/ Monthly Market Update - October 2025

AI Boom, Doom & Gloom on the horizon?

The humanoid robots – science fiction or strategically important reality

Table of Contents

Insights

AI : Growing Fast

The market is hot because many believe AI will transform the economy. Investors at Sequoia Capital recently argued it will be “as big if not bigger than the Industrial Revolution”. They argued that AI luminaries are not just after the “tens of trillions or hundreds of trillions of value” the tech could add to their firms, they are “in a race to create a Digital God”. That belief would justify any amount of spending.

Will AI really become God-like? Perhaps, but a recent report by UBS finds that revenues to date have been disappointing. Based on some estimates, total revenues from the tech accruing to the West’s leading AI firms are now $50bn a year. Although such revenues are growing fast, they are still a tiny fraction of the forecasted $2.9trn cumulative investment in new data centers globally between 2025 and 2028, a figure by Morgan Stanley which excludes energy costs.

AI revenues could continue to grow quickly, but only if firms continue to believe the tech is useful to them, and this is not guaranteed. A recent study by researchers at the Massachusetts Institute of Technology finds that 95% of organizations are getting “zero return” from investments in generative AI.

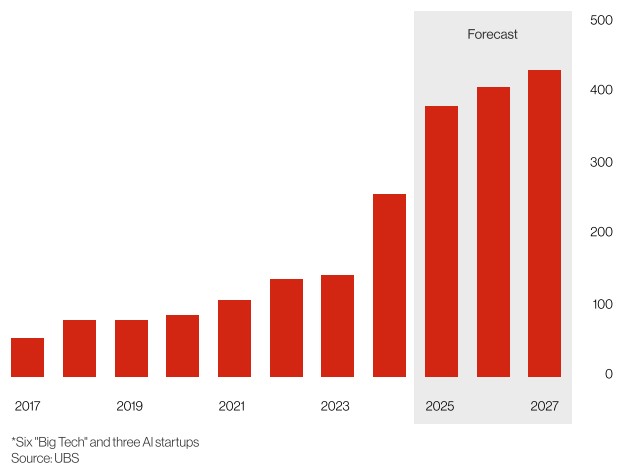

Chart 1 : Stairway to heaven

US, capital expenditure of large tech firms*, $bn

The main factor determining a crash’s severity is who bears the losses. When lots of individual investors lose a little, the economic damage is limited. This is what happened after America’s electronics and dotcom booms. Amid the British railway bust of the 1860s, by contrast, losses were concentrated among banks, which ended up with lots of bad loans. They then cut new lending, deepening the downturn.

Dotcom bubble vs AI boom

Both the dotcom bubble and today s AI boom have been fueled by the belief in American economic dominance. In 1999, the US economy was experiencing 5% GDP growth, deregulation, and a booming stock market while other major economies struggled to keep pace. Emerging markets collapsed during the Asian financial crisis, Mexican tequila crisis, and Russian default. Meanwhile, developed markets like Japan and Europe faced sluggish growth. The period became known as the « American Age of Affluence.

AI provides compelling reasons to be optimistic about future productivity gains and their moderating effect on inflation. Although there is significant uncertainty about the precise impact, recent research suggests the productivity gains from AI over the coming years could be substantial. Comparing AI to past technological revolutions led to an estimated range of 0.8% to 1.3% productivity gain per year. It is also possible that these historical parallels are insufficient to capture the productivity gains that are likely to come from AI.

Notable from then Chair Greenspan’s description of the late 1990s period, is the presence of other factors that contributed to softer inflation. Greenspan highlighted the importance of soft import price pressures and subdued inflation expectations in reinforcing the disinflationary effects from productivity gains. He also highlighted the importance of subdued nominal wage growth.

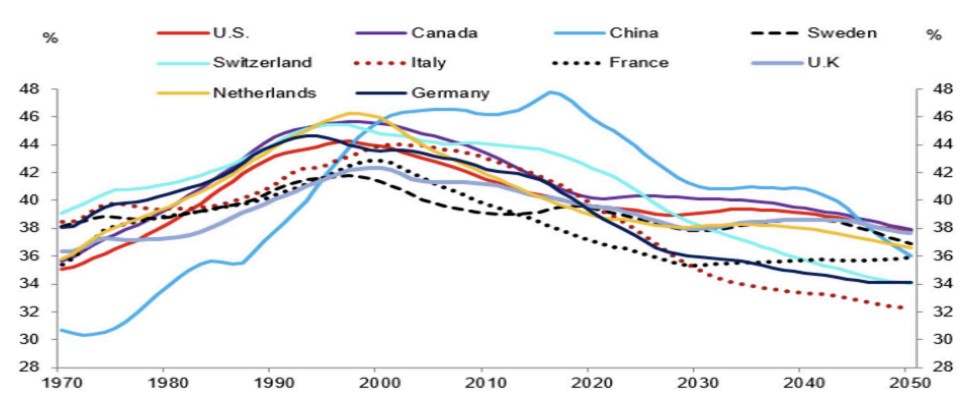

Unlike the 1990s, other forces could counteract, rather than amplify, the benefits of faster productivity growth. In addition to productivity growth, the 1990s benefited from positive labor supply trends. The current labor outlook looks like a mirror image of the late 1990s, an aging global population along with a turn away from immigration flows that will lead to tighter US labor markets and structurally higher cost pressures from labor.

Looking ahead, the shift towards de-globalization of the US economy will reverse this earlier disinflation. Studies found that a reversal of globalization trends could add 30bps to 40bps to core inflation looking ahead, depending on how much the US turned away from global trade. This estimate abstracted from the implementation of tariffs, which could add significantly more to inflationary pressures over the near term as well as over the medium term, to the extent that tariffs incentivize a shift toward less efficient production.

But can the AI boom continue forever?

Probably not, but most investors quickly push back with the following claims to argue that this time will be different from the dotcom era in 2000:

- Tech companies today are higher-quality businesses compared to 2000

- Tech companies today are cheaper compared to 2000

- The broader US market today is cheaper compared to 2000

The remaining runway in most technological end markets is an issue. Once a company becomes the proverbial 800-pound gorilla in its respective sector, sustaining supernormal topline growth tends to be virtually impossible.

How fast can Microsoft or Nvidia grow now that they respectively control approximately 60% of the entire software and semiconductor industry’s profits? On the current trajectory, the risk exists to see long-term revenue growth decelerate to single digits within the next five years. In other words, big tech might no longer offer a unique growth profile relative to other sectors. Indeed, a few of these larger spenders like Amazon and Alphabet have been trending in that direction for some time, all while their capex-tosales ratios reach new highs.

Below we look at some factors that warrant some caution in the current dynamics.

Market Exuberance and Bubble Dynamics

Since the release of ChatGPT in 2022, the value of America’s stock market has risen by $21trn. Just ten firms, including Amazon, Broadcom and Nvidia, account for 55% of the rise. All are riding high on enthusiasm for artificial intelligence, and they are not the only ones. Larry Ellison briefly became the world’s richest man, after AI enthusiasm prompted the share price of Oracle, his firm, to leap. In the first half of the year an IT investment boom accounted for all America’s GDP growth; in the year to date a third of the West’s venture-capital dollars have gone to AI firms.

This may seem like a striking admission, but even today’s tech leaders argue that bubbles are normal when new technologies emerge. Tech enthusiasm always runs ahead of tech realities . according to Michael Parekh, a former analyst at Goldman Sachs. History tells us that periods of major technological innovation are often accompanied by speculative bubbles as investors overreact to genuine advances in productivity, reads a study published in 2008 by the Federal Reserve Bank of San Francisco.

An academic study in 2018, which examined 51 innovations from between 1825 and 2000, found that 37 were accompanied by bubbles. One lesson from history is that, when tech bubbles burst, leading firms give way to upstarts. It might be a miracle if, in a decade or so, all the magnificent seven listed tech firms, and the biggest AI startups, still exist.

Then there is the way capital is deployed. Much of the capex by Japanese electronics firms in the 1980s ultimately served no useful function. By contrast, bubbles can benefit society if they create enduring assets. The railway mania built the backbone of England’s rail network, even if profitability took a long time to arrive. The tens of millions of miles of fiberoptic cable laid across America during the late 1990s were far more than the internet needed at the time. But in recent years this has facilitated dataintensive services such as streaming and video calls.

In another respect, though, America’s economy is in a historically unique position: individuals’ exposure to the stock market has never been so high. Ownership of stocks accounts for about 30% of the net worth of American households, compared with 26% in early 2000, at the peak of the dotcom bubble.

Such ownership is concentrated among the rich, whose spending (i.e. top 10% earners in the US now account for almost 50% of total consumption in America and own 85% of US stocks) has powered economic growth of late. According to Oxford Economics, consumer spending rises and falls by about 14 cents for every dollar change in financial wealth. These changes, in turn, depend more than ever on a few giant firms whose prospects will be shaped by AI.

AI-related stocks have driven a substantial portion of market performance in the last 3 years, accounting for roughly 75% of S&P 500 returns, 80% of earnings growth, and 90% of capex growth. This surge has been fueled by aggressive investment from hyperscalers, whose annual capex has quadrupled to around $400 billion, with just ten firms contributing a third of all public company capex.

However, signs of maturity are emerging: free-cash-flow growth has turned negative, price competition is intensifying, and speculative dealmaking is reminiscent of past bubbles. AI-linked capex is growing at ten times the rate of consumer spending and has become a key driver of GDP surprises, contributing an estimated 100 basis points to Q2 growth. Yet, as valuations stretch and cash flow tightens, investor focus might be shifting toward return-on-investment discipline.

Earnings revisions also tend to be a trailing indicator. For example, in December 2000, several quarters after the peak of the dotcom bubble, analysts were still forecasting nearly 9% earnings growth for 2001. Many leading companies, like Microsoft, continued to grow enviably well in the years following the bubble’s burst. This recalls Howard Marks’s view that there are no bad assets, only bad prices. Today feels like an era where bad prices are rampant.

Increased competition

During the 2010s, we viewed big tech as a collection of monopolies: Amazon dominated e-commerce, and Google dominated search. Their only competition came from sleepy incumbents ripe for disruption, such as cable television or brick-and-mortar retailers.

That is no longer the case today. Instead of playing in different sandboxes, big tech has largely converged into the same AI Arms race, where they now compete directly against each other.

Another great example of the deteriorating competitive landscape is the cloud market, which has been one of the most important growth drivers for several tech giants. This was once a stable three-player market: Microsoft, Amazon, and Alphabet. However, a disruptive fourth player (Oracle) just entered in a big way and is explicitly undercutting peers on pricing by 40%, according to some research. Adding to the shakeup, CoreWeave, a financially constrained fifth player with an arguably more cutting-edge product, has announced its intention to aggressively gain market share through pricing pressure.

Advertising revenue - a cap on growth

Most of today’s AI capital expenditures are funded by advertising revenue, the lifeblood of Silicon Valley. Digital advertising now accounts for more than 70% of all advertising, so the penetration-driven growth story could be approaching its final innings. Morgan Stanley expects the US digital ad industry to grow at a 9% compound annual growth rate (CAGR) from 2025 to 2030, less than half of its 20% CAGR between 2014 to 2019.

At these rates, the sector may only grow in line with sleepy sectors, think transmission and distribution utilities or property and casualty insurance, yet with considerably higher risk and cyclicality.

Countless new competitors have entered the digital advertising sector, including Walmart, Netflix, and Uber. Chinese Internet companies have also become fierce global competitors. In fact, ByteDance recently surpassed Meta to become the biggest social network by revenue worldwide.

At the end of the day, ad budgets are finite, and tech companies are increasingly competing against each other rather than legacy media companies for incremental growth. Despite massive innovation over the past century, total advertising revenue has remained constant at around 2% of GDP, and AI probably cannot change this fact. Moreover, there are only 24 hours per day, placing a natural limit on how much each digital platform can monetize users.

Labor supply dynamics & policies affecting productivity

The labor boom was not confined to the US during the 1990s. During that period, several countries experienced increasing shares of their population in the prime age group. Moreover, US companies capitalized on the global labor supply boom as globalization allowed firms to outsource production to lower cost countries, further helping to restrain domestic labor cost pressures on price inflation.

Looking ahead, the positive impact from global labor supply dynamics observed in the 1990s is in reverse. The US population is aging, putting downward pressure on labor force participation rates. This dynamic is observed across several economies (see chart 2), amplifying the retrenchment in global labor supply. US immigration policies are exacerbating these trends. With the US population likely to begin reversing by around the end of this decade without positive net immigration flows. Indeed, given the potential for net negative immigration flows, this figure is likely optimistic.

Trade protectionism and the push to de-globalization will also have meaningful impact. Analysis from the San Francisco Fed in 2019 finds that nearly half of US imports are intermediate imports. In this sense, a tax on imports (i.e. tariffs) is a tax on exports, as it raises costs for US producers that sell goods and services domestically and abroad.

Moreover, analysis from the Bureau of Labour Statistics in 2018 found that imports have contributed importantly to productivity gains in the US over time. Over the 1997 to 2015 period they find that 9% of productivity growth was due to imported intermediates.

Finally, the Trump administration’s decisions to significantly reduce funding for R&D at the university level could weigh on productivity growth ahead. Academic research has long argued that R&D is a critical input to productivity growth.

Chart 2 : Prime-age share of the population: 1990s benefited from a positive global labour supply shock

How much of your net worth do you want invested in a cyclical sector where many of the largest players appear to be exhibiting growth deceleration, free cash flow margin deterioration, and increasing competition?

How much of your net worth do you want invested in a cyclical sector where many of the largest players appear to be exhibiting growth deceleration, free cash flow margin deterioration, and increasing competition?

It may be hard for investors to face the uncomfortable reality that the trade that worked for over a decade may be over. After all, most money managers today do not carry the scars of the dotcom era. Of the approximately 1,700 active large-cap US portfolio managers, just 4% invested through that period. There is a difference between living through a downturn and merely reading about it.

For much of the last 15 years, investors who compared the exuberant periods in the technology sector to the dotcom era have been repeatedly proven wrong. Is it different this time? Some investors believe so.

Geopolitics and the fate of Chips

The nature of AI capex is also worrying. For now, the splurge looks modest by historical standards. According to some generous estimate, American AI firms have invested 3-4% of annual American GDP over the past four years. British railway investment in the 1840s was 15-20% of GDP. Yet if forecasts for data-center construction are correct, that will change.

What is more, an unusually large share of capital investment is being devoted to assets that depreciate quickly. Nvidia’s cutting-edge chips will inevitably look clunky in a few years’ time. We estimate that the average American tech firm’s assets have a shelf-life of just eight years, compared with 15 for telecoms assets in the 1990s.

President Donald Trump said the US will do whatever it takes to lead the world in AI when the US released its AI Action Plan last July. The plan proposed dismantling regulation that might obstruct innovation, build out US infrastructure and energy capacity, and ensure that allies use cuttingedge American technology while rivals, namely China, face tighter export controls. Both countries are trying to become self-sufficient in AI chips, with the US also seeking to deprive China of its most advanced technology on national security grounds.

Nvidia, which designs the advanced chips that are the cornerstone of cutting-edge AI, is at the heart of the issue. It has been producing strippeddown versions of its flagship chips, notably the H20, to sell in China since 2022. However, it was hit with a total ban in April, only for that ban to be reversed in July and then for export licenses to be granted recently with the condition that it handed over 15 percent of the revenue to the US government. Not long after, China’s internet regulator had banned the country’s biggest technology companies from buying Nvidia’s artificial intelligence chips.

The geopolitical position is complicated because little more than 10 percent of semiconductors are manufactured in the US. Nvidia, Apple, AMD, Qualcomm and other companies depend on Taiwan Semiconductor Manufacturing, on the island claimed by China, to build most of their critical chips. The US has also sought to shore up its capacity to build chips at home by taking a 9.9 percent stake in Intel, which makes chips as well as designing them. The US is tightening its regime by the day. Very recently, it revoked authorizations allowing South Korea’s Samsung and SK Hynix to ship US semiconductor equipment to their factories in mainland China.

In recent months, China, the world’s largest chip importer, has been doing more with less, as with the DeepSeek model built using cheaper chips at a fraction of the price. It has also been able to access some high-end chips through back doors, according to multiple reports. Critically, it has been developing (inferior but improving) chips of its own to reduce its dependence on the US and potential exposure to security risks from US chips. Chipmakers are aiming to triple production of domestic AI chips next year amid soaring demand.

Huawei’s Ascend chips have become the national standard, while rivals including Alibaba are racing to develop their own substitutes. That has contributed to an investment frenzy, boosted by evidence of real growth in AI and cloud revenues. Alibaba shares climbed more than 18 percent during a single trading session after it posted a triple-digit percentage gain in first-quarter AI revenue. Challenger chip designer Cambricon was recently forced to warn that its stock price may have deviated from fundamentals as its shares surged by more than 130 percent in a month.

AI and the energy conundrum

As AI adoption accelerates, the energy demands of data centers, the backbone of AI infrastructure, are surging to unprecedented levels. However, the U.S. faces significant structural challenges in meeting this demand. The national electricity grid, much of which was built decades ago, is increasingly outdated and ill-equipped to handle the load from hyperscale data centers. Grid congestion, transmission bottlenecks, and aging infrastructure pose risks to reliability and scalability. The issue is the slow pace of grid modernization.

The Department of Energy estimates that at least $2 trillion in investment may be needed by 2050 to upgrade and expand the grid to meet future demand. Compounding this issue is the long lead time required to build new sources of clean, stable energy.

Nuclear power, often cited as a solution for baseload capacity, faces a steep uphill climb: the last major nuclear plant in the U.S. (Vogtle Units 3 and 4 in Georgia) took over a decade to complete and was plagued by delays and cost overruns. The U.S. has also lost much of the industrial know-how and supply chain depth needed for rapid nuclear deployment.

Meanwhile, renewable energy sources like solar and wind, while growing, are intermittent and require substantial grid upgrades and storage solutions to support AI’s 24/7 computing needs. Without a coordinated national strategy to modernize the grid and accelerate energy infrastructure investment, the expansion of AI could be constrained not by innovation, but by electricity.

Valuation Risks and Capex Cycle

No wonder more people are asking if AI investment has become irrationally exuberant. Global Crossing is reborn, argues Praetorian Capital, a hedge fund, referring to the firm that hugely overbuilt crosscontinental fibers in the dotcom era. Valuations in the space are indeed flashing red and leave little room for cashflow disappointments, according to another report by UBS. Private-investment firm Apollo has noted that AI stocks are more richly valued than dotcom stocks in 1999. Even Sam Altman, CEO of OpenAI and one of AI’s most fervent evangelists, is sounding the alarm. Are we in a phase where investors are overexcited about AI? My opinion is yes.

Last is the question of who would bear the losses from a crash. Almost half the forthcoming $2.9trn in data-center capex, Morgan Stanley reckons, will come from giant tech firms’ cashflows. These companies can borrow a lot more to fund their investments if they wish, since they have little existing debt. They make up about a fifth of the S&P 500 index’s market value but, as borrowers, they account for only 2% of the investment-grade bond market. Their balance sheets look rock-solid.

Since the 2008 financial crisis, the US technology sector has been the standout investment trade, defying the concerns of value investors over steep valuations. While many initially underestimated the business quality, growth runway, and long-term earnings power of big tech, these companies evolved into monopolistic giants, delivering fast growth and robust profit margins. In a growth-starved, zero-interest-rate world that continuously drove capital toward secular growing compounders, this was the perfect setup for massive outperformance.

Even the best companies can falter when valuations are stretched, and expectations appear exuberant. During the dotcom crash, Microsoft and Cisco lost a third of their value in a matter of a week, and Amazon shed nearly 80% of its value over 12 months.

Conclusion

In summary, while the AI revolution presents transformative potential across industries, investors and policymakers must remain vigilant. The parallels to past technological booms are instructive, but today’s unique macroeconomic, geopolitical, and valuations dynamics suggest a more complex path forward. A balanced approach, embracing innovation while managing risks, will be essential to ensure sustainable growth and societal benefit.

Disclaimer

The documents herein are issued for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only. Please refer to the provisions of the legal information/disclaimer page of this website and note that they are fully applicable to any document herein, including and not limited to provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier & Cie does not provide any investment service or advice to US persons as defined by the regulations of the US Securities and Exchange Commission, thus the information herein is by no means directed to such persons or entities. © 2025 Bordier Group and/or its affiliates.