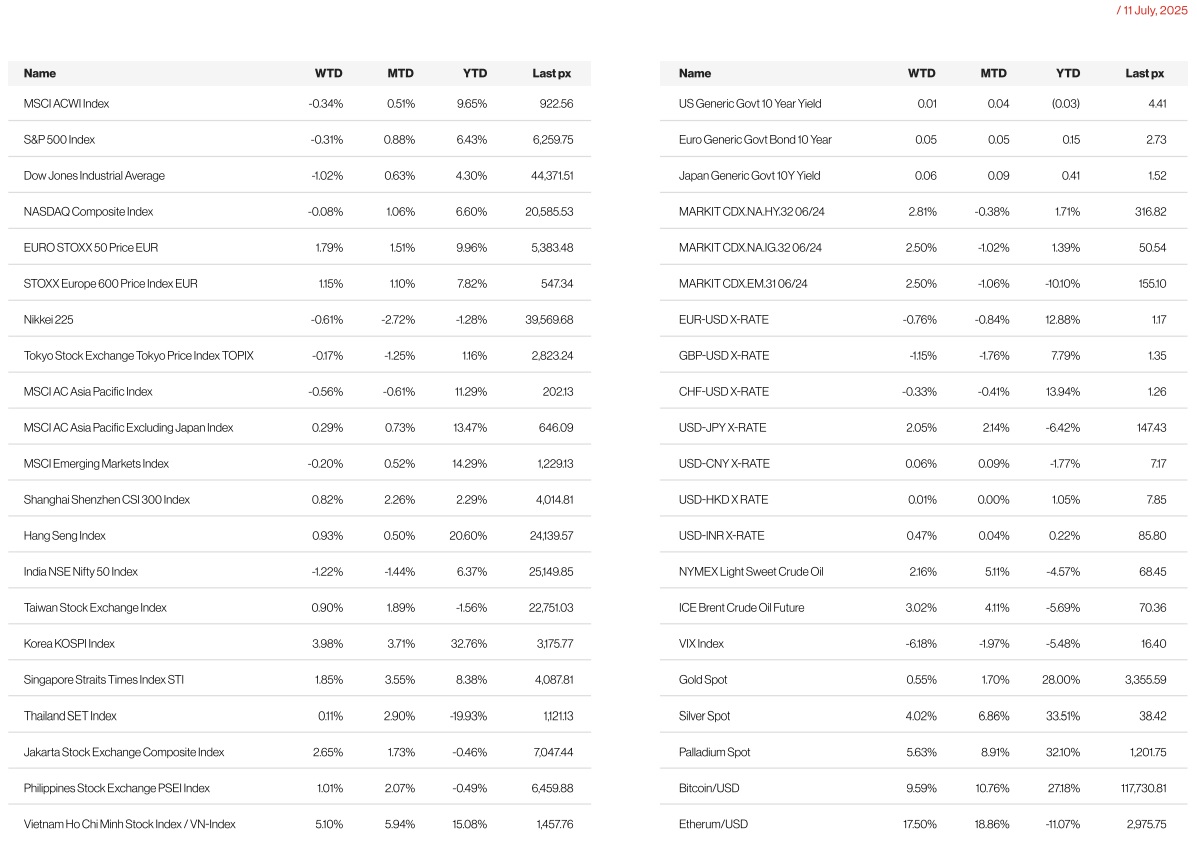

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets ended the week slightly down as tariff headlines and new tariff threats on US’ trading partners dampened sentiment, with some calling it a tariff triggered profit taking. Trump sent letters to several countries which included a 25% tariff on goods from South Korea and Japan, and 35% on some Canadian goods. Trump had also threatened a 50% tariff on Brazil over its domestic political affairs. President Trump also said that he would impose a 50% tariff on copper imports. And, over the weekend, President Trump declared a 30% rate for the EU and Mexico effective August 1st vowing no more extensions. Trump did however, leave an opening for additional adjustments where conditions and clauses could still get these rates reduced.

Who are the biggest buyers of US goods?

A quiet week on the economic data front with little market moving data, the NFIB small business sentiment index fell 0.2 points to 98.6 in June, in line with consensus expectations. Some economists expected that the progress of the One Big Beautiful Bill Act (OBBBA) in June as well as a relatively quiet period for tariff news would have supported sentiment in the month. The index remains 6.5 points below the post-election spike in December but remains just above its long-term average of 98.

The FOMC faces a difficult dilemma: upside risks to inflation and downside risks to growth from potential tariffs and trade policy changes. The June FOMC meeting minutes stated as much: « Participants noted that the Committee might face difficult trade-offs if elevated inflation proved to be more persistent while the outlook for employment weakened. » While the FOMC on the whole viewed uncertainty as diminished relative to the previous meeting, uncertainty remained elevated in their view, amidst rapidly evolving trade, fiscal and geopolitical developments. This is consistent with the dispersion of views regarding the appropriate policy stance later this year from the June Summary of Economic Projections: recall these showed 10 of 19 officials expected at least two rate cuts in 2H2025, but 7 expected no cuts, and 2 expected one cut. On inflation, the following sentence from the minutes gives us a little more colour : « While a few participants noted that tariffs would lead to a one time increase in prices and would not affect longer-term inflation expectations, most participants noted the risk that tariffs could have more persistent effects on inflation. » The minutes added the following sentence on inflation: « some participants observed that because inflation has been elevated for some time, there was a heightened risk of longer-term inflation expectations becoming unanchored if there is a long-lasting rise in inflation”.

Despite this, US equities have climbed from record to record over the past couple of weeks, betting on the resilience of American companies and hopes that the Federal Reserve will eventually start lowering interest rates. Earnings season starts this week with the six biggest US banks on scheduled to disclose second-quarter results. Big tech performed well with Nvidia, being the 1st company in history to hit the $4 trillion market cap mark, following commitments to AI spending from Nvidia’s biggest customers, Microsoft, Meta, Amazon, and Alphabet.

On China, Treasury Secretary Bessent said that he would be meeting his Chinese counterpart in the next couple of weeks. US Secretary of State Rubio touted that there is a high probability that Presidents Xi and Trump will meet later this year. This week will be a busy one for data releases, starting with CPI on Tuesday where core MoM is expected at 0.3% from 0.1%, headline YoY at 2.6% from 2.4%, PPI, Retail Sales, the Fed’s Beige Book and the U. of Mich. inflation expectations and consumer sentiment to end the week.

A very senior member of the Trump administration yesterday sent a letter to Fed Chair Jerome Powell asking whether he misrepresented facts to Congress with regards to the costly renovation of the Federal Reserve headquarters. Some are arguing that this is opening a legal avenue for President Trump to remove Chair Powell for cause. What if this happens and President Trump asks Powell to leave?

First, the market is arguably currently pricing a very low probability of this happening. Direct odds of a Powell departure are below 20%, while the distinctive kink in the money market curve in Q2 is suggestive of investors focusing on the shift in monetary policy from next year rather than imminently. Finally, the broad dollar has been stable over the last couple of weeks though front-end inflation expectations have moved a little higher recently. Second, because of the above, we believe the market reaction would be large. It is stating the obvious that investors would likely interpret such an event as a direct affront to Fed independence putting the central bank under extreme institutional duress. With the Fed sitting at the pinnacle of the global dollar monetary system it is also stating the obvious that the consequences would reverberate far beyond US border. So how large would we expect the market reaction to be? The empirical and academic evidence on the impact of a loss of central bank independence is clear: in extreme cases, both the currency and the bond market can collapse as inflation expectations move higher, real yields drop, and broader risk premia increase on the back of institutional erosion.

Europe

European equites finished the week with moderate gains. Eurostoxx 600 was up 1.15%.

Over the weekend, President Donald Trump announced that he would place 30% tariffs on goods from the European Union and Mexico and would take effect on August 1. In his letters to the EU and Mexico, Trump warned that if either trade partner retaliated with import duties of their own against the US, he would hit back by raising tariffs by a similar percentage over and above the 30%.

EU will extend its suspension of retaliatory measures on US goods, which were set to take effect in the coming days, hoping to procure a deal with the Trump Administration before the US starts charging its higher tariffs on August 1.

Looking at the economic data, German industrial production excluding construction rebounded 2.2% m/m (-1.9% m/m in April), reaching the highest level since April 2024. This was due to increases in the automotive (+4.9% m/m) and pharmaceutical industries (+10.0% m/m) as well as energy production (+10.8% m/m).

EA retail sales contracted by 0.7% m/m in May, reversing the gains recorded in both March and April, consistent with the ongoing downward trend in the EC survey consumer confidence.

Final national inflation releases for June were broadly in line with the flash prints. In France, headline HICP inflation was revised up 0.1pp to 0.9% y/y due to corrections to services and energy but core inflation continued to round to 1.6% y/y. In Germany, headline and core inflation were unrevised at 2.0% y/y and 2.5% y/y.

This week, focus will be on the final June inflation releases for Spain, Italy and the euro area (Tue, Wed and Thu), euro area May industrial production (Tue) and euro area May international trade in goods (Wed). On the policy side, we expect to see the already mentioned presentation of the French government’s fiscal consolidation strategy (Tue) and the European Commission to outline its 2028-2034 Multiannual Financial Framework proposal (Wed).

In the UK, GDP contracted by 0.1% m/m in May, driven by a 0.9% m/m contraction in industrial production while services activity posted positive but muted growth. While services output (+0.1% m/m) grew broadly in line with expectations, the overall weakness was driven primarily by a 0.9% m/ m drop in industrial production.

Two recent reports have reignited concerns about the UK economy—one showing a dip in May’s GDP (as above) and another from the Office for Budget Responsibility (OBR) warning of long-term fiscal risks, including soaring debt. The OBR emphasized that the UK cannot afford its current promises without significant tax increases, especially as pressures from an ageing population and rising welfare costs mount. Despite some signs of economic optimism and investment interest, the government faces tough decisions in the upcoming Budget, possibly involving £10–£20 billion in tax hikes.

This week, we will see the CPI data and the labour data such as unemployment rate, the average weekly earnings and the jobless claims change.

Asia

Asian equities were mixed. MSCI Asia ex Japan gained 0.29% for the week while the Nikkei 225 was down 0.61%.

Singapore GDP growth in Q2 expands on stronger export growth at 4.3% y/y in Q2. By sector, manufacturing industries outperformed and grew 5.5% y/y in Q2, construction sector expanded 4.9% and services sector grew 4.8%.

Japan core machinery orders fell 0.6% m/m in May, less than expectations of a 1.5% decline.

In China, the FX reserves rose US$32.2bn to US$3,317.4bn in June. Implied capital outflows are estimated at US$59.1bn yuan, widening from May s – $54.8bn. For 1H as a whole, FX reserves increased by US$115bn, benefiting from valuation gains. As for gold reserves, the central bank added another 0.07mn oz in June, extending the gains for the eighth consecutive month. The PPI deflation dropped to -3.6% y/y due to weak infrastructure and real estate investment, soft energy prices, and external trade uncertainties, while CPI inflation turned slightly positive at 0.1% on food and appliance gains. Despite policy efforts like anti-involution measures and trade-in subsidies, domestic demand remains weak.

Taiwan’s exports continued to surge in June, driven by strong tech demand —especially AI-related products—and front-loaded orders from the U.S., with U.S.-bound shipments up 182%. Imports also rebounded, led by agricultural and industrial raw materials. Taiwans headline CPI inflation moderated to 1.4% y/y.

Thailands headline CPI fell 0.2% y/y in June, rising from -0.6% y/y in May, core inflation stayed unchanged at 1.1%.

GeoPolitics

The 1st of August seems to be the new 9th of July. President Trump announced on the 7th of July a new round of reciprocal trade tariffs targeting 14 countries, including 9 Asian countries (Japan 25%, South Korea 25%, Malaysia 25%, Indonesia 32%, Bangladesh 35%, Cambodia 36%, Thailand 36%, Laos 40% & Myanmar 40%).

On the same day, President Trump threatened to impose additional 10% tariffs on member of the BRICS bloc, if they adopt policies towards the US that the Trump administration ‘determines’ as hostile. Two days later, the US Government announced 50% tariffs on copper, compared with the 25% initially envisaged. This announcement took the market by surprise both in terms of its scale and timing. According to Commerce Secretary Howard Lutnick, the tariffs should also be in place by August 1. The statement predictably sent copper futures in New York surging to their largest intraday gain in decades.

One day later, President Trump was threatening to hit Brazil with tariffs of 50%, in significant escalation of tensions between the US and Latin America’s biggest economy. In a letter posted to Truth Social, Trump lashed out at the government of Luiz Inácio Lula da Silva over the treatment of Brazil’s former right-wing president Jair Bolsonaro. On the same day, President Trump threatened the Pharma sector with 200% tariffs after a transition period of one, one and a half years. The aim is to give companies time to move their production capacity to the United States. The announcement of tariffs was expected by the market at any time. While the amount mentioned (200%) is considerably higher than the level expected (25%), our analyst believes that the proposed timeline is excellent news for the sector, indicating that there would be no tariffs for at least a year. The timeline gives companies time to manage stock levels in the US, make progress on reorganizing the supply chain and start investing, if necessary, in new production capacity. Bordier Geneva research team takes a positive view of the President’s statement, which tends to significantly reduce the risk of tariffs for the sector.

On Friday President Trump said that he will impose blanket tariffs of 15% to 20% on most trading partners. He also said that he will impose 35% tariffs on Canada, starting 1st of August. And finally on Saturday, President Trump announced a 30% trade tariffs on the European Union & Mexico exports to the US.

Israel’s airstrikes on Iran’s nuclear facilities (starting mid-June) continued to dominate regional geopolitics. Moderates in Iran are gaining influence, pushing for renewed nuclear talks with the U.S., though major disagreements remain—especially over uranium enrichment rights.

President Trump signed a sweeping bill slashing $1 trillion from Medicaid and social programs, while extending tax cuts for the wealthy. More than 300 rural hospitals in the US are at risk of closing down. The bill is expected to leave 17 million uninsured and increase the national debt by $3.3 trillion.

Russia becomes the first country to formally recognized the Taliban government in Afghanistan, signaling a shift in regional alliances and challenging Western diplomatic norms. The decision marks a major milestone for the Taliban almost four years after they swept into Kabul and took power.

UN AI for Good Summit: Held July 8–11, this summit addressed the security implications of AI, building on earlier global agreements. Health was a prominent theme this year where AI-powered triage in emergency care to diagnostic tools in rural areas were explored.

Credit/Treasuries

Last Wednesday, 10Years US Treasury yield dropped by 7bps, after five consecutive sessions of losses, following a robust auction which comes 0.3bp through and is well-received (bid-to-cover ratio: 2.61x; 12m average: 2.56x), seemingly easing some concerns around demand.

In the Eurozone, long term government bond yields have been edging higher on the back of upgrades to growth forecasts, as markets continue to digest the extent of planned fiscal easing across the EU. As well as mitigating the need for monetary easing, this policy initiative will be adding materially to supply over the next several years. Yet this is coming at a time when demand for longer-dated bonds appears to be continuing to wane. Upcoming Dutch pension fund changes (Dutch pension funds are expected to sell around EUR 125Bn of long dated government bonds between 2026 to 2028) have been spoken about in this context and it is noteworthy to reflect that a segment of the market that had been responsible for a material volume of long-end demand is now poised to turn a net seller. With this being the case, we see a case for long-end curve steepening in the EU.

The US Treasury curve bear steepened last week with the 2years yield up 3bps, 5years yield up 7bps, 10years yield up 8bps and the long bond yield up 10bps. US 5years IG credit spreads finished the week unchanged while US 5years HY credit spreads widened by 6bps.

FX

DXY USD Index rose 0.69% to close the week at 97.85, as USD continued its rebound since its recent low on 1st July. USD was supported by tariff escalation as President Trump unveiled higher tariff rates for a slew of countries via letters that were close to Liberation Day levels, announced 50% tariffs on copper imports to the US, 50% tariffs on imports from Brazil, 35% tariffs on Canada and threatened pharma sector tariffs as high as 200% and a new baseline tariff rate of 15-20%, although the deadline was pushed towards 1st August from 9th July. June FOMC minutes reaffirm the belief that rates are well positioned to wait for more clarity, while illustrating the divergence in participants’ outlooks on the policy path ahead. USD strength came despite President Trump continuing to ratchet up political pressure on Fed, calling for 300 bp worth of rate cuts and extending Powell criticism to Fed HQ renovations. Market pricing implies a 61.7% chance of a September rate cut.

European Currencies fell against USD with EUR (-0.76% to 1.1689), GBP (-1.15% to 1.3493) and CHF (-0.33% to 0.7966). CHF outperform driven by safe-haven demand from tariff uncertainty. GBP underperform as UK May GDP comes in below expectations, contracting -0.1% m/m (MSe: -0.1%; C: 0.1%) driven by weak manufacturing and consumer-facing services. In addition, the OBR’s Fiscal risks and sustainability report reveals the UK may need to rely more on foreign investors as UK pensioners slow down their gilt purchases. Over the weekend, President Trump declared a 30% tariff on the European Union, to take effect on 1st Aug if better terms are not negotiated.

Antipodean Currencies performed mixed against USD with AUD (+0.34% to 0.6578) and NZD (-0.86% to 0.6008). The RBA maintained its policy rate at 3.85% at its July meeting, against expectations for a cut, in a 6:3 vote split. RBA Governor Bullock noted that the RBA was still on an easing path, but that there was scope to « wait for a little more information. » The statement emphasized that economic conditions were evolving as expected, with only modest upside risks to inflation forecast and downside risks to growth forecast. AUD was boosted as reports indicate that in China, the NDRC is considering expanding the funding channel to include ultra-long-term special treasury bonds, on top of local government special bonds, for the buyback of completed housing inventory and idle land in cities with population inflow. The RBNZ maintained its policy rate at 3.25% at its July meeting, as widely expected. The pause came with the guidance that “if medium-term inflation pressures continue to ease as projected, the Committee expects to lower the Official Cash Rate further”.

USDJPY rose 2.05% to close the week at 147.43 driven by widening USJP rate differential. JPY underperform after President Trump announces 25% tariffs on goods from Japan, and amid heightened domestic fiscal concerns ahead of the election. In addition, BoJ Board Member Koeda says « it is inappropriate to talk about a specific timing for the next rate hike » given the stronger-than-expected inflation.

Oil & Commodity

WTI crude and Brent crude oil futures rose 2.16% and 2.27% to close the week at 68.45 and 70.36 respectively, as Traders focus on President Trump’s planned major statement on Russia on Monday. President Trump’s renewed criticism towards Russia President Putin, along with expectations that the Senate will pass a tougher Russia sanction bill, are increasing odds that future Russian energy exports may decline. In addition, reports suggest that OPEC+ members are discussing a pause in output hikes from October.

Copper future rose 9.12% to close the week at 556.20 after President Trump announced a 50% tariffs on all copper imports, effective 1st August.

Economic News This Week

- Monday – JP Core Machine Orders/Indust. Pdtn, CH Trade Balance, SW CPI

- Tuesday – AU Westpac Cons. Conf., CH GDP/Retail Sales/ Indust. Pdtn, EU Zew, CA CPI, US CPI/Empire Mfg

- Wednesday – UK CPI/RPI, US MBA Mortg. App./PPI/Indust. Pdtn

- Thursday – NZ Food Prices, AU/UK Unemploy. Rate, EU CPI, US Retail Sales/Initial Jobless Claims

- Friday – JP Natl CPI, US Housing Starts/UMich.

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.