KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

A fairly lackluster week that ended with the last 10 mins of trading on Friday night, pushing the S&P 500 to cap 4 consecutive monthly gains, as economic data supported expectations that the Fed Reserve will commence lowering interest rates mid-September. The S&P 500 advanced a percent on Friday ahead of an MSCI index rebalancing. The rally was broad-based with some 81% of the S&P 500 stocks trading above their respective 50-day moving averages.

We also saw the Fed’s preferred inflation gauge, the PCE holding steady at 2.5% from a year earlier, household spending picking up in July, and consumer sentiment rose for first time in five months. Core month-on-month PCE came in at a benign 0.2% unchanged, personal spending came in as expected at 0.5%, personal consumption earlier, came in better than expected at 2.9% from 2.3% previously. In company earnings, what appears to be the benchmark to go by, Nvidia, fell as its outlook failed to live up to elevated expectations, even as the company’s results showed strong growth in the latest quarter. Investors continue to bid up smaller, non M7 companies likely to benefit from lower interest rates and a still-expanding economy. The other tailwind for stocks is corporate demand for buybacks, which remains strong. The S&P 500 is just shy of its all-time high after rebounding from the previous selloff as recession fears faded. The Dow has set a new record high. The latest data showed the US economy grew at a stronger pace in the second quarter than initially reported, inflation data was softer than expected and jobless claims came below expectations. . Annualised GDP QoQ came in higher than expected at 3%. Financials were closely watched and ended the day up, after Wells Fargo analysts led by Mike Mayo said that a soft landing should be good for banks, which may outperform the market by as much as 10% after the first rate cut. Over the top expectations have been brutal on those companies that beat sales expectations but wasn’t enough to satisfy investors after big run-ups this year, for eg. consumer stocks like Foot Locker and Abercrombie & Fitch which fell by double digits. Still, equity flows continue to pour in US markets.

Trading in stock options shows that investors are positioning for gains after August’s wobble. The disinflation train continued with the U. of Mich. 1 Yr inflation expectation falling to 2.8% from2.9% whilst the 5-year outlook remained unchanged at 3%. This week will be a shortened week with markets closed tonight in observance of Labour Day. Key data to look out for will be ISM data on Tuesday, JOLTS on Wednesday, ADP Employment Change on Thursday, and the highly volatile non-farm payrolls on Friday. Bloomberg expects a +165k change and a drop in the unemployment rate to 4.2% from 4.3%. The $ was a tad stronger across the board and the yield curve bull steepened marginally with UST10’s closing at 3.90% and the 2’s at 3.916%.

With the VIX lower again, and the S&P 500 close to its record high set in July, we would suggest to put in place 5% out-of-the-money puts as a hedge given:

- September has been traditionally a negative month going back to the 1950s

- Everchanging dynamics of the upcoming US election

Europe

The Stoxx 600 index added less than 0.1%, bringing gains for the week to 1.3%. the index has rallied for the past four straight weeks, the longest streak since March, with investors growing increasingly confident that the ECB will lower rates.

Euro area HICP plunged to the lowest level since mid 2021 to 2.2% in August. Core inflation edged down to 2.8% from 2.9% but the drop was marginal at only 1bp from 2.85% to 2.84%. The main reason for headline getting much closer to the 2% target was energy inflation declining to -3% yoy, on the back of large base effects from last year and a fall in fuel prices this month.

Services inflation printed at 4.2%, up from 4% in July. Morgan Stanley reported that the expected a boost from the French Olympics, but the euro area print came higher expected and services inflation remained stable or increased in other countries. This has confirmed that disinflation process remains slow. Goods inflation printed at 0.4% yoy surprised on the downside. Meanwhile, unemployment data unexpectedly dipped to 6.4% suggested further labour market tightness.

Q2 2024 GDP growth for Germany was confirmed at -0.1% qoq. The details of the release showed that domestic demand took a major hit, deteriorating by more than consensus expectations. September consumer confidence deteriorated against expectations from -18.6 to -22. As a result, the euro area business cycle clock has been pushed further into recession territory and thus continues to underscore adverse economic growth concerns. The EC sentiment survey increased 0.6pt to 96.6 and it sent an important signal on inflation. The price expectation data, which correlate well with GDP deflator, remained stable in August, suggesting that the inflation rate of the GDP deflator is set to decline further reaching a level below 3% in the coming quarters. This is an encouraging sign as ECB expect the core inflation to decline significantly by the end of 2025.

Overall, the positive inflation news help sustain the upbeat mood evident at the Federal Reserve’s annual Jackson Hole symposium last week. Investors are now betting on 2 or 3 more ECB cuts this year, plus additional steps in 2025.

Compared to the US and in the Euro area, UK’s labour market report was on the stronger side thanks to solid activity data and modest pickup in pay growth. Payrolls were up, unemployment rate fell, meaning the Sahm’s rule is no longer triggered. Overall, UK’s economic data surprises remain decently positive. It is therefore unsurprising that market pricing for cuts by end of 2025 for the BoE is limited relative to the Fed and ECB.

This week, we will see a couple of data releases, manufacturing PMIs in the UK and Euro area on Monday, services and composite PMIs on Wednesday, retail sales in the Euro area on Thursday, and lastly, GDP in the Euro area on Friday.

Asia

Asian markets closed marginally higher last week, MSCI Asia Ex Japan closed the week up 0.45%. Hang Seng was the best performer while South Korea was the weakest, down 1% last week.

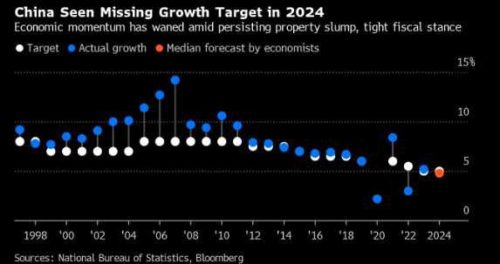

China data: July’s industrial profits grew faster than expected buoyed by high-tech manufacturing. Industrial profits grew +4.1% y/y. Growth in high-tech manufacturing was highlighted, which grew 12.8% YTD, contributing nearly 60% to the broad growth. Lithium-ion battery manufacturing, semiconductor equipment manufacturing and smart consumer device manufacturing were sectors that were singled out. Equipment manufacturing is seen as another pillar with its share rising to 35.1% of aggregate profits. China factory activity however contracted for a fourth straight month in August, according to an official poll of manufacturers.

The latest property sales figures showed a worsening residential slump, after China Vanke Co. — one of the nation’s biggest developers — underlined the industry’s woes late Friday by reporting a half-year loss for the first time in more than two decades. Asian shares edged lower this morning after ratcheting up four months of gains, as China’s efforts to support its ailing economy showed no signs of taking hold.

Last week, Bloomberg reported that China may allow homeowners to refinance US$5.4tn in mortgages with lower borrowing costs for millions of families and boost consumption. Under the plan, homeowners would be able to renegotiate terms with their current lenders before Jan, when banks typically reprice the fixed rate mortgages. They would also be allowed to refinance with a different bank for the first time since the global financial crisis according to news reports.

Hang Seng however was trading lower by 1.5% this morning. CSI is down 1.23%. UBS has cuts China growth forecast for 2024 and 2025 due deeper-than-expected property market downturn.

Japan services PPI inflation slowed by more than expected in July while prior month’s print was revised higher. Japan’s factory activity contracted at a slower pace in August thanks to a recovery in output and new orders, a private-sector survey showed, offering some hope for an economy that is starting to find its feet.

India first-quarter gross domestic product hits 15-month low of 6.7% in June quarter. Despite India’s GDP growth hitting a five-quarter low in the first quarter of the current fiscal, India remains the fastest-growing major economy in the world, as China’s GDP growth in the April-June quarter came in at 4.7%.

Malaysia is on track to reach 4-5% 2024 GDP growth, with inflation remained at 2%, and Q2 GDP is strong at +5.9% due to robust spending and export and imports reaching record highs in Jul driven by AI/ semiconductor related Electronic & Electrical products. Nomura upgraded Indonesian and Malaysian stocks to overweight from neutral, partly on their view that the two markets will benefit more from cuts to US interest rates.

Thailand – Tourist arrivals rose 24.6% y/y to 3.1m topped by Chinese returning. Foreign tourist arrivals rose 13.2% in July from the previous month, as reported by the Ministry of Tourism and Sports. Thailand exports surged more than 15% y/y.

Singapore Manufacturing production y/y +1.8% versus (4.3%) in prior month.

GeoPolitics

Prime Minister Justin Trudeau announced Ottawa will impose 100% tariffs on Chinese EVs, effective on 1-Oct, joining Washington and Brussels in protecting domestic car production. In addition, Trudeau’s government will also impose 25% tariff on Chinese steel and aluminum. Moves will certainly worsen its relations with China and could invite Beijing’s retaliations against Canadian agricultural exports.

Israel’s largest labor group is poised for a nationwide strike on Monday, the strongest push yet to force the government into a Gaza cease-fire and secure the release of hostages held by Hamas. Hundreds of thousands of Israelis demonstrated in cities around the nation on Sunday — in what appeared to be the largest protests since the Oct. 7 attacks — after the bodies of six hostages were found in a tunnel in the Gaza Strip.

The deal between Malaysia and Singapore to establish a special economic zone in Johor is likely to delay to Nov this year.

FX

DXY USD Index rose 0.97% to 101.70, driven by month-end USD buying and robust US GDP growth. Data wise, US Q2 GDP growth at 3.0% qoq (C: 2.8%), personal consumption at 2.9% (C: 2.2%). Year end GDP now at 3.1%, strongest pace since Fed started hiking rates in early 2022. Core PCE deflator at 2.8% (C: 2.9%). US conference board consumer confidence beat, headline up 1.4pts to 103.3 in August, now at highest level since February. Michigan Consumer sentiment at 67.9 (C: 68.1, P: 67.8); 1 year inflation expectation at 2.8% (C: 2.9%). Immediate resistance level at 102.30, 103. Support level at 101, 100.

EURUSD fell 1.29% to 1.1048, while GBPUSD fell 0.66% to 1.3127. EURGBP continued its downward trend, down 0.63% to 0.8415, driven by positive risk sentiment from easing of US recession risk. Data wise, Eurozone CPI came in in-line at 0.2% mom and 2.2% yoy.

USDJPY rose 1.25% to 146.17, driven by wider US-JP rate differential. US 10 years yield rose 10 bps, while JP 10 years yield was relatively unchanged. Data wise, Japan Tokyo Inflation came in higher than estimate, with headline rising 2.6% (C: 2.3%). Core inflation rose 2.4% (C: 2.2%), while Core-core inflation rose 1.6% (C: 1.4%).

AUDNZD fell 0.7% to 1.0825, continuing its long positioning reversal. Data wise, AU headline inflation beats consensus at 3.5% yoy (C: 3.4%, P: 3.8%). NZ business confidence surge. Activity outlook index more than doubled in August, from 16.3 to 37.1. Bounce follows the RBNZ lowering the policy rate much earlier than suggested by its previous guidance and should support a rebound from recession as policy continues to ease.

Commodity

WTI fell last week, with WTI and Brent falling 1.71% and 0.28%. This was despite the robust US economic data and worsening supply disruptions in Libya. Oil price movement continued to be dominated by bearish expectation from lower demand and higher OPEC+ output in the last quarter of 2024.

Gold fell 0.37% to 2503.4. Immediate resistance at 2530, while support level at 2475, 2440.

Economic News This Week

-

Monday – AU/JP/CH/SZ/SW/NO/EU/UK Mfg PMI Aug Final, AU Melbourne Inflation/Building Approvals

-

Tuesday – SZ CPI/GDP, CA/US Mfg PMI Aug Final, US ISM Mfg/ISM Prices Paid

-

Wednesday – AU/JP/CH/EU/UK Svc/Comps PMI Aug Final, NZ ANZ Commodity Price, AU GDP, EU PPI, US Mortg. App./Trade Balance/JOLTS/Factory Orders/Durable Goods Orders, CA BOC Rate Decision

-

Thursday – AU Trade Balance, SZ Unemploy. Rate, UK Construction PMI, EU Retail Sales, US ADP/Initial Jobless Claims/Svc PMI/Comps PMI/ISM Svc Index

-

Friday – EU GDP, CA Unemploy. Rate, US Nfp/Unemploy. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.