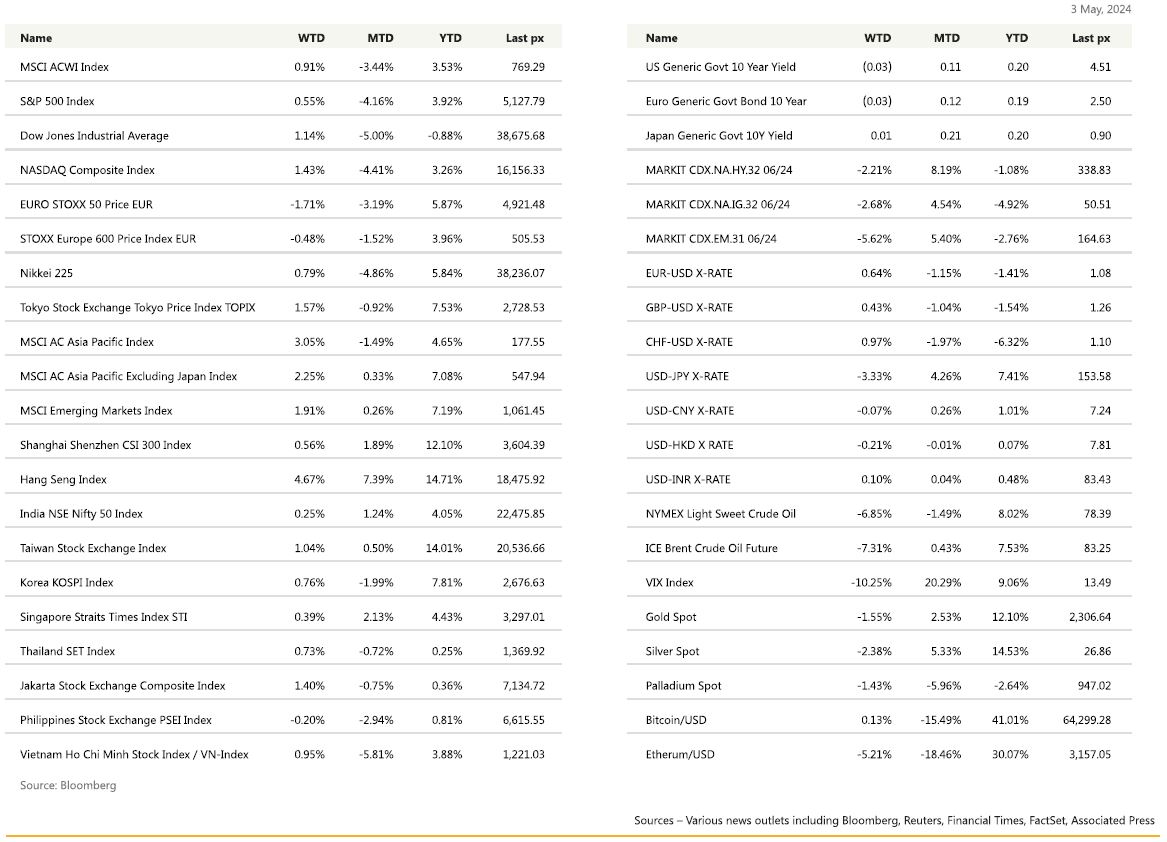

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

Friday sealed the fortunes for the week as US markets ended up for a second straight week of gains. April’s jobs data showed some cooling boosting confidence that the Fed will be able to start cutting rates, this year. Nonfarm payrolls advanced 175,000 last month below expectations of +240k, the smallest gain in six months, a Bureau of Labor Statistics report showed Friday. The unemployment rate ticked up to 3.9% and wage gains slowed. Powell, who spoke Wednesday after the central bank held interest rates steady for a sixth straight meeting, noted that wage growth probably needs to “move down incrementally” for policymakers to meet their inflation objective. Friday’s report showed some movement in that direction. Average hourly earnings climbed 0.2% from March and 3.9% from a year ago, the slowest pace since June 2021. Treasury yields and the dollar fell, with the UST10’s closing at 4.5077% and the 2’s retreating to 4.8160%. Investors returned chances of a rate cut in September to above 50%. The Fed also said it would start slowing the pace of unwinding its balance sheet in June. Overall, a slightly less hawkish tilt was what we got from his presser. Fed-speak after the number included Chicago President Austan Goolsbee saying that more employment prints like Friday’s would give him comfort the economy is not overheating, while Governor Michelle Bowman separately expressed concerns about sticky inflation but said sustained elevated rates should cool price pressures down the line. The FOMC meeting earlier in the week unanimously voted for no-change with Powell calming some nerves when he said that it was unlikely for the Committee to raise rates next although he did signal fresh concerns about inflation which is likely for the Fed to keep borrowing costs elevated for longer. Irrespective of any cuts this year, sentiment turned positive on the basis that inflation does not heat up and the economy holds up reasonably well. Earlier in the week we saw the JOLTS job openings lower than expected together with a fall in ISM Manufacturing. The more volatile weekly claim both came in lower than expected.

Companies making waves for the week were Apple which rallied following its results which were better than feared and Tesla which reversed its selloff following reports the firm has cleared an important regulatory hurdle in China by partnering with search giant Baidu. The deal with Baidu brings Musk a step closer to rolling out Tesla’s self-driving technology in China.

This week will see a much less impactful release of data in the form of University of Mich. Sentiment and Inflation expectations. Cryptos staged somewhat of a rally following the less hawkish statement from the Fed, to trade at BTC $64k and ETH at $3150.

So far to date, we have only witnessed a one decent correction of approx. 5% last month. The up-trend remains intact and we view any pullbacks, given the steady earnings growth reported thus far, as opportune to add. Sectors we prefer remain in commodities – copper & gold in particular, and financials and of course AI.

Europe

European stock markets closed higher on Friday, rounding off a broadly negative week dominated by corporate earnings. The Stoxx 600 index was up 0.44% by the close, holding gains following a weaker rise in U.S. payrolls than markets were expecting.

Last week, EA preliminary Q1 real GDP surprised to the upside, showing an increase of 0.3% qoq, rebounding from a previously revised -0.1% q/q. Strength was broad-based geographically, but domestic demand remains weak in Italy and Germany. The EC business and consumer surveys exhibited weakness in April, with economic sentiment down to 95.6(-0.6pt), still well below the long-term average of 100, and employment expectations declining 0.7pt, to 101.8. Meanwhile, the final April EA consumer confidence was unrevised at -14.7, up -0.2pt from March, also remaining well below its long-term average. EA April flash HICP remained unchanged at 2.4% y/ y, but core inflation decelerated 0.2pp, to 2.7% y/y, driven by services and core down to 2.7% y/y, 28bp lower than in March. Core inflation momentum also eased further, helped by the deceleration in services. ECB’s Lane cautioned against precommitting to an easing path, as decisions will have to be taken meeting-by-meeting, including during non-projection meetings.

This week, the ECB releases its account of their April Monetary Policy on Friday. There are also many activity data releases, including final April services and composite PMIs on Monday, as well as country March industrial production data on Wednesday and Friday.

Over in the UK, the April final PMIs broadly came in line with the flash release with the composite adjusted to 54.1 from 54.0, reflecting marginal upward revisions to the services and manufacturing headline indices. Overall, while the picture of a two-speed recovery across sectors prevails, the composite index remains at resilient levels, suggesting a strong start to the second quarter. On inflation, the BRC Shop Price Index eased further in April (0.8% y/y, down from 1.3% y/y in March), its lowest level since January 2022. Looking into the details, the food and clothing/footwear categories continued to soften, printing at 3.4% down from 3.7% y/y. The BRC data provide corroborative evidence that both headline and core inflation are likely to continue to decline further.

This week, we think the MPC will keep the rates unchanged at 5.25%. The data since March probably haven’t been sufficient for most members to vote for a cut at the May meeting. For now, expectations of the first cut to be in June, but data could also push it later.

Asia

CSI 300 was up 0.56% taking YTD gains to + 12.10%. Hang Seng was up 4.67% last week, taking its YTD gains to +14.71%. Both markets lead the gains in Asia for the year alongside Taiwan which is up 14% for the year.

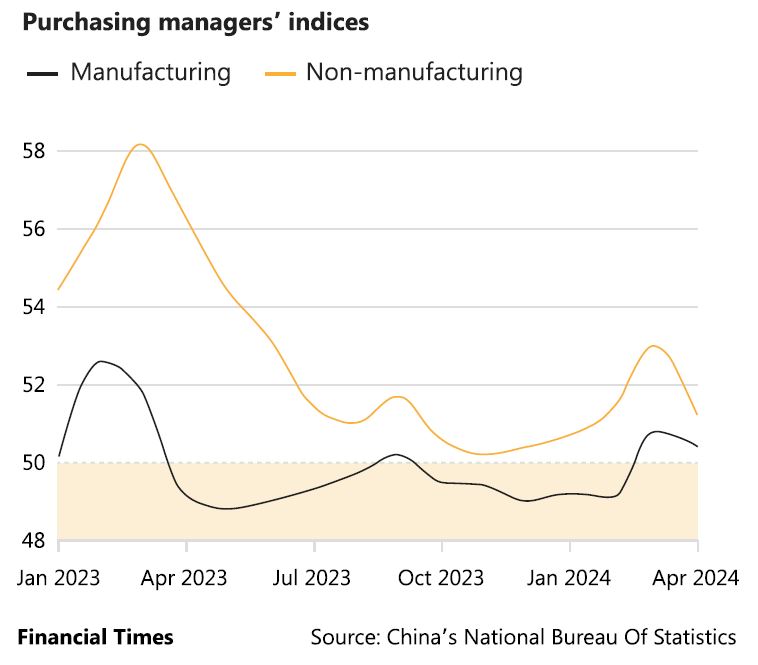

China Politburo meeting mitigated concerns around policy risk. China’s leaders have pledged more support, saying it “still faces many challenges” even as high-tech manufacturing helped factory activity expand for a second consecutive month in April.

The bull case for Chinese equities looks more compelling than for a long time. And this is starting to draw investors back, despite the scars of last year’s failed reopening trade. The Chinese economy registered strong growth in 1Q24 at 7.4% q/q, led by strong Industrial Production numbers, with notable export growth, and solid manufacturing investment amid policy support for high-tech, IT and green economy.

The Japanese government appears to have deployed roughly $35bn supporting the yen last Monday according to money market data released by the Bank of Japan. Japanese authorities had stepped into the markets on Monday shortly after the yen hit a 34-year low of just under ¥160 against the US dollar. The yen is trading at 153.58 this morning with the USD depreciating 3.3% against the yen last week.

Indonesia’s central bank is “ready for the worst” and will provide more support for the rupiah if needed, the head of its monetary management department has said. Bank Indonesia raised rates unexpectedly late last month and warned of worsening global risks, saying the rate increase was a pre-emptive move to ensure inflation remained within its target. Countries around the world are trying to protect their currencies from a strengthening dollar amid growing expectations the Fed will delay cutting interest rates while inflation stays stubbornly above its 2 per cent target.

South Korea has announced a crackdown on “shrinkflation”. The Korea Fair Trade Commission said on Friday it was designating the practice of slimming down products while keeping their prices unchanged and not informing consumers as an “unfair transaction”. The move comes amid international anger at the practice of shrinking products to pass on the cost of inflation to consumers. US President Joe Biden in March criticised companies for downsizing products, while French finance minister Bruno Le Maire has called shrinkflation a “scam” and announced that supermarkets would have to label products where volumes had been reduced.

Some data out of Asia last week: Thailand inflation rises more than expected in April. Headline inflation rose 0.2% in April, higher than expectations. Bloomberg consensus: -0.2%. Malaysia’s trade balance continues narrowing in March. Indonesia’s April headline CPI came in a touch below expectations, up 3.0% yoy and up 0.1% mom basis. Core inflation came in at 1.8% yoy – inline with expectations.

GeoPolitics

US – Saudi Arabia: Both countries are nearing a security deal that would lay path for diplomatic ties with Israel. The White House had stated it will not sign defense agreement with Saudi Arabia if kingdom and Israel don’t agree to normalize relations.

Israel – Hamas: Ceasefire talks falter. This morning, Israel shut the Kerem Shalom crossing to humanitarian aid after rockets were fired from Rafah, according to IDF. Several people were injured and sent to the hospital after approximately 10 “projectile launches” crossed from an area adjacent to the Rafah crossing toward Kerem Shalom on Sunday.

Israel – Turkey: Turkey has suspended all trade with Israel over its offensive in Gaza, citing the “worsening humanitarian tragedy” in the strip. The Turkish trade ministry said the measures would be in place until Israel allowed an “uninterrupted and sufficient flow” of aid into Gaza. Trade between the two countries was worth almost $7bn (£5.6bn) last year.

Israel – Columbia: Colombia breaks diplomatic ties with Israel.

Israel – Al Jazeera: Israel has ordered the closure of Al Jazeera in the country, a move the Qatar-based news network called a “criminal act.” According to a government spokesperson for Israel, the network’s “broadcast equipment will be confiscated, the channel’s correspondents will be prevented from working, the channel will be removed from cable and satellite television companies, and Al Jazeera’s websites will be blocked on the Internet.

CREDIT/TREASURIES

US Treasuries had sold off by a couple of basis points following the latest borrowing estimates from the US Treasury. These saw the expected Q2 issuance rise from $202bn to $243bn, “largely due to lower cash receipts”. This was slightly puzzling given what have been strong tax receipts in the recent April tax period. Still, while the Q2 estimate was revised slightly higher, the Q3 number (excluding TGA movement) was in line with expectations, so rates strategists don’t see meaningful alteration to the fiscal outlook.

The US Treasury curve flatten over the week with the 2years & 5years yield down by 17bps, 10years lost 14bps & 30years lost 10bps. IG Credit spreads were 1bps tighter over the week and HY credit spreads tightened by 7bps. Most if not all the move lower in term of yield and credit spreads happened last Friday after the employment data.

US IG gained 1.20% over the week while US HY gained about 0.80%. Leverage loans gained 0.10%.

FX

DXY USD Index fell 0.86% to 105.03, driven by the below consensus US Non-Farm Payroll and average hourly earnings. Unemployment rate came in at 3.9%, above consensus. This drive the market to price in a full rate cut in November and 45 basis point cut for 2024, compared to 34 basis point cut a week ago. On other US data, US Conference Board Consumer Confidence Index fell to 97.0 in April (C: 104.0; P: 103.1). ISM services index fell to 49.4 (C: 52.0; P: 51.4). ISM manufacturing PMI fell to 49.2 (C: 50.0; P: 50.3). FOMC remained on hold at 5.25-5.50% and announced June start to QT taper. Chair Powell noted a lack of further progress toward the inflation goal but retains reference to eventual rate cuts. Immediate support at 104.60/104, while immediate resistance level at 105.60/106.

EURUSD rose 0.64% to 1.076, driven by USD weakness. Data wise, EU preliminary April Headline HICP remained at 2.4% (C: 2.4%) and Core HICP fell to 2.7% (C: 2.6%; P: 2.9%), with lower services inflation, preliminary 1Q24 GDP grew by 0.3% q/q (C: 0.1%; P: -0.1%). EURCHF fell 0.40% to 0.974, as CHF strengthens due to an upside surprise in inflation. Swiss Headline CPI rose 1.4% y/y in April (C: 1.1%; P: 1.0%).

GBPUSD rose 0.43% to 1.2547 (200 days MA), driven by USD weakness. UK data was light last week, but we have the BoE rate decision this coming Thursday and BoE is expected to keep rates on hold. Immediate support level at 1.25/1.246, while resistance level at 1.26 (50 days MA) and 1.264 (100 days MA).

USDJPY fell 3.33% to 153.05, as Japan BoJ/MoF intervened in the market last week. Volatility on USDJPY was at extreme level, with a high of 160.17 and a low of 151.86. The intervention occurred 3 times last Monday (Japan public holiday) and 1 time last Thursday (NY afternoon time after FOMC), all with thin liquidity. Total size of intervention package is estimated at around USD 60 billion last week. The intervention has been largely a success given that USDJPY closed below 155. Resistance level at 155/160, while support level at 152/150.

Oil & Commodities

Oil future fell last week, with WTI and Brent falling 6.85% and 7.31% to close the week at 78.11 and 82.96 respectively. Based on EIA oil inventory report, US crude stockpiles continue to sit at the highest levels since June and in the absence of further escalation in the middle east, is driving oil prices downside. Both WTI and Brent broke their 200 days MA last week, and are now testing next level, which is the 100 days MA.

Gold fell 1.55% to 2301.74 despite USD weakness and fall in US treasury yields (2 yrs -17.7 bps/ 10 yrs -15.5 bps/ 30 yrs -11 bps), suggesting that current price movement is driven more by the absence of further escalation on geopolitical tension. Immediate support level at 2280, while resistance level at 2340.

Economic News This Week

-

Monday – AU Melbourne Inflation, NZ ANZ Commodity Price, CH Svc/Comps PMI April, EU Svc/Comps PMI April Final/ Sentix Inv. Confid./ PPI, US SLOO

-

Tuesday – JP Svc/Comps PMI April Final, AU RBA Rate Decision, SZ Unemploy. Rate, UK Cons. PMI, EU Retail Sales

-

Wednesday – Norway Indust. Pdtn, US Mortg. App./ Wholesale Inv.

-

Thursday – CH Trade Balance, UK BOE Rate Decision, US Initial Jobless Claims

-

Friday – NZ Biz Mfg PMI, JP BoP, UK GDP/ Indust. Pdtn/ Mfg Pdtn/ Trade Balance, Norway CPI, CA Unemploy. Rate, US Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.