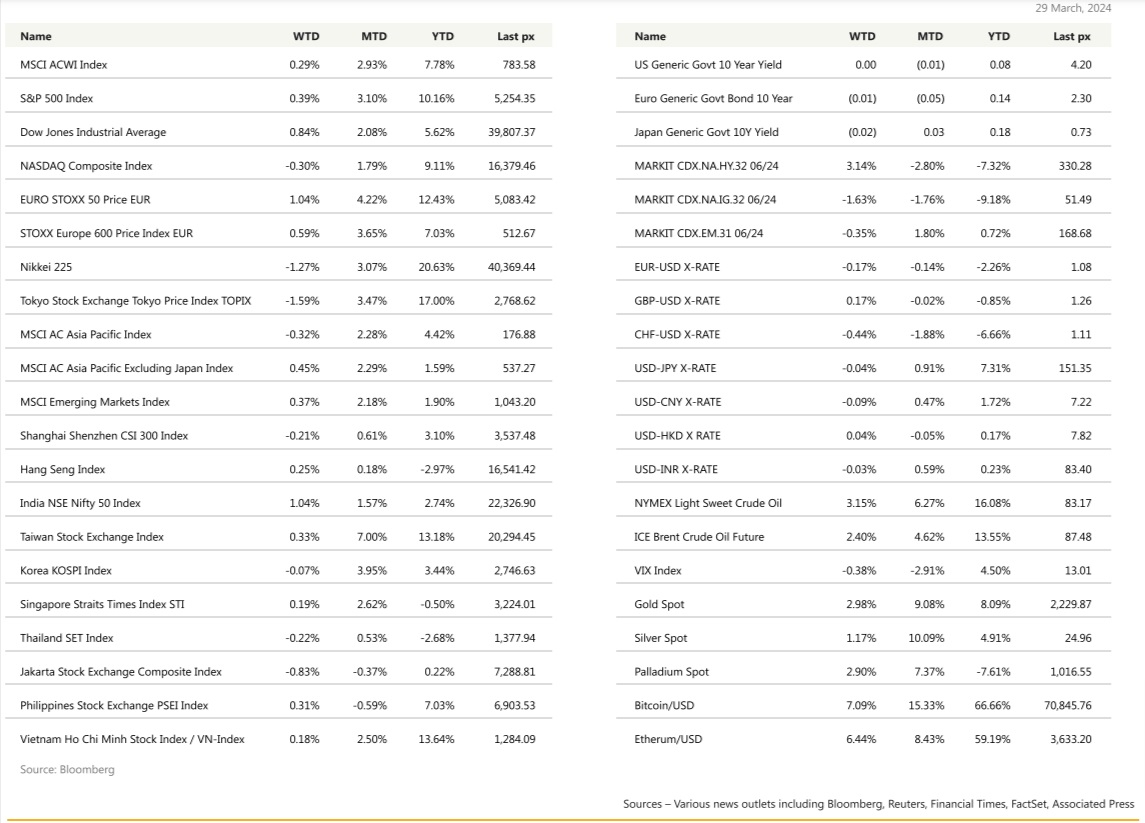

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

The end of the shortened week also marked the end of the first quarter for 2024. US stocks posted its best Q1 gain since 2019 posting yet another fresh record. Small-cap shares were the biggest gainers for a second day, up 0.5% underpinning the narrative that the historic rally in US markets continues to broaden. The S&P 500 notched a 10% quarterly gain, beating the Nasdaq 100’s 8.5% and the Dow’s 5.6%. Nasdaq was down for the week following earlier reports that the European Union opened an investigation into how Apple and Google, along with Meta Platforms Inc., are complying with new laws meant to rein in the power of Big Tech. The third and final estimated QoQ GDP annualised rate came in at a higher than expected 3.4% lending support to speculation the Fed Reserve is steering the economy to a soft landing. Jobless claims were in line with forecasts.

Fed Governor Waller, had earlier commented that recent inflation figures were “disappointing” and said he wants to see “at least a couple of months of better inflation data” before cutting. He also said that there is no rush to cut rates right now but reaffirmed that rate cuts are not off the table. “It is appropriate to reduce the overall number of rate cuts or push them further into the future in response to the recent data”. Following his commentary, the probability of a rate cut moved to 60% from hovering around 70% earlier in the week.

The PCE data which was released on Friday when the markets were closed, cooled last month while household spending rebounded. Core PCE increased 0.3% from the prior month’s adjusted 0.5%. The core YoY PCE was on the nose at 2.8%. Fed officials may nonetheless take comfort in a tame increase in a narrower gauge of services inflation within the report. Chair Jerome Powell said the figures were “pretty much in line with our expectations” and reiterated the central bank doesn’t need to rush to cut interest rates. At the same time, inflation-adjusted consumer spending exceeded all estimates on the heels of the biggest gain in wages in over a year, according to the report from the Bureau of Economic Analysis. This lack of so-called “consumer-fatigue” which crept up in retail sales previously makes it hard for businesses to adjust prices lower. However, as we have seen of late, the savings rate fell to the lowest since the end of 2022, possibly indicating that people are dipping into savings to support spending.

Other data included durable goods orders which rose 1.4% MoM which was much better than last month’s -6.9%. March University of Michigan sentiment index printed higher than expected at 79.4 Vs 76.5 expected and previous Month. However long term forecast of inflation printed lower than expected, 1year forward at 2.90% Vs 3.10% & 5years forecast at 2.80% Vs 2.90%.

This week will see the kick-off of Q1 earnings. We will also be inundated with jobs & labour data starting with the JOLTs job openings to ADP and NFP as well as the average hourly earnings to cap the week We expect an NFP of another +200k jobs at an unemployment rate of 3.8%. Some comfort can be taken here from an earlier statement from Fed Chief Powell who said, “strong job growth is not a reason for us to be concerned about inflation,” and that “strong hiring all by itself would not be a reason to hold off on rate cuts” and the ISM manufacturing & Services as well as the March PMI Services.

We like a theme that is slowly forming that will run alongside AI and Generative AI. Quantum computing which is in its infancy but will affect multiple industries, nevertheless. Quantum computing is opening new possibilities for scientific experimentation, as it is much faster at modelling complex scenarios. QTUM US Defiance Quantum ETF.

Europe

European markets closed the first quarter of 2024 around 6.8% higher as recent inflation data continues to show pressures from higher prices are cooling. It was the best quarter in a year, according to LSEG data, and the best month since December 2023.

On the data front, the EC sentiment data increased 0.8pt to 96.3 in March, reinforcing the positive signal from the PMI survey last week. The EC survey showed Germany lagging behind due to its manufacturing sector. In the PMI, the latter has been holding the composite output index back in a modest contraction territory. On the inflation side, the price expectations balances in the EC survey declined again in March and suggesting that some moderation in domestic price setting. The GDP deflator could likely slow down to 3% oya pace in the coming quarters.

Services HICP inflation in the EU for March is likely to slow by 20bp to 3.8% and likely for the ECB to begin its cutting cycle in June. The March drop in the manufacturing PMI was driven primarily by France and Germany.

In the UK, BoE released its quarterly Financial Policy Summary which argued that that assets prices look stretched relative to historical norms. This in turn reflected soft landing views embodying lower inflation, resilient growth, and lower interest rates. So far, the economy has proved resilient to higher rates, and hard-landing risks appear to have receded. GDP in the 4Q was left unrevised at -0.3% q/q.

BoE’s Haskel, a hawkish member of the rate-setting committee, is the latest official to warn against rate cut expectations and he commented that cuts were still a long way off because of its underlying inflation. Nevertheless, markets are still pricing in a high probability of a June move and fully priced for an August cut. At least 3 rate cuts are priced in by year-end with several sell-side economists revising their calls up to 4 -5 rate cuts.

This week, the focus will be firmly on March HICP inflation in the EU. We expect stable headline inflation and a continuation of slowing core inflation. However, there are some risks of upside surprises which could affect the expectations for ECB rate cuts.

Asia

Asian equities finished mixed last week. MSCI Asia ex Japan was higher by 0.45%, while the broader MSCI Asia index closed lower by 0.35%. Japan was the drag, with the TOPIX lower by 1.59% for the week, but still up 17% year to date.

BOJ minutes from 22-23-Jan meeting noted members agreed inflation likely to be above 2% through FY24 and underlying inflation likely to gradually increase toward price stability target toward end of projection period. Some members saw high likelihood 2024 wage talks would produce pay growth above last year. Members agreed if virtuous cycle is confirmed BOJ would likely weigh whether to continue with easing measures such as NIRP. One member saw Japan policy flexibility reduced if overseas central banks began cutting interest rates, adding BOJ should not miss current window of opportunity to exit. Many members saw high likelihood of financial accommodations remaining accommodative beyond NIRP exit, with some arguing it is unnecessary for Japan to rapidly tighten policy.

The yen continued to languish near its weakest in decades. It slipped to 34-year low at 151.97 per dollar on Wednesday last week. Japan’s finance minister issued his strongest warning to date – saying authorities could take “decisive steps”, language previously used before intervention.

Profits at China’s industrial firms jumped 10.2% in the first two months from a year earlier, National Bureau of Statistics (NBS) data showed. The surge comes on the heels of upbeat indicators earlier this month that suggest a stabilisation in Asia’s largest economy. But overall gains remain tempered by the persistent fragility in China’s property market, pointing to a divergence in the country’s post-pandemic recovery.

China official manufacturing PMI surprises to the upside, expands for first time in six months to 50.8; non-manufacturing PMI moved to 53, highest since September. Millions of tourists are also returning to Macau. The IMF forecasts that Macau’s economy will grow 13.9 per cent in real terms this year, following growth of 80.5 per cent last year, making it one of the world’s fastest-growing economies.

Taiwan central bank unexpectedly raised its benchmark interest rate to the highest since 2008, as it ramped up efforts to tackle stubborn inflation and officials warned there could be structural shift in prices.

Singapore’s manufacturing output rose more than expected as country’s uneven economic recovery continued. February CPI came in higher by +3.4% y/y vs +2.9% in prior month.

South Korea’s consumer sentiment dropped sharply in March on growing worries about higher produce prices, a central bank survey showed. Inflation expectations among consumers for the next 12 months rose for the first time in five months, to 3.2% from 3.0%, according to the survey, with two-thirds of the respondents saying produce prices would drive inflation. That was up from 51.5% in the previous month responding to the same question.

Thailand’s economy was strong in Feb 2024, led by consumption (+2.1% yoy, +0.1% mom), merchandise exports (+2.5% yoy), and tourist arrivals (3.4m). Exports rose in February although at a slower pace than in January. Current account surplus came in at US$2bn, beating expectations.

GeoPolitics

US & UK – China: US and UK accused state-backed Chinese hackers of orchestrating cyberespionage campaign targeting politicians and companies and theft of UK voter data. China dismissed allegations as unwarranted while its embassy in London called the charges “completely fabricated and malicious slanders”. Both US and UK imposed sanctions on a firm they said was linked to Ministry of State Security and two individuals.

US – China: China filed dispute with WTO over US EV subsidies, arguing elements of Inflation Reduction Act discriminatory and seriously distorted global EV supply chain. USTR Tai acknowledged China’s complaint, though also accused Beijing of engaging in unfair, non-market policies that aid its domestic manufacturers. China-made EVs have become increasingly contentious amid accusations Beijing flooding export markets and threatening domestic manufacturers.

It was reported that the Biden administration is considering blacklisting a number of Chinese semiconductor firms linked to Huawei. After which, Beijing is releasing new guidelines phasing out the use of semiconductors from US companies AMD and Intel from government PCs and servers. The new rules also seek to sideline Microsoft’s operating system in favour of domestic software as Beijing pushes towards autonomy from Western tech. Big US companies are also asking Taiwanese manufacturing partners to ramp up production of AI-related hardware in Mexico to dampen reliance on China.

US – Japan: US President Joe Biden and Japanese Prime Minister Fumio Kishida will announce the biggest upgrade in their security alliance since 1960. Per the FT reports, the deal will restructure the US military command in Japan to give it more operational authority to coordinate with local counterparts. The defence boost is expected to be announced during Kishida’s April US visit.

US – Russia – India: More than 250,000 barrels per day of U.S. crude is set to arrive in India next month, the highest in more than a year. India, the world’s third-biggest oil importer and consumer, is looking to diversify its oil supplies as fresh U.S. sanctions on Moscow threaten to dent Russian oil sales to India, the biggest buyer of Russian seaborne crude. Last month, the U.S. tightened efforts to reduce Russia’s oil trade adding sanctions on state-owned shipping firm Sovcomflot and 14 crude oil tankers involved in Russian oil transportation. India’s Reliance, operator of the world’s biggest refining complex, will not buy Russian oil loaded on tankers operated by Sovcomflot after recent U.S. sanctions, sources told Reuters last week.

Credit/Treasuries

Wednesday yields on Treasuries climbed across tenors following Fed Governor Christopher Waller’s remarks that there is no rush to lower interest rates, and he wants to see “at least a couple months of better inflation data” before cutting. Two-year Treasury yields, which are more sensitive to policy moves, rose four basis points following Waller’s remarks. The dollar strengthened against its Group-of-10 peers. “Some economists believe that the current market easing expectations for the Fed still need to adjust which might support further dollar appreciation.”

The US Treasury curve was mostly unchanged during last week, 2 & 5years yields were up 2bps, 10years was up 1bps and 30years was down by 1bps. IG credit spread tightened by 1bp but HY credit spreads widened by 7bps.

In term of performance, US IG gained 0.50%, US HY gained 15bps and leverage loans were unchanged. The S&P500 managed to gain 0.60% over this shortened week.

FX

EURUSD slides from key resistance levels near 1.10. Markets are now pricing in 68.5% chance of the Fed cutting rates in June versus 57% chance at the end of last week.

USDJPY continues to consolidate under 152 amid the threat of intervention which may offer buying opportunities. Investors will be watching to see if support at March low of 146.49 holds on any selloff . Weekly resistance: 151.97, March 27 high. Weekly support: 146.49, March 8/11 lows.

GBP whipsaws back to the lower end of the Dec-Mar range.

AUDUSD couldn’t muster bullish follow through and saw two failed attempts to follow other cyclical rallies. The RBA dropped its hiking bias which weighed on AUD, but stronger labour market presents an opportunity to fade dovish pricing.

INR India’s foreign exchange reserves rose for the fifth straight week to hit a fresh all-time high of $642.631 billion in the week ending on March 22, as per the latest data released by the Reserve Bank of India (RBI). The reserves jumped by $139 million in the reporting week. Gold reserves during the week rose from $347 million to $51.487 billion.

Oil & Commodities

Both benchmarks finished higher for a 3rd consecutive month, with Brent holding above $85 a barrel since mid-March as the OPEC and their allies pledging to extend production cuts to the end of June which could tighten crude supply during summer in the northern hemisphere.

Brent Oil fell 0.2% to $86.83 after rising 2.4% last week. WTI was down 0.1% to $83.06 per barrel.

Gold extended a rally that’s been driven by the Federal Reserve moving closer to rate cuts and deepening geopolitical tensions. Gold prices hit a record high on Thursday and logged their best month in over 3 years, propelled by US interest rate cut expectation and strong safe-haven demand. Gold managed to gain about 2.85% last week and is up another 1.20% this morning.

Iron ore fell to the lowest in 10 months as China’s years-long property crisis continued to pressure prices.

Bitcoin was steady after trading above $71,000. The largest digital currency has jumped almost 70% this year amid persistent demand for US exchange-traded funds holding the token.

Economic News This Week

-

Monday – SK Exports/Imports/Trade Bal, US ISM Mfg

-

Tuesday – Germany CPI Final Prelim, US JOLTS, US Factory Orders, SK CPI, ECB 1Y/3Y CPI expectations

-

Wednesday – EU HICP flash, EU unemploy. Rate, US ADP Employ, US ISM Servc, US Mort App

-

Thursday – EU/Germany/France/Italy/Spain Services/Comp PMI, EU PPI, UK services/comp PMI, US Initial Jobless Claims

-

Friday – France Indust. Prod, Germany Mfg Orders, US unemploy. Rate, US AHE, India repo rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.