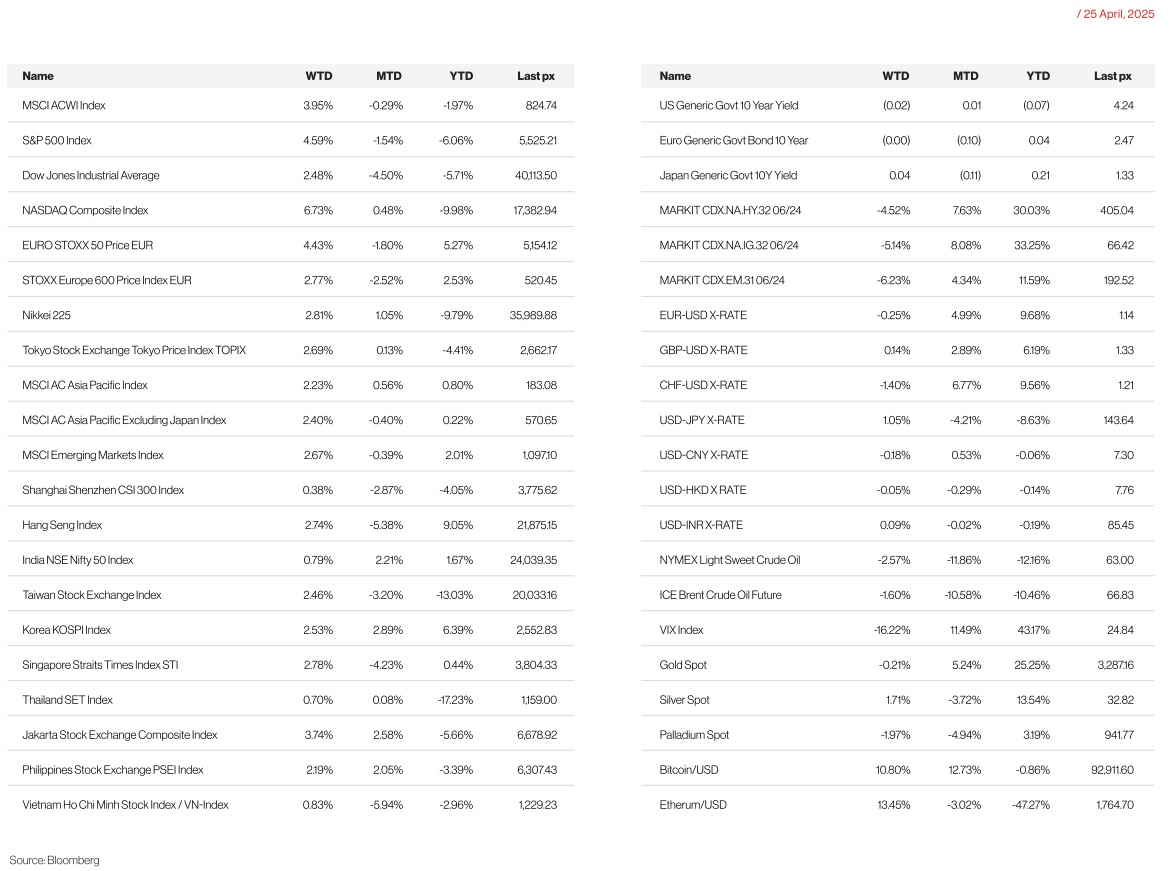

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

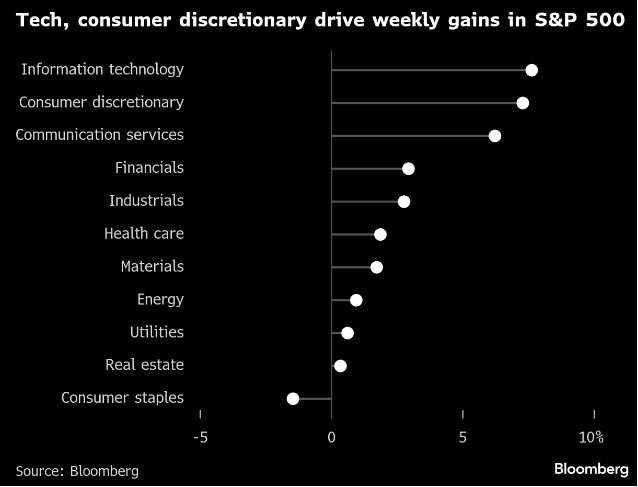

Tech stocks led the way for its 2nd biggest weekly gain since the beginning of the year, brought about by President Trump’s seemingly rethinking some of the more aggressive elements of his approach to trade as well as comments from Fed officials. Treasury Secretary Scott Bessent told a closed-door investor summit that the tariff standoff with China was unsustainable. Relief also came after President Trump said on Tuesday that he had no intention of firing Fed Chair Jerome Powell which came a day after he sent several missives sharply criticizing the Fed chair, which raised questions about the central bank’s independence that rattled markets which were already on edge. Some three quarters of the post-Liberation Day selloff has now been erased. Sentiment is starting to turn positive, now that the market is beginning to price in a post tariff environment.

Expectations of the Fed cutting rates sooner than expected lifted stocks, after Fed Governor Waller told Bloomberg Television on Thursday that he would support rate reductions in the event of tariffs driving job losses. Separately, Fed Bank of Cleveland President Hammack said officials could move as early as June if it had clear evidence of the economy’s direction.

President Trump’s softer stance on China about talks having already started was refuted by China, who maintained that development in talks was “groundless”. Still, reports from China that they were mulling exempting some US imports from the 125% tariffs helped lift overall sentiment. Authorities in China are mulling removing the additional levies for medical equipment, some industrial chemicals like ethane as well as waiving the tariff for plane leases. The dispensation, which follows deescalatory statements from Washington, signals that the world’s two largest economies were prepared to rein in their conflict, which had frozen much of the trade between them and raised fears of a global recession.

Earnings reports out so far remained mixed with some expectedly, choosing to provide cautious or even no guidance. The VIX closed Frida around 24, its lowest since Liberation Day. Tesla stood out as a big winner as it cheered Elon Musk’s plan to scale back his work with President Donald Trump and Tesla’s plan to launch 10-to-20 Model Y robotaxis in Austin this June.

Data out during the week saw applications for unemployment benefits pick up slightly, reflecting a stable labour market. And sales of previously owned homes fell by the most since 2022 in March. US consumer sentiment fell to one of the lowest readings on record and long-term inflation expectations climbed to the highest since 1991 on fears of the economic fallout from tariffs. The Fed’s Beige Book survey of regional contacts showed uncertainty over Trump’s heightened use of tariffs on trading partners has loomed large across the country in recent weeks.

A big week for data this week as we see the JOLTS report on Tuesday, GDP annualised and PCE on Wednesday, where core PCE YoY is expected at 2.6% from 2.8%. Friday will see the release of employment data from the BLS – NFP expected at +130k and an unemployment rate unchanged at 4.2%.

Europe

European stock markets closed higher on Friday, marking their fourth straight day of gains. Leading the rally were sectors such as construction, industrials, and travel and leisure, while mining and telecom stocks lagged behind. Much of the momentum was fueled by reports that China is considering removing some U.S. goods from its steep 125% tariffs.

Despite the upbeat market performance, economic data from the Eurozone painted a less optimistic picture. April’s flash PMI revealed that economic growth nearly came to a halt, slipping 0.8 points to 50.1—barely above the neutral 50 mark. The decline was primarily due to weakness in the services sector, which dropped to 49.7. In contrast, manufacturing output showed modest strength, inching up to 51.2. However, the European Commission’s consumer confidence indicator declined for the second month in a row, falling 2.2 points to -16.7 in April.

In France, data from the INSEE survey suggested a more stable economic environment, with the business climate index barely changed at 96.4.

The UK’s economy also showed signs of strain. April’s flash PMIs revealed a slowdown, with the composite index falling to 48.2 from 51.5. Services activity dropped sharply to 48.9, while manufacturing output slipped to 44.0. These figures bring the composite measure to 2.6 points below the first-quarter average. However, UK retail sales surprised to the upside, rising 0.4% month-over-month, defying expectations of a decline. On an annual basis, sales increased 2.6%. Good weather was credited for a boost in clothing and outdoor retail sales, although this was partially offset by weaker supermarket performance. Non-food sales jumped 1.7%, marking their strongest performance since March 2022. Despite stronger sales, consumer sentiment remained weak, with the GfK confidence index dropping to -23 in April.

On the regulatory front, the European Central Bank has launched a new task force, led by top officials from Germany, France, and Italy, aimed at simplifying the region’s banking rules. This move comes amid concerns that the EU is falling behind in global competitiveness. Efforts already underway include streamlining approval processes for bank capital models. Meanwhile, the European Banking Authority is working to standardize regulations. In the UK, authorities have introduced over a dozen reforms this year to ease the regulatory burden, including a major reduction in capital rule red tape and less frequent stress testing.

While the ECB has trimmed its deposit rate seven times since last June, it remains high enough to neither stimulate nor constrain economic activity, currently standing at 2.25%. Markets are pricing in at least two additional rate cuts, and Bank of America now anticipates the rate could fall to 1.25% by year-end, implying four more 25-basis-point cuts. The bank recently revised down its euro area GDP forecasts to 0.8% for 2025 and 1.0% for 2026, highlighting tariff-related uncertainty, a stronger euro, and subdued global demand. The IMF recently downgraded its eurozone growth outlook, citing ongoing tariff pressures and tighter financial conditions.

Looking ahead, this week brings a flurry of key Euro Area data releases, including preliminary Q1 GDP figures, April EC business surveys, the ECB’s March inflation expectations, money and credit statistics, unemployment data, and final manufacturing PMI readings.

Asia

Markets were broadly in the green last week across the globe. In Asia, MSCI Asia ex Japan was up 2.4%. Nikkei Index was also higher by 2.81%. Hope returned to the markets as Asian economies, such as South Korea, Japan, and India, led the way in trade negotiations with the Trump administration.

Trump said he would strike a deal with China — something he has said repeatedly — and that tariffs would “come down substantially”. There are no signs, however, that the US and China are about to start negotiations. On Thursday, He Yadong, a Ministry of Commerce spokesman from China, dismissed reports of progress, urging the US to show sincerity if it wants a resolution. China on its part, has demanded the US revoke all unilateral tariffs, claiming there have been no discussions on a trade deal.

China’s Ministry of Commerce also warned other countries in talks with the US against “reaching a deal at the expense of China’s interests. China’s Foreign Minister Wang Yi also held phone calls with his British and Austrian counterparts on Tuesday, urging the UK and the European Union to work with Beijing on safeguarding international trade.

Other Tariff updates: The US Administration is set to add new fees to Chinese-built shipping vessels, set to go into effect in 6 months (BBG), charging $50 per net ton rising by $30 a year over the next 3 years; additional fees of $120/ container will apply and $150/vehicle. The US builds 0.1% of ships while China has a 63.9% market share, according to Bloomberg data.

China hits back – Customs data revealed China imports of US-produced LNG fell to zero in March. A second jet sold to a Chinese airline was en route back to the US on Monday. China has cancelled 12,030 metric tons of pork orders from the U.S., the largest cancellation since the pandemic. And, Chinese state-backed funds are cutting off new investment in US private equity. China’s top leaders have pledged to step up support for the economy stricken by a high-stakes trade war with the United States as Beijing dismisses President Donald Trump’s claims of being engaged in tariffs negotiations.

South Korea- Seoul will seek a speedy solution over auto tariffs in trade talks with U.S. counterparts and is also prepared for the prospect of Washington bringing up the issue of defense costs.

Japan – The United States and Japan are moving closer to an interim arrangement on trade. The dollar hit a seven-month low of 140.615 yen on Monday on simmering market speculation that Japan could face U.S. pressure to prop up the yen, and help Washington reduce the huge U.S. trade deficit.

India – U.S. Vice President JD Vance on Tuesday called for enhanced engagement with India and said the South Asian country should buy more defense equipment and energy from the U.S. and allow Washington greater access to its market, lending momentum to an expected bilateral trade deal. Both countries have set an ambitious target of more than doubling their bilateral trade to $500 billion by 2030.

Taiwan – Taiwan’s premier on Thursday proposed another $10 billion in spending as a special budget to help the economy deal with the impact of U.S. tariffs/ 7 The US set new duties as high as 3,521% on solar imports from four Southeast Asian countries, delivering a win for domestic manufacturers while intensifying headwinds already threatening the country’s renewable power development. The duties announced Monday are the culmination of a yearlong trade probe that found solar manufacturers in Cambodia, Vietnam, Malaysia and Thailand were unfairly benefiting from government subsidies and selling exports to the US at rates lower than the cost of production.

Data from Asia: China left its 1Y and 5Y LPRs were unchanged as expected although economists still expect RRR and rate cuts ahead. Japan’s factory activity shrank for the tenth consecutive month in April as confidence among manufacturers dived to almost 5-year lows. South Korea’s real GDP unexpectedly contracted 0.1 per cent in the first three months of this year. Declines were reported in nine out of the country’s ten major export categories excluding semiconductors. Singapore’s core inflation came in a touch below expectations, edging lower from 0.6%oya in February to 0.5%oya in March.

GeoPolitics

Israel – US- Yemen: Yemen’s Houthi rebels have claimed responsibility for attacks on two US aircraft carrier groups currently patrolling the Red Sea and areas off Yemen’s coast on Monday, and further announced fresh drone launches on the southern Israeli cities of Ashkelon and Eilat.

Israel -US: Nine plane loads of bunker-busting bombs were shipped from the US to Israel. The munitions are intended to prepare Israel for a potential war with Iran. Washington also sent additional interceptors for the THAAD air defence system to Tel Aviv according to Israeli broadcasting authority KAN.

Israel – Lebanon: The Israeli army said on Sunday (Apr 27) it struck a southern Beirut building being used to store precision missiles belonging to Hezbollah. The attack was a further test of a fragile ceasefire between Israel and the Iranian-backed militant group.

Ukraine – Russia – US : President Volodymyr Zelenskyy said on Tuesday Ukraine was ready for talks with Russia « in any format » once a ceasefire is set. On Thursday, Ukraine reported that combined missile and drone attack from Russia triggered fires, smashed buildings, and buried residents under rubble in the Ukrainian capital Kyiv, killing nine people and injuring more than 70. President Donald Trump and Volodymyr Zelenskyy had a « very productive » meeting on Saturday. Details about the meeting was not reported.

China, Russia and Iran: Three countries jointly met with the International Atomic Energy Agency (IAEA) to discuss Iran’s nuclear programme. Separately, Russian President Vladimir Putin has signed a law ratifying a comprehensive strategic partnership agreement with Iran, Russian state-controlled media reported.

India – Pakistan: India announced a raft of measures to downgrade its ties with Pakistan on Wednesday, a day after an attack at the tourist destination in Kashmir, the worst attack in two decades. New Delhi would immediately suspend the 1960 Indus Waters Treaty « until Pakistan credibly and irrevocably abjures its support for cross-border terrorism. » India also closed the only open land border crossing point between the two countries and said that those who have crossed into India can return through the point before May 1.

A Pakistan government minister has said India’s suspension of a river treaty following a deadly attack on tourists in Kashmir was an act of « water warfare ». Pakistan Minister Hanif Abbasi openly threatened India with nuclear retaliation, warning that Pakistan’s arsenal – including Ghori, Shaheen, and Ghaznavi missiles along with 130 nuclear warheads – has been kept « only for India ».

China – South Korea : Anger is building in South Korea over Chinese fish farming installations in the Yellow Sea, opening another front in Beijings tensions with its neighbours. Beijing insists the structures are intended for fishing, but officials and experts in South Korea see them as the latest example of Chinas grey zone tactics, which critics say Beijing uses to bully countries including the Philippines, Vietnam and Taiwan in their territorial waters.

Credit/Treasuries

US Treasury yields were again very volatile following the different announcements from the US Administration. Yields initially went up during the first part of the week, before collapsing last Thursday & Friday. UST10Y and UST2Y ended the week lower at 4.235% and 3.748% respectively as odds for a June rate cut picked up.

The US Treasury curve bull flattened with the 2 years yield losing 2bps over the week, 5years yield loosing 7bps, 10years yield down 10bps and the long bond yield lower by 13bps. US IG 5years credit spreads tightened by 5bps over the week while US HY 5years credit spreads tightened by 25bps.

FX

The DXY USD Index dropped to a year-to-date low of 97.92 but rebounded to 99.47, driven by easing US China trade tensions and optimism about potential trade deals. President Trump softened his stance on Fed Chair Powell, and Treasury Secretary Bessent emphasized the need for de-escalation in tariffs. Comments from Fed officials suggested possible rate cuts, with Cleveland Fed President Hammack noting action could come as early as June. A break below 98.0 could signal further declines in the DXY, while a rise above 100.0 would indicate a trend reversal.

Safe-haven currencies underperformed as optimism around potential trade deals lifted risk sentiment. USDCHF rose by 1.42%, closing the week at 0.8284 after rebounding from 0.8040, while USDJPY gained 1.05%, ending at 143.67 after recovering from 139.89. The Bank of Japan is expected to highlight that higher U.S. tariffs wont derail its focus on rising wages and inflation, crucial for maintaining interest rate hikes. Japans April CPI exceeded expectations, with Tokyo CPI rising to a two-year high of 3.5% YoY, fueling speculation of future rate hikes by the BOJ.

EURUSD touched a high of 1.1573 (highest level since 2021) last Monday, before paring back its gains and closed the week at 1.1365 (-0.25% for the week). The IMF cut its forecast for the 20 countries sharing the euro currency to 0.8% growth in 2025 and 1.2% growth in 2026, both forecasts 0.2 point lower than the lender of last resort predicted at the start of the year. CB Governing Council Member Rehn commented that a larger 50bp ECB cut could be considered, while market implied probability of a 25bp ECB cut in June rises to 99%. ECB President Lagarde said the ECB is close to its goal of 2% inflation and the Central Bank must be « data dependent in the extreme due to the volatility and shocks such as from US tariffs. A break below 1.12 (Key support level) would imply a lower EURUSD.

With RSI indicator above 50, EURUSD is still supported and trading with an upward trend. Deutsche Bank see EURUSD heading towards 1.30 over the remainder of the decade, based on three assessments: (1) a reduced desire by ROW to fund growing US twin deficits; (2) leading to a gradual unwind in elevated US asset holdings; and (3) a greater willingness to deploy domestic fiscal space to support growth and consumption outside of the US.

GBPUSD closed the week at 1.3315 (+0.14%) driven more by positive risk sentiment, despite the IMF cutting UK growth prospects more than other European peers. In addition, BoE External Member Greene says she believes US tariffs pose more of a disinflationary risk than an inflationary risk . In the UK, the preliminary Composite PMI fell to 48.2 in April (49.9; C: 50.4; P: 51.5) as the Manufacturing PMI fell to 44.0 (42.0; C: 44.0; P: 44.9), and the Services PMI fell to 48.9 (51.0; C: 51.5; P: 52.5).

Oil & Commodity

WTI crude and Brent crude oil futures fell last week, closing the week at 63.02 (-2.57%) and 66.87 (-1.60%) respectively amid reports of heightened tensions within OPEC+ as some members exceeded output caps, with some members allegedly seeking another supply hike. Kazakhstan’s Energy Minister rejected pressure to cut output, prioritizing national interests over OPEC+ obligations, leading to fears of an escalating price war. OPEC+ members may seek another supply hike for June, which could exacerbate a global oil surplus and worsen the bearish outlook, with a video conference scheduled for May 5 to decide on the next step.

Gold touched a high of 3500 per ounce last Monday, before closing the week at 3319.72 (-0.21%). Extreme positioning in Gold drove the big drawdown in Gold prices amid renewed optimism with heightened volatility. Banks have progressively become more positive about gold with Goldman forecasting USD 4,000 an ounce midway through next year.

Economic News This Week

- Monday – SW PPI, US Dallas Fed Mfg Act.

- Tuesday – SW Retail Sales, ECB CPI Exp./ Cons./Econ./ Indust./Svc Confid., US Wholesale Inv./ JOLTS/ Cons. Confid.

- Wednesday – JP Retail Sales/ Indus. Pdtn, NZ ANZ Biz Confid., AU CPI, CH PMI, UK Nationwide Hse Px, EU GDP, US MBA Mortg. App./ ADP/ GDP/ Personal Income/Spending/ Core PCE/ Pending Home Sales

- Thursday – AU/JP/US/CA Mfg PMI April Final, AU Trade Balance, JP BoJ Rate Decision, SZ Retail Sales, UK Mortg. App., US Initial Jobless Claims/ ISM Mfg

- Friday – JP Jobless Rate, AU PPI/ Retail Sales, Norway Unemploy. Rate, SZ/EU/NO Mfg PMI April Final, EU CPI, US Nfp/ Factory Orders/ Durable Goods Orders

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.