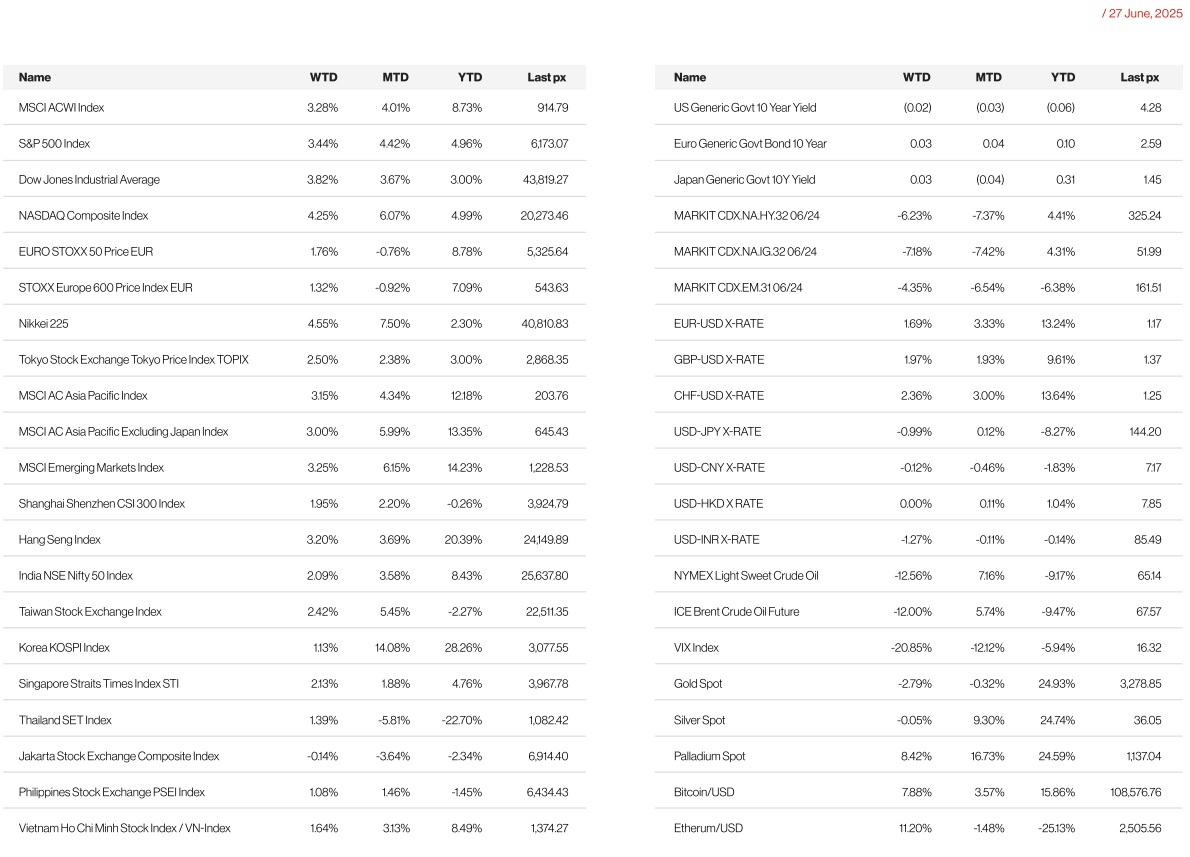

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

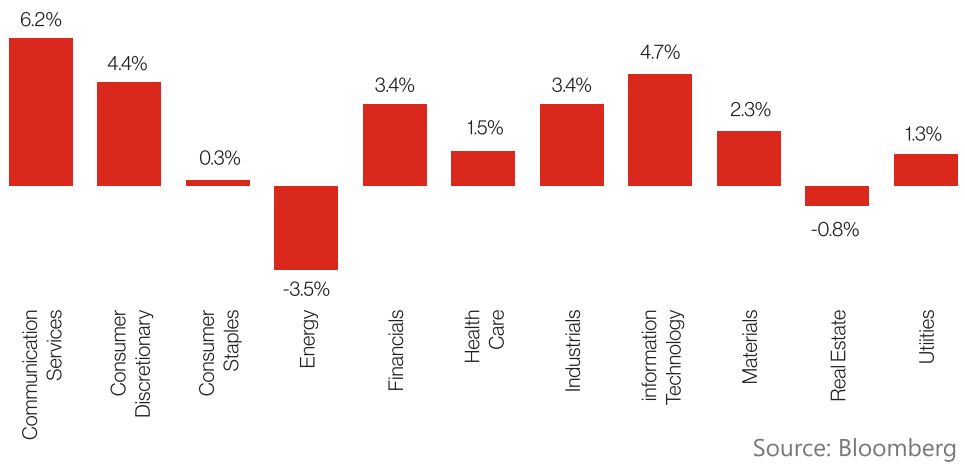

The last full week of June came in strong, edged on amid a lack of volatility as a ceasefire in the Middle East reduced geopolitical risk. A confirmation on both sides, China and the US announcing further progress in tariff deals fueled sentiment. The VIX closed down at 16.32 with the S&P 500 closing out the week with a 3.45% gain. Both the Nasdaq and the S&P 500 hit record highs. Communication Services, Information Technology and Consumer Discretionary were the main winners whilst Energy, Real Estate and Consumer Staples underperformed. Among financials, JPMorgan Chase & Co. and Goldman Sachs Group Inc. climbed to record highs after the Fed unveiled a plan Wednesday to decrease a key leverage ratio that requires banks to hold a certain amount of capital relative to their assets.

Data showed a sharp deceleration in consumer spending growth in Q1, down to 0.5% from 1.2%. Both personal income and spending contracted into negative territory in May. The Fed’s preferred inflation gauge, the PCE price index minus food and energy, rose 0.2%, slightly more than expected suggesting that higher prices from tariffs may be starting to work its way through the economy. Headline YoY PCE came in on the nose at 2.3%.

We had quite a few Fed members in the media with mixed opinions: Chair Powell in his testimony firmly reiterated that they are well positioned to wait and see how Trump’s policies pan out, SF’s Daly saying she only sees a rate cut in the fall. Federal Reserve Vice Chair for Supervision Michelle Bowman signaled support for lowering interest rates as soon as July, which sent yields lower. Fed Bank of Chicago President Goolsbee said the central bank could resume rate cuts if the inflation hit from tariffs remains subdued, without weighing in on the exact timing of such a move. Boston’s Collins expects only the 1 cut this year and thinks July would be too early for such a move.

10y UST yield was lower by approximately 13bps on the week as the UST market rallied in tandem with equities. Yields shifted lower across the curve, led by intermediates, as the expectations of two rate cuts from the Fed for the rest of the year continue to solidify as the base case.

With markets already looking ahead to the 4th of July Independence Day holiday on Friday, we expect a relatively quiet week on the company and macro front, though the June Non-farm Payrolls report is likely to be the highlight. Consensus is at +113k for the change in NFP at an unemployment rate of 4.3% from 4.2%. We will also have JOLTS and ISM data on Tuesday.

For now, according to Deutsche’s Jim Reid, “…Markets are not particularly concerned about, the upcoming July 9 tariff deadline . When asked if the deadline was set in stone, President Trump replied, “No, we can do whatever we want.” Despite Trump’s apparent flexibility as to the dates, the executive order he signed on April 9 is not flexible unless it’s formally updated (CNBC, June 27).

However, the lack of events could leave markets more vulnerable to geopolitical headlines. It remains to be seen if indeed, the US would hold a meeting with Iran this week.

On the tax bill, the Senate has voted to open debate on Trump’s $4.5 trillion tax cut bill, with a final vote expected to spill into Monday.

Europe

European equity markets finish higher last week. French and Spanish inflation data was faster than expected in June. Meanwhile, Spanish retail sales beat on a y/y basis while French consumer spending a bit firmer than forecast. Eurozone economic sentiment data registered a small dip in June update.

European Commission President von der Leyen said the EU is reviewing the latest U.S. tariff proposal. EU leaders are debating whether to accept a quick, imperfect deal that may leave some tariffs in place. Brussels is considering reducing tariffs on certain U.S. goods to expedite an agreement. Other options include digital taxes on U.S. tech firms, easing non-tariff barriers, increasing U.S. imports, and cooperating on China. Germany’s Merz urged a swift resolution, citing time constraints, while France’s Macron supported a quick deal only if it remains balanced. Leaders also explored new trade partnerships with Asia-Pacific nations to reform the WTO framework.

Eurozones Jun inflation data, due Tues 1-Jul, poised to show headline returning ECBs 2% target, following benign updates from France and Spain.

French inflation edged up 0.8% y/y in Jun from May s four-year low of 0.6%, driven primarily by services costs that climbed to 2.4%.

Spanish prices advanced 2.2% versus 2.0% prior, matching analyst expectations, with the increase attributed mainly to rising fuel prices and modest upticks in food costs.

Asia

In Asia the mood was upbeat, MSCI Asia Pacific ex-Japan rose 3.15% last week to reach a 3-year high, led by Hong Kong (+3.2%), and Taiwan (+ 2.4%).

Updates on Tariffsd

- White House announced trade deal struck last week with China, though details lacking. US and China had “agreed to an additional understanding for a framework to implement the Geneva agreement” . Commerce Secretary Lutnick said only Beijing would deliver rare earths curbs and US would remove countermeasures.

- Lutnick also flagged 10 deals with trading partners ahead of 9-Jul tariff deadline, though White House also signaled flexibility on the date. US to continue negotiations with Japan and India this week, though obstacles remain including market access and demands for sectoral tariff removal.

- South Korea reiterated request for tariff exemptions, including steel and auto levies, following talks this week

- Thailand faces a 36% U.S. tariff on its exports, a key driver of growth, if it fails to negotiate a reduction before a moratorium expires in July. Thai Finance Minister Pichai Chunhavajira will travel to the United States for trade talks this week.

Other data points from Asia:

- Japan’s all-industry flash PMI rose 1.2 point to 51.4, citing expansion.

- Bank of Korea’s survey, the consumer sentiment index (CSI) rose further to a 4-year high of 108.7 in June, for the third consecutive monthly gain

- China’s industrial profits fell by 9.4% YoY, while revenue rose by 0.7% YoY in May.

- Inflation in both Malaysia and Singapore edged down in May.

- Bank of Thailand (BoT) kept its policy rate unchanged and revised up its growth forecast for 2025 to 2.3% from 2.0% in the previous meeting, reflecting the modest upward surprise in Q1 real GDP.

- In Vietnam, the National Assembly approved the new legislation on Jun 27, which authorizes the State Bank of Vietnam (SBV) to provide special unsecured loans to troubled banks at zero lending rates, effective from Oct 15. SBB Securities advisory commented on the move, stating, « The central bank could quickly support critical weak banks out of illiquid turmoil and maintain the financial system. »

GeoPolitics

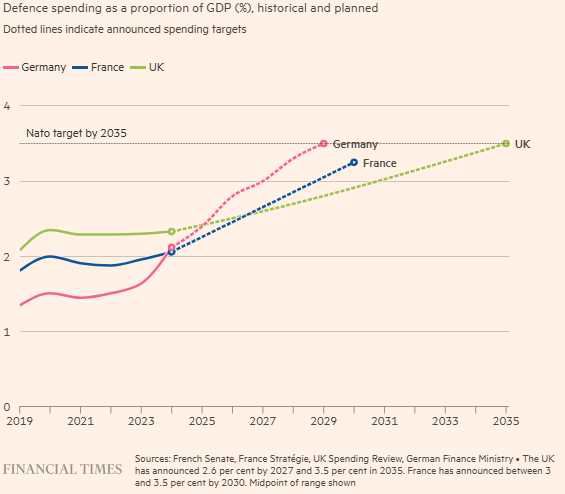

Europe: Germany will boost defence spending by more than two-thirds by 2029, outpacing France and the UK. German military expenditure is projected to reach €162bn in 2029, up from €95bn this year. President Emmanuel Macron has called for Frances military budget to rise to between 3 and 3.5 per cent of GDP by 2030, from about 2 per cent now. Britains progress is much slower than Germany s: it plans to raise defence spending from around 2.3 per cent of GDP currently to 2.6 per cent by 2027. But not everyone in Europe is onboard, Spains PM is capping his spending at 2.1%, and others like Belgium and Slovakia dont seem convinced with the 5% either.

Thailand Cambodia: Thailand s army closed border crossings with Cambodia in six provinces on Monday (Jun 23) to all vehicles and foot passengers except students and people seeking medical treatment, as a territorial row between the neighbors rages.

U.S. Israel- Iran: President Donald Trump announced on Monday (23 Jun) a complete ceasefire between Israel and Iran, ending the 12-day war that saw millions flee Tehran and prompted fears of further escalation in the war-torn region. Ceasefire agreed between Iran and Israel appears to be holding by end of the week, though some allegations earlier of potential violations by both sides. Israel had bombed a target near Tehran earlier while Trump took to Truth Social to assert the ceasefire was still in effect.

The official line from the Trump administration was that the three nuclear sites that it targeted suffered “severe damage and destruction” but a final assessment is still being made. Iranian Foreign Minister Abbas Aragchi said that it evacuated the sites at Natanz and Isfahan and removed nuclear material. The International Atomic Energy Agency (IAEA) said that it did not detect any radiation in the area following the US attacks.

US- China: Donald Trumps dramatic intervention in the Iran-Israel war has reverberated well beyond the Middle East, forcing rival China to reassess how the US president might wield American military power in the event of a conflict in Asia. Beijing strongly criticized Trumps decision to strike Iranian nuclear targets and voiced concerns over the threat that conflict in the Middle East poses to energy supply lines for the worlds biggest oil buyer.

Credit/Treasuries

The Federal Reserve has kicked off one of the largest reductions of US bank capital requirements since the 2008 financial crisis by proposing to allow higher leverage at the biggest American banks. The US central bank said on Wednesday it planned to slash the enhanced supplementary leverage ratio for the biggest banks. The rule requires them to have a preset amount of high-quality capital against their total leverage, which includes assets such as loans and off-balance sheet exposures such as derivatives. It was established in 2014 as part of sweeping reforms in the wake of the financial crisis. The change would reduce aggregate capital requirements at the holding company level for the eight big banks affected by $13bn, or 1.4 per cent, the Fed said. The Fed proposal would lead to a bigger reduction in capital requirements for the deposit-taking subsidiaries of the biggest US banks. These subsidiaries’ capital requirements would fall by 27 per cent, resulting in a $210bn reduction in bank capital, according to the central bank.

The US Treasury curve bull steepened last week with the 2years yield -18bps, 5years yield -14bps, 10years yield -9bps & 30years yield -4bps. US 5years IG credit spreads tightened by 4.5bps while US 5years HY credit spreads tightened by 23bps.

FX

DXY USD Index fell 1.32% to close the week at 97.40 (the lowest level since 2021). There were several factors driving USD weakness. First was it was reported that President Trump is considering accelerating when he will announce a successor for Fed Chair. Fed Chair Powell testifies before Congress, noting that many paths are possible for monetary policy, but adds that a significant majority of the committee sees rate cuts by yearend if inflation does not prove to be as high or the labour market weakens. This was reinforced by several dovish fed official comments. In addition, soft US economic data further support the USD weakening.1Q25 GDP is revised down to -0.5% q/q a.r. Core PCE annualized inflation in the last three months came in at 1.65% (April: 2.86%), and the six-month annualized pace at 2.92% (April: 2.76%).

EURUSD rose 1.69% to close the week at 1.1718, while GBPUSD rose 1.97% to close the week at 1.3716. The gain in EUR was driven by the agreement by NATO to ramp up defence spending to 5% of their countries economic output by 2035 from the previous 2%. GBP gained even more given the positive risk sentiment on trade front.

AUDUSD rose 1.19% to close the week at 0.6529. In Australia, Headline CPI slowed to 2.1% y/y in May (C: 2.3%; P: 2.4%) and Core CPI slowing to 2.4% y/y (P: 2.8%). The report showed services inflation easing from to 3.3% y/y (P: 4.1%), and housing inflation reversing after a stronger April figure. OIS is pricing almost a full cut in July meeting (94.3%) and more than 3 cuts (81.5 bps cut) in 2025.

USDJPY fell 0.99% to close the week at 144.65, dominated by USD weakness. BoJ official commented that if inflation risks rise, the Bank may need to raise rates and act decisively, despite heightened uncertainties but still cautioned that the BoJ should wait for further clarity. In Japan, Tokyo Core CPI (excluding fresh food) decelerated to 3.1% y/y in June (C: 3.3%; P: 3.6%), while Core-of-Core CPI (excluding fresh food and energy) slowed to 3.1% y/y (C: 3.3%; P: 3.3%;).

Oil & Commodity

WTI crude and Brent crude oil futures fell 12.56% and 12% to close the week at 65.52 and 67.77 respectively driven by dampened Middle East tensions as President Trump brokered ceasefire between Israel and Iran. In addition, it was reported on Bloomberg that several OPEC+ delegates said their countries are set to consider extending OPEC’s three-month run of « super-sized » 411K bpd production increases at its next meeting on 6-July. This reporting is largely in-line with current analyst expectations. Goldman Sachs anticipates a final similar production increase in August amid signs of solid demand heading into the summer season. Morgan Stanley is forecasting three more 411K bpd hikes. News follows reports Russia is open to further hikes with Russian President Putin saying Friday OPEC+ is projecting rising global demand especially in the summer months. Developments cap off a volatile week for oil with WTI set to end roughly 12% lower as supply risks ease after Iran-Israel ceasefire. Goldman Sachs also noted options markets now price just a 4% chance of a Strait of Hormuz disruption following truce.

Gold fell 2.79% to close the week at 3274.33, while Silver was flat for the week (-0.05%). The fall in gold prices was driven by de-escalation in the Middle East with the fragile ceasefire between Iran and Israel in place. In addition, better trade headlines drove weakness in gold price as Trump administration officials said US and China formalized the Geneva consensus, noted nearing agreements with 10 other trading partners, downplayed importance of 9 Jul reciprocal tariff deadline and left door open for extensions.

Immediate support for Gold at 3200 and 3168 (100 days MA).

Economic News This Week

- Monday – JP Indust. Pdtn, AU Melbourne Inflat., CH PMI, UK GDP/Mortg. App., US Chic. PMI/Dallas Fed Mfg Act.

- Tuesday – NZ Building Permits, JP Tankan, JP/CH/EU/UK/ US Mfg PMI Jun Final, UK House Px, EU CPI, US ISM Mfg/ISM Prices Paid

- Wednesday – AU Building App./Retail Sales, US MBA Mortg. App./ADP Employ.

- Thursday – NZ ANZ Commo. Prices, CH/EU/UK/US Svc/ Comps PMI Jun, SZ CPI, US Nfp/Initial Jobless Claims/ Factory Orders/ISM Svc/Durable Goods Orders

- Friday – JEU PPI

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.