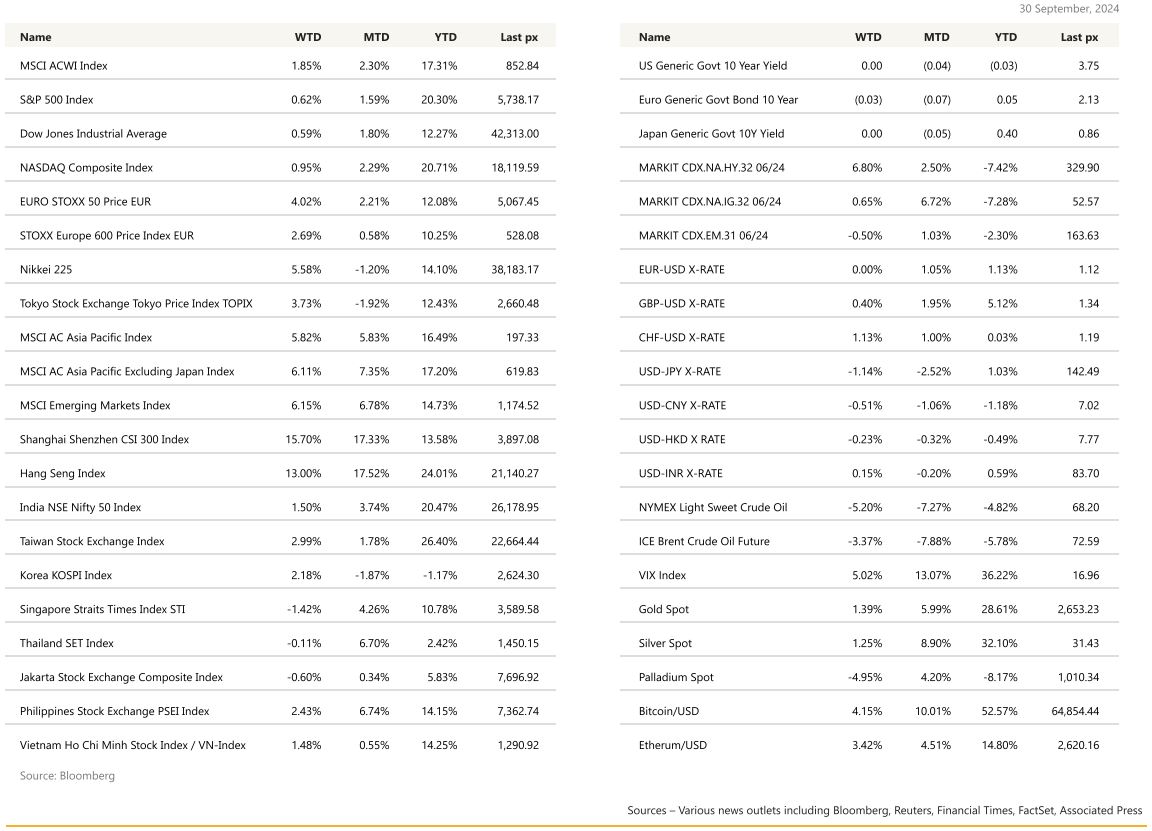

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

We saw yet another up week for US stocks, making it a 3- week consecutive gain, mainly on optimism the Fed Reserve will proceed with further rate cuts. September, which has been traditionally a negative month has held up well with the S&P 500 stretching ytd gains to 20%. Markets also enjoyed a fresh burst of optimism as policymakers globally move to support economic growth. Core MoM PCE came in lower than expected at 0.1% as did headline PCE YoY at 2.2%, within a whisker of the Fed’s target of 2%. Personal income & spending also came in lower than expected at 0.2% each, underscoring the Fed’s view that inflation is indeed under control. We also saw the U. of Mich. Inflation expectations for 1 Yr and 5-10 Yr coming in at a tame 2.7% and3.1% respectively. “Inflation is no longer the story in the PCE data for the Fed.” It’s now all about spending and keeping the economy strong,” said one manager. The data does suggest another 50 bps reduction in November is possible. What we are facing today is a rate-cut cycle when no recession takes place, which is positive for risk assets and investors are now of the view that the Fed and indeed, Chinese officials’ policies are sufficient enough to lift growth, said Bank of America Corp.

USD Bonds appear to be in a nice, sweet spot over equities, with the latter still struggling with relatively high valuations particularly in the tech sector. IG papers in the 3 year duration mark today are yielding around UST2Y + 80/85 bps (4.40%). UST10’s close at 3.75% up 1 bp whilst 2’s were at 3.56% down 3 bps, marginally steeper at 19bps for the week.

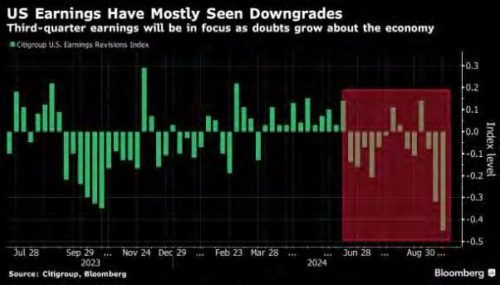

Initial jobless claims fell to a four-month low in the week ended Sept. 21, remaining muted despite a recent slowdown in hiring. Revised data showed the economy bounced back from the pandemic stronger than initially thought, while second-quarter gross domestic product grew at a 3% annualized pace, unchanged from a previous estimate and beating estimates at 2.9%. Still, sentiment remains fragile as investors await the next set of data. Again, what appears to be the main headwind going into year end is the upcoming US elections in November, with policies promised by both parties appear to be inflationary. Focus will now shift to October’s Q3 earnings season with a Citigroup Inc. index showing profit downgrades have picked up in recent weeks.

Fed-speak during the week heard Minneapolis’s Kashkari signalling support for lowering rates by an additional 50 bps this year, Atlanta’s Bostic said starting with a jumbo cut will help bring rates closer to neutral as risks between inflation and employment become more balanced. Meanwhile, Fed Governor Michelle Bowman in a speech Tuesday said the central bank should lower interest rates at a “measured” pace, arguing that inflationary risks remain and the labor market hasn’t shown significant weakening.

Cryptos did well for the week, joining the risk-on sentiment wagon, to trade at BTC $66k and ETH $2,650.

This week will see the JOLTS report together with ISM data, factory orders and the highly volatile non-farm payrolls at the end of the week. Bloomberg is expecting a pick-up of 146k with the unemployment rate to remain unchanged at 4.2%.

Europe

In the Euro Area, Inflation expectations of consumers in the euro area decreased in August. The ECB’s survey showed consumers becoming slightly less pessimistic on the economy, foreseeing a 0.9% contraction over the next 12 months compared with a 1% retreat previously.

The euro area PMI data were dovish almost entirely across the board. Manufacturing remains solidly in contraction; services activity is slowing notably (beyond what the Olympics would suggest) and services price indicators are easing substantially. The headline composite PMI now standards at 48.9 in September, down from 51.0 in August and the first time it has been contractionary since February. The fall in services price pressures resumed. Services output prices fell to 52.0 in September from 53.7 (and in France they are now contractionary), while services input prices fell substantially to 55.7 from 57.8. There were also easing manufacturing cost pressures.

In comparison with the euro area PMIs, the changes in the UK PMI indicators were more modest. There was a small downside surprise to the consensus on the composite PMI at 52.9 in September, down from 53.9 in August (consensus: 53.5), driven equally by services and manufacturing. At 52.9, this is still solidly in expansionary territory unlike in the euro area. There is also evidence that the UK is likely to face a tougher time with inflation persistence. There was essentially no change in the UK services PMI output and input price indicators and employment activity only weakened marginally and is still in expansion territory.

UK economic outperformance relative to the euro area adds to the risk of a slower BoE cutting cycle relative to the ECB. We only expect the BoE to cut rates at a quarterly pace, resuming in November and continuing until the terminal rate of 3.50% is reached in early 2026.

This week, we will the see the CPI results in eurozone on Tuesday, unemployment rate on Wednesday. In the UK, we will see GDP on Monday and the S&P Global PMIs on Friday.

The Swiss National Bank took a third step to loosen monetary policy this year last Thursday, bringing its key interest rate down by 25 basis points to 1.0%. The third trim comes amid similar signals from the European Central Bank and the U.S. Federal Reserve, which took the long-awaited plunge to slim down its interest rates with a 50-basis-point cut last week. Domestically, Swiss inflation remains subdued, with the latest headline print pointing to a 1.1% annual increase in August. The bank took its inflation forecast “significantly lower” than its June indications, citing the strength of the local currency, a weaker oil price and electricity price cuts announced for next January. The new outlook puts average annual inflation at 1.2% for 2024, 0.6% for 2025 and 0.7% for 2026, compared with 1.3%, 1.1% and 1.0% sketched out in June for the respective periods. The Swiss franc gained ground against major currencies on the back of the latest interest rate decision. The U.S. dollar and euro were down nearly 0.14% and 0.16% against the Swiss coin.

Asia

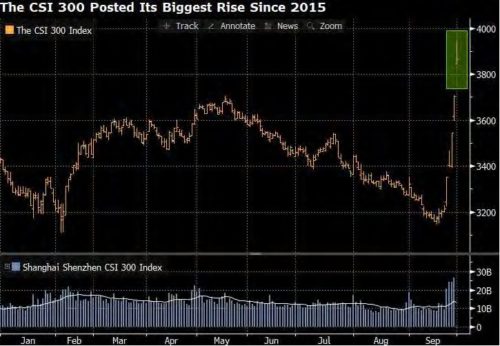

Markets are digesting the combined impact of China’s stimulus, softer US inflation, rising geopolitical tensions, together with the surprise Japan LDP election results. Investors are so underweight everything Chinese, and Chinese equities are extremely undervalued that a serious rally is entirely possible. With China stepping up at the same time as the Federal Reserve is cutting interest rates, and with oil prices remaining low, risk assets might do very well in the absence of geopolitical and black swan events. The CSI 300 was up 15.7% last week, while the Hang Seng was higher by 13%.

Key measures announced

- A 20bp cut in the 7-day repo rate

- A 50bp cut in the RRR Cut in Gut in outstanding mortgage rates, reduction of minimum down-payment ratio

- Funds and brokers to borrow money from the PBOC to buy stocks

- Further housing destocking facilitation for local governments

That will unleash 1 trillion yuan ($142 billion) in liquidity, Pan said. China may also cut the RRR further this year by another 0.25 to 0.5 percentage points at appropriate time, he added. China will also launch new monetary policy tools to support stock market, according to PBOC Governor Pan Gongsheng.

Japanese stocks dropped heavily in early trading on Monday in the first market session after Shigeru Ishiba’s victory in Japan’s ruling Liberal Democratic party election. Within 20 minutes of the open, the Nikkei 225 Index was 4.2 per cent lower, while the broader Topix dropped 3.2 per cent. With Ishiba now set to become prime minister on Tuesday, Japan’s new leader has indicated that he may call a snap general election in October.

Singapore’s core inflation rose to 2.7 per cent year-on-year in August, the first time it has increased in six months. The increase in August from the 2.5 per cent in July was largely due to a rise in services inflation, said the Monetary Authority of Singapore (MAS)

RBA kept the cash rate on hold, as expected, and forward guidance remained hawkish at its September meeting: the Board “cannot rule anything in or out” and will “remain vigilant to upside risks to inflation.

The Thai SET Index made new highs last week fuelled by the Fed 50bps cut, and mkt pricing in more cuts as risk appetite remained positive, but lost momentum towards the end of the week. Prospects of faster interest rate cuts from the BOT and the THB’s appreciation should continue to support the uptrend of the SET Index.

GeoPolitics

Egypt’s foreign minister warned Sunday (Sep 22) of the risk of an all-out regional war as fighting between Israel and Lebanon’s Hezbollah intensified, saying the escalation “negatively impacted” Gaza truce talks.

Israel launched airstrikes on targets across southern Lebanon, killing nearly 500 people in one of the deadliest days of fighting in nearly two decades and fanning fears of all-out war.

China has urged its citizens in Israel to leave “as soon as possible”, as tensions between Israel and Lebanon’s Iran-backed militant group Hezbollah escalate.

The front pages of Israeli newspapers on Sunday declared a “new Middle East.” Prime Minister Benjamin Netanyahu proclaimed the death of Hezbollah chief Hassan Nasrallah had knocked out “the main engine of Iran’s axis of evil” – a network of anti-Israel militias stretching from Hamas in Gaza to Yemen’s Houthis and allies in Syria and Iraq. Israelis who’ve spent the past 12 months fearing they’re surrounded by enemies and in astate of profound insecurity are being told the tide has turned. Even the possibility of direct retaliation from the Islamic Republic is doing little to dim the jubilation. “Israel changed the rules of the game,” said Kobi Michael, a former top official and senior researcher at the Misgav Institute for National Security and Zionist Strategy, a hawkish think tank. “Once Hezbollah is paralyzed, the entire axis is paralyzed. Iran is vulnerable.”

Meanwhile, Cease-fire talks between Israel and Palestine have stalled and about 100 Israeli hostages are still being held.

President Biden said he was “using every bit of energy I have” to try to halt the fighting in the hope that a “ceasefire in Lebanon” could pave the way to “dealing with the occupied West Bank and Gaza”. There was around 800 death last week in Lebanon.

Russia plans to raise Defence spending by $142B in 2025, or 6.2% of GDP

credit treasuries

US treasuries gained after PCE inflation data for August came in cooler than anticipated, showing that inflation continues to moderate. On the US Treasury curve, 2years yield lost 4bps, 5years unchanged, and 10 & 30years gained 1bps. US IG 5years credit spreads finished the week unchanged while US HY 5years credit spreads widened by 20bps.

Europe – French 10Years OAT yield now on par with 10Years Spanish Bonos. This spread was 50bps in favour of France six Months ago. As a reminder, the European Commission wants to bring public deficit below 3% and public debt below 60% of GDP. France’s debt on GDP was standing at 111% at the end of March this year, while its budget deficit is now expected to rise close to 6% in 2024. Some economists believe that : “the debt, economy and political situation in France all justify significant compensation to own French Government Bond. If France is unable to address structural issues, it will join Italy in the Eurozone periphery, with the country’s status as a semi-core credit now in doubt”. The 10years spread between France & Greece was 225bps two years ago and now stand at 20bps. 5Years French OAT yield is now 10bps higher than Greece.

In Asia HY, the China space saw rally continuing alongside Chinese equity markets. All benchmark performing property and industrial names closed 1 to 3.5pts higher with Vanke leading the way again. New World took a round trip, going +2pts higher in the morning session before moving -6pts lower at the lows, and closed unchanged to -1pt lower on the day. In India and Southeast Asia HY, while the rally looks to have legs, there was profit taking from private banks and hedge funds. Flows were two-way with carry bonds being lifted. Supply have been coming from accounts selling front end rotating into China.

FX

DXY USD Index fell 0.34% to 100.381. US Macro data was mixed last week. US Core PCE rose 0.13% m/m in August (C: 0.2%; P: 0.2%). Personal Income rose 0.2% m/m (C: 0.4%; P: 0.3%) and Personal Spending rose 0.2% (C: 0.3%; P: 0.5%). Composite PMI was at 54.4 (vs. 54.3 expected), continuing the run since May where all the readings have had a 54 handle. Conference Board’s consumer confidence print for September, where the headline reading slipped back to 98.7 (C: 104.0), and the monthly decline of -6.9pts was also the largest in just over three years. Weekly initial jobless claims fell to 218k in the week ending September 21 (C: 223k), which is the lowest they’ve been since May.

EURUSD closed the week unchanged at 1.1162. Composite PMI for the Euro Area was back in contractionary territory for the first time in 7 months, at 48.9 (vs. 50.5 expected), and both the French (47.4) and German (47.2) numbers were beneath 50 aswell. Overnight index swaps lifted the chance of an October rate cut to 82%, having been at just 26% the previous week.

USDCHF fell 1.11% to 0.8406, as SNB cuts rates by 25bps as expected. The statement notes further cuts may become necessary in coming quarters, this was more dovish than previous, where they will adjust policy if necessary.

USDSEK fell 0.75% to 10.0928, as Riksbank delivered a 25bp cut in their policy rate to 3.25% as expected. That marks their third rate cut this year, and they also signalled that further reductions were ahead, with their forecast for the average policy rate in Q4 at 3.11%, with a further decline to 2.38% in Q2 2025. Back in June, their policy rate forecast stood at 2.94% in Q2 2025, so that’s a noticeably more dovish path relative to last quarter.

AUDUSD rose 1.41% to 0.6903 (YTD high), as RBA maintained its policy rate at 4.35% as expected, and signalled that the Bank intends to stay on hold for an extended period. Australia consumer price inflation slowed to a three-year low of 2.7% y/y in August, down from a +3.5% gain in July, but aligning with market forecasts. Core CPI inflation remains elevated and above the RBA’s target range but did also ease. The trimmed mean inflation rate slowed to an annual 3.4%, from 3.8% in July.

USDJPY rose to an intra-week high of 146.49, alongside with a rise in UST yields on the back of healthy US macro data and as BoJ Governor Ueda reiterates his less hawkish stance. USDJPY eventually reversed and closed the week at 142.21 (-1.14% for the week), aided by repositioning in the case that Sanae Takaichi, who has recently opined against BoJ rate hikes and called for expansionary fiscal measures, wins the LDP leader election. Data wise, Tokyo core CPI (ex. fresh food) decelerated to 2.0% y/y in September (C: 2.0%; P: 2.4%), while Core-of-core CPI (ex. fresh food and energy) growth was unchanged at +1.6% y/y (C: 1.6%)

USDCNH fell 0.86% to 6.9816 (YTD low), breaking below the key psychological level of 7, as PBOC unveils broad stimulus measures to support the property and equity markets alongside policy rate and RRR cuts. The PBoC cut the 7-day reverse-repo rate by 20bp to 1.50% and the reserve requirement ratio by 50bp, which would release ~RMB 1tr of liquidity. The central bank also provided forward guidance stating that there is room for a further 25-50bp RRR cut for the rest of the year.

Commodity

Oil futures fell last week, with WTI and Brent falling 5.20% and 3.37% to close the week at 68.18 and 71.98 respectively as Saudi Arabia was reported to be committed to increasing output in December, while factions in Libya reached a deal that could open the way to returning some production. In addition, there was a report that OPEC+ countries subject to output caps have together pumped more than 600,000 barrels a day above their self-imposed limits this year.

Note that we have no official communication yet, but the existing OPEC+ production cuts are slated to expire on 1 December, and this will be a shift from the trend since 2022 where focus has been on cutting, rather than increasing, oil production.

Based metals rose last week, with Iron Ore leading the gain (7.61%), Copper and Aluminium rose 7.43% and 6.45% respectively. This was following China stimulus, where there seems to be more urgency tackling the slowdown in China economy this time round.

Gold continued its upward trend, rising 1.39% to 2659.24, as 2 years US treasury yield fell 3 bps. This put gold prices firmly in the overbought territory based on RSI indicator.

Economic News This Week

-

Monday – JP Indust. Pdtn/Retail Sales, NZ ANZ Biz Outlook, CH PMI, UK Nationwide Hse Px/GDP/Mortg. App, SW Retail Sales

-

Tuesday – JP Jobless Rate/Tankan Index , AU Building App. / Retail Sales, SZ Retail Sales, JP/SZ/EU/UK/US/CA Mfg PMI Sep Final, EU CPI, US ISM Mfg

-

Wednesday – EU Unemploy. Rate, US MBA Mortg. App

-

Thursday – NZ ANZ Commodity Price, AU/JP/SW/EU/UK/US Svc/Comps PMI Sep Final, SZ CPI, EU PPI, US Initial Jobless Claims/Factory Orders/Durable Goods Orders/ISM Svc

-

Friday – US NFP/Unemploy. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.