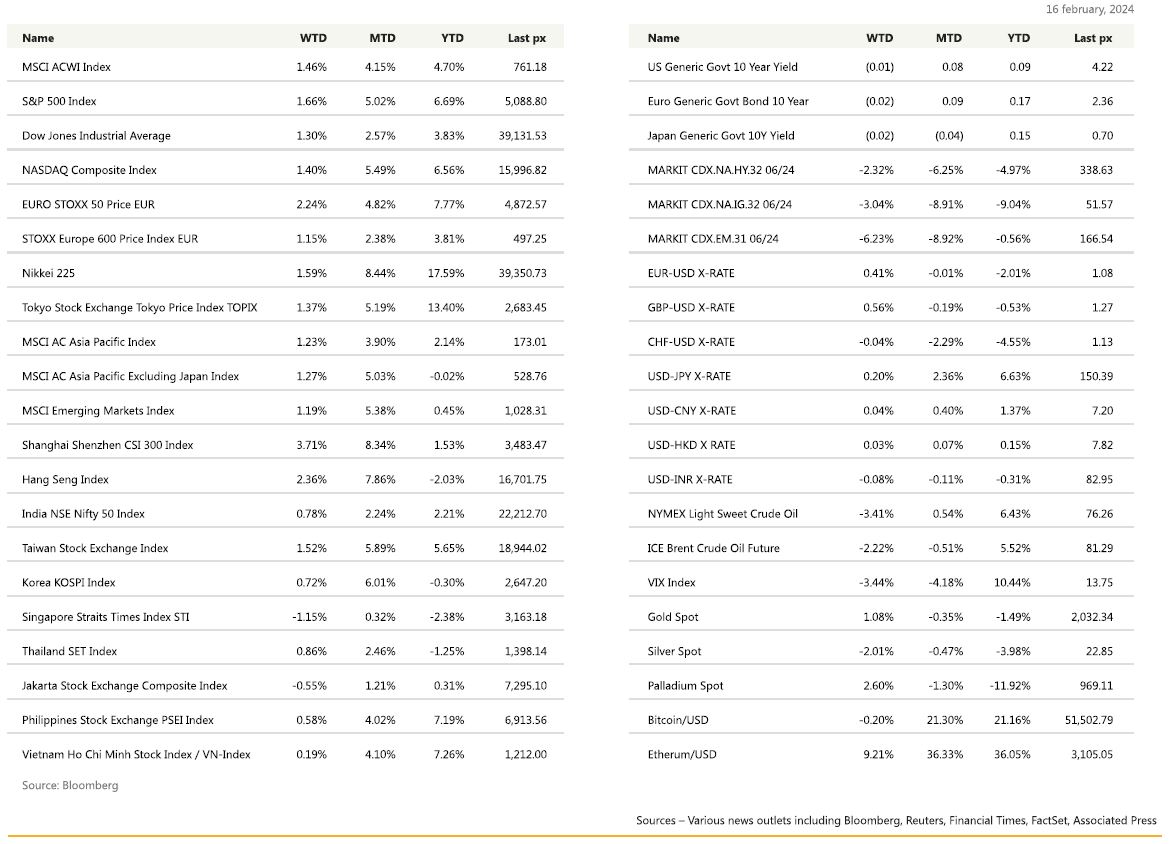

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

It was all about the chip! Nvidia single handedly fuelled the weekly gains for all 3 major indices during the shortened week following its blockbuster earnings results. Friday lost some steam as pullbacks in travel stocks kept a lid on broader gains. All 3 indices made record highs during the week. AI’s outperformance has quashed fears that the theme was all but a passing phase.

The Philadelphia Stock Exchange Semiconductor Index, which jumped 5%, closed at a record on Thursday. Nvidia’s outlook on surging global demand for AI lifted peers Advanced Micro Devices Inc., Marvell Technology Inc. and Broadcom Inc., along with other Big Tech firms including Alphabet Inc. Amazon climbed after S&P Dow Jones Indices announced that it will replace Walgreens Boots Alliance Inc, in the Dow Jones Industrial Average. However, we went into the weekend with investors taking a breather following gains seen in 15 of the past 17 weeks. Yields continued to be elevated following the week before hotter than expected CPI and PPI readings. This week’s PCE data should give us more of a better read to see if inflation continues to re-emerge or if it’s just another January effect. Regardless, the street has pushed back it view on when the Fed will begin cutting interest rates to June after parsing recent comments from the central bank and minutes of its January meeting. Vice-Chair Philip Jefferson and Philadelphia’s Patrick Harker both warned against the Fed reducing rates too much, saying it could undermine progress in getting prices down. They each said cuts will probably begin this year, but as Harker put it: “I would caution anyone from looking for it right now.”

On the economic front, initial applications for US unemployment benefits fell to the lowest in a month last week, underscoring continued strength in the labor market despite a growing number of high-profile job cuts at large companies. The preliminary February Manufacturing & Services PMI’s were released. Services printed below expectations at 51.3 (Vs 52.3 expected) but Manufacturing came out at 51.5, above expectations of 50.7 and this indicator printed above 50 for the second Month in a row. Initial Jobless claims & continuing claims came out better than expected.

This week main economic data in the US will be the February Conference Board Consumer Confidence, January Personal Income & Spending, but the most important data will probably be the January PCE Core Deflator where the headline and core PCE are both likely to come in at a hot 0.4%month-over-month pace vs 0.2% prior for both, driven by residual seasonality. The release is the last PCE release before the next FOMC rate decision which is schedule on the 20th of March. Finally on Friday, the February University of Michigan sentiment index will be released.

Bloomberg however expects the base effects to likely allow annual core to edge down to 2.8% vs 2.9% prior. We will also see personal income & spending on Thursday. U. of Michigan 1 Year and 5-10 Year expectations will round of the week ahead.

Gold has remained in a range at the beck and call of the dollar as views remain split on the greenback’s next trajectory. We have seen gold trade in a range of around $1980 to $2080 an oz. We see the metal remaining in a tight range until further clarity can be identified vis-a viz the Fed’s next move. We would suggest picking up some gold via put options: strike at $1990 off a spot of $2010 would give you a premium of just under 1% of notional for a 3 month tenor.

Europe

Europe’s equity markets finished higher Friday which was followed by broad strength on Thursday. Stoxx Europe 600 extending gains to close at new all-time high. Autos stocks were up 1%, while technology stocks fell 0.33%.

On the data front, activity in both the euro area and the UK improved in February seen in the services sector. However, there was a contrast in the sectors driving the month-on-month improvement. In the euro area, the services sector drove the increase, with the euro area’s manufacturing sector weak. In the UK, the manufacturing sector’s improvement drove the UK’s monthly uptick.

UK flash composite PMI recorded the highest level in 9 months in February at 53.3 vs consensus 52.9. Services sector continues to perform relatively well unchanged from January’s 8 month high of 54.3 vs 54.1 forecast. Manufacturing ticked up to 3 months high of 47.1 vs consensus 47.5.

The Euro area composite PMI output index rose to 48.9 in February from 47.9 previously. Strength was entirely driven by the services PMI, which saw output rise by 1.6pts to 50, whereas the manufacturing PMI output index declined to 46.2 from 46.6. This is the composite PMI output index’s highest level since its recent trough in October 2023, when it printed at 46.5.

ECB consumer Expectations Survey showed inflation expectations over the next 12 months edged up 0.1% to 3.3%, while 3 years ahead remained unchanged at 2.5%. ECB highlighted inflation over 1 year and 3-year horizon remained well below perceived past inflation rate, which stood at 6.0% in January from prior 6.9%.

The ECB’s January minutes released last week showed that the Governing Council was gaining increasing confidence that inflation was on a downward trajectory based on data available at the time. In terms of the path of inflation going forward the minutes still flag upside risks to the inflation outlook. They note that the decline in inflation has been concentrated in the non-wage-intensive components, suggesting that while the labour market remains tight services inflation might remain firm.

Market pricing for cuts has retracted a lot since the start of this year. Bloomberg reported the Eurozone money markets have pulled back ECB rate cut expectations. First rate cut seen in June and only 1 in 3 chance of April move. ECB officials also appear reluctant to shift away from restrictive policy, even as demand continues to weaken.

Currently, a 29bp cut is priced for August in the UK so a 1 25bp cut and an almost 20% chance of another. Just over 3 25bp cuts are priced between now and February next year.

This week, most focus will be on the flash inflation numbers. Apart from that, we will also see the PMI manufacturing and unemployment rate in Europe. In the UK, we have the BoE lending data.

Asia

MSCI Asia ex Japan index was up close to 1.3% last week. Except for the Singapore and Indonesian index, all Asian markets closed higher. Nikkei surpassed all-time high last week powered by semiconductor-related stocks and optimism for corporate earnings in the manufacturing sector, though a key gauge of Japan’s manufacturing activities slid to the lowest since Aug 2020.

CSI 300 index in China took the lead last week, up almost 3.7%, taking month to date returns to +8.34%. China reopened last week after closing a week for the Chinese new year. Chinese travellers made 474 million trips across the country during the eight-day break, up 19% from 2019, the ministry said – the world’s largest annual migration. Domestic spending on tourism came in at 632.7 billion yuan (US$87.9 billion), up 7.7% from pre covid levels in 2019. On Tuesday last week, the People’s Bank of China (PBoC) reduced the five-year loan prime rate to 3.95% from 4.2%. The PBoC kept the one-year rate steady at 3.4%. The five-year rate is used as the benchmark for mortgages, while household and corporate loans are based on the one-year rate.

Looking ahead, China’s annual “Two Sessions” – the National Committee of the Chinese People’s Political Consultative Conference (CPPCC) and the National People’s Congress (NPC) will begin on Mar 4th and Mar 5th respectively. Serving as China’s most important annual political event, the “Two Sessions” through mid-Mar will discuss and review the annual government work report and fiscal budget report and release a series of 2024 economic targets. Thousands of NPC deputies and CPPCC members will travel to Beijing and top policymakers will discuss crucial economic and political issues for this year.

Vietnamese equities were making new highs and marching towards the peak back in August 2023 as the market sentiment was boosted by positive earnings growth, M&A activities, and the government’s determination to achieve the emerging market status. The Ho Chi Minh index is up more than 7.2% year to date.

Bank Indonesia (BI) decided to keep the benchmark interest rate at 6%. The decision to maintain the BI Rate is consistent with the pro-stability monetary policy focus, aiming for the strengthening of the rupiah exchange rate. The central bank anticipates a rise in global economic growth despite ongoing financial market uncertainty. The global economy is expected to expand by 3.1% in 2023 and 3% in 2024, surpassing the initial projections. Bank Indonesia forecasts Indonesian economic growth in 2024 to range between 4.7% and 5.5%, following the 5.05% growth recorded in 2023.

Bank of Korea kept its policy rate unchanged Friday and reiterated that “The Board will maintain a restrictive policy stance for a sufficiently long period of time” to get inflation back to target. Malaysia’s economy grew slightly slower than expected last year at 3.7% missing street estimate of 3.8%, as tepid global demand hurt its exports and manufacturing activity. Thailand’s 4Q23 real GDP rose 1.7%, coming in below market expectations (consensus: 2.5%). This brings overall 2023 growth to 1.9%, down from 2.5% in 2022 and significantly below the pre-pandemic average.

GeoPolitics

China – Hungary: China offered to support long-time strategic partner Hungary on public security issues, going beyond trade and investment relations, during a rare meeting with Prime Minister Viktor Orban, just as NATO struggles to expand its network in Europe. China’s security assurance comes as Hungary, a Russian ally, has worked to dilute its dependence on Western countries in the past decade under Orban, recently resisting pressure to approve the expansion of NATO in Europe. Hungary is the only NATO state that has not ratified Sweden’s application to join the security bloc.

China – Saudi Arabia: Saudi Arabia is mandating that leading Chinese technology companies invest in the Gulf kingdom in return for huge deals. Saudi investors are applying increasingly stringent requirements to fund deals. In some cases, Chinese companies have to share technical expertise with their new Saudi partners.

Australia: The country has outlined a decade-long plan to double its fleet of major warships and boost defence spending by an additional US$7 billion, in the face of a quickening Asia- Pacific arms race. The announcement comes after a massive build-up of firepower by rivals China and Russia, and amid growing confrontation between nervous US-led allies and increasingly bellicose authoritarian governments. The plan would see Australia increase its defence spending to 2.4% of gross domestic product, above the 2 per cent target set by its NATO allies.

US: U.S. aid to Ukraine is boosting the U.S. economy. European allies and the Pentagon are putting in orders for weapons, increasing defence industry production by 17.5% since 2022.

Credit/Treasuries

The key takeaway from the minutes was that most officials were worried about the risks of easing policy too early. The FOMC minutes were followed by a pretty weak 20Years US Treasury auction during which the bid-to-cover ratio came out at 2.39 Vs 2.53 during the previous auction. The yield was fixed at 4.60%, some 3bps higher than the initial guidance. Given that long term interest rates have rebounded since the start of the year, it is quite telling that demand has not returned.

US Treasury curve inverted some more last week and especially after yields on the long part of the curve collapsed last Friday for no specific reason and after the 10years yield briefly traded above 4.35%, its highest level since end of November last year. Over the week the 2years US Treasury yield gained 4bps, 5years lost -1bps, 10years & 30years lost respectively -6bps & -10bps. Credit spreads were a bit tighter last week, with credit spreads on IG & HY tighter by respectively 1 & 7bps. Both US IG & HY managed to gain about 55bps last week, IG supported by lower interest rates & HY supported by tighter credit spreads. Leverage loans gained 10bps last week.

FX

DXY USD Index fell 0.33% to 103.94 despite FOMC minutes reinforcing the narrative that the Fed was in no rush to ease policy. On QT, the minutes confirmed plans to begin in-depth balance sheet discussions at the March meeting, though this came with a view “to guide an eventual decision to slow the pace of runoff”, so not just suggesting that a change on QT is imminent. US composite PMI modestly fell 0.6 points to 51.4 (vs 51.8 expected), driven by a fall in services to 51.3 (vs 52.3 expected). Manufacturing rose to 51.5 (vs 50.7 expected).

EURUSD rose 0.41% to 1.0821. EU composite PMI modestly rose 0.5 points to 48.9 (vs 48.4 expected), driven by a rise in services to 50.0 (vs 48.8 expected). Manufacturing fell 0.9 points to 46.1 (vs 47.0 expected). Adding to this, the publication of the ECB’s January meeting accounts showed officials were of the view that the risk of cutting rates too early was the greater danger relative to holding them steady, particularly with the limited indications of a wage turnaround.

GBPUSD rose 0.56% to 1.2672. BoE Governor Bailey commented that it is not required for inflation to come back to target before interest rate is cut, suggesting that the next move was likely to be a rate cut. Data wise, Composite PMI rose to 53.3 (vs 52.9 expected) and Services rose to 54.3 (vs 54.1 expected). Manufacturing PMI came in at 47.1, below expectation but higher than prior months. UK GfK Consumer Confidence fell to -21 in February (C: -18; P: -19).

USDJPY rose 0.20% to 150.51 despite growing confidence that the BoJ will adjust their ultra-loose monetary policy, as Governor Ueda said he expects the virtuous economic cycle to continue, and pointed out that services prices were continuing to rise. It is highly likely that positive risk sentiments contributed to JPY weakness, with JPY as the funding currency. Support level at 150/149.5, while resistance level at 150.75/151.50.

Oil & Commodities

Crude Oil fell, with WTI and Brent falling 3.41% and 2.22% to close the week at 76.49 and 81.62 respectively, as reduced bets for interest rate cuts overshadowed positive signal for crude demand. Positive signal is coming from China, where a boom in travel amid the LNY Holiday is raising hopes for a more sustained recovery in consumption. In addition, OPEC+ is widely expected to prolong its current cutbacks into the next quarter at its meeting early next month. Trading range on WTI between 70 and 80, while trading range on Brent between 75 and 85.

Gold rose 1.08% to 2035.4, driven by USD weakness last week. Resistance level at 2040/2065, while support level at 2020/2000.

Economic News This Week

-

Monday – US New Home Sales

-

Tuesday – JP Natl CPI, EU M3 Money Supply, US Durable Goods Orders/Richmond Fed Mfg/Cons. Confid./Dallas Fed Svc

-

Wednesday – AU CPI, NZ RBNZ OCR, EU Cons/Svc/Indust./Econ Confid., US MBA Mortg. App./GDP/Personal Cons./Core PCE/ Wholesale Inv.

-

Thursday – JP Retail Sales/Indust. Pdtn, NZ ANZ Biz Confid., AU Retail Sales, SW GDP/Retail Sales, UK Mortg. App., CA GDP, US Personal Income/Personal Spending/PCE Deflator/Initial Jobless Claims/Pending Home Sales

-

Friday – NZ ANZ Cons. Confid./Building Permits, JP Jobless Rate, AU/JP/SZ/EU/US Mfg PMI Fed Final, CH PMI, EU CPI/ Unemploy. Rate, US Mich Sentiment/ISM Mfg/ISM Prices Paid

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.