/ Monthly Market Update - February 2026

The Unstoppable Rise of Gold

“It's good until it's not, it works until it doesn't.”

- Barbara Ann Webber, a former Credit and Financial Analyst, March 2018.

Table of Contents

Insights

Insights

Today, gold is the topic of many investment discussions, not a day goes by without discussing gold. However, when I started my career in finance in 2001, this was not the case at all.

What has changed over the past years?

A lot has changed…for sure.

First let’s rewind 2 weeks ago to the end of January 2026 and the precious metal flash crash.

1. What happened to precious metals on the Friday 30 January 2026?

The yellow metal was rushing toward $5,600 on Thursday 29th January after 2 weeks of strong rally which saw gold adding $1,000 in the same period. The price action was uniquely rapid, and many investors understood that we were facing overextended price levels and that an “healthy” pullback could come at any time.

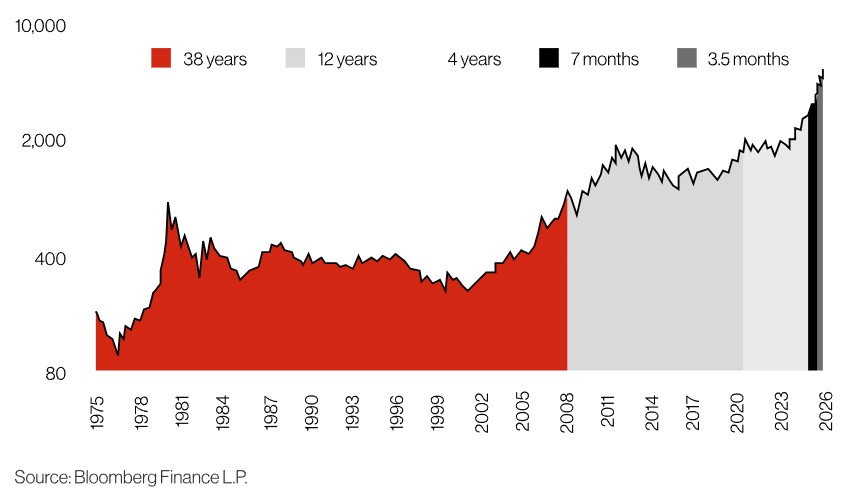

Graph 1 – the price evolution of gold by segment of $1,000 – acceleration of the price increase in 2025–2026

The nomination of Warsh as the new chair of the US Federal Reserve (Fed) on Friday 30th January, turned out to be a nightmare for precious metals investors and the catalyst for the pullback that was feared. Prices plummeted at an unprecedented pace as those who fuelled the amazing ascent started to sell. Silver stole the show, dropping more than 25% for its largest one day decline ever. Gold was down almost 10% on Friday 30th January.

This brutal event was driven by the repricing of few elements, first the expectation of a continued weakness of the US dollar, second fears of increasing political interference with the Fed, and finally expectations of lower US interest rates and a potential loss of trust in the US dollar as the world’s reserve currency.

This crash was accelerated by forced selling from investors who established long positions with leverage (options, forwards) and got caught short when the gold spot price started to fall following some profit taking actions.

Another reason why precious metals have fallen may simply be that investors decided to turn to other assets (outside of precious metals) to diversify away from the USD, looking at “safe haven” currencies like CHF, JPY, and to smaller extent to AUD, and NOK for example.

It is worth noting that many observers made the parallel between what happened at the end of January 2026 with what happened in October 2025 when gold had a sharp extension to $4,300/oz and suffered a subsequent correction down to $3,950/oz. And then gold started its rally again until end of January 2026.

However, the fundamental of holding gold in the current world has not changed. US twin deficits, US policies uncertainty, fiscal pressures unresolved, trade tensions, and global geopolitical risks still motivate investors to own gold in their portfolio as a safe haven asset.

It is interesting to note that amidst the crash in precious metals at the end of January, the USD was consolidating and holding up steady. This is because the three big issues surrounding the USD that had pushed investors to renewed USD selling have faded:

- President Trump’s inconsistent foreign policymaking lost some of its scare.

- Concerns about USD debasement receded after US Treasury Secretary Bessent backpalled on President Trump’s earlier comments about not caring about a weak USD, suggesting that policymakers continue to prefer the USD’s strong role as the global reserve currency.

- Worries about Fed independence diminished following President Trump’s nomination of Kevin Warsh as the new Fed chair on Friday 30th January 2026. Kevin Warsh is perceived as a regime change. He is expected to be less data dependent and more forward looking, being able to anticipate a lower inflation because of an AI-led increase in productivity.

Some articles speculate about the potential intervention on Friday 30th January of larger investors coming in, taking significant short gold positions to take advantage of the negative spiral and making very profitable trades in the process by forcing less robust investors to liquidate their positions at loss and accentuating the fall in spot price by doing so.

2. What are the main drivers of gold price, why is it so popular now

The fundamentals supporting an increase in gold price remain in place. One large factor is the central banks activity in accumulating gold to diversify away from USD. The other supporting factor is the investors demand.

According to JP Morgan, over the second half of 2025, demand from investors and central banks together came in at 944 tonne in 3Q25 and 757 tonnes in 4Q25, respectively.

The notional of gold demand from investor and central bank in 3Q25 and 4Q25 averaged approximately $103 billion ($105 and $101 billion, respectively) at average gold prices for the respective quarters, roughly $40 billion above the average of the first half of 2025.

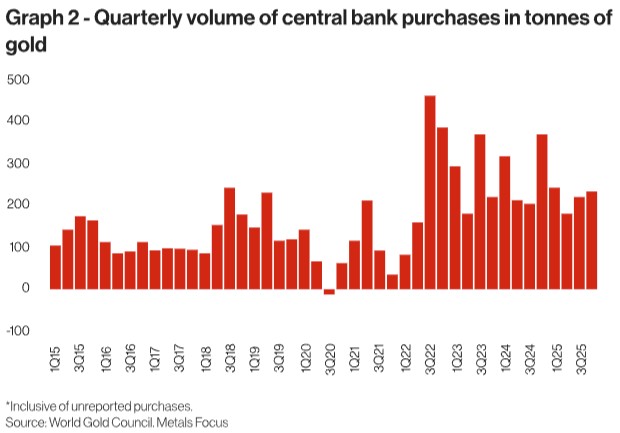

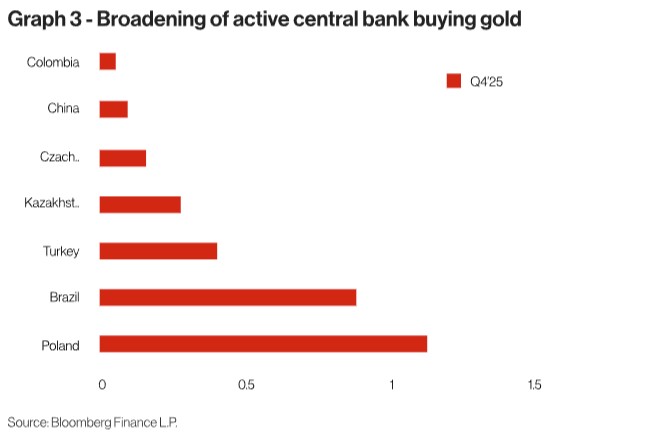

This overshoot in demand came on the back of both continued strong central bank buying and greater investor inflows. In the whole of 2025, central banks purchased 863 tonnes of gold. Graph 2 shows the quarterly volume of central bank purchases over the past 10 years. The level of accumulation is slowing down from the peak years of 2022 and 2023 but at the same time we observe a broadening of the purchaser base (usual suspects like central banks from Turkey, Kazakhstan or China are now joined by central banks such as Poland, Brazil and the Philippines which started purchasing gold in 2023–2025).

Poland’s central bank’s investment in gold stood out in 2025 as the largest buyer of gold, with Poland’s central bank actively purchasing 100 tonnes of gold last year. They also indicated an appetite to reach an allocation of gold in the central bank reserves of 700 tonnes amounting to about ~28% of the total reserve assets.

As a result of this momentum, JPMorgan concludes that a “continued structurally elevated central bank purchases combined with increasing investor diversification and allocation into gold amounts to a demand environment that is stressing inelastic supply, pushing prices (of gold) higher”.

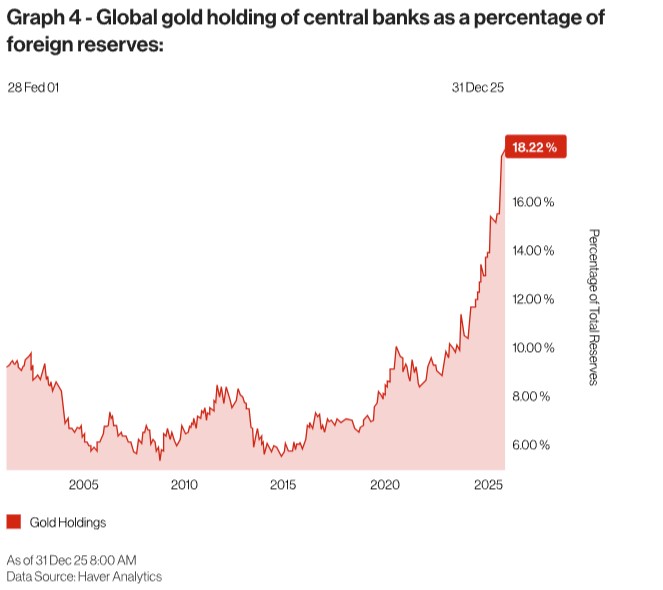

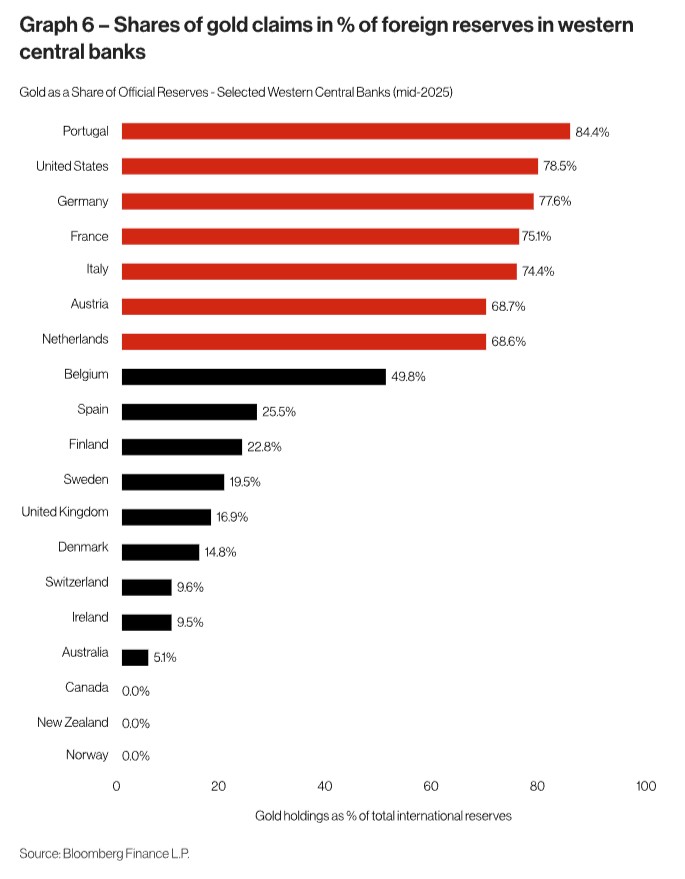

There is still space for more gold accumulation by some central banks. The current average gold allocation as part of central bank reserves globally is around 18% as of end of December 2025. This is much less than the average gold allocation of the western central banks.

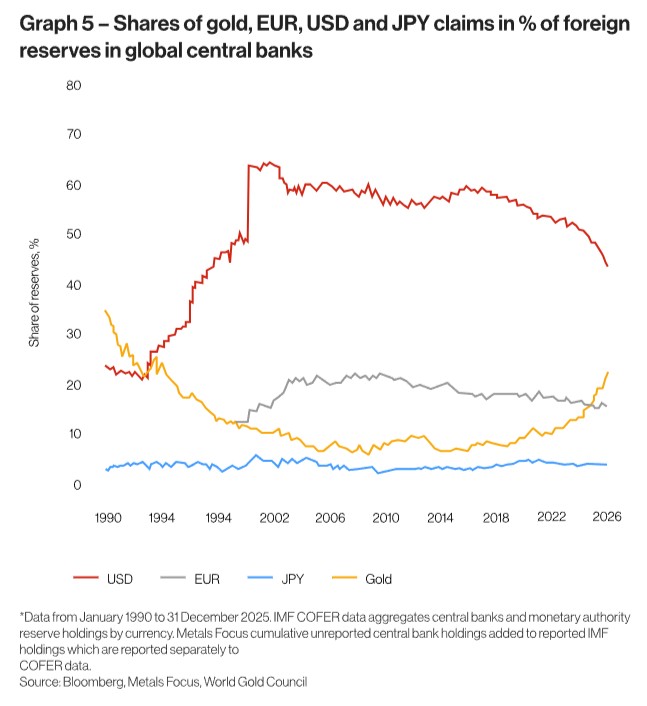

Looking at the foreign reserves of central banks, we see that gold allocation is increasing in proportion, returning back to levels last seen in the 1990s. The loser in the central bank’s allocation is the USD which is being replaced by gold – this is showed by the reduction in US treasuries in central banks reserves. The other reserve currencies remain relatively stable across time.

According to the World Gold Council, western economies such as the US, Germany and France maintain between 65% and 70% of their foreign reserves in gold. For instance, the US holds over 8,133 tonnes of gold, which is roughly 71% of its total reserves. In contrast, emerging economies like China and India allocate a far lower percentage, typically less than 10% of reserves to gold. Recent estimates place China’s gold reserves at about 8% of total reserves, while India’s allocation is just under 18%.

This disparity underscores the anticipation of a multi-tiered trend of Eastern central banks increasing their gold reserves as they move towards a reserve composition more reflective of those in the West.

There remains a possibility that central banks in developed markets could shift towards monetization. If these central banks decide to rebalance their reserves or sell gold to address budget shortfalls, it will represent a crucial risk that could undermine the fundamentally bullish outlook.

Such discussion has been happening in countries across Europe as well as Singapore which has been a net seller of gold over the past quarters.

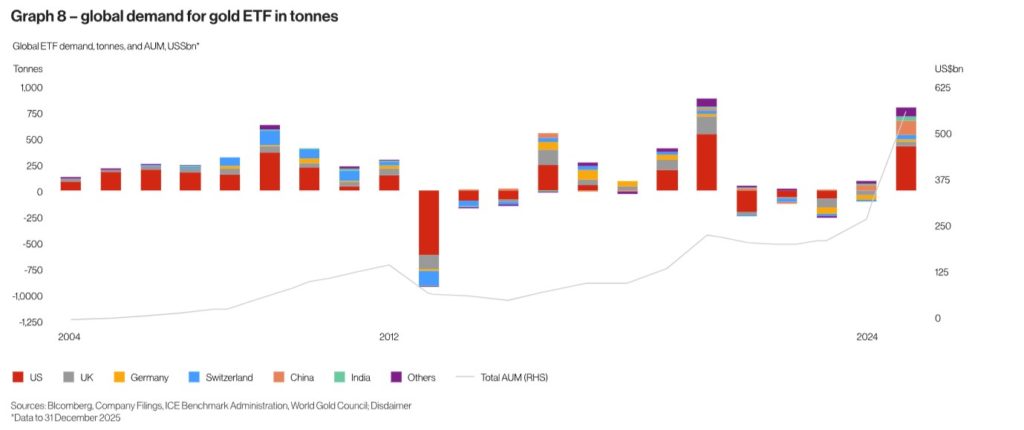

Beyond central banks, robust investment demand came through large purchases in ETF holdings for a size close to 800 tonnes in 2025.

In addition to that, there is the demand for physical bars and coins.

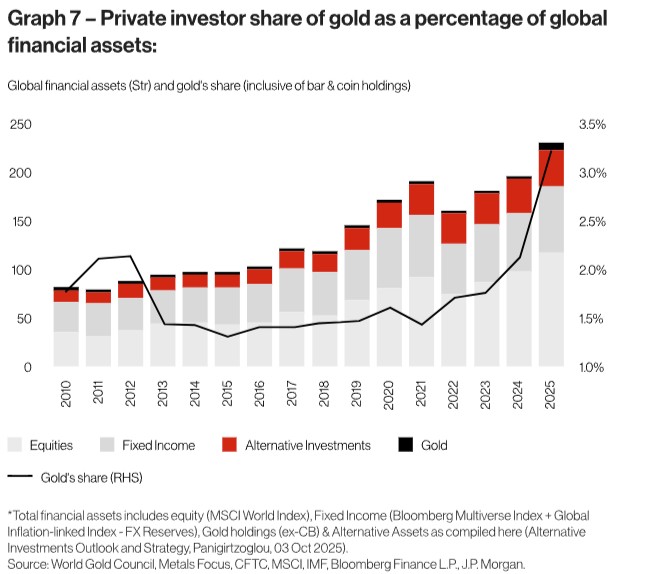

Looking at the private investor side, with these added inflows and higher prices, JPMorgan estimates that private investor holdings of gold (via ETFs, bars & coins, and COMEX futures) have reached around 3.2% of total AUM of equities, fixed income, and alternatives.

Here it is worth pausing and noting that Bordier has been adding to its gold position over the past 12 months from a strategic weight of 5% to a tactical weight of 8% across investment risk profiles. This is quite a large allocation and expresses the perspective of the bank about the structural USD weakness.

On the investment side, gold continues to be viewed as a dynamic, multi-faceted portfolio hedge, motivating increasing diversification into the metal.

The list of concerns driving investors into gold is the same as central banks, spanning from U.S. debt sustainability, sticky inflation, real asset diversification following relatively stretched equity valuations, unpredictable geopolitical landscape, and general U.S. trade and policy uncertainty.

The numerous factors mentioned attracts even more investors from different horizons.

Aside from the boosted allocation to your “traditional finance” investors, new entrants continue to meaningfully expand the pool of gold ownership. The most prominent example of this is Tether, the issuer of the largest stablecoin USDT. The company reportedly bought more than 70 tonnes of gold in 2025, ranking it as the second largest reported gold purchaser when compared to central banks, behind Poland. This takes Tether’s holdings to ~140 tonnes, most of which are its own reserves, with the company continuing a buying pace of about 1-2 tonnes a week for now, according to its CEO. One more factor supporting the gold price.

3. What to expect in 2026?

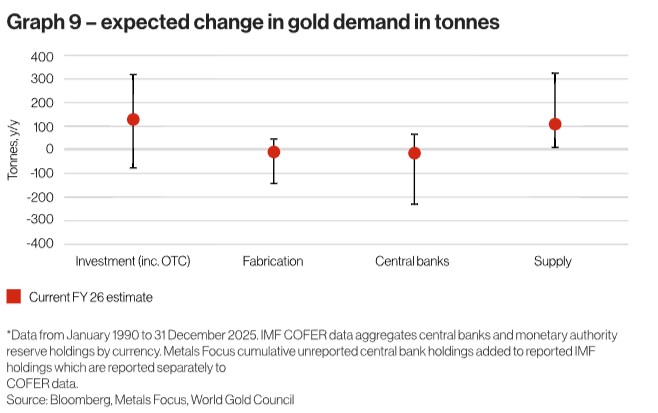

The World Gold Council forecasts a slight increase in demand for gold in 2026 vs 2025, supported by investment demand, rather than central banks demand.

A significant equity correction that strains market and investor liquidity through margin calls is a major risk investors should be aware of. Under this scenario, the first impulse for investors will be to sell gold to raise cash for margin calls – this is what we saw in 2022 which led to a peak to trough sharp price move of -20% for gold.

The incredible rise in volatility observed in gold prices over the past few weeks signals attention and interesting phenomenon. Gold price rose at the same time as the volatility rose. This pattern has invited a different type of investor – one who is looking at gold not only as a safe haven asset but potentially as a growth asset.

On the opposite spectrum, conservative investors can be seen wondering if they should hedge any potential downside risk on their gold position, which would have been considered odd not too long ago.

As Deutsche Bank explains it, “This means that investors likely now accept that gold can exaggerate portfolio risks rather than tame them. At the same time, it also means gold may be considered as a potential source of excess returns in exchange for giving up its protective qualities. This means the profile of a prototypical gold investor from now on (if not already since 2020–21 onwards) is likely to be of a higher risk tolerance, with possibly a more tactical than strategic investment horizon.”

Where will the gold price go from here?

Banks like Deutsche Bank, UBS or JP Morgan are positive on the gold outlook for 2026 and set their target price of gold pushing higher towards $6,000/oz, $5,900/oz respectively and even $6,300/oz for JP Morgan.

However, according to data compiled by Bloomberg, a consensus estimate of gold price forecast for 2026 among diverse institutions set a price for end of 2026 at $4,500/oz which would represent only a modest 4–5% performance for 2026, far from the performance we saw in 2025 (+64%), 2024 (+27%) or even in 2023 (+13%).

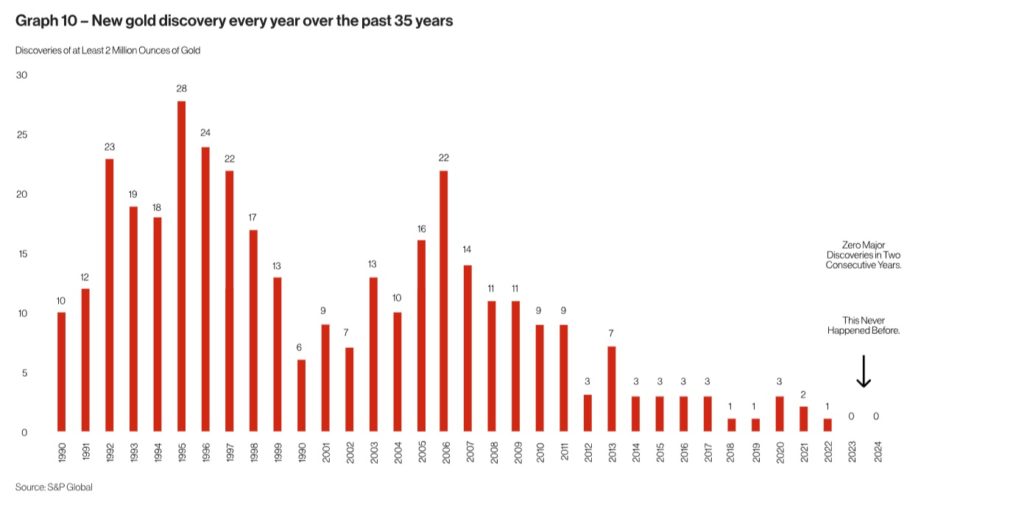

While targets are extravagant and generally biased to the upside, one thing we did not discuss in this report is the exploration or mining of gold which is a critical driver of price. Usually, new gold deposits are discovered every year; however small these deposits might be. Over the past two years though, no new deposit has been discovered. Such supply constraint will create even more tension in the price of gold which already shows signs of inelasticity. A proof of that is the continued purchasing of investors and central banks despite the surge in price of gold over the past 2 years.

This fact begs the question of how to best invest in gold, is it through ETFs, or XAU metal account or maybe with physical gold instruments. This is another topic in itself!

Sources are research reports from JP Morgan, Deutsche Bank, Goldman Sachs, Bloomberg and the World Gold Council.

Conclusion

A world that is stable – until it isn’t. Bring it on!

Disclaimer

This material is for the use of the recipient in accordance with the restrictions and/or limitations implemented by any applicable laws and regulations only. It is intended only for the recipient and may not be published, circulated, reproduced or distributed in whole or in part to any other person without the Bank’s prior written consent. Unless otherwise indicated, the information is made available for informational purposes only, without considering the recipient’s financial situation, investment objectives, risk tolerance, financial situation, or any other particular needs and should not be treated as legal or taxation advice.

The information is not and should not be construed as an offer or a solicitation to deal in any investment product or to enter into any legal relations. Any investment decision made based on the information provided is the sole responsibility of the client. The Bank disclaims any liability for any losses or damages resulting from the use of this information. The Bank assumes no responsibility for the way in which the client may choose to use or apply this information, or for any investment decision or transaction that the client might undertake as a consequence. It is the client’s own responsibility to ensure that this product is suitable for him or her and the client must make his or her own decision concerning this product. The client may also wish to obtain advice from other sources before making any decision.

Past performance is not indicative of future results. Any forecast on the economy, stock market, bond market and economic trends of the markets are not necessarily indicative of the future or likely performance of the product. Any investment involves risks, including the total loss of the invested capital.

For queries arising from, or in connection with this material, please contact the person who sent you this material. This advertisement has not been reviewed by the Monetary Authority of Singapore.