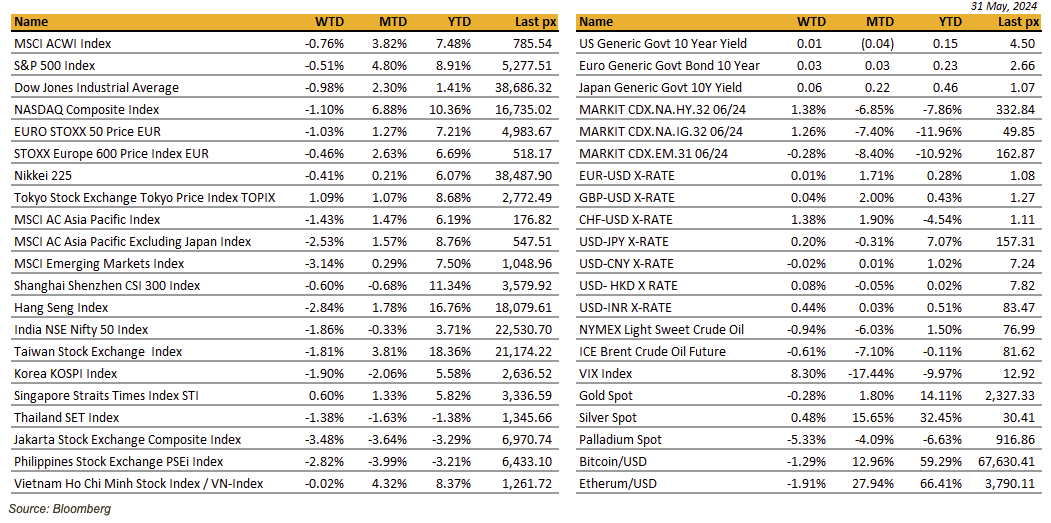

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets ended the shortened week marginally lower, with the S&P 500 snapping a 5-week win streak despite staging a late comeback Friday. This was the first weekly fall for the month, amid concerns over the potential for an economic slowdown and higher-for-longer interest rates. Nasdaq fell more than a percent after a couple of Tech ‘darlings’ Dell and Salesforce Inc failed to live up to expectations, underlining challenges for the sector more broadly, and weighed on peers including Oracle and Adobe. Data showing real personal spending unexpectedly declined to 0.2% from 0.8% previously. Personal income came in as expected at 0.3% from 0.5% previously. Meanwhile, the Nvidia fell on a report that US officials have slowed the issuing of licenses to companies such as Nvidia and Advanced Micro Devices for large-scale AI accelerator shipments to the Middle East.

The Federal Reserve’s preferred measure of inflation — the personal consumption expenditures index — rose 0.3% month over month in April, in line with expectations, with a slightly lower rise in the core measure at 0.2%. The Core YoY rate was also on the nose coming in at an unchanged 2.8%. Whilst unlikely to move the needle for the Fed, it did breathe some relief to risk assets that rates cuts are still on the table this year. Earlier on Thursday, weekly jobless claims rose more than expected, and the US economy grew at a slower pace in the first quarter than initially reported at 1.3%, helping soothe some of the rates anxieties.

Tuesday also saw the return to T+1 for stock settlement – after about a hundred years ago. The change is ultimately intended to reduce risk in the financial system. The $ also weakened across the board, helping lift cryptos BTC and ETH to $68k and $3800 respectively.

Claudia Sheinbaum is set to become Mexico’s first female leader in a landslide victory, capitalizing on outgoing President (AMLO) Andres Manuel Lopez Obrador’s popularity. It is the first time that Mexico elects a woman as president. Policies of the new incoming executive administration should remain pretty much in line with her predecessor. Mexico is obviously still having big issues with Drug Cartels that the previous administration did not resolve. On the other hand, economic situation in Mexico is quite bright and the pesos has been the best performing EM currency over the last 2years, very much supported by an increase of trades with the US, leading Mexico to become the first trading partner of the US, ahead of China. The US presidential election in 5Months time, depending on its outcome, might put pressure on the pesos.

This coming week, we’ll get more of an insight into the future path of interest rates as we parse a slew of economic data including ISM on Monday, durable goods orders on Tuesday, purchasing managers’ index data on Wednesday, jobless claims Thursday and the unemployment reading Friday. Bloomberg expect the unemployment rate to remain unchanged at 3.9% whilst NFP is expected to rise to 190k.

We have embarked on a strategy as an alternative to buying Puts, via a 100% Principal Protected Note on a long-short HF for a year. Please reach out to us for any further information.

Europe

European stocks closed higher Friday as investors digested fresh euro zone inflation data. The Stoxx 600 index was provisionally up 0.28% higher as markets closed. Sectors were mostly in positive territory, with utilities adding 1.04% while tech lost 1.48%. The Stoxx 600 benchmark finished the month of May 2.3% higher, its biggest gain since March.

The May inflation print in the Euro Area surprised to the upside with the EA headline and core HICP accelerated by 0.2pp to 2.6% and 2.9% y/y respectively, showing further signs of firmness in services inflation. While ECB’s April Consumer Expectations Survey confirmed that inflation expectations remain well-anchored and falling, with the one-year ahead measure reaching its lowest level since September 2021 (at 2.9%, down from 3.0% in March).

The Q1 real GDP expenditure breakdowns in France and Italy showed a sequential improvement in domestic demand, which increased by 0.4% pp q/q and 0.3% q/q respectively. The EC surveys also point to a modest improvement in activity in the euro area, with the economic sentiment indicator ticking higher by 0.4 pt to 96 on the back of stronger demand conditions in the manufacturing and services sectors. On labour market, unemployment data reached a new historical low of 6.4%.

Since the March macroeconomic projections were compiled, data releases have likely increased confidence in the prospects of a recovery in activity over the course of the year. Forward-looking components from most surveys also signal that growth is set to strengthen further, driven by a resilient services outlook while manufacturing is showing signs of a modest recovery. Having kept policy on hold for the last 5 consecutive meetings so far, we expect the GC the start its easing cycle next week by 25 bps.

S&P cut its rating on France’s sovereign debt on Friday from ‘AA’ to ‘AA-’ with the expectations that higher-than-expected deficits would push up debt in the eurozone’s second biggest economy. This downgrade makes S&P the second of the 3 big rating agencies to downgrade its view on French debt, after Fitch cuts its rating to AA- in April 2023. However, Citigroup analysts said that a downgrade would have minimal impact on France’s borrowing costs, possibly adding only 3-5 basis points to the spread on French benchmark bonds.

There will be important data releases this week. We will be watching the EA May final PMIs (3-5 June), the April EA retail sales (6 June), and the final print of the euro area Q1 GDP. Most Importantly, is the ECB rate decision this Thursday.

Over in the UK, election campaign has started, and a clearer picture is beginning to emerge on policy platforms. The 2 largest parties have both pledged fully funded packages and not to raise any major taxes in the next parliament. This week, focus will be on BoE’s Decision Maker Panel (6 June) for a signal of firm’s views on price and wage dynamics. The final May PMIs (manufacturing on 3 June; services/composite on 6 June).

Asia

Asian equities and currencies fell last week, following US markets. MSCI Asia Pac ex Japan index down almost 2.5% for the week. India down by 1.8% on election jitters, Southeast Asia all lower with the exception of Singapore closing the week up 0.6%. Hang Seng was lower by 2.84. IMF raised their forecast for the China’s gross domestic product growth in 2024 to 5 per cent from 4.6 per cent. The multilateral lender also increased its forecast for 2025 to 4.5 per cent from 4.1 per cent. Beijing’s own growth target for 2024 is about 5 per cent, the same figure as last year and the lowest in decades.

Vietnam was flat -0.02%. Vietnam’s annual inflation rate edged up to 4.44% in May, official data showed on Wednesday, nearing the government’s target ceiling of 4.5% for the year and a potential challenge to efforts to boost credit growth to drive activity. Vietnam is targeting economic growth of 6.0%-6.5% this year, faster than an expansion of 5.05% last year. The State Bank of Vietnam has said it is aiming for credit growth of 15% to help meet the growth goal, but local banks have struggled to increase their lending this year. The State Bank of Vietnam also signalled that it’s ready to defend the dong after the currency slipped to a record low amid bouts of US dollar strength.

Exit polls suggest a resounding victory for Indian Prime Minister Narendra Modi’s Bharatiya Janata Party-led alliance, following the conclusion of a weeks-long general election on Saturday. Polls suggest the alliance will clinch substantially more seats than the 272 required for a majority in the 543-seat lower house of parliament. Most pollsters are predicting the group will win between 350 and 400 seats. In 2019, the alliance won 352.

Geophysical exploration results in South Korea have shown that there is a high possibility that a huge amount of oil and gas is buried in the waters off country’s southeast coast near Pohang, President Yoon Suk Yeol said in a televised speech on Monday. The estimated oil reserve could be worth over 4 years of consumption and gas for up to 29 years. Once the drilling work starts late this year, the result will be out by 1H 2025.

Other data from Asia : Japan services PPI inflation quickened by most in 32 years (PPI +2.8% y/y vs consensus +2.3%). This is coming amid heightened BOJ sensitivity to homegrown pricing pressures but all of the country’s underlying inflation measurements were below 2.0% in April. China manufacturing PMI missed, down 0.9pts in May to 49.5. Non-manufacturing fell as well, down 0.1pt to 51.1. Malaysia producer prices rose to more than a year high, up 1.9% year – on year. In Taiwan, the Directorate General of Budget, Accounting and Statistics (DGBAS) on Thursday raised its forecast for Taiwan’s gross domestic product (GDP) growth in 2024 to 3.94 percent, the highest in three years.

GeoPolitics

Beijing has launched its largest-ever chip investment fund with backing from state-owned banks. Worth $47.5 billion, the fund is being created as the US imposes sweeping restrictions on the export of American chips and chip technology.

China, Japan, South Korea summit

Leaders concurred on importance of cooperation in IP. Japan aims to have candid talks on the future shape of a trilateral FTA, though specifics were light apart from brief mention of an RCEP-plus agreement. Subsequent remarks by China Premier Li Qiang indicated enthusiasm towards stronger trade ties, while lobbying Japan and South Korea to “reject external disruptions” (Xinhua). Attention defaulted to geopolitics, where Kishida expressed serious concern over North Korea’s nuclear and missile activities and military cooperation between Russia and North Korea, reaffirming denuclearization of North Korea and the stability of the Korean Peninsula is the common interest of the three countries. Kishida also vowed Japan will continue severe sanctions against Russia and strong support for Ukraine. On Middle East conflict, three leaders concurred on efforts towards resolution, sharing the importance of realization of a sustainable ceasefire and the support of a “two-state solution”.

US- Israel – Palestine – Egypt

The Biden administration said on Tuesday it was closely monitoring the probe into a deadly Israeli airstrike it called tragic, but that the recent deaths in Rafah didn’t constitute a major ground operation there that crosses any U.S. red lines. The U.S. administration’s response was criticized earlier Tuesday by human rights and Arab American groups. “Sadly, because of President Biden’s insistence on sending more bombs to enable Netanyahu’s war crimes in Rafah, this is now as much an American genocide as it is an Israeli genocide,” said Nihad Awad, executive director at the Council on American-Islamic Relations. Israeli and U.S. officials have denounced the use of the term genocide to describe events on the ground in Gaza. By Wednesday (29th May), Israeli forces have taken control of a buffer zone along the border between the Gaza Strip and Egypt, the country’s military said, giving Israel effective authority over the Palestinian territory’s entire land border.

Tensions have risen between Egypt and Israel over the takeover of the southern border. Egypt demands Israel withdraws from Rafah crossing for it to operate again. Egypt had facilitated the entrance of aid through the Kerem Shalom crossing last week, the re-opening of Rafah is crucial as humanitarian agencies warn of looming famine in Gaza.

China – Israel

Chinese President Xi Jinping called on Thursday (May 30) for a peace conference on the war between Israel and Palestinian militant group Hamas as he addressed Arab leaders and diplomats at a forum in Beijing. Xi also said China “supports Palestine’s full membership in the UN, and supports a more broad-based, authoritative and effective international peace conference”.

Spain, Ireland and Norway

All three countries have formally recognised a Palestinian state on Tuesday (May 28) in a coordinated decision slammed by Israel as a “reward” for Hamas, more than seven months into the devastating Gaza war. The three European countries believe their initiative has strong symbolic impact that is likely to encourage others to follow suit.

Ukraine

The annual Shangri-La Dialogue became a stage for competing demands on U.S. global power, including the war in Ukraine and tensions over Taiwan. Mr. Zelensky, who had a surprise turn up in Singapore, told reporters that Russia had persuaded China to try to help limit Asian participation. He gave no details; the Chinese foreign ministry did not immediately respond to the allegation. He also said that Chinese economic and technology flows to Russia were helping it wage war. The Chinese government has repeatedly denied sending weapons to Russia.

CREDIT/TREASURIES

US markets were close last Monday. Yield on US Treasury yields rebounded significantly last Tuesday following a pair of weak 2 & 5years US Treasury auctions. Yields were also supported by stronger than expected May Conference Board Consumer Confidence. US Treasury curve continued to bear-steepen on Wednesday after another weak auction this time on the 7years US Treasury. The most important economic data in the US last week was the PCE Deflator & Core Deflator for April last Friday which printed almost exactly in line with expectations and also in line with the previous Month data. Treasuries rallied as PCE data showed April consumer price trends were stable at 2.7% YoY, posting the smallest increase this year.

The US Treasury curve flattened last week with the 2years yield dropping by 5bps, the 5years was roughly unchanged, 10years gained 3bps & 30years gained 7bps. US IG credit spreads were unchanged and US HY credit spreads widened by 5bps.

In term of performances during last week, US IG lost 10bps, US HY and leverage loans were roughly flat.

FX

DXY USD Index was relatively unchanged (-0.05%) for the week at 104.67, as US April PCE (Actual: 0.3%, P: 0.3%) was in line with expectations with softer personal spending and confirmed inflationary pressures were decelerating relative to the strong 1Q24 data. Second revisions of 1Q24 GDP showed the economy grew slower than initially reported to 1.3% q/q (C: 1.3%; P: 1.6%; 4Q24: 3.4%), with personal consumption slowing more than expected to 2.0% q/q (C: 2.2%; P: 2.5% %; 4Q23: 3.3%). The downside miss in consumption came alongside weaker inflation data, with the 1Q24 Core PCE Price Index slightly below the initial report.

EURUSD was relatively unchanged (+0.01%) for the week at 1.0848. Data wise, Eurozone unemployment Rate fell to 6.4% in April (C & P: 6.5%), while HICP rose to 2.7% in May (C: 2.6%; P: 2.4%). EURCHF fell 1.35% to 0.9789, as CHF was supported with SNB President Jordan seeing a small upward risk to the bank’s inflation forecast.

GBPUSD was relatively unchanged (+0.04%) for the week at 1.2742. Data in the UK was light last week, with the only major data on Mortgage Approvals for April, which fell to 61.1k in April (C: 61.5k; P: 61.3k).

USDJPY rose 0.20% to 157.31, with JPY continuing its depreciation and above levels where potential intervention occurred.. Japan MoF data shows Japan spent JPY 9.8 trillion in FX intervention in May, exceeding the amount of 2022’s intervention. Data wise, Tokyo CPI ex. Fresh Food accelerated to 1.9% y/y in May (C: 1.9%; P: 1.6%) due to a rise in electricity charges and city-gas prices on the back of a rise in the renewable energy surcharge, while Tokyo CPI ex. Fresh Food and Energy slowed to 1.7% in May (C: 1.8%; P: 1.8%).

Oil & Commodities

Oil future fell last week, with WTI (-0.94%) and Brent (-0.61%) closing the week at 76.99 and 81.62 respectively, despite an Energy Information Administration report showing US inventories declining sharply. Over the weekend, OPEC+ agreed to extend its oil output cuts in full in the third quarter and then be gradually phased out over the following 12 months. The total production level of the OPEC+ member states should stand at 39,725 million bpd in 2025. At the point of writing, oil prices are trading slightly down following OPEC+ decision.

Gold fell 0.28% to close the week at 2327.33, as Fed seeks more inflation clues before next move. Market is on the lookout for more confirmation from US policymakers on the rate trajectory, with the focus turning to the next meeting on June 11 and 12. Immediate support at 2300/2270, while resistance level at 2375/2400.

Economic News This Week

M – JP Capital Spending, AU Melbourne Inflation, JP/CH/SZ/EU/UK/CA/US Mfg PMI May Final, US ISM Mfg/ISM Prices Paid

T – SZ CPI, US JOLTS/Factory Orders/Durable Orders

W – AU/JP/CH/EU/UK/US Svc/Comps PMI May Final, AU GDP, EU PPI, US Mortg. App./ADP/ ISM Svc Index, CA BOC Rate Decision

Th – AU Trade Balance, SZ Unemploy. Rate, UK Construction PMI, EU Retail Sales/ ECB Rate Decision, US Trade Balance/Initial Jobless Claims

F – EU GDP, CA Unemploy. Rate, US Nfp/Wholesale Inv.

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.