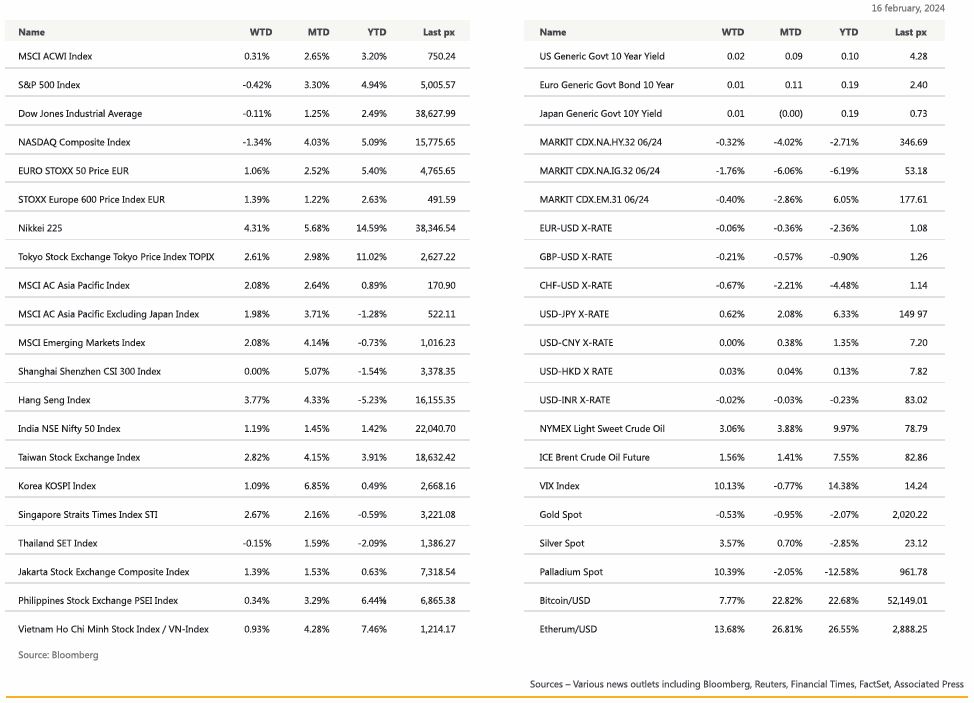

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

After being on a tear for weeks on end, US markets took a breather ending the week slightly flat to lower with the Nasdaq taking the brunt of it, -1.34%.

Two inflation releases coming in higher than expected were enough to halt its advance.

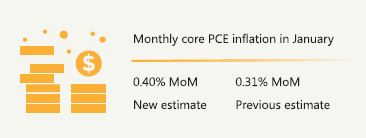

Core MoM CPI came in higher at 0.4% and a no-change in core YoY at 3.9% pushed back expectations of rate cuts next month. Coupled with a PPI release of core MoM & YoY at 0.5% and 2% respectively, both higher than the previous month’s, reaffirmed that view. Regarding PPI’s detailed components that are relevant for the Core PCE, which will be release on the 29th of February, they came in, on net, stronger than expected. Based on CPI and PPI data, Nomura now expect monthly core PCE inflation to be 0.40% MoM in January, up from their previous estimate of 0.31%. If their forecast materializes, January core PCE inflation would be the highest since January 2023. They expect a 0.57% MoM increase in super core PCE prices, which would be the highest reading since early 2022.

Shelter caught everyone by surprise and increased 0.6% in January, the largest factor in the monthly increase in the core index. If that was the only anomaly, the report might have been seen as a one-off. But we also saw ‘super core inflation’, which covers core services ex housing, rise to 4.3% YoY, its highest level since last May and with the largest monthly increase, +0.85%, since April 2022.

What the market is struggling to get a hold on is whether the data was just a bump on the road or not, as reflected in the fluctuations between gains and losses during the trading sessions. What bucked the trend was the retail sales data which underwhelmed coming in way below expectations at -0.8% MoM vs -0.2% expected and ex-auto even lower at -0.6% vs 0.2% expected. Analysts were perplexed in trying to reconcile this to the hotter inflation data, easing some worries about the path of interest rates.

Brewing headwinds in the form of commercial real estate (CRE) loans prompting US regulators to “closely focus” on banks added to the risk-off sentiment. However, commercial real estate stocks such as CBRE Group reported strong fourth-quarter earnings suggested the worst could be over for the downtrodden market for office leasing. VIX closed higher at 14.24 albeit off its (3-month) highs of 15.85 from earlier in the week following the CPI release. Fed-speak during the week saw (non-voter this year) Chicago’s Goolsbee saying slightly higher inflation data for a few months would still be consistent with a path back to the central bank’s 2% goal. He also reiterated that the Board’s inflation goal is based on PCE, not CPI and that he doesn’t support “waiting until inflation on a 12-month basis has already achieved 2% to begin to cut rates”.

This week is a shortened trading week in observance of President’s Day tonight. A quieter data week with leading index and S&P Global US PMI among the key releases.

Crypto-related names including Coinbase Global Inc., Riot Platforms Inc., MicroStrategy Inc. and Marathon Digital Holdings Inc. all finished more than 10% higher as Bitcoin traded above $51,000nd ETH above $2750-$2800. It would appear the winter has indeed finally thawed out.

Disinflation we think is still the theme and should be good for equities and we remain slightly risk-on. We like defense especially in drones and in cybersecurity: BAE Systems, a UK advanced defense and drone manufacturer and BUG, a cybersecurity focussed ETF.

Europe

European markets end higher with the STOXX Europe 600 hit an all time high. Cyclical sectors like banks and miners the best performer, while defensives like utilities, food/beverage, and healthcare lag.

In the UK, we had a broad-based set of more hawkish data from the labour market report, with wage growth surprising to the upside and unemployment falling further. However, CPI inflation was weaking than consensus expectations across the headline, core, and services categories, where it rose 4% less than forecast of 4.1% in January, with downward trends in the cost of food and household goods. The core CPI figure came in at an annual 5.1% below consensus estimate of 5.2%. Services inflation rose 6.5%, lower than both consensus estimates of 6.8% and the BoE’s expectations of 6.6%. Recent developments continue to put inflation on a downward path.

GDP surprised to the downside, but retail sales surprised to the upside in the UK with the GDP contracted 0.1% m/m, driven by weak consumption and net trade. On the other hand, retail sales in the UK rose by 3.4% m/m in January which fits in with notion of economy already recovering from recession.

In the Eurozone, in terms of data, the 4Q23 GDP came in at 0%, in line with the preliminary release but the details pointed to still solid at 0.3% qoq employment growth in Q4. The December Industrial Production rose 2.6% m/m vs the -0.2% expected and this upside was mostly due to distorted Ireland data.

Goldman Sachs raised its 2024 Stoxx Europe 600 index estimate last Thursday to 510 from 500, citing improving economic activity, potential decline in interest rates and attractive valuation. This represented about 5% upside from current levels. With the tight labour markets expected to keep wages higher than inflation, this would lead to positive real income growth and falling interest rates for households. The Stoxx Europe 600 trades at 14x one-year forward PE ratio, vs S&P500 index at 25x, indicating more attractive investment opportunity in Europe.

This week, we see prelim numbers in the Eurozone from consumer confidence survey and PMI manufacturing and the HICP final final, similarly in the UK.

Asia

MSCI Asia ex Japan closed the week higher by 1.98%. Leading the region was Hang Seng, up 3.77%.

In January, China experienced intensified deflation in its Consumer Price Index (CPI), with a 0.8% year-on-year (YoY) decline, marking the lowest YoY CPI since the Global Financial Crisis (GFC). Core CPI inflation also eased, rising 0.4% YoY. China set a record-high for new loans in January, reaching CNY 4.92 trillion. However, the 6.8% growth in new loans was the lowest in more than 20 years. The People’s Bank of China (PBOC) reiterated a prudent policy stance in its Q4 report, focusing on ‘reasonable and balanced growth’ in credit and liquidity. Policy coordination would support consumption, stabilize investment, and maintain prices at “reasonable levels.”

Tourism revenues in China during the Lunar New Year holidays that ended on Saturday surged by 47.3% year-on-year and surpassed 2019 levels, thanks to a domestic travel boom amid a longer-than-usual break, official data showed on Sunday. Domestic tourism spending jumped by 47.3% to 632.7 billion yuan ($87.96 billion) from the same holiday period in 2023, according to the data by the Ministry of Culture and Tourism. The number of domestic trips made during this year’s holiday grew by 34.3% from a year ago, totalling 474 million.

Japan’s GDP contracted by an annualized 0.4% in Q4 2023, following a 3.3% slump in the previous quarter. wo consecutive quarters of contraction signify a technical recession. The Bank of Japan is expected to end negative interest rates in the coming months, despite the economic downturn.

India’s retail inflation eases to 5.10% in January 2024 (from 5.7% in December 2023). The improved inflation numbers came days after the Reserve Bank of India (RBI) decided to hold the benchmark interest rates for the sixth time in a row at 6.5%.

Singapore has maintained its growth forecast for 2024 at a range of 1 to 3 per cent. The economy expanded by 1.1 per cent in 2023. Growth was mainly driven by the services industry, such as the information and communications and transportation and storage sectors.

Vietnam retail sales rose +8.1% YoY in Jan led by accommodation & catering services and tourism which went up +10.2% YoY and 18.5% YoY respectively, as international arrivals reached 1.5mn and the highest monthly level since pandemic. Vietnam pledged tax breaks and other perks to semiconductor companies that help to develop the sector, and aims to train 50,000 chip engineers by 2030.

GeoPolitics

Pakistan – Voters have given a significant victory to politicians aligned with the Pakistan Tehreek-e-Insaf (PTI) party despite challenges, with independent candidates backed by PTI winning 93 National Assembly seats. Imran Khan, the former PM, is barred from holding elected office for 10 years due to criminal convictions. A coalition government, likely led by PML-N and PPP, is expected to be formed in Pakistan.

India – Indian security forces have fired tear gas in a bid to stop thousands of farmers marching on New Delhi after talks with the government failed. The threat of renewed protests comes ahead of national elections that are likely to start in April. Protests by farmers against agricultural reform bills in November 2020 lasted for more than a year, forming the biggest challenge to Prime Minister Narendra Modi’s government since it came to power in 2014. Two-thirds of India’s 1.4 billion people draw their livelihood from agriculture, accounting for nearly a fifth of the country’s GDP.

Israel– Israel has launched air strikes on Rafah after Netenyahu ordered plan to evacuate civilians. The operation, which Biden had warned against, comes after Prime Minister Netanyahu rejected Hamas’ peace deal last week and vowed to totally destroy the terrorist group.

Netherlands – A Dutch court ruled that the Netherlands must stop delivering parts for F-35 fighter jets used by Israel in the Gaza Strip. The court determined there was a “clear risk” that the planes would be involved in breaking international humanitarian law, supporting human rights organizations’ claims.

EU – The European Union (EU) has put forward new trade restrictions targeting approximately two dozen companies, including one from India and three from China, accused of backing Russia’s war in Ukraine, as per a Bloomberg report.

Credit/Treasuries

A March cut was largely taken out of play after the numbers last week, as the probability of a March 25bps cut fell to 10%. A full 25bps cut is now only just priced in by the June meeting. Overall, market last week took out 25bps of expected cuts in 2024, with 87bps priced in by the December meeting. That is down from a peak of 168bps on January 12, and market expectations are now nearing the 75bps of cuts pencilled by the median FOMC member in the last SEP in December.

The US Treasury yields rebounded quite a lot last week with the 2years gaining 17bps, 5years up 14bps, 10years up 10bps & 30years up 7bps. 10year yield is now back at 4.28% having touched a low of 3.80% at the end of last year. IG & HY credit spreads were surprisingly unchanged or even a touch tighter last week. In term of performances, US IG lost 0.65%, US HY lost 0.35% and leverage loans gained 5bps.

FX

DXY USD Index rose 0.16% to 104.27 driven by US CPI and PPI. Headline CPI result come in at 0.3% mom (vs 0.2% expected), with the yoy value at 3.1% (vs 2.9% expected). Core CPI, which excludes food and energy prices, rose 0.4% mom (vs 0.3% expected), its highest value since last May. This brought the core CPI up to 3.9% yoy (vs 3.7% expected), reducing the already slim chances that the Fed will be lowering rates in the near-term. January PPI data pointed to an acceleration in all PCE inputs: domestic air transportation; acceleration in health services; financial services and insurance. However, headline US retail sales missed to the downside, falling -0.8% mom (vs -0.2% expected), and with the December reading revised down from 0.6% to 0.4%. This is the weakest report since last March and showed a broad-based cooling with nine of the 13 spending categories declining.

EURUSD fell to a year to date low of 1.0695 intraweek (after the strong US CPI), before rebounding to close the week relatively unchanged (-0.06%), closing the week at 1.078. The price movement on EURUSD was muted despite the strong US PPI, indicating support at current level. Key support level at 1.07. Data wise, the second print of Q4 GDP confirmed at the stagnant (0.0%) flash reading, but the details pointed to still solid (+0.3% qoq) employment growth in Q4. We also had the December industrial output, which posted at +2.6% mom (vs -0.2% expected), but this upside was mostly due to distorted Ireland data.

GBPUSD fell 0.21% to 1.26 due to the downside surprise in UK CPI. UK CPI rose 4.0% yoy (vs 4.1% expected), and core by 5.1% (vs 5.2% expected). Services inflation rose 6.5%, lower than both consensus estimates (6.8%) and the BoE’s expectations (6.6%). UK GDP fell by a larger-than-expected -0.3% qoq in Q4 (vs -0.1% expected and -0.1% prev.), driven by weak consumption and net trade, indicating that the economy slipped into a technical recession in the second half of last year. Last Friday, GBP shrugs off a significant upside surprise in January UK retail sales that show the impact of seasonal adjustments, following the weak December data. Support level at 1.254/1.25.

USDJPY broke the key resistance level of 150 and closed the week (+0.62%) to 150.21, driven by US CPI and higher UST yields. Data wise, preliminary Japanese Q4 GDP results came in at -0.4% qoq (vs 1.1% expected). There is now a high likelihood Japan is in a technical recession, and markets pared back expectations of rate hike bets. The spike up in USDJPY prompted verbal intervention, indicating that the authorities would take appropriate action if needed to stem the weakness in the currency while describing the recent currency movement as rapid and speculative.

Oil & Commodities

Crude Oil rose last week, with WTI (+3.06%) to 79.19 and Brent (+1.56%) to 83.47, after geopolitical tensions in the Middle East overshadowed the expectations of the IEA, which warned of a slowdown in demand. Threats continued in the Red Sea after a missile fired from Yemen hit an oil tanker heading to India. In addition, a monthly report by OPEC showed that there has been uneven delivery of its new quarterly production cuts in the first month of its new agreement. Reaction on oil prices were muted despite EIA report showing a significant increase in US crude oil inventories, where it rose by 12.02mn barrels, the greatest increase since December, and the second consecutive week of gains.

Gold fell 0.53% to 2013.59 due to US CPI and higher US real yield. Gold dipped to a year to date low of 1984.34 after the US CPI report, below rebounding to close the week at 2013.59. Support level at 2000/1992, resistance level at 2030.

Economic News This Week

-

Monday – JP Core Machine Orders, SW CPI, CA Industrial Product Price

-

Tuesday – AU RBA Mins, CH LPR, CA CPI, US Leading Index

-

Wednesday – NZ PPI, JP Trade Balance/Machine Tool Orders, US MBA Mortg. App., EU Cons. Confid.

-

Thursday – NZ Trade Balance, AU/JP/EU/UK/US Mfg/Svc/ Comps PMI Feb Prelim, EU CPI, CA Retail Sales, US Initial Jobless Claims/Existing Home Sales

-

Friday – NZ Retail Sales, EU ECB CPI Expectations

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.