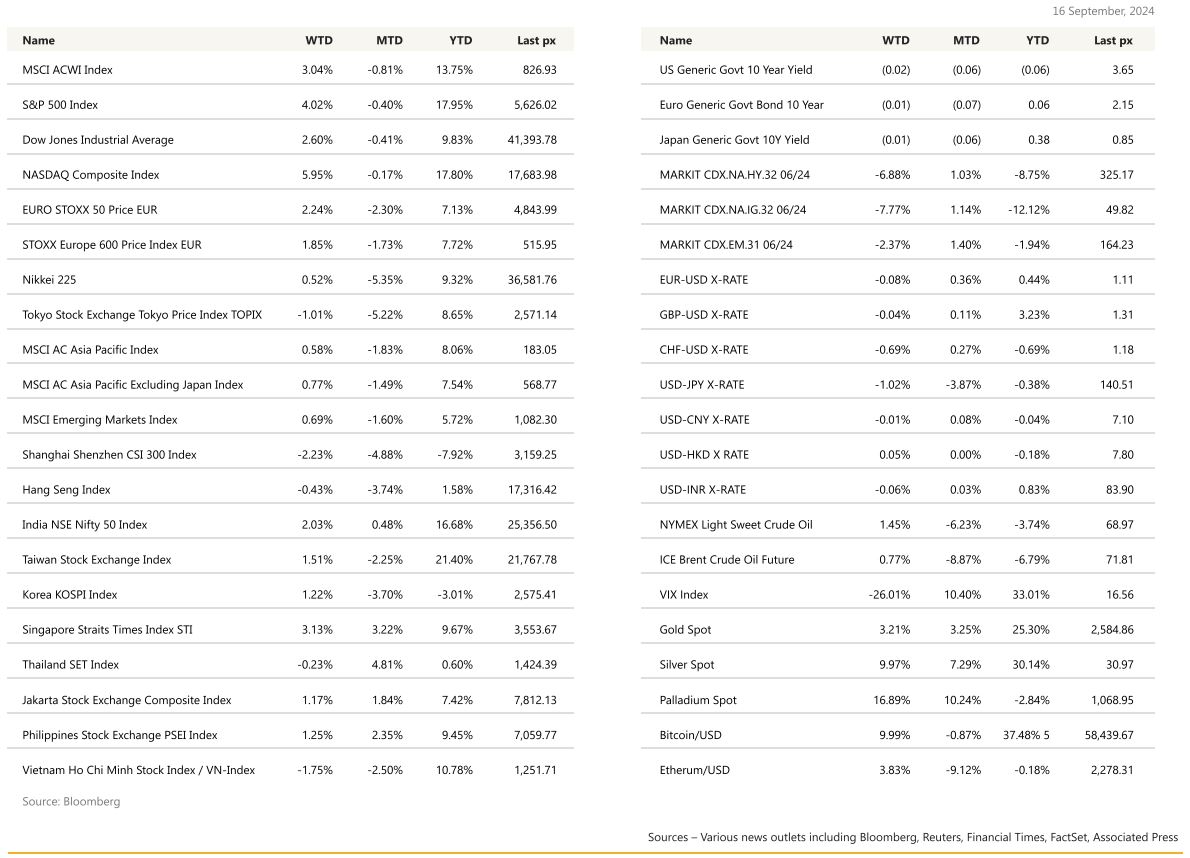

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

What a difference a week can make. The Nasdaq Composite rose 6% whilst the S&P 500 rallied 4% for the week. Mixed economic data this week reignited the debate over whether the central bank will ease rates gradually or start with an outsized half-point cut. Bond traders are once again ramping up wagers on a half-point interest-rate cut by the Fed next week, just days after that bet seemed all-but-over. On the US debate between Harris Vs Trump, most polls are showing that Harris won by 58% to 36%. ABS News/Ipsos polls are now showing that Harris is leading, among all categories of voters by a margin of roughly 5%.

A consumer price index report earlier this week showed underlying inflation accelerated slightly in August, setting the tone for gradual easing by the Fed. But the very next day, higher applications for unemployment benefits stirred concerns that growth is cooling too fast and renewed bets on accelerated cuts. Headline CPI came in on the nose at 2.5% from 2.9% previously whilst the core MoM rate came in a tad higher than expectations at 0.3%. PPI had a similar phenomenon with its core MoM at 0.3% from 0.2% whilst the YoY final demand release was also on the nose at 1.7%, down from a revised 2.1% previously. Initial jobless and continuing claims had its previous releases revised higher. All in all, the late recovery across the semiconductor sector is lifting the Tech sector and the market, as the acceptance that we will most likely only see a 25 basis point Fed Funds rate cut next week is clearly providing some lift to stocks. The thought of a 50 bps cut should it happen, may backfire – a lot would depend on how Chair Powell articulates their decision, should it happen, at his presser post FOMC, Thursday morning. The selloff we saw at the start of the month was blamed on hedge funds who continued to unwind their positions in US stocks after previous economic data fuelled concerns that the economy is cooling, and the Fed is moving too slow. Here are some highlights from the street, “at JPMorgan Chase & Co., Michael Feroli says he’s sticking with his call that officials will do the “right thing” and cut a half-point”, “In the event the Fed decides to go bigger, small caps would get a “significant rally” — and, would still rally with a “very dovish 25,” said Eric Johnston at Cantor Fitzgerald. The great rotation to small-mid capped stocks continues.

This week, all eyes will be focussed on what the Fed does – a 25 bps cut in the Fed Funds rate, its first since 2019 is what is widely expected Thursday. But before that, we have empire manufacturing on Monday and retail sales on Tuesday where it is expected to weaken from July’s.

Cryptos rallied with risk sentiment improving pushing BTC to $60k and ETH above $2,400.

We would like to add to some duration here as the Fed commences its easing cycle ~ 5 to 6 years, remaining in IG.

Europe

European stocks closed higher on Friday as investors continued to digest the ECB’s decision to cut rates. The Stoxx 600 closed 0.72% higher, with all sectors in positive territory. For the week, the benchmark added 1.09%. Retail stocks led gains Friday, up 1.84%, while autos added 1.6%. Food and beverage stocks were the sole outlier, dipping by 0.32%.

As widely expected, the ECB cut the deposit rate by 25bps, taking the deposit rate to 3.5%. The September move is unlikely to be the last. The monetary policy decision statement struck a balanced tone. It highlighted strong wage growth and high domestic inflation, but indicated progress is being made on bringing them down. New projections showed a weaker growth outlook and more stubborn core inflation. Updated forecasts see headline inflation averaging 2.5% in 2024, 2.2% in 2025 and 1.9% in 2026, unchanged from June. The forecasts for GDP growth were lowered by ppt for every year for the investment horizon. They stand at 0.8% for 2024, 1.3% for 2025 and 1.5% for 2026. The unchanged core inflation at the end of the horizon suggests that the downward revision to growth reflects a modestly more pessimistic view of potential output growth rather than cyclical weakness. The ECB narrowed the spread between the main financing rate and the deposit rate to 15bps from 50bps. The move was announced in March as part of the changes to the operational framework for implementing monetary policy and was intended to come into effect this month. The narrower corridor has little impact on the monetary policy stance.

There was little guidance on the next steps, both in the statement and in Lagarde’s press conference. The ECB will remain data dependent which suggests the ECB is currently continuing with quarterly cuts of 25bp. The door to an earlier move in October is open as the ECB stuck to its data dependent and meeting-bymeeting approach and gave no pre-commitment on rates. The ECB has now cut rates twice, in June and in September, and markets are currently betting on at least one more reduction by the end of the year. Given officials’ preference for using their quarterly economic forecast to guide them on policy moves, December might appear the more logical to act.

The euro rose 0.3% while euro area bonds held earlier losses. Money markets price in 5.5bps of easing in October, down 3bps on the day.

In terms of data, the Sentix survey, an indicator of sentiment among investors, is the first major survey in the euro area to be conducted and published each month, shows an ongoing decline in the outlook. Its not only the survey data that have been weak, including the industrial production number. Italy’s output fell by 0.9% mom, a much larger fall than expected by consensus of -0.2% mom, while Spain’s output was down 0.4% mom. Overall, euro-area industrial activity is generally sluggish and weak business sentiment data in August suggests an immediate recovery remains unlikely. With the August manufacturing PMI still in contractionary territory, we see little sign of a 3Q rebound in industrial activity. For now, euro area growth is likely to rely much more on the services sector.

In the UK, the BoE has relaxed its Basel III plan for capital requirements. New changes will come into force from 1 Jan 2026 instead of 1 Jul 2025. Bulk of the package already in force across major lenders. It has made concessions to ease capital requirements on small business lending, mortgages, trade finance and infrastructure, which means key capital thresholds for banks would rise by less than 1% over the next 4 years. The BoE said it would support growth and competitiveness, while also ensuring the UK aligns with international standards.

This week, the main data release will be the August final HICP on Wednesday, preliminary September consumer confidence on Friday in the euro area. Over in the UK, we have the CPI results on Wednesday and the BoE’s MPC meeting on Thursday. It is expected to keep rates unchanged at 5.00% and the MPC will also be voting on the size of the upcoming QT envelop.

Asia

Markets rebounded last week in Asia except for China, Hong Kong, and Vietnam. MSCI Asia ex Japan was higher by 77bps. Japan was somewhat mixed with the Nikkie 225 was higher by 52bps while TOPIX was lower by 1%. Japan GDP missed, up 0.7%qoq in Q2, consensus at 0.8%. Private consumption a touch below consensus at 0.9%qoq, business spending at 0.8%qoq. Markets in mainland China and South Korea are closed Monday for Mid-Autumn festival. Japan markets are closed for are closed for the Respect for the Aged Day.

CSI 300 was the weakest, down 2.23% last week. Pressure is growing on Chinese authorities to quickly ramp up fiscal and monetary stimulus to hit this year’s growth target of around 5%. Data published Saturday showed China’s industrial output growth( 4.5% year on year) slowed to a five-month low in August, while retail sales ( 2.1% in August) and new home prices weakened further. People’s Bank of China signalled in a rare statement alongside disappointing credit data that fighting deflation would become a higher priority and indicated more monetary easing ahead. The focus is now on October’s third quarter reading. Data so far suggests GDP will expand at 4.6%-4.7% for the period

The Thai market has experienced a strong rebound of 12% since early August, and Goldman has upgraded the market in anticipation of the launch of Thailand’s public fund ‘Vayupak’ which is expected to provide both sentimental and liquidity support.

Thailand’s average household debt however has reached a record high due to slow economic growth, lower incomes and high living costs, a university survey showed. The average debt per household was 606,378 baht (US$17,908), up 8.4% from the previous year. It was the highest average debt level since the survey began in 2009. The SET index is flat, up 60 bps YTD.

Other data from Asia: Japan manufacturer sentiment fell to seven-month low amid soft China demand. South Korea exports rose 24.6% y/y in first 10 days of September while its unemployment level fell slightly to 2.4% in August. RBA’s Hunter noted labour market still operating above full employment. Singapore’s central bank survey showed higher GDP growth and lower inflation forecast among economists. The Bank of Japan meets on Friday and is widely expected to hold steady. It may however lay the groundwork for a further tightening in October.

GeoPolitics

US elections: Geopolitics loomed large as ever with Republican presidential candidate Donald Trump the subject of a second assassination attempt on Sunday. Last week, in a preview of Trump 2.0, Goldman Sachs estimated that the economy would shrink by half a percentage point during Trump’s first year if he imposed all of his policies, including new tariffs on imports and a business tax cut that pushed annual deficits higher. Harris’s plan, by contrast, would modestly boost GDP growth, according to Goldman.

China – Canada: A spokesperson from China’s commerce ministry said preliminary evidence and information show dumping took place in imported canola from Canada, causing “substantial damage” to China’s domestic industry. Added China’s anti-dumping investigation follows WTO rules and is fundamentally different from Ottawa’s “discriminatory measures”.

China – EU: Spanish PM Pedro Sanchez said there does not need to be a trade war between EU and China, and two sides should seek to find compromise around planned tariffs. Sanchez said EU’s member states and the commission should reconsider its vote on EU tariffs on Chinese EVs.

Russia: Russian President Vladimir Putin on Thursday strongly warned the US against allowing Ukraine to use NATO missiles in long-range strikes inside Russian territory, saying the move would put the Western military alliance “at war with Russia.” Putin’s comments came after the White House was said to be finalizing plans to expand the areas inside Russia where Ukraine can use US and British-provided missiles.

China – Russia: Chinese state media confirmed the start of joint China-Russia naval patrols in the Pacific. Global Times said that Chinese warships and warplanes have arrived in the Peter the Great Bay and Vladivostok just ahead of the exercises, which will run through September. Russia and China could “combine their potential” if faced with aggression, Moscow’s foreign ministry has also asserted in the middle of tensions around NATO long range missiles.

Separately, Russia is said to be considering export limits on uranium, titanium, and nickel to protest Western sanctions

Iran – Russia: Iran’s President Masoud Pezeshkian will attend the upcoming BRICS summit in Russia, state media cited Tehran’s ambassador in Moscow as saying on Sunday, amid tensions with the West over military cooperation between the two countries.

credit treasuries

UST10’s closed at 3.65% and the 2’s declined to 3.58% lowest since September 2022. The shape of the US Treasury curve did not change at all last week, with all points on the curve being down by roughly 7bps. US 5years IG credit spreads tightened by roughly 4bps, or in other words gained what they lost the previous week. The exact same thing happened on US 5years HY credit spreads, tighter by 25bps last week. The same pattern happened on VIX which moved down from 21 to mid-16 last Friday. In term of performances, US IG gained 55bps last week, US HY gained 38bps and leverage loans were unchanged.

FX

DXY USD Index was relatively unchanged (-0.06%), closing the week at 101.114.

Data wise, Core CPI m/m surprises to the upside at 0.3% (C: 0.2%) with a re-acceleration in OER primarily driving the beat, while headline CPI m/m in-line at 0.2%. Core CPI y/y at 3.2%, while Headline CPI y/y at 2.5%. Headline PPI rose 0.2% m/m (C: 0.1%; P: 0.0%) and Core PPI rose 0.3% m/m (C: 0.2%; P: -0.2%) with downward revisions to July data. Michigan Consumer sentiment higher at 69.0 (C: 68.5). Market currently pricing 116 bps worth of rate cut in 2024. Expectations for a 50bp cut in Sep got further traction yesterday from an FT report, which suggested the Fed “faces a close call” whether to cut by a larger 50bps. We have the US retail sales this Tuesday and FOMC rate decision on Wednesday this week.

EURUSD rebounded from a low of 1.10 intra-week to close the week at 1.1075, unchanged from previous week after ECB lowered its policy rate by 25 bps to 3.5%, in-line with consensus. Forecasts show an anticipated downward revision to growth, but an upward revision to core inflation projections for 2024 and 2025. ECB President Lagarde maintains her data-dependent approach to future easing but said that growth risks are tilted to the downside. Market currently pricing 46% probability of an Oct rate cut.

GBPUSD closed the week at 1.3124 (-0.04%). Data wise, Average weekly Earnings came in at 4.0% (C: 4.1%, P: 4.5%), while unemployment rate came in at 4.1% (C: 4.1%, P: 4.2%).

USDJPY fell 1.02% to close the week at 140.85. Data wise, Japan 2Q24 GDP unexpectedly revised down to 2.9% SAAR (C: 3.2%; P: 3.1%), PPI m/m at -0.2% (C: 0.0%, P: 0.3%) and PPI y/y at 2.5% (C: 2.8%, C: 3.0%). Hawkish remarks from BoJ Board Member Tamura, who argued that Japan’s policy rater should be at least 1% in the latter half of the BoJ’s forecast horizon (late 2026) supported yen appreciation.

Commodity

Oil future rebounded last week, with WT2 and Brent closing the week at 68.65 (+1.45%) and 71.61 (+0.77%) respectively. WT2 and Brent fell to a year to date low of 65.27 and 68.68, as continued weakening in China’s oil demand signalled by soft import data sent oil prices sharply lower. 2n addition, weekly E2A report for the week ending September 6, showed a 0.8mn increase in crude oil inventories added to oil prices misery. However, the rebound in risk sentiment towards the end of the week drove the technical rebound in oil prices.

Gold rose 3.21% to close the week at 2577.7 (new YTD high), as the 2 years US treasury yields fell 6 bps to 3.58% and with the FOMC expected to cut interest rate on Wednesday. Based on RS2 indicator, gold is still not trading at overbought territory. Gold price remains on course to test the next key resistance level of 2600.

Economic News This Week

-

Monday – US Empire Mfg, CA Mfg Sales/Existing Home Sales

-

Tuesday – EU Zew Exp., US Retail Sales/2ndustrial Pdtn, CA CPI

-

Wednesday – JP Core Machine Orders, AU Westpac Leading Index, UK CP2/RP2, EU CP2, US Mortg. App./Building Permits/ Housing Starts/FOMC Rate Decision

-

Thursday – NZ GDP, AU Employ., Norway Rate Decision, UK BoE Rate Decision, US 2nitial Jobless Claims/Leading 2ndex/ Existing Home Sales

-

Friday – UK Cons. Confid., JP Natl CP2, CH LPR, UK/CA Retail Sales, EU Cons. Confid.

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.