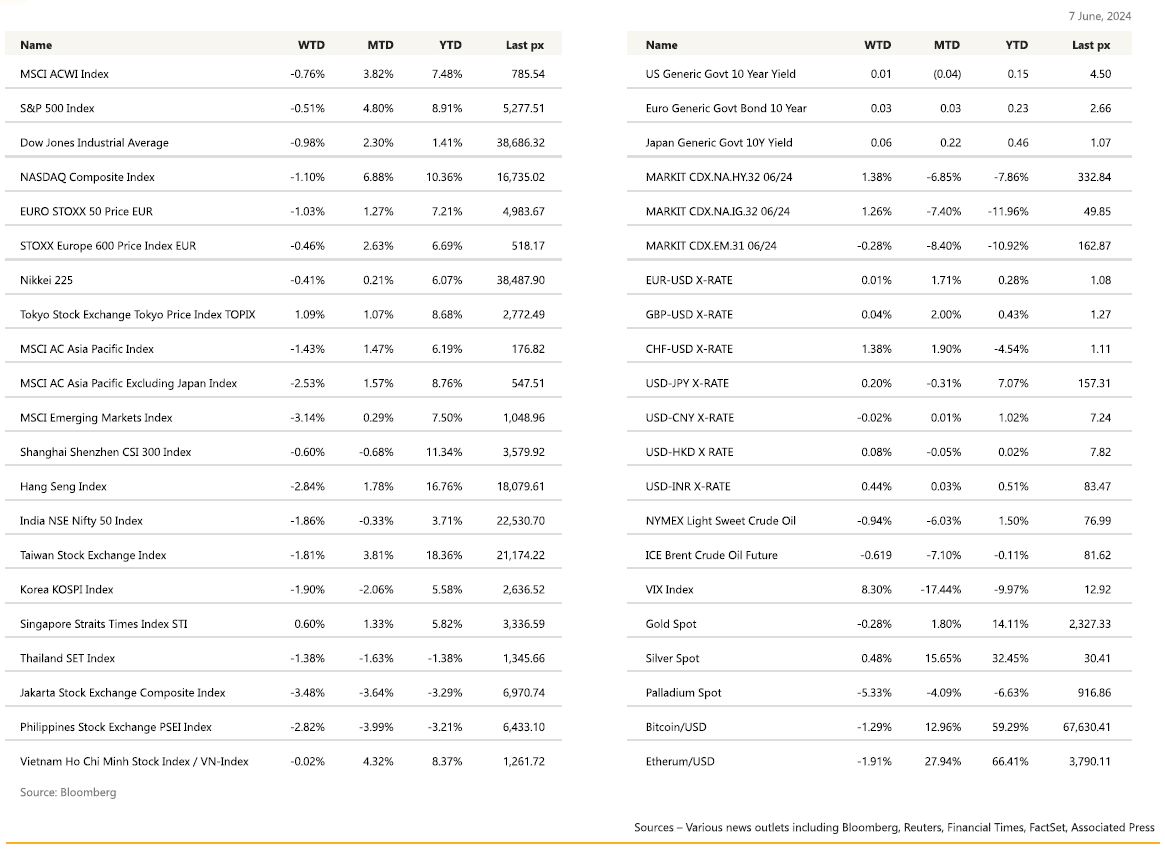

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets notched another weekly gain clocking fresh all-time highs along the way, in spite of a stronger-than-expected jobs report. Upside to wages is seen as concerning re. inflation but ultimately investors saw strong payrolls as net positive for equity markets supporting the growth narrative as good for earnings. Non-farm payrolls grew past all expectations at +272k last month. April NFP had very little revision and remained weak compared to previous 3Months and the May data. The unemployment rate ticked up to 4% from 3.9%. Labor force participation rate was down 2 tenth of 1 percent at 62.50%. May average hourly earnings MoM increased by 0.40% Vs 0.30% expected and on a YoY basis they increased by 4.10% Vs 3.90% expected. Previous YoY data was revised up from 3.90% to 4.00%. This data should support the FED to keep short term interest rates unchanged during the FOMC meeting this week on the 12th of June. As this FOMC meeting is a quarterly meeting, it will be interesting to see by how much they adjust their SEP’s compared to March data. Stubbornly high inflation is raising the stakes for both the stock market ahead of Wednesday’s reading on consumer prices, and for investor bets on the Federal Open Market Committee’s policy decision.

The FOMC will meet this week – all eyes would be on the dot plot, whether the 3 cuts pencilled in in March would change. Still, expectations remain of a cut this year after both the ECB and the Bank of Canada lowered policy rates. Jobless claims earlier in the week had indicated a slightly larger than expected release both in initial and continuing claims. JOLTS Job Openings contracted to 8.059 mln in April, its lowest reading since February 2021. The accuracy of JOLTS could definitely be argued about, and due to their frequency, they should not be considered as a leading indicator for the job market. It’s likely the job openings will return to around 7 mln which was the trending level in 2019, before Covid. Whilst ISM manufacturing data continued to come in below forecast, the Services component was higher than expected indicating that the services sector remain robust – a sticky point in the core CPI. We’ll get a taste of CPI on Wednesday: core MoM is expected at 0.3%, YoY at 3.5% and a yearly headline CPI of 3.4%. PPI will follow suit on Thursday with PPI Final Demand MoM expected at 0.1% from 0.5%.

Gold and Crude gave in following Friday’s jobs report that saw the USD strengthen across the board. Exceptional to this was the direction of cryptos which rallied to BTC $70k while Ether was much more subdued at $3,700. Crypto die-hards are saying that if Bitcoin stays on its current trajectory, it will open the floodgates to more IPO’s especially, given a US regulatory environment that’s turning more favourable. Nvidia’s Jensen Huang’s keynote speech & outlook at the Computex Summit in Taiwan talked about how Nvidia has given massive “power tools” to the industry, which is undoubtedly, wide ranging. The fundamental in accelerated computing tells us that we are still at a nascent stage of it. Add to the ETF in this sector. (AIQ, XAIX)

Europe

European stocks closed lower on Friday with the Stoxx 600 closed 0.16% lower. Almost all the sectors traded in the red, with utilities down 1% as healthcare stocks added 0.5%.

As widely expected, the ECB cut all three policy rates by 25bp, marking the end of the 9-month ‘holding season’. It takes the key bank rate in the 20-nation euro zone to 3.75%, down from a record 4%. However, the official communication was cautious and non-committal on the path for rates ahead, with the Governing Council (GC) sticking to its datadependent and meeting-by-meeting approach. In terms of timing of the next possible move, Lagarde mentioned that the ability of the ECB to carry out further cuts would only be assessed based on future data outturns ‘much later in the summer’. As for growth and inflation projections, the upward revision was stronger than expected. The ECB raised its GDP forecast for 2024 to 0.9% from 0.6% previously, and 10bp higher than expected. It lowered its 2025 forecast to 1.4% from 1.5%, consensus was a no change. 2026 was unchanged, as widely expected. As for headline inflation, ECB was revised up marginally to 2.5% 2024 from 2.3% previously expected, and to 2.2% in 2025 from 2%. Upward revisions are owing to higher commodity prices as well as oil and natural gas futures.

Data wise, in line with the preliminary estimate, EA Q1 GDP was confirmed at 0.3% q/q, putting an end to 5 consecutive quarters of stagnation. The expenditure breakdown sent mixed signals regarding the strength of domestic demand, with the acceleration in economic activity driven by a boost in net trade while private consumption continued to disappoint. EA final PMIs printed broadly in line with the flash release with only slight revisions to the headline indices. At the EA level, the PMIs continue to signal services disinflation and improving demand conditions, notably in the manufacturing sector. This week we have the Euro Area Sentix report today and the aggregate industrial production on Thursday.

Over in the UK, the Decision Maker Panel attracted the most attention. It is a survey of business that is closely followed by the BoE and the results feeds partly into its forecasts. Overall, it was a dovish report with a sharp fall in expected wage growth being the stand out. Dovish elements included a continued fall in expected and realized price growth. Expected price growth for a year ahead fell to 3.9% yoy in May from 4.0% in April and realized price growth was 4.9% yoy in May from 5.2% in April. Wage growth was more dovish than expected. 1 year ahead expectations fell to 4.1% yoy from 4.6%. CPI expectations was neither hawkish or dovish with both 1y and 3y ahead expectations remaining unchanged at 2.9% and 2.6%. This week, the focus will be on the REC/KPMG labour market survey, the April ONS labour market release on Tuesday, April GDP on Wednesday.

Asia

Asia markets were generally higher last week. MSCI Asia ex Japan was up 2.8%.

It looks like the easing cycle has begun as Bank of Canada and ECB both lower rate this week. US Fed rate cut bets has also escalated. Indonesian large caps saw some bottom fishing on the back of this potential new cycle. However, it was still not enough to help the Jakarta index, JCI was lower by 1% for the week.

Japan was net bought for the first time in 3 months, with net allocation increasing to 5.1% (3-year high). Japan personal spending grew for first time in more than a year while forex reserves dipped sharply in the wake of last month’s yen intervention. NKY was higher by 0.5% last week.

Vietnam stock markets outperformed regional peers and retested YTD highs, on expectation of good brokerage earnings on abundant market liquidity from domestic investors and a circular on no-prefunding to be finalized this month. Index is up 10.6% YTD.

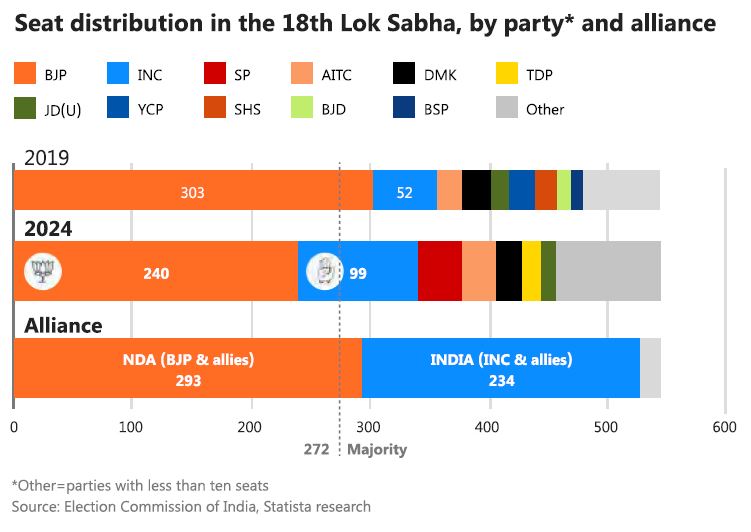

The big news however was India. Indian Prime Minister Narendra Modi was sworn in for a third time. He’s only the second person in the country’s history to hold the office for three consecutive terms. A narrower-than-expected victory for Modi’s alliance may raise doubts about the new government’s ability to push through politically difficult reforms seen as crucial to sustain India’s economic growth, which is already the world’s fastest. Results published showed the BJP had lost its majority for the first time since 2014. The ruling party won 240 seats in India’s 543-seat Lok Sabha, or lower house, where it will remain the largest party. The opposition INDIA bloc, led by the formerly ruling Indian National Congress, performed better than expected, winning 234 seats. Nifty closed the week higher by 3.37%.

Other data from Asia:

RBI left rates unchanged and retained its hawkish “withdrawal of accommodation” stance, setting to one side PM Modi’s narrowerthan- expected general election win. Thai inflation was 1.5% yoy in May 24, higher than estimates. Economists expect Bank of Thailand will keep rates unchanged at 2.50% next week as inflation is likely to trend higher again in 2H24F. South Korea’s consumer inflation slowed for a second straight month in May data showed. The consumer price index (CPI) in May stood 2.7% higher than a year earlier and rose 0.1% on a monthly basis. The BOK, which held interest rates steady for an 11th straight meeting in May, is expected to lower its policy rate by 50 basis points to 3.0% in the fourth quarter of 2024, according to a Reuters poll in May.

GeoPolitics

Israel – Palestine: Last week, Israel said it hit a school compound because Hamas members were operating there. Hamas-affiliated outlets deny this, and witnesses say the dead included families sheltering in the school. The Israeli military has announced the resumption of operations in central Gaza this week, saying Hamas units have regrouped there. On Saturday morning, Israeli special forces were given the goahead to embark on one of their most complex operations of the war: a raid in Nuseirat in central Gaza to free several hostages captured by Hamas in its October 7 attack on Israel.

For Palestinians in Nuseirat, the raid was one of the deadliest days in what has become the bloodiest war in the history of the Israeli-Palestinian conflict.

Centrist politician Benny Gantz has resigned from Israel’s emergency government and called for early elections, accusing Prime Minister Benjamin Netanyahu of mishandling Israel’s war in Gaza. In a wide-ranging speech, Gantz also backed a US-led push to free the roughly 120 Israeli hostages still held in Gaza via a deal with Hamas, and supported a commission of inquiry into the failures surrounding October 7.

US – G7 – Gaza: US warns Israel even a limited war in Lebanon could draw Iran into the conflict.

Leaders of the Group of Seven (G7) major democracies “fully endorse and will stand behind the comprehensive” ceasefire and hostage release deal for the Gaza war outlined by US President Joe Biden and call on Hamas to accept it, a statement said on Monday (Jun 3). The deal “would lead to an immediate ceasefire in Gaza, the release of all hostages, a significant and sustained increase in humanitarian assistance for distribution throughout Gaza, and an enduring end to the crisis, with Israel’s security interests and Gazan civilian safety assured”, the statement said.

Russia – Ukraine: Russian president Putin has said he’s considering sending long-range weapons to countries that might use them to strike Western targets. His comments come after Western leaders endorsed Ukraine using Western-supplied arms to strike back at targets inside Russia.

Credit / Treasuries

Regarding the US Treasury curve, interest rates across the curve have been moving down the whole of last week, except for a very significant rebound of yields last Friday following the job data. 2Years US Treasury yield managed to gain 3bps over the week, 5years yield went down 2bps, 10 years down 4bps and 30years lost 6bps of yield. Credit spreads on US IG & HY widened marginally during the week.

FX

DXY USD Index rose 0.20% to close the week at 104.885, driven by a significant upside surprise in May US nonfarm payrolls at 272k (C: 180k).

As a result, pricing for the first full 25bp Fed rate cut is pushed out to December. Average hourly earnings rose to 4.1% yoy (C: 3.9%; P: 4.0%). Despite the stark headline data, the underlying details were not as strong. Unemployment rate ticked up to 4.0% (P: 3.9%), despite a drop in the labor force participation rate to 62.5% (P: 62.7%). ISM services had a stronger-than-expected rebound to 53.8 in May (C: 51.0; P 49.4), but the Prices Paid Index fell to 58.1 (C: 59.0; P: 59.2), which signalled a decline in inflationary pressures. Soft ISM Manufacturing data provide additional confidence in decelerating inflation and reaffirm trends of slower growth amid a tight labor market.

EURUSD fell 0.43% to close the week at 1.0801, driven by strong US nonfarm payrolls. ECB delivered a 25bp cut as expected but revised up its growth and inflation projections higher than consensus. Little forward guidance (data dependent) was offered other than to implicitly suggest that the director of travel is further cuts. GDP growth was revised to 0.9% yoy (P: 0.6%) in 2024, 1.4% yoy (P: 1.5%) in 2025 and 1.6% (unchanged) in 2026. For 2024, headline was revised to 2.5% yoy (P: 2.3%) and core was revised to 2.8% yoy (P: 2.6%)

GBPUSD fell 0.18% to close the week at 1.2719, driven by strong US nonfarm payrolls. UK Composite PMI in May came in at 53.0 (C: 52.8).

USDJPY fell 0.36% to close the week at 156.75 as BoJ Governor Ueda reiterates it is appropriate to reduce the amount of bond purchases and the BoJ will proceed cautiously on interest rates. We have the BoJ rate decision this coming Friday.

Oil & Commodities

Oil future fell last week, with WTI (-1.90%) and Brent (-2.45%) to close the week at 75.53 and 79.62 respectively. WTI and Brent fell to a low of 72.48 and 76.82 respectively after OPEC+ decision to extend and then phase out its production cuts. Both oil futures rebounded later into the week as OPEC+ ministers reiterate the group can pause or reverse production cuts, if necessary. But ultimately, oil future fell back slightly to close the week given the higher for longer rate narrative.

Gold fell 1.44% to close the week at 2293.78, below key support level. The bulk of the fall in gold price occurred last Friday as it fell more USD 90 in a single day. Higher for longer policy rate narrative was supported given the unexpected beat in the employment data and average hourly earnings. Immediate support at 2275.

Economic News This Week

-

Monday – JP GDP/BoP Current Acc., Norway,CPI, EU Sentix Inv. Confid.US NY Fed 1Yr Inf. Exp.

-

Tuesday – AU Biz Confid., JP Machine Tool Orders, UK Unemploy. Rate, US Small Biz Optim.

-

Wednesday – JP PPI, CH CPI/PPI, UK Indust. Pdtn/Mfg Pdtn/Trade Balance, US MBA Mortg. App./CPI/FOMC Rate Decision

-

Thursday – AU Unemploy. Rate, EU Indust. Pdtn, US Initial Jobless Claims/PPI

-

Friday – NZ House Sales/Food Prices, JP Indust. Pdtn, SW CPI, US Michigan Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.