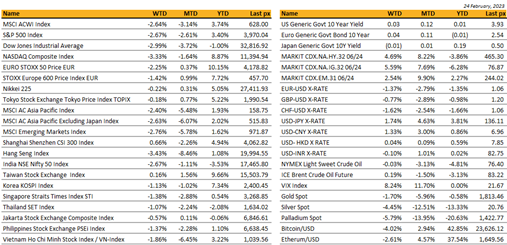

KEY MARKET MOVES

MACRO OVERVIEW

Global

Fed hike jitters on the back of 3 warmer than expected inflation prints stoked fears that the Fed Reserve will have to keep its policy rate higher and for longer.

A bumper January employment report, CPI, PPI and now the PCE fueled the selloff for the shortened week triggering a 2.7% and 3.3% decline for the S&P 500 and Nasdaq Composite respectively. The PCE index which is the Fed’s preferred inflation gauge, came in at 0.6% vs expectations of 0.4% MoM and 4.7% vs 4.3% expectations YoY. The goods component of the index came in unexpectedly higher than anticipated spelling out to investors that the Fed has much work to do. Consumer spending, in a parallel universe would have been ‘good news’ for markets turned out to be just the opposite as spending rose the most since 2021 at 1.8% in January reinforcing inflation is probably more persistent and, a little too soon for the Fed to declare ‘mission accomplished’.

We saw a barrage of Fed officials flagging the risk of sticky inflation and reiterated that the Fed needs to raise, probably higher than expected, and for longer. US jobless claims dropped to the lowest level in 3 weeks reflecting unrelenting tightness in the labor market. Q4 GDP was revised lower to 2.7% from 2.9%. Fed minutes released on Wednesday hardly helped with sentiment despite broad consensus to slow the pace of rate hikes. A few policy makers however favored a 50 bps hike at the last FOMC on Feb the 1st. The message to take away is that it signaled a determination to keep hiking rated to combat inflation.

Although US data broadly remains robust and consumer spending is resilient, policy acts with a lag, and the effects of last year’s four jumbo 75bps hikes have yet to truly filter through to the economy. Historically it has taken anywhere up to 18 months to two years for an economy to feel the full effects of a hiking cycle. So, there remains a strong possibility of a policy error through over tightening which could lead to a prolonged recession.

Other data pointed to Uni. of Mich. 1 year inflation expectation falling to 4.1% from 4.2% whilst the 5-10 year expectation remained unchanged at 2.9%. ISM data out this week together with durable goods and PMI.

Cryptos held firm for the week after Coinbase rose following its Q4 EBITDA beat vs expectations. BTC and ETH are at $23k and $1600 respectively.

Asia

It was a fourth week of declines for MSCI Asia Pacific Index, closing down 2.4% for the week. Month to date, the index is now lower by 5.48%. Largely contributed by Hang Seng which is lower by 8.5% for the month so far.

Geopolitical tensions remain a hot topic with US to ramp up troop presence in Taiwan and China and Russia talking about deepening ties. China released its Ukraine ‘peace plan’, which called for cease-fire and resumption of peace talks. However, the document was mostly a rehash of China’s foreign policy stance and avoided concrete compromises. Blinken also noted China strongly considering providing lethal military support on top the said military drones that are being supplied to Moscow.

Chinese authorities have given window-guidance to some SOEs, urging them to phase out using big four accounting firms due to data security concerns. Cited sources that SOEs told to hire Chinese or Hong Kong accountants when contracts due for renewal. Noted suggestion was not new but recently re-emphasized as China seeks to move away from US-linked audit firms and boost its own accounting industry. Move shows US-China decoupling continues despite last year’s audit deal which removed immediate threat to delist Chinese companies off US bourses.

China left 1Y and 5Y Loan Prime Rate unchanged, as expected, after PBOC had also left medium-term lending facility rate unchanged last week. Central bank added further CNY224B via OMOs, coming after Friday’s record liquidity injection. China watchers still see scope for cuts to RRR and policy rates amid drag from property market and softening external demand.

Japan’s February flash manufacturing PMI reading fell to the weakest since August 2020, services PMI rose to the highest since June last year. Japan core CPI rose 4.2% y/y in January, matching a September 1981 high. Consensus was 4.3%, marking the first downside surprise in a year.

South Korea exports fell again in the first 20 days of February but rate of fall slowed. BOK held rates at 3.5% as expected.

Singapore’s core January inflation rose to 14-year high 5.5% y/y from December’s 5.1% as services’, food and retail prices all increased significantly, effect of raised GST also counted. Headline inflation increased to 6.6% y/y. MAS said core inflation to remain elevated in H1-23 before slowing discernibly in H2 as labor market tightness eases, global inflation moderates. High inflation prints raises possibility of MAS tightening monetary policy through currency band adjustments at next meeting in mid-April following five rounds since Oct-21

Adani companies are paying some creditors ahead of schedule. Adani Ports and Special Economic Zone managing director Karan Adani said the company would repay or pre-pay more than $600mn of loans in the coming financial year, to bring down its debt to earnings ratio. The company repaid Rs5bn ($60.3mn) to an Indian mutual fund against maturing commercial papers last week.

Thailand is restricting plastic waste imports and will ban scrap shipments of the material starting in 2025, as officials seek to halt a flood of refuse from rich countries that has impacted the health of its citizens and polluted its air and water.

Credit

Data announced last week were very resilient and are showing that the economy as well as prices are surprising on the upside. The impact on financial markets were pretty bad which shows that the market is still very much in this rhetoric of good economic data equals to bad news for financial markets, as it will probably support the FED in its decision to continue hiking interest rates further and keep the FED fund higher for longer.

Equity indices in the US lost quite a lot of ground last week, the S&P500 lost 2.67% and the Nasdaq 100 lost slightly more than 3% during the past week which included only 4trading sessions as last Monday was a day off in the US.

Fixed income assets also lost some grounds last week, US IG lost about 1.10%, US HY lost 0.50% and leverage loans lost 0.25%.Fixed income assets were negatively impacted by higher rates as well as widening credit spreads, US IG spread widen by 5bps and US HY spreads widened by 20bps.

Some further yield curve inversion happened last week on the US Treasury market. The 2Years and 5years yield increased by 15bps. The 2years yield is now trading at 4.80%, its highest level since 2007, overtaking the highest point touched early November last year. The 10years yield gained about 10bps and the longest part of the curve gained about 5bps.

The US dollar was well bid and behaved as expected in this type of risk off environment. The dollar index gained about 1.20% over the week.

This week, we will have plenty of data about the health of the real estate market in the US. We will also have the February Richmond FED Manufacturing Index as well as the February Manufacturing and Services ISM.

FX / COMMODITIES

DXY. USD index rose 1.3% to 105.214 (YTD high) as US Core PCE outperforms at 4.3% qoq (C: 3.9%). Market terminal rate reached 5.45%, while rate cuts continued to be priced out of 2024. Other leading indicators on US data were strong as well; PMI for February prelim beats consensus with Composite PMI at 50.2 (C: 47.5), New Home Sales came in at 670; (C: 620k), Michigan Sentiment came in at 67.0 (C:66.4). GDP 4Q22 came in below consensus at 2.7% (C: 2.9%).

EURUSD fell 1.37% to 1.0548 due to broad based USD strength. Data wise, Manufacturing PMI underperforms while services PMI outperforms to bring composite PMI for February prelims above consensus at 52.3 (C: 50.7). Inflation for January came in in-line at 8.6%

GBP fell 0.77% against USD to 1.1944 due to broad based USD strength, but rose 0.60% against EUR t0 0.88319 as UK PMIs are defiantly strong. UK PMI beats consensus with manufacturing PMI at 49.2, services PMI at 53.3 and composite PMI at 53.0. In addition to the strong index level readings, activity and hiring picked up as well and the composite new orders sub-index rose to its highest level since May 2022.

USDJPY rose 1.74% to 136.48 partly due to broad based USD strength. In addition, JPY displays broad-based underperformance after BoJ governor candidate Ueda assesses Japan’s inflation is driven by cost-push factors and does not appear sustainable. Ueda agrees with the current BoJ stance that achieving the 2% stability target will take time. Data wise, inflation yoy came in in-line at 4.3%.

Oil & Commodity, Bloomberg Commodity Index fell 0.92% due to higher market terminal rates pricing and deteriorating risk sentiment. Aluminium and Copper fell 2.64% and 3.81% respectively. Gold fell 1.70% to 1811.04, while silver fell 4.45% to 20.764. WTI and Brent were almost unchanged, with WTI falling 0.03% to 76.32 and Brent rising 0.19% to 83.16. Anticipated supply cuts from Russia outweighed concerns of a rise in US inventories.

ECONOMIC DATA

M – NZ/SW/NO Retail Sales, EU M3 Money Supply/ Cons./Econ/Indust./Svc Confid., US Durable Goods Orders/Pending Home Sales/Dallas Fed Mfg Act.

T – JP Indust. Pdtn/Retail Sales/Housing Starts, NZ Biz Confid., AU Retail Sales, SW/CA GDP, US Wholesale Inv./MNI Chic PMI/Cons. Confid.

W – NZ Building Permits, AU GDP, JP/CH/EU/UK/US Mfg PMI Feb Final, CH PMI, UK Nationwide Hse Px, NO GDP, SZ Retail Sales, UK Mortg. App., US ISM Mfg/ISM Prices

Th – JP Capital Spending, AU Building App., EU CPI, US Initial Jobless Claims

F – NZ Cons. Confid., AU/JP/CH/SW/EU/UK/US Svc/Comps PMI Feb Final, JP CPI/Jobless Rate, NO Unemploy. Rate, EU PPI, US ISM Svc Index

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.