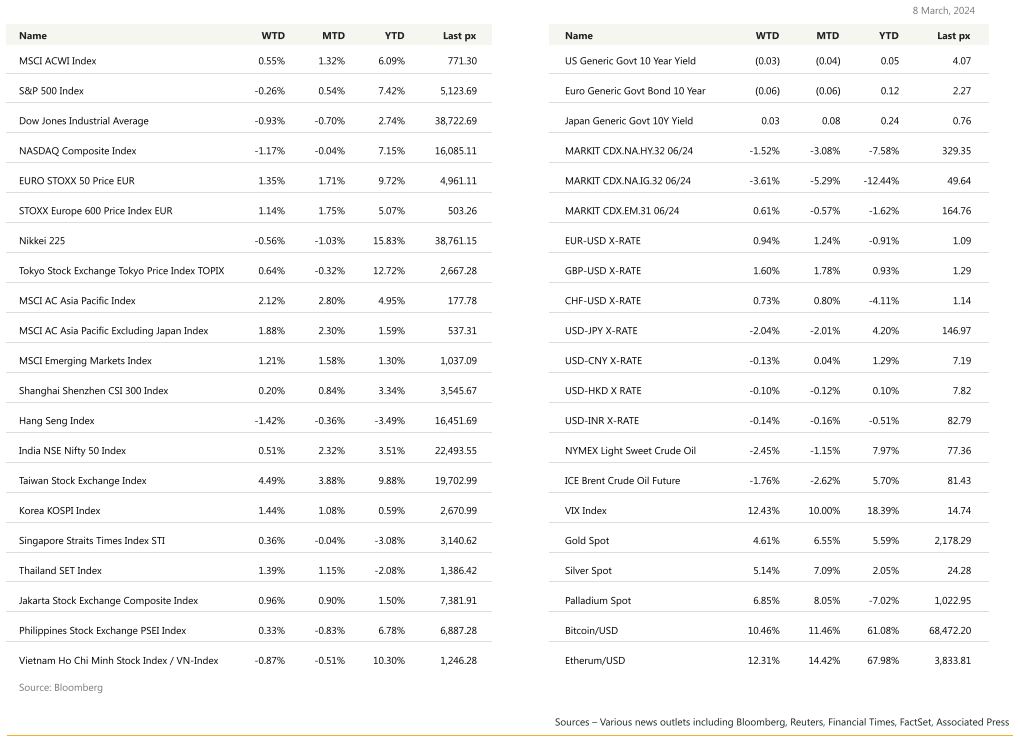

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

A couple of events dominated last week’s direction – Powell’s semi-annual Humphrey Hawkins & Senate Committee on Banking testimonies and the US jobs report. Both tilted slightly on the dovish side pushing yields lower to close the week at 4.0749% and 4.4735% for the UST10’s and 2’s respectively. Fed chair Powell, in the second day of testimony before the US Senate Committee reiterated the same talking points he gave the House on Wednesday: they are looking for greater confidence that inflation is moving sustainably toward 2%; rate hiking cycle likely peaked and needs to see “a little bit more data” before cutting rates later this year.

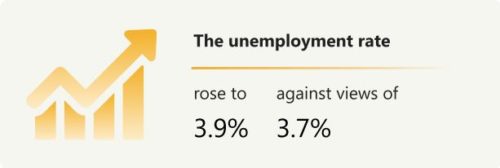

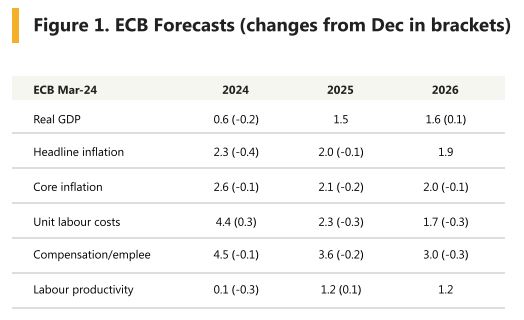

US employment data surpassed expectations in February while wage gains moderated. The unemployment rate rose to 3.9% against views of 3.7% whilst non-farm payrolls reported a higher-than-expected gain of 275k jobs with private payrolls beating expectations. January’s data was revised down. There was a massive downward net revision of the previous 2Months by -165K. Labor for participation was in line with previous month at 62.50% but nevertheless 0.10% below consensus. Average hourly earnings mom printed below consensus at +0.10% but came out in line with consensus on a YoY basis at +4.30%, nevertheless down 0.10% compared to previous month. Average weekly hours came out in line with consensus at 34.3, up 0.10 compared to previous month.

Could this be early signs of fatigue? The latest jobs report pointed to moderating but still somewhat healthy employment growth that will likely keep consumer spending firm. From the perspective of the Federal Reserve, some softening in the labour market and lower wage growth are both viewed favourably, as these can help alleviate inflationary pressures. The Fed’s own set of economic projections from December indicate that the unemployment rate may reach 4.1% in 2024.

Still, all 3 major indices closed lower on Friday and for the week, taking a breather and some profit-taking following weeks of outperformance with new record highs along the way. The latest ISM Services Employment data experienced a contraction at 48 in February as with manufacturing employment Index (previously reported) that could see further pressure on services employment going forward.

Banking stocks had a reprieve during the week following new capital infusion into troubled CRE lender NY Community Bancorp from former US Treasury Sec Mnuchin’s fund et al which should ease concerns about its capital levels and management capabilities, although getting to the bottom of the situation has yet to kick-in. The JOLTS report earlier showed job openings down a tad from last month’s but higher than expected at 8.863 mln, still a strong showing. That said, there was a continued decline in the quits rate of those voluntarily leaving their jobs, which fell to its lowest since August 2020, at 2.1%.

This week will see 2 inflation reports before the next FOMC. CPI on Tuesday expected at a headline reading of 3.1% YoY and a monthly core reading of 0.3% which is slightly lower than January’s 0.4%. Retail sales and wholesale inflation PPI comes out Thursday. We’ll also have the U. of Mich. Inflation expectations on Friday both expected to tick up by 10 bps for the year and 5-10 years.

Cryptos have been on a tear with Bitcoin making new record highs briefly breaching the $70k level on the back of expectations of the halving event and of course, easier access now via ETF’s.

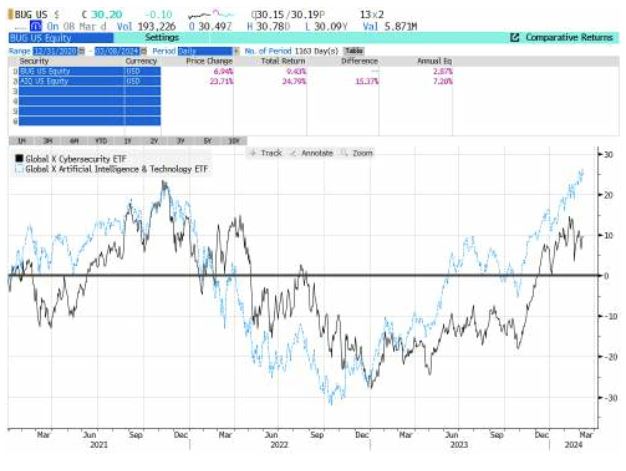

Crowdstrike’s better than expected earnings confirms to us that the sector remains very much in demand. Cyber security as an investment and acting as somewhat of a proxy to AI remains attractively priced. We are looking to add to the sector via the BUG ETF (Global X Cybersecurity ETF).

Europe

European equity markets finished mixed last Friday. STOXX Europe 600 hit new record high. Financial services, Real estate and insurance outperform while retail, technology, and utilities lag.

On European macro calendar, German industrial production missed after big drop in factory orders. Eurozone Q4 GDP confirmed at 0%. ECB’s key gauge or euro area pay eased at end of 2024 with compensation per employee at 4.6% vs prior 5.1%.

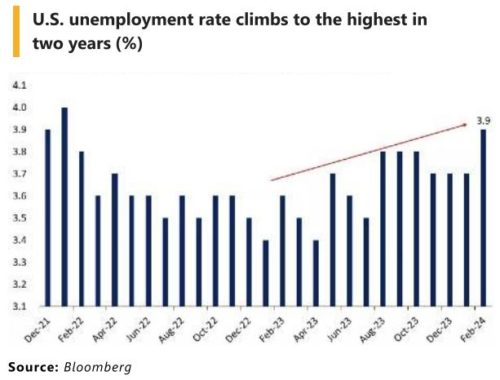

As widely expected, there were no changes in policy at the March’s ECB meeting and no clear guidance on when the policy may change. It was stressed that the ECB will have a better picture of the data by its June meeting.

The ECB decision was a big catalyst for the rally, since although it left rates unchanged, several aspects suggested the window for rate cuts was coming into view. For instance, its latest inflation projections were revised downwards, with headline inflation seen at 2.3% this year, 2.0% in 2025 and 1.9% in 2026, while core inflation is expected at 2.6% this year, 2.1% in 2025 and 2.0% in 2026. So in a couple of years the ECB is pointing to core being back at target and headline being slightly underneath. The nearterm growth forecast was also revised down. In President Lagarde’s comments, there was also something of a steer towards June, saying that ‘’We will know a little more in April but we will know a lot more in June’’. Therefore, economists continue to see June as the likely starting point for cuts with 14% chance of a rate cut happening in April and a 92% in June. This is also the same month markets are expecting the Fed’s first rate cut with 96% priced in June. Money markets are pricing in up to 100bps worth of easing by year-end meeting.

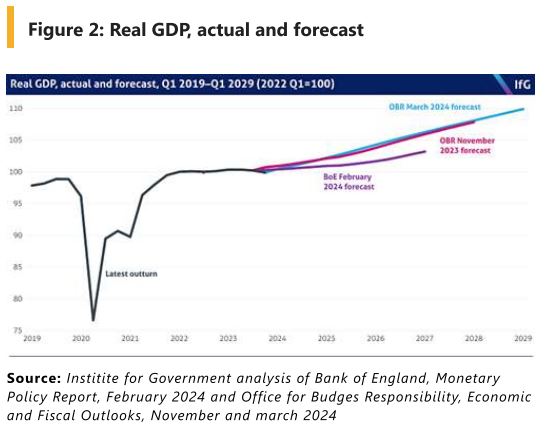

In the UK, the Office for Budget Responsibility (OBR) has upgraded its expectations for UK growth over the next couple of years on the back of lower inflation and growing population.

They have also announced a 10billion pounds tax cut for 27 million workers for a second time in under 4 months and this would reduce a further 2p in National Insurance Contributions (NICs) effective from 6 April to help encourage people back to work and deliver a high wage, high skill economy.

The lowers the level of the debt with a headroom of just 8.9bn pounds to meet the target of getting debt falling in the 5th year of forecast, down from 13bn pounds in November. This move is to try and win back voters for the General Election and along with other measures announced, OBR believes this could boost GDP growth by 0.25pp on average across the forecast horizon.

Asia

Asia markets closed the week higher, MSCI Asia ex Japan was up 1.88%. Nikkei index was lower by 0.56%. Taiwan was the best performer, helped by the chips rally, taking the index up close to 4.5% last week. The index in Taiwan is up almost 9.9% year to date now, one of the best performing markets this year, alongside Vietnam (+10.3%)

Chinese Premier Li Qiang announced an ambitious 2024 economic growth target of around 5% on the backs of China’s National People’s Congress (NPC). Beijing has signalled it is prioritising growth over any reforms even as Li pledged bold new policies. It’s more difficult to achieve 5% this year than last year because the base number has become higher, indicating that the top leaders are committed to supporting economic growth. The International Monetary Fund projects China’s 2024 growth at 4.6%, declining towards 3.5% in 2028.

Details

- China plans to run a budget deficit of 3% of economic output, down from a revised 3.8% last year.

- China plans to issue 1 trillion yuan ($139 billion) in special ultra-long term treasury bonds, which are not included in the budget.

- The special bond issuance quota for local governments was set at 3.9 trillion yuan, versus 3.8 trillion yuan in 2023.

- China also set the consumer inflation target at 3% and aims to create over 12 million urban jobs this year, keeping the jobless rate at around 5.5%.

- Budgetary plans included an increase in defence spending by 7.2% this year, similar to 2023

- Li pledged to harness national resources to speed homegrown scientific breakthroughs, reaffirming priority to achieve self-reliant in key technologies amid rivalry with US

Premier Li Qiang did not hold a press conference after close of this year’s NPC, ending a three-decade-old tradition. This decision is likely to fan investor fears around opaque policymaking, especially since a NPC spokesperson added there will be no such media event for the premier for the remainder of this term of NPC, which is until 2027. In terms of flows, Morgan Stanley said outflows from Chinese stocks slowed into endFebruary and some active managers started adding growth and tech stocks.

China Caixin services PMI showed growth unexpectedly eased. China’s consumer prices however rose for the first time in six months due to spending linked to the Lunar New Year, offering some reprieve for the world’s second-biggest economy grappling with weak consumer sentiment, while factory-gate prices fell again. Hong Kong’s 10 biggest residential estates saw transactions rise to the highest in three years last weekend. Hong Kong property buyers have been rushing to snap up homes after the government removed extra property levies last month to boost the market.

Tokyo core CPI rose 2.5% y/y in February, matching expectations, following revised 1.8% in the previous month. Ex-fresh food & energy inflation was largely stable, up 3.1%, also in line, after revised 3.3% in January. Main factor was energy drags, which narrowed by 0.82 ppt as government subsidies for electricity and gas are phased out. Average wage hike demand hit 5.85% for this year, topping 5% for the first time in 30 years. Bank of Japan (BOJ) board member Junko Nakagawa said the economy was making steady progress towards achieving the central bank’s 2% inflation target and signalled conviction that conditions for phasing out its massive stimulus were falling into place. Japan’s economy avoided falling into a recession at the end of last year. Gross domestic product expanded at an annualized pace of 0.4%qoq in the final three months of last year. The yen and bond yields rose on notions that the BOJ is edging closer to ending the world’s last negative interest rate, with market expectations ramping up for a move as early as this month. The next BOJ policy meeting decision is on 19 March.

India has signed a free trade deal with the European Free Trade Association (EFTA). It will see investments in India of $100bn. The EFTA is made up of Norway, Switzerland, Iceland and Liechtenstein.

The agreement comes after almost 16 years of negotiations. Under this deal, India will lift most import tariffs on industrial goods from the four countries in return for investments over 15 years. The investments are expected to be made across a range of industries, including pharmaceuticals, machinery, and manufacturing.

GeoPolitics

US- China: The U.S. might bar sales to China from its strategic oil reserve. A measure in a funding bill introduced to avert a government shutdown includes the prohibition.

US – Palestine – Israel : The US will set up a port on the Gaza coast for large ships carrying humanitarian supplies. The port will take “a number of weeks” to set up, officials have said, and will be able to receive large ships carrying food, water, medicine, and temporary shelters. Initial shipments will arrive via Cyprus, where Israeli security inspections will take place. President Biden added that no US troops would land in Gaza. The UK said it would work with the US to set up a sea corridor. The plan was drawn up by the US in co-ordination with the EU, Cyprus, the United Arab Emirates and the UN, which would ultimately take over the administration of the aid supplies into Gaza. Another US official has commented that the port would include a temporary pier and was intended to provide “the capacity for hundreds of additional truckloads of assistance each day”. The US aims to transition it to a commercially operated port over time. An Israeli official said Israel “fully supports the deployment of a temporary dock” on Gaza’s coast and the operation would be carried out “with full coordination between the two parties.”

Credit/Treasuries

During Powell’s actual remarks to the Senate banking committee last week, he said that “it will likely be appropriate to begin dialling back policy restraint at some point this year”, which was in line with recent signals that the Fed were still planning to cut rates in 2024. However, Powell also cautioned that “ongoing progress toward our 2 percent inflation objective is not assured”, and that the FOMC “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainable toward 2 percent.” Powell continued to validate expectations for rate cuts this year but maintained that the Fed wanted more evidence of inflation being durably back at target. Consensus is now for the first cut to happen in June or July. Financial markets are still expecting roughly 4 rate cuts to happen by the end of this year, which seems elevate. We will have more colour about the Fed Monetary Policy moving forward during the next FOMC meeting which will happen on the 20th of March and during which meeting they will publish their revised SEP & Dot Plots.

Regarding the US Treasury curve, it inverted some more last week with the 2years yield losing 7bps over the week, 5, 10 & 30years losing about 11bps. IG & HY credit spreads were tighter respectively by 2 & 5bps over the week.

In term of performances, US IG gained 1.20% & US HY gained 0.30%. Leverage loans gained 0.10%.

FX

DXY USD Index fell 1.11% to 102.712. In testimony to the Senate Banking Committee, Fed Chair Powell remarked the Fed is “not far” from getting confidence that it will be appropriate to begin dialing back the level of restriction.

On labor data, strong headline nonfarm payrolls were coupled with details which showed signs of easing in the labor market, with downward revision to previous months Nonfarm. Unemployment rate rose to 3.9% (C: 3.7%; P: 3.7%). This was despite a drop in the labor force participation rate to 62.5% (C: 62.6%; P: 62.6%). Average hourly earnings slowed to 0.1% m/m (C: 0.2%; P: 0.5%). In addition, ISM Services Index fell to 52.6 in February (C: 53.0; P: 53.4).

EURUSD rose 0.94% to 1.0939, dominated by USD weakness. ECB left rates unchanged at 4.00% (C: 4.00%) and reiterates it will continue to follow a data-dependent approach. Further progress on disinflation was confirmed in the statement. In addition, its latest inflation projections were revised downwards, with headline inflation seen at 2.3% this year, 2.0% in 2025, and 1.9% in 2026, while core inflation is expected at 2.6% this year, 2.1% in 2025 and 2.0% in 2026. OIS market is now pricing 85% chance of a cut in June. Data wise, composite PMI came in at 49.2 (C: 48.9; January: 47.9), and the Services PMI came in at 50.2 (C: 50.0; January: 48.4). Producer prices fell 8.6% yoy in January (C: -8.1%; P: -10.7%).

GBPUSD rose 1.60% to 1.2858, dominated by USD weakness. The UK budget did not contain any significant surprises, which included some fiscal easing over the years ahead, with one of the main policies being a 2 ppt cut in the main rate of national insurance contributions (a payroll tax). Elsewhere, another move was to replace the existing ‘non-dom’ regime from 2025 with a new system, so those who have been resident in the UK for more than four years will pay the same tax, whatever their domicile status. Data wise, UK final February Composite PMI came in at 53.0 (C: 53.3; P: 52.9), 0.3ppt below the preliminary estimate.

USDJPY fell 2.04% to 147.06, led by decline in UST yields and therefore, USD weakness. In addition, JPY strengthened, as market pricing of BoJ normalization in March increases following a media report that suggested some government officials were in support of a near term lift-off. In addition, Japan Largest Labor Union Rengo’s strong wage growth target of 5.85% (2023: 4.49%) also seemingly encouraged speculation. Data wise, Japan’s Tokyo CPI beat at the headline in February, up 2.6% yoy, consensus 2.5% yoy. Core core in line at 3.1%, as prior month revised up for both.

Oil & Commodities

Crude Oil fell, with WTI falling 2.45% to 78.01 and Brent falling 1.76% to 82.08. This was despite USD decline and suspended at the keystone pipeline, a crucial conduit carrying Canadian crude to the US. Oil has been trading in a tight band this year, WTI (between USD 70 to 80) and Brent (between 75 to 85), confining prices to their narrowest range since September 2021.

Gold rose 1.11% to 2178.95 (New YTD high), driven by escalating tension in the Middle East, buying by macro funds and speculation over the timing of Fed rate cut. Fed Chair suggested that the Fed is close to the confidence it needs to start lowering rates. Three seafarers were killed by a Houthi missile attack on a ship in the Gulf of Aden last week, the first confirmed deaths of crew members since the attacks on commercial shipping started in mid-November. China’s central bank added gold to its reserves for a 16th straight month in February. In addition, domestic buyers in China are showing strong ongoing demand for gold due to concerns over China patchy economic recovery

Economic News This Week

-

Monday – JP GDP/Machine Tool Orders, NO CPI, US NY Fed 1-Yr Infl. Exp.

-

Tuesday – JP PPI, AU Biz Confid., UK Unemploy. Rate, US CPI

-

Wednesday – Food Prices, UK Indust. Pdtn/Mfg Pdtn/Trade Balance/GDP, EU Indust. Pdtn, US MBA Mortg. App.

-

Thursday – SW CPI, CA Mfg Sales, US Retail Sales/PPI/Initial Jobless Claims

-

Friday – NZ Biz Mfg PMI, CH Medium Term LFR, CA Housing Starts, US Empire Mfg/Indust. Pdtn/Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.