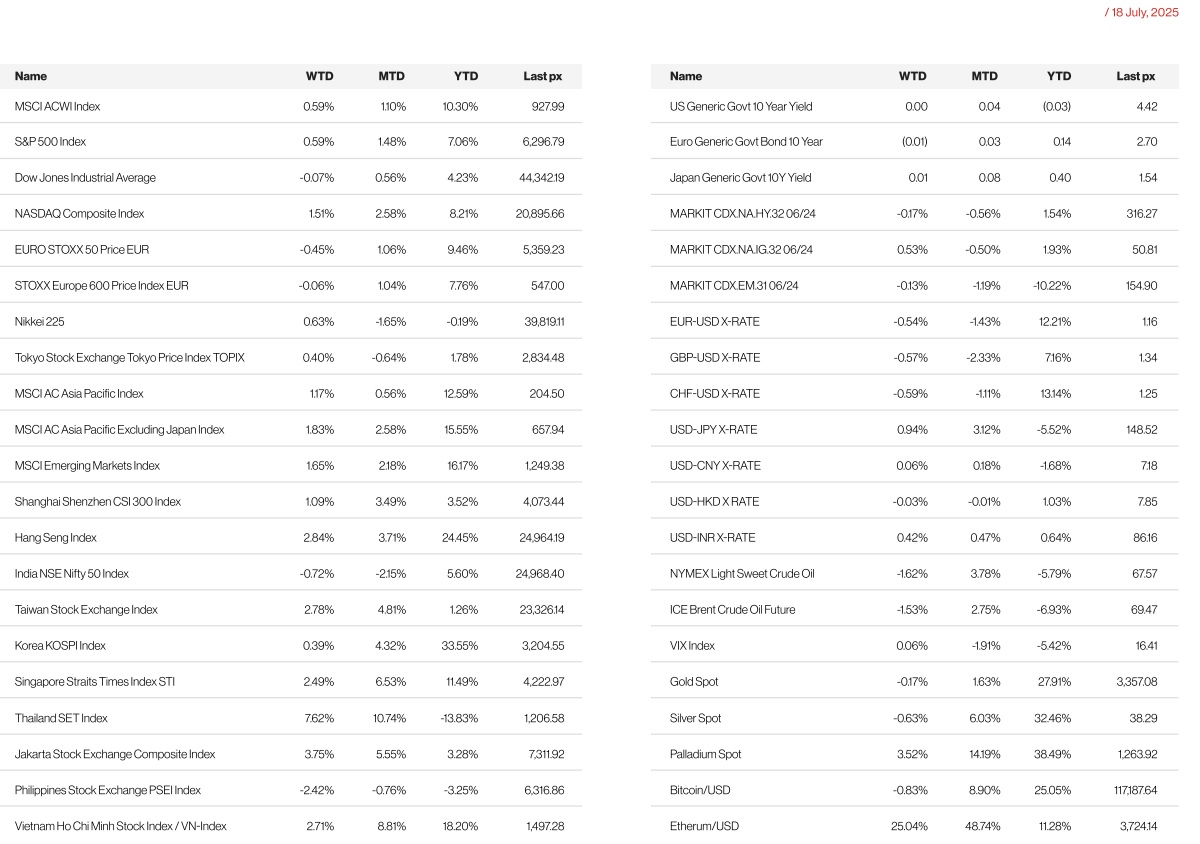

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets ended higher for the week as economic data outshone tariff angst. Retail sales which was a barometer for higher tariff costs, surprised to the upside coming in at 0.6% m/m vs 0.2% expected. Indicating limited pass-through of tariff costs so far. Helping along was also corporate earnings for Q2, which is off to a strong start beating forecasts. June core m/m CPI rose a below consensus 0.2% with headline CPI y/y coming in at 27% from 2.4%. Shelter rose 0.2% m/m, driving most to the overall increase but decelerating from May’s 0.3%. Some areas of deflation seen in hotels (-2.9%), used vehicles (-0.7%), new vehicles (-0.3%), and airfares (-0.1%), while food, OER, and primary rent were steady. June PPI was cooler than expected but there are some tariffexposed categories seeing upward price pressure. The latest Fed Beige Book reported slight increase in economic activity although hiring remained generally cautious.

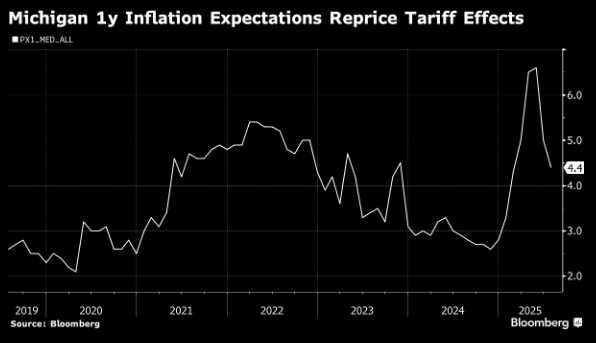

US consumer sentiment rose to a five-month high in early July as expectations about the economy and inflation continued to improve, with the preliminary July sentiment index rising to 61.8 from 60.7 a month earlier. Consumers expect prices to rise at an annual rate of 4.4% over the next year, down from 5% in the prior month and the lowest since February, according to the U. of Mich. expectations.

In Fed-speak, the committee remains split on cuts with most opting to hold or minimise cuts to 2 this year given uncertainties surrounding White House’s policies. Strong advocate for a cut in late July came from Fed Governors Waller reiterating his previous stance, and Michelle Bowman who (may) favour a July cut, citing mild inflation.

Information technology stocks led gains among sectors, helped by Nvidia and Advanced Micro Devices as both companies secured assurances from Washington that they would be able to resume sales of some AI chips in China.

On tariffs, President Donald Trump is readying plans for industry-specific tariffs to kick in alongside his country-by-country duties in two weeks. He also said that he would send letters to more than 150 smaller countries notifying them their tariff rates could be 10% or 15% as he forges ahead with his trade agenda. For much of the world and Asia in particular, which faces among the highest levies the rate announcement could be seen as a positive.

On removing incumbent Fed Chair Powell, Trump denied he is seeking to remove Powell, after raising the idea in a closed-door meeting with congressional Republicans that leaked to the media. Analysts have warned that if Trump were to follow through on ousting Powell it would roil financial markets as the Fed Reserve’s independence would come into question.

A quieter week ahead with only the S&P Global PMIs and durable goods data as tier one data releases.

Europe

European markets retreated, leaving the Stoxx 600 index at a loss. Healthcare and technology stocks dragged on Friday.

On Wednesday, the European Commission unveiled its 2028-2034 budget proposal of €1.8Trn (1.26% of EU GNI), up from €1.2trn. However, after deducting the due repayments of NGEU funds, the amount of money effectively available is rather 1.15% of GNI, i.e. very close to the previous 2021-2027 budget. The EU budget is actually rather small, in comparison. The current proposal for spending over seven years is very close to what the French public administration spends in one year, i.e. €1.7Trn.

In France, Prime Minister Bayrou outlined his fiscal consolidation strategy for 2026. PM Bayrou confirmed on Tuesday 15 July that the government aims at reducing France s public deficit to 4.6% of GDP in 2026 from 5.4% in 2025. The projected path thereafter is also unchanged, with a deficit below 3% expected in 2029. With that, needed savings amount to €43.8Bn (1.4% of GDP) in 2026 (a slight upgrade from €40Bn mentioned previously).

There were 5 key topics discussed

- expected savings on the central government (including public operators) and local authorities amount to 0.5pp of GDP.

- health expenditure would increase by €10Bn next year, and the government´s objective is to limit it to €5Bn. Social benefits would be kept unchanged in nominal terms, which, because of inflation, is equivalent to cuts of €7.1Bn

- tax increases (including the reduction of some tax credits), which would amount to 0.25pp of GDP in 2026, less than 2025 (ca 0.7 pp of GDP)

- additional revenues due to two bank holidays being scrapped (which increases revenues from taxes and social contributions) – Easter Monday and 8 May (surrender of Nazi Germany in 1945 and the end of World War II in Europe).

- measures against fraud, as well as to structural reforms (notably on unemployment insurance)

Left parties and the far-right National Rally (RN) expressed opposition to Bayrou’s proposals. The lower house is now in recess, thus no motion of no confidence can be triggered in the near term.

In economic data, final inflation release for June with the headline/ core unrevised at 2.0%/2.3% y/y in the Euro Area, showed a sequential rebound in the momentum of less volatile core components from the very soft May reading. Looking at the main components of euro area inflation, services had the highest annual rate in June (3.3%, compared with 3.2% in May), followed by food, alcohol & tobacco (3.1% compared with 3.2% in May), non-energy industrial goods (0.5%, compared with 0.6% in May), and energy (-2.6%, compared with -3.6% in May). The gap between services and core goods inflation widened further. The increase in the headline rate was driven by a 1%-pt increase in energy inflation to -2.6% y/y, which more than offset the modest 0.1%-pt decline in food inflation to 3.1% y/y. German PPI down 1.3% y/y in Jun thanks to energy price retreat. Eurozone’s construction output down by 1.7% in May while current account surplus expanded. In the UK, jobless rate rose to 4.7% and payrolls in the private sector contracted for the 13th straight month.

Services inflation inflected higher to 4.7% y/y, reverting to its April level. Goods inflation accelerated a bit more than expected. In June, core goods inflation in the UK stands 1.1pp higher than in the US.

This week, at its 24 July meeting, we expect the ECB to leave policy unchanged, maintaining the deposit facility rate at 2.0%. As for data releases, Thursday will get us the July flash PMIs in France, Germany and the Euro Area as a whole. In the UK, we will see the PMI flash figures on Thursday, the GfK consumer confidence and retail sales on Friday.

Asia

Trade letters from the US continue to get mailed out, April 2nd has become July 9th which has now become August 1st for an ever increasing list of countries. Asian Markets closed the week higher. MSCI Asia ex Japan was up 1.83%. Thailand’s SET index continues to gain with the index higher by 7.62% last week. Thailand however remains the worst performing market year to date still down almost 14% from the start of the year. India and Philippines were the two negative markets, down 0.72% and 2.42% respectively.

Japan: The fringe far-right Sanseito party emerged as one of the biggest winners in Japan’s upper house election. Japanese Prime Minister Shigeru Ishiba said he intended to stay on even as his ruling coalition suffered a historic setback in an upper house election on Sunday, an outcome that may further unsettle markets.

The Chinese economy expanded 5.2 percent year on year in the second quarter. The rate, which slightly exceeded the 5.1 percent average estimate from analysts polled by Reuters, positions Beijing to hit its full-year target of about 5 percent. It shows how China has been able to keep growth on track through exports and investment even as it struggles with weak demand at home. China trade data likely includes some front loading in Asian exports to the US, but that might be coming to an end.

Chinas National Bureau of Statistics reported on Tuesday that industrial output grew 6.8 percent year on year in June, exceeding an average analyst forecast of 5.7 percent. Chinas real estate downturn continued to drag on growth. Average new home prices declined about 3.7 percent last month from a year.

India’s current account deficit is tracking a benign 0.6% of GDP in 2Q25, down from a surplus in 1Q25. Inflation remains soft, with CPI at a 77-month low of 2.1%oya in June, driven by softer food prices due to strong monsoons and record harvests.

Singapore’s key exports enjoyed a surprisingly strong rebound in June as businesses likely front-loaded orders ahead of threatened US tariff increases. Non-oil domestic exports expanded 13 percent in June from a year ago. In June, shipments of electronic products grew 8 percent year on year. Integrated circuits, or chips, grew 17.5 percent, while personal computers surged 53.8 percent and bare printed circuit boards rose 17 percent. These three segments contributed the most to the increase in electronics shipments.

Indonesia’s central bank cut its benchmark interest rate by 25 bps to 5.25%, following a new trade deal with the U.S. that reduced previously threatened tariffs on Indonesian goods to 19% from 32%. The Indonesian Market index was higher by 3.75% last week.

Vietnam market continues to gain significant momentum, driven by Prime Minister’s meeting with FTSE Russell to discuss upgrading Vietnam’s market status to Emerging Market, alongside discussions for a more ambitious GDP target. The VN index is higher by 18.2% so far this year.

Malaysia’s trade balance rose from a subdued US$0.2bn in May to US$2.0bn in June. June slowing in exports reflected a big drop in exports to the US (-15.5%m/m) which are cumulatively down 22% from their April peak of around US$5.0bn. But exports to EM Asia also slowed most importantly China (-7.2%m/m), Taiwan (-12.5%m/m), and Singapore (-9.4%m/m)

Tariff Negotiation updates

- Trump’s softer stance on China to secure a summit with Xi also supporting mainland China stocks

- India continues to be next in line for a deal

- Trump reiterated Japan’s tariff would remain at 25 percent.

- President Donald Trump announced Indonesian goods entering the United States would face a 19 percent tariff, far below the 32 percent he had earlier threatened.

- The government remains reluctant to allow US farm products, especially agriculture, from entering Thailand tariff-free for fear of impacting local farmers.

GeoPolitics

US – BRICS: Another no-show by U.S. Treasury Secretary Scott Bessent, Donald Trump’s tariff threats and rising tensions between Washington and BRICS countries all look set to overshadow this week’s meeting of G20 finance chiefs in Durban, South Africa. Trump’s threat to impose further tariffs on BRICS countries adds complexity, given that eight G20 members – including host South Africa – belong to the expanded BRICS grouping. The overlap hints at the emergence of competing forums as Western-led institutions face credibility challenges.

EU – Russia: EU approved one of the strongest Russia sanctions to date, following Slovak PM Fico’s decision to lift veto after securing additional guarantees from Brussels on Russian gas imports. Package targets Russia’s banking, energy, and military-industrial sectors with unprecedented scope. Key provisions include banning financial transactions with 22 additional Russian banks already excluded from SWIFT, prohibiting use of the Nord Stream gas pipelines, and blacklisting 105 more « shadow fleet » vessels-bringing the total to over 400 ships. EU also introduced a dynamic oil price cap, lowering it from $60 to $47.6 per barrel and automatically adjusting it every six months to remain 15% below market prices. Among other targets, sanctions also placed on Russian-owned oil refinery in India and two Chinese banks as the EU seeks to curb Moscow’s ties with international partners.

Ukraine – Russia – US: U.S. President Donald Trump has privately encouraged Ukraine to step up strikes deep in Russian territory, even asking Ukrainian President Volodymyr Zelenskiy whether he could hit Moscow if the U.S. provided long-range weapons, the Financial Times reported on Tuesday. Trump also discussed sending Ukraine U.S.-made ATACMS missiles, the FT reported, citing the same sources.

A sustained Ukrainian drone attack on Russia caused Moscow’s major airports to be temporarily closed and saw at least 140 flights cancelled, officials said. More than 230 Ukrainian drones were downed over Russia since Saturday morning – including 27 over the capital – according to the Russian defense ministry.

US – China : Faced with geopolitics and trade war, US companies in China report record-low new investment plans.

Credit/Treasuries

US Treasuries retreat as higher PCE forecasts and increasing signs of tariff induced price pressures support a pricing out of near-term Fed cuts. USTs begin to sell-off (2y +5bp) as Fed rate expectations reprice higher (December 2025: +5bp).

The shape of the US Treasury curve remained roughly unchanged with the 2years yield down 1bps, 5years yield down 2bps, 10years yield was unchanged and the long bond yield was up 2bps. 5years US IG credit spreads finished the week unchanged while 5years US HY credit spreads tightened by 2bps.

This week macroeconomic data in the US will be less busy with the main announcements being the July preliminary US Manufacturing & Services PMI’s. The Fed will enter their blackout period before the FOMC Meeting on the 30th of July.

FX

DXY USD Index rose 0.64% to close the week at 98.48 driven by firm US macro data, which pushed out rate cut expectations. USD fell more than 1% after news reports indicated Trump was actively considering firing Fed Chair Powell, though those reports were denied within an hour by the President and USD quickly rebounded. On the US macro data, downside surprise in US CPI is overshadowed by firm core goods as tariffinduced price pressures begin to show, and by higher PCE translations. US retail sales and UMich consumer sentiment came in stronger than expected. UMich sentiment has now reached its highest value in 5 months, though remains 16% below Dec-24 level. Market implied pricing indicated 45.6 bps cut, down from 50 bps cut a week ago.

European Currencies fell against USD with EUR (-0.54% to 1.1626), GBP (-0.57% to 1.3416) and CHF (-0.59% to 0.8013). ECB is likely to leave the interest rate unchanged at 2% this Thursday and postpone a response to US President’s threatened tariffs until they materialize and their impact can be better assessed. In UK, headline CPI unexpectedly accelerates to 3.6% (P: 3.4%), reaching the highest level since January 2024. That said, additional BoE easing is priced in after BoE Governor Bailey hints at larger rate cuts should labor market slack « open up much more quickly.

Antipodean Currencies fell against USD with AUD (-1.05% to 0.6509) and NZD (-0.77% to 0.5962) amid above consensus GDP growth in China. AUD underperformed as AU June employment growth surprises to the downside, rising 2k (C: 20k), and the unemployment rate jumps to 4.3%, the highest level since November 2021. Market participants price in 10bp of additional RBA easing through year-end.

USDJPY rose 0.94% to 148.81 driven by firm US macro data and amid the renewed concern over the upper house elections. This was despite reports that the BoJ could upgrade their inflation outlook at the July meeting weigh on the front-end. In addition, Japan’s core core CPI beat, up 3.4%yoy in June, consensus at 3.3%. Headline in line at 3.3%yoy. At the point of writing, yen recouped some of last week lost as some market investors had positioned for a larger setback for the coalition and even anticipated the PM’s resignation, which led to the initial yen rebound.

Oil & Commodity

WTI crude and Brent crude oil futures fell 1.62% and 1.53% to close the week at 67.34 and 69.28 respectively amid the focus on US trade deal progress and the EU’s efforts to curb Russia energy exports. The EU agreed to a lower price cap for Russia’s crude as part of a package of sanctions against Moscow, which included curbs on fuels made from Russian petroleum and additional banking limitations.

Gold fell 0.17% to close the week at 3349.94. Recent media reports that President Trump is expected to sign an executive order to allow US 401(k) investors to allocate to alternative investments including metals. Based on Deutsche estimate, the potential price impact of this on gold may be between USD 400-900 over time.

Economic News This Week

- Monday – NZ CPI, CH LPR, US Leading Index

- Tuesday – NZ Trade Balance, US Richmond Fed Mfg

- Wednesday – AU Westpac Leading Index, JP Machine Tool Orders, US MBA Mortg App./Existing Home Sales

- Thursday – AU/JP/EU/UK/US Mfg/Svc/Comps PMI July Prelim., EU ECB Rate Decision, US Initial Jobless Claims/New Home Sales

- Friday – JP Tokyo CPI, UK Retail Sales, US Durable Goods Orders

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.