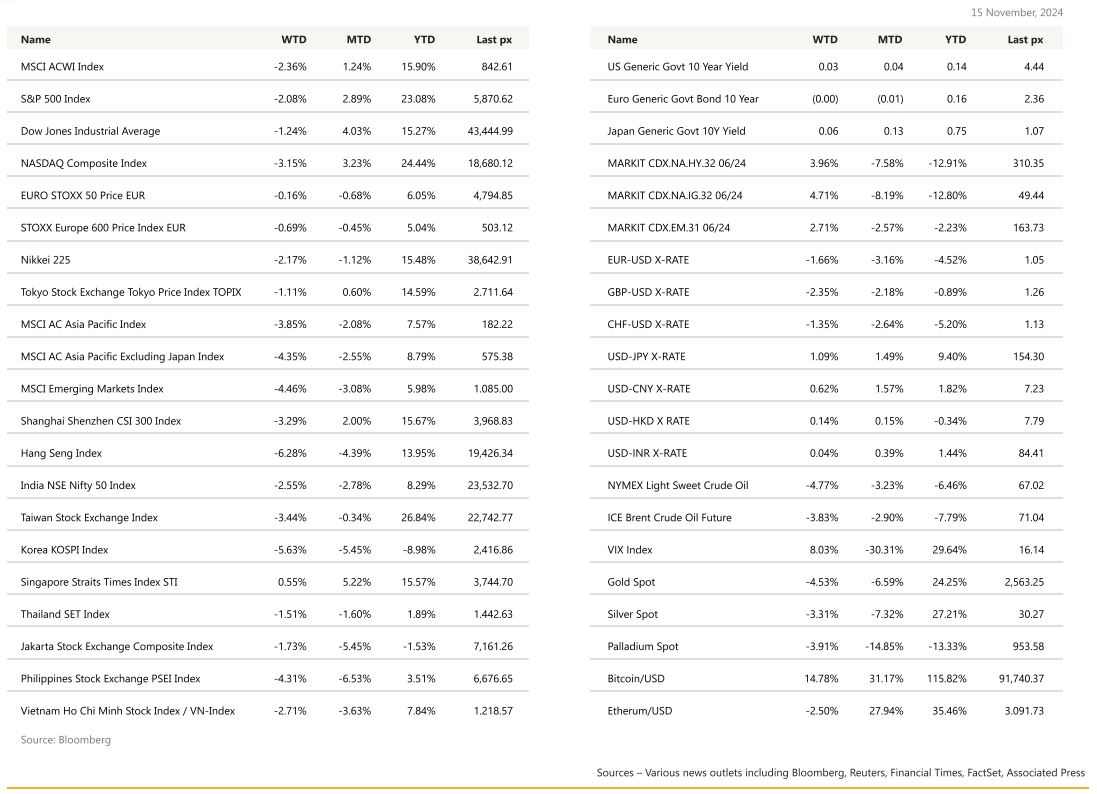

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US stocks had its worst week since September, falling by more than 2% for the S&P 500 as dis-inflation somewhat stalled in October. Traders started to dial back their bets on an interest rate cut in December, from 80% to less than 60% (cc. CME Group data) after the release of CPI, Wednesday. Headline CPI increased by 2.6%yoy, up from September’s three-year low of 2.4%. Core inflation, excluding food and energy prices, remained steady at 3.3%, while the super core CPI (core inflation less housing) printed 4.4%yoy. The CPI data also matched the Cleveland Fed’s Nowcast model, which forecasts year-on-year headline inflation at 2.7% and core at 3.3% in November.

Fed-speak soon followed with Minneapolis’ Neel Kashkari saying he’s confident inflation is headed down toward the central bank’s 2% goal, speaking just after US core CPI MoM held at a 0.3% gain for a third month in October. St Louis’ Alberto Musalem expects gradual rate cuts, while Lorie Logan and Jeff Schmid both voiced a note of caution. PPI Final Demand YoY also accelerated in October to 2.4% from September’s revised (up) 1.9%. Inflationary fears of Trump’s tariffs accelerated following the Republican’s “governing trifecta” – the Presidency and both chambers of Congress – giving the President-elect significant power to advance his agenda. Powell himself signalled that the central bank wasn’t in a rush to cut rates, “The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully”, he said. An interesting detail in Powell’s prepared remarks was the implication that he does not expect more progress on core goods and supercore disinflation. Powell said core goods and service inflation “will continue to fluctuate in their recent ranges.” His comments suggest the Fed’s disinflation narrative is dependent on further decline in rent inflation. Private rent data point to continued rent disinflation measured by CPI/PCE price index, but not necessarily undershooting the pre-COVID trends, which means rent disinflation might not become weak enough to offset resilient supercore inflation. In addition, Powell seemed less confident in the future path of rent inflation as he said the Fed is “closely tracking the gradual decline in housing services inflation.” His remarks on inflation imply heightened uncertainty around the inflation outlook and policymakers might have become less confident, which is consistent with comments from other FOMC participants this week. Powell didn’t give a direct answer when asked if Fed could look through a temporary increase in inflation due to tariffs. However, he did push back on an earlier Fed analysis (pre-COVID) that said central banks should look through tariff-driven inflation, noting the situation is significantly different from six years ago with inflation running above-target with some lingering concerns about inflation expectations.

US initial jobless claims fell to the lowest level since May last week, indicating the labour market’s still strong despite recent storms and strikes. The Fed’s quarterly Senior Loan Officer Survey (SLOOS), which showed aggregate bank credit conditions staying at around neutral levels. The SLOOS showed further normalisation of credit standards for CRE lending, while banks’ willingness to make consumer loans turned positive for the first time in two years. But the positive credit cycle read through was offset by a renewed decline in demand for C&I lending and a tightening in mortgage standards.

The healthcare sector, fell after Trump picked prominent vaccine sceptic Robert Kennedy Jr to lead the Department of Health and Human Services. US retail sales advanced in October, boosted by auto sales while other categories signalled some momentum heading into the holiday season. Speculation is now rife on whether the post-election equity rally has run its course following its recent pullbacks from record highs.

Corporate earnings remain a key focus for investors as they evaluate how firms are navigating the economic environment. The VIX closed higher at 16.14. Gold took a beating whilst cryptos made new highs during the week, hot on the heels of Trump’s support of the latter. Bitcoin and Ether traded at $91k and $3,100 respectively. In the longer run, strategists continue to see the metal offering value regardless. This week’s data releases are a little lighter with only the S&P Global US manufacturing & Services PMI and U. of Mich. sentiment and inflation expectations of note.

We continue to favour small caps to play catch-up as President-elect Trump’s policies are expected to favour protectionism for domestic companies.

Europe

European equity markets close broadly weaker by -0.69%. Mining and energy were the best gainers, while media and pharma were the biggest decliners. Ongoing attention Europe’s stock market underperforming the US which has been turbocharged by Trump’s election victory, leaving the Stoxx 600 index facing its largest gap vs US counterparts in nearly 30 years. Bloomberg mentioned that this lag is expected to worsen as Trump’s win has driven a strong preference for US assets. Year to date, the S&P 500 has surged by 25%, while Europe’s Stoxx 600 has only gained 5%.

On the macro front, Euro area Industrial Production excluding construction was down 2.0% m/m in September, with manufacturing production down 2.1% m/m, offsetting the strong August gain. On the other hand, retail sales have been trending up since the start of the year and have been expanding at a strong pace in recent months, which could affect manufacturing output in near term. The outcome of the US election, however, is likely to be negative for corporate sentiment in the Euro area due to the threat of higher tariffs. The second Euro area GDP released on Thursday was in line with the flash estimate, at 1.5% ar for 3Q24.

The IG Metall Union, one of the main unions in Germany, has agreed on a new pay deal for its members. The agreed increased was relatively weak by historical standards and probably softer than the ECB expected. It translates into a weak 1.5% oya approximately for the next 2 years and this puts the outcome well below the level consistent with the ECB’s inflation target.

In the UK, the regular average weekly earnings growth eased only slightly in September, while private sector earnings growth was unchanged at 4.8%. Unemployment increased while employment remained weak and vacancies continued to fall, signaling an easing labour market. The UK Q3 GDP data missed with a 0.1% expansion vs consensus 0.2% and prior 0.5% increase. ONS details showed in the quarter, services sector grew 0.1%, construction sector expanded 0.8%, while production sector fell by 0.2%. At a monthly frequency, September GDP printed softer than expected, contracting by 0.1% m/m. This was largely driven by softness in ICT services and manufacturing. BoE Governor Bailey said in his Mansion House speech that Brexit has weighed on the UK economy and relations must be rebuilt while respecting decision of the people. He mentioned that UK was facing headwinds from broader fragmentation of the economy, and it is important to keep trade open.

On a side note, gas prices in the UK and Europe hit the highest level since November 2023. Cold weather increasing demand amid strong withdrawals from gas storage and low levels of renewable power generation. Bloomberg highlighted Russia’s Artic LNG 2 project has cut output to nearly zero so far this month after stopping liquefaction last month due to sanctions. In addition, Germany has told state-operated has import terminals to reject any Russian cargoes of LNG to protect public interest. Overall, risks to the European gas prices this winter are skewed to the upside, owing primarily to a relatively tight LNG market.

This week, we will see the UK CPI and PPI on Wednesday and retail sales on Friday. On Tuesday, we will have the Euro area composite PMI and the HICP figures.

Asia

Last week the MSCI Asia ex Japan closed the week lower by -4.35%.

Trump appointed more China-hawks to his cabinet, and as concerns grow over the impact of tariffs on inflation and regional trade. Heightened odds of a US-China trade war next year have triggered wholesale ASEAN growth downgrades. Central banks in South Korea and Indonesia last week warned on forex volatility, which added to likely RBI support of the rupee and PBOC s managed weakening of the yuan. Potential US – China trade conflict will likely have very limited direct impact on India.

China s October industrial output grew 5.3% from a year earlier, slowing from September s pace of 5.4%, reflecting concern about confidence and demand woes confronting a sluggish economy. Retail sales, a gauge of consumption, grew 4.8% in October, up from a 3.2% increase in September.

China’s new home prices continued to fall in October despite a barrage of government support efforts, although the pace of decline slowed across a mixed economic backdrop. China s Ministry of Finance announced tax cuts for homebuyers, effective 1-Dec to boost the real estate market. The new policy cuts the tax rate to 1% for individuals purchasing a sole residence of 140 square meters or less from current level of as much as 3%. Separately, China lowered the threshold for the land appreciation tax by 0.5 ppt, the State Taxation Administration said. China will also allow top-tier cities to drop the distinction between ordinary and luxury homes.

Finance Minister Lan pledged to carry out more forceful fiscal policies next year after unveiling a 10 trillion yuan ($1.4 trillion) debt swap for local governments, signalling bolder steps could come after US President-elect Donald Trump takes office.

Taiwan’s October trade report shows a stabilizing export trend, following the strong growth momentum in recent months. Merchandise exports grew 8.4% over-year-ago in October, modestly below expectations.

India’s October CPI inflation rate rose to 6.21%, led by a surge in food inflation to 10.87%. For rural and urban areas, CPI inflation came in at 6.68% and 5.62%, respectively, while food inflation was reported at 10.69% for rural areas and a higher 11.09% for urban areas. September IP printed in line with expectations at 3.1%. Manufacturing activity, which better reflects underlying economic activity, remained soft, rising by just 0.4% m/m, sa in September.

GeoPolitics

US- Israel- Lebanon: Israel is expanding its ground operations in southern Lebanon, moving troops into villages farther from the border, raising concerns of a prolonged conflict. U.S. efforts to broker a cease-fire are ongoing, with optimism for an agreement before President-elect Trump takes office, though challenges remain. The U.S.-brokered proposal would move Hezbollah forces north of the Litani River, with Lebanese and U.N. forces preventing their return.

UK PM Starmer and French President Macron to hold talks on boosting weaponry for Ukraine ahead of a Trump presidency. Telegraph sources suggested there are hopes in London that Biden may give approval for Ukraine to fire long-range missiles deeper into Russia. While Starmer has privately backed the move, Storm Shadow missiles require use of a US targeting system. Polish PM Tusk will also meet with EU leaders and NATO chief Rutte on Ukraine. European leaders have talked up support for Ukraine, but have also said they do not want conflict to escalate.

Philippines – US- China: Philippines Defence secretary, Gilberto Teodoro, said in an interview that his country was looking at getting mid-range capability (MRC) launchers, which the US brought to the Philippines in April for two bilateral military exercises. “We do intend to acquire capabilities of such sort,” Teodoro said. “We will not compromise with our right to acquire any such kind of capabilities in the future within our territory.” The launcher has remained in the Philippines since the exercises. Beijing has denounced both the initial deployment and its extension as “provocative” and “destabilising”. Procuring MRC missile launchers will be part of Marcos’s push to enable the Philippines’ armed forces to detect and deter threats, as he shifts the country’s focus from countering long-running internal insurgencies to protecting its sovereignty. The modernisation effort, backed by a tripling of the military’s budget, includes plans for several new naval and air bases. The Philippine military is building its first BrahMos base on the west coast of Luzon, facing the disputed South China Sea.

Taiwan – US – China: Taiwan is considering buying a big package of US weapons, including the Aegis destroyer, to show the incoming administration of Donald Trump that it is serious about boosting its own defences against China. A senior Taiwanese national security official said there had been “informal discussions” with the Trump team about what kind of arms package would demonstrate Taiwan’s determination to invest in its own defence.

Singapore and China have signed 25 agreements at their annual apex meeting, boosting cooperation in areas like trade, finance and maritime as they strengthen ties amid a troubled geopolitical climate. Singapore’s Deputy Prime Minister Gan said – We’ll continue to build and strengthen the connectivity between Singapore and China, and to encourage China businesses to use Singapore as a gateway to the Asia, Southeast Asian markets, ASEAN market.

Sri Lanka: The leftist government of President Anura Kumara Dissanayake is headed for a landslide victory in Sri Lanka’s parliamentary election. Dissanayake’s government is now tasked with addressing the fallout from a 2022 economic crisis that forced Sri Lanka into a debt restructuring deal with creditors.

Credit Treasuries

The UST2’s vs UST10’s steepened with the front end dropping whilst the longer end steepened at 4.303% and 4.439% respectively, locking in 13.6 bps of premium.

The shortened week on US Treasury saw the US Treasury curve bear steepened with the 2years yield up 4bps, 5years yield gained 8bps, 10years yield gained 12bps & 30years yield gained 14bps. The 10years yield briefly touched 4.50% level and is now trading close to its highest level over the last 6Months. 5years US IG credit spreads widened by 2bps, giving up part of their gain from the previous week. The same pattern happened on the 5years US HY credit spreads, which finished the week 12bps wider.

In term of performances, US IG lost 1.25% over the week while US HY lost 60bps. Leverage loans finished the week unchanged.

Bloomberg reported China is marketing dollar bonds in Saudi Arabia, the first dollar debt sales in three years. It’s offering 3Y and 5Y securities with initial price guidance of about 25 bp and 30 bp over respective US Treasury yields. MoF said earlier it planned to sell up to $2B of notes while deal had received orders exceeding $25.7B. Beijing and Riyadh have boosted economic ties in recent years.

FX

DXY USD Index rose 1.61% to 106.687, as US Treasury yields continued to rise.

In addition, Chair Powell stated that the US economy is not signalling a need for Fed to hurry rate cuts. US macro data was mixed last week, US NFIB small business, above consensus matching post-covid high (A: 93.7; C: 92.0; P: 91.5). US CPI in line, headline up 0.2%mom in October, core up 0.3%, both in line with consensus, and leaving year-ended at 2.6% and 3.3%yoy, respectively. US producer prices in line, up 0.2%mom in October. US jobless claims down a bit, close to consensus: initial at 217k, down 4k, continuing at 1873k, down 11k. US Retail Sales headline above consensus, while core below consensus. Based on OIS, market is pricing at 58% chance of a Dec cut, compared to 65% a week ago.

European Currencies fell against USD following USD broadbased strength. EURUSD fell 1.66% to 1.054, GBPUSD fell 2.35% to 1.2618, while USDCHF rose 1.37% to 0.8876. Data wise, Eurozone GDP in line, +0.4%qoq in Q3, year-ended at 0.9%, steady from Q2 but still well below pre-covid average. UK 3rd Qtr GDP qoq came in at +0.1% (C: 0.2%; P: 0.5%), which brings the yoy to +1.0% (C: 1.0%; P: 0.7%). UK unemployment up 0.3ppts to 4.3% in 3 months to September (C: 4.1%); employment up 220k (C: at 287k). Wages stronger, +4.3%yoy with upward revisions (C: 3.9%).

AUDUSD fell 1.84% to 0.6462, below key support level of 0.65. Australia macro data was mixed, consumer sentiment up 5.3% in November to highest since April 2022 (just after hiking cycle began). NAB business conditions unchanged in October, but employment sub-component fell two points. Business confidence up 7pts to highest since 2023. Australia wages missed, up 0.8% qoq in Q3, 3.5% yoy. Australia employment missed, up 15.9k, consensus at 25k. Unemployment steady at 4.1%, consensus at 4.2%.

USDJPY rose 1.09% to 154.30 driven by USD strength. Towards the end of the week, USDJPY rose to a high of 154.63, but most of the gain was pared back last Friday as investors became more concerned about inflation which invoke negative risk sentiment supporting JPY. Data wise, Japan’s Q3 GDP data came in with an annualised quarterly gain of +0.9% (C: +0.7%), but the Q2 growth was revised down to an annualised pace of +2.2% (C: +2.9%). Japan PPI mom in Oct came in at +0.2%, above consensus, which brings the yoy to 3.4% (C: 2.9%; P: 2.8%).

Oil & Commodities

Oil futures fell last week, with WTI and Brent falling 4.77% and 3.83% respectively, to close the week at 67.02 and 71.04. OPEC reduced their expectations of demand growth this year for a fourth straight month in their latest market report. Since July, the group has chopped 430,000 barrels a day, or 19%, from 2024 demand growth projections and 310,000 barrels a day, or 17%, from next year’s outlook. But OPEC remains markedly more optimistic than its consumer-side counterparts, seeing growth of 1.8 million barrels a day this year, whereas the International Energy Agency and the US Energy Information Administration both peg growth a little below 1 million barrels a day.

Gold fell sharply by 4.53% to 2563.25 as USD strengthened with UST yields still rising following the US election. Support level at 2548 (100 DMA) and 2500. Key psychological level at 2400 (200 DMA). Immediate resistance level at 2600. Technically, based on RSI indicator, Gold price is still not at oversold territory, implying further downside.

Economic News This Week

-

Monday – NZ PPI, JP Core Machine Orders, EU Trade Balance

-

Tuesday – AU RBA Mins., EU/CA CPI, US Housing Starts/ Building Permits

-

Wednesday – AU Westpac Leading Index, CH LPR, UK CPI/ PPI, US Mortg. App.

-

Thursday – Norway GDP, EU Cons. Confid., US Initial Jobless Claims/Leading Index/Existing Home Sales

-

Friday – JP Natl CPI, AU/JP/EU/UK/US Svc/Mfg/Comps PMI Nov Prelim, UK Gfk Cons. Confid./Retail Sales, CA Retail Sales, US UMich

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.