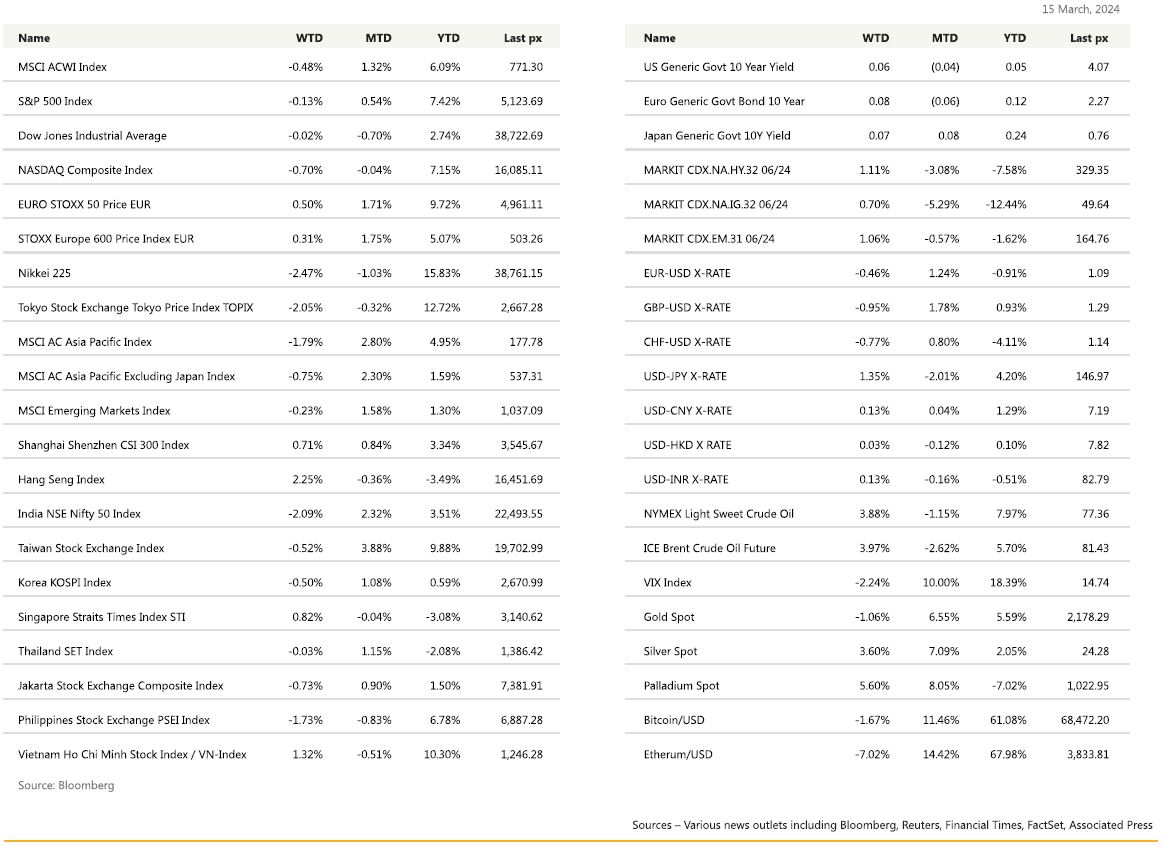

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

Two hotter than expected inflation gauges were enough to send US markets down for a second straight week as the mood soured ahead of this week’s Fed policy meeting.

The VIX advanced higher to 14.41 (Futures 15.68). Big Tech led the selloff notably with Adobe which posted weaker than expected quarterly forecasts. CPI on Tuesday came in at a core month on month rate of 0.4% against expectations of 0.3% and year on year headline also came in higher at 3.2% from 3.1% previously. Markets had earlier rallied post CPI data focussing instead on the super core data which focuses on the price of services and excludes energy & housing which climbed 4.3% in February – down from 6.1% a year ago. Thursday’s PPI went the same way, rising the most in six months driven by elevated fuel and food costs, coming in a bit higher than expected with core monthly PPI at 0.3% against views for 0.2% and the yearly final demand headline at 1.6% from January’s 0.9%. The consensus view is that these numbers are not enough to derail plans for cutting rates later this year but emphasises that the Fed has time to be patient.

With the Fed funds rate at a mid-point of 5.38% (5.25% – 5.5%) its currently at approx. 258 bps above the PCE rate of 2.8%. Now, if one were to assume that 100 bps above inflation were to be its neutral rate at 3.8%, that suggest far more than the 3 rate cuts the Fed is suggesting for this year. We’ll have to see what Powell has to say after Thursday’s FOMC meeting. Retail sales rose 0.6 % month on month beating last month’s revised (down) -1.1% but missed the consensus for 0.7%.

However, according to Bank of America, investors continue to dismiss the risk of stagflation sending record flows into US equities.

Sell-side strategists from SocGen noted that if indeed there’s a bubble forming in US stocks, it still has plenty of room to expand before it bursts, saying that the advance is justified by strong earnings and signs of economic re-acceleration.

Other data out showed the Federal Reserve Bank of New York’s general business conditions index contracted by more than expected whilst the University of Michigan’s consumer sentiment index held steady in early March. The U. of Mich. 1 Yr and 5-10 Yr Inflation expectations matched last month’s at 3% and 2.9% respectively. Also in the news is the move by the US to ban Tik Tok, which faces headwinds in the Senate to be passed. There is broad support but no agreement yet on the right approach to take. Presidential hopeful Trump reiterated in an interview with CNBC that he’s against banning Chinese-owned social media company TikTok because it would aid Facebook. Nothing personal we guess?

In cryptos, Bitcoin has suffered a sharp pullback from record highs – linked to profit taking and uncertainly about when interest rate cuts will take place.

This week’s focus will be Thursday’s FOMC meeting as well as the S&P Global US manufacturing and services PMI’s.

US equities continue to rally and is widely reported to be broadening beyond just Tech. We are taking this opportunity to rebalance some, out of our recommended fund Findlay Park and into a more broad-based value fund Smead US Value UCITS Fund.

Europe

European markets closed lower on Friday with the European Stoxx 600 ended the session down 0.2%, giving up earlier gains. Household goods led losses, down 1.8%, while telecoms added 1.5%.

The focus last week in the Euro area was the ECB operational Framework Review. The ECB is preparing for a time when excess liquidity is lower and the overnight interest rate is much lower than deposit rate. The key change is narrowing the spread between main refi rate (MRO) and deposit rate from current 50bp to 15bp. By doing this, any upward drift and volatility will be within a narrow band and will therefore not have an impact on the monetary policy stance. Industrial Production in the Euro area was down 3.2% compared to the previous month and comparing it to a year ago it was down 6.7%. The figures were dragged down by Ireland, which reported a slump of 29% mom.

Last week’s data in the UK were mixed, the most important labour market numbers being softer. Private sector regular pay fell by 0.1% mom in January, and this is the second time wages have fallen in recent months. The unemployment rate rose from 3.8% to 3.9%, employment was down, and vacancies declined more quickly. GDP recovered in January, rising 0.2% mom after -0.1% mom in December.

This Thursday, the European Council will meet to discuss support to Ukraine. European Defence Industry Strategy and European Defence Industry Programme have been created to support the EU Defence industry. Their aim is to shift from the emergency measures taken since Russia’s invasion to European Council terms ‘’structural EU defence readiness’’ which is to support Ukraine’s economy, society, armed forces and future reconstruction.

On the data front this week, flash PMI and consumer confidence expected to improve as inflation is easing. Over in the UK, while some of the key data has eased since February, it would be enough to convince the MPC that inflation is on a sustained path back to 2%. Therefore, we expect the MPC to maintain its message that they need further evidence before they start easing. UK BoE to keep rates unchanged this Thursday and projection of a first rate cut likely to be in June.

Asia

Asia closed the week higher with MSCI Asia ex Japan down 1.8%. Hang Seng was the best performer, with the HSI index up close to 2.25% for the week. India closed the week lower by 2.09% as India’s markets regulator said last week it is open to revising rules for mutual funds investing in small-cap stocks amid rising concerns about stretched valuations for this segment. Shares of small- and medium-sized companies have powered the record rally in Indian shares in the past year, with funds focused on these stocks getting nearly 40% of net equity inflows of $19.5 billion in 2023.

Japan started the week lower, the index plunged after revised Q4 2023 yoy GDP was a mere +0.4% vs +1.1% expected, but still above the initial -0.4% reported. Dollar Yen trading at 149.16 this morning. Meanwhile, Toyota is giving out higher paychecks. The carmaker agreed to give factory workers in Japan their biggest raises in 25 years as inflation remains historically high.

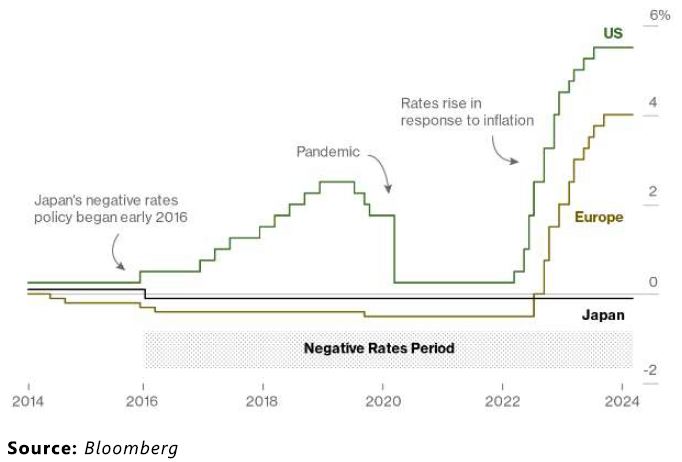

Bank of Japan Governor Kazuo Ueda and his board have one more day to decide if it’s time for the nation’s first interest rate hike in 17 years, as speculation builds that it will proceed. Some 90% of BOJ watchers sees the risk of authorities ending the negative rate on Tuesday at the meeting’s conclusion, with that likelihood bolstered after the nation’s largest union group announced first-round results to annual wage negotiations that far exceeded expectations.

A delay may trigger a sharp weakening in the yen in the short-term, possibly even back past 150 to the dollar and into an area of concern for the government.

World’s Last Negative Policy Rate Is Coming to End

BOJ is mul l ing the first rate hike since 2007

The PBOC held the 1-year medium-term lending facility (MLF) rate at 2.5% in March. The PBOC remains on a dovish tilt, but depreciation pressure on the RMB limits room for monetary easing in China before global central banks start to cut rates.

China issued action plan to increase spending on equipment in sectors such as industry, agriculture, transport, education and healthcare by at least 25% by 2027 compared with 2023. It also pledges funding support, adding equipment renewal or upgrades can receive support from central government budget together with tax breaks and targeted lending from banks. The plan to encourage consumers and businesses to replace old equipment and goods is seen as crucial for growth target of 5% this year, while economists noted should add 0.7% of growth each year until 2027.

Recent rally in Chinese equities is spurring views that markets have bottomed with net inflows continuing in March. Since the lows in Feb, CSI 300 has climbed up almost 15%.

South Korea’s central bank said on Thursday it needed to be cautious about a policy shift amid persistent economic risks, such as likely U.S. interest rate cuts and uncertainty over the domestic housing market and debt. In its quarterly monetary policy report, the Bank of Korea (BOK) said: “There are risks remaining to be noted in the final stage of entering the period of price stability.”

India’s wholesale price index in February rose at a slower pace than in the previous month, mainly due a sharper fall in manufactured products and power prices, government data showed on Thursday. India’s industrial output growth stood at 3.8% in January, unchanged month-on-month, indicating the steady pace of growth for the Indian economy. Trade deficit widens to $18.7 billion in February; imports, exports rise 12.2%, 11.9% YoY.

GeoPolitics

US – Palestine – Israel: The first aid ship under a new Cyprus Maritime Corridor Initiative set sail from Cyprus to Gaza earlier on Tuesday. When announcing the initiative last week, European leader Ursula von der Leyen said “this is the first time that a ship is authorized to deliver aid to Gaza since 2005.” The journey, which will take two days, comes after UN officials said some 576,000 people in Gaza are “one step away from famine”. Separately, America’s most prominent Jewish politician called for Benjamin Netanyahu’s hardline government to be replaced, accusing him of weakening his country’s “political and moral fabric” and being an “obstacle to peace”. Chuck Schumer, a close ally of President Joe Biden and the most senior Democrat in the US Senate, said that Washington should use its leverage over Israel to force Netanyahu’s ruling coalition to adopt a more moderate course, if it remained in power after the war with Hamas. Netanyahu had been “too willing to tolerate the civilian toll” in Gaza and was “pushing support for Israel worldwide to historic lows”, the Senate majority leader said. Schumer also said it would be a “grave mistake” for Israel to reject a two state solution and urged negotiators in the Israel-Gaza conflict to do everything possible to secure a ceasefire, free hostages and get aid into Gaza.

US – Ukraine: BlackRock and JPMorgan are backing a $15 billion investor fund to rebuild Ukraine. It’s certainly not nothing, but reconstructing Ukraine could cost half-a-trillion dollars.

China – India: Beijing has lodged a diplomatic complaint with New Delhi after Indian Prime Minister Narendra Modi officially inaugurated a tunnel along the contested India-China border. Separately, New Delhi is reportedly preparing to send an additional 10,000 troops to its border area.

US – China: Tensions flared up again as the House overwhelmingly passed a bill that would force ByteDance to sell TikTok or face a ban in US. House of Representatives passed a bill on Wednesday calling for the app’s Chinese developer ByteDance to divest from the company or be booted out of US app stores. The Protecting Americans from Foreign Adversary Controlled Applications Act passed with overwhelming bipartisan support, receiving 352 votes in favour, and only 65 against.

Many House legislators have argued that the app could allow the Chinese government to access user data and influence Americans through the wildly popular social media platform’s addictive algorithm. The White House has backed the bill, with President Joe Biden saying he would sign it if it passes Congress. Former US President Donald Trump, the Republican candidate for president, has also changed his position on TikTok. His administration tried to ban the app in 2020, but switching sides four years later could earn him votes with younger voters in November.

Credit/Treasuries

Last week saw a dramatic bond sell-off, with 10yr Treasury yields (+23.1bps) up to 4.31% as concerns mounted about stubborn inflation. The main driver was a strong US CPI and PPI report, both above consensus. But alongside that, oil prices closed at their highest level since November, which added to fears that inflation was still gathering momentum.

And on top of that, there was growing anticipation that the Bank of Japan would end their negative interest rate policy at next week’s meeting, which added to the upward pressure on global yields. US yield curve bear flattened, with 2 years (+25 bps), 5 years (+ 27 bps), 10 years (+23 bps), 30 years (+17 bps). Given the rise in UST yields and the below consensus US retail sales, both the credit spreads on High Yield (+1.11%) and Investment Grade (+0.70%) widened.

FX

DXY USD Index rose 0.70% to 103.43, driven by stubborn inflation in the US. Core PPI (ex-food, energy, and trade services) rose by 0.4% mom in February (C: 0.3%; P: 0.6%) and ticked up to 2.8% yoy (P: 2.7%). Core CPI increased by 0.358% mom in February (C: 0.3%; P: 0.39%), and this brought the annual rate to 3.8% (C: 3.7%; P: 3.9%). On the CPI details, the OER-Rent wedge narrows, but the acceleration in rent reverses four months of progress. 3m annualized core CPI rises to 4.18% (P: 3.97%). US retail sales disappointed, with headline retail sales up +0.6% in February (vs. +0.8% expected) with the previous month revised down to show a larger -1.1% decline. The weakness only served to dampen risk appetite further. We have the FOMC dot plots this coming Wednesday.

EURUSD fell 0.46% to 1.0889, driven by USD strength. Based on OIS, market is pricing a 84% chance of an ECB cut by June. Resistance level at 1.092/1.10, while support level at 1.084/1.08.

GBPUSD fell 0.95% to 1.2736, driven by USD strength and negative risk sentiment. Data wise, UK labour market data was a bit weaker than expected over the three months to January. Wage growth slowed to an 18-month low of +5.6% (vs. +5.7 expected), and the unemployment rate ticked up to 3.9% (vs. 3.8% expected). UK GDP grew by 0.2% mom in January (C: 0.2%; P: -0.1%) driven by a combination of a retail sector rebound and solid public sector output growth.

USDJPY rose 1.35% to 149.04, driven by USD strength, despite preliminary results of Rengo spring wage negotiations above 5% for the first time in 33 years, which were stronger-than-expected, with a March BoJ hike already in the price. There were a few media reports suggesting that BoJ will likely remove NIRP at its March meeting, this coming Tuesday.

Oil & Commodities

Crude Oil rose to its highest year to date last week, WTI closing the week +3.88% to 81.04 and Brent +3.97% to 85.34. The rise in oil price was driven by Ukrainian drone strikes against Russian oil refineries and data showing that US crude stockpiles declined for the first time in seven weeks. The API figures also showed crude stockpiles at Cushing, Oklahoma, the delivery point for WTI, fell by almost 1 million barrels. In a monthly report, International Energy Agency forecast a supply deficit through 2024, changing its earlier projection of a surplus, on the premise that OPEC+ maintains production cuts.

Gold fell 1.06% to 2155.9, driven by USD strength and rise in UST yields. Based on RSI indicator, Gold price has now retreated below the overbought territory. Resistance level at 2175/2020, while support level at 2130/2000.

Economic News This Week

-

Monday – JP Core Machine Orders, CH Retail Sales/Industr. Pdtn, Norway GDP, EU CPI, CA Industr. Pdtn Price

-

Tuesday – AU RBA OCR, JP Industr. Pdtn/BoJ Rate Decision, EU Zew, CA CPI, US Building Permits/Housing Starts

-

Wednesday – CH LPR, UK CPI/PPI, US MBA Mortg. App/FOMC Rate Decision, EU Cons. Confid.

-

Thursday – NZ GDP, AU/JP/EU/UK/US Mfg/Svc/Comps PMI Mar Prelim, AU Unemploy. Rate, Norway Deposit Rates, UK BoE Rate Decision, US Initial Jobless Claims/Leading Index/Existing Home Sales

-

Friday – NZ Trade Balance, JP Natl CPI, UK Cons. Confid./Retail Sales, Norway unemploy. Rate, CA Retail Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.