KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

Tech stocks suffered its biggest weekly loss in almost 18 months, due to tensions in the Middle East and the continued uncertainty surrounding when the Fed may cut rates. The S&P 500 fell for the 6th straight session and 3rd straight week leaving it more than 5% below its all time high of March 28th. Eight of the 11 S&P 500 sectors declined. The information technology (-7.3%), consumer discretionary (-4.5%), and communication services (-3.2%) sectors logged some of the largest declines, clipped by weakness in their mega cap constituents. Israel launched a retaliatory strike on Iran following last week’s missile and drone barrage from Tehran, according to two US officials, though media from both countries appeared to downplay the significance of the incident. Futures prior to Friday’s open pointed to a bounce following easing concerns of a retaliatory act by Iran, failed to lift markets during the day’s session.

This coming week will be critical with the release of the PCE Deflator to further indicate if the disinflation process has stalled. Various comments from Fed officials contributed to the negative sentiment by fuelling speculation that the start of its rate cuts could be pushed back. The consensus as fickle as it is, is for the first rate cuts to begin in September, months later than the June meeting that were once talked about by Fed watchers. There are also some floating the idea there may not be any rate cuts until 2025 as the economy remains resilient and the path to 2% could be bumpy. The 2-yr note yield settled 10 basis points higher at 4.98% and the 10-yr note yield settled 12 basis points higher at 4.62%.

US weekly jobless claims released Thursday showed that the labor market remains resilient and the Philly Fed Manufacturing Index rose to 15.5 from last month’s 3.2%. Retail sales earlier were stronger than expected fortified by a strong job market, consumers continued to spend freely in March in an act that will continue to support a soft landing or no landing outlook for the U.S. economy suggesting the Fed may be right in not rushing to lower rates. In fact, on Tuesday the IMF gave the US its biggest upside revision, going from 2.1% per their January’s forecast to 2.7% now. Citi’s strategists are calling to buy the equity dip if oil doesn’t spike. Key data to watch this week – GDP Annualised data QoQ, Personal consumption, income & spending data and Friday’s PCE Deflator. Bloomberg expects a MoM Core release of 0.3% (unchanged from Feb) and 2.6% YoY from Feb’s 2.8%.

The US House passed $61 billion in fresh aid for Ukraine on Saturday, ending a six-month political impasse.The Ukraine aid will be combined with funding for Israel and Taiwan, for a foreign assistance package totaling $95 billion. Treasury really has its work cut out for them …. The Bitcoin network on Friday evening completed its fourth “halving,” reducing the rewards earned by miners to 3.125 bitcoins from 6.25. Mechanically, the halving itself shouldn’t affect the price of bitcoin in the short term, but many investors are expecting big gains in the months ahead, based on the cryptocurrency’s performance after previous halvings. After the 2012, 2016 and 2020 halvings, the bitcoin price ran up about 93x, 30x and 8x, respectively, from its halving day price to its cycle top. BTC trades around $65k whilst Ether is at $3150.

Europe

European stock markets closed lower on Friday, rounding off a week in which escalating tensions in the Middle East and repricing of interest rate expectations have been in focus. The regional Stoxx 600 index provisionally ended 0.1% lower. After a strong start to 2024, the index is heading for its first monthly loss since October.

Last week started on a bright activity note in the Euro Area, with February EA industrial production ex construction growing at 0.8% m/m. This rebound was fueled by heightened output of durable, investment, and intermediate goods, though there were decreases in non-durable and consumer goods. Sectors reliant on energy saw robust growth, increasing by 2.6% month-on-month, marking the most significant monthly increase since the COVID recovery began in the summer of 2020. Overall, hard data are now slowly moving in line with soft data which recently indicated improvements in the manufacturing outlook.

Euro Area final March HICP release was unrevised from the flash reading, at 2.4% y/y with core at 2.9% y/y. While services inflation remained robust, this was influenced by a few volatile components impacted by the early Easter holiday. Barclays approximated that the early Easter contributed roughly 0.2 percentage points to services inflation. Likewise, core goods inflation continued to ease, dropping further to 1.1% year-on-year from 1.6% year-on-year. Overall, with services inflation back on track and core goods coming in very soft, this print increased the confidence in further core disinflation.

Chief Economist Lane delivered an update last week on the euro area’s disinflationary trend. The key insight from his briefing is that forward-looking wage indicators suggest that the ongoing slowdown in wage growth is intensifying, bolstering confidence in the disinflation trajectory. Additionally, more hawkish members are closely monitoring the possibility of cuts. This week, on the data side, we will get several early indicators for economic activity in the Euro Area throughout the week. The focus will be on Tuesday’s prelim April PMIs, EC EA April Prelim consumer confidence.

Over in the UK, regular private sector wage growth was stronger than expected in February but broadly in line with BOE’s most recent forecast. However, the larger than expected rise in the unemployment rate points to building slack in the labour market.

UK’s March headline CPI printed at 3.2% y/y and core at 4.2% y/y continued to ease but printed above forecast, owing to stronger momentum in the services sector. Retail sales stalled in March printing slightly above consensus forecast. While this week’s inflation and wage data have overall surprised us to the upside, we remain of the view that the activity and price data released since the last MPC meeting have been broadly in line with the February MPR. This week, the April flash PMI surveys will be the main data release next week. The April flash print will provide preliminary insights as per the strength of the of activity at the beginning of the second quarter in the UK.

Asia

Markets in Asia ended generally lower last week with Vietnam and Nikkei leading losses, down 7.97% and 6.2% respectively. CSI 300 beat the overall trend to close up 1.89% last week. The latest developments on the geopolitical front, prompted the risk off concerns. Specifically, the potential widening of the Israel-Hamas war in Gaza to include other countries in the Middle East. The sell off in chip related stocks specifically signalled investors might be rotating out of this sector in tech related stocks.

China reported Q1 GDP that grew 5.3% in January-March from the year earlier. On a quarter-by-quarter basis, GDP grew 1.6% in the first quarter, above the forecast for growth of 1.4%. China data appears to be strong on the headline, but the details are weak. A slew of China’s economic data points showed that the nation’s economic rebound remains uneven. While both gross domestic product and fixed assets investment beat forecasts, data on retail sales and industrial output fell short of estimates. March data on exports, consumer inflation, producer prices and bank lending showed that momentum could falter again and reinforced calls for more stimulus to shore up growth.

India began voting on Friday in the world’s largest election as Prime Minister Narendra Modi seeks a historic third term in office on the back of growth, welfare, his personal popularity and Hindu nationalism. Elections are being held in India from 19 April to 1 June 2024.

Japan’s exports grew 7.3% year-on-year in March, up for the fourth straight month, according to the Ministry of Finance. The reading compared with an 8.0 % gain recorded in the previous month. Imports fell 4.9 per cent in the year to March, versus a decline of 4.7 per cent expected and a 0.5% gain in February. Japan CPI missed, up 2.7%yoy in March and core-core inflation rose 2.9%.

Indonesian equities resumed trading last Monday after being closed for a full week of Eid Mubarak celebration. More than 1.1 million travellers during this festive period. Bank Indonesia stepped in to support the rupiah after the currency weakened past 16,000 per dollar for the first time in four years. The rupiah’s decline adds pressure on Bank Indonesia to maintain stability in the currency amid persistent dollar strength and foreign capital outflows. The nation’s foreign- currency reserves fell $3.6 billion last month as the authorities intervened in the currency and bond markets. Rupiah stability is a priority in BI policy.

The State Bank of Vietnam (SBV), the central bank, will be flexible in its handling of the exchange rate. “We are ready to intervene if the exchange rate has a negative impact, even from today” said officials, adding the country had sufficient foreign exchange reserves. The Dong weakened past 25,000 per U.S. dollar earlier this month and is trading at record lows.

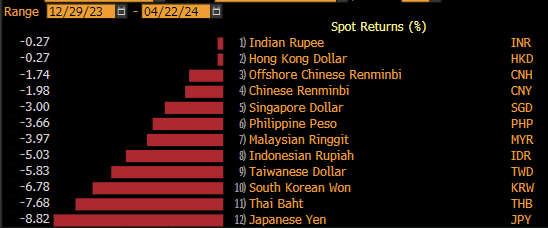

Other Asian currencies, like the Indian rupee plummeted to a record low against the dollar at 83.739 on Wednesday last week. Taiwan’s currency dropped to the lowest level in almost eight years this week. Malaysia issued verbal intervention last Monday, the MYR is trading at 26-year low. Seoul is “thoroughly” monitoring developments in the FX market with scenario-based response plans in place.

GeoPolitics

Israel – Iran : Iran’s historic attack on Israel over last weekend was “performative”. It was calibrated to send a message rather than cause damage. Netanyahu pushes back against Western calls for restraint, says Israel will do “everything necessary” to defend itself. Iran’s foreign minister on Friday said Tehran was investigating an overnight attack on Iran, adding that so far a link to Israel had not been proven as he downplayed the strike. Iranian media and officials described a small number of explosions, which they said resulted from air defenses hitting three drones over Isfahan in central Iran in the early hours of Friday. Israel has said nothing about the incident.

US – Iran : Biden administration announced a series of sweeping sanctions Thursday targeting leaders and entities tied to Iran’s Islamic Revolutionary Guard Corps, Tehran’s defense ministry and its missile and drone program following last weekend’s missile and drone attack against Israel. The Treasury Department also sanctioned five companies that provide or purchase steel production materials to Iran’s Khuzestan Steel Company, a US-designated entity.

US- Foreign Aid : The US House approved $95 billion in aid for Ukraine, Israel and Taiwan, ending months of political impasse. The Senate is expected to vote on the combined package Tuesday, which could then head to Joe Biden’s desk for signing later in the week. Volodymyr Zelenskiy said the support will give Ukraine the means “to retake the initiative.”

US- Africa: Thousands of people in Niger’s capital on Saturday protested for the immediate departure of US soldiers from the north, after the military junta in Niamey said it was withdrawing from a military agreement with Washington.

US- China : Trade tensions between Washington and Beijing ratcheted higher overnight on several fronts. Reuters reported Washington plans to reverse a two-year tariff exemption that allows the import of dominant solar panel technology from China and other countries, although no timetable has been put in place for the change. Bloomberg reported Beijing has criticized a White House move to launch a review of its maritime, logistics and shipbuilding sector, saying the probe was “full of false accusations”. President Biden also accused China of “cheating” and called for a tripling of steel and aluminium tariffs against Chinese imports, adding China’s steel companies need not worry about profit because they were so heavily subsidized.

FX

DXY USD Index rose 0.11% to 106.154 driven by upside surprise on US Retail Sales and Chair Powell speech. US Headline Retail Sales rose by 0.7% m/m in March (C: 0.4%; P: 0.9%), with an upward revision to prior two months. Chair Powell accentuated that recent data has not provided the confidence to ease policy and instead indicated that rate cut has been pushed back. Resistance level at 106/107. Support level 105.70/105.

EURUSD rose 0.12% to 1.0643. ECB President Lagarde reiterated that ECB is heading towards a moment where they have to moderate. EU CPI came in in-line with y/y at 2.4% and m/m at 0.8%. Resistance level 1.075. Support level 1.06/1.05.

GBPUSD fell 0.66% to 1.237, breaking the support level of 1.24, despite UK inflation beating consensus in March but lower than previous month. UK March Retail Sales surprised to the downside across the board. BoE Governor Bailey suggested the UK is disinflating at full employment, expecting a drop in the labour part of services inflation and inflation forecasting errors have diminished. Resistance level 1.24/1.245. Support level 1.23/1.225.

USDJPY rose 0.92% to 154.64 driven by USD strength. Japan Nationwide CPI (ex-fresh food) eased to 2.6% y/y in March (C: 2.7%; P: 2.8%), although this marked the 24th consecutive month above the 2% price stability target. The finance ministers of Japan, South Korea, and the U.S. hosted trilateral talks over the recent sharp depreciation of both the Yen and Won. The MoF has seemingly made it difficult to justify intervention, given the recent rise in USD/JPY has been driven by a change in US fundamentals, in response to strong US economic data. Resistance level at 155/155.50. Support level at 154/153.70.

Oil & Commodities

WTI crude oil future fell last week, with WTI (-2.94%) and Brent (-3.49%) ending the week at 83.14 and 87.29, after Iran playing down reported Israeli attacks, signalling no retaliation. Iran’s foreign minister said the drones, which the sources said Israel launched against the city of Isfahan, were “mini-drones” and that they had caused no damage or casualties. US Crude Oil Inventory rose to the highest since June 16, 2023, adding to limited upside on oil prices from demand side.

Gold rose 2.03% to 2391.93, supported by Middle East tension and despite the rise in US treasury yields. However, Gold price has been trading downward this morning, trading at 2376 at the point of writing, as Iran downplayed reported Israeli strikes. Resistance level 2410/2440. Support level 2340/2300.

Economic News This Week

M – CH LPR, US Chicago Fed Nat Act., EU Cons. Confid.

T – AU/JP/EU/UK/US Mfg/Svc/Comps PMI Prelim Apr, US New Home Sales/Richmond Fed Mfg

W – NZ Trade Balance, AU CPI, SW Unemploy. Rate, US MBA Mortg. App./Durable Goods Orders, CA Retail Sales

Th – US GDP/Personal Cons./GDP/Core PCE/Wholesale Inv/Pending Home Sales

F – NZ Cons. Confid., JP Tokyp CPI/BoJ Rate Decision, AU PPI, EU ECB CPI Exp./M3 Money Supply, US Personal Income/Spending/PCE Deflator/Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.