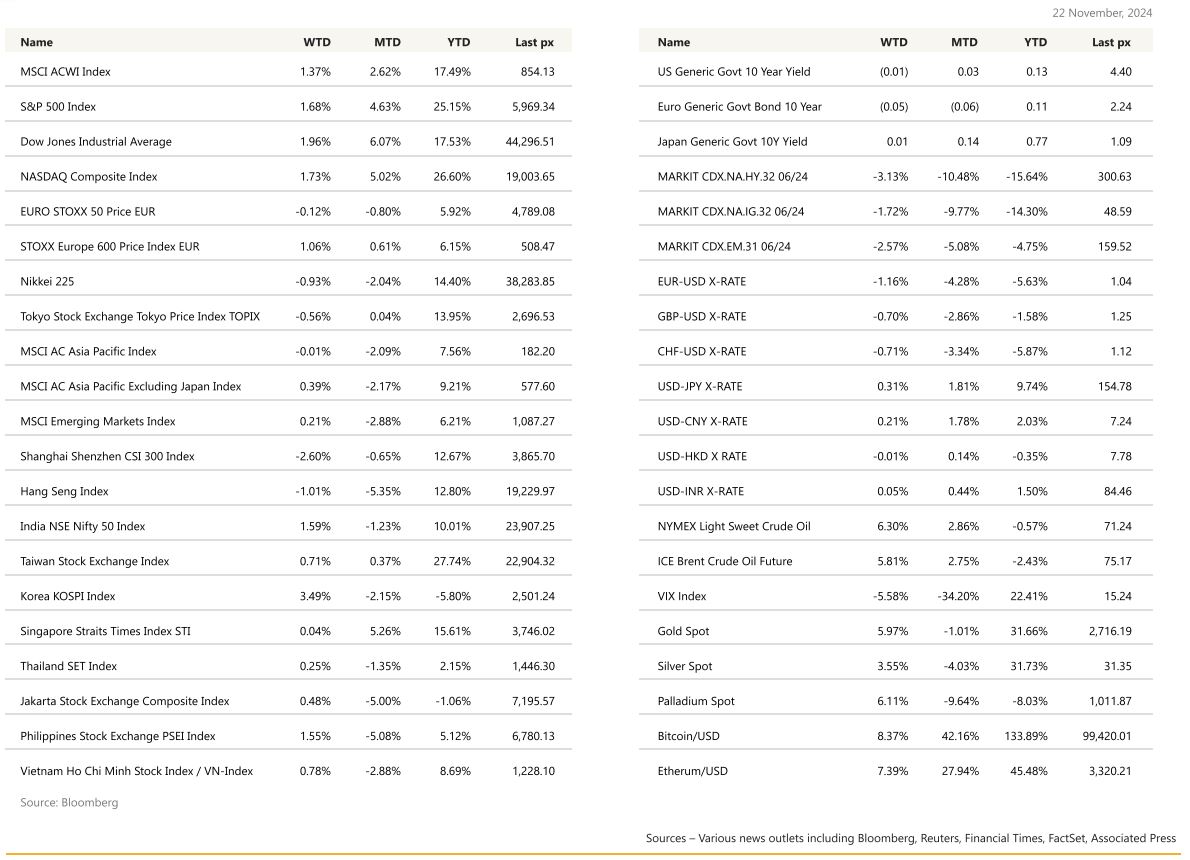

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US stocks made a comeback for the week with the S&P 500 closing 1.72% higher for the week. The Russell 2000 Small Cap Index rallied 4.5% as investor confidence improved following strong results from some major retailers and strongest growth in business activity in more than 2 years.

The S&P Global flash November composite output index for service providers and manufacturers showed manufacturers were the most upbeat about production over the coming year since April 2022.

The one report that most view is of higher importance than that of the employment or CPI report, Nvidia’s earnings came and went with little hiccup. Nvidia posted a record-breaking USD35.1bn in revenue for the third quarter—up 17% from the last quarter and a jaw-dropping 94% compared to last year. Irrespective of the street’s mild disappointment in the results, Nvidia continues to be the one company powering some of the world’s most advanced AI supercomputers, clearly driving AI innovation globally on a massive scale, underscoring that the AI investment theme continues to accelerate.

Governor Cook’s speech appears more neutral or less dovish than her previous comments. She maintained an easing bias by saying it likely will be appropriate to reduce rates “over time” and she continued to view employment risks “as weighted to the downside.” However, she stressed data-dependency regarding “the magnitude and timing of rate cuts,” expressing no sense of urgency on rate cuts. Similar to other FOMC participants, she discussed the recent pick-up in labor productivity growth and cited several supporting factors (e.g., new business formation, worker reallocation, automation and other investment on new technologies). She did not mention the implication of higher labor productivity growth on monetary policy or the neutral rate of interest. However, Nomura think her longer-run projection for the federal funds rate might be revised higher at the December FOMC meeting, which would be hawkish. She did not comment on the impact of tariffs or fiscal policy under the second Trump administration.

Initial jobless claims rose less than expected, once again indicating that the labour market remains resilient. The US November Manufacturing PMI came out roughly in line with expectations at 48.8 but the Services PMI came out stronger than expected at 57.0 The U. of Mich. inflation expectations (which the Fed monitors) for 1-Year came in unchanged at 2.6% whilst the 5-10 Yr rose slightly to 3.2%. Bitcoin flirted with $100k, a key milestone price.

Trump’s transition team has begun to hold discussions over whether to create a new White House position, dedicated to digital-asset policy, according to Bloomberg. This week will be a shortened one with the US closed for Thanksgiving on Thursday, with the main data release this week being the PCE and personal income/spending on Wednesday. Core PCE is expected at 0.3% (unchanged from Sept) MoM, the YoY headline number at 2.3% (up 0.2% from Sept). We will also have the last FOMC minutes and a GDP Annualised QoQ revision.

We continue to see the AI eco-system demanding more energy, and with Trump’s (previous) stance on alternatives, electricity generation and crude oil generated energy, remain our favoured picks.

Europe

The Eurostoxx index closed 1.06% higher, with all sectors except banks ending in positive territory, Health care and retail stocks led the gains, both up over 2%, while Europe’s banking index slipped 2%.

The final Euro area HICP print came broadly in line with the flash release. Headline inflation rebounded 0.3%pt to 2.0% in October. Core inflation was stable at 2.7%. Services inflation was revised up a tick to 4.0%. Domestic inflation, which is an important indicator for the ECB, decreased sequentially for the fifth consecutive month and in line with the broad trend of labour costs.

The Euro area composite PMI output index fell to 48.1, from 50 previously. Weakness in output was registered in both services and manufacturing. The weaker PMIs will add to ECB concerns over near-term economic growth. ECBspeak became markedly dovish immediately following the weaker-than-expected October PMIs, which saw hawkish ECB members refuse to rule out a 50bp rate cut in December. ECBspeak then edged less dovish following the stronger official activity data.

Financial markets, in response to the November PMIs, have priced in a further 8bp of cuts for December relative to close yesterday, and now price 37.5bp of cuts for December. In effect, markets are now pricing a 50% chance of a 50bp rate cut in December.

UK inflation accelerated more than forecast in October to well above the BoE’s 2% target. CPI rose to 2.3% from 1.7% in September after a jump in energy bills. Services inflation, which is being monitored closely by rate-setters for signs of domestic pressures, remained elevated at 5%, in line with BoE forecast and up from 4.9% in September. This marked the biggest pickup in headline inflation between months since October 2022. The BoE expects the rate to reach almost 3% by 3Q2025 as an expansionary budget adds to the inflationary impulse caused by last year’s fall in energy prices dropping out of the annual calculations. A December cut from the BoE continues to look very unlikely following October’s CPI print. The market now expects just two more quarter-point decreases in 2025, with a 40% chance of a third. The BoE believes Chancellor Rachel Reeves’ fiscal plans may fuel inflation by increasing costs for businesses and boosting borrowing to pay for public investment.

UK Composite PMI fell in November and is now back below 50 again, indicating contraction. While the PMI output index fell below 50, the CBI’s industrial trends survey improved. The total orders balance improved to -19, which is now broadly in line with its pre-pandemic average. Consumer confidence rose to -18 in November, up from -21.

This week, we will have the Eurozone economic confidence on Thursday and Eurozone CPI on Friday.

Asia

MSCI Asia ex Japan closed 0.39% higher for the week.

In China, investors digest another letdown from Big Tech earnings. Just over the past week, the 5 biggest tech firms erased $41 billion in market value, while a gauge of sector stocks listed in Hong Kong has fallen into bear market territory.

The PBoC held the interest rate on the 1-year medium term lending facility steady at 2% today. China’s economic data showed some early signs of stabilization last month, after the government rolled out a range of measures from late September to put the economy back on track to hit the government’s growth target of about 5% this year.

Over in Japan, the October’s real exports fell 4.9%m/m, more than reversing a rise in the prior month. The flash PMI rose 0.2 points to 49.8 in November. The manufacturing fell 0.2 points to 49.0. This marks its third consecutive monthly decline and leaves the index at its lowest level since March. The services index rose 0.5 points to 50.2, only partially reversing a sharp drop in October. The nationwide CPI inflation weakened slightly in October for the overall index, from 2.5% to 2.3% due primarily to base effects that lowered energy inflation. Meanwhile the CPI excluding perishables and energy strengthened to 2.3% from 2.1%.

On 18 November, BoJ Governor Ueda reiterated that the BoJ would gradually adjust policy rates if growth and inflation remain ‘’on track’’. On the 21st, he remarked that rate hikes would be decided at each meeting based on data available at that time, that it was impossible to forecast the outcome of the December meeting. He also indicated that the December policy meeting is going to be live.

The Bank Indonesia (BI) left its policy rate unchanged at 6.00% on 20 November.

Singapore’s non-oil domestic exports (NODX) showed signs of slowing momentum where it contracted 7.4% m/m sa in October. The growth forecast was raised for this year as the economy is recovering faster than anticipated. It is upgraded to an estimate of 3.5% from a previous range of 2%-3%, it sees next year’s growth in a 1%-3% range, reflecting global volatility given likely trade tensions generated by Donald Trump’s Presidency. In Malaysia, the October trade data also hinted at a loss of momentum in tech exports, with the October seasonally adjusted level of electrical and electronics exports 2.1% lower than the Q3 monthly average.

The Hong Kong unemployment rate ticked up to 3.1% and the headline CPI inflation came in lower than expected in October, urning down to 1.4%. Taiwan’s October export orders beat expectations, led by orders from the US and the ASEAN region. Tech orders rebounded in October, rising 4.9% m/m. Looking into 2025, tech demand outlook remains solid, led by structural strength in AI-related products. JPMorgan thinks there is a strong possibility of a US tariff hike on Chinese exports will hit regional supply chain activity ad global business sentiment, exerting a drag on Taiwan manufacturers.

This week, we will have the Singapore’s CPI on Monday, South Korea rate decision on Thursday, Tokyo CPI and Japan unemployment on Friday.

GeoPolitics

President Vladimir Putin last Tuesday approved an updated nuclear doctrine that allows Russia to expand its use of atomic weapons, days after the US gave Ukraine limited permission for long-range missile strikes on Russian territory. Putin signed a decree allowing Russia to fire nuclear weapons in response to a massive conventional attack on its soil. Russia will view aggression against itself or its allies by a nonnuclear state backed by other nuclear powers as a joint attack, the document posted online said. In September, Putin said Russia would revise its doctrine to account for “aggression” by non-nuclear states backed by a nuclear power. US Treasuries, the Japanese yen and Swiss franc, typical havens at times of geopolitical strife, rose. The Russian leader has warned the US and its European allies against allowing Ukraine to strike deep inside Russia using Western long-range high-precision weapons, saying this would bring them into direct conflict with his country.

US ATACMS permission by the Biden’s administration and Russia’s modifications to their nuclear weapons doctrine engendered a brief sell-off in risk markets. This development followed Ukraine’s use of ATACMS missiles to strike a military target in Russia’s Bryansk region after the previous weekend news that President Biden had authorized Ukraine to use US long-range missiles inside Russia for the first time. The recent decision by the Biden administration to permit the use of longrange weapons systems can be viewed as an attempt to strengthen Kyiv’s hand, or on the other hand, to make the situation even more complicated when the new US administration will take over in about 7weeks time. “Without the Americans, it is impossible to use these high-tech missiles,” Sergei Lavrov, Russian foreign minister, said in comments quoted by Reuters. The Russian ministry of defence confirmed an attack on its soil had taken place but said its air defence systems shot down five of six Atacms missiles over the Bryansk region.

On the 21st of November Ukraine reported wrongly that Russia Fires an Intercontinental Missile in response to the US & UK used of medium-to-long range missiles to strike the Russian territory. Russia did respond to this attack, but they used a new type of high velocity intermediate-range ballistic missile, which is called the Oreshnik, to strike ammunition facilities in the city of Dnipro. They did not use an ICBM as earlier reported.

Credit Treasuries

The US Treasury 10Y yield has risen 80 bps to early July levels, despite two rate cuts totaling 75 bps in September and November. The Fed and other central banks are still looking to reduce monetary policy restrictions but have turned cautious on growth/inflation uncertainties over Trump’s policy pledges and heightened geopolitical risks.

The US Treasury curve flattened during the week with the 2years yield up 7bps, while the 5years, 10years & 30years finished the week down by 5bps. US IG 5years credit spread finished the week unchanged, while US HY 5years credit spread finished tighter by 10bps. In term of performances US IG lost 5bps and US HY gained 12bps.

FX

DXY USD Index rose 0.81% to close the week at 107.55, driven by upside surprises on US services PMI and escalation in geopolitical tensions.

New year to date high was achieved last Friday at 108.71, a level last seen in Oct 2022. US macro data was mixed, initial jobless claims fell to lowest level since April (A: 213k, C: 220k), while continuing claims surge to a three-year high (A: 1908k, C: 1880k). Philadelphia Fed Manufacturing Index unexpectedly falls into contraction, though the six-month forward expectation rises by over 20 points. US services PMI above consensus (A: 55.0, C: 57.0, P: 55.0); slight miss on manufacturing PMI (A: 48.9, C: 48.8, P: 48.5); Composite PMI above consensus (A: 55.3, C: 54.3, P: 54.1). Resistance level on DXY at 108. Support level at 106.60/106.0.

European Currencies weakened against USD driven by diverging PMIs. EURUSD fell 1.16% to close the week at 1.0418 (below key technical support level of 1.05). Euro area PMIs were soft with Services PMI below consensus and under 50 (A: 49.2, C: 51.6, P: 51.6). Manufacturing PMI below consensus (A: 45.2, C: 46.0). This drive soft composite PMI (A: 48.1, C: 50.0, P: 50.0). Final October HICP came in line with the preliminary estimate at 2.0% y/y (C: 2.0%), and Core HICP confirmed the preliminary release of 2.7% y/y (C: 2.7%). Support level at 1.04/1.03. Resistance level at 1.05/1.06. USDCHF rose 0.71% to close the week at 0.894 following the disappointing European data. In addition, SNB Chairman Schlegel reiterates that the SNB will not rule out the possibility of negative rates. GBPUSD fell 0.70% to close the week at 1.253 as UK PMIs deteriorated below consensus as well, though CPI beats consensus. UK Manufacturing PMI (A: 48.6, C: 50.0, P: 49.9); services PMI (A: 50.0, C: 52.0); composite PMI (A: 49.9, C: 51.7, P: 51.8). UK headline and Core CPI both beat consensus; headline yoy (A: 2.3%, C: 2.2%, P: 1.7%); core yoy (A: 3.3%, C: 3.1%). Support level at 1.247/1.24; Resistance level at 1.264/1.27).

AUDUSD rose 0.60% to close the week at 0.65. Minutes from the November RBA meeting reveal that the Board believed that underlying inflation remained “too high.” Members noted the “already lengthy period in which inflation had been above target,” adding that the Board has “minimal tolerance to accommodate a more prolonged period of high inflation, even if this occurred because of factors that constrained the economy’s supply capacity”. Based on OIS, market is pricing a full cut in May 2025.

USDJPY rose 0.31% to close the week at 154.78, as BoJ Governor Ueda hints that the December meeting is live, noting that a “vast amount” of information will become available ahead of the meeting. In addition, Higher-than-expected Japan nationwide core CPI supported the JPY.

USDCAD fell 0.79% to close the week at 1.3978 driven by a beat on Canada CPI and solid Canada Retail Sales data with a meaningful upside surprise in the ex-auto measure. Canada Headline CPI rose 0.4% m/m in October (C: 0.3%; P: -0.4%) to 2.0% y/y (C: 1.9%; P: 1.6%) but remained firmly within the BoC’s 1-3% inflation range. The CPI-Trim rose to 2.6% y/y (C: 2.4%; P: 2.4%) and CPI-median rose to 2.5% y/y (C: 2.4%; P: 2.3%). This raised the average of the 3-month annualized pace of the two measures to 2.8% (P: 2.1%). Market is pricing some chance of a 50bp cut in December, the beat here suggest risk is tilted towards a 25bp cut.

Oil & Commodities

Oil futures rose significantly last week as escalation in the Russia-Ukraine conflict over the weekend spurred concerns around oil supply. WTI and Brent rose 6.30% and 5.81% to close the week at 71.24 and 75.17 respectively. EIA report for the week ending November 15 showed a 1.2mn barrel increase in crude oil inventories, the third consecutive weekly increase, with underlying data pointing to weak fundamental.

Gold rose 5.97% to close the week at 2716.19 as escalation in the Russia-Ukraine conflict supported flight to quality. Resistance level at 2740/1800, while support level at 2600/2540.

Economic News This Week

-

Monday – NZ Trade Balance, JP Leading Index, US Chicago Fed Nat Act. Index/Dallas Fed Mfg Act.

-

Tuesday – US New Home Sales/Cons. Confid./Richmond Fed Mfg/FOMC Mins.

-

Wednesday – AU CPI, NZ RBNZ OCR, US GDP/Personal Cons./Core PCE/Wholesale Inv./Durable Goods/Initial Jobless CLaims/Personal Income/Personal Spending/Pending Home Sales

-

Thursday – NZ Biz Confid., EU Cons./Svc./Indust./Econ. Confid.

-

Friday – JP Jobless Rate/Retail Sales/Indust. Pdtn/Housing Starts, SW GDP, Norway Unemploy. Rate, EU ECB CPI Exp., UK Mortg. App., EU CPI, CA GDP, ST – CH PMI

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.