Chips, Geopolitics, and the future of Generative AI

“Artificial intelligence is the future … Whoever becomes the leader in this sphere will become the ruler of the world” – Vladimir Putin, September 2017

Chips

Semiconductors have now become the cornerstone of modern economies, like how oil played a vital role in industrial economies during the 1900s. These chips, which serve as the “brains” of electronic devices, are essential components found in a wide range of products, from cars to home appliances to smartphones. In the realm of artificial intelligence (AI) , neural networks, which have driven significant breakthroughs like AlphaGo and ChatGPT, heavily rely on these semiconductor chips. Moreover, chip technology holds immense importance in modern high-tech militaries. Any disruption in the semiconductor supply chain could not only impede production across multiple industries globally but also pose a significant threat to nations due to its strategic, geopolitical, and security implications, encompassing technology, data security, and military capabilities.

The chip supply shortage that occurred in 2021 vividly underscored this point. According to consulting firm AlixPartners, automotive manufacturers suffered an estimated $210 billion in sales losses due to chip shortages. Considering the level of connectivity in today’s average car, which can incorporate over 100 chips, and the extensive semiconductor requirements for safety features, electrical systems, powertrains, infotainment, and connectivity, the impact on the automotive industry was substantial. Apple also experienced a $6 billion sales decline in 2021 due to chip shortages, prompting the company to reduce its projected production targets by as many as 10 million units.

Since 1965, semiconductors have followed Moore’s Law, an exponential trend that roughly doubles the number of transistors on an integrated circuit every two years. In this rapidly advancing chip technology industry, substantial investments in research and development, as well as attracting top talent, are key factors for staying ahead. Regrettably, the United States has experienced a decline in its share of global chip manufacturing, with its portion shrinking from 37% in 1990 to 12% over the past three decades. The 2021 supply crunch shed light on the heavy reliance of manufacturers on semiconductor components sourced from East Asia.

Geographical and Technological Significance

The concentration of chip production in China, Taiwan, and South Korea has raised concerns among U.S. military and political leaders. These three regions collectively dominate 81% of the global foundry market. Any disruptions to the free flow of goods and technology can have significant strategic implications at both the national and global levels. China perceives Taiwan, which is self-governed, as a renegade province that will eventually reunify with the mainland. In such a scenario, access to chips could become a pivotal bargaining chip in geopolitical negotiations.

Currently, only three companies in the world possess the capability to manufacture advanced chips that are close to the cutting edge of semiconductor technology: TSMC, Samsung, and Intel. Among these three, TSMC stands out as the most reliable producer of the most advanced chips, including those that will power the next generation of AI, such as Nvidia’s H100 GPUs.

Unfortunately for the United States, the Taiwanese company TSMC is indispensable, particularly for American companies like Apple, Nvidia, AMD, Qualcomm, Xilinx, and MediaTek. These companies design customized technology but lack the capacity to develop the most advanced chips in large quantities. Until recently, TSMC also supplied chips to Huawei, but it terminated its ties with the Chinese tech giant in May 2020 due to U.S. Department of Commerce restrictions prompted by security concerns. In 2021, TSMC announced a massive investment of $100 billion over three years to expand its fabrication capabilities. The company has already spent $20 billion on the construction of Fab 18, a cutting-edge fabrication facility where the world’s most advanced chips, including Nvidia’s H100s, are produced. To provide a sense of scale, Nvidia’s A100 GPU transistors are a mere seven nanometres wide, while a human hair is approximately 100,000 nanometres wide.

Maintaining a position at the forefront of semiconductor technology is imperative for the advancement of key technologies that will drive America’s future economic growth and competitiveness in AI, cloud, edge computing, and 5G. Leading-edge chips are equally, if not more, essential for U.S. national defence, as they play a vital role in advanced communication systems, command and control systems, radar and targeting systems, military simulations, and autonomous systems like drones.

The United States’ lack of cutting-edge semiconductor fabrication plants has prompted the development of a strategic vision for building a semiconductor “ecosystem” that will propel the nation’s economy into the future. The Chips and Science Act, signed into law in August 2022, allocates $52 billion in subsidies for semiconductor manufacturing and research. In late 2022, TSMC announced a $40 billion investment to establish two state-of-the-art fabrication facilities in Arizona, United States.

The World in Catch Up

Other nations have also taken substantial measures by investing heavily and implementing policies to foster the development of their own semiconductor ecosystems. Japan, South Korea, and India are notable examples in this regard. The Japanese government, for instance, has committed a substantial sum of $6.8 billion in incentives with the aim of attracting global chipmakers. Similarly, South Korea unveiled plans in May of the previous year to bolster its semiconductor industry, with companies committing to invest 510 trillion won ($451 billion) and increased tax benefits to enhance competitiveness. President Moon Jae-in emphasized the government’s commitment to forge a semiconductor powerhouse in collaboration with private enterprises. In India, Prime Minister Narendra Modi announced incentives worth 760 billion rupees ($10.2 billion) to attract global chipmakers to the country. The European Commission President, Ursula von der Leyen, also unveiled plans to ensure that Europe captures 20% of the world’s microchip production by 2030.

On the other hand, China is striving for self-sufficiency in response to U.S. efforts to restrict its access to vital supplies. In recent years, China has made significant investments and offered incentives, such as tax breaks, to bolster its semiconductor industry. However, China still lags behind other nations in this domain. SMIC, China’s largest foundry and a competitor to companies like TSMC and Samsung, trails its Taiwanese and South Korean counterparts by several years in terms of technology. Furthermore, due to U.S. sanctions and actions, China faces immense challenges in advancing its capabilities. Achieving cutting-edge chip production without equipment from the United States or its allies is virtually impossible for China. Bank of America predicts a delay of approximately five years before China can make significant progress under the current circumstances.

Future of Generative AI and the struggle for power

Semiconductor technology lies at the core of the strategic and technological rivalry between the United States and China, exerting a significant influence on the global trajectory of generative AI, particularly in China. ChatGPT, for instance, underwent training on a vast array of nearly 10,000 Nvidia A100 Graphics Processing Units (GPUs), which are currently subject to access restrictions in China. A comprehensive examination of U.S. export controls reveals a deliberate structuring aimed at curtailing access to GPU features that are especially valuable for training Large Language Models (LLMs) and other computationally demanding AI applications. To mitigate the impact of these restrictions, leading Chinese technology firms have stockpiled advanced semiconductors, including A100s, prior to the enforcement of these limitations. Baidu’s ERNIE 3.0 Titan application, for instance, is trained on Nvidia V100 GPUs, while Huawei utilizes its own AI-optimized semiconductors, which currently elude U.S. export controls. However, as LLMs continue to grow in both size and complexity, Chinese companies may encounter greater challenges in finding alternative solutions and keeping pace with global competition.

Projections indicate that the global AI market will expand more than ninefold from 2020 to 2028. Amidst the surging popularity of tools such as ChatGPT and Bard, the generative AI industry now exhibits an unprecedented appetite for Nvidia’s chips. The pursuit of developing the next generation of AI is not limited to tech giants like Microsoft and Google; it has become a competition among nations, each striving fervently to foster and advance its own technological capabilities. The ongoing trade war between the United States and China, which originated during the Trump administration, has transformed into a geopolitical struggle for power, with chip technology serving as a central battleground. The contest over AI technology unfolds during a period of heightened tensions between the U.S. and China, with substantial stakes at play. If China were to attain dominance in cutting-edge semiconductor manufacturing, either independently or by exerting control over Taiwan, it would pose a substantial threat to the U.S. economy and national security.

In 2017, Vladimir Putin astutely remarked that “Artificial intelligence is the future… Whoever becomes the leader in this sphere will become the ruler of the world”.

And today, six years later it is evident that everyone desires a share of this lucrative domain for this very reason.

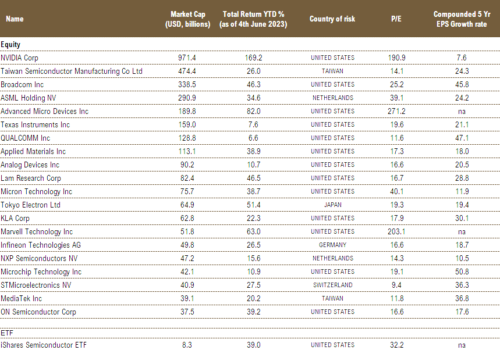

See below for Key Companies in this industry. All Data in the table are as of 4th June 2023.

(Source, Bloomberg)

Disclaimer

The documents herein are issued for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only. Please refer to the provisions of the legal information/disclaimer page of this website and note that they are fully applicable to any document herein, including and not limited to provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier & Cie does not provide any investment service or advice to “US persons” as defined by the regulations of the US Securities and Exchange Commission, thus the information herein is by no means directed to such persons or entities.

© 2020 Bordier Group and/or its affiliates.