, JP CPI, UK/CA Retail Sales, US Mich. Sentiment/ Existing Home Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.