/ Monthly Market Update - November 2025

The Takaichi trade

The humanoid robots – science fiction or strategically important reality

Table of Contents

Insights

Takaichi Takes the Helm

It was third time lucky for Sanae Takaichi, a protégé of the late Shinzo Abe, who has made history as Japan’s first female prime minister. The 64-yearold emerges as the fourth leader in five years from the scandal-battered Liberal Democratic Party (LDP). Once the undisputable force of post-war Japanese politics, the LDP has in recent years seen its grip weaken: it has lost its majority in both houses of parliament, and its decades-long coalition with the socially conservative Komeito party fractured last October over disputes about campaign finance and anti-corruption reforms.

After assuming the LDP’s leadership, Ms Takaichi stitched together a new alliance with the Japan Innovation Party, a smaller conservative faction, giving her just enough parliamentary backing to clinch the top job. Now, she inherits a daunting in-tray. She has pledged to tackle inflation and surging living costs—issues that have eroded household purchasing power and voter patience alike. An even greater challenge looms in reversing Japan’s demographic decline: the population shrank by 0.75% in 2024, the sharpest drop since records began in 1968, and fertility remains among the lowest in the developed world.

Foreign policy may prove equally testing. Ms Takaichi has met with President Donald Trump to discuss defence and trade, including a mooted US$550 billion Japanese investment package whose details remain murky. The two leaders appear ideologically aligned, both favouring a brand of populist conservatism that prizes national strength and economic self-reliance.

Closer to home, she must navigate an increasingly assertive China. Once a fierce critic of Beijing—she once declared that “Japan is completely looked down on by China”—Ms Takaichi has recently moderated her tone, notably avoiding this year’s controversial visit to the Yasukuni Shrine honouring Japan’s war dead. The recalibration hints at a pragmatic turn as she seeks to balance national security with economic diplomacy.

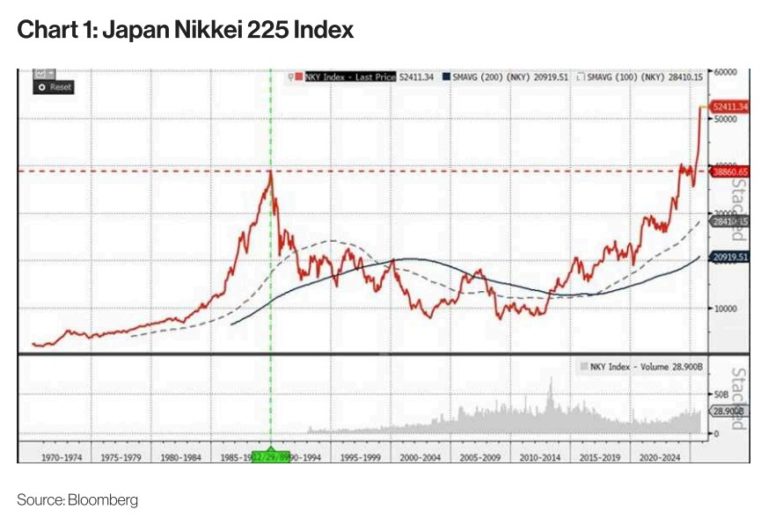

Markets, for now, are giving her the benefit of the doubt. Investors have cheered her victory and reformist rhetoric, sending Japan’s Nikkei 225 past the 50,000 mark for the first time in its 75-year history—well above the previous bubble-era peak of 1989. Whether Ms Takaichi can convert this burst of confidence into lasting political and economic renewal is the question that will define her premiership. Ms Takaichi faces the twin tests of domestic credibility and international influence.

Sanaenomics - Japan’s Recalibrated Economic Agenda

Sanae Takaichi’s ascent also signals the debut of “Sanenomics” — a continuation, yet reconfiguration, of the late Shinzo Abe’s economic plan. A long-time disciple of Abe’s policies, Japan’s new prime minister keeps faith with the “three arrows” of Abenomics — easy money, generous fiscal spending, and structural reform — but with a sharper focus. Sanenomics seeks to harness fiscal spending not merely as stimulus, but as strategic investment — channelling funds toward technological competitiveness, supply-chain resilience, and industrial upgrading. Monetary policy will be loose but underpinned by a stronger dose of structural guidance.

Domestically, Ms Takaichi’s economic agenda mixes populist gestures with pragmatic aims. She has vowed to curb inflation, abolish the provisional gasoline tax, and raise the income tax-free threshold to relieve pressure on households. A newly established Growth Strategy Council will steer efforts to revitalise Japan’s economy and boost productivity. Notably, she has ruled out major reforms to the country’s social welfare system — a politically cautious move given Japan’s ageing population and widening fiscal strain.

Her foreign-policy outlook remains anchored in Abe’s vision of a “Free and Open Indo-Pacific.” Ms Takaichi has pledged to deepen ties with the United States and the Quad alliance, while reinforcing deterrence across the region. She has taken a hawkish stance toward China and North Korea, promising to lift defence spending to 2% of GDP by March 2026—two years ahead of schedule.

“The free, open and stable international order that we were accustomed to is being violently shaken,” she told parliament, citing the military assertiveness of China, North Korea, and Russia. Her planned security overhaul could grant Japan’s Self-Defence Forces a more offensive role, ease restrictions on arms exports, and expand the defence budget.

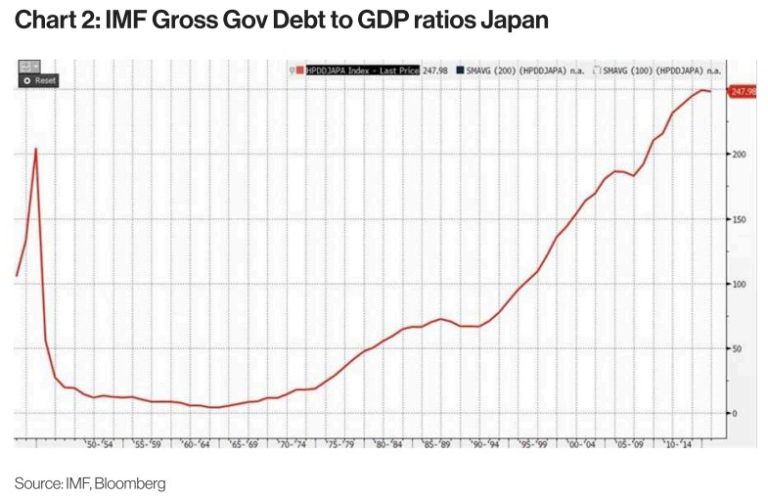

How she will finance these ambitions, however, remains unclear: Japan’s debt is already around 250% of GDP, leaving limited room for fiscal manoeuvre.

Ms Takaichi’s first overseas visit, to Malaysia for the Japan–ASEAN summit in late October, underscored her bid to position Tokyo as a stabilising force in the region. Both sides agreed to deepen cooperation on defence equipment, artificial intelligence, and economic integration a move ASEAN described as promoting cooperation, not confrontation.

For all her assertive rhetoric, fiscal realities may temper her ambitions. Finance Minister Katayama is thought to favour a balanced, pragmatic approach, wary of policies that could trigger yen depreciation. Even so, more aggressive fiscal expansion cannot be ruled out if growth falters.

Should Ms Takaichi succeed, she could redefine Japanese conservatism and cement her place in history as the country’s first female leader to deliver durable reform. If she fails, comparisons to Margaret Thatcher may fade swiftly replaced by those to Liz Truss, another female leader undone by market turbulence and unmet expectations.

Trump Takaichi Meeting

n a symbolic and substantive demonstration of Japan’s alignment with Washington, Ms Takaichi hosted President Trump with the full ceremonial flourish: state dinners featuring American produce reimagined with Japanese ingredients, and a gift of Abe’s golf putter.

On 28 October, the leaders signed memoranda of understanding to expand cooperation in shipbuilding, artificial intelligence, and other strategic technologies. The agreements follow Japan’s concession to reduce threatened tariffs on its exports, with Tokyo pledging $550 billion in investment in the U.S. through January 2029.

Security and supply-chain concerns were also addressed. The two nations announced a framework to secure rare earths and critical minerals, aimed at reducing dependence on China. Details were light, with the pledge limited to jointly identify projects of interest to address gaps in supply chains, leaving investors eager for concrete commitments.

The meeting underscored Ms Takaichi’s twin priorities: aligning economic strategy with strategic security while signalling to markets and allies that Japan is prepared to play an initiative taking global role.

Market Implications

The U.S.–Japan partnership and the broader policy agenda have immediate and longer-term implications for markets. In the short term, defence, trading houses, materials and mining, semiconductor equipment, and energy sectors are beneficiaries. Medium- and long-term gains could accrue to nuclear technology, shipbuilding, and advanced manufacturing.

Fiscal expansion may increase government bond supply, potentially steepening the yield curve, while monetary policy normalization may slow, weighing on the yen. Over the medium term, however, the currency may regain support as the U.S. moves into an interest-rate-cutting cycle. Yen carry trades could continue to inject liquidity into global markets, providing a modest boost to risk appetite.

Japan’s equity performance has broader regional implications. A sustained bull market in Japanese stocks often triggers capital flows into other Asian risk assets. Investor confidence in Japan could encourage reallocations toward markets with lower valuations and improving policy environments.

Thematic Opportunities:

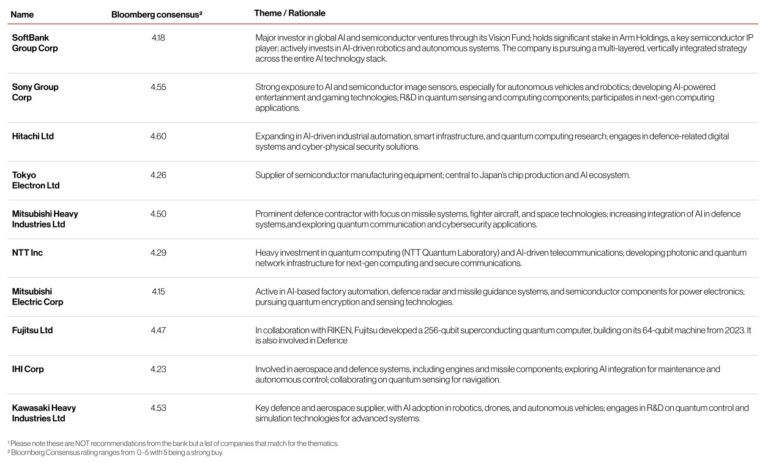

Takaichi’s policy agenda points to structural opportunities in three strategic themes: AI/semiconductors, energy/nuclear, and defence.

The table highlights leading Japanese listed companies positioned to benefit.

Advertising revenue - a cap on growth

Conclusion

Sanae Takaichi’s premiership is shaping a market environment where strategic policy alignment, fiscal backing, and technological ambition converge. Investors seeking thematic exposure can focus on AI/semiconductors, next-generation nuclear and energy infrastructure, and defence modernization. While opportunities are clear, execution risk, project timelines, and geopolitical dynamics remain critical considerations for long-term outcomes

Disclaimer

The documents herein are issued for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only. Please refer to the provisions of the legal information/disclaimer page of this website and note that they are fully applicable to any document herein, including and not limited to provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier & Cie does not provide any investment service or advice to US persons as defined by the regulations of the US Securities and Exchange Commission, thus the information herein is by no means directed to such persons or entities. © 2025 Bordier Group and/or its affiliates.