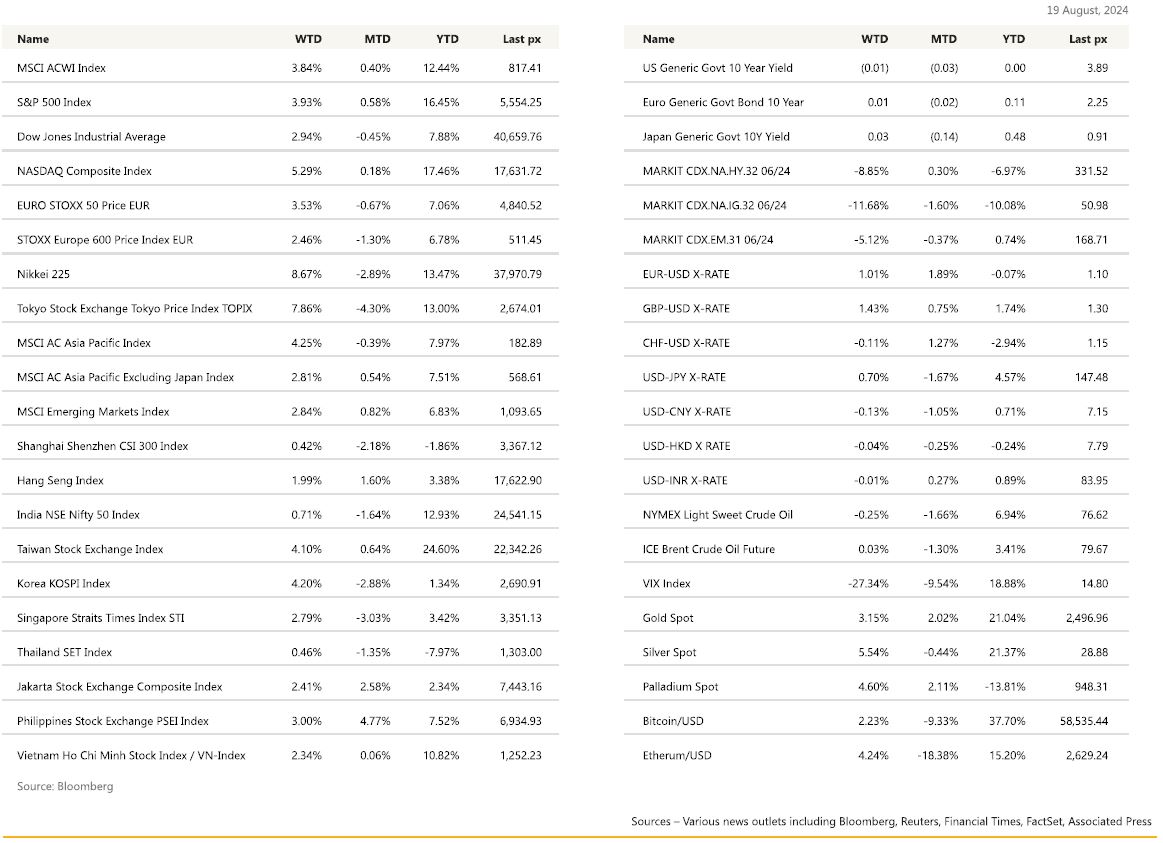

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

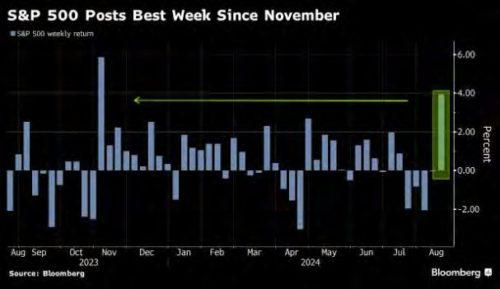

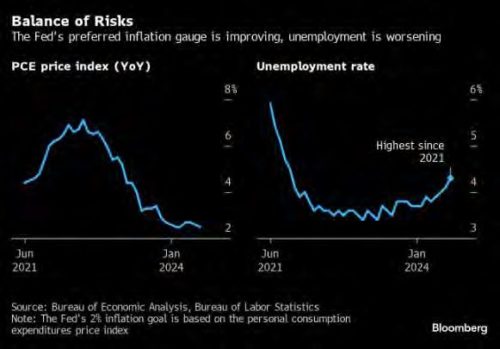

In a case of reverting to logical conclusions, good news is starting to equate to positive moves in the markets! US stocks posted its best week of 2024 after a big dead-weight, in dimming outlook for the US consumer was lifted following a better-than-expected Retail Sales data, as it showed a 1.0% MoM increase versus last month’s -0.2% helped ease fears of an economic slowdown. Weekly jobless claims fell by 7,000 to 227k which was lower than expected. This even prompted Goldmans to revise down its forecast for a recession next year from 25% to 20%, who cited these data as looking reasonably good, and possibly even a further downgrade to 15% if the economy continues its merry way. Such is the sentiment that the S&P 500 and the Nasdaq Composite both closed an admirable 4% and 5.4% respectively for the week. Cooler inflation earlier in the week also played a large part in the rally after the core reading in CPI came in as expected at 0.2% month-on-month whilst the headline year-on-year CPI reading fell to 2.9% from 3.0% previously. Core at 3.20% YoY, in line with consensus. In the details, however, worrying signs with a bounce in primary and OER rents. Shelter inflation is a focus for the FED; the bounce here increases uncertainty about the pace of the inflationary downtrend. Not enough to unwind a September rate cut, but pushes against a 50bp reduction. July Retails Sales printed higher than expected. Retail sales control group came out at +0.30% Vs +0.10% expected. The July industrial production report showed some underlying strength despite a 0.60% decline in the headline IP. Hurricane Beryl exacted a 0.30% drag on manufacturing output according to the Fed, Yet, manufacturing ex autos, still rose 0.30% in July.

Consumer sentiment rose to 67.8 for the first time in 5 months, the U. of Mich. Data showed with its inflation expectations unchanged. The Goldilocks narrative is back – slowing inflation, employment, and growth resilience and in the background, a Fed Reserve that’s about to cut interest rates.

The price action in Indices is starting to support the view that the grand rotation which saw the smaller cap outperform Mega-Tech, may be over (or close to) as both indices are starting to move in tandem.

The Fed’s engineering of a soft-landing seems to be in play.

Producer prices earlier in the week went the same way as the CPI, coming in lower than expected, solidifying expectations that the Fed will start easing policy in September to keep an overly restrictive stance from stalling the economy. 25 bps is all but baked in. We’ll get more of that from Chair Powell out of the Jackson Hole symposium this week. Fed officials have reinforced the view that the central bank is prepared to cut rates. St. Louis Fed president Alberto Musalem said Thursday the time for rate cuts is nearing, echoing similar comments by Atlanta Fed president Raphael Bostic, who told the Financial Times he was open to a September rate cut, and Chicago Fed president Austan Goolsbee on the labor market and inflation.

Data this week will be light with only the last FOMC minutes and jobless claims to be of note. Jackson hole retreat will commence Friday and into the weekend. The Democratic National Convention (DNC) will be happening in Chicago, starting today till 22nd of August. In terms of macroeconomic data in the US, the latest FOMC meeting minutes will be released on the 22nd and the August manufacturing & Services PMI also will be released on the 22nd.

Cryptos had a quieter week as well hovering between BTC$56,200 andBTC$61,750.

It may be time to re-take the small/mid-cap train again, especially given a heavy tilt of a rate cut next month irrespective of the size of the rate reduction. The Russell 2000 Index is up 5.67% ytd but off its highs last seen in July: The Heptagon-Driehaus US Small Cap Equity Fund.

Europe

The Stoxx 600 index closed up 0.31%, to record a weekly gain of 2.4%. Autos stocks recorded the biggest sectoral gain, adding 1.06%, while oil and gas stocks lost 0.15%.

Eurozone’s second estimate of Q2 GDP growth unchanged from flash at 0.3%. The ECB has acknowledged that the recovery is weak and there remains downside risks to growth. Monthly Eurozone industrial production missed expectations, down 0.1% m/m vs consensus at 0.5% and compared with prior 0.9% dop. This leaves industrial output in the aggregated Eurozone down for the 5th consecutive quarter. Despite signs of weakening in activity, the labour market is still quite resilient. Eurostat data showed employment expanding 0.2% on the quarter, while the unemployment rate is at 6.5%, after ticking up in June from May’s all-time low of 6.4%.

ECB has published insight of Eurozone banks and found some lenders too optimistic when valuing commercial property. They have found frequent misconceptions and may be inflating the value, which effectively masks deterioration in asset quality, which means the collateral backing loans may be worth less than assumed. In addition, inspections found out some banks are basing valuations on transaction data from 2021 or earlier and do not adjust to reflect market downturns or different economic circumstances.

This week, on activity, the main releases will be the EA August flash PMIs on Thursday, EC flash August consumer confidence on Friday. On inflation, the EA July final HICP on Tuesday and the ECB survey of consumers’ expectations on Thursday.

UK inflation surprises on the downside. Headline CPI at 2.2% y/y vs consensus of 2.3%, while core eased to 3.3% vs 3.4% forecast. The rise in headline rate has been widely expected amid a pickup in household has and electricity prices yet was offset by fall in restaurant and hotel prices. The BoE has forecast headline inflation to accelerate to 2.8% by the end of the year and then easing back towards target by end of 2025 and under target by late 2026. Real GDP grew 0.6% q/q following unrevised growth of 0.7%. Monthly GDP data for June suggest the economy flatlined in the final month of the quarter, with service sector output contracting and industrial production and construction contributing positively.

With these data in mind, UK interest rate markets have increased BoE rate cuts bets. Bloomberg noted that the market is fully priced for two rate cuts by year-end compared with 44 bps last Tuesday. It is the first time in 2 weeks that the swaps market is pricing two cuts. In addition, it is pricing in a 45% chance of a September move, though economists are still split on the timing on the next cut. With the economy performing better-than-expected, majority still anticipate a very cautious BoE rate cut cycle. Both wages and services prices are moving in the right direction, yet still at levels inconsistent with meeting its inflation target sustainably.

This week, we will have data on the public sector finances for July on Wednesday and flash PMIs for August on Thursday.

Asia

Asian equities finished higher almost everywhere Friday, taking WTD returns for MSCI Asia ex Japan to +2.81%. The region led by Japan stocks with the Nikkei recording its first weekly gain in a month, up 8.67%. Rest of North Asia – Korea and Taiwan, was also higher by more than 4%. Main catalyst was broadly pinned on a stronger than expected US retail sales report, placing the goldilocks scenario back into play.

In Japan, wholesale inflation accelerated in July, The corporate goods price index (CGPI), which measures the price companies charge each other for goods and services, rose 3% in July from a year earlier. Q2 GDP grew 3.1% annualized, or 0.8% from previous quarter. Spending on services such as dining was unchanged, purchases of semi-durable goods like clothing gained 2%, while consumption of cars, appliances and other durables was up 8.1%. Purchases of non-durables such as food rose 0.8%. The strong rise in consumption and backing the case for another near-term interest rate hike. Separately, Japanese Prime Minister Fumio Kishida said on Wednesday (Aug 14) he will not seek re-election as head of his party.

China activity data- Output from factories in China slowed for a third month in July. Data from the National Bureau of Statistics (NBS) showed industrial output grew 5.1% from a year earlier, slowing from the 5.3% pace in June. But retail sales rose 2.7% in July, up from a 2.0% increase in June. On Loans, central bank data showed new bank loans plunged to a 15-year low in July, while other key gauges showed export growth slowed, and factory activity slumped as manufacturers grapple with tepid domestic demand. China’s latest economic data suggests the world’s second-largest economy will be lucky to reach its 5% growth target for this year.

India CPI CPI inflation expectedly gapped down to below 4% in July — printing at 3.54% versus the 5.1% in June. On a sequential basis, headline CPI prices rose 0.9% month on month.

Daughter of divisive political heavyweight Thaksin Shinawatra, Paetongtarn sailed through a House vote on Friday, winning 319 votes, or nearly two-thirds of the house to become Thailand’s second female prime minister and the third Shinawatra to take the office.

Other news from Asia – Korea’s seasonally adjusted unemployment rate unexpectedly fell 0.3%pt to 2.5%. Singapore’s economy grew 2.9% in the April-June quarter from a year earlier. Singapore’s external demand outlook is expected to be resilient for the rest of the year the trade ministry said, though it noted downside risks remained from any intensification of geopolitical and trade conflicts or if global financial conditions stayed tighter for longer than expected.

This week, investors will be looking to central bank meetings in Indonesia and South Korea for signs of policy easing.

GeoPolitics

Middle East tensions also in focus on early in the week amid a report that Iran could attack Israel within next 24 hours (13 Aug) . The US is now deploying a guided missile sub, and accelerating the arrival of an aircraft carrier (the USS Abraham Lincoln), amid concerns over a possible Iranian attack on Israel following the assassination of Hamas leader Ismail Haniyeh. Hezbollah had launched 30 rockets into Israel last Monday though no causalities have been reported thus far. Despite the headlines, some analysts have noted chance of material supply disruptions remains low and geopolitical risk can only carry oil prices so far.

On Tuesday last week, the State Department approved a series of potential weapons sales to Israel worth over $20 billion that includes F-15 fighter jets and tank munitions.

Today 19th Aug, US Secretary of State Antony Blinken has arrived in Israel in his latest effort to push for a ceasefire and hostage-release deal in Gaza. Mr Blinken will attempt to maintain pressure on the Israeli leader when they meet on Monday. Hamas accused Israeli Prime Minister Benjamin Netanyahu of putting “obstacles” in the way of an agreement and “setting new conditions and demands” with the aim of “prolonging the war”. It added it holds him “fully responsible” for thwarting mediators’ efforts and “obstructing an agreement”.

India and the UAE. India has completed its first crude oil transaction with the UAE using local currencies, bypassing the US dollar. The transaction is integrated with the XRP Ledger System CryptoTradingFund (CTF). Both India and the UAE have been strong supporters of the overall BRICS mission to ditch the US dollar. The two nations have struck multiple deals already together, but this is the first of its kind fully bypassing the greenback. This could mean a more efficient system using blockchain tech while reducing the transfer costs associated with the USD. It’s a significant development for not just the UAE and India, but all of BRICS.

Credit / Treasuries

The US Treasury market was much less volatile than the previous week. The 2years yield gained 1bp, the 5years lost 2bps, the 10years lost 4bps and the 30years lost 6bps. In term of credit spreads, 5years US IG tightened by 6bps over the week and are now only 3bps wider than their tightest level reached this year about a Month ago. 5years US HY credit spread tightened by 31bps last week and are now trading 20bps wider than their tightest level touched around mid-March this year.

In term of performances US IG & US HY gained about 1.10% last week.

FX

DXY USD Index fell 0.65% to 102.46. Strong US Macro data eased fear of imminent US recession, while continuation of disinflation trend continue to support the belief that the Fed will soon begin cutting rates. US Headline CPI slowed to 2.9% (P: 3.0%) and Core CPI 3.2% (P: 3.3%). US Retail Sales grew 1.0% mom (C: 0.4%; P: 0.0%) while Retail Sales (ex-Auto) rose 0.4% mom (C: 0.1%; P: 0.5%) in July. US Initial Jobless Claims fell to 227k in the week ending August 10 (C: 235k; P: 233k) and Continuing Claims fell to 1,864k in the week ending August 3 (C: 1870k;P: 1,871k). NFIB Small Business Survey rose to 93.7 in July (C: 91.5; P: 91.5). University of Michigan Consumer Sentiment rose to 67.8 (C: 66.9, P: 66.4).

GBPUSD rose 1.43% to 1.294, driven by solid UK GDP and retail sales, as well as positive risk sentiment. UK 2Q24 GDP rose 0.6% q/q (C: 0.6%; P: 0.7%), driven by government spending, investment, net trade, and inventories, while Retail Sales ex Fuel Volumes gained 0.7% m/m in July (C: 0.6%; P: -1.5%). However, UK inflation in July was less than consensus. Headline CPI rose to 2.2% yoy (C: 2.3%; P: 2.0%), Core CPI fell to 3.3% yoy (C: 3.4%; P: 3.5%), and RPI Inflation rose to 3.6% yoy (C: 3.5%; P: 2.9%) in July

USDNOK fell 1.21% to 10.676. Norges Bank maintained its policy rate at 4.50% at its August meeting (C: 4.50%). In line with expectations, the Board’s focus was divided between currency weakness and softer-than-expected inflation data. These countering forces meant that Norges Bank stayed clear of committing to a first rate cut timing.

USDJPY rose 0.70% to 147.63, driven by positive risk sentiment. Intra-week, USDJPY sharply fell toward 146.08 amid headlines that Prime Minister Kishida would not run for the next term as the leader of Japan’s ruling party. USDJPY rebounded to close the week higher following strong US macro data. Data wise, Japan 2Q24 Real GDP rose 3.1% q/q (C: 2.3%; P: -2.9%) driven by strong private consumption and capex.

AUDNZD rose 0.57% to 1.1018. AUD was supported by beat in July Australia job growth. AU Jobs rose 58k in July (C: 20k). Participation rate rose to a record high of 67.1%, which resulted in the unemployment rate ticking up to 4.2% (C: 4.1%; P: 4.1%). In NZ, RBNZ delivered a 25bp cut alongside dovish guidance from Governor Orr that the RBNZ is now “confident” about inflation returning to target. He noted that weakening economic activity “has become more pronounced and broad-based,” describing the economy as “contracting faster than anticipated”.

Commodity

Oil future price movement was mixed last week, with WTI falling 0.25% to 76.65 and Brent rising 0.03% to 79.68. According to the weekly EIA Crude Oil Inventory Report, US crude oil inventories increased by 1.4 million barrels in the week ending August 9. In addition, OPEC announced a cut to its demand forecast for 2024 by 135kb/d. Oil prices were supported by Middle East tensions, as White House spokesperson John Kirby commented that the US shared Israel’s concerns that an attack is “increasingly likely” and that its timing “could be this week”.

Gold rose 3.15% to a new YTD high of 2508.01, breaking the strong resistance level of 2500. Positive risk sentiment and a fall in US treasury yields (resulting in weaker USD) likely contribute to the gain in Gold prices.

Economic News This Week

- Monday – JP Core Machine Orders, US Leading Index

- Tuesday – NZ Hse Sales/ Trade Balance, CH LPR, AU RBA Mins., SW Riksbank Policy Rate, EU/CA CPI

- Wednesday – US MBA Mortg. App.

- Thursday – AU/JP/EU/UK/US Mfg/Svc/Comps PMI Aug Prelim., Norway GDP, US Initial Jobless Claims/ Existing Home Sales, EU Cons. Confid.

- Friday – NZ Retail Sales, UK Gfk Cons. Confid., JP Natl CPI, EU CPI Exp., CA Retail Sales, US New Home Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.