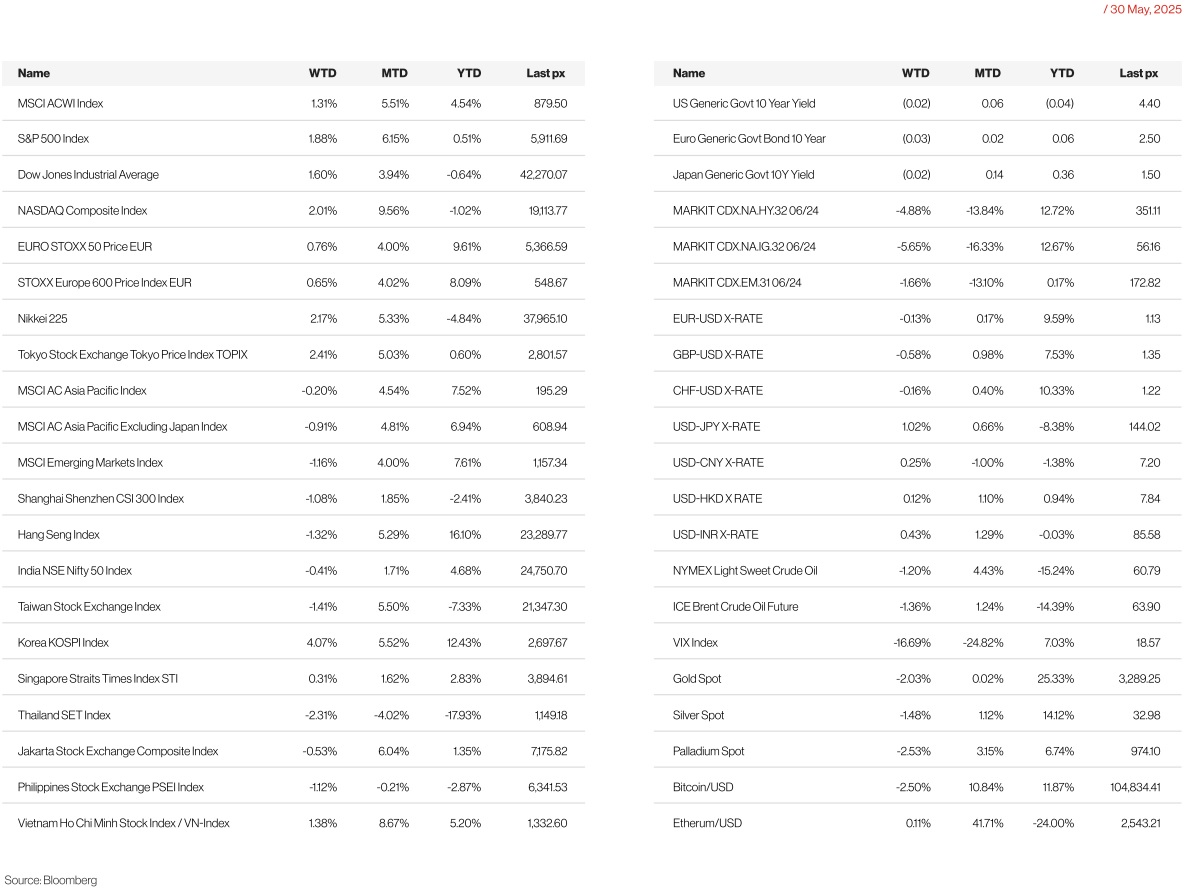

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

On Friday, the S&P 500 closed out the month of May with a more than 6% gain, its best monthly performance since November 2023. The tech-heavy Nasdaq Composite surged more than 9% for the month and the Dow Jones Industrial Average rose about 4%.

A 50% tariff on the EU would lift the trade-weighted average tariff rate back up to 22% (from 15% currently). As a base case, economist expect the EU and the US to strike a deal that averts the 50% rate before the 9 July deadline but still think the 10% universal rate will remain in effect.

Last Friday’s Treasury statement offered the first glimpse of the scale of tariff revenues after the Liberation Day. As a reminder, the majority of large US importers opt to pay their monthly tariffs in a single lump sum under a so-called ‘Periodic Monthly Statements’ system. The due date for the payment is always the 15th business day of the following month, meaning that revenues reflected tariff payments for the calendar month of April. The revenues reached USD16.5bn, bringing the total tariff revenues paid in May up to USD22.3bn. For context, typical monthly tariff revenues during H2 2024 were around USD8-9bn. As tariff rates have fluctuated both up and down considerably since the Liberation Day, making precise forecasts of future tariff revenues is tricky. But if we assume revenues remain close to current levels, then the additional income earned over the coming year would be around USD190bn. This would mark a fiscal tightening of around 0.6% of GDP, which is not trivial, but also not substantial compared to the expected net easing from the Republicans’ ‘Big Beautiful Bill’. Danske Bank estimate that the bill, which passed through the House with a margin of one vote last Thursday, could lift 2026 deficit estimates by 1.5% of GDP and 2027 by 1.8% of GDP. The final passage through the Senate is still expected to take several weeks.

Conference Board consumer confidence rose 12.3 points to 98.0 in May, above consensus (87.1). Today’s data marked the largest monthly gain in four years, off April’s five-year low matching April 2020. The index still sits below its 2024 average (104.5) but has now roughly retraced declines in March and April. The expectations index drove the improvement in the headline, rising 17.4 points to 72.8. That also roughly retraced the declines in March and April. The present situation index rose to a lesser extent, also as we expected, up 4.8 points to 135.9.

The FOMC May 2025 meeting minutes continued to signal the Committee was in “wait and see” mode while leaving the policy rate steady at 4.50% for the third consecutive meeting. Waiting for more clarity on trade policy and its impact on inflation and growth is consistent with Chair Powell’s commentary during the press conference following the May 7 meeting, as well as with more recent Fedspeak. Some of the commentary (such as “participants observed that the tariff increases announced so far had been significantly larger and broader than they had anticipated”) may have been overtaken by events since the May 6/7 FOMC discussions.

According to the minutes, “downside risks to employment and economic activity and upside risks to inflation had risen, primarily reflecting the potential effects of tariff increases . As of May 7, however, the starting point for real activity, hence employment side of the mandate, appeared relatively closer to the FOMC’s target than inflation was to its target, as we describe in the most recent Weekly, A new tax bill . The minutes read, “economic activity had continued to expand at a solid pace and labor market conditions continued to be solid, but inflation remained somewhat elevated.” and, further on, participants judged that labor market conditions remained broadly in balance. By contrast, with respect to inflation, “participants observed that inflation had eased significantly since its peak in 2022 but remained somewhat elevated relative to the Committee’s 2 percent longer-run goal. Participants noted that progress on disinflation had been uneven recently, with elevated monthly readings in January and February having been followed by a relatively low reading in March. Markets continue to dial back their expectations for Fed rate cuts. Indeed, the amount priced in by December is now down to just 44bps, the fewest since February.

US core PCE deflator in line, up 0.1%mom in April, year-ended at 2.5%, also in line with consensus despite a small upward revision to March. Solid beat on personal income, up 0.8%mom (consensus 0.3%mom), spending in line with consensus at 0.2%mom. Little evidence of concern for the US consumer, so far, in these hard data points.

US trade deficit narrowed sharply in April to $87.6bn, much smaller than consensus ($143.0bn), and smallest deficit since 2023. In the details, imports plunged 19.8%mom as tariffs introduced, largest drop on record, and fully unwinding the surge in imports seen since January and ahead of tariff implementation.

Europe

European equity markets ended the week on a positive note, with the EuroStoxx 600 closing higher on Friday.

The European Commission’s Economic Sentiment Index improved slightly in May, rising by 1.0 point to 94.8. However, it still remained about 0.7 points below the average for the first quarter. First-quarter GDP figures were confirmed at +0.1% q/q in France and +0.3% in Italy. The euro area’s final Q1 GDP release, expected this coming Friday, will provide further detail on the sources of growth—particularly the extent to which early demand from the U.S. contributed to export performance. Consumer sentiment was unchanged from the preliminary estimate, holding at -15.2, up 1.4 points from April, but still below levels seen prior to ‘Liberation Day.’ Meanwhile, expectations around unemployment continued to climb, rising by 1.1 points to 28.5—the highest since December.In retail trends, German sales fell by 1.1% m/m in April. In contrast, French household spending on goods saw a modest recovery, rising 0.3% following three months of declines.

On the inflation front, headline HICP inflation moderated across several countries: it dropped by 0.3 percentage points in France and Spain (to 0.6% y/y and 1.9% y/y, respectively), and by 0.1 points in Germany and Italy (to 2.1% and 1.9% y/y). Core inflation in Italy also eased, declining by 0.3 points to 1.9% year-on-year.

Short-term inflation expectations continued to tick higher. According to the ECB, the median 12-month inflation forecast rose to 3.1% in April, up from 2.9% in March and significantly above the 2.4% low recorded in September 2023. Medium and long-term expectations remained steady at 2.5% (three years ahead) and 2.1% (five years ahead), respectively.

Markets widely expect the European Central Bank to reduce all three policy rates by 25 basis points at its meeting on 5 June, bringing the deposit rate down to 2.0%.

In terms of policy initiatives, the European Council approved the €150 billion SAFE (Security Action for Europe) fund, which will support national defence investments through 2030. Member states must submit their strategic defence plans within six months, with the first disbursements expected later this year.

Germany’s coalition government outlined its legislative agenda for the weeks leading up to the summer recess starting 14 July, aiming to deliver on key commitments in the coalition agreement. Meanwhile, France’s Prime Minister Bayrou announced plans to introduce a multi-year fiscal strategy in early July. The aim is to reduce the deficit-to-GDP ratio to 4.6% by 2026, down from a projected 5.4% in 2025.

This week will bring key data for assessing the start of Q2 economic activity. Euro area manufacturing figures for April, unemployment data (due Tuesday), and final PMIs (Monday and Wednesday) will be in focus. On Friday, the euro area will also release final Q1 GDP and employment figures. In the UK, markets are awaiting final PMI results and the Bank of England s Decision Maker Panel Survey.

Asia

Markets in Asia were mixed last week. South Korea (+4.07%) and Vietnam (+1.38%). Korea was buoyed by rate cuts, and Vietnam by Trade deals with France and news of Trump tower in Ho Chi Min City.

Most other countries in Asia pulled back on Friday after Trump accused China of violating its agreement with the U.S., adding pressure to already fragile trade sentiment. Largest detractor was Thailand, down 2.31% followed by Hang Seng, which ended the week lower by 1.32%.

MSCI Asia ex Japan ended the month of May higher still, up some 4.81%, taking Year to date gains to 6.94%.

Bank of Korea cut the policy rate, but with cautious medium-term guidance. The BOK nearly halved its economic growth projection for this year to 0.8% , reflecting deepening challenges both at home and abroad. Industrial production and the monthly GDP proxy indicator declined in April according to data, following a strong gain in March. The consumer sentiment index (CSI) in South Korea however, improved further by eight points to 101.9 in May, reaching the level seen last October before the political uncertainty spike. Backed by the rate cut and the US federal trade court ruling against several tariff actions of the Donald Trump administration, South Korea’s benchmark Kospi soared to a year high last week.

China industrial profits improved further in April. Profits rose 1.4% year-onyear in the January-April period. Profits in the mining sector fell 26.8% year on year in the January to April period, while the manufacturing and utilities sectors — electricity, heating, gas and water supply — saw them rise 8.6% and 4.4%, respectively.

Taiwan released Strong 1Q GDP growth on export boom. However, the trade-reliant economy is expected to grow at a slower pace in 2025 than previously forecast with growth forecast at 3.1%.

Thailand’s customs trade balance fell sharply from a surplus of US$1.0 billion in March to a deficit of US$3.3 billion in April. Factory output for April however spiked on restocking and front-loading drive. Thailand’s manufacturing production index (MPI) expanded 2.2%.

India April IP printed much higher than expectations, recording growth of 2.7% India , 1Q25 GDP growth gapped up sharply from an upwardlyrevised 6.4% in 4Q24 to print at 7.4%, significantly above consensus expectations.

GeoPolitics

France- Asia: French President Emmanuel Macron has begun a six-day visit to Vietnam, Indonesia, and Singapore in which he will tout France and Europe as trade and security partners of choice. In Vietnam, 14 contracts were signed for co-operation in defence, civilian aviation, transport, and energy, among others. Vietnam’s President Luong Cuong said the defence partnership involved “sharing of information on strategic matters”. After Vietnam, Macron headed down to resource-rich Indonesia, where President Prabowo Subianto is seeking foreign investments to spur a slowing economy. During his final stop of his south-east Asian trip in Singapore, the French president said the division between the US and China was the biggest threat in the world right now. Macron warned against a “division between the two superpowers and an instruction to all the others that you have to choose a side”. He said: “If we do this we kill the global order … all the institutions created after the second world war to preserve peace.”

US – Asia: Defense Secretary Pete Hegseth delivered a message of reassurance to US allies in Asia, committing to counter China’s coercive threats and remain present in the Indo-Pacific region. Despite Hegseth’s diplomatic efforts, concerns about President Donald Trump’s erratic policymaking and trade policies persisted. The absence of a Chinese defense minister at the security conference allowed US officials to set the tone and work with other countries, while also sparking pushback against efforts to establish “spheres of influence” and promoting greater cooperation among IndoPacific nations and Europe.

US – India: Legal immigrants in the US would pay taxes on their outgoing remittances, with some percentage of the money going to the US Treasury. US has lowered its proposed excise tax on external money transfers from 5% to 3.5%, after it raised concerns among Indians living and working in the nation. The 3.5% remittance excise tax has the potential to have a big effect on India if it is implemented. The country gets about $25 billion in remittances from the US annually.

US- EU – Russia: Trump said he’s considering new sanctions on Russia after Moscow launched widespread strikes across Ukraine. Germany has given Ukraine the green light to strike deep inside Russian territory, with Friedrich Merz saying there are “absolutely no range limits anymore.” The Kremlin called such a decision dangerous and counter to the goal of reaching a political settlement.

US- Canada: Canada’s steel industry warns of ‘catastrophic’ job losses, factory slowdowns and supply chain complications following Trump’s doubling of tariffs. President Trump announced a tariff hike on steel imports during his visit to the United States Steel Corp. plant, linking the decision to protecting American jobs and supporting the anticipated agreement with Japan’s Nippon Steel Corp.

Credit/Treasuries

Ultra-long tenor government bonds across the DM space got some relief amidst speculation that the BOJ is poised to tweak JGB issuances. 30Y JGB fell by 19bps yesterday, dropping below 3%. However, at current levels, 30Y yields are still some 57bps higher than where they were at the start of the year. Concomitantly, 30Y UST yields were dragged lower, closing below 5% overnight. The rapid rise in long-end yields is a concern for the market and policymakers and a shift in issuance profile, tilting away from the long end, is a reasonable policy choice. Note that the UK has already done this and it is very likely that the BOJ would follow suit. Without a meaningful reduction in budget deficits, investors are unlikely to be able to regain confidence sustainably. Term premium is likely to build, albeit at a slower pace as supply pressures shift to the belly. From a sentiment perspective, market participants are consistent across the asset classes. As long end yields fall, market angst get reduced, supporting risky assets in the process. We note that USTs are still trading like risky assets in this environment, performing with US stock indices and the USD.

The shape of the US Treasury Curve did not really change last week with all the points on the curve losing around 10bps of yield, except the long bond yield that dropped by 7bps. US IG 5years credit spread tightened by 1bps while US HY 5years credit spreads tightened by 9bps over the week.

FX

DXY USD Index rose 0.22% driven by month-end rebalancing. This was despite escalation on US-China economic tensions. President Trump said China has “totally violated its agreement with us”, and US announced new export restrictions to China, including on chip design software. Tariff headline volatility and related trade policy uncertainty not going away despite US Court of International Trade ruling that struck down tariffs imposed under International Emergency Economic Powers Act (IEEPA). Federal appeals court temporarily reinstated the tariffs while it hears appeal and White House widely expected to shift legal authorization for tariffs. FOMC minutes leaned hawkish as it affirmed the Fed’s view that policy is “well positioned to wait for more clarity” as uncertainty about the economic outlook had increased, while emphasizing that upside risks to inflation and downside risks to employment and economic activity had risen. US macro data was mixed. Consumer confidence jumped in May, increasing for first time in five months and highlighting potential for tariff offramps to drive a soft sentiment data catch-up rather than a hard data catch-down. Headline PCE inflation came in cooler than expected for April, leaving the y/y rate just slightly above the Fed’s 2% inflation target. Continuing claims highest since 2021, consumer spending revised down in second release of Q1 GDP and pending home sales down most since 2022 in April.

European currencies fell against USD with EUR ( 0.13%), GBP ( 0.58%) and CHF ( 0.16%). EUR outperform within the European currencies as the US and EU signal a willingness to work towards a trade deal with President Trump delaying the 50% EU tariff. ECBs latest survey of consumer expectations, which found that 1yr inflation expectations were up to +3.1% in April, the highest in 14 months. So that added to fears that inflation could remain sticky above the ECBs target. That said, a 25 bps cut from ECB is fully priced by the market on 5th June meeting.

Antipodean currencies fell against USD with AUD ( 0.88%) and NZD ( 0.42%). Australia headline CPI remained at 2.4% y/y in April (C: 2.3%; P: 2.4%). Core CPI ticked up slightly to 2.8% y/y (P: 2.7%). Despite a higher than consensus CPI, the release was not read as strong enough to change the RBAs outlook on inflation. NZD rose 0.42% against AUD as RBNZ lowered its policy rate by 25bp to 3.25% at its May meeting (C: 3.25%; P: 3.50%) , in a 5:1 vote split with one member favoring keeping rates unchanged. Chief Economist Conway said the benchmark rate is now close to its neutral level.

USDJPY rose 1.02% to close the month at 144.02 driven by broad based USD strength. Japan macro data was robust. Japan Tokyo Core CPI (excluding fresh food) accelerated to 3.6% y/y (C: 3.5%; P: 3.4%), and Core of Core CPI (excluding fresh food and energy) rose to 3.3% y/y (C: 3.2%; P: 3.1%) in May. Retail sales m/m came in in line at 0.5% (P: 1.2%).

USDCAD closed the week almost flat at 1.3739 with CAD outperforming after an upside surprise in growth with 1Q25 GDP rising 2.2% q/q (C: 1.7%), coming in above the BoCs forecast of 1.8%.

Oil & Commodity

WTI crude and Brent crude oil futures fell 1.20% and 1.36% to close the week at 60.79 and 63.9 respectively as investors worried about a supply glut after Iranian and U.S. delegations made progress in their talks and on expectations that OPEC+ will decide to increase output at a meeting on 31st May. Over the weekend, OPEC+ agreed to add 411k barrels a day of supply in July. The decision to match increases for May and June was in line with expectations, but defied reports that the group was considering an even bigger volume. Coupled with increased geopolitical and trade risks where Iran criticized a report showing its growing stockpiles of enriched uranium, and President Trump increasing tariffs on steel and aluminium to 50% over the weekend, Oil futures rose this morning with WTI and Brent trading at 62.49 and 64.32 at the point of writing.

Gold and Silver fell 2.03% and 1.48% to close the month at 3289.25 and 32.98 respectively driven by broad based USD strength. That said, both gold and silver prices are well supported with both RSI above 50. Support level on Gold at 3200 and 3050 (100 days MA). Resistance level on Gold at 3400 and 3500 (YTD high). Support level on Silver at 32 and 31.60 (200 days MA), while resistance level at 34 and 34.60 (YTD high).

Economic News This Week

- Monday – JP/SW/SZ/NO/EU/UK/CA/US Mfg PMI May Final, AU Melbourne Inflation, UK Nationwide Hse Px, SZ Retail Sales/GDP, US ISM Mfg/ISM Prices Paid

- Tuesday – CH Caixin Mfg PMI, SZ/EU CPI, US Factory Orders/Durable Goods Orders/JOLT

- Wednesday – U/JP/SW/EU/UK/CA/US Svc/Comps PMI May Final, AU GDP, US MBA Mortg App./ADP/ISM Svc

- Thursday – CH Caixin Svc/Comps PMI May, SZ Unemploy. Rate, SW CPI, EU ECB Rate Decision, US Initial Jobless Claims

- Friday – EU Retail Sales/GDP, CA Unemploy. Rate, US Nfp/ Unemploy. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.