KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets extended its gains for the week following better than expected earnings from Meta and Amazon and robust data releases.

Their earnings results validated its belt-tightening strategies of 2023 aided by job cuts and their core businesses performing well over the holiday period. Meta announced plans for an additional $50 bln share buyback coupled with a first quarterly dividend. Amazon posted its best online sales growth since early in the pandemic. This followed a spate of disappointing earnings from Microsoft Corp., Alphabet Inc. and Apple which declined after their earnings failed to live up to the hype that drove their shares to record highs in recent weeks. Earlier in the week, sentiment had been dampened after Federal Reserve Chair Jerome Powell said it’s unlikely the central bank would cut interest rates in March. Powell said the Fed needs “continuing evidence” that inflation is easing toward its 2% goal, signalling no cuts until it’s more confident inflation is nearing its 2% target. The FOMC ended with no change as expected.

On the data front, US payrolls rose the most in a year last month, +353k easily beating expectations and wages increased more than expected, according to a Bureau of Labor Statistics report. The unemployment rate came in unchanged at 3.7%. Participation Rate remained steady at 62.5%. Yields surged to UST10Y 4.02% and UST2’s to 4.36% and equities fell post data but recovered strongly afterwards as views that a strong jobs market is seen as a net positive for both the economy and the stock market, in support of the Fed’s softlanding narrative. JOLTS data showed higher than expected job openings coming in at 9.026 mln in December, ISM and factory orders also beat expectations at 49.1 vs 47.2. Sub-categories Price Paid & New Orders beat expectations, printing respectively at 52.9 Vs 46.9 & 52.5 Vs 48.2. US consumer sentiment surged in January from a month earlier by the most since 2005 to 114.8. This week will see a lighter data-set with ISM Services data and SLOOS to note.

With an election year in the US and 2 wars on-the-go, we would add to the Defense and Cybersecurity ETFs. Drones are another area to consider.

ITA US, BUG US and AVAV US – Aerovironment Inc, an Arlington based drone and small unmanned aircraft manufacturer.

Europe

European equity markets ended broadly flat and off best levels after a hotter-than-expected January nonfarm payrolls report. Autos added 1.1% to lead gains while oil and gas stocks fell 1.4%.

The earnings season in Europe is pointing to the worst earnings season in 15 years if the trend continues. Among Stoxx 600 firms that have reported so far, only 45% topped projections. It is a huge difference compared to the 79% rate coming from corporate America. BNP Paribas and Adidas have all issued warnings about profits this year. Commodity companies are the biggest drag to overall earnings growth as many oil and mining companies are managing with slumping demand from China.

Apart from earnings, we have a few economic data coming from Euro area and in the UK. First, the Euro area January flash inflation data surprised to the upside, with headline HICP printing at 2.8%, down from 2.9% in December and core HICP printing at 3.3% versus 3.4% previously. Both were stronger than consensus expectations. But this is lowest core inflation has been since March 2022, but the slower decline has added to questions about how soon the ECB will be able to cut rates. Furthermore, the HCOB eurozone manufacturing PMI rose to 46.6 in January from 44.4 in December, to its highest level in 10 months.

Second, The Euro Area unemployment rate had remained at 6.4% in December. The economic sentiment in the EC survey was broadly unchanged in January at 96.2, reflecting a slight improvement in business sentiment and a larger fall in consumer sentiment. In terms of GDP, according to the flash estimate, the Euro area economy stagnated in 4Q.

All in all, the combination of the stronger data and the acceleration in underlying momentum in services inflation, as well as the Fed now likely going later than market expectations, supports the view that ECB is likely to begin its cutting cycle only in June versus market expectations of April. The pricing of a March cut by the ECB decline from 23% to 16% overnight.

BoE kept rates unchanged at 5.25% and the vote split was more hawkish than expected, with 2 votes going for a hike, 1 for a cut and 6 votes for a hold. As long as 2 of its members vote for a hike, it makes it challenging for that message to be that rate cuts are needed. The BoE’s latest inflation forecasts showed inflation above the target during H2 2024 and 2025, based on market rate expectations. Market reaction leaned slightly hawkish after the February MPC due to inflation projections and the less dovish vote split. Nevertheless, the MPC recognised the progress already done on the inflation front and more importantly suggested the potential for easing in the near term if inflation evolves as expected.

This week, most attention will likely be on the Sentix survey because this is the first survey indicator published for February. We also have the ECB consumer expectations survey, PPI and retail sales.

Asia

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.48% and clocked a year to date loss of 3.84%. CSI 300 closed 4.63% lower last week. The tech-heavy ChiNext dropping 7.85%, the lowest since 2019, dragged by sharp falls in solarrelated, AI-themed names. China has pledged to stabilize markets after shares sank to a five-year low in chaotic trading on Friday, but policymakers offered no specifics on how they plan to end a selloff that’s erased more than $6 trillion of value and dented confidence in the world’s second-largest economy. The brief statement followed a sudden plunge in the benchmark CSI 300 Index on Friday — and an outpouring of frustration on social media from individual investors just days before families across the country gather to celebrate the Lunar New Year.

In terms of data out of China, profits at industrial firms in China fell 2.3% in 2023, second straight year of decline, reflecting widespread corporate pain amid sluggish demand both at home and abroad, falling prices. The Caixin manufacturing PMI in China remained at 50.8 in January, which was in line with expectations and a third consecutive month in expansionary territory. China’s CPI and PPI data for January, due Feb. 8.

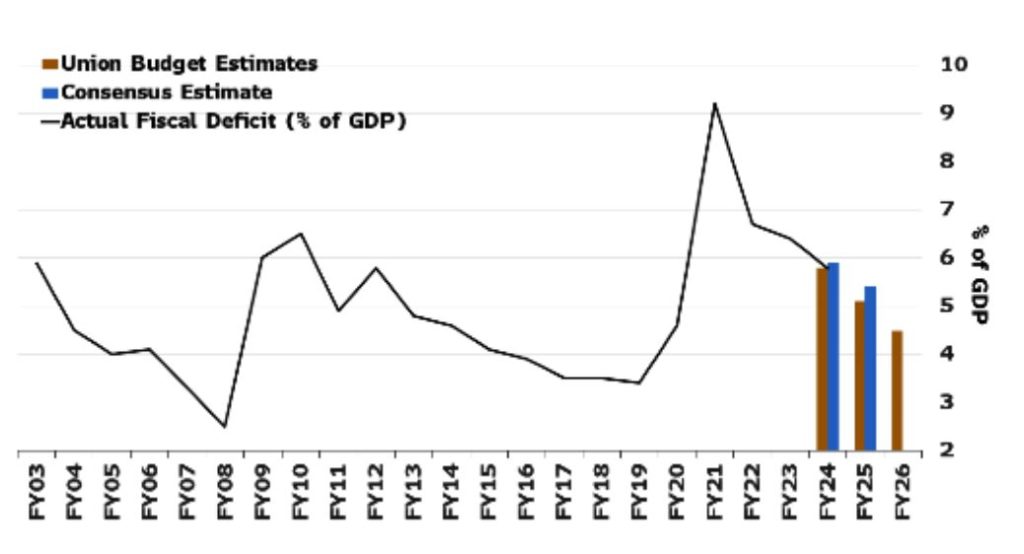

Finance Minister of India Nirmala Sitharaman delivered a pro-growth budget that should drive the resurgence in private investment – providing a boost to India’s economy. India plans to borrow 14.13 trillion rupees ($170 billion) in the coming fiscal year, significantly lower than the 15.2 trillion rupees estimated in a Bloomberg survey. The budget deficit for the next fiscal year is targeted at 5.1% of the gross domestic product, compared with 5.8% for the current period. RBI rate decision is set for Thursday the 8th Feb.

Sri Lanka signed a free trade pact with Thailand. The debtstricken island nation made the deal to try and boost its economy after declaring bankruptcy in April 2022.

Other data from Asia 4Q23 GDP came in below expectations in Hong Kong. Taiwan’s advanced 4Q GDP came in above expectations again, rising 5.12% oya (implying significant sequential growth of 8.8% q/q saar). The upside surprise in 4Q GDP came from domestic spending, for both public and private consumption. South Korea’s factory activity, PMI stood at 51.2 in January. Output and orders returned to growth on improving demand in key export markets for the first time in 19 months. Japan’s final manufacturing PMI shrank further in January and other Asian PMIs continued to expand or saw their slowdowns decelerate, hinting the worst could be over for manufacturing sectors in the region. South Korea has emerged in recent years as one of the world’s biggest arms exporters with sales jumping to $17 billion in 2022 from $7.25 billion the year before, data from the defence ministry showed. The country’s arms exports to the Middle East grew nearly tenfold between 2013 and 2022, according to the Korea Chamber of Commerce and Industry. Japan’s industrial output rose in December. Industrial production rose 1.8 per cent in December from the previous month. Japan’s labour market showed signs of tightness, pressing on the yen and JGB yields. Australian consumer price inflation slowed more than expected to a two-year low in the fourth quarter. The annual pace of CPI inflation slowed to 4.1 per cent, was well below the peak of 7.8 per cent in December 2022. The Australian dollar slid to $0.6564 after the surprisingly soft domestic inflation data.

GeoPolitics

US – Iran: The drone strike that killed three American risks the US being dragged deeper into regional hostilities triggered by war in Gaza. The Biden administration blamed “radical Iranbacked militant groups” for the strike and vowed to hold “all those responsible to account at a time and in a manner of our choosing”. A network of Iran-backed militant groups across the region, which Tehran refers to as the “axis of resistance”, includes Hamas.

The US said it will launch further strikes against Iran-backed groups. Tehran-aligned factions were hit with a second wave of strikes against Iran-backed Houthi militias in response to a deadly attack on US troops in Jordan last week.

US – China: Spokesperson for Beijing’s Taiwan affairs office said a Donald Trump victory in US presidential election later this year could lead to Washington abandoning Taiwan as it pursues an America-first strategy. Still President Biden has repeatedly said US would defend Taiwan if it came under attack by China.

Former President Donald Trump said he might impose a tariff on Chinese goods of more than 60% if elected, signalling an increasingly hawkish tone against the top supplier of goods to the US. Trump, the front-runner for the 2024 Republican presidential nomination, rejected criticism that the moves would start a trade war, saying that he “did great with China with everything” during his presidency.

Europe: Tractors now line up on streets in Spain and Portugal as the blockades in France inspire others to take action against agriculture regulations. Spanish farmers’ associations said on Tuesday they were planning to take to the streets in February in protest against strict European regulations and lack of government support as unrest continues to spread across Europe. Among farmers’ grievances are local and EU regulations, while in France, Poland, Slovakia and Romania, they have also objected to cheaper imports from Ukraine flooding their markets. After the Russian full-scale invasion in 2022, the EU agreed to lift tariffs on Ukrainian grain and produce, which have lower production costs and do not have to follow EU standards.

Separately we have another topic, which we would call “welcome to the beautiful world of the European Union blackmail”, the EU has agreed on the 1st of February on a deal on a €50bn financial support package for Ukraine after Hungarian Prime Minister Viktor Orbán caved to pressure from his fellow leaders and rescinded his veto on the aid. Interestingly, this followed a news that was released 1week ago about a document drawn up by EU officials and seen by the Financial Times, in which Brussels has outlined a strategy to explicitly target Hungary’s economic weaknesses, imperil its currency and drive a collapse in investor confidence in a bid to hurt “jobs and growth” if Budapest refuses to lift its veto against the aid to Kyiv. The document, produced by an official in the Council of the EU, the Brussels body that represents member states, lays out Hungary’s economic vulnerabilities, including its “very high public deficit”, “very high inflation”, weak currency and the EU’s highest level of debt servicing payments as a proportion of gross domestic product. It lays outs how “jobs and growth depend to a large extent” on overseas finance that is predicated on high levels of EU funding. A spokesperson for the Council of the EU said they did not comment on leaks.

Credit/Treasuries

These blockbuster data and earnings numbers helped support a strong rebound in yield last Friday. The 2years US Treasury yield managed to end the week up by 2bps. Treasury yields went down earlier last week following a reduction in this quarter’s US borrowing levels. The US Treasury eased concerns about the flood of debt being issued to cover the federal deficit. Current quarter borrowing is now seen at $760bn, a drop from the initial estimate of $ 816bn. US Treasury estimates $202bn Net borrowing for April to June.

There was also a flight to quality middle of last week wish push yield lower following the trouble with a couple of banks and their exposure to CRE. More on that later. In the meantime, the 5year yield went down 5bps over the week while 10years yield dropped by 10bps & 30years yield dropped by 15bps. IG & HY Credit Spreads were unchanged over the week. In term of performances, US IG gained 40bps, US HY lost 30bps and leverage loans lost 10bps. Probability that the Fed will now cut in March has dropped from 80% two weeks ago to 18% this morning.

On another note, Deutsche Bank published recently a report called “Everything points to a soft landing, except history”. This report is suggesting that the current US data points to a soft landing. However, history cautions that the lags from a hiking cycle are long and variable and regularly have a substantial sting in their tail. Often these come from an unforeseen event. Clearly in this cycle, the Regional Bank shock was dealt with aggressively by the Fed last year.

However, this was mainly helping them out with high quality assets (e.g. treasuries and MBS) that had been (and still are) marked down. Although the BTFP (Bank Term Funding Program) ends in March, the market generally would expect the Fed to do something similar if the need arose. However, if the next round of problems covered CRE then could the Fed really intervene as quickly or as easily given a more challenging moral hazard issue? Underwater CRE which could be impaired is a very different proposition to underwater Treasuries.

We’re clearly some way from that now but it’s worth highlighting that the latest attack on US regional banks is more for fear of potential credit losses than the mark to market losses of highquality securities of last year, which could be more easily mitigated via liquidity measures. On a related theme, it will be interesting to see the Fed’s SLOOS on Monday to see whether banks have continued to loosen conditions relative to what are still very tight lending standards to the wider economy and CRE.

The market shrugged off the continued concerns over NYCB, New York Community Bancorp, which fell 44% over 2days after news the previous evening that Moody’s had placed their credit ratings on review for a downgrade. Equities seemed to respond to the data whereas the bond market saw a flight to quality. Overnight in Japan it’s been a similar story, with Aozora Bank, currently the worst performer in the Nikkei, losing 35% during the last two trading sessions last week.

FX

DXY USD Index rose 0.47% to close the week at 103.92, driven by unexpectedly strong US labor and FOMC pushback against March rate cut. US Nonfarm Payrolls same in at 353k in January (C: 185k), with a cumulative +126k of backward revisions. In addition, Conference Board Consumer Confidence Index rose to 114.8 in January (C: 114.8; P: 108.0), above the average in 2023 and back to levels from late 2021. US JOLTS Job Openings rose to 9026k in December (C: 8750k; P: 8925k). ISM Manufacturing came in at 49.1 (C: 47.2). Fed Chair Powell laid out a base, bull, and bear case for the economy, and explained that their base case consists of a strong labor market and stronger growth is not looked at “as a problem,” in that it will not prevent the Fed from cutting rates. The totality of the January payrolls report certainly reduces the odds of an “unexpected weakening” in the labor market, which would bias rate cuts sooner, as in their bear case.

EURUSD fell 0.60% to close the week at 1.078, driven by USD strength. Data wise, both preliminary Euro Area HICP core and headline inflation came in stronger than expected. Preliminary 4Q23 GDP came in at 0.0% q/q (C: -0.1%; P: -0.1%), while EU Commission Economic Sentiment fell to 96.2 in January (C: 96.1; P: 96.3). EURUSD is now trading close to its 100 days MA (1.0784) and below 1.08. Next support level at 1.06, resistance level at 1.08.

GBPUSD fell 0.57% to close the week at 1.263, driven by USD strength and BoE vote split (2 votes for hikes, 1 for cut and 6 holds). However, the details of BoE rate decision were less hawkish. BoE kept rates unchanged at 5.25% and dropped reference to risk of further tightening. At the press conference, Governor Bailey effectively said that every meeting was live, and the guidance clearly flagged that the question of cuts was when and not if Bank rate should be maintained at its current level.

USDJPY rose 0.16% to close the week at 148.38, driven by USD strength. This was despite the Summary of Opinions from the January BoJ meeting suggesting many members had more conviction about achieving their target and began to discuss the sequence for removing monetary easing. Resistance level at 149/150. Support level at 147.50/146.

Oil & Commodities

Crude Oil closed the week with WTI (-7.35%) to 72.28 and Brent (-7.44%) to 77.33 respectively, as Bloomberg reported that negotiations were advancing for Israel-Hamas ceasefire and to free civilian hostages captured by Hamas. The decline in oil prices were supported by US rate cut bets in March. On a further note, Saudi Aramco was given a directive to drop plans to expand its maximum sustainable capacity to 13 mn b/d by 2027. However, oil prices were supported this morning, as US launched attacks against the Houthis over the weekend after earlier hitting Iranian troops and militias in Syria and Iraq. Technically, Oil price is currently in a downward trend indicated by RSI and MACD indicators.

Gold rose 1.05% to close the week at 2039.76 due to safe-haven demand, following the reports that 3 US soldiers were killed in Jordan in an attack by an Iranian-made drone. Resistance level at 2045/2065, support level at 2025/2000.

Economic News This Week

-

Monday – AU Melbourne Inflation/ Trade Balance, NZ ANZ Commo Price, AU/JP/CH/SW/EU/UK/CA/US Svc/Comps PMI Jan Final, EU Sentix Inv. Confid./ PPI, US ISM Svc Index

-

Tuesday – AU Retail Sales/ RBA OCR, EU ECB CPI Expectation/ Retail Sales, UK Construction PMI, CA Building Permits

-

Wednesday – NZ/SZ Unemploy. Rate, US MBA Mortg. App./ Trade Balance

-

Thursday – JP Trade Balance, CH PPI/CPI, US Initial Jobless Claims/ Wholesale Inv.

-

Friday – Norway CPI, CA Unemploy. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.