- Singapore

A brief recap of the market’s past week, by Bordier Singapore

Our website uses cookies to improve the overall user experience. By continuing, you are agreeing to our Data Protection, to our Disclaimer and use of cookies on the site.

|

You are using an insecure Internet browser Navigateur internet non sécurisé |

||

|

We have noticed that you are using Internet Explorer which is an outdated and insecure Internet browser. Please use one of the browsers below for a safe and optimal experience on our website.

Nous avons remarqué que vous utilisez Internet Explorer, qui est un navigateur internet obsolète et non sécurisé. Nous vous recommandons d’utiliser à la place l’un des navigateurs ci-dessous pour une expérience sûre et optimale sur notre site.

|

||

| Edge | Firefox | Chrome |

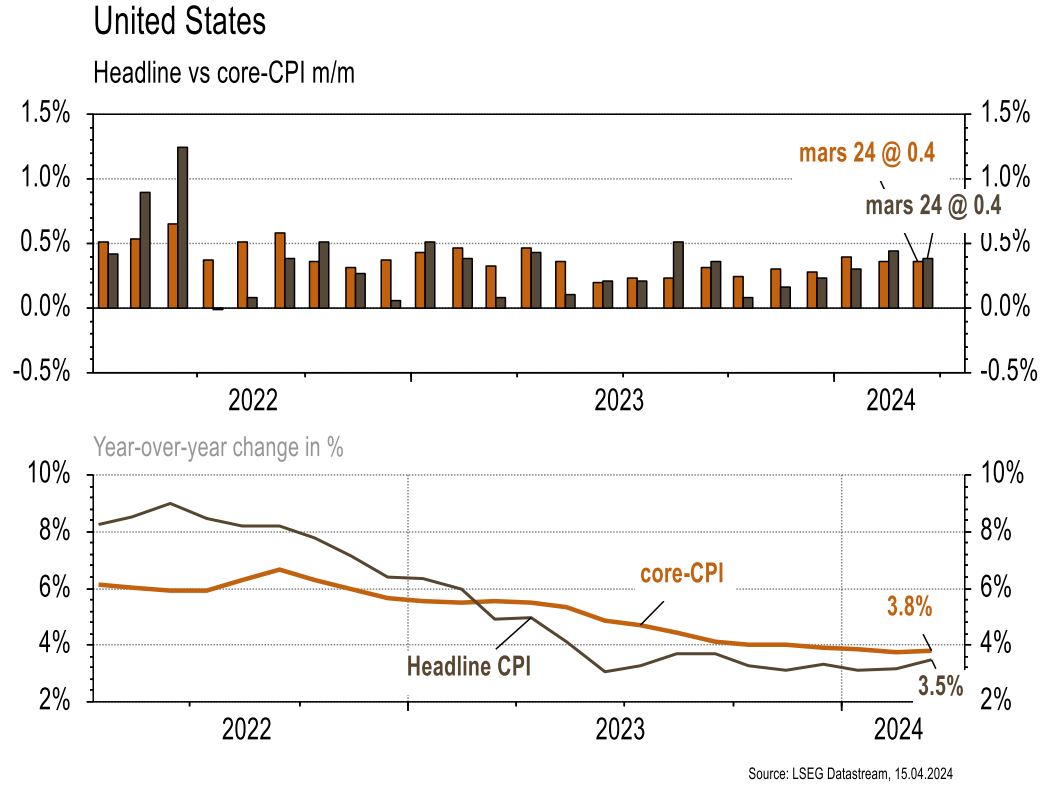

The statistics published in the US tended to disappoint. The general consumer price index rose more than expected in March (+0.4% m/m) and accelerated vs Feb. (from +3.2% YoY to +3.5%). Underlying inflation also disappointed (+0.4% m/m), but did not decelerate over the year (+3.8% vs. 3.7% expected). SME confidence (NFIB index) fell from 89.4 to 88.5, whereas an increase was expected in March. Household confidence fell more than expected in April, from 79.4 to 77.9. In the eurozone, Sentix investor confidence recovered (from -10.5 to -5.9 in April) and came as a positive surprise. In China, consumer prices slowed YoY (from +0.7% to 0.1% y/y), more than expected, a sign that activity is still fragile. Moreover, international trade is disappointing: exports (-7.5% y/y) and imports (-1.9% y/y) are contracting.

According to the International Energy Agency, global CO2 emissions rose by 1.1% in 2023, to 37.4 billon tons. On the other hand, emissions from developed economies fell by 4.5% despite economic growth of 1.7%, a drop of 520 Mt, back to their 1973 level. In particular, demand for coal in the G7 has returned to its 1900 level.

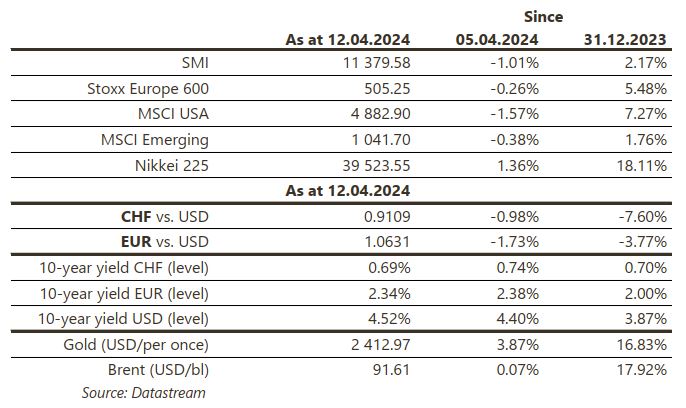

As expected, the ECB kept its rates unchanged and, unlike the Fed, confirmed the possibility of cutting them in June. Gold (+3.9%) benefited from tensions in the Middle East. US debt (-0.9%) and corporate bonds (-0.9%) suffered from US inflation figures, as did equities in developed countries (-1.5%), which were also impacted by Iran’s threats to Israel, which were carried out over the weekend. This will have to be closely monitored this week, in addition to retail sales, industrial production, property developers’ confidence, housing starts and building permits in the United States; industrial production and new car registrations in the eurozone; retail sales, industrial production, investment, Q1 GDP and new house prices in China.

Coming up this week: production-import prices in March (FSO), accommodation statistics in March (FSO) and foreign trade/exports in watches in March and Q1 (FSO). The following companies will be releasing figures: Bystronic, Sulzer, Sika, DocMorris, Lalique, Schindler, ABB, Addex, Gurit & Comet.

ALSTOM (Satellite): Goldman Sachs has declared to the French markets authorities (AMF), in accordance with stock market regulations, that it has exceeded the threshold of 5% of the share capital and voting rights, to 6.38%.

ASML (Satellite) will publish its Q1 2024 results on 17.04. The group reassured with a significant increase in its order book (€9.2 billion, +45% y/y), supported by TSMC and memory chip manufacturers (Samsung, Micron, SK). We are waiting to see how resilient the order backlog is: note that the sell-side consensus is for an order backlog of €5 billion for Q1, compared with a buy-side consensus of €7 billion.

The banking results season opened on Friday with reports from JPMORGAN and CITIGROUP (US Satellites). Both groups reported better-than-expected results, but the failure to raise interest income targets and a rise in expenses at JPM were greeted coolly by markets that were perhaps a little too complacent.

TSMC (Satellite) will publish its Q1 2024 results on 18.04. The group continues to benefit from the boom in data centers, with the production of Nvidia’s Blackwell chips, AMD’s MI300, certain Intel processors and certain big tech projects. TSMC will also give a more precise plan for the processes that will be used in the USA.

VEOLIA (Satellite): Moody’s has affirmed its Baa1 rating (equivalent to S&P’s BBB+) for the group’s long-term debt, with a stable outlook.

In the US, inflation came in above expectations for the third month running (0.38% vs. 0.30% consensus). This led to a significant re-evaluation of Fed Funds rate expectations, with c. 1.7 cuts now expected for 2024 (vs. 2.6) and the US yield curve rising (2Y +15bp/10Y +12bp). In Europe, Mrs Lagarde highlighted a potential divergence in monetary policy with the FED and left the door open to a cut in June. As a result, EU rates decoupled from US rates and ended lower (10Y Bund -4bp/BTP -6bp).

Stock exchange

After a second week of consolidation, the markets got off to a cautious start this week amid an increasingly unstable geopolitical situation. The week will be punctuated by the publication of numerous quarterly results, while on the macro front, retail sales, industrial production and property sales are due to be published in the US, and the ZEW and CPI in the eurozone. Caution is the order of the day.

Currencies

After a sharp correction last week (CPI, Middle East), the €/$ is trading at 1.0655, and a break of the €/$ 1.0623 support would confirm the downtrend; the 1.0885 res. remains valid. The $/CHF is trending higher, and we expect the following range to be 0.9074-0.9244. CHF regains strength at €/CHF 0.9731, above 0.9650, res. 0.9848. The pound falls to £/$ 1.2470, up 1.2337, down 1.2709. After an all-time high of $2431/oz, gold falls to $2354/oz, above 2265.

This document has been issued for information purposes and is exclusively supplied by Bordier & Cie SCmA in the framework of an existing contractual relationship with the recipient of this document. The views and opinions contained in it are those of Bordier & Cie SCmA. Its contents may not be reproduced or redistributed by unauthorized persons. The user will be held liable for any unauthorized reproduction or circulation of this document, which may give rise to legal proceedings. All the information contained in it is provided for information only and should in no way be taken as investment, legal or tax advice provided to third parties. Furthermore, it is emphasized that the provisions of our legal information page are fully applicable to this document and namely provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier Bank does namely not provide any investment services or advice to “US persons” as defined by the Securities and Exchange Commission rules. Furthermore, the information on our website – including the present document – is by no mean directed to such persons or entities.

insights

© 2024 Bordier & Cie

Please select your location and language below. If your location is not listed please select "International".