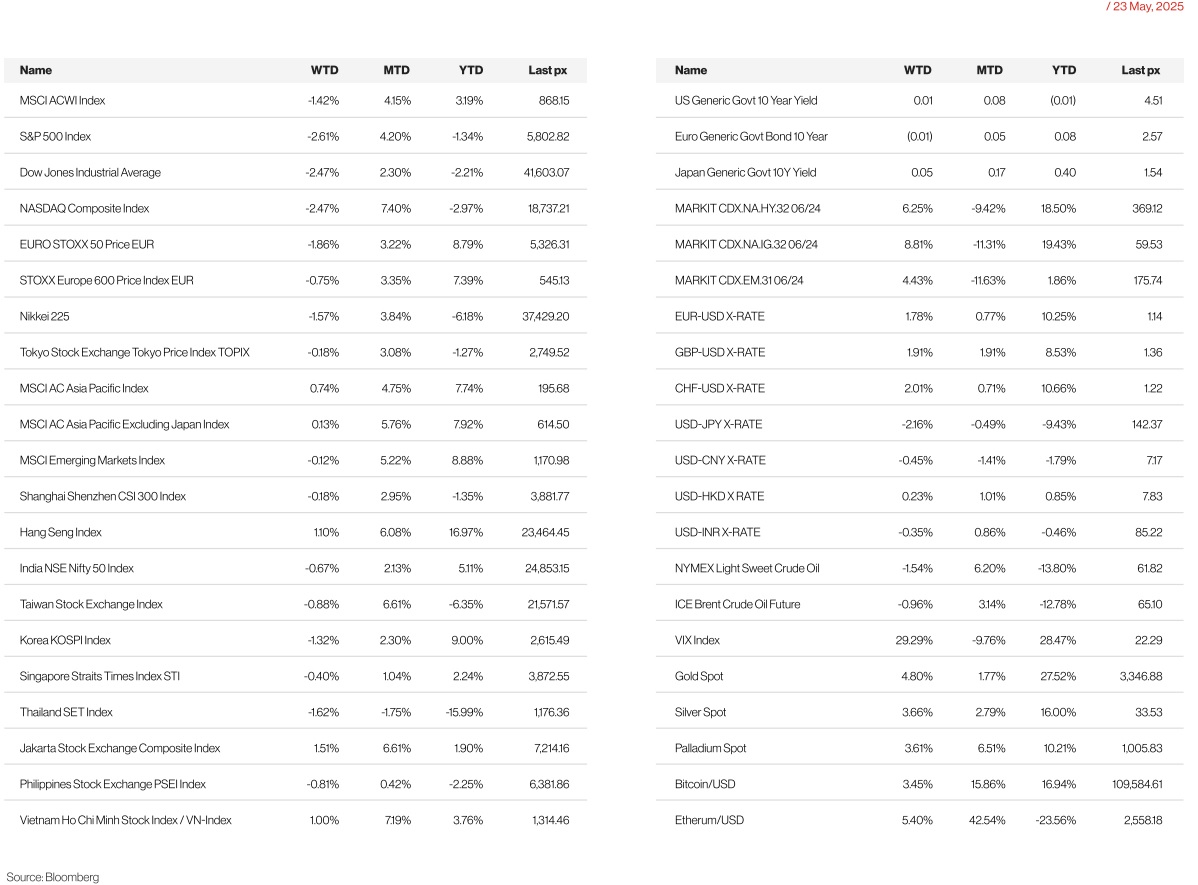

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

It was indeed a tough week for US markets which started on its backfoot following Moody’s downgrade of the US sovereign rating. Wednesday’s poor 20 year bond auction did not help, pushing long end yields to levels last seen in 2023. The budget negotiations in Congress were also in focus as the US Senate plans to revise President Trump’s tax and spending package which would need to be returned to the House of Reps for approval and thus skirting within range of the debt ceiling. Then….

President Trump threatened to impose tariffs on the European Union by a sweeping 50% from June the 1st and said a potential levy against smartphones would apply to all foreign-made devices. Trump complained that trade discussions with the EU bloc were “going nowhere” accusing the bloc of slow-walking negotiations and unfairly targeting US companies with lawsuits and regulations. Trump then took aim at Apple, threatening a 25% tariff if it didn’t move its iPhone production to the US. Whilst we are knew tariff threats can crop up anytime, the Truth Social announcement caught investors off guard, with many believing the worst of the trade news was in the rear-view mirror. The all-too-familiar script was played out yet again – equities started to slide, yields crept up, the dollar weakened and, sectors most exposed to EU trade led declines. Friday marked the S&P 500’s fourth-straight session of declines. The VIX spiked to above 22. Technology and consumer companies were broadly weak after the US open, alongside other stocks that are closely linked to global trade and the strength of the economy. Gold unsurprisingly, ran with it and surged to close at $3,357 an oz. On US data released, business activity and output expectations improved this month amid easing trade-related anxiety. Applications for US unemployment benefits fell to a four-week low. And sales of previously-owned homes unexpectedly dropped in April to the slowest pace in seven months. In Fed-speak, everyone sang to the same hymn: St. Louis’ President Alberto Musalem said tariffs will likely weigh on the US economy and weaken the labour market. San Francisco Fed President Mary Daly and Cleveland Fed President Beth Hammack continued a trend among policymakers of stressing that the US central bank can be patient and assess upcoming data before adjusting policy as the economy navigates heightened uncertainty from Trump’s tariff fights.

Federal Reserve Governor Waller suggested that the central bank could cut interest rates in the second half of the year if Trump’s tariffs on trading partners settled around 10%.

Monday will be a holiday in the US in observance of Memorial Day. We will see durable goods orders, GDP Annualised QoQ and on Friday Consumer Sentiment, personal income & spending together with April’s PCE. Core PCE MoM is expected at 0.1% from 0% and headline YoY at 2.2% from 2.3% in March. We will also have minutes from the last FOMC meeting out early Thursday morning.

The main event however for the week would most likely be Nvidia’s earnings when it reports Q1 results.

Flash update from late Sunday: President Donald Trump agreed to extend the deadline for the European Union to face 50% tariffs until July 9 after a phone call with Commission President Ursula von der Leyen. That’s the date that Trump’s 90-day pause of his so-called reciprocal tariffs had originally been set to end.

Europe

On Sunday, President Donald Trump announced an extension of the deadline for imposing a 50% tariff on European Union (EU) imports, moving it from June 1 to July 9. This decision followed a request from European Commission President Ursula von der Leyen for additional time to finalize a trade agreement. Initially, Trump had threatened to implement a 50% tariff last Friday due to stalled negotiations, but the extension reflects renewed diplomatic efforts to resolve trade tensions between the U.S. and the EU.

Data in the Eurozone: wage growth moderated significantly in the first quarter of 2025, with negotiated salaries increasing by 2.4%, down from 4.1% in the previous quarter. This cooling of wage inflation could give the European Central Bank (ECB) more flexibility to lower interest rates. Markets expect a 25bp cut on June 5, which would reduce the deposit rate to 2%. Germany’s economy outperformed earlier estimates, with Q1 GDP growth revised upward to 0.4% from 0.2%, buoyed by stronger household spending and business investment. Preliminary May data showed the Eurozone’s Composite PMI slipping to 49.5 from April’s 50.4, missing the forecast of 50.7 and hitting its lowest point since November 2024. The services sector contracted, with the index falling to 48.9 from 50.1, while manufacturing remained weak at 48.4, though slightly better than April’s 48.0. Germany’s Composite PMI dropped to 48.6 from 50.1, as a modest rise in manufacturing (48.8) was offset by a sharp fall in services (47.2). In France, the Composite PMI edged up to 48.0 from 47.8, with manufacturing improving to 49.5 its highest since early 2023 though services continued to lag at 47.4. Consumer sentiment in the euro area showed a slight improvement in May, with a 1.4 percentage point increase, recovering from April’s sharp drop. Nonetheless, confidence remains well below long-term norms. Final April inflation data confirmed the headline CPI held steady at 2.2% year-on-year, while core inflation rose to 2.7%, up 0.3 percentage points from March.

In the UK, retail sales surged in April, climbing 1.2% month-over-month, well above the forecasted 0.3% increase. This marks the fourth straight month of growth, highlighting consumer resilience despite economic headwinds such as higher living costs and global trade uncertainty. Consumer sentiment also improved in May, with the GfK confidence index rising by three points to -20, recovering most of April’s decline. Inflationary pressures intensified in April, with headline consumer price index (CPI) inflation rising to 3.5% year-on-year from 2.6% in March. Core CPI followed a similar trend, increasing to 3.8% year-on-year. While this acceleration was partially anticipated due to seasonal pricing and base effects, the final figures slightly exceeded expectations, mainly driven by higher servicesector inflation and the impact of vehicle taxes and the Easter holiday.

At the Lancaster House summit on May 19, the UK and EU unveiled a new post-Brexit agreement designed to build upon the 2020 Trade and Cooperation Agreement (TCA). The parties also established a Security and Defence Partnership, expanding their collaborative scope. The deal could eventually allow the UK to join EU-wide procurement projects underthe SAFE initiative, potentially giving British companies access to contracts without facing the usual foreign content limitations—pending further negotiations.

Looking ahead, several key data releases are expected this week. Flash inflation figures (HICP) for May will be published for France, Spain, Germany, and Italy (on Tuesday and Friday), along with the ECB’s April consumer inflation expectations (Wednesday). On the activity side, watch for the European Commission’s May business surveys (Tuesday), final Q1 GDP data from France and Italy (Wednesday and Friday), and household consumption figures in France for April (Wednesday).

Asia

Equities in tumbled last Friday ahead of the long weekend, as hopes on a de-escalating trade war diminished after Trump said that he would recommend a 50% tariff on the EU from June 1. (this has since been extended to July 9th on EUs request.) Asia markets closed higher last week MSCI Asia Pacific index was higher by 0.74%. Hang Seng led Asia up 1.1%. The world’s largest EV battery-maker, CATL, just shook the financial world with its Hong Kong IPO last week, raising $4.6 billion in the world’s largest public offering this year. It was up almost 16% upon listing. The institutional tranche of the Hong Kong deal was oversubscribed 15.2 times, according to CATL’s filings, while the retail portion was 151 times oversubscribed.

Beijing condemned on Wednesday (May 21) new US warnings on the use of AI chips made in China, vowing it would take steps against bullying efforts to restrict access to high-tech semiconductors and supply chains. Washington also unveiled fresh guidelines warning firms that using Chinese-made high-tech AI semiconductors, specifically tech giant Huawei’s Ascend chips, would put them at risk of violating US export controls. The United States warned last week about the potential consequences of allowing US AI chips to be used for training Chinese AI models. The commerce department said its policy was aimed at sharing American AI technology with trusted foreign countries around the world, while keeping the technology out of the hands of our adversaries.

Trump has broadly endorsed Nippon Steel’s $15bn deal to buy US Steel, in an apparent reversal of his opposition to a cross-border transaction that was blocked by Joe Biden on national security grounds. “This will be a planned partnership between United States Steel and Nippon Steel, which will create at least 70,000 jobs, and add $14 Billion Dollars to the US Economy,” the US president wrote in a social media post last week.

Other data from Asia:

- Japan’s core machinery orders rose 13.0 per cent in March from the previous month

- Singapore maintains 2025 growth forecast at 0-2%; economy grew 3.9% in Q1. “Given the steps taken by major economies to de-escalate global trade tensions, MTI’s assessment is that Singapore’s external demand outlook for the rest of the year has improved slightly compared to April” according to MIT.

- Thailand’s 1Q25 real GDP rose 3.1%oya posting an upside surprise.

- Bank Indonesia (BI) lowered the policy rate by 25bp, from 5.75% to 5.50%, in line with consensus expectations

- The RBA cut rates by 25bps at its May meeting to 3.85% as expected, but dovish undertones make the upcoming July meeting more ‘live’ than we had expected.

GeoPolitics

EU Defence: EU capitals have agreed to launch a €150bn loans-for-arms fund backed by the bloc’s shared budget, in a landmark shift for Brussels spurred by Russia’s war against Ukraine and US President Donald Trump’s demands for Europe to spend more on its own security. The initiative, will allow EU countries to borrow from Brussels and spend on weapons systems and platforms through joint procurement. It will allow for the expansion of EU’s defence-industrial sector after decades of decline by diverting the majority of the cash to EU-based arms companies and encouraging non-EU subcontractors to relocate to the continent. EU capitals on Monday agreed the loans can be spent on products where at least 65 per cent of the value of the components are from arms companies in the EU, Ukraine, Iceland, Liechtenstein, Norway and Switzerland. The scheme will cover purchases of key capabilities including artillery ammunition, missiles and drones, air defence systems, strategic aircraft for military mobility and cyber and artificial intelligence systems.

US Defence: President Trump has unveiled his plans to develop a new massive missile defence system to cover the entire territory of the United States, which he has dubbed the “Golden Dome” project. The idea of the Golden Dome is to develop space-based interceptors that could shoot down the most advanced missiles in the world. An estimate from the Congressional Budget Office put the price tag at $500 billion over 20 years.

China – US: China is « seriously concerned » about the US Golden Dome missile defence shield project and urged Washington to abandon its development. Chinese foreign ministry spokesperson said it carries « strong offensive implications » and heightens the risks of the militarisation of outer space and an arms race. She also alleged that putting interceptors into orbit is an offensive action that “violates the principle of peaceful use in the Outer Space Treaty.”

Israel – Palestine: Benjamin Netanyahu said Israel planned to take over all of Gaza as the country escalated its offensive. The aim of the expanded Israeli campaign was “to take over all of the territory of Gaza” in a bid to fully defeat Hamas, Netanyahu said in a video on Monday. Authorities in Gaza say Israel’s “starvation policy” has killed at least 326 Palestinians since March 2, as the UN warns that 14,000 babies are at risk of dying within 48 hours. Israeli forces continue bombarding Gaza, dismissing criticism from the UK and the EU over the “monstrous” war in the enclave. The British government says it will suspend new free trade negotiations with Israel.

Israel – Iran: Israel might be making preparations to swiftly strike Iran’s nuclear facilities if negotiations between the U.S. and Iran collapse. It was not clear whether Israeli leaders have made a final decision. The fifth round of nuclear talks between the US and Iran in Rome ended Friday with « some but not conclusive progress’’.

Spain – Israel: Last month, Spain cancelled a $7.5million worth of Israel arms deal. On Tuesday (21 May), the Spanish Parliament voted in Favor of a motion put forth by leftist and nationalist parties. The proposal advocates for prohibiting the sale of weapons to countries implicated in genocide, explicitly including Israel. Sanchez urged for Israel’s exclusion from international cultural events, such as the Eurovision Song Contest, citing its continued aggression in the Gaza Strip. He drew a parallel to Russia’s exclusion from such events after its invasion of Ukraine.

Russia – Ukraine: Donald Trump said after his call on Monday with President Vladimir Putin that Russia and Ukraine will immediately start negotiations for a ceasefire, but the Kremlin said the process would take time and the U.S. president indicated he was not ready to join Europe with fresh sanctions to pressure Moscow.

Syria – US- Israel: Secretary of State Marco Rubio told Congress on Tuesday (20th May) that the US assesses the new al-Qaeda linked Syrian government could collapse within weeks and that the country could descend into “full scale civil war.” Just a week before, President Donald Trump announced in Saudi Arabia that he would lift all sanctions on Syria, the decision, which will boost a country devastated by 13 years of war, took many in the region by surprise. Syria has also faced heavy airstrikes from Israel since the regime change, and the Israeli military has invaded and seized territory in southern Syria. Sharaa has signalled that he’s willing to normalize relations with Syria to obtain sanctions relief from the US, but Israel appears more interested in continuing its occupation and bombing campaign in the country.

US – Philippines: Philippines and the United States have taken part for the first time in joint maritime exercises with naval and air force units in the contested South China Sea. The « maritime cooperative activity », which was the second for the year and sixth overall since the allies launched the joint activities in 2023, included communication drills and search and rescue scenarios, the military said in a statement.

Credit/Treasuries

Last Monday, we saw a large round trip in Treasuries around the news, with the 30yr yield briefly reaching its highest intraday level since 2023, at 5.035%, before paring back that move to close at 4.90%, 4.1bps lower on the day and virtually in line with where we were immediately before the news late on Friday (i.e. US Sovereign rating cut by Moody’s). That recovery started shortly after the US open and continued as the session went on. It perhaps indicates the slow moving trend of overseas investors selling Treasuries but domestic investors increasing their holdings.

Last Wednesday, the 30-year Treasury yield reached its highest level since late 2023 and only 2bps away from its highest level since 2007, extending a multi day rise. Real yields led the move higher, with 30yr real yields rising +11.2bps to 2.78%, their highest level since 2008. Why this is happening: Investors are worried about the US fiscal outlook. Their fears were also reflected in a weak $16bn auction of 20-year Treasuries, which were sold at their highest interest rate since 2020. Primary dealers’ banks, required to buy any unsold bonds, purchased 16.9 per cent of the offering, above the average of 15.1 per cent. One analyst noted: “Markets really have no appetite for duration here.”

The U.S. House of Representative has passed President Trump Big Beautiful Tax Bill (BBB) by a razor thin margin of 215 214. The sweeping legislation extends tax cut from Trump’s first term, slashes green energy incentives, tighten eligibility for health and food programs, and boost military spending. It is expected to add about $3.8 trillion to the national debt over the decade.

The US Treasury curve bear steepened last week. The 2 & 5years US Treasury yield were roughly unchanged while 10years yield gained 4bps & the long bond yield gained 8bps.

FX

DXY USD Index fell 1.96% to close the week at 99.11 as President Trump threatened 50% tariff on EU and 25% tariff on Apple iPhones late last Friday. In addition, waning US exceptionalism trade narrative and more headline of FX as part of trade negotiations supported a weaker USD. US economic data was mixed with an increase in continuing jobless claims and softer-than-expected existing home sales, offset by an unexpected improvement in US PMIs. While Fed officials continue to urge patience, with Atlanta Fed President Bostic saying the Fed « will have to wait 3-6 months to see how uncertainty settles » and New York Fed President Williams saying June and July are too early to have a clear picture of the US economic outlook, pushing back expectation of rate cuts. Based on OIS, 46 basis points of cut were priced by the market compared to 50 bps cuts a week ago.

European currencies gained after the UK and EU reach a post-Brexit « reset » deal, while also supported by the broad-based USD. EURUSD rose 1.78% to 1.1362, GBPUSD rose 1.91% to 1.3537 and USDCHF fell 1.97% to 0.8211. Over the weekend, President Trump agreed to extend the deadline for the EU to face 50% tariffs until July 9 after threatening to impose the tariffs starting June 1 if negotiations didn’t progress. As such, EURUSD rose above 1.14 at the point of writing. In UK, upside surprise in UK CPI led by an acceleration in services inflation supported GBP. In Switzerland, SNB Chair Schlegel said he sees « no alternatives » to US treasuries, even after Moody’s credit rating downgrade. He also said he still sees Switzerland’s inflation outlook as uncertain.

Antipodean gained with AUDUSD rising 1.28% to 0.6488 and NZDUSD rising 1.82% to 0.5988 driven by broad based USD weakness. The RBA lowered its policy rate by 25bp to 3.85% at its May meeting, as widely expected though it was a dovish cut. Forecasts were revised modestly weaker, across GDP, labor market, and inflation. The statement indicated that “risks to inflation have become more balanced.” During the press conference, Governor Bullock said that the RBA believes there is still restrictiveness in monetary policy, which gives the RBA the opportunity to lower rates further. She also revealed that the RBA considered lowering rates by 50bp. In NZ, budget release contains lower GDP forecasts as global growth underperformance weighs on the domestic economy.

USDJPY fell 2.16% to 142.56. At the meeting between US and Japan financial officials, US Treasury Secretary Bessent and Japanese Finance Minister Kato “reaffirmed their shared belief that exchange rates should be market determined and that, at present, the dollar-yen exchange rate reflects fundamentals.”

USDCAD rose 1.7% to 1.3731. Canada headline CPI cooled to 1.7% y/y in April (C: 1.6%; P: 2.3%) as the removal of the carbon tax led to lower energy prices. However, that decline was moderated by higher travel and food prices. The BoC’s key underlying core inflation measures saw more inflationary pressures. The CPI-Trim rose to 3.1% y/y (C: 2.8%; P: 2.8%), while the CPI-median rose to 3.2% (C: 2.9%; P: 2.9%). 10bps of BoC easing this year taken out of market pricing after the print.

Oil & Commodity

WTI crude and Brent crude oil futures fell 1.54% and 0.96% to 61.53 and 64.78 respectively as OPEC+ members are discussing a potential third consecutive oil production surge in July, with an output hike of 411,000 barrels a day among the options under consideration. The cartel has helped sink crude prices since announcing 411,000-barrel hikes for May and June, with oil prices dropping 0.9% to $64.31 a barrel as of 9:13 a.m. in London. A final decision on the production hike is due to be taken at a gathering on June 1, with many forecasters predicting a bearish outlook for the market this year. EIA report for the week ending May 16 showed a 1.3mn barrel increase in crude oil inventories, adding to oil prices misery.

Gold rose 4.8% to close the week at 3357.51 driven by broad based USD weakening as President Trump threatened 50% tariff on EU and 25% tariff on Apple iPhones late last Friday. Safe haven demand rose as CNN reported that Israel is preparing to possibly strike Iranian nuclear facilities. On the flipside, there were positive developments in the Russia-Ukraine conflict as President Donald Trump said that Moscow and Kyiv would begin talks « immediately » on ending the war in Ukraine after a phone call with Russian President Vladimir Putin. Putin described the call with Trump as « frank » and « very useful, » and said Russia would work on a memorandum with Ukraine for a possible future peace treaty but offered no details on conditions for a settlement or timeline for a ceasefire.

Economic News This Week

- Monday – JP Leading Index

- Tuesday – CH Indust. Profit, EU Cons./Econ./Indust./Svc Confid., US Durable Goods Orders/Cons. Confid./Dallas Fed Mfg Act.

- Wednesday – NZ RBNZ Rate Decision, EU ECB CPI Exp., US MBA Mortg. App./Richmond Fed Mfg

- Thursday – NZ ANZ Biz Confid., US GDP/Initial Jobless Claims/Pending Home Sales

- Friday – NZ Cons. Confid./Building Permits, JP Jobless Rate/ Tokyo CPI, AU Building app./Retail Sales, SW GDP, EU M3 Money Supply, CA GDP, US Personal Income/Personal Spending/Core PCE/UMich

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.