China Politburo: A Pivotal Moment?

“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful”

– Warren Buffet

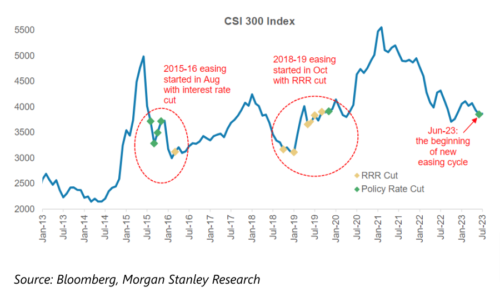

Since the China politburo meeting on 24 July, China markets have rebounded substantially, with CSI 300 Index and Hang Seng Index

rising 5.57% and 7.56% respectively, as of end of July.

The Nasdaq Golden Dragon China Index, which comprised of companies whose common stock is publicly traded in the US and the majority of whose business is conducted within China, rose 9.67%. The meeting analysed the economic situation and pointed out the policy direction in the short and long term. In general, it was more dovish than expected, pledging to step up stimulus measures, to enhance domestic demand, improve expectations, and prevent risks. The meeting acknowledged that the current economic operation is facing new challenges, which include insufficient domestic demand, difficulties in some enterprises’ operations, multiple risks in key areas, and a complex and severe external environment.

The central queries revolve around whether this juncture marks a crucial turning point for the Chinese market and whether the surge in Chinese equities can be maintained over time. On the first question, this could potentially be a pivotal moment, but on the sustainability, our opinion is no, given the known fact that there is no quick resolution to the many structural issues facing China domestically. Coupled with geopolitical tensions and high inflation in key developed markets, external environment has been extremely tough as well. Post the positive signal from Politburo meeting, China market risk has been dominated by short covering flows.

Based on Morgan Stanley report, long buying has been muted, while new short has been added after the meeting. US institutional investors continued to be net sellers of Chinese ADRs in July, in which US hedge fund managers led the selling.

Below are the key takeaways from the official readout of the meeting on the direction China’s economic policy will take in the second half of 2023, which are brief and high level. Even though many issues are still left unaddressed, but the meeting does signal stimulus policies in the next 1 -2 months.

|

Macro Policies |

|

|

Property |

|

|

Local Government Debt |

|

|

Household Consumption |

|

|

Private Sector |

|

At the start of 2023, the situation was looking favourable for China after the relaxation of its Covid Zero policy. However, year to date, China’s recovery has gone from bad to worse, due to sluggish housing and infrastructure construction and continued industrial de-stocking amid slow demand recovery. The latest China data indicated that its economy grew by 6.3% in the second quarter of 2023, well below of 7.1% forecasted by economists based on Bloomberg. Quarter on quarter, China’s GDP rose by only 0.8%, slowing from a rise of 2.2% in the first quarter. Retail sales rose by 3.1% in June from a year ago, down from 12.7% growth in May, while property investment, which often accounts for one third of the total investment, also fell by 7.9 per cent in the first half of the year. This imply that consumers remain sceptical on the recovery, and are wary of spending, while there remains a significant lack of property investment appetite. We will discuss further why China’s recovery has faltered since the start of the year.

China’s property sector is expected to grapple with persistent weakness for years, mainly related to lower-tier cities and private developer financing. The property weakness will likely by a multi-year growth drag. The data above has shown that China’s property sector is still struggling to turn around, despite signs of recovery earlier this year. Goldman Sachs assumed an “L-shaped” recovery, defined as steep declines followed by a slow recovery rate. They believe that the policy priority is to manage the multi-years slowdown, rather than engineer an upcycle.

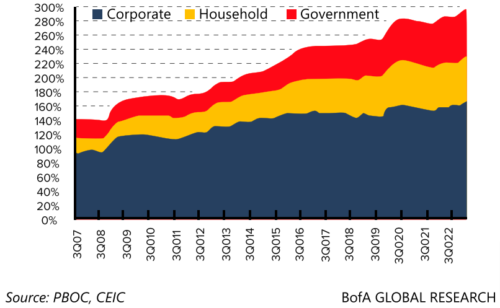

China’s ability and willingness to conduct a strong stimulus in 2023 are both limited, due to its high debt. This is can be seen in its current policy, where all stimulus implemented are targeted and measured. China’s total debt/GDP leverage surged from 140% in 2007-08 to 297% by 1Q23, and nearly all segments are heavily indebted.

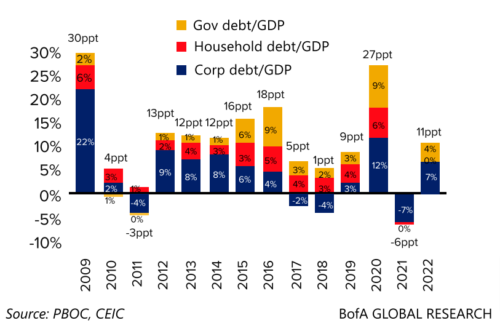

The debt/GDP leverage rose by 16-30ppt during the previous strong stimulus years (eg 2009, 2016-17, 2020), or 10-15ppt during the weak stimulus years. The ratio will probably rise by 10-15ppt p.a. in 2022-24, similar to the period in 2012-14.

Exhibit 21: China’s debt/GDP leverage by segments

Debt/GDP leverage rose to 297% by 1Q23

Exhibit 22: YoY change in debt/GDP leverage by segment

China will see modest rise in debt leverage in 2022-24, similar to 2012-14

China’s exports recorded the biggest decline in more than 3 years, contracting in June at the fastest pace since the start of the Covid-19 pandemic, as high inflation in key developed markets and geopolitics hit global demand. In addition, latest data in the developed countries show consistent signals of further weakness which will likely put more pressure on China’s exports in the rest of the year.

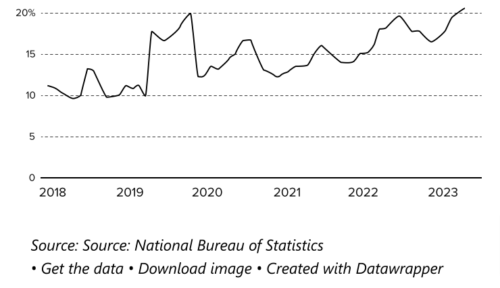

Rising youth unemployment adds to China concerns as well, with the jobless rate for the 16-24 age group hit a new high of 21.3%

in June, up from 20.8% in May. However, the overall urban surveyed jobless rate remained unchanged at 5.2 per cent last month.

China’s youth unemployment rate (16-24)

Survey-based

Despite all the negative factors discussed above, we believe that the downside risks remain limited given the cheap valuation on China markets and the upcoming policy stimulus, while upside potential is substantial. Guideline has been issued on boosting the growth of the private economy, promising to improve its business environment, enhancing policy support, and strengthening the legal guarantee for its development. The guideline also pledged measures to promote entrepreneurship in the private economy, and measures to create a nurturing social environment for the private economy. China’s Premier recently chaired a symposium with big tech firms. The symposium praised these tech giants for boosting domestic consumer demand, driving innovation, and creating employment. The Premier also urged government at all levels to provide a transparent and stable regulatory environment for tech firms and improve policies on investment access.

Exhibit 1: Successive stimulus measures had culminated in recovery in previous cycles

Patience on investing in China needs to be emphasized especially so, after 5 years of US-China tensions, 3 years of regulatory reset and 2 years of Covid lockdown. While China recovery looks extremely fragile, certain sectors within China still looks extremely attractive at current level, and should benefit from current supportive government measures, which include the Big tech and AI, tourism and EVs. Our high conviction China list include Alibaba (9988 HK) (easing regulation with attractive valuation), Anta Sports (9988 HK) (one of the fastest growing large cap consumer brands globally with clear visibility), Netease Inc (9988 HK) (Best-in-class video games publisher with global expansion as Long Term driver, Baidu (9988 HK) (Best AI play in China) and ZTO Express (Delivery company capturing consumption recovery) etc. Following is a full list of our high conviction stocks in China.

Disclaimer

The documents herein are issued for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only. Please refer to the provisions of the legal information/disclaimer page of this website and note that they are fully applicable to any document herein, including and not limited to provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier & Cie does not provide any investment service or advice to “US persons” as defined by the regulations of the US Securities and Exchange Commission, thus the information herein is by no means directed to such persons or entities.

© 2020 Bordier Group and/or its affiliates.