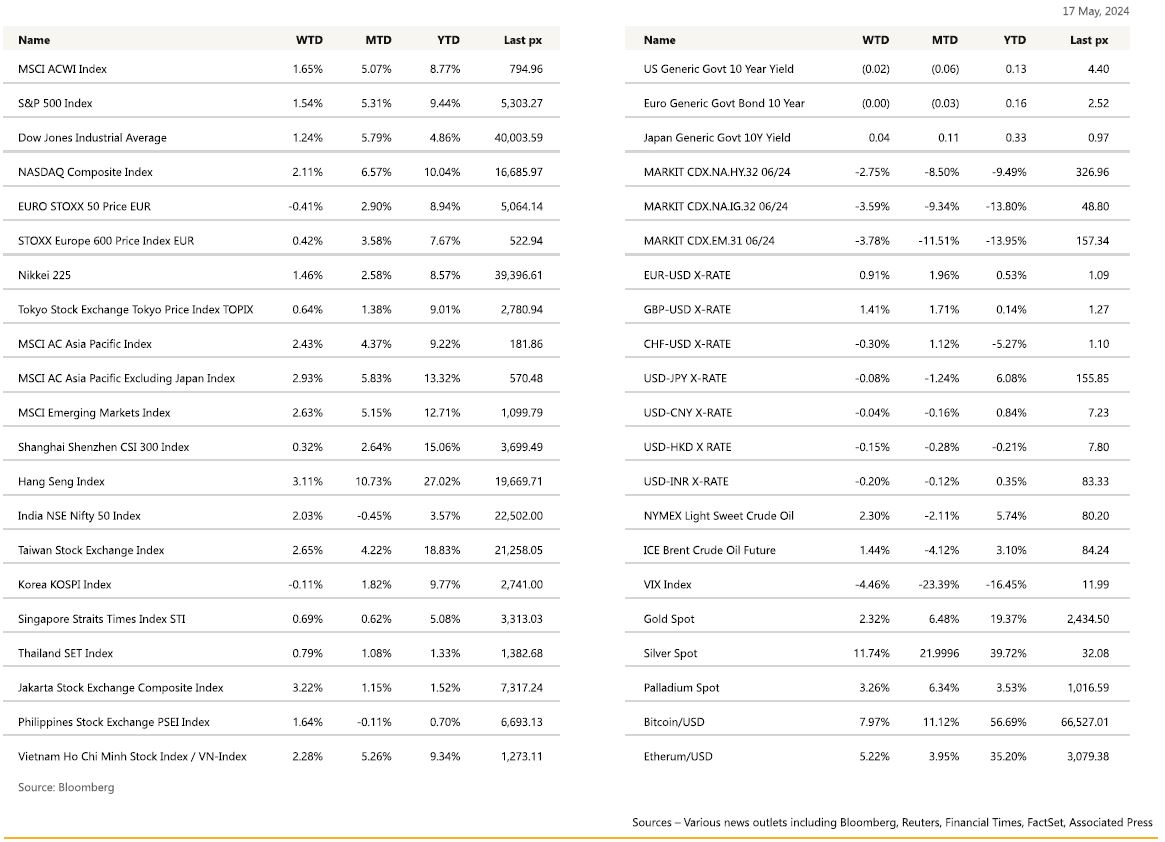

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

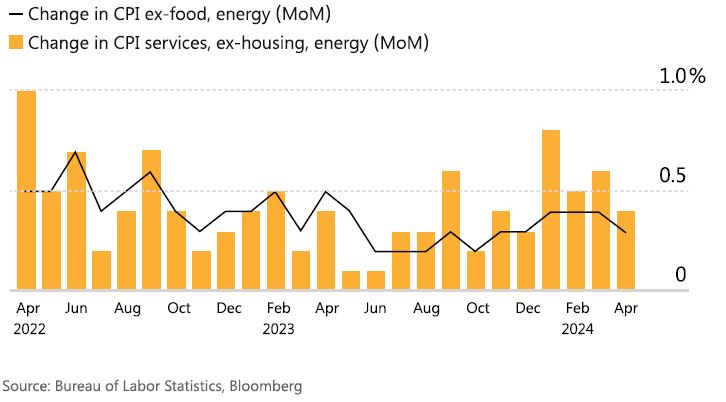

US markets end the week higher after yet another economic data-feed that rekindled speculation that the Fed Reserve is still on board with rate cuts this year. CBOE’s VIX closed at its lowest level since November of 2019 at 11.99! The gains were spurred by resurgent bets on a Fed pivot later this year after the consumer price index came in at a slightly slower than expected pace, easing worries about sticky inflation that rattled the markets for much of this year. The Dow closed above 40,000 for the first time boosted earlier by the prospect of a resilient US economy, ebbing inflation, and robust corporate earnings. PPI on Tuesday started the ball rolling in spite of higher-than-expected readings, when the previous month’s reading was revised down higher than expected. The final PPI demand YoY came in as expected at 2.2% whilst March’s 2.1% was revised down to 1.8% Core PPI YoY for March was revised down from 2.4% to 2.1%. Data released Wednesday showed a measure of underlying US inflation ebbed in April for the first time in six months, providing some progress in the direction Fed officials would like to see. The MoM core consumer price index rose 0.3% from March after three months of greater-than-expected readings. Headline CPI was on the nose at 3.4%, enough to put 2 rate cut hopes back on the table, starting in September. A weaker retail sale which advanced 0% against expectations of 0.4% MoM was largely ignored. Industrial production data also disappointed, coming in at 0% in April from a revised down figure of 0.1% in March. Still, at least three Fed officials said the central bank should keep borrowing costs high for longer as policymakers await more evidence inflation is easing, suggesting they’re not in a rush to cut interest rates. Cleveland Fed President Loretta Mester, New York Fed President John Williams and Richmond Fed President Thomas Barkin, speaking separately Thursday, argued it may take longer for inflation to reach their 2% target. Mester said the report offered a “welcome tick down” in monthly inflation, but she and other central bankers have said they want to see more data to be confident inflation is headed to the Fed’s 2% goal. Fed Chair Jerome Powell said earlier on Tuesday that officials will “need to be patient and let restrictive policy do its work.” Services inflation is the one to watch for we think, before confidence can be secured by the Fed.

With generally optimistic sentiment, the market’s attention is now firmly on this coming Wednesday’s Nvidia results.

US Core Inflation Steps Down for First Time in Six Months

April reading offers some relief to Fed officials looking to cut interest rates

President Biden hits Chinese electric cars, steel, solar cells and other goods with higher tariffs, estimated to be around $18 bln worth of imports. However, analysts said the tariffs were largely symbolic and intended to shore up votes in a tough election year. This week data wise, would be quieter with only the last FOMC minutes, PMI and U. of Michigan sentiment and inflation expectations to look out for.

Cryptos took advantage of the pivot sentiment and rallied ahead to take out BTC $67k whilst Ether to trade above $3,100.

With AI the best sector to perform year to date, Utilities is next, supporting demand from players in the AI field. Duke Energy notes the growing investment opportunities to support the energy demands and transition through the electrification of uses.

Europe

European equity markets finish lower Friday, but off worst levels. Banks, Basic Resources and Personal/Household Goods lead; Utilities, Real Estate and Construction/Materials lag.

Over in the Euro Area, the prelim Q1 GDP growth estimate was confirmed at 0.3% q/q and employment growth remained robust and grew 0.3% q/q. Q1 employment and output estimates indicate that the gap between GDP and job creation has begun to narrow, providing tentative signs that the projected recovery in productivity might have started to materialize. On the activity side, EA industrial production ex. Construction grew 0.6% m/m in March, following a 1.0% m/m uptick in February. However, the March increase was driven mainly by the volatile Irish print of +12.8% m/m.

Eurozone final CPI for April unchanged at 2.4% with core print declining or the 9th straight month. Indicators of underlying inflation continued to show mixed progress in April, with no tangible improvement in slowing sequential services price growth and domestic inflation.

ECB communication has further hinted that the rate-cutting cycle would begin in June, but it keeps warning against pre-commitments beyond the first move. European parliament elections will take place on 6-9 June 2024, where citizens will elect 720 members of Parliament, based mostly on national electoral laws.

This week, the focus will be on the May flash PMIs and the Q1 negotiated wages. We will also have the May EA consumer confidence on Thursday and the final GDP for Germany on Friday.

Labour market data in the UK last week showed regular private sector wage growth is easing, which should contribute to a deceleration of services inflation. Across sectors, earnings growth was strongest in wholesale, retail and hospitality.

In comments last week, BoE Chief Economist Huw Pill continued to walk a cautious road towards rate cuts. He suggested that a summer rate cut is ‘not unreasonable’, which points to June or August. While he acknowledged that there was still some way to go to bring inflation to target, he also highlighted that the BoE could cut while leaving ‘restriction in the system’.

Focus this week is on the April CPI print on Wednesday, which is the next crucial piece of data towards June’s MPC meeting. May Preliminary PMIs will be released on Thursday, consumer confidence on Friday and April retail sales on Friday.

Asia

Asian markets closed the week generally higher. MSCI Asia ex Japan was up by 2.94%. Hang Seng closed above 19k level for the first time since 11-Aug 2023 last week. HSI index is now up almost 27% for the year, the best performing Asian market YTD.

Chinese blue-chips staged a late rally last week after the government unveiled a series of “historic” steps to underpin the property sector. It is allowing local governments to buy “some” apartments, relaxing mortgage rules and pledging to deliver unfinished homes. PBOC said it would set up a 300-billion-yuan ($41.53 billion) relending facility for affordable housing and further lower mortgage interest rates and downpayment requirements.

PBOC Q1 policy report conveyed upbeat economic assessment, highlighting 5.3% y/y Q1 GDP growth and positive CPI inflation. Said it will ensure reasonably ample liquidity and credit expansion to consolidate China’s economic recovery. Will handle relationship between its credit and bond markets carefully. Added central bank will keep yuan basically stable to prevent risk of exchange rate overshooting. China activity data was mixed with industrial production growth coming in stronger-than-expected on acceleration in auto output. However, retail sales growth unexpectedly slowed amid weak car sales. Fixed asset investment underwhelmed amid slower growth in infrastructure investment. Industrial production +6.7% y/y vs consensus +5.5%. Fixed asset Investment (YTD) +4.2% y/y vs consensus +4.6%. Mixed data offset somewhat by stimulus hopes with CNY1T special bond issuance commencing Friday with strong demand for the inaugural tranche worth CNY40B of 30Y bonds and tying into expectations of follow-up monetary easing.

In other data around Asia, Japan’s economy contracted by more than expected in Q1 weighed down by falls in private consumption, capex and external demand; March retail sales and industrial output also contracted. Australian employment data mixed with rebound in headline jobs overshadowed by surprise jump in unemployment rate. Philippines central bank kept base interest rate on hold as expected but raised the possibility of an August rate cut. Korea’s import prices in local currency terms rose 3.4%m/m, sa, in April after falling 1.0% and 1.6% in the prior two months. Malaysia GDP grew 4.2% in Q1, fastest in a year. The central bank forecasts annual growth of 4% to 5% this year, versus 3.7% in 2023. Last week, the central bank kept its benchmark interest rate unchanged at 3.0%, citing “resilient domestic expenditure and a positive turnaround in exports,” against a backdrop of moderating inflation of 1.8% in March.

Some key events this week

- China loan prime rates, Monday

- Thailand GDP, Monday

- Indonesia rate decision, Wednesday

- Singapore CPI, GDP, Thursday

- South Korea rate decision, Thursday

- India S&P Global Manufacturing & Services PMI, Thursday

- Japan & Malaysia CPI, Friday

GeoPolitics

US- China : Biden administration will increase tariffs on Chinese EVs to 102.5% from 27.5% and will double or triple levies for other targeted industries. It is unclear which items were spared but Biden won’t announce any rate reductions. Noted White House has signalled to US solar industry that some items would be excluded, including machinery used to make solar panel components. Added Biden’s plan for more tariffs mostly symbolic. Meanwhile Trump said he would put 200% tax on made-in-Mexico vehicles by Chinese carmakers who wanted to bypass tariffs via USMCA and pledged 60% across-the-board tariff on all Chinese goods.

President Biden’s announcement of tariff hikes on Chinese imports last week prompted follow-up discussions about potential China retaliation after Commerce Ministry vowed to take unspecified “resolute measures.” While China is expected to respond, trade experts urging Beijing to proceed cautiously amid potential for economic blowback from tit-for-tat retaliation. Analysts have speculated on potential China retaliation measures, such as targeting certain critical minerals, imposing export restrictions on products US identified for tariff exclusions, devaluing yuan, or engaging in non-trade actions such as denying some multinationals access to Chinese markets. China may also target products from politically sensitive US industries or electorally important US states according to Barron’s. Key risk is that tariff response kicks off a cycle of retaliation with negative consequences for global trade, particularly with EU mulling its own tariffs on Chinese EVs and former President Trump vowing to broaden tariffs on Chinese imports if he wins November election.

The White House has ordered a Chinese group that runs a crypto-mining operation in Wyoming to sell the land where it keeps its servers because the facility is next to a base that houses US nuclear ballistic missiles. “The proximity of the foreign-owned real estate to a strategic missile base and key element of America’s nuclear triad, and the presence of specialised and foreign-sourced equipment potentially capable of facilitating surveillance and espionage activities, presents a national security risk to the US,” Biden said in the order.

President Xi Jinping met his Russian counterpart Vladimir Putin in Beijing for the 43rd time. Xi Jinping and Vladimir Putin on Thursday pledged a “new era” of partnership between the two most powerful rivals of the United States, which they cast as an aggressive Cold War hegemon sowing chaos across the world. Putin brings along a high-level delegation to China with six out of 10 deputy prime ministers as well as central bank head in the entourage as Russia’s economy is getting more dependent on trade with China amid western sanctions. Beijing has been accused of aiding Moscow’s war by supplying technology and components – but China says none of this is lethal and has commercial applications.

The Republican-led U.S. House of Representatives passed a bill on Thursday that would force President Joe Biden to send weapons to Israel, seeking to rebuke the Democrat for delaying bomb shipments as he urges Israel to do more to protect civilians during its war with Hamas.

The Israel Security Assistance Support Act was approved 224 to 187, largely along party lines. Sixteen Democrats joined most Republicans in voting yes, and three Republicans joined most Democrats in opposing the measure. Republicans accused Biden of turning his back on Israel after facing widespread pro-Palestinian protests. Democrats also accused the other party of playing politics, saying Republicans are distorting Biden’s position on Israel. Israel, a major recipient of U.S. military assistance for decades, is still due to get billions of dollars of U.S. weaponry, despite the delay of one shipment of 2,000-pound (907-kg) and 500-pound bombs and the review of other weapons shipments by the Biden administration.

FX

DXY USD Index fell 0.81% to 104.445, driven by weak US inflation and retail sales. US Core CPI increased by 0.29% m/m in April (C: 0.3%; P: 0.36%), which brought the annual rate down to 3.62% (C: 3.6%; P: 3.80%). Headline CPI increased by 0.31% m/m in April (C: 0.4%; P: 0.38%), which brought the annual rate to 3.36% (C: 3.4%; P: 3.48%). Headline Retail Sales were flat m/m in April (C: 0.4%; P: 0.6%), with a downward revision of 10bp to March and downward revision of 20bp to February. April US CPI provides a step towards “additional confidence”: rents continue to cool, core services ex-shelter and ex-auto insurance drops sharply, while core goods deflation continues. Immediate support on DXY at 104/103.60, resistance at 105.

EURUSD rose 0.91% to 1.0868, driven by weak USD, despite remarks from ECB Governing Council Member Knot that reiterate expectations for a June rate cut. Data wise, Euro Area Preliminary 1Q24 GDP came in at 0.3% q/q (C: 0.3%; 4Q23: -0.1%), and Industrial Production rose by 0.6% m/m in March (C: 0.4%; P: 1.0%).

GBPUSD rose 1.41% to 1.2701 amid USD weakness and risk on sentiment in risk assets. UK Labor Market data for April showed Private Sector (ex-bonus) pay below the BoE expectations, with strong headline data largely due to public sector earnings. The jobless rates ticked up, but the BoE continues to place low weight on this figure. Market expectation is 2 rate cuts and 55 bps cut in 2024.

USDJPY was unchanged for the week at 155.65 despite USD weakness and fall in UST yields. Market participants seemingly believed it would be difficult for the MoF to intervene again, as it had been suspected to have done recently amid US Treasury Secretary Yellen mentioning intervention should be rare and communicated. Data wise, Japan 1Q24 Real GDP came in at -2.0% q/q annualized (C: -1.2%; P: 0.0%), with a 0.4ppt downward revision to the prior quarter.

Oil & Commodities

Oil future rose last week, with WTI (+2.30%) and Brent (+1.44%) closing the week at 80.06 and 82.79 respectively. Sentiment remained supported by a second consecutive weekly drop in US crude inventories and signs of slowing inflation. Crude inventories dropped by 2.5 million barrels to 457 million barrels in the week ending May 10 according to EIA report, compared with analysts’ expectations in a Reuters poll for a 543,000-barrel draw. Immediate support level on WTI and Brent at 77 and 81 respectively.

Gold rose 2.32% to 2415.22 driven by signs of slowing inflation and fall in UST yields. Silver rose 11.74% to 31.493.

Economic News This Week

-

Monday – CH LPR, JP Tertiary Industry Index

-

Tuesday – AU Cons. Confid./ RBA Minutes, CA CPI

-

Wednesday – JP Trade Balance/ Core Machine Orders, NZ RBNZ OCR, UK CPI/ RPI, US MBA Mortg. App./ Existing Home Sales

-

Thursday – NZ Retail Sales, AU/JP/EU/UK/US Mfg/Svc/Comps PMI May Prelim, US Initial Jobless Claims/ New Home Sales, EU Cons. Confid.

-

Friday – NZ ANZ Cons. Confid./ Trade Balance, JP Natl CPI, UK Cons. Confid./ Retail Sales, CA Retail Sales, US Durable Goods Orders

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.