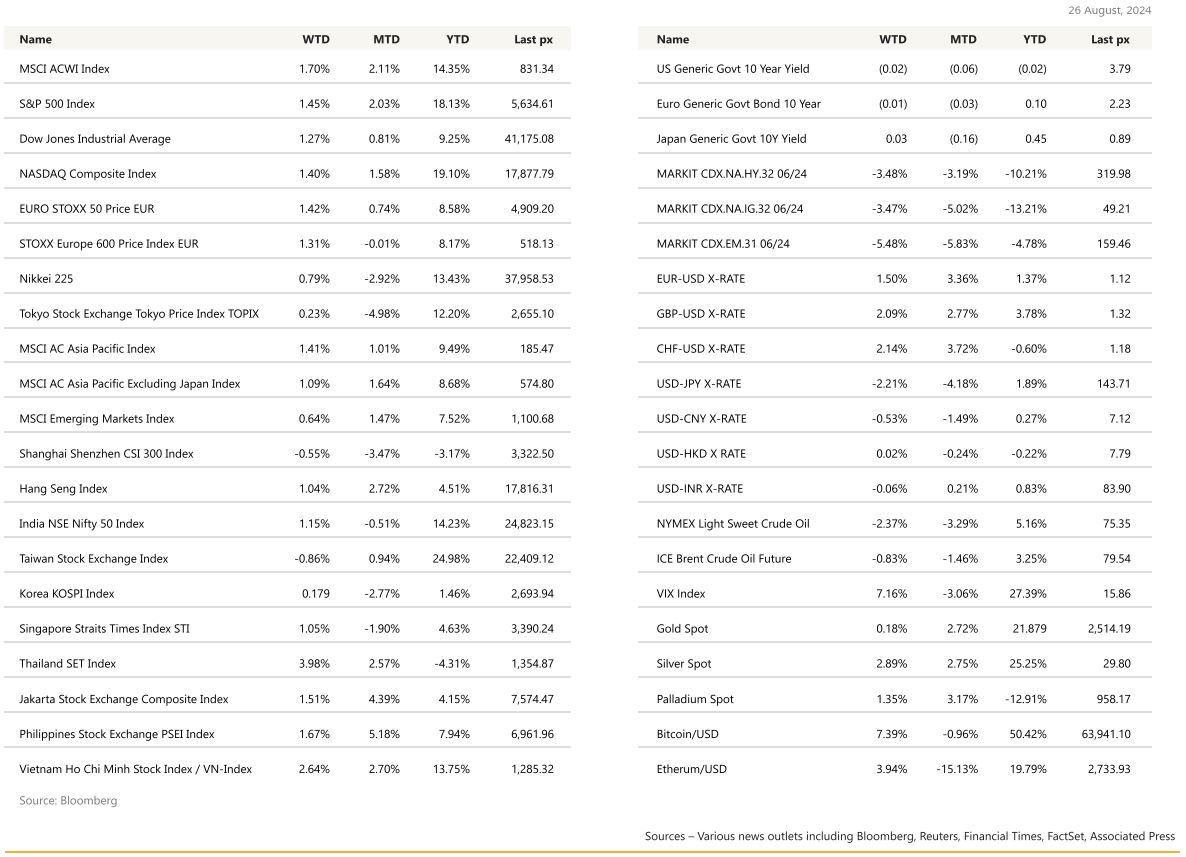

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

The event everyone was waiting for took place Friday night, when Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole symposium cemented bets that the central bank will start cutting interest rates next month. Powell made clear his intention to prevent further cooling in the labour market and acknowledged recent progress on inflation. US markets rallied with real estate taking the podium as the best finisher up 3.6% for the week. The 3 major indices ended up around 1.5% for the week whist the Russell 2000 rallied 3.6%. Powell reiterated that the “pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks”. The UST10Y yield fell 5.5 bps to 3.799% whilst the more sensitive 2Y yield fell 9 bps to 3.915%. The dollar weakened across the board. Turning to data releases during the week, initial jobless claims barely rose last week, signalling that the labour market is moderating only gradually. The fourweek moving average, which smooths out some of the volatility, fell to the lowest in a month. Sales of previously owned homes rose in July for the first time in 5 months, suggesting the housing market is poised to stabilise as mortgage rates decline. Futures markets are pricing in a high probability that the central bank’s benchmark rate will be reduced by a full percentage point over the next three meetings:

Source: Bloomberg

The last FOMC minutes indicated that several Fed officials acknowledged there was a plausible case for cutting interest rates at their July meeting before the central bank’s policy committee voted unanimously to keep them steady. “Several observed that the recent progress on inflation and increases in the unemployment rate had provided a plausible case for reducing the target range 25 basis points at this meeting or that they could have supported such a decision.” Clearly, the focus has now shifted to the Fed’s other mandate of employment, with “some participants noting the risk that a further gradual easing in labour market conditions could transition to a more serious deterioration.” Data published Wednesday by the Bureau of Labor Statistics, the US Preliminary Benchmark Revisions showed payroll growth in the year through March was likely overstated by 818,000, underscoring the notion that the labour market has been cooling more and for longer than previously thought. The minutes offered little guidance on any changes to the continued wind-down of the central bank’s balance sheet, noting only that officials “judged that it was appropriate to continue the process of reducing the Federal Reserve’s securities holdings.” Fed-speak from earlier in the week echoed the sentiment with Minneapolis’ Kashkari suggesting he’s open to lowering rates in September and SF’s Daly saying that she has “more confidence” that inflation is under control. It should be noted that there are still 3 more inflation reports and 1 more employment due before the next FOMC announcement on September the 18th. Manufacturing activity improved from last month.

This week will see durable goods orders, consumer confidence, personal income & spending, and the Fed’s preferred inflation gauge, PCE at the end of the week. Headline YoY PCE is expected to pick up to 2.6% from 2.5% previously and core MoM to come in unchanged at 0.2%.

Unsurprisingly, with the weaker $, gold rallied as did cryptos with BTC at $63k and ETH at $2,750.

We continue to favour mid-capped stocks in utilities (electricity generation) and would add Cadence Design Systems, a leader in electronic system design, building upon more than 35 years of computational software expertise. Cadence’s design realization solutions are used to design and develop complex chips and electronic systems, including semiconductors.

Europe

Europe markets close 0.5% higher after Powell, at the Fed’s annual retreat in Jackson Hole said that ‘’The time has come for policy to adjust…The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks’’. We see the British pound gained 0.8% against the US dollar to trade above $1.319 which is its highest levels since March 2022 while the Euro strengthened 0.58% to $1.118.

Eurozone August flash PMI data showed a surprising uptick, with composite PMI rising from 50.2 to 51.2 vs 50.1 expected. The increase was primarily driven by a surge in French services activity, which was largely attributed to the Olympic games. New orders were weaker at 43.6 vs 44.1 previously. While services PMI climbed to 53.5 and manufacturing continued to struggle with the output PMI at a contractionary 45.7. The Euro area July HICP was left unchanged in the final print. The headline inflation increased to 2.6% yoy while core inflation was stable at 2.9%.

The ECB minutes for July signaled the next key decision to come at 12 September meeting. Governing Council member Kazaks who is known for his hawkish stance, expressed openness to discussing a rate reduction, citing confidence in inflation returning to 2% target and concerns about economic growth. Policymakers noted extensive new data would be available and widely seen as a good time to reevaluate level of policy restriction. This sentiment aligns with market expectations of a second cut following June’s initial decrease. Recent inflation expectations data also supports further policy easing, with the 5 year forward inflation swap below 2.1% for the first time since October 2022, down from over 2.3% last month.

In terms of earnings, European Q2 showed improvement, with EPS growth reaching 3% in Europe, surpassing consensus estimates. However, market reaction remained subdued due to cautious full-year outlooks from companies. Cyclical sectors underperformed, particularly in Europe, while financials demonstrated strength.

In the UK, the Composite PMI recorded a four-month high of 53.4 vs 52.9 forecast. Services sector activity was also at its highest since April at 53.3. S&P global said the level of PMI is consistent with quarterly expansion of approximately 0.3%. The increase in activity was supported by an upturn in new orders, which contributed to an increase in staff hiring. As such, we see the rate of employment growth the fastest since June 2023. While labor markets seem to be holding up better than the BoE expects, inflationary pressures continue to moderate.

BoE Governor Andrew Bailey spoke at the Jackson Hole symposium, and he identified himself more clearly with the more benign and dovish inflation scenario laid out by the BoE in August, leaving the impression that further cuts lie ahead. Investors were pricing a roughly one in three chance of the BoE cutting interest rates by a further quarter point at its September meeting. Median forecasts show Bank Rate at 4.5% at end March, 4.25% and end-June and final 2025 cut to 3.75%.

This week, the main data release in the Euro area will be the August CPI report on Friday where expectations are to fall to within touching distance of the ECB’s inflation target of 2%, while core inflation could ease to 2.8% and the unemployment rate for July releasing on Friday

Asia

Asian markets closed last week positive, with MSCI Asia ex Japan up 1.4%, taking YTD gains to 8.68%. Thailand was the best performer last week, up close to 4%.

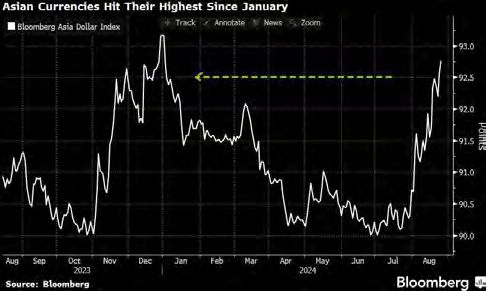

The highlight last week was Powell who confirmed that we will shortly be entering an easing cycle and that the fight against inflation is done. The Bloomberg Asia Dollar Index kicked off the week by advancing to its highest since January. The Korean Won climbed, while Singapore’s Dollar advanced to its strongest in almost a decade as traders weighed the difference between the local monetary authority’s relatively hawkish policy outlook compared with that of the Fed.

Japan data – Japan’s trade balance, which showed that export growth accelerated up to +10.3% year-on-year (vs. +11.5% expected), whilst imports were up by +16.6% (vs. +14.6% expected), which is the fastest growth for imports since January 2023. Japanese core inflation rises to 2.7% in July. Japan is ramping up promotional efforts to boost seafood exports to more destinations in Asia, the U.S., and Europe as it seeks to fill a sales gap left by a year-long Chinese import ban, the head of the Japan External Trade Organization said. China, previously the biggest market for Japanese seafood exports, banned purchases of Japanese-origin seafood citing risk of radioactive contamination.

The People’s Bank of China left the rate on its one-year policy loans, or the medium-term lending facility, at 2.3%. The one-year loan prime rate was unchanged at 3.35%, and the five-year rate remained at 3.85%. The decision underscores Beijing’s cautious approach in supporting the economy, even as China reported a rare contraction in bank loans amid weak demand. The PBOC has been walking a fine line of stimulating growth and cooling a government-bond buying spree to limit financial risks in recent months. Reflecting the lacklustre performance of the economy, the CSI 300 Index of stocks closed lower by 0.55% for the week and down 3.17% YTD.

Taiwan’s export orders rose +4.8% y/y, more than expected in July. Ministry sees August orders between +6.7% and +11.0% y/ y. Taiwan’s orders in July for telecommunication products increased 11.0% from the prior year, while electronic products rose 2.2% from a year earlier.

The consumer price index — Malaysia’s main gauge of inflation rose 2.0% in July from a year earlier, the Department of Statistics Malaysia said in a statement.

Asian central banks – The Bank of Korea kept its key interest rate at 3.50% on Thursday. The BOK also downgraded forecasts for both growth and inflation this year opening up an October cut possibility. Bank Indonesia (BI) kept its 7D repo rate unchanged at 6.25% as expected Wednesday and has lined up cuts in the fourth quarter. Bank of Thailand kept policy rate at 2.5%, also as widely expected despite pressure from new government officials to trim rates as economic growth remains tepid; bank still concerned with high household debt.

GeoPolitics

Israel – Palestine – US: Antony Blinken said Benjamin Netanyahu accepted a Gaza cease-fire “bridging agreement” and that “the next important step is for Hamas to say yes. But Hamas said on Tuesday that the new proposal was a “reversal” of the previous US-backed plan and showed an “American submission to the terrorist Netanyahu’s new conditions and his criminal plans towards the Gaza Strip.” Members of Israel’s negotiating team say Netanyahu is purposely sabotaging the deal, and that he only agreed to the US proposal because he knew Hamas would reject it. Hamas is calling for the ceasefire proposal presented by President Biden in May to be implemented.

Hezbollah launched hundreds of rockets and drones at Israel early on Sunday as Israel’s military said it struck Lebanon to thwart a bigger attack. It was one of the biggest clashes in more than 10 months of border warfare. The Iran-backed Lebanese group said it had fired 320 Katyusha rockets towards Israel and hit 11 military targets in what it called the first phase of its retaliation for Israel’s assassination of Fuad Shukr, a senior commander, last month. The strikes destroyed thousands of launcher barrels, aimed mostly at northern Israel but also targeting some central areas, Israel’s military said.

Australia and Indonesia: Both countries have agreed on a treaty-level defence cooperation agreement which allow Australian and Indonesian militaries to operate from each other’s countries. Australia has struck a number of defence deals in recent years, most notably the AUKUS military alliance with the United States and Great Britain that angered China. Indonesia’s Prabowo said at a forum last November that Indonesia was committed to its policy of non-alignment and would keep good ties with both China and the United States.

Ukraine – Russia: Ukraine attacked Moscow on Wednesday with at least 11 drones that were shot down by air defences in what Russian officials called one of the biggest drone strikes on the capital since the war in Ukraine began in February 2022. The war, largely a grinding artillery and drone battle across the fields, forests and villages of eastern Ukraine, escalated on Aug. 6 when Ukraine sent thousands of soldiers over the border into Russia’s western Kursk region.

US – China – Russia: The United States on Friday added 105 Russian and Chinese firms to a trade restriction list over their alleged support of the Russian military as Washington seeks to keep up pressure on Moscow’s war effort in Ukraine. The companies — 63 Russian and 42 Chinese as well as 18 from other countries — were targeted for a host reasons, from sending U.S. electronics to Russian military-related parties to producing thousands of Shahed-136 drones for Russia to use in Ukraine.

US Elections: RFK Jr. exit and endorsement expected to benefit Trump but likely only marginally.

Credit / Treasuries

US Treasury curve bull steepened last week, with the 2 years (-13 bps), 10 years (-8 bps) and 30 years (-5 bps) following Fed Chair dovish remark. US 10 years yield fell and closed the week at 3.799%. Key support level at 3.70%. Global credit spreads tightened driven by positive risk sentiment from imminent rate cut expectations (US IG -2 bps), (US HY -12 bps), (EM IG – 9 bps), (Europe IG -2bps)

FX

DXY USD Index fell 1.7% to 100.72 following Chair Powell’s dovish remark (“the time has come to adjust rates”) at Jackson Hole. Market is now pricing 103 bps of cuts in 2024. Data wise, S&P Global Composite PMI fell to 54.1 (C: 53.2 P: 54.3) as the Manufacturing PMI fell to 48.0 (C: 49.5; P: 49.6) while the Services PMI rose to 55.2 (C: 54.0; P: 55.0) in August. The data showed business activity in the US remained robust, which helped to alleviate imminent recession fears. Inflation data within the survey also showed it continues to slow. BLS preliminary estimate of the annual revision to payrolls showed a preliminary downward revision of -818k, which was on the larger end of market expectations. July FOMC minutes revealed that the majority of participants expects to cut rates in September if economic data continue to come in as expected.

EURUSD rose 1.5% to 1.119, while GBPUSD rose 2.09% to 1.3214 driven by the weak USD. EURGBP fell 0.59% to 0.8468 driven by positive risk sentiment and outperformance of UK PMI compared to Eurozone PMI. Eurozone PMIs showed higher services and weaker manufacturing, while UK PMIs showed better than consensus on both services and manufacturing.

USDSEK fell 2.49% to 10.18 driven by the weak USD. Riksbank cut rates by 25bp, as expected, and forward guidance flagged the possibility of two or three more cuts this year, conditional on the inflation outlook remaining the same.

USDJPY fell 2.21% to 144.37, closing the week below the strong support level of 145. BoJ Governor Ueda maintains his hawkish stance from the July monetary policy meeting that the BoJ could hike rates dependent on data developments. Data wise, Japan Core CPI (ex fresh food) picked up slightly to 2.7% y/y (C: 2.7%; P: 2.6%), while core-core CPI (ex-fresh food and energy) slowed to 1.9% y/y (C: 1.9%; P: 2.2%) in July.

AUDNZD fell 1.06% to 1.0901, as NZD benefited more from USD weakness. RBA minutes stated rates could be held for an “extended period” and pushed back against market pricing of ~20bp of cuts through the end of the year, as rates may need a “longer period than currently implied by market pricing” in order to return inflation to target.

Commodity

WTI fell to a low of 71.46, while Brent fell to a low of 75.65 intra-week last week, a level last seen in January 2024, as concerns over high OPEC+ supplies coupled with weaker demand, particularly from China faltering economy drove oil prices weakness. WTI and Brent rebounded and closed the week at 74.83 (-2.37%) and 79.02 (-0.83%) respectively, driven by positive risk sentiment from Jackson Hole on rate cut expectations.

Gold continued its upward trend, rising 0.18% to 2512.59, as Fed Chair Powell affirmed expectations that the central bank will start cutting interest rates next month.

Economic News This Week

-

Monday – CH LFR, US Durable Goods Orders/Dallas Fed Mfg Act.

-

Tuesday – CH Indust. Profits, SW PPI, US Cons. Confid./ Richmond Fed Mfg

-

Wednesday – EU M3 Money Supply, US MBA Mortg. App.

-

Thursday – NZ ANZ Biz. Confid., SW GDP, EU Cons./Svcs/ Indust./Econ. Confid., US GDP/Personal Cons./Core PCE/Initial Jobless Claims/Pending Home Sales

-

Friday – NZ Building Permits, JP Jobless Rate/Tokyo CPI/ Indust. Pdtn/Retail Sales, AU Retail Sales, UK Nationwide House Px, UK Mortg. App., EU CPI/Unemploy. Rate, CA GDP, US Personal Income/Personal Spending/PCE Price/Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.