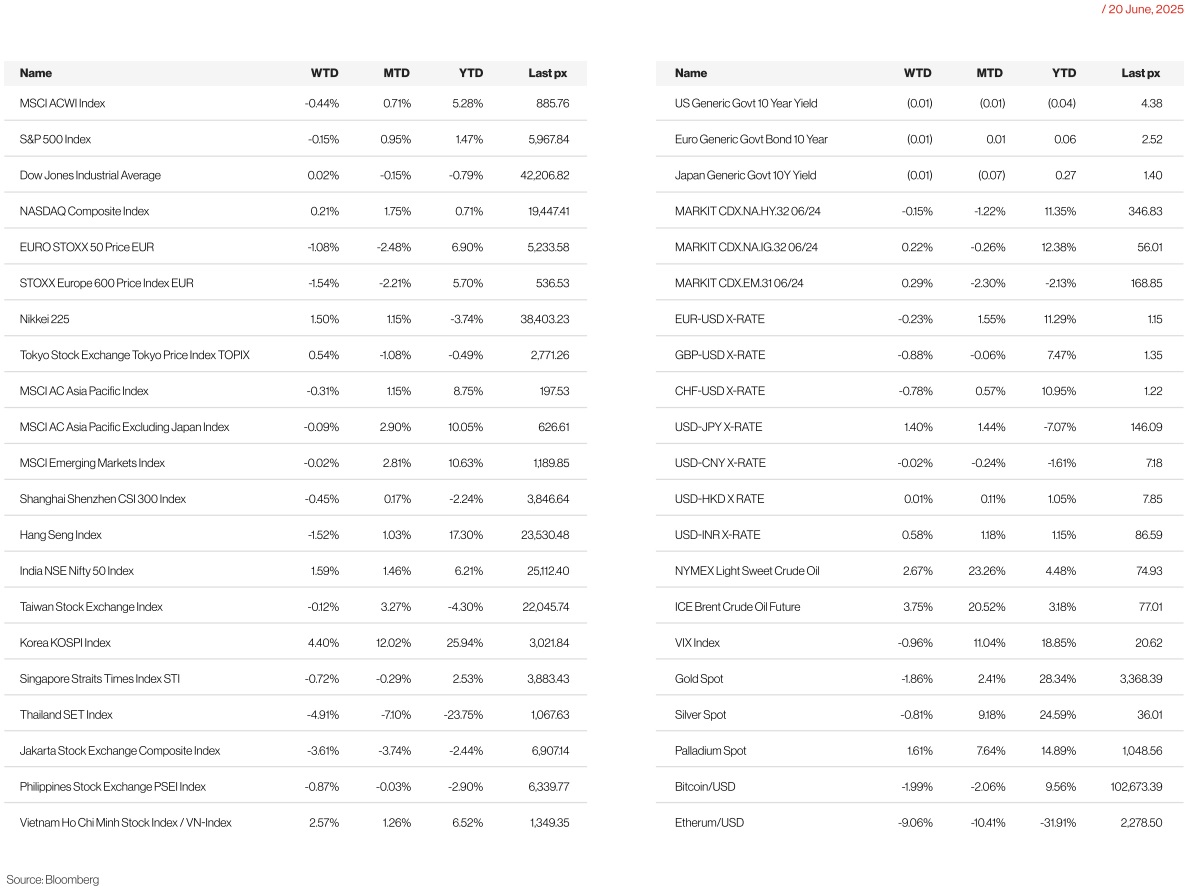

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

Over the weekend, the US conducted air strikes on Iran, bombing 3 nuclear sites. Claiming success over the bombings, President Trump stated that “Now Is The Time For Peace!”

Jittery reactions to markets as we open here in Australasia as US futures opened weaker. Crude oil and the dollar index higher in early Monday trading. Anxiety surrounding any kind of retaliatory actions pointing to yet another endless war in the ME will keep global markets in check. Bloomberg Economics reports this: It’s very early days, but our initial assessment is that Iran will be wary of triggering an escalation in a war it knows it can’t win. That suggests a calibrated and targeted retaliation against the US is the more likely option.

Markets for last week’s shortened week were flat, even after President Trump de-escalated tensions when he said that he would mull any US attacks on Iran over the next 2 weeks, giving diplomacy a last-ditch chance. After the weekend’s bombing however, he simply stated that his patience had run out.

Retail sales in May fell by the most since the start of the year, suggesting new tariffs are deterring consumers from spending, with retail sales advance m/m coming in at -0.9% from a revised -0.1% previously. When autos are stripped out, overall sales fell 0.30%. Sales at the control group of stores, which feeds into the BEA’s estimates of goods spending in the national accounts, rose 0.40% over the month, a touch better than consensus and our expectation (both 0.30%).

Industrial production fell 0.20% in May, a little weaker than consensus (0.00%). Prior months were little revised on net, with the overall level of total IP in April up one tenth in today’s data versus the prior vintage. Overall, the report was gloomy outside of vehicle production. Manufacturing surveys in May had signaled softer manufacturing output.

The dollar was little changed, and yields closed the week marginally higher at 4.375% and 3.907% for the UST10’s and 2’s respectively. The US Senate passed stablecoin legislation setting up regulatory rules for cryptocurrencies to be pegged to the dollar on Tuesday. It was a landmark win for both the crypto industry and President Trump.

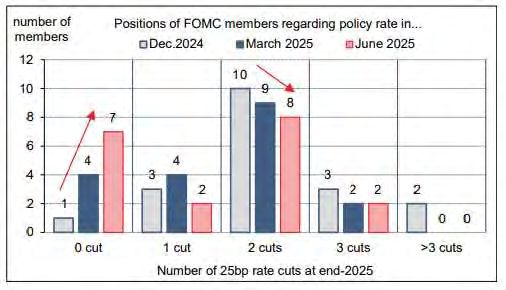

Progress on tariff deals were scarce with no new deals reported. A toplevel meeting between Japan and the US was cancelled, as well as reports of revoked waivers for semiconductor companies dampened sentiment. Friday saw an earlier rally after comments made by Fed Governor Christopher Waller, who said the central bank could lower interest rates as soon as next month. Waller said economic data shows GDP growth and inflation are running close to the Fed’s targets. The Fed which met on Wednesday left rates unchanged as expected, pencilling in 2 rate cuts this year, though new projections showed a growing divide among policymakers over the trajectory for borrowing costs as tariffs make their way through the US economy. There was a hawkish shift as seven officials projected no cuts this year, up from four in March. Beyond, fed funds projections moved 25 bps higher in 2026 and 2027, motivated by a stickier inflation profile. Chair Powell’s press conference did not take the opportunity to reinforce the potential nearterm dovish signal from the dot plot. Instead, Powell indicated that the labor market and economy remain solid and that they continue to anticipate inflation will rise due to tariffs. He also emphasized that uncertainty remains historically elevated, a reason to downplay rate projections, and that all of the fed fund’s paths in the Summary of Economic Projections could be reasonable. The dispersion of the 2025 dots indicates, there is clearly no strong consensus at this point. They retained the language that “labor market conditions remain solid” and “inflation remains somewhat elevated.” The Committee noted that “uncertainty about the economic outlook has diminished but remains elevated.” Similarly, they also removed the statement that the risks of higher unemployment and inflation have risen. This is likely a function of a clearer direction of travel with respect to the Trump administration’s tariff policy as well as more clarity around the contours of the reconciliation bill working its way through Congress.

The G7 leaders meeting which happened last week, we noted that the G7 leaders’ statement was only 121 words, compared with June 2024’s statement of 19,834 words, and Dec 2023’s statement of 5,108 words. It also only discussed the Israel/Iran conflict whereas normally a whole host of topics are covered.

This week will see US PMI’s and home sales with the key release being PCE on Friday – core MoM expected at 0.1% (unchanged) and headline YoY PCE at 2.3% from 2.1%.

Whilst there remains a split in camps within the Fed Reserve regarding rate cuts, tariffs have yet to de-rail the disinflation train. However, with the strait of Hormuz which Iran partially controls, if shut could see crude jump to $120-$130 pb (cc. JP Morgan) wreaking havoc on global inflation. Nearly 30 per cent of global oil and a third of the world’s LNG (liquefied natural gas) passes through the strait daily.

Europe

European stocks ended up 0.1% on Friday but lost 1.5% for the week as investors remained focused on the escalating conflict between Israel and Iran.

Inflation across the euro area in May held steady at 1.9% annually for headline prices and 2.3% for core inflation. Despite the steady y/y figures, underlying price pressures appear to be easing, with core inflation excluding volatile items slowing to its lowest pace in over a year at 2.0% on a seasonally adjusted annualized basis.

In Germany, the federal cabinet is expected to approve the 2025 national budget and a new law for the €500 billion investment fund on Tuesday. These proposals will then head to parliament, with initial debates set for early July and final decisions expected after the summer break in September.

Looking ahead, key data releases this week in the Euro Area include flash inflation figures for June from France and Spain, due Friday. Other notable indicators this week include the eurozone’s flash PMI figures (Monday), Germany’s Ifo business climate index (Tuesday), and the European Commission’s confidence surveys (Friday). The ECB will also publish its May survey on consumer inflation expectations.

In the UK, economic growth outperformed expectations in the first quarter, rising 0.7% q/q. However, the momentum softened in April, with GDP shrinking by 0.3% and trade data indicating a reversal in earlier export activity, particularly to the U.S. May retail sales were especially weak, dropping 2.7% — far below both market and in-house forecasts — and more than undoing April’s 1.3% gain. Despite a small improvement in sentiment from -18 to -20 previously, consumer confidence remains low. Inflation eased slightly in May, with headline CPI falling to 3.4% and core inflation down to 3.5%.

The Bank of England left rates on hold at 4.25%. The biggest ”surprise” from the BoE meeting was that there were three, not two votes for a 25bps cut – from not only Dhingra and Taylor (after their decisions to vote for a 50bp cut in May) but Ramsden joining in the dissents too. Elsewhere, there were few surprises: the Bank’s guidance remained unchanged – still on track for “gradual and careful” cuts, the policy path not being pre-set (i.e. taking a meeting-by-meeting approach), the Committee still focused on the persistence of inflation and on the balance between demand and supply in the economy, and policy needing to remain restrictive for “sufficiently long”. We think the Bank will cut three times more: in August, November and February, for a 3.50% terminal rate by early 2026.

Norges Bank cut its policy rate by 25bps to 4.25% in a surprise move as consensus expected it to leave the policy rate unchanged. The day before the announcement, markets priced in just a 1bp cut. The Riksbank cut its policy rate by 25bps to 2.00%, due to evidence of economic weakness, which was in line with consensus expectations. The SNB cut its policy rate by 25bps to 0.00% to counter lower inflationary pressures, in line with expectations. Conditional on the policy rate remaining at 0.00%, the SNB forecasts CPI inflation to average 0.0% in Q2 (down from 0.4% in the March forecast), and 0.1%, followed by 0.3% inflation in Q3 and Q4 2025, respectively – both down by 0.3pp compared with the March forecast.

In trade developments, former President Trump signed executive orders finalizing a UK-U.S. trade agreement, cutting tariffs on UK car exports. Talks on steel and aluminum tariffs, however, remain unresolved.

Next week, attention will turn to the UK’s flash PMI results for June, due Monday. A slight improvement is expected, with the composite index inching up to 50.6, supported by modest gains in both manufacturing and services.

Asia

Asia was slightly down, with the MSCI Asia ex Japan Index flat for the week (–0.09%). Japan, South Korea, India and Vietnam were largely positive while Hong Kong, Indonesia, and Thailand were weaker.

Thailand: Thai Prime Minister Paetongtarn Shinawatra’s government has been rocked after a major coalition partner quit amid mounting public anger over a leaked phone call she had with a former Cambodian leader. The loss of Bhumjaithai’s 69 MPs after they pulled out on Wednesday 18th June, leaves Paetongtarn’s coalition with a slim majority in the 495- member parliament, raising the prospects of a snap election just over two years since the last one. The crisis engulfing Paetongtarn has prompted fears that another coup could eventuate. Set index in Thailand was down 4.91% last week, YTD the index is down almost 24%, weakest in Asia.

The BoJ kept the policy rate unchanged and maintained the pace of reducing JGB purchases by JPY400 billion per quarter until 1Q26. However, it decided to slow down the reduction pace to JPY200 billion per quarter from 2Q26 to 1Q27.

Japanese Prime Minister Shigeru Ishiba and US President Donald Trump failed to achieve a breakthrough that would lower or eliminate tariffs. The Japanese leader’s discussion with Trump in Canada came after six rounds of trade talks between his tariff negotiator Ryosei Akazawa and US Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent. Ishiba, is also under pressure to secure an agreement before national upper house elections next month that could weaken his grip on power.

Japan’s core inflation rate accelerated to 3.7 per cent in May, official data showed on Friday (Jun 20), posing a threat to Prime Minister Shigeru Ishiba’s leadership ahead of July elections. Ishiba has pledged cash handouts of 20,000 yen (US$139) for every citizen – doubling it for children – to help households combat inflation ahead of the July elections.

At the 2025 Lujiazui Forum in Shanghai, PBOC Governor Pan Gongsheng predicted a shift toward a multi-polar international monetary system, challenging the long-standing dominance of the US dollar. He highlighted the renminbi’s growing global role as the second-largest trade finance currency and third-largest in global payments. Pan criticized the risks of overreliance on a single currency, especially amid geopolitical tensions and sanctions. To support this transition, China is expanding its digital renminbi infrastructure and promoting the Cross-Border Interbank Payment System (CIPS) as an alternative to SWIFT, with new international partners like Singapore’s OCBC and Kyrgyzstan’s Eldik Bank.

After surging 11.5%m/m in April, Singapore’s non-oil domestic exports (NODX) fell 10.1% in May. While this was much weaker than expected, it still leaves NODX tracking a 9.2% gain for 2Q, after contractions over 4Q24 and 1Q25. Tech exports were down only a modest 6%, but core exports fell 13.1%, fully reversing their April surge. Exports to EM Asia—which had underpinned the strength in April NODX—fell sharply, led by China, Taiwan, and Indonesia. While re-exports to the US remained elevated for a third month. MAS’s June survey lowers Singapore’s 2025 GDP forecast to 1.7% (vs prev. survey of 2.6%)

Other data prints from Asia:

- PBOC sets USD/CNY reference rate at 7.1695 vs. 7.1729 previous.

- Taiwan’s central bank kept its rate at 2%, citing strong tech exports and easing inflation, signaling no cut this year

- Indonesia’s central bank paused rate cuts, urged banks to lower lending rates, maintained 2025 growth forecast, and emphasized economic stimulus

- Philippine central bank cut rates to 5.25%, forecasts further cut to 5.00% amid lower inflation and moderating growt.

- Hong Kong SAR’s labour market loosened again in May. Unemployment rate edged up 0.1%pt to 3.5%

- Korea’s producer prices index (PPI) rose by 0.3% in May, following a 0.8% gain in April. Seasonally adjusted, the PPI continued to decrease by 0.3%m/m, marking the fourth consecutive monthly decline.

- Vietnamese government extended its 2% VAT reduction, lowering the rate from 10% to 8%, through the end of 2026

GeoPolitics

US- Israel – Iran: Israel s defense minister said the country is planning to attack very significant targets in Tehran and residents should evacuate, showing possible signs of escalation. U.S. president Donald Trump also called for large scale evacuations in a post on Truth Social: Everyone should immediately evacuate Tehran!” Trump then called for Irans unconditional surrender . Intense Israeli airstrikes targeted Iran’s capital early Wednesday, a day after U.S. President Donald Trump demanded unconditional surrender. Iran has said it will only agree to negotiate an end to the conflict and resume talks over its nuclear program if Israeli forces halted their bombing campaign, according to diplomats. By weekend, the US carried out a 37-hour operation, including a feint involving B-2 bombers, to strike Iran’s Fordow, Isfahan, and Natanz nuclear sites, with the goal of preventing Iran from acquiring a nuclear bomb. The US government claims the mission was a success, with President Trump stating that Irans key nuclear enrichment facilities have been completely and totally obliterated.

Investors anxiously wait to see if Iran would retaliate to US attacks on its nuclear sites. Optimists are hoping Iran might back down after its nuclear ambitions had been curtailed, or even that a possible regime change might bring a less hostile government to power there. Analysts at JPMorgan, however, cautioned that past episodes of regime change in the region typically resulted in oil prices spiking by as much as 76 per cent and averaging a 30 per cent rise over time. Key will be access through the Strait of Hormuz, which is only about 33km wide at its narrowest point and sees around 20 per cent of the world s daily oil consumption. US Secretary of State Marco Rubio on Sunday (Jun 22) called on China to encourage Iran to not shut down the Strait of Hormuz after Washington carried out strikes on Iranian nuclear sites.

The Middle East will be high on the agenda at a NATO leaders meeting at the Hague this week, where most members have agreed to commit to a sharp rise in defense spending. French President Emmanuel Macron, has warned last week that it would be the biggest error to seek regime change in Iran, warning that the ousting of the Iranian leaders would lead to chaos . Trump publicly condemned Macron.

China – Israel: Chinas embassy in Israel on Tuesday (Jun 17) urged its citizens to leave the country as soon as possible , after Israel and Iran traded heavy strikes. Beijing s embassy said on Tuesday the conflict was continuing to escalate.

Israel – Palestine: Israeli tanks fired into a crowd trying to get aid from trucks in Gaza on Tuesday (Jun 17), killing at least 59 people, and leaving 221 wounded according to medics, in one of the bloodiest incidents yet in mounting violence as desperate residents struggle for food. Casualties were being rushed into the hospital in civilian cars, rickshaws, and donkey carts. It was the worst death toll in a single day since aid resumed in Gaza in May.

US: Trumps US travel ban 2.0: 36 more countries face potential entry restrictions. The countries that could face a full or a partial ban if they do not address these concerns within the next 60 days are: Angola, Antigua and Barbuda, Benin, Bhutan, Burkina Faso, Cabo Verde, Cambodia, Cameroon, Cote DIvoire, Democratic Republic of Congo, Djibouti, Dominica, Ethiopia, Egypt, Gabon, The Gambia, Ghana, Kyrgyzstan, Liberia, Malawi, Mauritania, Niger, Nigeria, Saint Kitts and Nevis, Saint Lucia, Sao Tome and Principe, Senegal, South Sudan, Syria, Tanzania, Tonga, Tuvalu, Uganda, Vanuatu, Zambia, and Zimbabwe. That would be a significant expansion of the ban that came into effect earlier this month. The countries affected were Afghanistan, Myanmar, Chad, Congo Republic, Equatorial Guinea, Eritrea, Haiti, Iran, Libya, Somalia, Sudan and Yemen. The entry of people from seven other countries – Burundi, Cuba, Laos, Sierra Leone, Togo, Turkmenistan and Venezuela – has also been partially restricted.

France – Israel: Israel has slammed France for barring four of its arms manufacturers from the Paris Air Show, in the latest sign of increasing tensions between the two countries. The stands of Elbit Systems, Rafael, Israel Aerospace Industries and Uvision were obscured behind black barriers on Monday after they refused to comply with an order from the French government to remove any offensive weapons from display. During a visit to the air show, French prime minister François Bayrou said France was a staunch ally of Israel, but that what was happening in Gaza was “morally unacceptable” and required France to mark its “disapproval and distance”.

Russia – North Korea: North Korea will send military builders and sappers to help restore Russia’s western Kursk region after Ukraine’s incursion, Russian news agencies cited Moscow’s security chief as saying on Tuesday (Jun 17) on a trip to Pyongyang.

Credit/Treasuries

The shape of the US Treasury curve did not really change last week with the 2years yield -6bps, 5years yield -5bps, 10years yield -4bps & the long bond yield -3bps. US IG 5years credit spreads widened by 2bps while US HY 5years credit spreads widened also by 2bps.

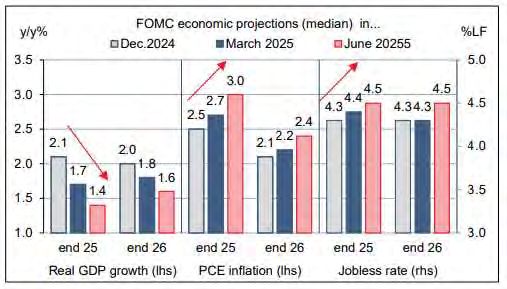

Though the median policy rate forecast for 2025 remained at two cuts, this was a very close call with only one official determining where the median landed. Similarly, while the 2026 and 2027 medians moved up by 25bps to 3.6% and 3.4% respectively, both were very close to remaining unchanged with only a one-dot margin for 2026 and two for 2027. With respect to the SEP forecast, 2025 real GDP growth was marked down 30bps to 1.4% on the back of the Q1 GDP print. Note that their 2025 forecast implies slightly over 1.8% growth from Q2 through Q4 this year. Overall, the participants appear to see the policy mix as negative for growth and estimate below trend growth in 2025 and 2026 before returning to trend in 2027. The 2026 median forecast fell by 20bps to 1.6% while 2027 remained unchanged at 1.8%, their median estimate of trend growth. Correspondingly, the median unemployment rate forecast rose by one-tenth in 2025 (to 4.5%), twotenths in 2026 (to 4.5%), and one-tenth in 2027 (to 4.4%).

UBS thinks that the unemployment rate heads somewhat higher, almost rounding up to 4.9% next year. The entire forecast path for inflation was revised higher. Both headline and core PCE inflation saw similar revisions. The median forecast for 2025 rose three tenths (headline to 3.0% and core to 3.1%), 2026 increased by two-tenths (both to 2.4%), and 2027 ticked up a tenth (both to 2.1%). Interestingly, in December 2024, the FOMC was projecting 2.5% core inflation this year, falling to 2.2% in 2026 and reaching the 2.0% target in 2027. Now, with 0.60% more core inflation this year (3.1%), the FOMC median has the same number of rate cuts.

Additionally on the expected inflation supplied induced chock, at this stage, it is not easy to say who will bear the additional cost of customs duties, households (increase in price) or companies (erosion of margins). In April and May, thanks to product stocks imported before customs duties, prices were little affected. But what will happen in three months? After the pandemic, the pricing power of companies was maximum. Households had large excess savings allowing them to cope with inflation. From now on, they are more price conscious and more agile in adjusting their discretionary spending. Tariff uncertainty is today the main obstacle to the Fed’s rate cut.

In December 2024, the FED GDP Growth forecast for 2025 was around +2.50%. They now (18/06/2025) expect GDP Growth this year to be around +1.40%. Based on UBS models, US Corporate EPS growth, in average, should drop by approximately 6% to 8% for a 1% reduction in GDP growth. EPS Growth 2025 for the S&P500 was expected (December 2024) to be around 14%. EPS Growth, based on recent consensus, is estimated now to be around 9%. Does this 9% already factored in the margin compression that some corporates will have to absorb (i.e. lower EPS) due to higher import goods prices. When we add the current uncertainties.

- Trade tariffs (end of grace period for most countries 9th of July. If no extension is approved, EMU is still under threat of 50% trade tariffs, Japan 23%, etc..)

- Fiscal (Senate completed their reviewed of the OBBB and announced their recommended changed/amendments (Cap on SALT to remain at 10%, increase debt ceiling to USD 5T, further cut to Medicaid, etc..) Vs the bill voted by the House). OBBB will now go back to the House. It seems optimistic that this bill will be presented to President Trump to be signed on the 4th of July

- Geopolitics tensions have increased significantly since the 13th of June and have reached yet another level with the US strikes on Iran nuclear facilities last weekend. Nevertheless, the S&P500 PE Forward multiple is still currently trading around 22x.

UBS expects more weakness to unfold in the economy in the third and fourth quarters than the FOMC projects. They also think that comes alongside more worrisome downside risks than the FOMC currently appreciates. As a result, they expect a larger move toward neutral this year, with a 100bps of rate cuts in total across the September, November and December meetings, bringing the funds rate to 3.25% to 3.50% at the end of the year. The inflation tolerance shown in the SEP released today does not undo their sense that when those downside risks and labor market weakness become realized, there will also be a discussion of the toolkit. The funds rate won’t stop the tariff cost-push inflation, but restrictive monetary policy would risk making a weakening labor market even worse. That’s a discussion we expect to develop later this year.

FX

DXY USD Index rose 0.53% to close the week 98.707 as Chair Powell emphasized ongoing uncertainty around the economic outlook and the need to wait to see the tariff effects on inflation and the labor market in the coming months. As expected, The Fed keeps rates unchanged at 4.25 4.50%, with the Summary of Economic Projections (SEP) incorporating tariff effects with higher inflation and slower growth forecasts; median 2025 dot continues to show two cuts, while 2026 and 2027 dots are revised higher. Data wise, Mixed May US Retail Sales data with the headline figure falling 0.9% m/m (C: 0.6%), but control group sales rising 0.4% m/m (C: 0.3%) lifting 2Q25 GDP growth and consumption expectations.

Both EUR and GBP weakened against USD, with EUR 0.23% to 1.1523 and GBP 0.88% to 1.3451. EUR weakened in line with G10 pairs, and the lack of trade clarity continued as President Trump noted he had not yet seen a reasonable deal from the EU. In UK, BoE kept rates on hold at 4.25%, as widely expected, but the vote was 6 3 to hold, with the minority preferring a 25bps cut. Looking forward, they maintained their language about a gradual and careful approach to easing policy, and markets continue to price another cut at the August meeting as likely. May UK retail sales came in sharply below expectations, falling 2.7% m/m (C: 0.5%). As a result, EURGBP rose 0.64% to close the week at 0.8566, as EUR continues to benefit as an alternative to the USD.

USDCHF rose 0.79% to close the week at 0.8178. As expected, SNB cut rates by 25 bps to 0%. Guidance hints at easing bias into negative rates: Developments abroad cited as main risk, base case is that growth in the global economy will weaken over the coming quarters.

USDSEK rose 1.94% to close the week at 9.6685. As expected, Riksbank lowered its policy rate by 25bps to 2.0% at its June meeting, and revised the policy rate path downwards, indicating a possibility of another cut this year. The rate cut was delivered on the basis of the economic recovery proceeding slower than expected, and the inflation outlook pointing to lower trajectory than before. On projections, growth risks are still seen to the downside, and core inflation is expected to undershoot in 2026 and 2027 at 1.9% y/y.

USDJPY rose 1.40% to close the week at 146.09. The BoJ keeps rates unchanged and slows the pace of QT beginning in April 2026, as widely expected. BoJ Governor Ueda offered a cautious tone as he continued to focus on the uncertainty of US trade policy and its impact on Japanese economy. He said he believes that the negative impact of the trade policy will appear in hard data in the latter half of this year, and he stated that the Bank wants to assess its magnitude. As a result, market implies only a 14.7 bps rate hike for 2025. In Japan, Nationwide Core CPI (ex. fresh food) accelerated to 3.7% y/y in May (C: 3.6%; P: 3.5%), and core of core CPI (ex. fresh food and energy) rose to 3.3% y/y (C: 3.2%; P: 3.0%). Food prices (ex. fresh food) remained the main driver of CPI growth.

Oil & Commodity

WTI crude and Brent crude oil futures rose 2.67% and 3.75% to close the week at 74.93 and 77.01. Oil futures jumped another 4% with WTI at 76.96 and Brent at 80.28 at the start of today’s trading session since the US launched direct attacks against Iran, casting further shadow over the supply outlook in the embattled oil-rich Middle Eastern region. At the point of writing, oil futures pared its gain as the world awaits Iran response.

Gold fell 1.86% to close the week at 3368.39, while Silver fell 0.81% to close the week at 36.01 driven by USD strength. Gold fell slightly this morning despite US airstrikes on Iran, which raised geopolitical risk. This implies that market attached a low probability of further escalation from Iran after the airstrikes.

Economic News This Week

- Monday – AU/JP/EU/UK/US Mfg/Svc/Comps PMI Jun Prelim, US Existing Home Sales

- Tuesday – CA CPI, US Richmond Fed Mfg/Conf. Board Consumer Confid.

- Wednesday – AU CPI, JP Machine Tool Orders, US MBA Mortg. App./New Home Sales

- Thursday – US Wholesale Inv./GDP/Personal Cons./Core PCE Price Index/Durable Goods Orders/Initial Jobless Claims/Pending Home Sales

- Friday – JP Jobless Rate/Tokyo CPI/Retail Sales, CA GDP, US Personal Income/PCE Price Index/UMich

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.