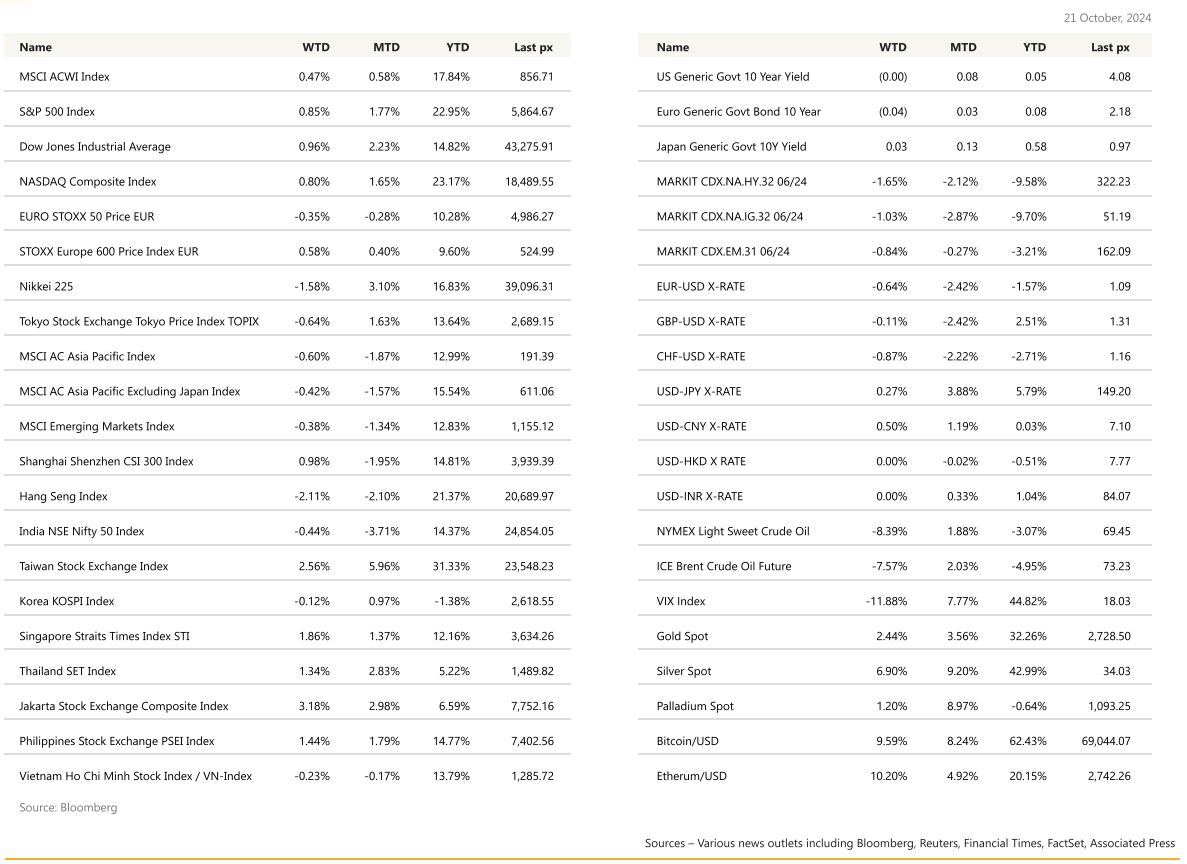

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets posted a 6 consecutive weekly rally – its longest winning streak of 2024 fuelled by upbeat earnings and economic data supporting a robust economy. Earnings from Apple and Netflix following in the footsteps of Morgan Stanley, Goldmans, JP Morgan and Citi earlier in the week, all beating consensus. Chip giant TSM raised its revenue outlook, helping ease concerns about global chip demand and the sustainability of an AI hardware boom. The tech heavy Nasdaq 100 Index posted its worst day earlier in the week after Dutch semi producer ASML Holding NV plunged on lower guidance for 2025. Retail sales, illustrating resilient consumer spending, rose 0.4% MoM versus expectations of 0.3%, and ex-vehicles rose 0.5% versus 0.1% expected, driving traders further to trim bets on the scale of rate cuts to come. Applications for unemployment benefits fell after jumping the previous week in Southeastern states affected by Hurricane Helene, and data will probably remain volatile in the coming weeks. US import prices fell a little more rapidly last month due to lower fuel costs as oil prices sank. Meanwhile, mortgage applications in the US fell 17% in the last week, the biggest drop since 2020. The CBOE Vix index fell to 18 whilst the UST10Y and 2Y yields closed at 4.8% and 3.948% respectively steepening slightly from earlier in the week. Crude oil fell for the week to close below WTI $70 after the Washington Post reported that Israel may avoid targeting Iran’s crude infrastructure.

Lots of Fed-speak last week with Federal Reserve Bank of Atlanta President Raphael Bostic said he’s not in a hurry to lower interest rates to the so-called neutral level, emphasizing that policymakers are committed to achieving their 2% inflation target and wouldn’t want disinflation to stall because “we haven’t been restrictive for long enough”. He also said that he never had a recession in his outlook because he always expected to be strong enough to absorb aggressive rate hikes. San Francisco Fed President Mary Daly said the central bank must stay vigilant as inflation declines and the labour market cools. Minneapolis Fed President Neel Kashkari said it appears likely that “further modest reductions” in the central bank’s benchmark rate will be appropriate in the coming quarters. Cryptos continued its upswing as risk sentiment returned, pushing BTC to test $69k and ETH 2,700.

This week will see a quieter set of economic releases – leading index tonight, S&P Global US Manufacturing and Services PMI, Durable goods and the U. of Mich. Sentiment and 1 & 5-10 Year Inflation expectations.

ASML NV fell about 13.8% for the week on the back of its lower guidance despite beating its earnings estimates. Given the buoyancy and still robust outlook for the sector, we take this as opportunistic to launch an FCN strike at 70% for a year with a yield of USD 10%.

Europe

The Eurostoxx ended the session up 0.21%, with most regional bourses and the majority of sectors in the green. The index also recorded its second consecutive week of gains. Tech stocks led gains, rising 2%, while mining stocks added 1.39%. Luxury stocks also climbed on Friday, with Gucci-owner Kering rising 3.5%, having climbed over 5% earlier in the session.

Some economic data: The September Euro area headline inflation print was revised down marginally, from 1.77%oya to 1.74%. core inflation declined 0.17%-pt to 2.67%, with services price inflation down 0.21%-pt to 3.92% and core goods inflation largely stable (0.44 after a 1bp upward revision), while food price inflation was broadly stable at 2.40%. Euro area IP jumped 1.8%m/m sa in August, after a 0.5%m/m decline in July. Manufacturing production in particular jumped 1.5%m/m with the July-August level standing 1.5% above the 2Q level. Overall, Euro area IP remains very weak following a sharp trend down during 2023. The signal of the PMI remains weak, with the manufacturing output indicator lowest in Germany among the main economies of the region.

The ECB cut rates 25bp today to 3.25%, as had been widely expected following the downside surprises in the September PMI and HICP reports. President Lagarde noted that last Thursday’s shift from quarterly to meeting-by-meeting cuts is a perfect demonstration of the ECB’s data-dependent and meeting-by-meeting approach. This implies that the next decision in December depends crucially on the data flow between now and then, rather than on anything the ECB is saying last Thursday. The overall tone of the meeting was on the dovish side. Some hawkish elements were retained, such as that “domestic inflation remains high” and that “wages are still rising at an elevated pace”. But, most other parts indicated a significant increase in confidence in the disinflation process, leading to the “well on track” comment already noted earlier. The focus now shifts to the significant amount of information that will emerge between now and the December meeting. We see the ECB continuing with meeting-by-meeting cuts of 25bp until the deposit rate reaches 2% in the middle of next year.

Over in the UK, Headline CPI inflation for September fell from 2.2% to 1.7% where consensus is at 1.9, Core inflation was down from 3.6% to 3.2% and services inflation fell from 5.6% to 4.9%. A large downside surprise in services inflation increases the odds that the MPC could cut at meetings in both November and December. According to JP Morgan, the MPC will need to see more slowing here to follow up with a second cut in December. With two more CPI reports to come before that meeting, its not clear whether there will be sufficient progress by then.

This week, we will have the Euro area consumer confidence on Wednesday, UK and Euro Area PMIs on Thursday, UK Gfk consumer confidence and the ECB will be posting their CES 3y inflation expectations on Friday.

Asia

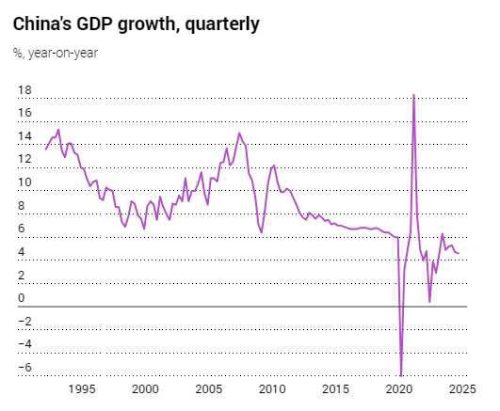

Asia closed the week mixed. MSCI Asia ex Japan ended the lower by 0.42%. Hang Seng was lower by 2% while CSI 300 closed the week up 98bps. Year to date, still up 21.3% and 14.8% respectively. China’s economy expanded 4.6% in the third quarter of the year from a year earlier. China’s full-year growth target is set at around 5%. According to Toru Nishihama, Chief Economist, Dai-Ichi Life Research Institute, “The GDP data confirmed that China faces excess supply and lack of demand. China is seen falling into fully-fledged deflation.”

A separate report showed that home prices declined for a 16th consecutive month in September, suggesting that efforts to bail out the property market have yet to work. The lacklustre data fuelled hopes of more stimulus which led to Hong Kong stocks halting a 4-day decline. Chinese stocks still have value after gaining more than 20% since the end of September, as they trade at a valuation discount of between 35% and 40% to the rest of emerging markets globally.

People’s Bank of China (PBOC) announced details of the 300- billion-yuan (US$42.2 billion) relending programme that will fund stock repurchases and stake increases. Some 21 banks will be allowed to extend such loans to qualified listed companies or major shareholders, according to a joint statement by the financial regulator, including the PBOC, on Friday.

China s housing minister Ni Hong said country will widen credit scope of so-called white list program to CNY4T ($562B) by yearend, part of authorities top-down plan to ensure unfinished homes delivered to buyers. Added all residential property projects will be included in the program to receive loan support. NFRA Deputy Director Xiao Yuanqi added loans for white list projects stand at CNY2.2T as of 16-Oct and amount will double by yearend. Ni said banks asked to lend to white list projects as much as possible and expedite loan issuance process. Ni added government will target to renovate 1M houses in urban villages . Officials said China s residential market is starting to find bottom. PBOC Deputy Governor Tao Ling said about 50M households expected to save CNY150B in mortgage costs from late October onwards.

This morning (21st Oct) , China cut its benchmark rates, China’s one-year loan prime rate, on which most new and outstanding loans are based, was cut to 3.10% from 3.35%, while the five-year rate was reduced to 3.60% from 3.85%. The latter influences the pricing of mortgages and other long-term loans.

Asian Central bank news:

- China’s central bank governor said on Friday (Oct 18) the reserve requirement ratio for commercial lenders could be cut further by 25 to 50 basis points by the year-end depending on liquidity conditions, keeping the door open to more policy easing steps.

- Singapore’s central bank kept its monetary settings unchanged, defying a global wave of policy easing as the citystate’s economy powered ahead in the third quarter.

- Bank of Thailand cut its overnight repo rate 25 bps to 2.25% against expectations for a hold.

- Bank Indonesia held after the surprising with 25 bps cut before Fed announced easing last month. BI held 7D reverse repo rate steady at 6.0%, in line with majority analysts expectations.

- Philippines central bank (BSP) may cut by 25 bps after beginning easing cycle in August.

Other Data out of Asia: Japan s exports fell for the first time in 10 months in September. The Soft demand in China and slowing US growth weighed on exports, while the yen s recent rebound, in part due to the Bank of Japan s unexpected rate hike in late July, helped further push down their value. Japan s core inflation slowed in September (+2.4% y/y) for the first time in five months due to the rollout of energy subsidies. India wholesale inflation accelerated to 1.8% y/y in September with a notable increase in food prices responsible. Singapore s non-oil domestic exports rose 2.7% in September. Shipments of electronic products rose 4% in September from a year earlier, while non-electronic products were up 2.3%.

GeoPolitics

Israel – Gaza: Israel has stopped processing requests from traders to import food to Gaza, according to people involved in the trade, choking off a track that for the past six months supplied more than half of the besieged Palestinian territory’s provisions. Since Oct. 11, Gaza-based traders who were importing food from Israel and the Israeli-occupied West Bank have lost access to a system introduced in spring by Cogat, the Israeli government body that oversees aid and commercial shipments and have received no reply to attempts to contact the agency, the sources said.

Israel – US: The U.S. is preparing to deploy the THAAD antiballistic missile systems in Israel, marking a significant move to bolster Israel’s defences, particularly amid tensions with Iran. This deployment will put American troops in harm’s way. President Biden agreed to send THAAD systems to Israel after Netanyahu assured him that strikes on Iran would avoid critical oil and nuclear infrastructure.

Israel – Lebanon – Iran: Israel’s strike will likely be carried out before 5-Nov election, as part of a series of responses. Official added Israel told US it intends to complete Lebanon operations in coming weeks. Israel said it killed Hamas leader Yahya Sinwar – mastermind of last year’s Oct. 7 assault – in southern Gaza, along with two other militants. Benjamin Netanyahu said the war is not over. A testament to the region’s long-running conflicts. Sinwar’s death follows last month’s strike which killed Hassan Nasrallah, the leader of Hezbollah, and it comes as Israel is still considering how to respond to Iran’s strikes earlier this month. Iran has condemned the killing of Hamas leader Sinwar, with the government claiming it strengthens “the spirit of resistance.” Iran continues its proxy influence through Hezbollah and supports an escalated stance against Israel.

Israel – UN: The United Nations peacekeeping mission (UNIFIL) in Lebanon has come under attack amid growing violence between Israel and Hezbollah, but peacekeepers will remain stationed there. The EU condemns attacks on UN missions, including recent attacks on UNIFIL by the Israeli forces.

Russia – Ukraine – NATO: Ukrainian President Volodymyr Zelenskiy said on Sunday that defence relationships with his country’s partners would have to change in light of North Korean transfers of people as well as weapons to Russian forces in Ukraine.

Last week, the North Atlantic Alliance kicked off its yearly war games that simulate a nuclear conflict with Russia. The Kremlin responded sharply to the drills. Kremlin spokesman Dmitry Peskov said, In the conditions of a hot war, which is going on within the framework of the Ukrainian conflict, such exercises lead to nothing but further escalation of tension.

China – Taiwan: China’s military conducted exercises to north and south of Taiwan island on Monday to test capability of its troops to coordinate across multiple arenas, mount systematic attacks and launch precision strikes. Move came after President Lai’s national day speech which irked Beijing. Meanwhile China’s actions have drawn condemnation from both Taipei and Washington

The BRICS Summit in Kazan will start tomorrow and will end on the 24th of October.

credit treasuries

Even though there was quite a lot of volatility on interest rates in the US last week, the whole US Treasury curve end the week where it started it with no change in yield on all the points on the curve. On credit, US IG credit spread also finished the week unchanged while US HY credit spreads tightened marginally by 2bp.

This week in the US will be pretty quiet in term of macro-economic data, the most look after number will be the preliminary October PMI Manufacturing & Services.

FX

DXY USD Index rose 0.59% to 103.493, driven by the solid beat on US retail sales.

Headline retail sales rose 0.4% m/m in Sept (C: 0.3%, P: 0.1%), while core rose 0.7% m/m (C: 0.3%, P: 0.2%) and with an upward revision to Aug. Immediate resistance level at 103.80 (200 DMA), next level at 104. Based on OIS, market is pricing 40 bps cut in 2024. Support level at 103.18 (100 DMA, next level at 102.85).

EURUSD fell 0.64% to 1.0867 as ECB cuts its policy rate by 25 bps to 3.25% (3rd time in 2024 and as widely expected). During the press conference. President Lagarde reiterated the intention to be data-dependent and make decisions meeting by meeting; but she also flagged more downside risks for inflation and highlighted downside risks to euro area growth. Nonetheless President Lagarde stressed that based on the current evidence, the eurozone was not heading towards a recession and that a soft-landing scenario was still the baseline.

GBPUSD fell 0.11% to 1.3052, driven by USD strength. Data wise, UK unemployment fell to 4.0% (C: 4.1%). Headline retail sales in Sept rose 0.3% (C: -0.4%), while core rose 0.3% (C: -0.3%). UK CPImissed, as headline CPI was flat (C: 0.1%), which drove the y/y to 3.2% (C: 3.4%). Core came in at 3.2% y/y (C: 3.4%). Based on OIS, market is pricing 45 bps cut in 2024.

AUDUSD fell 0.65% to 0.6706 despite solid beat on Australia employment. Employment grew 64k in September (C: 25k; P: 43k) while the Unemployment Rate came in at 4.1% (C: 4.2%), with the August unemployment rate revised down to 4.1% (P: 4.2%).

NZDUSD fell 0.64% to 0.6071. NZ CPI fell to 2.2% y/y in 3Q24 (C: 2.2%; P: 3.3%), falling back into the RBNZ’s target band for the first time in more than three years

USDJPY rose to a high of 150.32 intra-week, before paring back to close the week at 149.53 (+0.27% for the week). Data wise, Japan core CPI slowed to +2.4% y/y in Sept (C: 2.3%; P: 2.8%), while Core-core picked up slightly to 2.1% y/y (C: 2.0%; P: 2.0%). Media reports suggested that the Japanese Trade Union Confederation (Rengo) will again target wage hikes of “over 5%” in its shunto negotiations in 2025, while small businesses are expected to ask for “over 6%”, higher than this year. Risk is this will put additional upward pressure on inflation.

Oil & Commodities

Oil futures fell last week, with WTI and Brent falling 8.39% and 7.57% respectively amid reduced perceptions of escalation risks in the Middle East, as Israel is not expected to strike Iran’s oil industry. A release from the IEA noted that excess capacity from the OPEC+ nations is reaching records levels and that forecasts for 2025 are that the supply of oil to international markets poses downward risks to prices. The IEA has trimmed its 2024 oil demand growth forecast for a third month in a row as Chinese demand weighs on oil market. The agency forecasts global demand to grow by 862kb/d this year from 903kb/d previously. The IEA demand growth is still well behind the OPEC expectation of 1.93mb/d.

Gold reached a record high and closed the week at 2721.46 (+2.44% for the week) as escalating tensions in the Middle East (Israel’s killing of Hamas leader Yahya Sinwar) saw investors look for safe-haven investments. In addition, further buying from China drove the gold rally

Economic News This Week

-

Monday – CH LPR, US Leading Index

-

Tuesday – NZ Trade Balance, US Richmond Fed Mfg Index

-

Wednesday – SI CPI, CA BOC Rate Decision, EU Cons. Confid., US Existing Home

-

Thursday – AU/JP/EU/UK/US Mfg/Svc/Comps PMI Oct Prelim., US Initial Jobless Claims/New Home Sales

-

Friday – UK Gkf Cons. Confid., JP Tokyo CPI, EU ECB CPI Exp., CA Retail Sales, US Durable Goods Orders/Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.