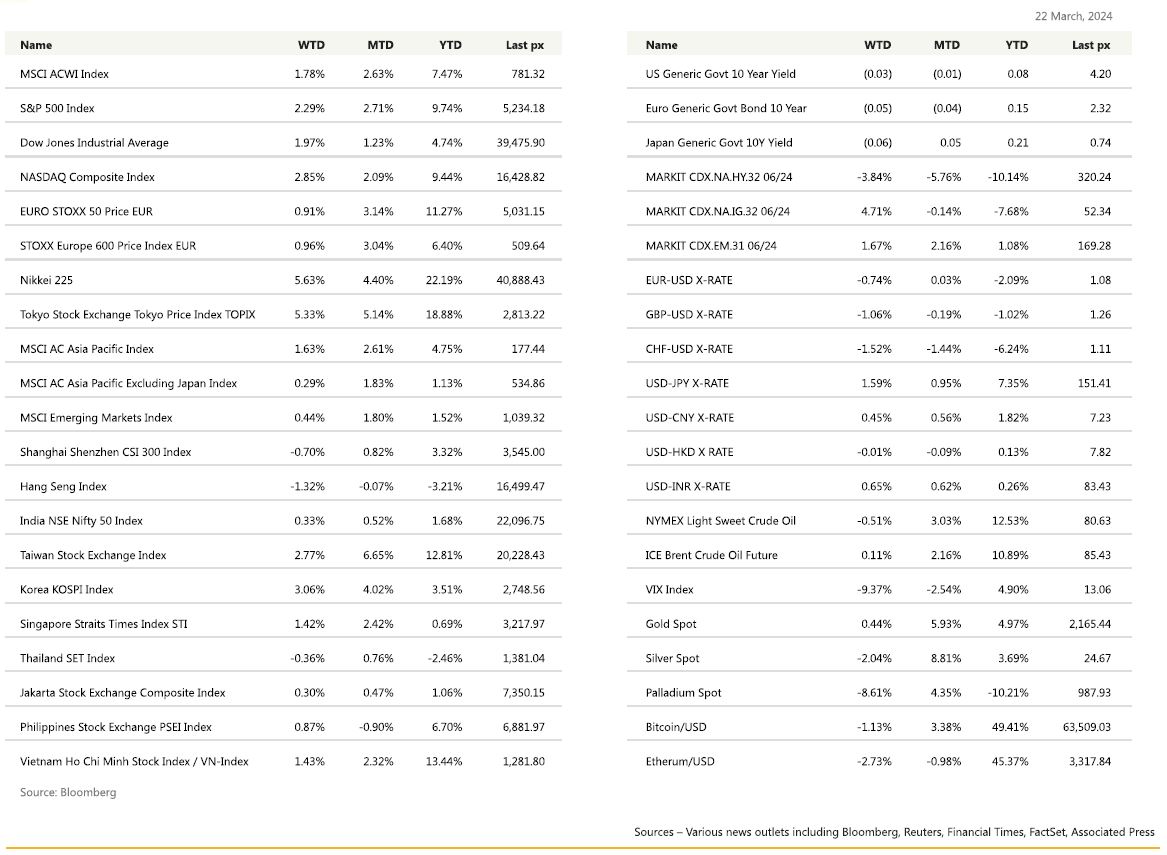

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

Following the FOMC meeting on Thursday, major indices ended the week higher amid optimism over the Fed’s rate path. Chair Powell said it will probably be appropriate to start rate cuts this year and added that the FOMC will probably begin slowing QT relatively “soon.” He noted that inflation has eased “notably” but is still too high, a comment which didn’t come as too much of a surprise, particularly given the underlying resilience of the economy. “The story is really essentially the same,” Powell said, with “inflation coming down gradually toward 2% on a sometimes-bumpy path as I mentioned. I think that is what you still see; we’re not going to overreact as well to these two months of data”.

Continuing jobless claims were slightly below expectations, while both manufacturing PMI and existing home sales were stronger than expected. The S&P 500 clocked up its best weekly performance for the year so far at +2.31%, hitting yet another fresh record along the way. The Russell 2000 also made significant strides, underpinning the sentiment that the rally continues to broaden.

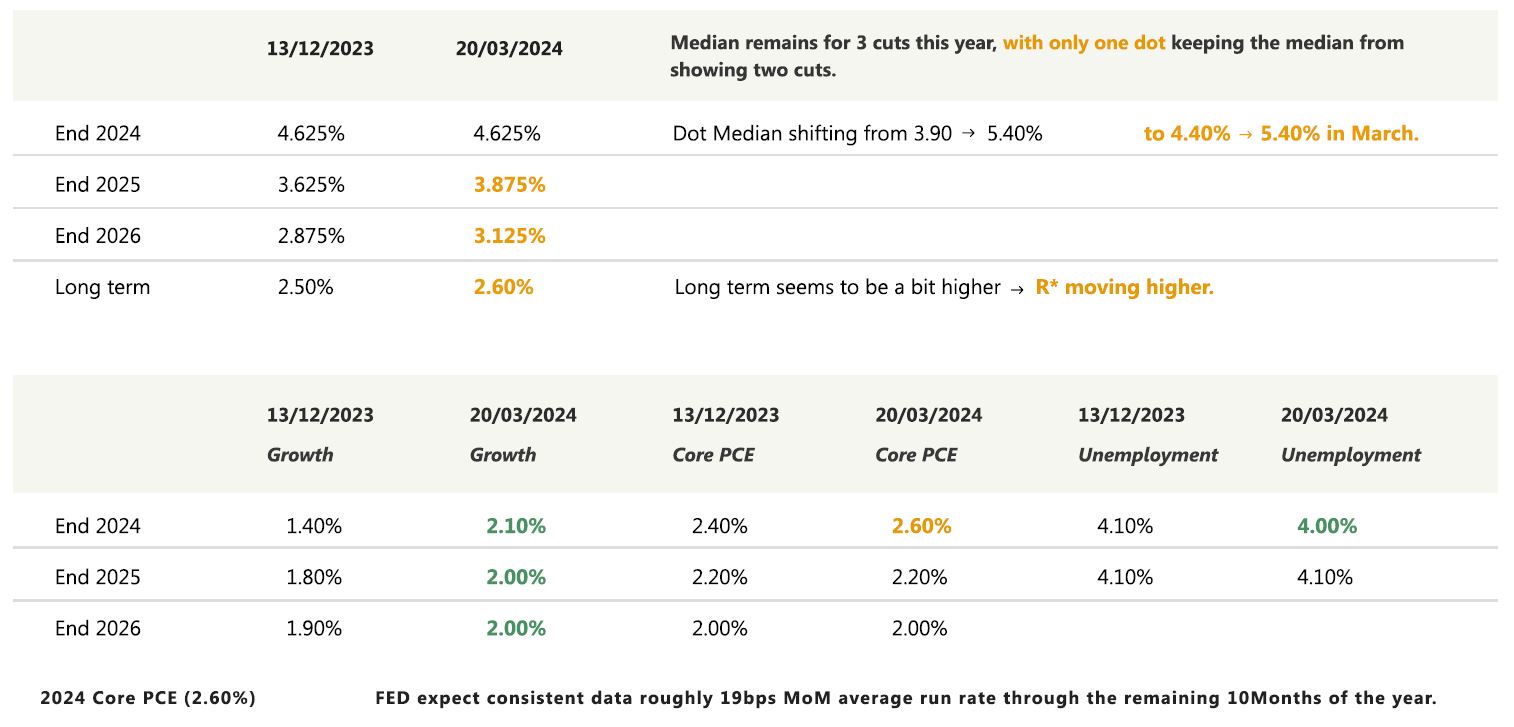

Markets had stalled earlier in the week in the run-up to the Fed meeting on concerns among investors that policymakers would scale back their forecast for three interest-rate cuts in 2024. The dot-plot remained on cue for 3 cuts this year although they did lift its core inflation expectation slightly. Now that that’s out of the way, strategists from HSBC, Goldmans, SocGen, and BofA are raising their tactical allocation to US stocks, noting that the sharp rally we’ve seen was justified.

This week will see the last of the inflation numbers being the PCE Deflator on Friday. Consensus is for a core MoM reading of 0.3% and YoY of 2.8%. We will also have Annualized GDP QoQ, personal income & spending data, and the U. of Mich. inflation expectations during the week.

In big Tech, Apple had a torrid week at home following lawsuits by the DOJ alleging Apple of breaching antitrust laws whilst its CEO, Tim Cook, met China’s commerce minister to deepen its development in China.

Apple, together with others, sees China’s acceleration in the development of innovation-led new quality productive forces, has broad prospects in high-tech fields such as artificial intelligence and cloud computing, which means great opportunities for enterprises from all over the world. Apple had also discussed using Baidu Inc.’s AI in iPhones and other devices within China, the Wall Street Journal reported, which helps keep Apple “in the game” following its usage ban, barring central government officials from using any Apple devices six months ago. Nvidia carried on its ascent following yet another upgrade (UBS).

On Apple, its correction from December last year at $199.62 to Friday’s close of $172.28 marks a healthy 13.7% correction. Given Apple’s refocus out of self-driving EV’s to AI and its continued romance with China irrespective of politics, makes it an attractive “add-on” or BUY.

Europe

The European stock market finished mixed. The FTSE 100 outperformed, ending the week up by 0.6% at 7930 points, while the STOXX 600 closed higher by 0.02%, with sectors showing mixed results. Tech and travel stocks led losses, down 0.7% and 1.17%, respectively. Citigroup raised its 2024 year-end target for the STOXX 600 index by about 6% to 540 from 510, stating that there is more clarity on the Fed’s interest rate trajectory and potential weakness in the US dollar.

Last week’s European PMI data was mixed. France was weaker, but that came after a stronger INSEE survey. The German and euro area PMIs reported a fall in the manufacturing indices but a rise in services. The UK, by contrast, bucked the trend with manufacturing up and services down. However, services were previously running at a reasonable rate. With the euro area composite PMI rising to almost 50 (49.9) and having a particularly close relationship with GDP growth, the economic recovery looks like it’s gaining momentum. In the UK, the relationship between the PMIs and GDP is less strong, but the PMIs themselves are higher. UK retail sales remained weak in February with an unchanged reading compared to a forecasted 0.3% drop. On a year-on-year basis, sales were down 0.4% versus a consensus for a 0.7% drop. Separately, a survey showed British consumer sentiment also held steady in March, but households turned positive about the outlook for their personal finances for the first time in 2 years.

In the UK, the Bank of England left rates on hold, but the announcement was a relatively dovish surprise, especially in the voting profile, but hinted cuts could be on the horizon as inflation falls faster than anticipated.

Markets were pricing in a very low chance of a cut, with only around half a basis point priced in ahead of the announcement. Market pricing in approximately a 70% chance for a June move and fully priced for August. The voting split was changed with the external members Haskel and Mann, who are the hawkish MPC members, dropping their votes for a hike and shifting to unchanged, respectively. The voting split has gone from a 1-6-2 (cut-unchanged-hike) to a 1-8-0 formation. For the BoE, weaker data might easily suggest a June cut, and stronger data might reinforce an August cut. Whatever the case, it certainly feels like rate cuts are coming.

The Swiss National Bank surprised on the dovish side, kicking off the global cutting cycle. The SNB cut its policy rate by 25 bps to 1.5%, making it the first major DM central bank to lower rates. The SNB’s main dovish move was to substantially lower its inflation forecast by 50 bps across its forecast horizon.

A series of data to watch in the eurozone this week include consumer and business sentiment data. The UK also updates the final Q4 GDP.

Asia

The big news last week was the BOJ ending the most aggressive monetary stimulus program in modern history. The central bank set a new policy rate range between 0% and 0.1%, shifting from a -0.1% short-term interest rate. The BOJ also scrapped the yield curve control program while pledging to keep buying long-term government bonds as needed. It also ended its purchases of exchange-traded funds. The bank’s indication that financial conditions will remain accommodative suggests this isn’t the beginning of an aggressive tightening cycle like those seen in the US and Europe in recent years. That stance appeared to disappoint some market players looking for a more aggressive rate outlook. The vote for the rate hike was 7-2. The yen has weakened post the announcement.

Japan’s core machinery orders fell more than expected in January due to a weak manufacturing sector, data showed on Monday, prompting the government to downgrade its view on the indicator for the first time in over a year. Official statistics showed China’s industrial production grew 7% from the same period last year, well above the forecasted 5% from analysts polled by Reuters. Retail sales were up 5.5%, slightly better than projected, although the rate was down from a 7.4% increase in December. Vietnam’s GDP in 2023 is estimated to have reached about US$433.3 billion, ranking fifth in Southeast Asia after Indonesia, Thailand, Singapore, and the Philippines, based on the latest data from the International Monetary Fund.

Tepid performance in India has corresponded with waning foreign investor enthusiasm. Foreign ownership of Indian stocks has eased to 17.1% from ~17.7% in mid-2023. Rich valuations, concerns over speculative excess in small-caps, and increased regulatory scrutiny on non-bank financial companies partly attributed to recent underperformance.

However, some sell-side analysts remain bullish on the outlook, arguing Indian stocks deserve higher multiples given stronger economic growth, political stability, loftier earnings growth, and geopolitical tailwinds. The expected election win by PM Modi’s BJP in April elections is viewed as an upside catalyst, with the party expected to push market-friendly policies that attract FDI. India will elect a new parliament in seven phases between Apr 19 and early June, the country’s election authority said. A victory would make Modi, 73, only the second prime minister after Jawaharlal Nehru, India’s independence hero and its first prime minister, to win a third straight term.

Indonesia’s central bank held key policy rates unchanged on Wednesday, as expected, amid pressure on the rupiah currency in recent days. Indonesian monetary policymakers have said they see room to cut interest rates in the second half of this year, with inflation seen remaining within the target through to 2025, even as Southeast Asia’s largest economy needs stimulus amid falling exports. Some economists expected BI to take its cue from the Fed on the timing and magnitude of monetary easing, in order to maintain a certain yield spread between assets in Indonesian rupiah and U.S. treasury yields. BI on Wednesday last week also kept Indonesia’s economic growth outlook for 2024 in a range of 4.7% to 5.5%.

Vietnam is seeking its third president in little more than a year after its ruling Communist Party forced the resignation of Vo Van Thuong, who was only elected last year after the sudden dismissal of his predecessor on Wednesday (Mar 20).

GeoPolitics

US – China: The Biden administration is considering blacklisting several Chinese semiconductor firms linked to Huawei, including Qingdao Si’En, SwaySure, and Shenzhen Pensun Technology. Sanctions may also extend to makers of semiconductor manufacturing equipment, including SiCarrier and Pengjin. Sources have stated that the timing of the decision will depend on the state of US-China relations and take into consideration other factors, such as the White House decision on adjusting Trump-era tariffs. Separately, Donald Trump said that if elected, he would impose a 100% tariff on cars made in Mexico by Chinese companies.

US – Russia – Europe: Russia controls a little under one-fifth of Ukraine, and President Vladimir Putin ordered troops to advance further after Moscow took the small eastern Ukrainian city of Avdiivka last month.

Russia, which has recruited hundreds of thousands of contract soldiers, will create two new armies and 30 formations, including 14 divisions and 16 brigades, Shoigu said. Western spy chiefs say the war could be at a turning point, as Kyiv needs more arms from its Western allies to avoid further battlefield setbacks. U.S. Defense Secretary Lloyd Austin stated on Tuesday that Ukraine’s survival was in danger.

US – Israel – Palestine: Israeli Prime Minister Benjamin Netanyahu told U.S. Republican senators on Wednesday that Israel will continue its efforts to defeat the Palestinian militant group Hamas in the Gaza Strip. U.S. Secretary of State Antony Blinken began a tour of the Middle East on Wednesday by holding talks in Saudi Arabia, hoping to secure a ceasefire in the Gaza war as increasing strain shows in Washington’s relationship with its ally Israel. In the Gaza Strip, where hunger is spreading and hopes were dashed for a ceasefire in time for Ramadan last week, residents of Gaza City in the north described the most intense fighting for months around the Al Shifa hospital.

Credit/Treasuries

There was a strong rebound in February housing starts, reaching 1’521’000 compared to 1’331’000 the previous month, as well as in building permits. February existing home sales came in at 4.38 million, surpassing the expected 3.95 million.

March’s preliminary US Manufacturing PMI printed at 52.5, well above the consensus of 51.8 and higher than the previous month’s 52.2. On the other hand, the Services PMI came out at 51.7, still in expansion territory but below both the consensus of 52.0 and the previous month’s 52.3.

During their latest meeting last week, the Fed indicated that they might reduce the pace of QT moving forward, possibly in May or during their June FOMC meeting. The Fed clarified that reducing the pace of QT does not necessarily mean that QT will stop.

The current Reserve Bank credit stands at $7.5 trillion after declining by $12.5 billion over the past seven days. The Fed’s portfolio of interest-bearing assets now stands $55 billion below levels seen a month ago, and 16% lower than the March 2022 high-water mark.

The US Treasury curve flattened during the week, with the 2 and 5-year yields dropping by 15 bps, the 10-year yield dropping by 10 bps, and the 30-year yield dropping by 5 bps. Credit spreads were mixed for the week, with IG credit spreads widening by 3 bps, but HY credit spreads tightening by 7 bps.

In terms of performance, US IG gained close to 1% over the week, and US HY gained about 60 bps.

The main data releases for this week will include the Conference Board Consumer Confidence for March, as well as the Richmond Fed Manufacturing Index and the March University of Michigan Sentiment Index.

FX

DXY USD Index rose 0.96% to 104.43 despite the FOMC maintaining the fed funds target range at 5.25-5.50% and a median projection of three 25bp rate cuts for 2024 (though it was just one dot away from 2 rate cuts).

The FOMC painted an optimistic picture of the US economic outlook, as the median growth projections were marked higher throughout the forecast horizon: to 2.1% in 2024 (P: 1.4%), 2.0% in 2025 (P: 1.8%), and 2.0% in 2026 (P: 1.9%). The median unemployment rate projection was marked down to 4.0% in 2024, maintained at 4.1% in 2025, and marked down to 4.0% in 2026. Powell leaned on supply-side improvements and said, “in and of itself, strong job growth is not a reason for us to be concerned about inflation.” Additionally, Chair Powell stated that “it will be appropriate to slow the pace of run-off fairly soon.”

EURUSD fell 0.74% to close the week at 1.0808 as preliminary March S&P Global PMIs reinforce divergent growth expectations between the US and Europe. Euro Area preliminary March Composite PMI rose to 49.9 (Consensus: 49.7; Previous: 49.2), Manufacturing came in at 45.7 (Consensus: 47.0; Previous: 46.5), and Services came in at 51.1 (Consensus: 50.5; Previous: 50.2). ECB Governing Council Member Nagel says the probability that the ECB delivers its first cut before “the summer break” in August is increasing. EURCHF rose 0.80% to 0.96991 as the SNB delivers a surprise 25bp rate cut, bringing its policy rate down to 1.50% (Consensus: 1.75%) in conjunction with a significantly lower conditional inflation forecast.

The GBP fell 1.06% against the USD to 1.2601 and 0.32% against the EUR to 0.8577 as the BoE maintained the Bank Rate at 5.25% in line with consensus. However, for the first time since September 2021, there are no votes on the MPC to hike interest rates. UK February inflation data was below both BoE and consensus expectations, while retail sales were above consensus. March preliminary Manufacturing PMI came in above consensus, while the Services PMI was below consensus. As a result, the composite PMI came in at 52.9 (Consensus: 53.1).

The JPY has experienced broad-based weakness despite the Bank of Japan removing its negative interest rate policy and ending its Yield Curve Control (YCC) framework, overshoot commitment, and ETF and J-REIT purchases.

Oil & Commodities

WTI crude fell 0.51% to close the week at 80.63, while Brent rose 0.11% to close the week at 85.43. The increase in Brent price was driven by Ukrainian attacks on Russian territory, including refineries. The decline in WTI crude prices was driven by USD strength following a surprise rate cut from the Swiss National Bank, as well as weakness in China’s yuan. Despite crude prices breaking out of a narrow range, gains have been limited by surging supply from outside the group and a muddled economic outlook in top importer China.

Gold rose to a year-to-date high of 2222.75 intra-week after the FOMC, before falling to close the week at 2165.44 (+0.58%). The decline in the gold price towards the end of the week was driven by the fall in global yields following a surprise rate cut from the Swiss National Bank. The entire UST yield curve was adjusted downwards, with US 2-year yields falling by 13.85 basis points.

Economic News This Week

-

Monday – US New Home Sales/Chicago Fed Nat Act. Index/ Dallas Fed MFG Act.

-

Tuesday – AU Cons. Confid., SW PPI, US Durable Goods Orders/Cons. Confid.

-

Wednesday – NZ Cons. Confid., CH Indust. Profit, EU Cons./ Svc/Indust./Econ Confid., US MBA Mortg. App.

-

Thursday – NZ Biz Confid., AU Retail Sales, UK/CA GDP, EU M3 Money Supply, /Personal Cons./Initial Jobless Claims/ MNI Chic PMI/Pending Home Sales

-

Friday – /Jobless Rate/Retail Sales/Indust. Pdtn, US Personal Income/Personal Spending/PCE Deflator/ Wholesale Inv.

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.