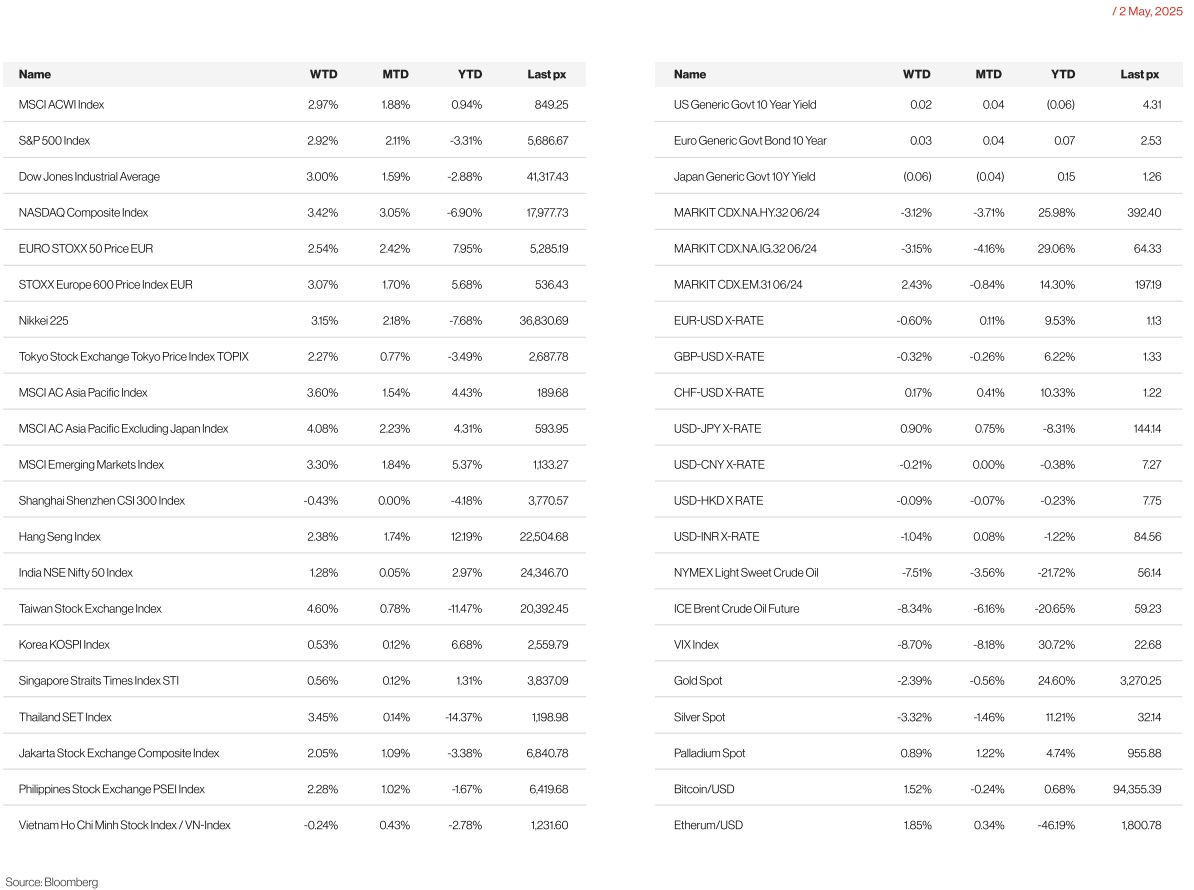

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

Steady as we goThe S&P 500 experienced its longest winning streak in some 20 years, erasing all its losses from April’s tariff turmoil. The S&P 500 closed the month of April down only marginally at -0.8% in spite of heightened volatility. International trade talks and Friday’s better than expected jobs data fuelled the rally, clocking in a nine-day rise. This came at the expense of bonds, with yields climbing to 4.308% as the market scaled back bets on Fed interest rate cuts.

A bit of clarity on the tariffs went a long way even with more pain, as tariffs seem unlikely to go back to zero. Solid employment report last Friday lowers the odds of rate cuts anytime soon. Nonfarm payroll employment expanded 177K in April, with private employment rising 167K and government 10K, better than what was expected (consensus 138K). Preceding months were revised down -58K, taking some of the sheen off the report, and the March gain was reduced by 43K, to a downwardly revised 185K. Unemployment rate remained at 4.20% while labour force participation increased by 0.10%. Average weekly hours also increase by 0.10%.

China weighing options to address the Trump administration’s complaints on Friday night gave risk assets a further boost. For the first time since late March, the spot Cboe Volatility Index — which gauges expected 30-day volatility of the S&P 500 — is below the first month-futures contract, a signal that the market stress is calming.

The Dallas Fed’s manufacturing survey plunged to its lowest level since May 2020. Specifically, the general business activity index was down to -35.8, and the raw materials prices index also moved up to its highest level since mid-2022, at 48.4. So that added to the stagflationary narrative, although it’s worth noting that this is a survey once again rather than hard data, and so far the surveys have tended to suggest a worse performance relative to the hard data. As a result, markets weren’t too reactive to the print directly, but it added to the more downbeat backdrop going into this week’s other releases.

Conference Board consumer confidence fell 7.9 points to 86.0 in March, relative to consensus expectations (88.0). This puts the overall index at levels not seen since the pandemic, with the index just above the April 2020 low of 85.7. As we’d expected to see, the expectations index drove the weakness in the headline with consumer expectations slipping 12.5 points to 54.4, a level well below those seen through the depths of the pandemic and not seen since 2011. The present situation index fell 0.9 points to 133.5. The greenback continues to move in tandem with US Treasuries and equities, while diverging from traditional safe havens such as the CHF, JPY, and gold, all of which declined yesterday.

The headline release was the Q1 GDP number, which showed there was an annualised contraction of -0.3% in Q1 (vs. -0.2% expected). That was driven by a huge surge in imports as people sought to get ahead of the tariffs, which were up by an annualised pace of +41.3%. Indeed, if you look at the last 50 years, that’s the second-biggest quarterly jump for imports, only behind Q3 2020 when the economy was emerging from the lockdowns. Given we’d already had the goods trade deficit numbers on Tuesday, that quarterly contraction wasn’t a huge surprise to markets. Indeed, there were even some positive signals from the GDP release, as final sales to private domestic purchasers (which is seen as a better measure of underlying demand) still grew by an annualised +3.0%. And later in the morning, the latest consumer spending data showed still strong real personal spending growth in March (+0.7% vs +0.5% expected). But investors were still concerned about the contractionary GDP print, and those fears were exacerbated by the ADP’s report of private payrolls for April, ahead of the US jobs report tomorrow. That was notably softer than expected, coming in at a 9-month low of +62k (vs. +115k expected), so that added to fears about a potential slowdown as well. Meanwhile, the Fed’s preferred inflation gauge, PCE for headline MoM and core were unchanged in March, the tamest in almost five years. The headline YoY PCE came in at 2.3% from a revised 2.7% in February. JOLTS data on job openings in March and a report on April consumer confidence both came in below expectations. The April ISM Manufacturing printed at 48.7, slightly below the previous Month (49.0) but nevertheless above market expectations 47.9.

A key valuation metric, called the Buffett Indicator which measures the ratio of the total value of the US stock market via the Wilshire 5000 Index divided by the dollar value of US gross domestic product, signalled that equities are relatively cheap which bolstered the case that the rebound in equities has further legs to run. Still, there are sceptics around indicating that a double-top technically, could lead to sell signals that would resume its decline. Earnings by some of the Mag-7 have been mixed overall but not a disaster, with Google’s, Meta’s and Microsoft’s better than expected sales providing a tailwind for the pact. US manufacturing activity shrank in April by the most in five months, with the Institute for Supply Management’s factory gauge easing to 48.7.

We’re certainly not out of the woods as yet as geopolitics continue to remain tense, with President Vladimir Putin insisting that Russia must take control of four regions of Ukraine it doesn’t fully occupy as part of any agreement to end the conflict, according to three people in Moscow familiar with the matter. President Trump earlier at the Vatican attending the Pope’s funeral, sealed a deal with Ukraine on rare earth minerals in exchange for continued military aid to Kyiv.

Key releases this week will be PMI and ISM data on services and prices paid with the highlight being Thursday morning’s FOMC rate decision by the Fed, widely expected to see no change for the Fed Funds rate at 4.25%-4.5%.

Europe

Europe’s Stoxx 600 index closed 1.7% higher on Friday, with Germany’s DAX index jumping 2.6%.

EA Q1 GDP printed at 0.4% q/q, above the ECB’s forecast for a 0.2% q/q expansion. EA growth was partly driven by Ireland’s robust performance (+3.2% q/q), which contributed approximately 0.1pp to the headline figure. In the first quarter, German real GDP growth printed at 0.2% q/q, in line with our expectations. The Destatis press release reported that “both household final consumption expenditure and capital formation were higher than in the previous quarter”.

Euro area HICP inflation was unchanged at 2.2% y/y in April on offsetting contributions from increasing energy deflation (-2.5pp to -3.5% y/y) and a 0.3pp re-acceleration of core inflation to 2.7% y/y driven by services (+0.4pp to 3.9% y/y). The preliminary data that is already available suggests that Easter was a significant but not the sole source of firmness. Money and credit data showed further incremental improvement in lending flows to both households and corporates in March. In annual terms, the growth rate of loans to households edged up to 1.7% y/y in March, from 1.5% y/y in February.

Similarly, the annual growth rate of loans to NFCs increased to 2.3% y/y in March, from 2.1% y/y in February. Consumer confidence was confirmed at -16.7, down from -14.5 in March. Households sharply downgraded their assessment of the expected general economic situation by 5.4 points to -33.7 and became more pessimistic about their current and future financial situation.

The ECB’s consumer inflation expectations rose in March reaching 2.9% at the one-year horizon (+0.3pp) and 2.5% at the three-year horizon (+0.1pp).

In the UK, The BoE will make its May decision next Thursday. We expect the MPC to vote 8-1 to cut rates by 25p, to 4.25%.

In the UK, the Reform UK, led by Nigel Farage, claimed its fifth Member of Parliament (MP) by winning the industrial northwestern torn of Runcorn by just six votes. Reform also won a mayoral election in Greater Lincolnshire, central England, but Labour held on to retain three other mayoralties.

A potential EU-UK defence agreement could be the key outcome of the upcoming London summit on May 19. Securing such a pact would allow the UK to participate in joint military procurement efforts with EU member states and permit EU countries to acquire British-made military equipment through a new €150 billion European initiative aimed at boosting defence spending. Negotiations between Brussels and London on this security and defence partnership are ongoing, with EU ambassadors set to review a preliminary draft prepared by the Commission’s External Action Service next week.

This week, we have the final Services and Composite PMI in the Euro Area. We will have the figures from Retail sales and the final PPI. In the UK, we will have the BoE bank rate decision on Thursday (08 May) and the Final Services and Composite PMI.

Asia

President Donald Trump said he is willing to lower tariffs on China because the current tariffs are so high that the two countries have essentially stopped doing business with each other. Chinese state media has said on Thursday there would be “no harm” in holding trade talks with the Trump administration, indicating a softening of Beijing’s position. “If it is talks, the door is wide open,” said Yuyuan Tantian. “If it is a fight, we’ll see it through to the end.”

The gesture comes as Trump has indicated he hopes to negotiate over trade and as the fallout has begun to show in China’s economic data, with factory activity in April dropping the most since 2023 as export orders dried up. China highlighted US economic data, including empty ports and a GDP contraction in the first quarter, saying Washington was “definitely the more anxious party” for negotiations.

Sentiment shifts around open talks lifted markets on both sides with MSCI Asia ex Japan higher 4.08% for the week.

China’s manufacturing activity contracted by the most in 18 months in April, according to an official survey, in an early sign of the economic impact from Trump’s trade war. China’s official April manufacturing PMI fell to 49.0 from 50.5. One of the biggest drops on the month was in new export orders, which fell to 44.7 from 49.0. The PMI data suggests that deflationary pressures could strengthen. The ex-factory price subindex fell to a seven-month low of 44.8. The raw materials purchase prices subindex declined to 47.0, a 22-month low. Also, the import subindex of 43.4 hit the lowest level since January 2023. If manufacturers see US demand drop off significantly as a result of tariffs, it could lead to further price competition. China’s non-manufacturing PMI saw only a modest drop to 50.4 from 50.8.

Japan and Vietnam agreed to boost bilateral trade and uphold global rules on the free flow of goods as Japan’s Prime Minister Shigeru Ishiba met Vietnamese leaders in Hanoi while both countries engage in talks with Washington to avoid tariffs.

Singapore’s stocks and currency are expected to get a boost after the ruling party’s convincing victory in the election, according to analysts. The People’s Action Party took all but 10 seats in the 97-seat unicameral legislature with a total of 65.57 percent of the more than 2.4 million votes cast in the wealthy island state in Saturday’s polls. Analysts expect the government to focus on supportive economic policies amid rising headwinds to growth, and the Monetary Authority of Singapore to ease again via a slight reduction in the nominal effective exchange rate slope this year. Singapore’s Purchasing managers’ index or PMI fell 49.6 points in April. It was a decline after 19 straight months of expansion.

In Japan, we saw BoJ kept policy on hold as expected. Japan March factory output -1.1% vs forecast -0.4%; U.S. tariffs rattle Japanese manufacturers, including auto. Japanese retail sales rose 3.1% in March from a year earlier.

Bank of Thailand cut its benchmark rate by 25 basis points to 1.75%, lowest in two years, acknowledging the much more challenging growth outlook. The bank warned that the economy could fall to as low as 1.3% in case of a “very severe” trade war and higher US levies, and that the unpredictable nature of future global trade policies poses significant challenges in assessing the economic and inflation outlook.

This week, China’s trade and credit data will show the early impact of its trade war with the US.. Other data points this week – Indonesia GDP, Thailand CPI, Taiwan CPI, and lastly wage growth data from Japan. We also have Malaysia’s Bank Negara meeting this week; it is expected to lower rates to support the economy.

GeoPolitics

Israel – Palestine: Since March 2, Israel completely cut off all supplies to the 2.3 million residents of the Gaza Strip, and food stockpiled during a ceasefire at the start of the year has all but run out. Germany, France and Britain last week called on Israel to adhere to international law by allowing the unhindered passage of humanitarian aid into Gaza, after Israel reiterated that no aid would be allowed to enter Gaza, to pressure Hamas. The U.N. views Gaza and the West Bank as Israeli-occupied territory. International humanitarian law requires an occupying power to facilitate relief programs for people in need and ensure food, medical care, hygiene, and public-health standards.

Iran – US: US president said on Thursday that anyone buying Iranian oil or products would be frozen out of doing business with the US, stepping up a crackdown on a vital revenue source for Tehran and further squeezing China, its biggest importer. China — with which the US is embroiled in a bitter trade war — is the country most exposed to Trump’s sweeping secondary sanctions. Beijing accounts for the vast majority of the roughly 1.5mn barrels a day of crude shipped by Iran.

Isreal – Spain: Israel’s Foreign Ministry harshly criticized the Spanish government for cancelling a controversial €6.6 million deal involving the purchase of 15 million bullets from an Israeli company. “The important thing today is that it is finally rescinded, and that the government of Spain does not do business with a genocidal government, as in this case it is the one massacring the Palestinian people,” said Labor Minister for Spain said. The Spanish government “continues to be on the wrong side of history against the Jewish state,” Israeli Foreign Ministry said. If taken literally, it means that China would have to choose between commercial relations with Iran or the United States.

Ukraine – Russia – US – EU : European and Ukrainian officials fear Donald Trump is on the brink of walking away from peace negotiations with Kyiv and Moscow, potentially using minor progress in talks as an “excuse” to say his job is done. Putin’s unwillingness to agree to key US and Ukrainian demands such as maintaining a postwar Ukrainian military force, and the complexity of the conflict has made Trump re-evaluate his commitment to a peace deal, said EU officials as per the FT.

North Korea – Russia: North Korea confirmed for the first time on Monday (Apr 28) that it had sent troops to fight for Russia in the war in Ukraine under orders from leader Kim Jong Un and that it had helped regain control of Russian territory occupied by Ukraine.

India – Pakistan: After the April 22 attack that killed 26 people, India has identified two of the three suspected militants as Pakistani, although Islamabad has denied any role and called for a neutral probe. In a sweeping second wave of retaliatory actions, the Indian government has announced a freeze on imports, halted all postal exchanges, banned docking of Pakistan-flagged ships, and restricted the flow of river water under the Indus Water Treaty framework.

Credit/Treasuries

Following all these data, but especially after the strong job report last Friday, interest rates on US Treasury finished the week higher. The 2years yield gained 6bps, 5years gained 4bps, 10years gained 6bps and the long bond gained 8bps. US IG 5years credit spreads tightened by 2bps while US HY 5years credit spreads tightened by 14bps over the week.

The Treasury released its latest quarterly borrowing estimates, with the Q2 issuance estimate revised up to $514bn from $123bn due to a lower starting cash balance and with the Q3 estimate at $554bn. These figures were slightly above strategists’ expectations, but this may be due to the Treasury not yet factoring in increased tariff revenues. The announcement had limited impact on yields, which closed near the session’s lows. In other fiscal news, after the US close Treasury Secretary Bessent said the administration hoped to have Congress pass their tax bill by July 4th.

FX

DXY USD Index rose 0.56% to 100.03 following decent US macro data and signs of de-escalation on the trade wars between US-China. On tariffs, the Trump administration adjusted its automotive tariffs to prevent overlapping levies on imported vehicles and parts, with the aim to ease the financial burden on U.S. automakers while encouraging domestic production. In addition, it was reported that the US has reached out to China to initiate trade negotiations. On US macro data, US preliminary 1Q25 GDP contracted at a -0.3% q/q annualized rate (C: -0.2%; P: 2.4%), but private domestic final demand rose 3.0%. Weakness in headline GDP reflected a 41% surge in imports ahead of tariffs. US Core PCE rose 0.03% (C: 0.1%; P: 0.5%), while Headline PCE fell -0.0% m/m (C: 0.0%; P: 0.4%) in March, but with upward revisions to prior months. ISM Manufacturing edged down to 48.7 in April (C: 48.0; P: 49.0). Total nonfarm payrolls rise 177k (C: 138k) and the employment rate remains at 4.2%, even as the labor force participation rises. As a result, Fed meetings reprice sharply higher, with 80 bps (P: 89 bps) of easing priced through December 2025.

European currencies fell against USD driven by broad-based USD strength with EUR (-0.60%) to 1.1297 and GBP (-0.32%) to 1.3272. In the Eurozone, headline HICP remained at 2.2% y/y in April (C: 2.1%; P: 2.2%) as Core CPI accelerated to 2.7% y/y (C: 2.5%; P: 2.4%) due to a rise in services inflation. Euro Area 1Q25 beats estimate at 0.4% q/q (C: 0.2%). Economic Confidence fell further to 93.6 in April (C: 94.5; P: 95.0) as high geopolitical and domestic uncertainties keep business sentiment at a low level.

USDJPY rose 0.9% to 144.96. The BoJ kept rates on hold at around 0.5% as expected but lowers its GDP and inflation forecasts while highlighting downside risks to growth and prices. The latest Outlook Report projects a sub-2% level for inflation in FY2026 (F3/27), chiefly on decelerating growth in FY2025-26, with the 2% inflation target now expected to be achieved later, in the second half of the new projection period (2H FY2026-FY2027). BoJ Governor Ueda says the Bank s confidence in achieving its baseline scenario has fallen, as it seems concerned about the risk of worsening corporate profits due to US tariffs hurting winter bonus payments and spring wage negotiations next year. A market implied probability of a full rate hike (25 bps) has now been pushed to 2026.

AUD outperformed in G10 FX, gaining 0.61% against the USD after an upside surprise in Australia 1Q25 CPI. AU CPI rose 0.9% q/q in 1Q25 (C: 0.8%; P: 0.2%). AU retail sales rose 0.3% m.m in March (C: 0.4%; P: 0.2%) with the annual rate now the strongest seen since December 2024.

Oil & Commodity

WTI crude and Brent crude oil futures fell 7.5% and 8.3% to close the week at 58.29 and 62.29 respectively following disappointing data in China and amid reports of oil production increases. Over the weekend, it was confirmed that OPEC+ agreed on a surge of 411K barrels a day in June, the second month in a row, in a bid to instil better discipline within the cartel. OPEC+ had originally planned to revive 2.2 million barrels a day of halted production in modest monthly slivers through to late 2026. Instead, it has approved the return of almost half that amount in just a few months. As a result, both WTI and Brent oil futures fell a further 3% this morning, with Brent below 60 (4 years low).

Gold fell 2.39% to 3240.49 following decent US macro data and signs of de-escalation on US-China tariff situation The uptrend on gold price is still intact with RSI at above 50. Key support level at 3200, while resistance level at 3500.

Economic News This Week

- Monday – U Melbourne Inst. Inflat., SZ CPI, US Svc/Comps PMI April Final/ ISM Svc Index

- Tuesday – CH/SW/EU/UK Svc/Comps PMI April Final, SZ Unemploy. Rate, EU PPI, US Trade Balance

- Wednesday – NZ Unemploy. Rate, JP Svc/Comps PMI April Final, SW CPI, SZ Foreign Curr. Reserves, UK Construction PMI, US MBA Mortg. App./ FOMC Rate Decision

- Thursday – SW Riksbank Rate Decision, Norway Rate Decision, UK BoE Rate Decision, US Initial Jobless Claims/ Wholesale Inv., US NY Fed 1Yr Inflat. Exp.

- Friday – China Trade Balance, Norway CPI, CA Unemploy. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.