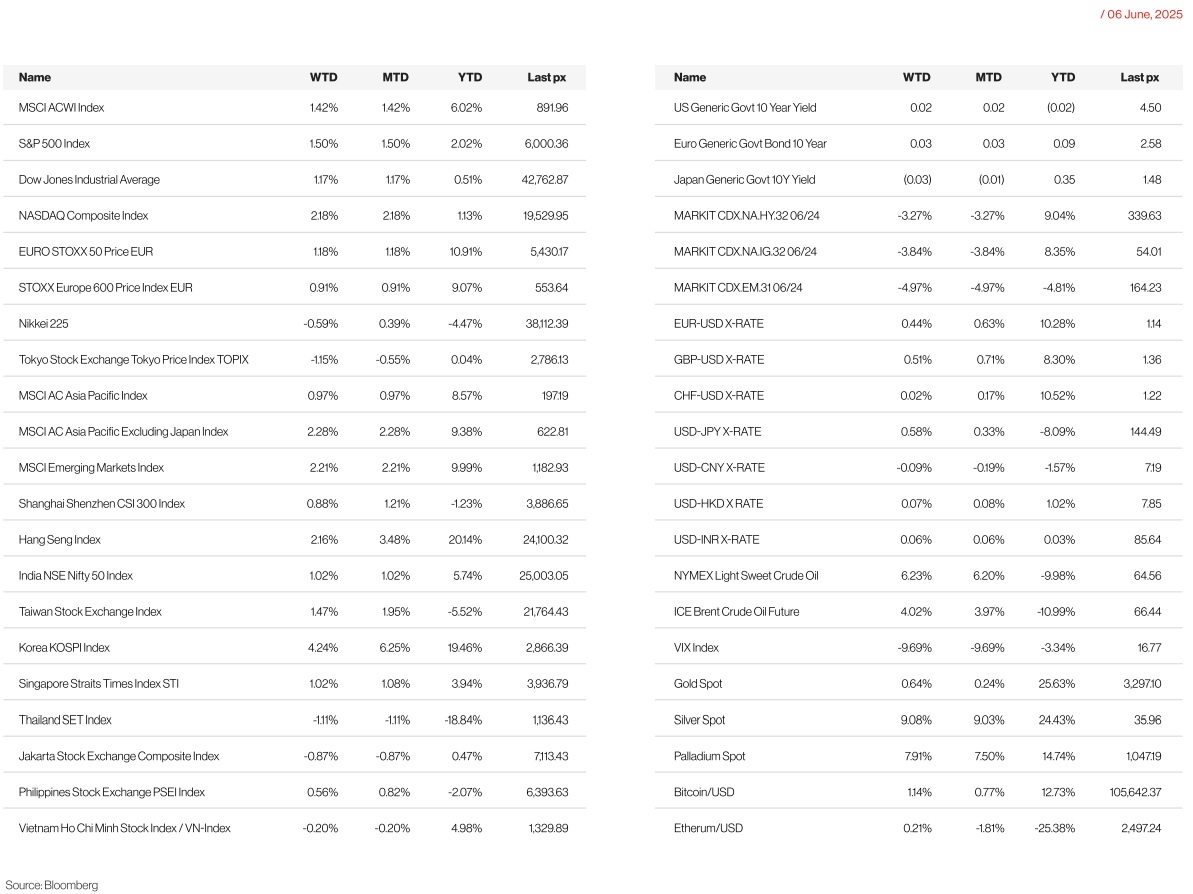

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

After a week of rather low volatility, US markets held their gains by the end of the week extending gains in May. The S&P 500 closed out May with a 6.29% gain, its best return since November of 2023.

Tech stocks were the clear outperformers during the week not so much as a consequence of earnings but rather on the more benign tariff situation and passing of peak tariff uncertainty. Thursday was eventful with a sharp selloff in markets in reaction to the spat between Elon Musk and President Trump over Trump’s multi-trillion $ tax bills aka the “Big Beautiful Bill” where Musk took to X to call the bill a “disgusting abomination” and posting: “Shame on those who voted for it: you know you did wrong.” He argued that the bill will irresponsibly add to the US national debt while Trump suggested that Musk was upset about the removal of subsidies and mandates for electric vehicles, which could affect his Tesla business. Trump told NBC News on Saturday that he has no plans to repair his relationship with Musk after it imploded last week.

Friday’s non-farm payrolls added fuel to the rally, coming in higher than expected at 139k with the unemployment rate steady, as expected at 4.2%. Labor force participation printed at 62.40% vs a consensus 62.6%. May Average Hourly Earnings MoM came out at +0.40% vs a consensus at +0.30%, and finally the average weekly hours came out at 34.3, in line with expectations. Additionally, both ISM Manufacturing and Services for May missed expectations and were contractionary level, at 48.5, below consensus (49.5), with prices paid components for both remaining stubbornly high. May US ISM Services Index printed at 49.9, below consensus (52.0). Price Paid surprised on the upside at 68.7 vs 65.1 expected and new orders came out at 46.4, consensus was at 51.6. The two latest ISM are now trading below the 50.0 mark.

The Federal Reserve in a survey of regional business contacts (Beige Book) said economic activity declined slightly in the US in recent weeks, indicating tariffs and elevated uncertainty are rippling across the economy. US JOLTS job openings report however, unexpectedly rose in April and hiring picked up, it was printed at 7.39mio vs 7.1mio expected and 7.19mio the previous month. The Quits rate came out at 2.00% vs 2.10% the previous month while Layoffs rate came out at 1.10% vs 1.00% expected. This indicated demand for workers remains healthy despite heightened economic uncertainty. May ADP Employment came out at 36k vs 114k expected.

Meanwhile, on tariffs, President Donald Trump said US and Chinese negotiators will resume trade talks on June 9 in London, looking to resolve a simmering dispute over tariffs and technology that has unnerved markets. Over the weekend, Beijing granted approval to some applications for the export of rare earths, a move that could ease tensions before trade negotiations between the US and China next week.

This week’s key data releases to note will be CPI on Tuesday with consensus looking for a MoM core reading of 0.3% from 0.2% and YoY headline of 2.5% from 2.3%, PPI on Wednesday and a still-elevated U. of Mich. inflation expectations on Friday.

Europe

European stock markets rose after digesting news of the ECB rate cut and the upward revision of first-quarter eurozone GDP last week. UBS shares surged up to 6% following Switzerland’s announcement of new capital rules requiring UBS to hold an additional $26 billion in Common Equity Tier 1 capital. The new rules aim to strengthen UBS’s resilience and lower bailout risks but may hurt its competitiveness and returns, putting it under more pressure than some global peers. UBS has until about 2033 to fully comply, a timeline analysts see as favorable, though challenges persist due to integration and external factors.

Euro area GDP growth for Q1 2025 was revised up to 0.6% from 0.3%, mainly due to a sharp 9.7% surge in Ireland’s output, driven by multinational activity. However, this boost may not indicate broader regional strength. Employment growth was slightly downgraded to 0.2%, showing only modest labor market gains.

Early Q2 data points to a potential slowdown in the eurozone’s momentum. While business activity slightly improved in May, with the PMI composite index rising to 50.2, growth remains modest. Italy continues to lead the recovery, whereas Spain is weakening. Retail sales saw only a small increase in April, and the labor market held steady, with unemployment falling to 6.2%, supported by improvements in France and Italy. Industrial production weakened in April, with Germany, France, and Spain all reporting declines.

Inflation across the euro area continued to cool. In May, headline inflation eased to 1.9% y/y, while core inflation dropped to 2.3%. A notable decline in services inflation, which fell to 3.2%, helped bring overall prices down to levels not seen since early 2022. Reflecting this softer inflation outlook, the European Central Bank lowered its key interest rate by 25 bps at its June meeting, bringing the deposit rate to 2.0%. We thought President Lagarde might send a soft signal of willingness to pause in July. The message that President Lagarde sent, that the ECB is “in a good position to navigate the uncertainties ahead”, feels more significant. It feels like the ECB is saying that it has reached the appropriate level of rates and can afford to remain at this level of rates for longer. The ECB acknowledges the arguments for macro resilience: rising real incomes, a robust labor market, easy financial conditions, and the anticipation of defence and infrastructure spending. Yet uncertainty remains high. The risks to growth are still described as being skewed to the downside. The outlook for inflation is “more uncertain than usual”.

Germany’s new government unveiled a tax relief plan to boost investment, featuring accelerated depreciation from 2025 to 2027 and a gradual cut in corporate tax rates from 15% to 10% by 2032. The reforms aim to reduce the overall corporate tax burden to about 25%, aligning it more closely with U.S. levels.

UK economic data showed signs of improvement in May, with the composite PMI revised up to 50.3, indicating growth in both manufacturing and services. Mortgage lending slowed to 2.7% y/y, likely due to a poststamp duty rush slowdown, while corporate lending continued to strengthen, rising to 4.2%.

Looking ahead, in Europe, focus will be on industrial production, trade data, final inflation figures, and an ECB wage update. In the UK, key reports include labor market data, April GDP, and an employment survey from REC/KPMG.

Asia

Asian markets were mostly up with the MSCI Asia ex Japan index closing the week higher 2.28%. Korea’s Kospi led gains, higher by 4.24%. South Korea’s opposition leader Lee wins election as voters punish conservatives after martial law chaos. Official results showed Lee winning by nearly three million votes ahead of his main rival, Kim Moon-soo of the incumbent conservative People Power Party.

A large relief last week came from US- China trade talk progress. Chinese Vice-Premier He Lifeng will meet a US delegation for talks next week in Britain, Beijing announced on June 7. US President Donald Trump had already announced on June 6 that a new round of trade talks with China would kick off in London beginning on June 9, after he spoke by phone with his Chinese counterpart Xi Jinping in a bid to end a bitter battle over tariffs. The discussions will mark the second round of such negotiations between the world’s two biggest economies. Later this month we will also be watching for developments and news from the G7 Summit (June 13-14) and NATO Summit (June 23-25).

India: In a surprise move, the Reserve Bank of India slashed policy rates beyond market expectations and shifted its policy stance from accommodative to neutral. RBI announced a jumbo 50 bps cut in the repo rate from 6% to 5.5% to spur growth in the economy, as inflation has come down below the lower RBI band of 4%. The RBI Governor said the repo rate has now been reduced 100 bps in quick succession since February this year and hence, the monetary policy stance has been changed from accommodative to neutral. This will enable the RBI to keep a close watch on the overall growth-inflation dynamics.

Slowing Asia: Asia’s factory activity shrank in May as soft demand in China and the impact of US tariffs took a heavy toll on companies, private surveys showed on Monday 2nd June. Trade-reliant Japan and South Korea continued to see manufacturing activity contract in May as US President Donald Trump’s automobile tariffs cloud the outlook for exports. China’s manufacturing activity shrank in May for a second month in a sign of weakness. Japan’s final au Jibun Bank Manufacturing Purchasing Managers’ Index (PMI) stood at 49.4 in May, up from April but staying below the 50.0 line that indicates contraction. The PMI for South Korea, Asia’s fourth-largest economy, stood at 47.7 in May, also staying below the 50 mark. Vietnam, Indonesia and Taiwan also saw factory activity contract in May, private surveys showed. Singapore’s overall factory activity improved in May but remained in contraction. This was as global powers’ trade tensions de-escalated, but the outlook remains uncertain. PMI posted a reading of 49.7, up 0.1 point from April. Indonesia’s May inflation undershot expectations driven by a 1.4%m/m sa drop in food prices. Headline inflation eased to 1.6%oya from 1.9% while core inflation ticked down to 2.4%.

GeoPolitics

Russia- Ukraine: The United States believes that Russian President Vladimir Putin’s threatened retaliation against Ukraine over its drone attack last weekend has not happened yet in earnest and is likely to be a significant, multi-pronged strike. Russia launched an intense missile and drone barrage at the Ukrainian capital Kyiv on Friday and Russia’s Defense Ministry said the strike on military and military-related targets was in response to what it called Ukrainian “terrorist acts” against Russia. But the U.S. officials believe the complete Russian response is yet to come. Russia claimed Sunday that its forces are for the first time pushing into the central Ukrainian region of Dnipropetrovsk, an area it has been trying to reach for months, in a move that could create new problems for Kyiv’s much-stretched forces.

China- US: Trade talks in London this week are expected to take up a series of fresh disputes that have buffeted relations, threatening a fragile truce over tariffs. Both sides agreed in Geneva last month to a 90-day suspension of most of the 100%-plus tariffs they had imposed on each other in an escalating trade war that had sparked fears of recession. Since then, the U.S. and China have exchanged angry words over advanced semiconductors that power artificial intelligence, “rare earths” that are vital to carmakers and other industries. Student visas don’t normally figure in trade talks, but a U.S. announcement that it would begin revoking the visas of some Chinese students has emerged as another thorn in the relationship. President Donald Trump spoke at length with Chinese leader Xi Jinping by phone last Thursday in an attempt to put relations back on track. One area where China holds the upper hand is in the mining and processing of rare earths. They are crucial for not only autos but also a range of other products from robots to military equipment. The Chinese government started requiring producers to obtain a license to export seven rare earth elements in April.

Israel – Palestine: A ship with aid supplies for Gaza carrying Greta Thunberg and other activists was stopped by Israel from reaching the Palestinian enclave. The ship was carrying desperately-needed humanitarian supplies for the Gaza Strip, where the UN has warned that the entire population is at risk of famine. The Freedom Flotilla Coalition, the organization that launched the Madleen, has accused Israeli authorities of “kidnapping” the people on board. In a series of posts on Telegram, the group also said the ship had come “under assault in international waters” and that Israeli forces had sprayed the vessel with a “white irritant substance” before “illegally” boarding the ship.

Iran – US: Iran on Saturday strongly condemned a new US travel ban targeting citizens from several countries, including Iran, calling the move a “clear sign of deep-seated hostility toward Iranians.” The statement called on the United Nations and international human rights bodies to publicly oppose Washington’s “unilateral and discriminatory measures.” It also affirmed that Iran would use all available means to protect the rights of its citizens and respond to the consequences of such actions by the US administration. The White House signed a proclamation last Wednesday that would fully ban the entry of nationals from 12 countries: Afghanistan, Chad, the Republic of the Congo, Equatorial Guinea, Eritrea, Haiti, Iran, Libya, Myanmar, Somalia, Sudan, and Yemen.

On Sunday, 8th June, Iran’s parliament speaker said that the latest US proposal for a nuclear deal does not include the lifting of sanctions, it seems negotiations have hit a roadblock. The US and its Western allies have long accused the Islamic republic of seeking to acquire nuclear weapons, a charge Iran has consistently denied, insisting that its atomic programme was solely for peaceful purposes.

Credit/Treasuries

Most of the volatility on the US Treasury curve happened last Friday after the release of all the job data, which saw the USTs close at 4.036% and 4.505% for the 2’s and 10’s respectively. The 2years yield gained 13bps, 5years yield was up 15bps, 10years yield gained 9bps and the long bond yield was up by only 2bps. 5years US IG Credit Spread tightened by 2bps over the week while 5years US HY credit spreads tightened by 15bps.

FX

DXY USD Index fell 0.14% to close the week at 99.19, rebounding from a low of 98.35 intra-week, supported by stronger than consensus US labor data and trade optimism with US China trade negotiation. May nonfarm payrolls rise 139k (C: 126k), but the prior two month see 95k of cumulative downward revisions; the unemployment rate remains at 4.2% as labor force participation falls. After ISM Services unexpectedly falls into contraction, heightening growth fears. ISM Services data signals stagflation concerns, weakening to 49.9 (C: 52.0; P: 51.6); growth slows with new orders entering contraction territory for the first time since June 2024, while the Prices Index rises to its highest level since November 2022.

European currencies gained against USD with EUR (+0.44%) to 1.1397, GBP (+0.51%) to 1.3528. USDCHF closed the week flat at 0.8223. The ECB delivers a 25bps cut to 2% as expected, with the statement maintaining a data-dependent approach. That said, the tone changes during the press conference with ECB President Lagarde noting that the ECB is “getting to the end of the monetary policy cycle.” Data wise, Eurozone Headline CPI slowed to 1.9% y/y in May (C: 2.0%; P: 2.2%) as Core HICP fell to 2.3% y/y (C: 2.4%; P: 2.7%). Within core, the largest surprise came from services, which dropped to 3.2% y/y (P: 4.0%); this is the lowest figure since March 2022. The Euro Area Unemployment Rate remained at 6.2% in April (C: 6.2%). Eurozone 1Q25 Euro Area GDP was revised up to 0.6% q/q (C: 0.4%; Preliminary: 0.3%; 4Q24: 0.2%). Retail Sales rose 0.1% m/m in April (C: 0.2%; P: -0.1%). In Switzerland, Headline CPI slowed to -0.1% y/y in May (C: -0.1%; P: 0.0%), the first negative y/y release since March 2021. Imported goods & services rose to -2.4% y/y (P: -2.5%), domestic goods & services slowed to 0.6% y/y (P: 0.8%) and CPI ex Rent remained at -0.7% y/y. 1Q25 GDP rose 0.5% q/q (C: 0.4%; 4Q24: 0.3%).

AUDUSD rose 0.92% to close the week at 0.649. The RBA’s May minutes show that concerns about household consumption prompted discussion around a 50bps cut. Members noted “downside risks” to the domestic economy, “including that household consumption does not pick up as quickly as envisaged in the baseline forecast.”. Also during the debate around a 50bps cut, the minutes note it “should not be taken as implying a view that the cash rate path should be lower over the entire forecast period, merely that it reaches the same level sooner”.

USDJPY rose 0.58% to close the week at 144.85, seemingly had been supported by recovery in risk sentiment on the back of positive trade talks between US and China. BoJ Governor Ueda spoke and his tone was largely unchanged as he reiterated that domestic fundamentals including underlying inflation remain solid, while US tariffs and policy uncertainty could weigh on the economy. That said, he emphasized that policy uncertainty is high and could remain even after tariff levels are determined. BoJ officials are likely to consider slowing its pullback from buying government debt at a policy meeting later this month, according to people familiar with the matter. The officials will probably discuss making smaller reductions to the central banks bond buying from the current paring pace of ¥400.

USDCAD fell 0.31% to close the week at 1.3696. The BoC maintains its policy rate at 2.75%, as widely expected, but future BoC cuts are priced out as Governor Macklem emphasizes the firmer-than-expected core CPI. Data wise, Canada employment generated 8.8k jobs in May (C: -10.0k; P: 7.4k) but the Unemployment Rate edged up to 7.0% (C: 7.0%; P: 6.9%) reaching the highest level since September 2016 (outside of the COVID 19 pandemic).

Oil & Commodity

WTI crude and Brent crude oil futures rebounded 6.23% and 4.02% to close the week at 64.58 and 66.47 respectively after OPEC+ production increase was smaller than feared and amid heightening geopolitical tensions. Positive trade talks between US and China supported the rebound as well.

Gold and Silver gained 0.64% and 9.08% to close the week at 3310.42 and 35.98 respectively, amid escalation between Ukraine and Russia.

Economic News This Week

- Monday – JP GDP/BoP, CH CPI/PPI/Trade Balance, US Wholesale Inv.

- Tuesday – AU Westpac Cons. Confid./NAB Biz Confid., NO CPI, UK Unemploy. Rate, EU Sentix Inv. Confid., US Small Biz Optim.

- Wednesday – JP PPI, US MBA Mortg. App./CPI Pfd

- Thursday – UK GDP/Indust. Pdtn/Mfg Pdtn/Trade Balance, US PPI/Initial Jobless Claims

- Friday – NZ Biz Mfg, JP Indust. Pdtn, SW CPI, US UMich

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.