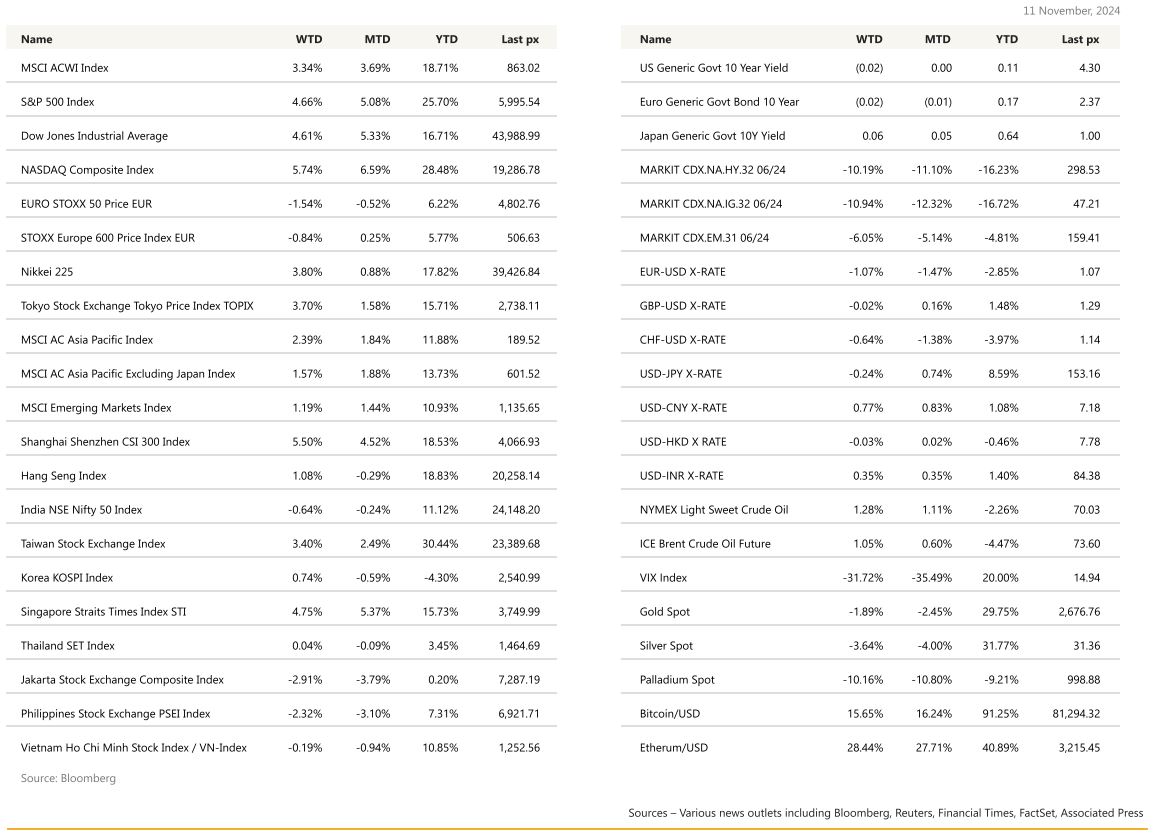

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

With a Trump win and a Fed rate cut, US markets posted its best week in a year rising 4.7% for both the Dow and S&P 500, whilst the Nasdaq Composite rose 5.8%. Small cap stocks posted their best session in 2 years rising some 8.6%. For the moment, there’s really only one thing that could stop this rally, that is if inflation does indeed turn upwards. Continued dire projections of a tariff induced reflation however, was kept at bay. A University of Michigan sentiment survey on Friday morning showed a better-than-expected improvement in sentiment and lower 1-year inflation expectations at 2.6% from 2.7%. The 5-10 year projection ticked up to 3.1% from 3%.. The Fed cut interest rates for the second straight meeting and signaled that labor market conditions have generally eased. As expected, the Fed reduced the Fed Funds rate by 25 bps to 4.50% – 4.75%. Continuing claims were higher than expected. “The labour market has cooled from its formerly overheated state and remains solid,” Fed Chair Jerome Powell said at his afternoon press conference, adding that growth in consumer spending has remained resilient. Post meeting statement notes also removed reference from prior statement that that Fed had “gained greater confidence” about the inflation outlook. The interpretation here could mean a less dovish outlook although Powell did mention that risks to both inflation and employment are “roughly in balance”. As to another reason why the S&P 500 is up……S&P 500 members have reported an average 7% upside earnings surprise so far this quarter, with nearly 90% of firms now reporting. The Fed is expected to cut once more in December, by 25 bps bringing down the benchmark rate to 4.25% – 4.50%, exactly 100 bps down from its peak.

The VIX fell to 14.94, the Usd held to its gains while gold fell below $2,700 per oz. In other data releases, we saw ISM Services beat expectations while mortgage applications fell by 10.8% from October’s -0.1% following a surge in LT yields. For the week, we saw some flattening of the yield curve to 5.04 bps with the UST10’s and 2’s ending at 4.30% and 4.25% respectively. This week will see CPI on Wednesday – Core MoM is expected to come in at 0.3% (unchanged) while the YoY headline figure is expected at 2.6% from 2.4%. PPI to follow on Thursday, PPI Final Demand MoM up 0.2% from 0% previously. Friday will see retail sales – expected to soften a tad to 0.3% and industrial production.

With one headwind out of the way, we can now look to the transition of power to the Republicans over the next couple of months and policies defined. We expect the upside momentum to continue and look to small to mid-caps to play catch-up: Jan 2023 till YTD ~ S&P 500 up 156.78% vs Russell 2000 up 137.06%:

Cryptos had a stella week following Trump’s victory with BTC recording a new record high at circa $80k on the weekend.

Europe

Europe equity markets closed lower on Friday, with the Eurostoxx 600 down 0.84% for the week, with most sectors closing in the red. Mining stocks led the losses, while travel and leisure stocks ticked up.

Germany s three party coalition collapsed after Chancellor Scholz removed Finance Minister Christian Lindner over differences in views on the budget. There had been disagreements on how to plug the gap in the finances, with the Chancellor favouring suspending the debt brake, but the finance minister, whose party is fiscally conservative, was unwilling to sanction the move. Defence spending and support for Ukraine were flash points; Trump’s victory in the US adds to the pressure for Germany to increase its military spending.

Chancellor Scholz announced a vote of confidence for 15 January. If he loses it, the President will quickly dissolve parliament, and an election would need to be called within 60 days. The new election is likely to be around mid-March, or about six months earlier than previously scheduled.

The next day, Jörg Kukies was appointed as Germany’s new finance minister, who previously held a state secretary role within the federal Finance Ministry and worked for Goldman Sachs in Frankfurt and London due to the pressures from the snap election.

With France also facing political uncertainty after snap elections this year, turmoil in the European Union’s two largest economies could hinder efforts to strengthen the bloc’s integration, just as it confronts challenges from both the east and west.

On the data front, the final release of the October PMI contained upward revisions. The manufacturing, services and composite indexes were revised up by 0.1pt to 46, 0.4pt to 51.6 and 0.3pt to 50, respectively. Despite the revision and the small uptick from September, the PMIs confirmed the weak momentum in activity at the start of the 4Q. The retail sales print was another positive number (+0.5% mom) in September. They rose by 0.9% qoq in 3Q24, pointing to solid consumption growth over the quarter.

Over in the UK, the MPC at its November meeting, voted 8-1 in favour of cutting Bank rate by 25bp, to 4.75%. The only dissenter was Catherine Mann, who preferred to maintain Bank Rate at 5.00%. the guidance in the minutes was little changed from September. The main messaging from the press conference was repeated emphasis on the extent of uncertainty at the current juncture, uncertainty around the impact of the fiscal package, uncertainty on the current state of the labour market and uncertainty on international developments and their consequences. However, there was a change in forecasts, particularly the sizeable effect of last week’s Budget, due to which the Bank added 0.75pp to GDP and about 0.5pp to inflation.

This week, we will see the September Industrial production print on Wednesday, the second release of 3Q GDP, 3Q employment growth Thursday in the Euro Area and the September GBP, industrial production, 3Q GDP on Friday in the UK.

Asia

Asian Markets rallied last week with China’s CSI 300 and Japan leading gains. The anticipation around the NPC and the Weak yen drove those gains last week. MSCI Asia Pacific was higher by 2.39%. CSI 300 up by 5.5% and Nikkei was up 3.8%.

In China we had a week long NPC meeting which failed to meet market expectations. On Friday, China announced $839 bn debt swap plan to support local governments. The CSI 300 Index and Hang Seng Index both edged lower following this briefing. It seems the Chinese government did not go “all out” and is instead preserving room to respond to a potential trade war when Donald Trump takes office next year. The Yuan fixing, was set at 7.166, the sharpest weakening by the People’s Bank of China since April 2022 and came after the Chinese yuan tumbled 1% against the dollar after the Trump election victory.

China Data:

- PMIs in China, mixed. The Caixin/S&P Global services PMI rose to 52 in October indicating stronger demand. However, this contrasts with the official PMI data released last week, which showed a slowdown in non-manufacturing activity in October.

- Trade surplus in China ballooned in October as the country’s exports surged in the October. Exports rose 12.7% year on year, well ahead of a 5% rise forecast by a Bloomberg poll. Imports declined 2.3% , larger than a forecast 2% decline by Bloomberg. The country’s trade balance was $95.7bn in October, significantly larger than the $75bn forecast by economists.

- China’s direct investment liabilities in its balance of payments dropped $8.1 billion in the third quarter, according to data from the State Administration of Foreign Exchange released late Friday. The gauge, which measures foreign direct investment in China, was down almost $13 billion for the first nine months of the year. Foreign investment into China has slumped in the past three years after hitting a record in 2021

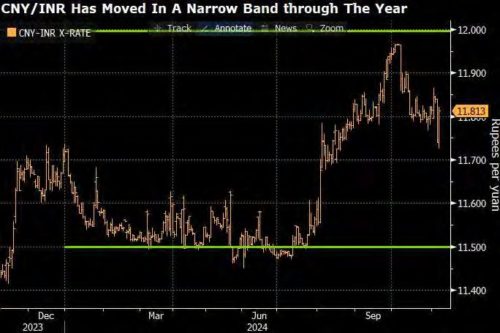

India’s central bank is ready to let the rupee weaken in tandem with the Chinese yuan after Donald Trump’s election win spurred fears of higher US tariffs, according to people familiar with the thinking of policymakers. A depreciating yuan will lower the cost of Chinese goods, potentially leading to more imports and further widening India’s biggest trade deficit with any country. The Reserve Bank of India is poised to cushion the blow by allowing a weaker rupee, even while using its ample reserves to keep the fall in check. India is looking to boost its manufacturing sector by attracting businesses wanting to relocate supply chains from China. To do that, policymakers need to keep the rupee competitive against its peers. India had just started taking export market share from China in sectors such as electronics exports.

Other data from Asia: South Korea inflation fell to lowest since Jan-2021 with core inflation down to lowest since Sep-2021, though economists expect BOK to hold in November. Korea’s consumer price index rose 1.3%oya in October, from 1.6% in September.

BoJ stands pat as expected, sets stage for December hike. Reserve Bank of Australia (RBA) left its key interest rate unchanged at 4.35% for an eighth meeting in a row. Japan’s household spending in September declined at a slower pace than expected, official data on Friday showed. Real household spending fell 1.1%.

Hong Kong’s monetary authority on Friday cut its benchmark interest rate by 25 basis points to 5%, mirroring the U.S. Federal Reserve move overnight. Hong Kong’s interest rates tend to move in lockstep with the Fed actions.

Australia’s Judo Bank services PMI came in at 51.0 in October, higher than last month’s figure of 50.5 as improvements in demand led to new business expanding at the fastest pace in almost two and a half years.

GeoPolitics

US – Israel: Israeli Prime Minister Benjamin Netanyahu spoke with President-elect Donald Trump to congratulate him on his victory against Vice President Kamala Harris and said the two discussed the “Iranian threat.” Netanyahu called Trump’s victory the world’s “greatest comeback” and appeared to take a shot at President Biden by saying Trump’s return to the White House “offers a new beginning for America and a powerful recommitment to the great alliance between Israel and America.”

Europe: European leaders on Thursday made a strained show of unity in the wake of the US elections and the collapse of the German government at a summit hosted by Viktor Orbán, the continent’s most prominent supporter of Donald Trump. Hungarian premier Viktor Orbán predicted that Washington would soon abandon its support for the war effort against Russia’s full-scale invasion of Ukraine. “The situation in which Europe finds itself is difficult, complicated and dangerous,” Orban said. He argued for a complete rethink of the “European model” given that the global economy is “faced with the frightening perspective of fragmentation”. Macron called Trump’s re-election a “decisive” moment for Europe that required the region to defend its own interests first.

US – AUKUS: The result of Tuesday’s U.S. presidential election won’t impact the future of the AUKUS or Quad security arrangements that the Biden administration has pushed in the Indo-Pacific, Australia and India’s foreign ministers said in a joint press conference in Canberra.

Indonesia and Russia: Both countries started their first joint naval exercises. The five-day joint exercise will be conducted in Surabaya, a port in the east of Java, and its surrounding waters, the Indonesian navy said on Monday last week. Russia had brought four warships, one helicopter and one tug salvage ship for the exercise, it added.

US- China: The chief of the US Space Force has warned that China is putting military capabilities into space at a “mind-boggling” pace, significantly increasing the risk of warfare in orbit. Saltzman spoke during a tour of Europe to raise awareness about the potential for conflict in space with powers including China and Russia and the need to co-operate with European allies to improve deterrence capabilities. The US Space Force, which monitors more than 46,000 objects in orbit, has about 10,000 personnel but is the smallest department of the US military.

credit treasuries

Last week saw huge moves on the USD interest rates following the results of the US Elections. The US Treasury curve ends the week in a bear flattening mood with the 2years up 10bps, 5years up 5bps, 10years up 1bps, 30years down 3bps. The rather hawkish Fed statement could, in part, explain this move. US IG 5years credit spread tightened by 6bps and is now trading at 47bps which is close to its tightest level over the last 10years. The same move happened on US 5years HY credit spreads which tightened by a massive 33bps and now trades below 300bps. In term of performances, US IG & US HY gained about 1% last week. The US bond market will be close today due to US Veterans Day.

FX

DXY USD Index rose 0.69% to 104.997 following the increased likelihood of a US Red Sweep, amid heightened expectations fiscal measures and growing concerns around tariffs and inflationary pressures.

The Fed cuts interest rate by 25 bps as expected, noting that risks to inflation and employment roughly in balance. Post meeting statement notes that labour market conditions have generally eased, but also removes reference from prior statement that that Fed had gained greater confidence about the inflation outlook, but concerns are eased as Chair Powell says it is not meant to send a signal. When asked about the election, Chair Powell said no impact on near-term policy outlook. Positive macro surprise momentum continued with ISM services highest since July 2022 while University of Michigan consumer sentiment highest in six months in preliminary November reading. ISM Services (A: 56.0, C: 53.8, P: 54.9); UMich (A: 73.0, C: 71.0, P: 70.5). Market currently pricing a 48% chance of a cut in Dec 2024.

Within the European Currencies, EUR underperformed, as EURUSD fell 1.07% to 1.0718 following the collapse of the German coalition government, which should give way to an election in Qtr1 next year. In terms of data, Eurozone PMIs were revised up in October. Retail Sales rose 0.5% m/m in September (C: 0.4%; P: 1.1%). The data came alongside strong upward revisions for July to 0.4% m/m (P: 0.0%) and August to 1.1% m/m (P: 0.2%). GBPUSD closed the week relatively flat at 1.2921. BoE cuts rates by 25 bps to 4.75% as expected, with a vote of 8-1. However, the messaging was mixed, as MPC’s inflation forecasts were revised upward and higher than expected, while BoE maintained the messaging of a gradual removal of restrictiveness. This assuaged some concerns around the economic implications of the Budget, supporting GBP.

On the Scandinavian currencies, USDSEK rose 0.67% to 10.8191, while USDNOK fell 0.57% to 11.0015 due to diverging path in its economies. The Riksbank lowered its policy rate by 50bp to 2.75% at its November meeting, as widely expected given weak economic activity and the associated downside risks to the inflation outlook, while it signalled that another rate cut may be delivered in December. The Norges Bank maintained its policy rate at 4.50% at its November meeting, as widely expected, with relatively unchanged forward guidance.

On the Antipodean currencies, both AUD and NZD both rose against USD, with AUDUSD (+0.37%) to 0.6583 and NZDUSD (+0.07%) to 0.5967, driven by positive risk sentiment. This was partially since both AUD and NZD were oversold leading to the election. RBA keeps rates on hold at 4.35%, as expected. Forward guidance in the post-meeting statement was barely changed from the previous meeting, reiterating that the RBA will “need to remain vigilant to upside risks to inflation and the Board is not ruling anything in or out.” In addition, there was a hawkish repricing of the rate path after comments from Governor Bullock are interpreted as likely ruling out a February 2025 cut. NZ employment down 0.5% qoq in Q2, larger fall than consensus at 0.4%qoq. Unemployment rate rose 0.2ppts to 4.8%. That was a smaller rise than the RBNZ and consensus expected, although it was associated with a large fall in the participation rate. Still, unemployment being lower than the RBNZ expected does not help the case for a super-sized 75bp cut in November.

Oil & Commodities

Oil futures rose last week, with WTI and Brent rising 1.28% 1.05% to 70.38 and 73.87 respectively. Both WTI and Brent future rose more than 4% after OPEC+ announced its decision to delay a planned December oil production increase by one month. However, oil future pared back some of its gain last Friday, after China policy support underwhelmed against market expectations, with China still focused on stabilization over stimulus (nothing to boost consumption).

Gold fell 1.89% to 2684.77 driven by stronger USD following the US Presidential Election Result and with the Republican leading in the House rate. Safe-haven demand pared back as uncertainty falls. In addition, prospects towards an end between Russia-Ukraine war have increased following President Trump Victory, contributing to Gold price downside. Support level at 2640/2600, while resistance level at 2740/2800.

Economic News This Week

-

Monday – JP BoP Curr. Acc., NZ 2Yr Inflat. Exp., NO CPI

-

Tuesday – AU Westpac Cons. Confid./NAB Biz Confid., JP Machine Tool Orders, UK Employ., EU ZEW, US Small Biz Optim./NY Fed 1Yr Inflat. Exp/SLOO

-

Wednesday – JP PPI, US Mortg. App./CPI

-

Thursday – NZ Food Prices MoM, AU Employ., SW CPI, EU GDP/Employ., US PPI/Initial Jobless Claims

-

Friday – NZ Biz Mfg PMI, JP GDP/Indust. Pdtn, CH Indust. Pdtn/Retail Sales, UK Indust. Pdtn/Mfg Pdtn/Trade Balance/ GDP, CA Mfg Sales, US Empire Mfg/Retail Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.