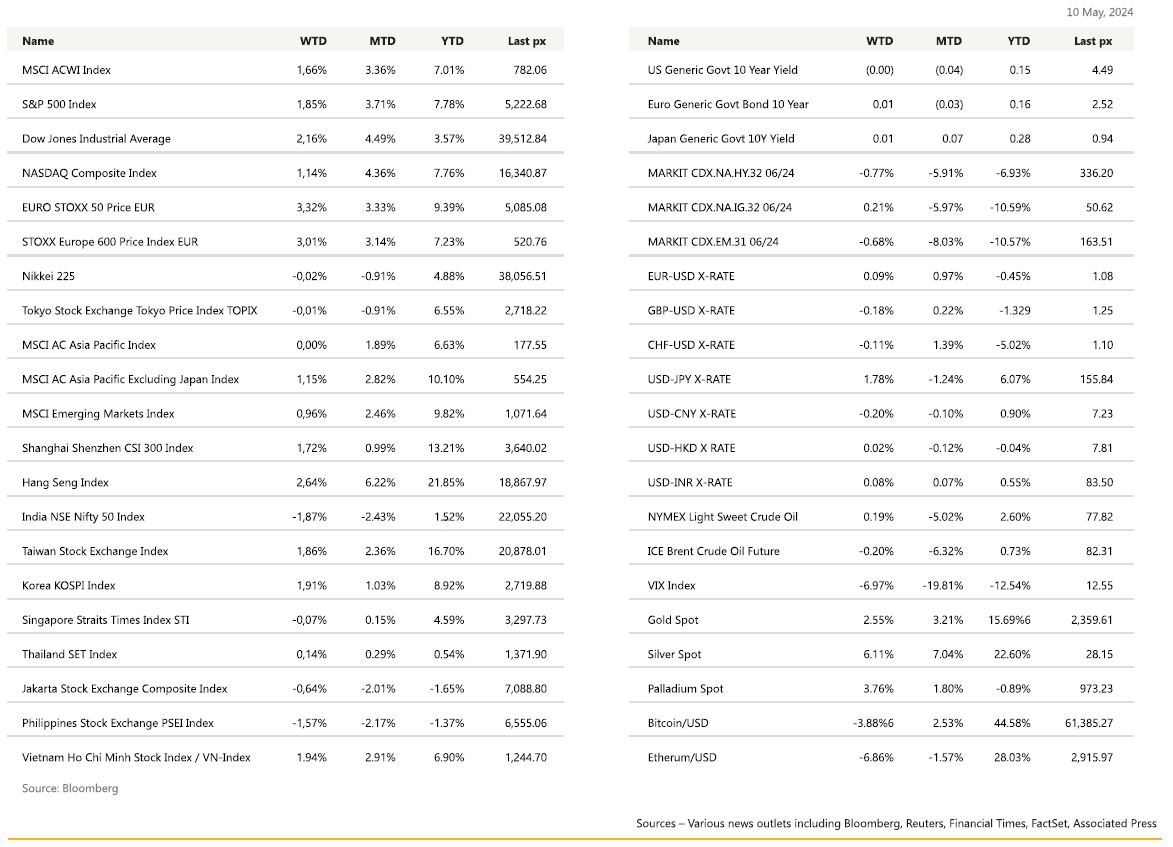

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

Stocks closed 3 up weeks in a row for the S&P 500, the Nasdaq, the small-cap Russell 2000 as well as the mid-cap S&P 400. The Dow made it up 4 straight weeks in a row. That is some performance to put in, given weakening consumer sentiment and hawkish comments from Fed Reserve officials. Q1 earnings have delivered more beats than misses keeping the riskon sentiment on a positive tone. The U. of Mich. US consumer sentiment declined to 67.4 a six-month low amid concerns about inflation and the job market. 1 Yr inflation expectations came in at a higher than expected 3.5% and the 5-10 Yr expectation crept up to 3.1% from 3.0%.

Initial applications for US unemployment benefits on Thursday, rose last week to the highest since August. SF Fed’s Mary Daly said the central bank would consider adjusting interest rates if the labor market falters which added to the market’s rally. However, Chicago Fed President Austan Goolsbee later, said there isn’t much evidence that inflation is stalling. Minneapolis Fed President Neel Kashkari said on Tuesday that the central bank will keep interest rates where they are for an extended period until officials are certain inflation is on track with their target. Higher for longer remains the Fed’s tagline but given growing expectations across the pond in Europe and the UK of a June rate cut, this narrative could soon also be in-check. Otherwise, data wise it was a relatively quiet week. The “big fireworks” from economic data are expected this week, when April’s inflation report is due where Bloomberg is expecting a core MoM reading of 0.3% (from 0.4%) and a YoY headline of 3.4% (from 3.5%). Core YoY is expected at 3.6% (from 3.8%). PPI will be released a day earlier on Tuesday with an expected PPI Final Demand MoM of 0.3% (from 0.2%). Retail sales to show the consumers’ resilience to higher rates for longer will top of the week’s highlights, expected to cool off to 0.4% from 0.7% in March.

Cryptos were range-bound for the week with BTC trading in a range of $60500 – $63880.

Utilities whilst categorised as defensive, is having its day in the sun. With AI expected to continue its stellar run and energy demand to soar, we think power companies are sitting now. We like American Electric Power and Duke Energy to articulate this view with dividends from AEP at 3.84% and DUK at 3.99%.

Europe

European markets closed higher on Friday as positive momentum continued into the end of week. The Stoxx 600 index was up by 0.8% by the close. Mining stocks and utilities led gains and were up 1.3% and 1.5% respectively.

After the strong Q1 GDP prints in the previous week, last week’s March industrial production declined in all the big 4 economies within Europe, with Germany and Spain losing some progress made in the past 2 months.

On the bright side, EA March retail sales rebounded +0.8% m/m from a -0.3% m/m contraction in February. The final EA April PMIs were revised higher, with the composite PMI now at 51.7, up 1.4pt from March.

This week, focus will be on final April HICP, second print of EA Q1 GDP and Q1 French unemployment.

Over in the UK, the BoE kept the bank rate unchanged with the MPC voted for 7-2 to hold the rate at 5.25%. Although there were surprises to the most recent services inflation and wage growth numbers the BoE said these were within the typical volatility of these numbers. Broadly, the MPC said there were no surprises since the last meeting and there are indications that the UK is returning to more normal times for inflation surprises. The BoE updated its rate guidance, further signaling that it is open to start dialing back policy restrictiveness should future data outturns be in line with the MPC’s expectations.

Based on market interest rates in Q1 2027 the Bank lowered its forecast to 1.5% from 1.9% 3 months ago. The fact that end-ofhorizon inflation is below target suggests that the BoE thinks market pricing is too high.

In Q1, the UK left behind its H2 23 recession as GDP growth rebounded to 0.6% q/q from -0.3% q/q in Q4 23, best reading since late 2021.

The March labour market data will be the main data release this week. Particular attention will be paid to the wages data.

Asia

Markets in Asia were mixed last week. The MSCI Asia Pacific index closed flat at 0%. Hang Seng and China’s CSI 300 were leading last week, up 2.64% and 1.72% respectively. China’s economy is showing fresh signs of stabilization with a solid first-quarter performance this year, laying a strong foundation for achieving its preset growth target of around 5 percent for 2024, said economists. Morgan Stanley has revised China’s 2024 real GDP growth forecast from 4.2 percent to 4.8 percent. Goldman Sachs raised its forecast to 5 percent from 4.8 percent. Lu Ting, chief China economist at Nomura, said potential risks in the property sector will remain the major challenge facing China’s broader economy.

Hang Seng Index’s YTD gains now stand at +21.85%, strongest in Asia.

Taiwan closed the week up 1.86%. Taiwan’s exports to the US jumped 81.6% year on year to $10.2 billion in April, data from the Finance Ministry in Taipei showed Wednesday. It was the biggest increase on record. Meanwhile, overseas shipments to mainland China fell 1.1% to $7.5 billion. Shipments of information, communication and audio-video products were the main drivers of the surge in exports to the US, rising approximately 200%.

Korea will push to set up a package worth over 10 trillion won ($7.29 billion) to support the chip industry as part of efforts to boost the competitiveness of the critical industry and to prop up economic growth, the finance ministry has said. The semiconductor industry is a key growth engine for Korea, which is the world’s biggest memory chip producer as the home to Samsung Electronics and SK hynix. The package would be created through a fund to be financed by private entities and public financial institutions, such as the state-run Korea Development Bank.

Bank Indonesia Governor Perry Warjiyo has signaled that policymakers don’t need to raise interest rates further while pledging to sustain efforts to boost the rupiah past the 16,000 level. The governor made the remarks, along with sanguine forecasts on economic growth and inflation, just two weeks after he surprised the markets with a quarter-point hike to shore up the currency.

The rupiah has since gained by about 1% as global funds returned to Indonesian assets. “Overall, we see improvements in global and market developments that are better than what we expected at the time of BI rate decision last month,” he said, while vowing to keep on working to spur the currency toward its fundamental level which is below 16,000 per dollar.

India Election Crosses Halfway Mark. Attention has shifted to the dip in voter turnout after the first three rounds of voting, with the uncertainty spreading to financial markets. While there are no definite reasons, analysts and poll watchers ascribe the trend to several factors including an on-going heat wave, the lack of an overarching emotive issue and also the underreporting of deaths during the Covid-19 pandemic, which may have artificially inflated voter rolls.

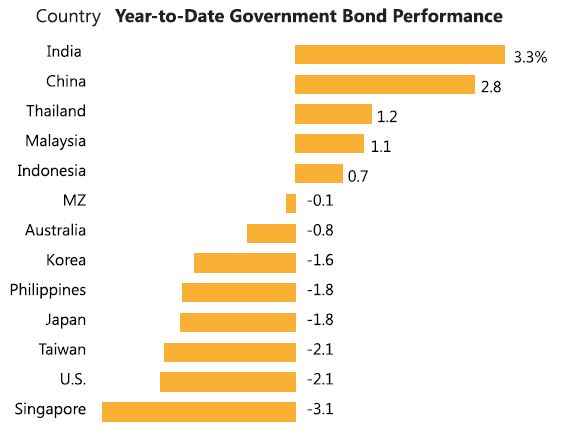

JPMorgan Chase & Co. said it was on track to include India in its emerging market debt index from June, a move that is expected to drive inflows from global investors. JPMorgan estimates foreign inflows will be between $20 billion and $25 billion, assuming an index-neutral position. India’s entry into global bond indexes will open an insular market where foreigners own just over 2%, helping develop another investor base. It also adds to the growing heft of the nation and its financial markets, which are seen as the next driver of global growth amid China’s economic woes.

Indian Bonds Outperforming Major Peers This Year

Some key events in Asia this week:

- India trade, CPI, Monday Japan PPI, Tuesday

- China rate decision, Wednesday

- Japan GDP, industrial production, Thursday

- China property prices, retail sales, industrial production, Friday

GeoPolitics

China – Europe: President Xi Jinping started his three-country European visit in Paris, where he will hold talks with French President Emmanuel Macron and President of European Commission Ursula von der Leyen aimed at stabilizing China’s relationship with Europe. Xi said he would deepen cooperation with France on innovation and clean energy and welcome French farm products and cosmetics to Chinese market. Macron also called for a reset of relations with China and advocated for European autonomy. Chinese President Xi Jinping said there was no such thing as “China’s overcapacity problem”, and he hopes EU adopt a positive policy toward Beijing. In separate meeting with Macron, Xi called for a global ceasefire during Paris Olympic Games this summer. On Ukraine, he called for a summit that would bring the parties together “on an equal playing field”. Macron emphasized war in Ukraine as an existential threat to Europe and added he appreciated Xi had reiterated commitment to abstain from selling arms to Moscow and to strictly control export of dual-use goods.

US – Israel: The United States has suspended a shipment of weapons to Israel, including heavy, bunker-busting bombs Israeli forces have used in their war against Hamas militants in Gaza that has killed nearly 35,000 Palestinians in seven months. U.S. President Joe Biden acted in the face of Israeli Prime Minister Benjamin Netanyahu’s decision to pursue a military assault on the Gazan city of Rafah over Washington’s objections, given large numbers of vulnerable displaced people there.

EU – Palestine: Spain, Ireland and other European Union member countries plan to recognise a Palestinian state on May 21, the EU’s foreign policy chief, Josep Borrell said last Thursday.

UN – Palestine: The United Nations General Assembly voted by a wide margin on Friday to grant new “rights and privileges” to Palestine and called on the UN Security Council to reconsider Palestine’s request to become the 194th member of the United Nations. The 193-member world body approved the Arab and Palestinian-sponsored resolution by a vote of 143-9 with 25 abstentions. The United States voted against the resolution, along with Israel, Argentina, Czechia, Hungary, Micronesia, Nauru, Palau and Papua New Guinea. The result of the latest UN General Assembly vote reflects a wider support for full membership of Palestine in the UN. US Deputy Ambassador to the UN Robert Wood said on Friday that for the US to support Palestinian statehood, direct negotiations must guarantee Israel’s security and future as a democratic Jewish state and that Palestinians can live in peace in a state of their own. Over the years, Israel, as the occupying power, has technically eroded the foundation of the two-state solution. The current conflict, which has lasted for more than seven months, is more likely to completely ruin the prospects of the two-state solution agreed by the international community.

FX

DXY USD Index fell 0.60% to 105.30, as higher than consensus initial jobless claims and lower than consensus Michigan sentiment drove USD weakness. Initial jobless claims came in at 231k (C: 212k) and Michigan sentiment came in at 67.4 (C: 76.2). Michigan 1 Year inflation expectation rose to 3.5% (C: 3.2%, P 3.2%). Immediate support level at 105/104.6, while resistance level at 105.6/106.

EURUSD rose 0.73% to 1.0771, driven by USD weakness. EU macro data was relatively resilient. Svc PMI for April final came in at 53.3 (C: 52.9, P 52.9), while Composite PMI for April final came in at 51.7 (C: 51.4, P 51.4). Retail sales mom rose to 0.8% (C: 0.7%, P -0.5%).

GBPUSD rose 0.26% to 1.2525, as BoE held rates at 5.25% with a 7 hold – 2 cut votes , but signal rate cuts overing the coming quarters. BoE Bailey even commented that it is possible BoE will need to cut rates more than currently priced into market rates. However, UK macro data was resilient, as UK economy exited a recession with a better than expected 0.6% growth (best reading since late 2021) in the first quarter (C: 0.4%, P -0.3%).

USDJPY fell 1.61% to 155.78, driven by USD weakness. In addition, US treasury yields fell with the 2 years (-12.79 bps), 10 years (-16.67 bps) and 30 years (-13.68 bps). In addition, the summary of BoJ has a hawkish tilt. The Summary suggested the board has confidence to deliver the next hike – the earliest timing of the hike to 0.25% at July, latest October, depends on the upcoming data, and reinforced that BoJ is intent on proceeding with balance sheet normalization, reduction in both JGBs and ETFs/J-REITs, regardless of the fundamentals.

Oil & Commodities

Oil future fell last week, with WTI (-6.67%) and Brent (-7.5%) to 78.26 and 82.79 respectively, continuing its downward trajectory since mid-April. This was despite U.S. commercial crude stockpiles declined by 1.4 million barrels in the first week of May. Oil prices gave up most of the geopolitical risk premium triggered by tensions in the Middle East, and they have also been pressured by a mixed demand outlook. Support level on WTI and Brent at 75 and 80 respectively.

Gold rose 0.96% to 2360.5, driven by the weaker USD and lower US treasury yield. In addition, escalation in the middle east supported gold prices, as Israeli forces pushed deeper into the southern city of Rafah. China’s central bank topped up its gold reserves for an 18th straight month in April, although the pace of buying slowed in the face of record prices. In April, PBOC bought 60k troy ounces, down from 160k ounces in March and 390k ounces in February.

Economic News This Week

-

Monday – NZ Food Prices/ 2Yr Inflation Exp., AU Biz Confid., CA Building Permits, US NYT Fed 1Yr Inflation Exp.

-

Tuesday – NZ Hse Sales, JP PPI/ Machine Tool Orders, Norway Cons. Confid., UK Unemploy. Rate, EU Zew Exp., US Small Biz Optim./ PPI

-

Wednesday – CH LFR, SW CPI, EU GDP/ Indust. Pdtn, US MBA Mortg. App./ Empire Mfg/ CPI/ Retail Sales

-

Thursday – JP GDP, AU Unemploy. Rate, Norway GDP, US Initial Jobless Claims/ Housing Starts/ Indust. Pdtn

-

Friday – CH Indust. Pdtn/ Retail Sales, EU CPI, US Leading Index

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.